COUNCIL TAX RESOLUTION 2014/15 1. Summary 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Just As the Priests Have Their Wives”: Priests and Concubines in England, 1375-1549

“JUST AS THE PRIESTS HAVE THEIR WIVES”: PRIESTS AND CONCUBINES IN ENGLAND, 1375-1549 Janelle Werner A dissertation submitted to the faculty of the University of North Carolina at Chapel Hill in partial fulfillment of the requirements for the degree of Doctor of Philosophy in the Department of History. Chapel Hill 2009 Approved by: Advisor: Professor Judith M. Bennett Reader: Professor Stanley Chojnacki Reader: Professor Barbara J. Harris Reader: Cynthia B. Herrup Reader: Brett Whalen © 2009 Janelle Werner ALL RIGHTS RESERVED ii ABSTRACT JANELLE WERNER: “Just As the Priests Have Their Wives”: Priests and Concubines in England, 1375-1549 (Under the direction of Judith M. Bennett) This project – the first in-depth analysis of clerical concubinage in medieval England – examines cultural perceptions of clerical sexual misbehavior as well as the lived experiences of priests, concubines, and their children. Although much has been written on the imposition of priestly celibacy during the Gregorian Reform and on its rejection during the Reformation, the history of clerical concubinage between these two watersheds has remained largely unstudied. My analysis is based primarily on archival records from Hereford, a diocese in the West Midlands that incorporated both English- and Welsh-speaking parishes and combines the quantitative analysis of documentary evidence with a close reading of pastoral and popular literature. Drawing on an episcopal visitation from 1397, the act books of the consistory court, and bishops’ registers, I argue that clerical concubinage occurred as frequently in England as elsewhere in late medieval Europe and that priests and their concubines were, to some extent, socially and culturally accepted in late medieval England. -

Mr C E Williams 2 Jockeyfields Ludlow SY8 1PU Phone: 01584 874661 Email: [email protected]

CAYNHAM PARISH COUNCIL Clerk: Mr C E Williams 2 Jockeyfields Ludlow SY8 1PU Phone: 01584 874661 Email: [email protected] The Minutes of the meeting of Caynham Parish Council held at Caynham Village Hall on Monday 18th November 2019 commencing at 7.00pm Present: Mrs B Ashford Mr. G. Cummings Mrs K Wyke Mr L Lowman-Brown Ms S Lowe Mr G Williams Mr A Pryor Mr. M. Galbraith Mr. A. Parmar Mrs H Jones Mr C E Williams (Clerk) Apologies: Mr S Boden Members of the Public: One member of the public present. 1. To Declare any Interests: Nil 2. Minutes: The Minutes of the Parish Council meeting held on the 18th September 2019 were approved and signed by the Chairman as a correct record. 3. Matters arising from the minutes not included on the agenda: Nil 4. Chairman’s Communications: No items to report. 5. Planning Items: Planning Application – 19/04666/Full – 3 Stone House Knowbury Ludlow – Change of use from commercial cattery to domestic garden land; erection of garden room – No Objection Planning Application – 19/03888/VAR – Land West of Springfield Park Clee Hill – Variation of condition no. 7 pursuant to SS/1/07/19934/F to allow a re-design of all approved properties; re-design of site layout to add two detached garage blocks. – No Objection although there was concern about the proximity of the double garage on the west edge of the site, adjacent to the boundary with Fern House and Trafford House. 6. Highway/Amenity Items: a) The Clerk reported on the transfer of the Amenity Land, roadway and footpath at Sycamore Grove Knowbury to the Parish Council from the Housing Association Connexus. -

Applications and Decisions for West Midlands

OFFICE OF THE TRAFFIC COMMISSIONER (WEST MIDLANDS) APPLICATIONS AND DECISIONS PUBLICATION NUMBER: 2839 PUBLICATION DATE: 17/05/2019 OBJECTION DEADLINE DATE: 07/06/2019 Correspondence should be addressed to: Office of the Traffic Commissioner (West Midlands) Hillcrest House 386 Harehills Lane Leeds LS9 6NF Telephone: 0300 123 9000 Fax: 0113 248 8521 Website: www.gov.uk/traffic-commissioners The public counter at the above office is open from 9.30am to 4pm Monday to Friday The next edition of Applications and Decisions will be published on: 24/05/2019 Publication Price 60 pence (post free) This publication can be viewed by visiting our website at the above address. It is also available, free of charge, via e-mail. To use this service please send an e-mail with your details to: [email protected] APPLICATIONS AND DECISIONS Important Information All correspondence relating to public inquiries should be sent to: Office of the Traffic Commissioner (West Midlands) 38 George Road Edgbaston Birmingham B15 1PL The public counter in Birmingham is open for the receipt of documents between 9.30am and 4pm Monday Friday. There is no facility to make payments of any sort at the counter. General Notes Layout and presentation – Entries in each section (other than in section 5) are listed in alphabetical order. Each entry is prefaced by a reference number, which should be quoted in all correspondence or enquiries. Further notes precede each section, where appropriate. Accuracy of publication – Details published of applications reflect information provided by applicants. The Traffic Commissioner cannot be held responsible for applications that contain incorrect information. -

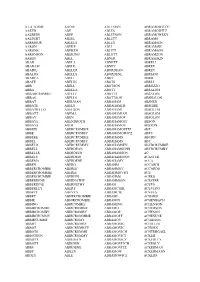

A La Torre Aaker Aalbers Aaldert Aarmour Aaron

A LA TORRE ABDIE ABLEMAN ABRAMOWITCH AAKER ABE ABLES ABRAMOWITZ AALBERS ABEE ABLETSON ABRAMOWSKY AALDERT ABEEL ABLETT ABRAMS AARMOUR ABEELS ABLEY ABRAMSEN AARON ABEKE ABLI ABRAMSKI AARONS ABEKEN ABLITT ABRAMSON AARONSON ABEKING ABLOTT ABRAMZON AASEN ABEL ABNER ABRASHKIN ABAD ABELA ABNETT ABRELL ABADAM ABELE ABNEY ABREU ABADIE ABELER ABORDEAN ABREY ABALOS ABELES ABORDENE ABRIANI ABARCA ABELI ABOT ABRIL ABATE ABELIN ABOTS ABRLI ABB ABELL ABOTSON ABRUZZO ABBA ABELLA ABOTT ABSALOM ABBARCROMBIE ABELLE ABOTTS ABSALON ABBAS ABELLS ABOTTSON ABSHALON ABBAT ABELMAN ABRAHAM ABSHER ABBATE ABELS ABRAHAMER ABSHIRE ABBATIELLO ABELSON ABRAHAMI ABSOLEM ABBATT ABEMA ABRAHAMIAN ABSOLOM ABBAY ABEN ABRAHAMOF ABSOLON ABBAYE ABENDROTH ABRAHAMOFF ABSON ABBAYS ABER ABRAHAMOV ABSTON ABBDIE ABERCROMBIE ABRAHAMOVITZ ABT ABBE ABERCROMBY ABRAHAMOWICZ ABTS ABBEKE ABERCRUMBIE ABRAHAMS ABURN ABBEL ABERCRUMBY ABRAHAMS ABY ABBELD ABERCRUMMY ABRAHAMSEN ABYRCRUMBIE ABBELL ABERDEAN ABRAHAMSOHN ABYRCRUMBY ABBELLS ABERDEEN ABRAHAMSON AC ABBELS ABERDEIN ABRAHAMSSON ACASTER ABBEMA ABERDENE ABRAHAMY ACCA ABBEN ABERG ABRAHM ACCARDI ABBERCROMBIE ABERLE ABRAHMOV ACCARDO ABBERCROMMIE ABERLI ABRAHMOVICI ACE ABBERCRUMBIE ABERLIN ABRAHMS ACERO ABBERDENE ABERNATHY ABRAHMSON ACESTER ABBERDINE ABERNETHY ABRAM ACETO ABBERLEY ABERT ABRAMCHIK ACEVEDO ABBETT ABEYTA ABRAMCIK ACEVES ABBEY ABHERCROMBIE ABRAMI ACHARD ABBIE ABHIRCROMBIE ABRAMIN ACHENBACH ABBING ABIRCOMBIE ABRAMINO ACHENSON ABBIRCROMBIE ABIRCROMBIE ABRAMO ACHERSON ABBIRCROMBY ABIRCROMBY ABRAMOF ACHESON ABBIRCRUMMY ABIRCROMMBIE ABRAMOFF -

NOTICE of ELECTION Shropshire Council Election of Parish Councillors for the Parish Listed Below

NOTICE OF ELECTION Shropshire Council Election of Parish Councillors for the Parish listed below Number of Parish Parish Councillors to be elected Alberbury with Cardeston Parish Council Nine 1. Forms of nomination for the above election may be obtained from the Clerk to the Parish Council, or the Returning Officer at the Shirehall, Abbey Foregate, Shrewsbury, Shropshire, SY2 6ND who will, at the request of an elector for any electoral area prepare a nomination paper for signature. 2. Nomination papers must be hand-delivered to the Returning Officer, Shirehall, Abbey Foregate, Shrewsbury, Shropshire, SY2 6ND on any day after the date of this notice but no later than 4 pm on Thursday, 8th April 2021. Alternatively, candidates may submit their nomination papers at the following locations on specified dates, between the times shown below: Shrewsbury Shirehall, Abbey Foregate, Shrewsbury, SY2 6ND 9.00am – 5.00pm Weekdays from Tuesday 16th March to Thursday 1st April. 9.00am – 7.00pm Tuesday 6th April and Wednesday 7th April. 9.00am – 4.00pm Thursday 8th April. Oswestry Council Chamber, Castle View, Oswestry, SY11 1JR 8.45am – 6.00pm Tuesday 16th March; Thursday 25th March and Wednesday 31st March. Wem Edinburgh House, New Street, Wem, SY4 5DB 9.15am – 4.30pm Wednesday 17th March; Monday 22nd March and Thursday 1st April. Ludlow Helena Lane Day Care Centre, 20 Hamlet Road, Ludlow, SY8 2NP 8.45am – 4.00pm Thursday 18th March; Wednesday 24th March and Tuesday 30th March. Bridgnorth Bridgnorth Library, 67 Listley Street, Bridgnorth, WV16 4AW 9.45am – 4.30pm Friday 19th March; Tuesday 23rd March and Monday 29th March. -

Preen News Summer 2019 IMPORTANT: If You Wish to Receive Personal Copies of These Newsletters, Please Complete the GDPR Form on the Back Page 1

Preen News Summer 2019 IMPORTANT: If you wish to receive personal copies of these Newsletters, please complete the GDPR form on the back page 1. Preen Reunion 2019 The 2019 reunion was held in Church Preen Village Hall on Saturday 22 June. It was a bright sunny day, a pleasant change for the recent weather. 24 members were present and the meeting started at 10.30. Normally it would have started with a talk on the family to be featured at this meeting. However on this occasion the topic was the history of Preen Manor (since we believe the family took its name from this Domesday Manor) and that was described in the programme given to everyone who attended. So we proceeded to the AGM, since there were important decisions to be taken. Group Photo of those attending AGM for the Preen Family History Study Group held on 22 June 2019 in Church Preen Present: (shown in the group photo) Philip Davies (F32) - Chairman and Publicity Officer Sue Laflin (F03) - Editor and Archivist Andy Stevens (F27) - Webmaster Also present: Michael Preen (F05), Patricia Preen (F05), Angela De'ath (F05), Philip Preen (F04), Patricia Preen (F04), Barry Kirtlan (F34), Maureen Foxall (F34), Douglas Round (F34), Vera Round (F34), Eric Beard (F32), Colin Preen (F07), Ann Preen (F07), Marion Bytheway (F03), Phillip Bytheway (F03), Philip Barker (F03), Pauline Davies (F32), Jan Edwards (F32), Kenneth Pugh (F04), Edith Pugh (F04), Malcolm Preen (F09) and Rita Preen (F09). 1 Minutes of 2019 AGM continued. 1) The minutes of the 2018 meeting were accepted as a correct record. -

All Stretton Census

No. Address Name Relation to Status Age Occupation Where born head of family 01 Castle Hill Hall Benjamin Head M 33 Agricultural labourer Shropshire, Wall Hall Mary Wife M 31 Montgomeryshire, Hyssington Hall Mary Ann Daughter 2 Shropshire, All Stretton Hall, Benjamin Son 4 m Shropshire, All Stretton Hall Sarah Sister UM 19 General servant Shropshire, Cardington 02 The Paddock Grainger, John Head M 36 Wheelwright Shropshire, Wall Grainger, Sarah Wife M 30 Shropshire, Wall Grainger, Rosanna Daughter 8 Shropshire, Wall Grainger, Mary Daughter 11m Church Stretton 03 Mount Pleasant Icke, John Head M 40 Agricultural labourer Shropshire, All Stretton Icke Elisabeth Wife M 50 Shropshire, Bridgnorth Lewis, William Brother UM 54 Agricultural labourer Shropshire, Bridgnorth 04 Inwood Edwards, Edward Head M 72 Sawyer Shropshire, Church Stretton Edwards, Sarah Wife M 59 Pontesbury Edwards Thomas Son UM 20 Sawyer Shropshire, Church Stretton Edwards, Mary Daughter UM 16 Shropshire, Church Stretton 05 Inwood Easthope, John Head M 30 Agricultural labourer Shropshire, Longner Easthope, Mary Wife M 27 Shropshire, Diddlebury Hughes, Jane Niece 3 Shropshire, Diddlebury 06 Bagbatch Lane ottage Morris James Head M 55 Ag labourer and farmer, 7 acres Somerset Morris Ellen Wife M 35 Shropshire, Clungunford Morris, Ellen Daughter 1 Shropshire, Church Stretton 07 Dudgley Langslow, Edward P Head M 49 Farmer 110 acres, 1 man Shropshire, Clungunford Langslow Emma Wife M 47 Shropshire, Albrighton Langslow, Edward T Son 15 Shropshire, Clungunford Langslow, George F Son -

Shrewsbury and Atcham Constituency

STATEMENT OF PERSONS NOMINATED, NOTICE OF POLL AND SITUATION OF POLLING STATIONS Shropshire Council Election of a Member of Parliament for Shrewsbury and Atcham Constituency Notice is hereby given that: 1. A poll for the election of a Member of Parliament for Shrewsbury and Atcham will be held on Thursday 8 June 2017, between the hours of 7:00 am and 10:00 pm. 2. One Member of Parliament is to be elected. 3. The names, home addresses and descriptions of the Candidates remaining validly nominated for election and the names of all persons signing the Candidates nomination paper are as follows: Names of Signatories Names of Signatories Name of Home Address Description (if any) Proposers(+), Seconders(++) & Assentors Proposers(+), Seconders(++) & Candidate Assentors BULLARD 42 Hereford Road, Shrewsbury, Green Party Newby Anthony J(+) Lemon Christopher J(++) (+) (++) Emma Catherine SY3 7RD Hayek Thomas J M Egarr Gareth S Mary Bell Charlotte A Latham David M Hayek Tereza Gilbert Peter J Dean Julian D G Lavelle Martha C DAVIES 49 Queens Park Road, Labour Party Mosley Alan N(+) Hudson Keith R(++) (+) (++) Laura Louisa Birmingham, B32 2LB Peacock Diane Bramall Anna E Pardy Kevin J Clarke John E Jones Ioan G Taylor Harry T G Moseley Pamela A Mosley Jacqueline A FRASER (address in the Shrewsbury and Liberal Democrats Craddock David(+) Baker Beverley J(++) (+) (++) Hannah Atcham Constituency) Vasmer David Lea Robert C Clark Daniel A Beardwell Martin W Faherty John M Lewis Caroline L Jones Neil D Evans Roger A HIGGINBOTTOM Rea Bank, Weir Road, Hanwood, UK Independence Party Burgess Frank J.H.(+) Conway David J(++) (+) (++) Edward Arthur Shrewsbury, Shropshire, SY5 8LA Burgess Jennifer Moxon Dylan P Gretton Jane D Faulkner Wayne J Price John K Morgan David J Lee Ethel Lee Douglas R KAWCZYNSKI 5 The Anchorage, Coton Hill, Conservative Party Morris Daniel O(+) Coward Beryl J(++) (+) (++) Daniel Robert Shrewsbury, SY1 2DP Candidate Picton Lezley M Jones Valerie A Potter Edward A Phillips Alexander G Adams Peter M Boulger Georgina A Carroll Dean S Nutting Peter A 4. -

Mondays to Fridays Saturdays Sundays Summer Bank Holiday

576 Shrewsbury - Oswestry Arriva Midlands Direction of stops: where shown (eg: W-bound) this is the compass direction towards which the bus is pointing when it stops Mondays to Fridays Notes $Sch $ $ $ $ $ $ $ $ $ $ $ SHOL Shrewsbury, Bus Station (Stand R) 0720 0730 0900 1000 1100 1200 1300 1400 1625 1702 1755 1900 Bomere Heath, adj Red Lion 0732 0742 0913 1013 1113 1213 1313 1413 1638 1808 1913 Walford, adj Main Gate 0741 0751 0924 1024 1124 1224 1324 1424 1718 1819 1924 Yeaton, opp Yeaton Farm 1647 Baschurch, opp Admiral Duncan 0744 0754 0927 1027 1127 1227 1327 1427 1652 1721 1822 1927 Westoncommon, adj War Memorial 1658 1828 Shotatton, opp Crossroads 0755 0805 0939 1139 1339 1439 1714 1844 1937 Kinnerley, adj Cross Keys 0806 0813 0949 1349 1449 1725 1854 Knockin, opp Church 0811 0818 0954 1154 1354 1454 1731 1859 Oswestry, opp Arriva Garage 0829 1005 1205 1405 1505 1745 1909 Morda, adj Marches School 0830 Oswestry, Bus Station (Stand 4) 0839 0834 1010 1210 1410 1510 1750 1914 1950 Saturdays Notes $ $ $ $ $ $ $ $ $ $ $ Shrewsbury, Bus Station (Stand R) 0730 0900 1000 1100 1200 1300 1400 1500 1700 1755 1925 Bomere Heath, adj Red Lion 0742 0913 1013 1113 1213 1313 1413 1512 1713 1808 1938 Walford, adj Main Gate 0751 0924 1024 1124 1224 1324 1424 1521 1724 1819 1949 Baschurch, opp Admiral Duncan 0754 0927 1027 1127 1227 1327 1427 1524 1727 1822 1952 Westoncommon, adj War Memorial 1828 Shotatton, opp Crossroads 0805 0939 1139 1339 1535 1739 1844 2002 Kinnerley, adj Cross Keys 0813 0949 1349 1546 1749 1854 Knockin, opp Church 0818 0954 -

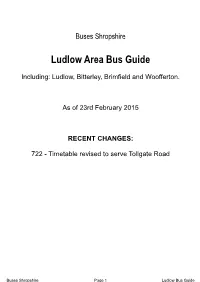

Ludlow Bus Guide Contents

Buses Shropshire Ludlow Area Bus Guide Including: Ludlow, Bitterley, Brimfield and Woofferton. As of 23rd February 2015 RECENT CHANGES: 722 - Timetable revised to serve Tollgate Road Buses Shropshire Page !1 Ludlow Bus Guide Contents 2L/2S Ludlow - Clee Hill - Cleobury Mortimer - Bewdley - Kidderminster Rotala Diamond Page 3 141 Ludlow - Middleton - Wheathill - Ditton Priors - Bridgnorth R&B Travel Page 4 143 Ludlow - Bitterley - Wheathill - Stottesdon R&B Travel Page 4 155 Ludlow - Diddlebury - Culmington - Cardington Caradoc Coaches Page 5 435 Ludlow - Wistanstow - The Strettons - Dorrington - Shrewsbury Minsterley Motors Pages 6/7 488 Woofferton - Brimfield - Middleton - Leominster Yeomans Lugg Valley Travel Page 8 490 Ludlow - Orleton - Leominster Yeomans Lugg Valley Travel Page 8 701 Ludlow - Sandpits Area Minsterley Motors Page 9 711 Ludlow - Ticklerton - Soudley Boultons Of Shropshire Page 10 715 Ludlow - Great Sutton - Bouldon Caradoc Coaches Page 10 716 Ludlow - Bouldon - Great Sutton Caradoc Coaches Page 10 722 Ludlow - Rocksgreen - Park & Ride - Steventon - Ludlow Minsterley Motors Page 11 723/724 Ludlow - Caynham - Farden - Clee Hill - Coreley R&B Travel/Craven Arms Coaches Page 12 731 Ludlow - Ashford Carbonell - Brimfield - Tenbury Yarranton Brothers Page 13 738/740 Ludlow - Leintwardine - Bucknell - Knighton Arriva Shrewsbury Buses Page 14 745 Ludlow - Craven Arms - Bishops Castle - Pontesbury Minsterley Motors/M&J Travel Page 15 791 Middleton - Snitton - Farden - Bitterley R&B Travel Page 16 X11 Llandridnod - Builth Wells - Knighton - Ludlow Roy Browns Page 17 Ludlow Network Map Page 18 Buses Shropshire Page !2 Ludlow Bus Guide 2L/2S Ludlow - Kidderminster via Cleobury and Bewdley Timetable commences 15th December 2014 :: Rotala Diamond Bus :: Monday to Saturday (excluding bank holidays) Service No: 2S 2L 2L 2L 2L 2L 2L 2L 2L 2L Notes: Sch SHS Ludlow, Compasses Inn . -

Village Directory2019

Village Directory 2019 ACTON BURNELL, PITCHFORD, FRODESLEY, RUCKLEY AND LANGLEY Ewes and lambs near Acton Burnell The Bus Stop at Frodesley CONTENTS Welcome 3 Shops and Post Offices 15 Defibrillators 4 Pubs, Cafes and Restaurants 15 The Parish Council 5 Local Chemists 16 Meet your Councillors 6 Veterinary Practices 16 Policing and Safety 8 Pitchford Village Hall 17 Health and Medical Services 8 Local Churches 18 Local Medical Practices 9 Local Clubs and Societies 19 Local Hospitals 10 Concord College Parish Rubbish Collection and Recycling 11 Swimming Club 20 Parish Map 12 Schools and Colleges 21 Bus Routes and Times 13 Acton Burnell WI 22 Libraries 14 Information provided in this directory is intended to provide a guide to local organisations and services available to residents in the parish of Acton Burnell. The information contained is not exhaustive, and the listing of any group, club, organisation, business or establishment should not be taken as an endorsement or recommendation. While every effort has been made to ensure that the information included is accurate, users of this directory should not rely on the information provided and must make their own enquiries, inspections and assessments as to suitability and quality of services. Village Directory 2019 WELCOME Welcome to the second edition of the Parish Directory for the communities of Acton Burnell, Pitchford, Frodesley, Ruckley and Langley. We have tried to include as much useful information as possible, but if there is something you think is missing, or something you would like to see included in the future, please let us know. We would like to thank the Parish Council for continuing to fund both Village Views and the Directory. -

Llwyntidmon Hall Maesbrook | Shropshire

Llwyntidmon Hall Maesbrook | Shropshire 2 Llwyntidmon Hall Maesbrook | Oswestry Shropshire | SY10 8QF Ad dress A charming Grade II Listed Hall with excellent equestrian facilities & approx 18.5 acres, nr Maesbrook, Shropshire. • Spacious 5/6 Bed 17th Century Hall with a host of original features. • GF: Large Kitchen, Snug, Study, Lounge, Sitting Room, Hall, Family Bathroom. • FF: Master Bed (En-suite Bath), Guest Bed (en-suite Shower), 3/4 further Beds & Family Bathroom. • Mature Gardens & Orchard. Garden Room attached to house • Extensive equestrian facilities & outbuildings, suitable for private or professional use. • Traditional 8 Box Stable Yard + American Barn with further 7 Stables, Hay/bedding/ Vehicle Store. • Coach House with scope for ancillary accom conversion sub to PP. • Manege 35m x 19m, 4furlong all weather canter loop. • Scope for a range of alternative business opportunities sub to PP. • Approx. 18.5 acres, range of grass P & R fenced paddocks with water & elec. LlanymynecLlanymynechh 2h 2m2 m |Knockin 2.5m | Oswestry 7m Welshpool 11m | Shrewsbury 15m Ellesmere 15m | Wrexham 21m | Chester 33m 3 Situation Llwynt idmon Hall is situated in a delightful rural location between the villages of Knockin & Llanymynech, amongst open farmland & with scenic views. A good range of local amenities are available at Llanymynech & Knockin including a post office/shop, church and public houses. The nearby market towns of Oswestry & Welshpool offer an extensive variety of educational, recreational and leisure facilities with the medieval county town of Shrewsbury being within easy commuting distance via the A5. There are good road c onnections north to Wrexham, Chester and Liverpool via the A483/A5 and south/east to Shrewsbury, Telford & the Midlands via the A5.