Annual Report 2020 Corporate Financials Additional Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Financial Hegemony, Diversification Strategies and the Firm Value of Top 30 FTSE Companies in Malaysia

Asian Social Science; Vol. 12, No. 3; 2016 ISSN 1911-2017 E-ISSN 1911-2025 Published by Canadian Center of Science and Education Financial Hegemony, Diversification Strategies and the Firm Value of Top 30 FTSE Companies in Malaysia Wan Sallha Yusoff1, Mohd Fairuz Md. Salleh2, Azlina Ahmad2 & Norida Basnan2 1 School of Business Innovation and Technopreneurship, Universiti Malaysia Perlis, Malaysia 2 School of Accounting, Faculty of Economics and Management, Universiti Kebangsaan Malaysia, Malaysia Correspondence: Wan Sallha Yusoff, School of Business Innovation and Technopreneurship, Universiti Malaysia Perlis, Malaysia. E-mail: [email protected] Received: August 8, 2015 Accepted: January 18, 2016 Online Published: February 23, 2016 doi:10.5539/ass.v12n3p14 URL: http://dx.doi.org/10.5539/ass.v12n3p14 Abstract This study investigates the relationships between financial hegemony groups, global diversification strategies and firm value of the Malaysia’s 30 largest companies listed in FTSE Bursa Malaysia Index Series during 2009 to 2012 period. We chose Malaysia as an ideal setting because the findings contribute to the phenomenon of the diversification–performance relationship in the Southeast Asian countries. We apply hegemony stability theory to explain the importance of financial hegemony groups in deciding international locations for operations. By using panel data analysis, we find that financial hegemony groups are significantly important in international location decisions. Results reveal that the stability of financial hegemony in BRICS and G7 groups enhances the financial value of the Malaysia’s 30 largest companies, whereas the stability of financial hegemony in ASEAN groups is able to enhance the non-financial value of the firms. -

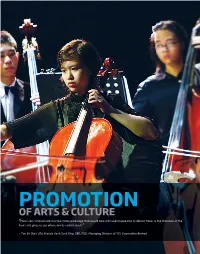

PROMOTION of ARTS & CULTURE ”Music Can Communicate in a Few Notes a Message That Would Take a Thousand Speeches to Deliver

PROMOTION OF ARTS & CULTURE ”Music can communicate in a few notes a message that would take a thousand speeches to deliver. Music is the literature of the heart and gives us joy where words cannot reach.” – Tan Sri Dato’ (Dr) Francis Yeoh Sock Ping, CBE, FICE, Managing Director of YTL Corporation Berhad 56 YTL CORPORATION BERHAD CORPORATE EVENTS 20 OCT 2016 UNVEILING OF NEW KLIA TRANSIT TRAINS Express Rail Link Sdn Bhd, a 45% associate of YTL Corporation Berhad, unveiled its new KLIA Transit train at its depot in Salak Tinggi, officiated by Malaysia’s Minister of Transport, YB Dato’ Sri Liow Tiong Lai. The six new train- sets, manufactured by CRRC Changchun Railway Vehicles Company Limited, will increase total service capacity by fifty percent. From left to right, Tan Sri Dato’ Seri (Dr) Yeoh Tiong Lay, Executive Chairman of YTL Corporation Berhad; YB Dato’ Sri Liow Tiong Lai, Minister of Transport; YB Datuk Ab Aziz Kaprawi, Deputy Minister of Transport; Tan Sri Mohd Nadzmi Mohd Salleh, Executive Chairman of Express Rail Link Sdn Bhd; and Puan Noormah Mohd Noor, Chief Executive Officer of Express Rail Link Sdn Bhd. 27 OCT 2016 ISETAN’S 1ST INTERNATIONAL FLAGSHIP JAPAN STORE OPENS IN LOT 10 SHOPPING CENTRE Isetan Mitsukoshi Holdings Ltd, Japan’s largest department store group, launched its first flagship Japan Store outside of Tokyo in Lot 10 Shopping Centre. Based on the ‘Cool Japan’ concept and occupying the store’s six floors, with a total floor area of about 11,000 square meters, the store features a range of high-quality and designer products from around Japan. -

ESG Ratings of Plcs Assessed by FTSE Russell# in Accordance with FTSE Russell ESG Ratings Methodology

ESG Ratings of PLCs assessed by FTSE Russell# in accordance with FTSE Russell ESG Ratings Methodology Definition Top 25% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Top 26-50% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Top 51%- 75% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Bottom 25% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Stock Company Name Sector F4GBM ESG Grading Code (sorted By Alphabetical) Index Band 6599 AEON CO. (M) BHD CONSUMER PRODUCTS & SERVICES ** 5139 AEON CREDIT SERVICE (M) BHD FINANCIAL SERVICES Yes *** 7078 AHMAD ZAKI RESOURCES BHD CONSTRUCTION *** 5099 AIRASIA GROUP BERHAD CONSUMER PRODUCTS & SERVICES *** 5238 AIRASIA X BERHAD CONSUMER PRODUCTS & SERVICES ** 2658 AJINOMOTO (M) BHD CONSUMER PRODUCTS & SERVICES Yes *** 2488 ALLIANCE BANK MALAYSIA BERHAD FINANCIAL SERVICES Yes *** 5293 AME ELITE CONSORTIUM BERHAD CONSTRUCTION * 1015 AMMB HOLDINGS BHD FINANCIAL SERVICES Yes **** 6556 ANN JOO RESOURCES BHD INDUSTRIAL PRODUCTS & SERVICES * 6399 ASTRO MALAYSIA HOLDINGS BERHAD TELECOMMUNICATIONS & MEDIA Yes **** 6888 AXIATA GROUP BERHAD TELECOMMUNICATIONS & MEDIA Yes *** 5106 AXIS REITS REAL ESTATE INVESTMENT TRUSTS ** 3395 BERJAYA CORPORATION BHD INDUSTRIAL PRODUCTS & SERVICES ** 1562 BERJAYA SPORTS TOTO BHD CONSUMER PRODUCTS & SERVICES ** 5248 BERMAZ AUTO BERHAD CONSUMER PRODUCTS & SERVICES Yes **** 2771 BOUSTEAD HOLDINGS BHD INDUSTRIAL PRODUCTS & SERVICES ** 4162 BRITISH AMERICAN -

Ac 2021 61.Pdf

Accounting 7 (2021) 1033–1048 Contents lists available at GrowingScience Accounting homepage: www.GrowingScience.com/ac/ac.html Can investors benefit from corporate social responsibility and portfolio model during the Covid19 pandemic? Ternence T. J. Tana* and Baliira Kalyebarab aFaculty of Business, Economics and Social Development, University of Malaysia Terengganu, Kuala Nerus, Terengganu, Malaysia bDepartment of Accounting and Finance, School of Business, American University of Ras Al Khaimah, United Arab Emirates C H R O N I C L E A B S T R A C T Article history: Since late 2019 and throughout 2020, the global economy has been experiencing difficult times due Received: November 15, 2020 to the outbreak of the lethal Coronavirus (COVID-19). This study looks at the financial impact of Received in revised format: this epidemic on the global economy using Malaysian market index i.e., FTSE Bursa Malaysia KLCI January 28 2021 before and during COVID-19. Measuring the financial impact of this epidemic on the Malaysia Accepted: March 2, 2021 Available online: economy may help policy makers to develop measures to avert similar financial catastrophic impacts March 2, 2021 on the global economy. The study uses Sharpe optimal and naïve diversification model to solve a scenario that factors in the level of corporate social responsibility (CSR) exhibited before and during Keywords: Corporate Social Responsibility the epidemic to measure the financial impact on the stock portfolio. The results show that the Naïve Diversification emergence of COVID-19exacerbated the already weak Malaysian economy. Our findings may help Optimal Portfolio the policy makers in Malaysia to develop and maintain techniques and policies that may mitigate the Sharpe Ratio negative financial impact and handle similar epidemics in the future. -

Malaysia Overall Domestic and Inbound Deal Activity Has Declined, Although Outbound Activity Remains Buoyant

Malaysia Overall domestic and inbound deal activity has declined, although outbound activity remains buoyant. Prospects for 2009 are cautiously optimistic weather the current financial turmoil with Malaysia’s substantial foreign reserves amounting to US$93 billion as at 15 December, which is sufficient to finance 7.8 months of retained imports and 3.4 times current short term debt. In politics, Malaysia’s Deputy Prime Minster, Datuk Seri Najib Razak is expected to replace Datuk Seri Abdullah Badawi as the next Prime Minister in March 2009. The proposed timeline is intended to pave the way for a smooth transition of leaders. Paran Puvanesan Corporate Finance Leader Malaysia Deal Activity Malaysia Deal Activity Current Environment Deal values Deal volume 16,000 After registering a strong rate of growth of 7.1% in the first 300 14,000 half of 2008, Malaysia’s economy is expected to have 250 12,000 expanded at a slower rate in the second half, in light of the 200 10,000 global financial crisis and a slowdown in the manufacturing, export and tourism sectors. Latest figures for third quarter 8,000 150 US$ million 6,000 No. of deals growth were 4.7% p.a., while full year growth is estimated 100 4,000 to have been 5.0%. 50 2,000 Despite the global financial crisis, domestic demand is - - projected to continue to grow, with contributions mainly 1Q2007 2Q2007 3Q2007 4Q2007 1Q2008 2Q2008 3Q2008 4Q2008 from the services sector, private and public consumption Source: Thomson Reuters, based on total domestic, inbound and outbound deals announced as and investment. -

Corporate Governance Monitor 2020

Securities Commission Malaysia 3 Persiaran Bukit Kiara Bukit Kiara 50490 Kuala Lumpur Malaysia Corporate Governance Monitor 2020 Tel: + 603 6204 8000 www.sc.com.my www.investsmartsc.my Twitter: @SecComMy CORPORATE GOVERNANCE MONITOR 2020 Securities Commission Malaysia 3 Persiaran Bukit Kiara Bukit Kiara 50490 Kuala Lumpur Tel: +603–6204 8000 Fax: +603–6201 5078 Website: www.sc.com.my COPYRIGHT © 2020 Securities Commission Malaysia All rights reserved. No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted in any form or by any means (graphical, electronic, mechanical, photocopying, recording, taping or otherwise), without the prior written permission of the Securities Commission Malaysia. DISCLAIMER This book aims to provide a general understanding of the subject and is not an exhaustive write-up. It is not intended to be a substitute for legal advice and nor does it disminish any duty (statutory or otherwise) that may be applicable to any person under existing laws. Published in October 2020. ii CORPORATE GOVERNANCE MONITOR 2020 CONTENTS Executive Summary 1 Key Highlights 4 Adoption of the Malaysian Code on Corporate Governance 6 Quality of Disclosure 18 Thematic Review 1: Conduct of Fully Virtual General Meetings 24 – A New Normal Thematic Review 2: Two-Tier Voting – Outcomes and Observations 31 Thematic Review 3: Board Remuneration – Design, Deliver, Disclose 34 Appendices 42 Glossary 51 CORPORATE GOVERNANCE MONITOR 2020 iii This page is intentionally left blank. iv CORPORATE GOVERNANCE MONITOR 2020 EXECUTIVE SUMMARY The release of the Corporate Governance Monitor 2020 (CG Monitor 2020) takes place at a time when countries across the globe are facing the COVID-19 pandemic, that has changed the normal course of life and tested the resilience of people and businesses. -

Hong Leong Bank Berhad

August 4, 2020 Global Markets Research Fixed Income Fixed Income Daily Market Snapshot US Treasuries US Treasuries closed weaker whlst being pressured on Monday, UST led by the long-ends and influenced by strong readings on Tenure Closing (%) Chg (bps) manufacturing numbers. The heavy IG issuance slate also helped 2-yr UST 0.11 0 cause yields to drift higher. The curve steepened as overall 5-yr UST 0.22 2 benchmark yields ended between 0-4bps higher with the UST 2Y 10-yr UST 0.56 3 within 1bps move at 0.11% and the much-watched UST 10Y 30-yr UST 1.23 4 spiking 3bps to 0.56%. Meanwhile officials are penciling in another $1.0 trillion stimulus package in to their calculations of financing MGS GII* needs over the next two quarters whilst lawmakers continue to Tenure Closing (%) Chg (bps) Closing (%) Chg (bps) debate a compromise between the $3.5 trillion in spending which 3-yr 1.92 1 1.94 -3 was approved in May and the GOP’s $1.0 trillion proposal last 5-yr 2.12 0 2.03 -4 week. The data front remains light today with attention expected to 7-yr 2.20 -4 2.27 -1 shift to the payrolls data this Friday. 10-yr 2.49 -6 2.55 -1 15-yr 2.92 -4 3.00 -2 MGS/GIIl 20-yr 3.16 -1 3.30 0 30-yr 3.53 1 3.66 0 Local govvies remained well-bid yesterday following positive vibes nd * Market indicative levels and also reports of the nation’s bonds emerging as the 2 best performer in Asia in July. -

Corporate Governance in Malaysia | October 2017

CORPORATE GOVERNANCE IN MALAYSIA | OCTOBER 2017 CORPORATE GOVERNANCE IN MALAYSIA Family ties and government control heighten governance risks. October 2017 Contents Ownership Snapshot 2 Tight family control and convoluted conglomerate structures preclude thorough investor analysis. Family Ownership 3 Uncertainty is compounded by looming succession questions surrounding aging patriarchs. Concerns Family Control 4 related to board entrenchment and infrequent board meetings leave minority investors at family firms Family Generational Succession 6 exposed to risks of decisions which heavily favor family groups. Financial Institutions 10 As a response to the Asian and global financial crises, enhanced banking regulations have strengthened Strong Board Oversight 11 independent oversight and ensured increased executive pay disclosure at Malaysian banks. Grandfathered Institutions 12 State Participation 13 Government-linked Companies (GLCs) are fundamental to Malaysia’s economy but we have identified Poor GLC Performance 14 concerns about poor performance, weak leadership structures and government intervention placing the Weak Leadership 16 national interest ahead of minority shareholders. Appendices Regulatory Developments 19 The MSCI Malaysia Index constituents underperform on corporate governance relative to both the MSCI Corporate Overview 21 Emerging Markets and MSCI ACWI Indexes as a whole. Board Overview 22 Gender Diversity 23 CORPORATE GOVERNANCE SCORE DISTRIBUTION Key Metric Overview 24 Best & Worst Scores 25 Ownership Diagrams 26 Top 5 Scores Bottom 5 Scores CIMB Group 7.6/10 IHH Healthcare 2.7/10 Laggards Leaders Alliance Financial Group 7.5/10 Genting Malaysia 2.4/10 Hong Leong Bank 7.4/10 Genting Plantations 1.7/10 Malayan Banking (Maybank) 7.3/10 YTL Power 1.4/10 0 1 2 3 4 5 6 7 8 9 10 RHB Bank 7.1/10 YTL Corporation 0.4/10 MSCI Malaysia Index MSCI Emerging Markets Index MSCI ACWI Index This report is based on the 41 constituents of the MSCI Malaysia ACWI Index as at 11 September AUTHORS 2017. -

YTL Corporation Berhad Annual Report 2019.Pdf

YTL CORPORATION BERHAD BERHAD CORPORATION YTL Our work stands the test of time by turning the right opportunity into the right thing and the right thing into lasting value. YTL is about building value that is not simply 92647-H lasting, but is worthy of lasting. ANNUAL REPORT 2019 Annual Report BUILDING THE RIGHT THING 2019 The Journey Continues... Our work stands the test of time by turning the right opportunity into the right thing and the right thing into lasting value. YTL is about building value that is not simply lasting, but is worthy of lasting. ANNUAL REPORT 2019 BUILDING THE RIGHT THING The Journey Continues... (Company No. 92647-H) CONTENTS CORPORATE REVIEW FINANCIAL STATEMENTS 2 Chairman’s Statement 96 Directors’ Report 6 Management Discussion & Analysis 107 Statement by Directors 44 Managing Sustainability 107 Statutory Declaration 46 Corporate Events 108 Independent Auditors’ Report 56 Notice of Annual General Meeting 117 Income Statements 59 Statement Accompanying Notice of Annual General 118 Statements of Comprehensive Income Meeting 119 Statements of Financial Position 60 Corporate Information 123 Statements of Changes in Equity 61 Profile of the Board of Directors 126 Statements of Cash Flows 66 Profile of Key Senior Management 130 Notes to the Financial Statements 68 Statement of Directors’ Responsibilities • Form of Proxy 69 Audit Committee Report 72 Nominating Committee Statement 76 Corporate Governance Overview Statement 83 Statement on Risk Management & Internal Control 87 Analysis of Shareholdings 89 Statement of Directors’ Interests 92 List of Properties YTL CORPORATION BERHAD Chairman’s Statement YTL Corporation Berhad (“YTL Corp”) and its subsidiaries (“Group”) recorded higher revenue of RM18.05 billion for the financial year ended 30 June 2019 compared to RM15.89 billion last year, whilst profit before tax stood at RM1.04 billion for the financial year under review compared to RM1.34 billion last year. -

ANNUAL REPORT 2019 Our Work Stands the Test of Time By

ANNUAL REPORT 2019 Our work stands the test of time by turning the right opportunity into the right thing and the right thing into lasting value. YTL is about building value that is not simply lasting, but is worthy of lasting. ANNUAL REPORT 2019 BUILDING THE RIGHT THING The Journey Continues... managed by PINTAR PROJEK SDN BHD (314009-W) CONTENTS CORPORATE REVIEW FINANCIAL STATEMENTS 2 Property Portfolio 86 Manager’s Report 22 Financial Highlights 93 Statement by Manager 24 Fund Performance 93 Statutory Declaration 26 Management Discussion & Analysis 94 Trustee’s Report 46 Review of the Property Market 95 Independent Auditors’ Report 54 Managing Sustainability 100 Income Statements 59 Notice of Annual General Meeting 103 Statements of Other Comprehensive Income 60 Corporate Information 104 Statements of Financial Position 61 Profile of the Board of Directors 106 Statements of Changes in Net Asset Value 64 Statement of Directors’ Responsibilities 110 Statements of Cash Flows 65 Audit Committee Report 113 Notes to the Financial Statements 68 Corporate Governance Overview Statement 77 Statement on Risk Management & Internal Control • Form of Proxy 80 Analysis of Unitholdings 83 Statement of Interests of Directors of the Manager YTL HOSPITALITY REIT Property Portfolio OVERVIEW ABOUT YTL HOSPITALITY REIT YTL Hospitality REIT has a market capitalisation of approximately YTL Hospitality REIT was listed on 16 December 2005 on the RM2.30 billion (as at 30 June 2019) with a wide portfolio of prime Main Market of Bursa Malaysia Securities Berhad under the name hotel properties. The hospitality assets range from business to Starhill Real Estate Investment Trust, and consisted of prime retail luxury hotels and are spread across a range of unique locations estate properties within the Golden Triangle of Kuala Lumpur – worldwide. -

The Brand Finance Top 100 Malaysia Brands 2015 November 2015

Malaysia 100 2015The Brand Finance Top 100 Malaysia Brands 2015 November 2015 Brand Finance Malaysia 100 November 2015 1. Foreword Foreword Over the past two decades, Brand Finance has been values available. Each brand has also been given a ranking of Top Malaysian Brands by Brand Finance and dedicated in helping companies track and measure brand rating, which indicates its strength, risk and hope that the market will benefit from the insights and their investments in their intangible asset portfolio. future potential relative to its competitors. information captured in this report. Certain steps can be undertaken to ensure that an I am therefore very excited to announce the annual economic value driven strategy occurs throughout the organization. 1. Accountability – ensure that all invested funds are Technology has enabled consumers to electively accounted for through returns on investment analysis research brands. Savvy brand owners will need to ensure that quality investments are made to grow brand 2. Credibility – ensure that investments are linked to share and presence. David Haigh organizational objectives Chief Executive Officer We have also observed that a number of brand 3. KPI’s setting – Economic returns based marketing Brand Finance plc valuation consultancies produce brand value league ROI becomes extremely critical to assess the success tables using methods that do not stand up to technical of marketing contribution to the bottom line, in hard scrutiny or to the ISO Standards for Brand Valuation. dollar value terms vs. softer qualitative KPIs currently Brand Finance is dedicated to using brand valuation as Brand Finance rankings are the world’s only published measured. -

A Study on Integrated Reporting Initiatives in Malaysia

2019-2937-AJBE 1 A Study on Integrated Reporting Initiatives in Malaysia 2 3 The lack of coherence, transparency and accountability in traditional financial 4 reporting, led the International Integrated Reporting Council (IIRC) to developed 5 Integrated Reporting (IR) in 2010. This study draws the attention towards the top 50 6 public listed companies listed in Malaysian Stock Exchange as per asset size, and 7 their fulfilment towards voluntary IR disclosures. To achieve this research objective, 8 the extent of disclosures was examined using published annual reports, in accordance 9 to the fulfilment of ISO26000, GRI G4 Guidelines and IR Framework. 10 The findings reveal that although there were traces of the fulfilment of all 11 requirements with regard to ISO 26000, which was 32% and GRI and IR was 12% 12 respectively, there were much to be done to encourage PLCs to incorporate such 13 reporting guidelines. It was also found that, government-linked companies have 14 greater fulfilment of these requirements. 15 16 Keywords: Integrated Reporting, ISO26000, GRI G4, IR Framework. 17 18 19 Introduction 20 21 The global financial and governance crises as well as the environment 22 business changes had increased the stakeholders demand for transparency and 23 accountability reporting on the companies (Abeysekera, 2013; Krzus, 2011; 24 Flack and Douglas, 2007). In fact, traditional financial reporting model shows 25 lack of coherence to long-term objectives set by organisations, and little 26 connection between the activities undertaken by organisations. This results in 27 the event that organisations‟ activities are often being presented in separate 28 reports such as annual reports and sustainability reports (Abeysekera, 2013).