A Study on Integrated Reporting Initiatives in Malaysia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Malaysian Invited Companies Company Name Country Robecosam Industry AMMB Holdings Bhd Malaysia BNK Banks Astro Malaysia Holdings

Malaysian invited companies Company_Name Country RobecoSAM_Industry AMMB Holdings Bhd Malaysia BNK Banks Astro Malaysia Holdings Bhd Malaysia PUB Media Axiata Group Bhd Malaysia TLS Telecommunication Services Batu Kawan Bhd Malaysia CHM Chemicals British American Tobacco Malaysia Bhd Malaysia TOB Tobacco Bumi Armada Bhd Malaysia OIE Energy Equipment & Services CIMB Group Holdings Bhd Malaysia BNK Banks Dialog Group Bhd Malaysia CON Construction & Engineering Digi.com Bhd Malaysia TLS Telecommunication Services Felda Global Ventures Holdings Bhd Malaysia FOA Food Products Gamuda Bhd Malaysia CON Construction & Engineering Genting Bhd Malaysia CNO Casinos & Gaming Genting Malaysia Bhd Malaysia CNO Casinos & Gaming Hong Leong Bank Bhd Malaysia BNK Banks Hong Leong Financial Group Bhd Malaysia BNK Banks IHH Healthcare Bhd Malaysia HEA Health Care Providers & Services IJM Corp Bhd Malaysia CON Construction & Engineering IOI Corp Bhd Malaysia FOA Food Products IOI Properties Group Bhd Malaysia REA Real Estate Kuala Lumpur Kepong Bhd Malaysia FOA Food Products Lafarge Malaysia Bhd Malaysia COM Construction Materials Malayan Banking Bhd Malaysia BNK Banks Malaysia Airports Holdings Bhd Malaysia TRA Transportation and Transportation Infrastructure Maxis Bhd Malaysia TLS Telecommunication Services MISC Bhd Malaysia TRA Transportation and Transportation Infrastructure Nestle Malaysia Bhd Malaysia FOA Food Products Petronas Chemicals Group Bhd Malaysia CHM Chemicals Petronas Dagangan BHD Malaysia OIX Oil & Gas Petronas Gas BHD Malaysia GAS Gas Utilities -

Financial Hegemony, Diversification Strategies and the Firm Value of Top 30 FTSE Companies in Malaysia

Asian Social Science; Vol. 12, No. 3; 2016 ISSN 1911-2017 E-ISSN 1911-2025 Published by Canadian Center of Science and Education Financial Hegemony, Diversification Strategies and the Firm Value of Top 30 FTSE Companies in Malaysia Wan Sallha Yusoff1, Mohd Fairuz Md. Salleh2, Azlina Ahmad2 & Norida Basnan2 1 School of Business Innovation and Technopreneurship, Universiti Malaysia Perlis, Malaysia 2 School of Accounting, Faculty of Economics and Management, Universiti Kebangsaan Malaysia, Malaysia Correspondence: Wan Sallha Yusoff, School of Business Innovation and Technopreneurship, Universiti Malaysia Perlis, Malaysia. E-mail: [email protected] Received: August 8, 2015 Accepted: January 18, 2016 Online Published: February 23, 2016 doi:10.5539/ass.v12n3p14 URL: http://dx.doi.org/10.5539/ass.v12n3p14 Abstract This study investigates the relationships between financial hegemony groups, global diversification strategies and firm value of the Malaysia’s 30 largest companies listed in FTSE Bursa Malaysia Index Series during 2009 to 2012 period. We chose Malaysia as an ideal setting because the findings contribute to the phenomenon of the diversification–performance relationship in the Southeast Asian countries. We apply hegemony stability theory to explain the importance of financial hegemony groups in deciding international locations for operations. By using panel data analysis, we find that financial hegemony groups are significantly important in international location decisions. Results reveal that the stability of financial hegemony in BRICS and G7 groups enhances the financial value of the Malaysia’s 30 largest companies, whereas the stability of financial hegemony in ASEAN groups is able to enhance the non-financial value of the firms. -

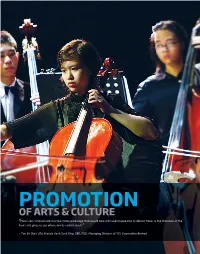

PROMOTION of ARTS & CULTURE ”Music Can Communicate in a Few Notes a Message That Would Take a Thousand Speeches to Deliver

PROMOTION OF ARTS & CULTURE ”Music can communicate in a few notes a message that would take a thousand speeches to deliver. Music is the literature of the heart and gives us joy where words cannot reach.” – Tan Sri Dato’ (Dr) Francis Yeoh Sock Ping, CBE, FICE, Managing Director of YTL Corporation Berhad 56 YTL CORPORATION BERHAD CORPORATE EVENTS 20 OCT 2016 UNVEILING OF NEW KLIA TRANSIT TRAINS Express Rail Link Sdn Bhd, a 45% associate of YTL Corporation Berhad, unveiled its new KLIA Transit train at its depot in Salak Tinggi, officiated by Malaysia’s Minister of Transport, YB Dato’ Sri Liow Tiong Lai. The six new train- sets, manufactured by CRRC Changchun Railway Vehicles Company Limited, will increase total service capacity by fifty percent. From left to right, Tan Sri Dato’ Seri (Dr) Yeoh Tiong Lay, Executive Chairman of YTL Corporation Berhad; YB Dato’ Sri Liow Tiong Lai, Minister of Transport; YB Datuk Ab Aziz Kaprawi, Deputy Minister of Transport; Tan Sri Mohd Nadzmi Mohd Salleh, Executive Chairman of Express Rail Link Sdn Bhd; and Puan Noormah Mohd Noor, Chief Executive Officer of Express Rail Link Sdn Bhd. 27 OCT 2016 ISETAN’S 1ST INTERNATIONAL FLAGSHIP JAPAN STORE OPENS IN LOT 10 SHOPPING CENTRE Isetan Mitsukoshi Holdings Ltd, Japan’s largest department store group, launched its first flagship Japan Store outside of Tokyo in Lot 10 Shopping Centre. Based on the ‘Cool Japan’ concept and occupying the store’s six floors, with a total floor area of about 11,000 square meters, the store features a range of high-quality and designer products from around Japan. -

ESG Ratings of Plcs Assessed by FTSE Russell# in Accordance with FTSE Russell ESG Ratings Methodology

ESG Ratings of PLCs assessed by FTSE Russell# in accordance with FTSE Russell ESG Ratings Methodology Definition Top 25% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Top 26-50% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Top 51%- 75% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Bottom 25% by ESG Ratings amongst PLCs in FBM EMAS that have been assessed by FTSE Russell Stock Company Name Sector F4GBM ESG Grading Code (sorted By Alphabetical) Index Band 6599 AEON CO. (M) BHD CONSUMER PRODUCTS & SERVICES ** 5139 AEON CREDIT SERVICE (M) BHD FINANCIAL SERVICES Yes *** 7078 AHMAD ZAKI RESOURCES BHD CONSTRUCTION *** 5099 AIRASIA GROUP BERHAD CONSUMER PRODUCTS & SERVICES *** 5238 AIRASIA X BERHAD CONSUMER PRODUCTS & SERVICES ** 2658 AJINOMOTO (M) BHD CONSUMER PRODUCTS & SERVICES Yes *** 2488 ALLIANCE BANK MALAYSIA BERHAD FINANCIAL SERVICES Yes *** 5293 AME ELITE CONSORTIUM BERHAD CONSTRUCTION * 1015 AMMB HOLDINGS BHD FINANCIAL SERVICES Yes **** 6556 ANN JOO RESOURCES BHD INDUSTRIAL PRODUCTS & SERVICES * 6399 ASTRO MALAYSIA HOLDINGS BERHAD TELECOMMUNICATIONS & MEDIA Yes **** 6888 AXIATA GROUP BERHAD TELECOMMUNICATIONS & MEDIA Yes *** 5106 AXIS REITS REAL ESTATE INVESTMENT TRUSTS ** 3395 BERJAYA CORPORATION BHD INDUSTRIAL PRODUCTS & SERVICES ** 1562 BERJAYA SPORTS TOTO BHD CONSUMER PRODUCTS & SERVICES ** 5248 BERMAZ AUTO BERHAD CONSUMER PRODUCTS & SERVICES Yes **** 2771 BOUSTEAD HOLDINGS BHD INDUSTRIAL PRODUCTS & SERVICES ** 4162 BRITISH AMERICAN -

ASEAN Asset Class Publicly Listed Companies 2019 (Score 97.50 Points and Above - by Alphabetical Order)

ASEAN Asset Class Publicly Listed Companies 2019 (score 97.50 points and above - by alphabetical order) NAME OF PUBLICLY LISTED COMPANY COUNTRY 1 2GO GROUP, INC. Philippines 2 ADVANCE INFO SERVICE PUBLIC COMPANY LIMITED Thailand 3 AIRPORTS OF THAILAND PUBLIC COMPANY LIMITED Thailand 4 ALLIANCE BANK MALAYSIA BHD Malaysia 5 ALLIANZ MALAYSIA BHD Malaysia 6 AMATA CORPORATION PUBLIC COMPANY LIMITED Thailand 7 AMMB HOLDINGS BHD Malaysia 8 ASTRO MALAYSIA HOLDINGS BERHAD Malaysia 9 AXIATA GROUP BERHAD Malaysia 10 AYALA CORPORATION Philippines 11 AYALA LAND, INC. Philippines 12 BANGCHAK CORPORATION PUBLIC COMPANY LIMITED Thailand 13 BANGKOK AVIATION FUEL SERVICES PUBLIC COMPANY LIMITED Thailand 14 BANK OF AYUDHYA PUBLIC COMPANY LIMITED Thailand 15 BANK OF THE PHILIPPINE ISLANDS Philippines 16 BDO UNIBANK, INC. Philippines 17 BELLE CORPORATION Philippines 18 BIMB HOLDINGS BHD Malaysia 19 BRITISH AMERICAN TOBACCO (MALAYSIA) BHD Malaysia 20 BURSA MALAYSIA BHD Malaysia 21 CAHYA MATA SARAWAK BHD Malaysia 22 CAPITALAND LIMITED Singapore 23 CENTRAL PATTANA PUBLIC COMPANY LIMITED Thailand 24 CHAROEN POKPHAND FOODS PUBLIC COMPANY LIMITED Thailand 25 CHINA BANKING CORPORATION Philippines 26 CIMB GROUP HOLDINGS BHD Malaysia 27 CITY DEVELOPMENTS LIMITED Singapore 28 COL PUBLIC COMPANY LIMITED Thailand 29 COMFORTDELGRO CORP LIMITED Singapore 30 DBS GROUP HOLDINGS LTD Singapore NAME OF PUBLICLY LISTED COMPANY COUNTRY 31 DIGI.COM BHD Malaysia 32 DMCI HOLDINGS, INC. Philippines 33 EASTERN WATER RESOURCES DEVELOPMENT AND MANAGEMENT PCL. Thailand 34 ELECTRICITY GENERATING PUBLIC COMPANY LIMITED Thailand 35 FAR EAST ORCHARD LIMITED Singapore 36 FRASER AND NEAVE LIMITED Singapore 37 FRASERS PROPERTY LIMITED Singapore 38 GLOBAL POWER SYNERGY PUBLIC COMPANY LIMITED Thailand 39 GLOBE TELECOM, INC. -

Lesser Government in Business: an Unfulfilled Promise? by Wan Saiful Wan Jan Policy Brief NO

Brief IDEAS No.2 April 2016 Lesser Government in Business: An Unfulfilled Promise? By Wan Saiful Wan Jan Policy Brief NO. 2 Executive Summary Introduction This paper briefly outlines the promise made by Reducing the Government’s role in business has the Malaysian Government to reduce its role in been on Prime Minister Dato’ Sri Najib Tun business as stated in the Economic Transformation Razak’s agenda since March 2010, when he Programme (ETP). It presents a general argument launched the New Economic Model (NEM). The of why the Government should not be involved NEM called for a reduction in Government in business. It then examines the progress intervention in the economy and an increase made by the Government to reduce its role in economic liberalisation efforts. The NEM in business through data showing Government furthermore, acknowledged that private sector divestments in several listed companies. growth in Malaysia has been hampered by “heavy Government and GLC presence” and This paper then demonstrates how this progress is offset by two factors – (i) the increased shares of Government-Linked Companies that there is a serious need to “reduce direct (GLCs) in the Kuala Lumpur Composite Index (KLCI) and (ii) the state participation in the economy” (National higher amount of combined GLC and GLIC asset acquisitions as opposed to asset disposals. This paper concludes with the argument Economic Advisory Council (NEAC), 2009). that the Government has not fulfilled its promise but in fact, has done the exact opposite. The increased shares of Government- 01 Linked Companies (GLCs) in the Kuala Author Two Factors Lumpur Composite Index (KLCI). -

Ac 2021 61.Pdf

Accounting 7 (2021) 1033–1048 Contents lists available at GrowingScience Accounting homepage: www.GrowingScience.com/ac/ac.html Can investors benefit from corporate social responsibility and portfolio model during the Covid19 pandemic? Ternence T. J. Tana* and Baliira Kalyebarab aFaculty of Business, Economics and Social Development, University of Malaysia Terengganu, Kuala Nerus, Terengganu, Malaysia bDepartment of Accounting and Finance, School of Business, American University of Ras Al Khaimah, United Arab Emirates C H R O N I C L E A B S T R A C T Article history: Since late 2019 and throughout 2020, the global economy has been experiencing difficult times due Received: November 15, 2020 to the outbreak of the lethal Coronavirus (COVID-19). This study looks at the financial impact of Received in revised format: this epidemic on the global economy using Malaysian market index i.e., FTSE Bursa Malaysia KLCI January 28 2021 before and during COVID-19. Measuring the financial impact of this epidemic on the Malaysia Accepted: March 2, 2021 Available online: economy may help policy makers to develop measures to avert similar financial catastrophic impacts March 2, 2021 on the global economy. The study uses Sharpe optimal and naïve diversification model to solve a scenario that factors in the level of corporate social responsibility (CSR) exhibited before and during Keywords: Corporate Social Responsibility the epidemic to measure the financial impact on the stock portfolio. The results show that the Naïve Diversification emergence of COVID-19exacerbated the already weak Malaysian economy. Our findings may help Optimal Portfolio the policy makers in Malaysia to develop and maintain techniques and policies that may mitigate the Sharpe Ratio negative financial impact and handle similar epidemics in the future. -

Stay Defensive on Expectation of More Pressure on Stocks

Headline Stay defensive on expectation of more pressure on stocks MediaTitle The Edge Date 04 May 2020 Language English Circulation 25,910 Readership 77,730 Section Corporate Page No 22,23 ArticleSize 1300 cm² Journalist N/A PR Value RM 67,149 Stay defensive on expectation of more pressure on stocks T*P hpnrhmark index FTSE Bursa Malaysia KLCI has rebounded since March 19, but analysts say there could ^sSnoS^Shrust. With the uncertainty over Covid-19 and how the worlds economy, respond post- pandemic, what should investors do when it comes to investing in the local stock market. BY KAMARUL AZHAR t has been a tumultuous four months for Malaysian equities, and analysts warn of further volatility ahead as a possible recession looms, caused by the Move- ment Control Order (MCO) and cautious consumer sentiment. Investors are ad- vised to stay defensive and invest in stocks that have defensive earnings qualities and strong fundamentals. Imran Yusof, senior analyst at MIDF Research,believes the FBM KLCI will face some downward pressure, given that sen- timent is likely to be hit by weak econom- ic data and corporate earnings, which are scheduled for release in the next couple of months following nearly two months of economic stagnation. "Therefore, there might be another downward thrust in the direction of the FBM KLCI. In addition, a bear market gen- erally follows a three-wave pattern, where- by the downward thrust (which we saw in March) would normally be interrupted by -19) at a department store in Seoul, South Korea April 30, 2020. an intermittent rebound and subsequent- People wear masks to avoid the spread of the coronavirus disease (COVID ly followed by another downward thrust," Imran tells The Edge via email. -

Malaysia Overall Domestic and Inbound Deal Activity Has Declined, Although Outbound Activity Remains Buoyant

Malaysia Overall domestic and inbound deal activity has declined, although outbound activity remains buoyant. Prospects for 2009 are cautiously optimistic weather the current financial turmoil with Malaysia’s substantial foreign reserves amounting to US$93 billion as at 15 December, which is sufficient to finance 7.8 months of retained imports and 3.4 times current short term debt. In politics, Malaysia’s Deputy Prime Minster, Datuk Seri Najib Razak is expected to replace Datuk Seri Abdullah Badawi as the next Prime Minister in March 2009. The proposed timeline is intended to pave the way for a smooth transition of leaders. Paran Puvanesan Corporate Finance Leader Malaysia Deal Activity Malaysia Deal Activity Current Environment Deal values Deal volume 16,000 After registering a strong rate of growth of 7.1% in the first 300 14,000 half of 2008, Malaysia’s economy is expected to have 250 12,000 expanded at a slower rate in the second half, in light of the 200 10,000 global financial crisis and a slowdown in the manufacturing, export and tourism sectors. Latest figures for third quarter 8,000 150 US$ million 6,000 No. of deals growth were 4.7% p.a., while full year growth is estimated 100 4,000 to have been 5.0%. 50 2,000 Despite the global financial crisis, domestic demand is - - projected to continue to grow, with contributions mainly 1Q2007 2Q2007 3Q2007 4Q2007 1Q2008 2Q2008 3Q2008 4Q2008 from the services sector, private and public consumption Source: Thomson Reuters, based on total domestic, inbound and outbound deals announced as and investment. -

Corporate Governance Monitor 2020

Securities Commission Malaysia 3 Persiaran Bukit Kiara Bukit Kiara 50490 Kuala Lumpur Malaysia Corporate Governance Monitor 2020 Tel: + 603 6204 8000 www.sc.com.my www.investsmartsc.my Twitter: @SecComMy CORPORATE GOVERNANCE MONITOR 2020 Securities Commission Malaysia 3 Persiaran Bukit Kiara Bukit Kiara 50490 Kuala Lumpur Tel: +603–6204 8000 Fax: +603–6201 5078 Website: www.sc.com.my COPYRIGHT © 2020 Securities Commission Malaysia All rights reserved. No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted in any form or by any means (graphical, electronic, mechanical, photocopying, recording, taping or otherwise), without the prior written permission of the Securities Commission Malaysia. DISCLAIMER This book aims to provide a general understanding of the subject and is not an exhaustive write-up. It is not intended to be a substitute for legal advice and nor does it disminish any duty (statutory or otherwise) that may be applicable to any person under existing laws. Published in October 2020. ii CORPORATE GOVERNANCE MONITOR 2020 CONTENTS Executive Summary 1 Key Highlights 4 Adoption of the Malaysian Code on Corporate Governance 6 Quality of Disclosure 18 Thematic Review 1: Conduct of Fully Virtual General Meetings 24 – A New Normal Thematic Review 2: Two-Tier Voting – Outcomes and Observations 31 Thematic Review 3: Board Remuneration – Design, Deliver, Disclose 34 Appendices 42 Glossary 51 CORPORATE GOVERNANCE MONITOR 2020 iii This page is intentionally left blank. iv CORPORATE GOVERNANCE MONITOR 2020 EXECUTIVE SUMMARY The release of the Corporate Governance Monitor 2020 (CG Monitor 2020) takes place at a time when countries across the globe are facing the COVID-19 pandemic, that has changed the normal course of life and tested the resilience of people and businesses. -

Download the 2018 Annual Report

ANNUAL REPORT 2018 FUTURE FOCUSED Sime Darby Berhad Annual Report 2018 FUTURE FOCUSED At Sime Darby Berhad, we are setting the stage for an exciting future. Our core trading businesses have growing footprints across the Asia Pacific growth region. Leaner and more agile, we are able to take advantage of new opportunities in key sectors and explore innovative technologies as potential new revenue streams. To support our strategy, we will continue to focus on operational excellence, growth acceleration and work towards rationalising our non-core businesses. The end goal is to be the leading motors and industrial player in Asia Pacific. With proven trading and services business models, balanced portfolio exposure and long-standing partnerships with established brands, we are well positioned to leverage on the region’s growth and rising affluence. To be the leading Motors and Industrial player in Asia Pacific. OUR VISION & MISSION We are committed to developing a winning portfolio of sustainable businesses. We subscribe to good corporate governance and high ethical values. We continuously strive to deliver superior financial returns through operational excellence and high performance standards. We provide an environment for our people to realise their full potential. OUR CORE VALUES Integrity Respect & Responsibility Uphold high levels of Respect for the individuals personal and professional we interact with and the values in all our business environment that we interactions and decisions. operate in (internally and externally) and committing to being responsible in all our actions. Excellence Enterprise Stretch the horizons of Seek and seize opportunities growth for ourselves and with speed and agility, our business through our challenging set boundaries. -

English Version

CONTENTS Page GROUP MANAGING DIRECTOR‟S STATEMENT 3 FUND PROFILE 4 GLOBAL AND LOCAL ECONOMIC REVIEW 8 EQUITY AND FIXED INCOME MARKET REVIEW 10 MARKET OUTLOOK AND INVESTMENT STRATEGY 12 FUND PERFORMANCE REPORT 14 SOFT COMMISSION RECEIVED FROM BROKERS 28 STATEMENT BY DIRECTORS 29 REPORT OF THE AUDITORS 30 STATEMENTS OF ASSETS AND LIABILITIES AS AT 31 DECEMBER 2011 32 STATEMENTS OF ASSETS AND LIABILITIES AS AT 31 DECEMBER 2010 33 STATEMENTS OF INCOME AND EXPENDITURE FOR FINANCIAL YEAR ENDED 34 31 DECEMBER 2011 STATEMENTS OF INCOME AND EXPENDITURE FOR FINANCIAL PERIOD ENDED 35 31 DECEMBER 2010 STATEMENTS OF CHANGES IN NET ASSET VALUE FOR FINANCIAL YEAR ENDED 36 31 DECEMBER 2011 STATEMENTS OF CHANGES IN NET ASSET VALUE FOR FINANCIAL PERIOD 36 ENDED 31 DECEMBER 2010 CASH FLOW STATEMENT FOR FINANCIAL YEAR ENDED 31 DECEMBER 2011 37 CASH FLOW STATEMENT FOR FINANCIAL PERIOD ENDED 31 DECEMBER 2010 38 NOTES TO THE FINANCIAL STATEMENTS 39 DETAILS OF INVESTMENTS 43 COMPARATIVE PERFORMANCE TABLE 53 P a g e | 2 GROUP MANAGING DIRECTOR’S STATEMENT In the Name of Allah, the Most Compassionate, the Most Merciful It is my great pleasure to present the 2011 Annual Report of Takaful Malaysia‟s Investment-Linked Funds consisting of the Ittizan (Balanced Fund), Istiqrar (Stable Capital Fund), Ihfaz Equity Index Fund, Ittihad Growth Fund, Istifad Blue Chips Fund, Irad Dividend Fund and Ihsan Balanced Fund for the year ended 31 December 2011. The year 2011 was a challenging year for the world economy as the United States (USA) suffered weaker than expected economic performance, Japan was hit by a devastating earthquake and Europe‟s sovereign debt crisis deepened.