Interim Meeting Minutes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mid-Year Report on State Legislative Activity

The goal of the traffic safety community remains unchanged each year: eliminate all fatalities on our roadways. Regardless of individual areas of focus, each organization and agency that operates within the highway safety sphere seeks to decrease the number of lives lost each year to preventable crashes. The ultimate goal of reaching zero lives lost in motor vehicle crashes continues to motivate advocates, practitioners, and legislators alike to take action. At the start of every new year, policy and programmatic solutions are put forth to target the road user behaviors that lead to fatal and serious injury crashes. After two years of increases in the number of individuals killed on our nation’s roadways there has finally been a marginal decline. According to the National Highway Traffic Safety Administration (NHTSA), 37,133 individuals were killed in motor vehicle crashes in 2017. This represents a 1.8% decrease from 2016. An examination of factors involved in fatal crashes reveals that avoidable behaviors such as alcohol-impaired driving, drug-impaired driving, speeding, distracted driving, and drowsy driving continue to contribute to motor vehicle collisions. For these reasons, it is crucial that we continue to focus prevention, education, and enforcement efforts on addressing impaired driving in all of its forms. Alcohol-impaired driving fatalities accounted for 29% of all motor vehicle fatalities, the lowest percentage since NHTSA began reporting national fatality data in 1982. This represents a 1.1% reduction in fatalities from 2016. While the decrease in fatalities represents progress, more work must be done, particularly when it comes to addressing the threat posed by high-risk impaired drivers (i.e., individuals who drive at high blood alcohol concentrations (.15>), drive impaired repeatedly, or drive after consuming a combination of alcohol and drugs or multiple drugs). -

MCF CONTRIBUTIONS JULY 1 - DECEMBER 31, 2016 Name State Candidate Amount U.S

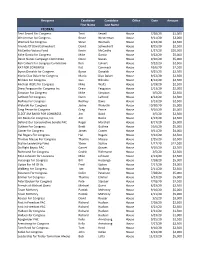

MCF CONTRIBUTIONS JULY 1 - DECEMBER 31, 2016 Name State Candidate Amount U.S. House Robert Aderholt for Congress AL Rep. Robert Aderholt $2,000 ALABAMA TOTAL U.S. House Crawford for Congress AR Rep. Rick Crawford $1,500 Womack for Cogress Committee AR Rep. Stephen Womack $500 ARKANSAS TOTAL U.S. House Kyrsten Sinema for Congress AZ Rep. Kyrtsen Sinema $500 ARIZONA TOTAL U.S. House Denham for Congress CA Rep. Jeff Denham $1,500 Garamendi for Congress CA Rep. John Garamendi $500 Kevin McCarthy for Congress CA Rep. Kevin McCarthy $1,000 Valadao for Congress CA Rep. David Valadao $1,500 U.S. House Leadership Majority Committee PAC--Mc PAC CA Rep. Kevin McCarthy $5,000 State Assembly Adam Gray for Assembly 2016 CA Assm. Adam Gray $1,500 Catharine Baker for Assembly 2016 CA Assm. Catharine Baker $2,500 Cecilia Aguiar-Curry for Assembly 2016 CA Assm. Cecilia Aguiar-Curry $2,000 Chad Mayes for Assembly 2016 CA Assm. Chad Mayes $2,000 James Gallagher for Assembly 2016 CA Assm. James Gallagher $1,500 Patterson for Assembly 2016 CA Assm. James Patterson $2,000 Jay Obernolte for Assembly 2016 CA Assm. Jay Obernolte $1,500 Jim Cooper for Assembly 2016 CA Assm. Jim Cooper $1,500 Jimmy Gomez for Assembly 2016 CA Assm. Jimmy Gomez $1,500 Dr. Joaquin Arambola for Assembly 2016 CA Assm. Joaquin Arambula $1,500 Ken Cooley for Assembly 2016 CA Assm. Ken Cooley $1,500 Miguel Santiago for Assembly 2016 CA Assm. Miguel Santiago $1,500 Rudy Salas for Assembly 2016 CA Assm. -

Citizen Initiatives Teacher Training Gas Taxes

DEFENDING AGAINST SECURITY BREACHES PAGE 5 March 2015 Citizen Initiatives Teacher Training Gas Taxes AmericA’s innovAtors believe in nuclear energy’s future. DR. LESLIE DEWAN technology innovAtor Forbes 30 under 30 I’m developing innovative technology that takes used nuclear fuel and generates electricity to power our future and protect the environment. America’s innovators are discovering advanced nuclear energy supplies nearly one-fifth nuclear energy technologies to smartly and of our electricity. in a recent poll, 85% of safely meet our growing electricity needs Americans believe nuclear energy should play while preventing greenhouse gases. the same or greater future role. bill gates and Jose reyes are also advancing nuclear energy options that are scalable and incorporate new safety approaches. these designs will power future generations and solve global challenges, such as water desalination. Get the facts at nei.org/future #futureofenergy CLIENT: NEI (Nuclear Energy Institute) PUB: State Legislatures Magazine RUN DATE: February SIZE: 7.5” x 9.875” Full Page VER.: Future/Leslie - Full Page Ad 4CP: Executive Director MARCH 2015 VOL. 41 NO. 3 | CONTENTS William T. Pound Director of Communications Karen Hansen Editor Julie Lays STATE LEGISLATURES Contributing Editors Jane Carroll Andrade Mary Winter NCSL’s national magazine of policy and politics Web Editors Edward P. Smith Mark Wolf Copy Editor Leann Stelzer Advertising Sales FEATURES DEPARTMENTS Manager LeAnn Hoff (303) 364-7700 Contributors 14 A LACK OF INITIATIVE 4 SHORT TAKES ON -

~""'->" class="text-overflow-clamp2"> H~,Iassi.. ".'~ }:;Ei:U;Ii"1>~""'->

11.. _II!III'Il!!IB'!!77,,="I:7r=m·!=== ..... ~ _. • • communi ty 16 I Griggs County Courier October 26, 2018 LEGAL NOTICES October s, 2018 24513 John Deere Financial 514.64 COMMISSIONERS PROCEEDINGS 24514 Kelly Printing Supplies The Board of County 122.95 Commissioners met in regular 24515 Samantha M Larson 72.00 session on Friday, October 5.2018 24516 NAACTFOTreasurer 75.00 at 1:00 pm. 24517 Napa Auto Parts 53.47 Chairman Olson opened the 24518 NO Attorney General 465.00 meeting and asked everyone to 24519 NDACO 445.61 stand for the Pledge of Allegiance. 24520 NDLTAP/UGPTI25.00 Chairman Olson took roll call 24521 NO Secretary of State and present were Commissioners 1005.98 Wakefield, Pedersen, Urness, 24522 NetCenter Supply 285.80 Steffen, and Olso n. Also present 24523 New Century Press 76.11 were Road Superintendent/911 24524 Ottertail Power Co 1206.11 Coordinator Oien, Treasurer 24525 ROOEquipment Co 2449.12 Eslinger, Clerk of Court Vincent, 24526 Reiten Inc 50.46 Extension AgentVig, & Tax Director 24527 State Treasurer 1643.45 Lunde. 24528 T and K Sales 2678.49 Chairman Olson opened 24529 Verizon Wireless 289.66 the floor for any changes to the 24530 Madison Wallace 72.00 agenda. Motion by Pedersen to 24531-24541 CWB 36547.1 0 accept the age nda as prese nted, 24542-24543 Cities/Townships second by Steffen and called fo r 7975.23 discussion three times with all 24554-24556 Schools 7472.27 ayes, no nays, and carried. 24557 Com Medical Center Hosp Chairman Olson opened the Dist 612.20 Please join us in voting for Kevin Cramer for U.S. -

House of Rep Daily Journal

Page 2285 1st DAY TUESDAY, AUGUST 2, 2016 2285 JOURNAL OF THE HOUSE - SPECIAL SESSION Sixty-fourth Legislative Assembly * * * * * Bismarck, August 2, 2016 The House convened at 9:00 a.m., with Speaker Belter presiding. The prayer was offered by Prayer by Reverend Rich Wyatt, Living Hope Church of the Nazarene. The roll was called and all members were present except Representatives Glassheim, Holman, Skarphol, and Wallman. A quorum was declared by the Speaker. OATH OF OFFICE CHIEF JUSTICE GERALD W. VANDEWALLE ADMINISTERED the Oath of Office to newly appointed Representative Greg Westlind. COMMUNICATION FROM SECRETARY OF STATE AL JAEGER I hereby certify that I have attached a true and correct copy of Executive Order 2016-03, executed by Governor Jack Dalrymple on July 13, 2016, in which he convenes the North Dakota Legislative Assembly into special session on Tuesday, August 2, 2016, at 9:00 a.m. I hereby certify that I have attached a true and correct listing of Representatives who were issued Certificates of Election by the State Canvassing Board prior to the beginning of their respective terms of office and who continue to serve, as of this date, in the legislative district to which they were elected. I hereby certify that on July 25, 2016, I issued a Certificate of Appointment to Greg Westlind for the House vacancy in Legislative District No. 15, executed according to Section 16.1-13- 10 of the North Dakota Century Code and whose name is included on the attached list. IN TESTIMONY WHEREOF, I have set my hand and affixed the Great Seal of the State of North Dakota at the Capitol in the City of Bismarck on this date. -

2021 FPA-ND Legislative Scorecard

2021 NORTH DAKOTA LEGISLATIVE REPORT CARD 67th LEGISLATIVE SESSION ABOUT THE SCORECARD We are pleased to share this scorecard for the 2021 North Dakota state legislative session. This is a snapshot of how lawmakers voted on key social and moral legislation related to life, education, family, religious freedom, and similar issues. Guided by our mission of building a state where God is honored, religious freedom flourishes, families thrive, and life is cherished, the scorecard focuses on seven bills. This scorecard is not an endorsement of any candidate or political party. It does not measure any lawmakers’ integrity, commitment to their faith, work ethic, or rapport with Family Policy Alliance of North Dakota. It is only a report on how each lawmaker voted. Please continue to hold our legislators accountable for their voting records and please pray that they may always vote in ways that uphold your biblical values as they make important decisions for our state. Sincerely, Mark Jorritsma Executive Director, Family Policy Alliance of North Dakota HOW WE FIGURED THE GRADES A bill is typically passed by a simple majority in the Senate (24 votes out of 47 senators) and the House (48 votes out of 94 Representatives.) Lawmakers earned percentage grades ranging from 0% to 100%, based upon dividing the candidate’s number of good votes cast by the number of total bills he/she voted on. The higher the score, the better their ranking. Not all lawmakers voted on every bill; the number of absences on these key bills is also noted and we encourage you to review whether your legislator actually voted on these important bills. -

2018 Election Re-Cap, What's It All Mean?

2018 Election Re-Cap, What’s it all mean? Western Dakota Energy Association November 8, 2018 Shane Goettle North Dakota – 2018 General Election • VOTER TURNOUT 329,086 • ELIGIBLE VOTERS 579,621 • PERCENT 56.78% North Dakota – 2018 General Election Big Take-away News -- Republicans Swept All Statewide Offices -- All Republican Congressional Delegation (not since 1950s) -- Democrats gained 1 seat in State Senate -- Democrats gained 2 seats in State House -- Measure 1 passed (Transparency of funding sources, lobbyists, conflicts of interest, and establishment of ethics commission) -- Measure 3 failed (No recreational marijuana) Federal Races U.S. Senate Race (6 year term) • Kevin Cramer (R) 55.10% • Heidi Heitkamp (D) 44.27% • 324,648 total votes (highest vote total for all statewide offices) • Heitkamp won 12 counties, Cramer the rest • Heitkamp won Sioux, Rolette, Benson, Nelson, Grand Forks, Steel, Trail, Barnes, Cass, Ranson, Sargent and Richland Counties. U.S. Senate Race U.S. House Race ( 2 year term) • Kelly Armstrong (R) 60.20% • Mac Schneider (D) 35.57% • Charles Tuttle (I) 4.06% • Schneider won 6 counties, Armstrong the rest • Schneider won Sioux, Rolette, Benson, Grand Forks, Steel, Cass and Ransom • 320,148 total votes U.S. House Race Executive Branch North Dakota Republicans swept all of the state executive branch offices, returning Republican incumbents to the Capitol in every race that was on the ballot. Secretary of State (4 year term) • Al Jaeger (I) 47.27% • Josh Boschee (D) 39.22% • Michael Coachman (I) 13.20% • 305,918 -

Directory Governor Doug Burgum North Dakota Legislative Hotline: Lt Governor Brent Sanford for 1-888-635-3447 Attorney General Wayne Stenehjem

North Dakota Elected Officials Reach Your Legislators Directory Governor Doug Burgum North Dakota Legislative Hotline: Lt Governor Brent Sanford for 1-888-635-3447 Attorney General Wayne Stenehjem Secretary of Al Jaeger Bismarck Area: 328-3373 State Legislative Web Site: Treasurer Kelly Schmidt www.legis.nd.gov 66th North Dakota Auditor Josh Gallion Legislative Assembly and Superintendent Kirsten Baesler of Public Join the North Dakota Catholic Elected Officials Instruction Conference Legislative Action Agricultural Doug Goehring Network Commissioner Sign-up at: ndcatholic.org/ Insurance Jon Godfread registration/ Commissioner Or contact the North Dakota Tax Ryan Rauschenberger Catholic Conference at: Commissioner (701) 223-2519 Public Service Brian Kroshus Commissioners Julie Fedorchak 1-888-419-1237 Randy Christmann [email protected] North Dakota Catholic Conference 103 South Third Street, No. 10 Bismarck, North Dakota 58501 U.S. Senator John Hoeven Christopher T. Dodson U.S. Senator Kevin Cramer Follow Us Executive Director U.S. Kelly Armstrong Representative (701) 223-2519 1-888-419-1237 Get contact information for all [email protected] state officials at nd.gov. www.facebook.com/ndcatholic ndcatholic.org Senate House of Representatives Howard C. Anderson, [email protected] 8 Patrick Hatlestad [email protected] 1 Dwight Kiefert [email protected] 24 JoNell A. Bakke [email protected] 43 David Richter [email protected] 1 Alisa Mitskog [email protected] 25 Brad Bekkedahl [email protected] 1 Bert Anderson [email protected] 2 Cynthia Schreiber-Beck [email protected] 25 Randy Burckhard [email protected] 5 Donald W. Longmuir [email protected] 2 Sebastian Ertelt [email protected] 26 David A. -

Nextera Energy PAC 2018 Contributions to State Candidates

NextEra Energy PAC 2018 Contributions to State Candidates Recipient 2018 Amount Chamber State Party Gretchen Whitmer for Governor $ 10,000 Governor MI D Thompson for Senate 2018$ 10,000 STATE SENATE OK R Friends of John Michael Montgomery 2018$ 8,000 STATE SENATE OK R Caldwell for State House$ 7,500 STATE HOUSE OK R Friends of Scott Fetgatter$ 7,500 STATE HOUSE OK R Ken Paxton Campaign$ 7,500 ATTORNEY GENERAL TX R Trey Caldwell for State House 2018$ 7,000 STATE HOUSE OK R Dana Murphy for Lt. Governor$ 5,000 LT. GOVERNOR OK R Friends of Charles McCall $ 5,000 STATE HOUSE OK R Friends of Larry Householder $ 5,000 STATE HOUSE OH R Friends of Todd Russ $ 5,000 STATE HOUSE OK R Stitt for Governor $ 5,000 GOVERNOR OK R Tony for Wisconsin $ 5,000 GOVERNOR WI D Tom Wolf for Governor $ 3,500 GOVERNOR PA D Charles Perry Campaign $ 3,000 STATE SENATE TX R Dawn Buckingham Campaign $ 3,000 STATE SENATE TX R Drew Darby Campaign $ 3,000 STATE HOUSE TX R Four Price Campaign $ 3,000 STATE HOUSE TX R Friends of Greg Babinec $ 3,000 STATE HOUSE OK R Kristi for Governor $ 3,000 GOVERNOR SD R Angela Paxton Campaign $ 2,500 STATE SENATE TX R Brian Birdwell Campaign $ 2,500 STATE SENATE TX R Citizens for Pat Grassley $ 2,500 STATE HOUSE IA R Dennis Bonnen Campaign $ 2,500 STATE HOUSE TX R Friends of James Leewright 2018 $ 2,500 STATE SENATE OK R Friends of John Zerwas $ 2,500 STATE HOUSE TX R Friends of Kim David $ 2,500 STATE SENATE OK R Friends of Stephanie Bice 2018 $ 2,500 STATE SENATE OK R Jacob Rosecrants for HD 46$ 2,500 STATE HOUSE OK D Ken King Campaign $ 2,500 STATE HOUSE TX R Parson for Missouri $ 2,500 GOVERNOR MO R Perryman in 2018 $ 2,500 STATE HOUSE OK D Phil King Campaign $ 2,500 STATE HOUSE TX R Robert Nichols Campaign $ 2,500 STATE SENATE TX R Texans for Kelly Hancock SPAC $ 2,500 STATE SENATE TX R William Casey Murdock 2018 $ 2,500 STATE HOUSE OK R Ana Maria Rodriguez Campaign $ 2,000 STATE HOUSE FL R Ardian Zika Campaign$ 2,000 STATE HOUSE FL R Brett Hage Campaign$ 2,000 STATE HOUSE FL R Bryan Hill for House 2018 $ 2,000 STATE HOUSE OK R Charles Clemons Sr. -

House Standing Committees

2019 NORTH DAKOTA LEGISLATIVE ASSEMBLY HOUSE STANDING COMMITTEES APPROPRIATIONS Committee Chairman - Jeff Delzer Committee Vice Chairman - Keith Kempenich Education and Environment Division David Monson - Chairman Tracy Boe Jim Schmidt - Vice Chairman Bob Martinson Mike Nathe Mark Sanford Mike Schatz Government Operations Division Don Vigesaa - Chairman Corey Mock Mike Brandenburg - Vice Chairman Thomas Beadle Larry Bellew Michael Howe Keith Kempenich Human Resources Division Jon O. Nelson - Chairman Richard G. Holman Gary Kreidt - Vice Chairman Bert Anderson Lisa Meier Randy A. Schobinger EDUCATION Mark S. Owens - Chairman Ron Guggisberg Cynthia Schreiber-Beck - Vice Chairman LaurieBeth Hager Pat D. Heinert Jeff A. Hoverson Dennis Johnson Mary Johnson Daniel Johnston Donald W. Longmuir Andrew Marschall Brandy Pyle Michelle Strinden Denton Zubke FINANCE AND TAXATION Craig Headland - Chairman Matt Eidson Jim Grueneich - Vice Chairman Alisa Mitskog Jake G. Blum Jason Dockter Sebastian Ertelt Jay Fisher Patrick Hatlestad Tom Kading Ben Koppelman Vicky Steiner Nathan Toman Wayne A. Trottier 12/6/18 HUMAN SERVICES Robin Weisz - Chairman Gretchen Dobervich Karen M. Rohr - Vice Chairman Mary Schneider Dick Anderson Chuck Damschen Bill Devlin Clayton Fegley Dwight Kiefert Todd Porter Matthew Ruby Bill Tveit Greg Westlind Kathy Skroch INDUSTRY, BUSINESS AND LABOR George Keiser - Chairman Mary Adams Mike Lefor - Vice Chairman Pamela Anderson Glenn Bosch Marvin E. Nelson Craig Johnson Jim Kasper Vernon Laning Scott Louser Emily O’Brien David Richter Dan Ruby Austen Schauer JUDICIARY Kim Koppelman - Chairman Ruth Buffalo Karen Karls - Vice Chairman Karla Rose Hanson Rick Becker Terry B. Jones Jeffery J. Magrum Aaron McWilliams Bob Paulson Gary Paur Shannon Roers Jones Bernie Satrom Luke Simons Steve Vetter AGRICULTURE Dennis Johnson - Chairman Ruth Buffalo Wayne A. -

Aicpa Fall Meeting of Council by Patrick Kautzman, AICPA Council Member

January 2019 | Volume XXXVI | No. 1 aicpa fall meeting of council By Patrick Kautzman, AICPA Council Member Since TCJA passed last December, we have heard from a multitude of professionals with varying levels of concern regarding the continued existence of the food and beverage deduction in light of the fate of entertainment expenses. Well, Notice 2018-76, issued October 3, 2018, clarifies that taxpayers generally may continue to deduct 50% of the food and beverage expenses associated with operating their trade or business. Professional Issues Update by Barry Meloncon, President and CEO of AICPA Barry’s professional issues update included his recurring reminders of the rapid pace of innovation and disruption in our world and our industry. • Since the year 2000, 41% of S&P consumer-centric companies have been acquired 2019 or gone out of business and 39% of the 5th to 85th largest firms no longer exist as standalone firms. Conference dates • The World Economic Forum’s Future of Jobs Report shows that of the top 10 de- clining jobs by 2022, #2 is Accounting, Bookkeeping, and Payroll Clerks and #7 is Accountants and Auditors. Barry’s response: They are referring to an industry that Management Conference is unwilling to change and adapt! He broke a future ready strategy down into 3 parts: May 22-23 • Technology – Master it before it masters you Fargo Holiday Inn • Trust – Build on CPAs expertise • Talent – Think broader Summer variety pack Technology – CPAs must embrace “Software as a Service” through client accounting June 17-19 services and virtual CFO services, “Big Data and Analytics”, “Artificial Intelligence” through Bismarck Ramkota machine learning and virtual assistance, and “Blockchain”. -

2020 PAC Contributions.Xlsx

Recipient Candidate Candidate Office Date Amount First Name Last Name FEDERAL Terri Sewell For Congress Terri Sewell House 7/28/20 $1,000 Westerman for Congress Bruce Westerman House 9/11/20 $3,000 Womack for Congress Steve Womack House 9/22/20 $2,500 Friends Of David Schweikert David Schweikert House 8/25/20 $2,500 McCarthy Victory Fund Kevin McCarthy House 1/27/20 $20,000 Mike Garcia for Congress Mike Garcia House 9/22/20 $5,000 Devin Nunes Campaign Committee Devin Nunes House 9/10/20 $5,000 Ken Calvert For Congress Committee Ken Calvert House 9/22/20 $2,500 KAT FOR CONGRESS Kat Cammack House 10/6/20 $2,500 Byron Donalds for Congress Byron Donalds House 9/25/20 $2,500 Mario Diaz‐Balart for Congress Mario Diaz‐Balart House 9/22/20 $2,500 Bilirakis For Congress Gus Bilirakis House 8/14/20 $2,500 Michael Waltz for Congress Mike Waltz House 3/19/20 $2,500 Drew Ferguson for Congress Inc. Drew Ferguson House 2/13/20 $2,000 Simpson For Congress Mike Simpson House 3/5/20 $2,500 LaHood For Congress Darin LaHood House 8/14/20 $2,500 Rodney For Congress Rodney Davis House 3/13/20 $2,500 Walorski For Congress Jackie Walorski House 10/30/20 $5,000 Greg Pence for Congress Greg Pence House 9/10/20 $5,000 ELECT JIM BAIRD FOR CONGRESS Jim Baird House 3/5/20 $2,500 Jim Banks for Congress, Inc. Jim Banks House 2/13/20 $2,500 Defend Our Conservative Senate PAC Roger Marshall House 8/17/20 $5,000 Guthrie For Congress Brett Guthrie House 10/6/20 $5,000 Comer for Congress James Comer House 9/11/20 $4,000 Hal Rogers For Congress Hal Rogers House 9/22/20 $2,500