Gei-Investment-Menu.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Procurar Conviction Australian Equity Portfolio

Procurar Conviction Australian Equity Portfolio Portfolio performance – March 2021 Cumulative performance 1 mth 3 mth 6 mth 1 yr 2 yr S.I. (%) (%) (%) (%) (% pa) (% pa) Portfolio Total 3.2 5.8 22.5 43.1 12.0 8.9 Return Benchmark* 2.3 4.2 18.5 38.3 8.7 8.2 Excess Return 0.9 1.6 4.0 4.8 3.3 0.7 Past performance is not a reliable indicator of future performance. Performance is calculated before taxes and other fees such as model management and platform fees and are net of underlying investment management fees. For full details of fees, please refer to the relevant platform provider. Performance is notional in nature and the actual performance of individual portfolios may differ to the performance of the Managed Portfolios. Inception date 1st March 2018. *Benchmark is the S&P/ASX 200 TR Index AUD. Market review The Australian equity market experienced another positive quarter Performance contributors of performance to the end of March, delivering a 4.1% return as Top 5 Contributors to Performance (12m) % measured by the S&P/ASX 300 Accumulation Index. Low levels of community transmission and the rollout of the COVID-19 vaccine Nine Entertainment Co 2.43 program have delivered a boost of optimism for investors, Santos 1.52 particularly sectors directly linked to the re-opening of the James Hardie 1.43 economy, in particular consumer discretionary, industrial and Xero Limited 1.36 resources. Seven Group 1.32 Top 5 Detractors from Performance (12m) % Global equities gained over the quarter, with the MSCI World ex Australia Index AUD up 6.0%. -

Stars Shine at the Downer Nines! the Downer Rugby League World Cup 9S Was One of the Most 4 Exciting Weekends of Football in 2019

Issue 17 December 2019 PAGE Stars shine at the Downer Nines! The Downer Rugby League World Cup 9s was one of the most 4 exciting weekends of football in 2019. 2 Hydrogen: a key energy 7 Walkin’ in a ginger 8 Maryborough celebrates source of the future wonderland 150 golden years 2 Issue 17 December 2019 THOUGHT LEADERSHIP CONTRACT WINS Hydrogen can be a key energy source in a zero-emissions future There is no doubt that the power generation industry is the most disrupted of all industries. The unholy trinity of climate By Pat Burke change, perceived soaring energy prices and legislative Executive General Manager, uncertainty underlined by an ageing workforce, increasing Asset Services activism and changing market fundamentals have combined to create a sector facing considerable uncertainty. Many traditional energy sources are becoming clear example of the advancements being made And, perhaps most importantly, we need to unsustainable, not to mention unpopular in the development of these new technologies. convince a sceptical public it can be safely stored, among a growing section of the population. and used in their cars and in public transport. I also saw advances in retrofitting existing The energy market is changing quicker than plant to better cope with changed operating For Downer, a move towards hydrogen energy most expected. There are also conflicting parameters, improve efficiency, reduce would also present many opportunities. views on which decarbonisation technologies emissions or even convert gas turbines to We have a strong reputation for the provision will most likely progress, and what the current handle hydrogen. of safe and reliable operational services status and development roadmap of those across a diversified range of commodities These technologies are directly applicable to technologies actually looks like. -

Industry Associations & ASX Companies

Industry Associations, ASX Companies, Shareholder Interests and Lobbying CONTENTS About the Authors ........................................................................................................................ 3 ACCR ............................................................................................................................................ 3 About ISS-caer ............................................................................................................................. 3 About the Report .......................................................................................................................... 4 Foreword ...................................................................................................................................... 4 Introduction .................................................................................................................................. 5 Report Structure .......................................................................................................................... 6 PART 1 - Background ................................................................................................................... 8 What is an Industry Association? .............................................................................................. 8 Advantages and Disadvantages of Belonging to an Industry Association ........................... 10 Australian Legislation and Regulations Covering Industry Associations ............................. 11 -

Download 2020 Half-Yearly Voting Report Here

VOTING REPORT 2020 HALF-YEAR OUTCOMES VIRTUAL AGMS, REAL DISCONTENT: ASX200 ASX300 The six months to 30 June 2020 saw a short voting MEETINGS season that focused largely on pre-pandemic issues: 47 69 • Investors delivered record support for climate RESOLUTIONS 326 436 change resolutions at Woodside, Santos and Rio REMUNERATION Tinto – sending a message on the need for STRIKES 1 2 further work on their practices and targets. • Capital Raising in the Spotlight - Concerning placement allocations as companies rush to bolster balance sheets amid COVID-19. • AMP Remuneration revolt - The outright defeat of AMP’s remuneration report amid pay-for- performance concerns. SHAREHOLDER CAPITAL RAISINGS REMUNERATION DIRECTOR ELECTIONS RESOLUTIONS Placements that don’t treat AMP remuneration report Eclipx’s chair Kerry Five of the 10 largest votes existing shareholders rejected outright for second Roxburgh in the spotlight in support of shareholder appropriately continued to time in three years. following impairments, resolutions in recent times. draw fire. Shopping centre operators downgrades, a failed merger and accounting Climate-related votes at ASX responds to investor Unibail-Rodamco-Westfield restatements. Woodside, Santos and Rio concerns in relation to the and Scentre Group Tinto reflected growing need for greater recorded sizeable investor Shareholder nominee Gary frustration with the slow transparency. opposition. Weiss again narrowly pace of change at some. Read more unsuccessful at getting on the Cromwell board. Read more Read more KEY COMPANIES: Read more KEY COMPANIES: AMP, Unibail-Rodamco- KEY COMPANIES: Cochlear, Next DC, Bellevue Westfield, Scentre, Sigma KEY COMPANIES: Woodside Petroleum, Gold Healthcare Eclipx, Spark Infrastructure, Santos, Rio Tinto, QBE Cromwell Property Group 1 SHAREHOLDER RESOLUTIONS RIO TINTO FACES CLIMATE HEAT The other resolution to receive significant support was The first half of 2020 saw five of the 10 largest votes in at Rio Tinto, where proponents called for Scope 1, 2 support of shareholder resolutions in recent times. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

Australian Equities Lending Margins Effective 21 April 2021

Australian Equities Lending Margins Effective 21 April 2021 Stock ASX Margin Stock ASX Margin Stock ASX Margin Code Rate Code Rate Code Rate A2B Australia A2B 40% AusNet Services AST 70% Costa Group Holdings CGC 60% The A2 Milk Company A2M 65% ASX ASX 75% Challenger Financial Australian Agricultural Company AAC 55% AUB Group AUB 50% Services Group CGF 70% Adelaide Brighton ABC 70% Australian United Challenger Capital Notes CGFPA 60% Abacus Property Group ABP 60% Investment Company AUI 70% Challenger Capital Notes 2 CGFPB 60% Audinate Group AD8 40% Aventus Retail Property Group AVN 50% Challenger Capital Notes 3 CGFPC 60% Adairs ADH 40% Alumina AWC 70% Charter Hall Group CHC 70% APN Industria REIT ADI 40% Accent Group AX1 40% Champion Iron CIA 50% Australian Ethical Amaysim Australia AYS 40% Cimic Group CIM 70% Investment Limited AEF 40% Aurizon Holdings AZJ 75% Carlton Investments CIN 50% Australian Foundation Bapcor BAP 60% Centuria Industrial REIT CIP 60% Investment Company AFI 75% Baby Bunting Group BBN 40% Collins Foods CKF 50% Ainsworth Game Technology AGI 40% Bendigo & Adelaide Bank BEN 70% Class CL1 40% AGL Energy AGL 75% Bendigo & Adelaide Bank BENHB 65% Clean Teq Holdings CLQ 40% AGL Energy USFDS AGLHA 75% Bendigo & Adelaide Bank CPS BENPE 65% Clover Corporation CLV 40% Automotive Holdings Group AHG 55% Bendigo & Adelaide Bank CPS BENPF 65% Charter Hall Long Wale REIT CLW 60% Asaleo Care AHY 50% Bendigo & Adelaide Bank CPS BENPG 65% Centuria Metropolitan REIT CMA 50% Auckland International Airport AIA 70% Bell Financial Group -

2014 Annual Report Leighton Holdings Limited Abn 57 004 482 982

www.leighton.com.au @LeightonGroup 2014 ANNUAL REPORT LEIGHTON HOLDINGS LIMITED ABN 57 004 482 982 construction l mining l engineering l ppps Leighton Holdings Limited Annual Report 2014 2014 Annual Report CONTENTS Section Page Executive Chairman and CEO’s Review 2 Directors’ Report 4 Operating and Financial Review 12 Remuneration Report 27 Financial Report 44 Shareholdings 150 Shareholder information 152 Glossary 153 In this Annual Report a reference to ‘Group’, ‘we’, ‘us’ or ‘our’ is a reference to Leighton Holdings Limited ABN 57 004 482 982 and the entities that it controls unless otherwise stated. The Leighton Holdings corporate governance statement is available on our website, in the section titled Board and Governance (www.leighton.com.au/our-approach/board-and-governance/corporate-governance-approach). 1 Leighton Holdings Limited Annual Report 2014 Executive Chairman and CEO’s Review Dear Shareholders, As the Leighton Holdings Executive Chairman and CEO, I am proud to provide you with this review of the Leighton Group’s progress during 2014. STRATEGIC REVIEW 2014 marked the commencement of the transformation of the Leighton Group. We began a significant restructure, making progress on the objectives we set in June 2014 of strengthening the balance sheet, streamlining our operating model, and improving project delivery. Our achievements included establishing dedicated, streamlined and efficient businesses focused on contract mining, construction, public private partnerships, and engineering. We also produced a sustainable reduction in overheads, divested John Holland and established a 50:50 investment partnership for the Services operations of Leighton Contractors and Thiess. The John Holland divestment and Services partnership are subject to customary approvals including from the Foreign Investment Review Board. -

South Australian Petroleum Prospectivity Summary

South Australian petroleum prospectivity summary NAPE 2021 1. South Australian Petroleum Review (PESA News, second quarter 2021 https://pesa.com.au/pesa- news-magazine/ ) 2. State of Play in SA, Elinor Alexander. Presented at PESA Deal Day on 14 June 2021 TECH TALK TECH TALK ") Marla Moomba South Australian ") ") Petroleum Review Coober Pedy (May–2021) INTRODUCTION Acreage Releases: Competitive acreage process (Figure 2). PEL 680 has been releases have been used successfully granted to Beach Energy and Cooper The Energy Resources Division in by the Department to manage highly Energy in the Otway Basin (formerly the South Australian Department for prospective Cooper Basin acreage OT2019-B block). Energy and Mining is the lead agency since 1998. The expiry of long term ") Ceduna for petroleum, geothermal and carbon exploration licenses (PELs 5 and 6) Petroleum Retention Licences: An ") Port capture and storage activities in the enabled the most significant structured initiative in 2013 to increase the extent Augusta state. It has responsibility for the release of onshore Australian acreage in of retention and production licences generation of royalty income, economic the industry’s history, and has generated has been very successful resulting in ") Port Bonython development, wealth and jobs, public (in today’s terms): a massive increase from 7,645 km2 in ") Port safety and the minimisation of impacts 2013, up to the current 17,107 km2 Pirie on the environment through efficient 44 PELs and 5 PELAs and resultant in April 2021. There are currently 210 management of the state's petroleum PPLs and PRLs from 89,100 km2 of petroleum retention licences, with and geothermal rights on behalf of the acreage; almost all of these located over proven people of South Australia. -

Insurance Australia Group Annual Report 2015 Insurance Australia Group Annual Report 2015

Insurance Australia Group Annual Report 2015 Insurance Australia Group Annual Report 2015 INSURANCE AUSTRALIA GROUP LIMITED ABN 60 090 739 923 CONTENTS Five year financial summary 1 Directors’ declaration 98 Directors’ report 2 Independent auditor’s report 99 Remuneration report 16 Shareholder information 101 Lead auditor’s independence declaration 36 Corporate directory 104 Financial statements 37 KEY DATES 2015 financial year end 30 June 2015 Full year results and dividend announcement 21 August 2015 Notice of meeting mailed to shareholders 7 September 2015 Final dividend for ordinary shares Record date 9 September 2015 Payment date 7 October 2015 Annual general meeting 21 October 2015 Half year end 31 December 2015 Half year results and dividend announcement 18 February 2016* Interim dividend for ordinary shares Record date 2 March 2016* * Payment date 30 March 2016 2016 financial year end 30 June 2016 Full year results and dividend announcement 19 August 2016* * Please note: dates are subject to change. Any changes will be published via a notice to the Australian Securities Exchange (ASX) 2015 Annual About this report General Meeting The 2015 annual report of Insurance Australia Group Limited (IAG, or IAG’s 2015 annual general meeting will the Group) includes IAG’s full statutory be held on Wednesday, 21 October 2015, accounts, along with the Directors’ and at the City Recital Hall, Angel Place remuneration reports for the financial Sydney, commencing at 10.00am. Details year 2015. This year’s corporate governance of the meeting, including information report is available in the About Us area of about how to vote, will be contained our website (www.iag.com.au). -

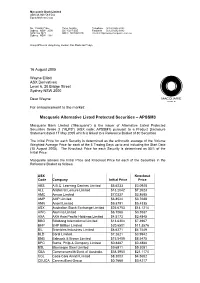

Macquarie Alternative Listed Protected Securities – APSSM3

Macquarie Bank Limited ABN 46 008 583 542 Equity Markets Group No. 1 Martin Place Telex 122246 Telephone (61 2) 8232 3333 Sydney NSW 2000 DX 10287 SSE Facsimile (61 2) 8232 6882 GPO Box 3423 SWIFT MACQAU2S Internet http://www.macquarie.com.au Sydney NSW 1164 Group Offices in Hong Kong, London, Sao Paulo and Tokyo 16 August 2005 Wayne Elliott ASX Derivatives Level 6, 20 Bridge Street Sydney NSW 2000 Dear Wayne For announcement to the market: Macquarie Alternative Listed Protected Securities – APSSM3 Macquarie Bank Limited (“Macquarie”) is the issuer of Alternative Listed Protected Securities Series 3 (“ALPS”) (ASX code: APSSM3) pursuant to a Product Disclosure Statement dated 17 May 2005 which is linked to a Reference Basket of 80 Securities. The Initial Price for each Security is determined as the arithmetic average of the Volume Weighted Average Price for each of the 5 Trading Days up to and including the Start Date (15 August 2005). The Knockout Price for each Security is determined as 55% of the Initial Price. Macquarie advises the Initial Price and Knockout Price for each of the Securities in the Reference Basket as follows: ASX Knockout Code Company Initial Price Price ABS A.B.C. Learning Centres Limited $5.6233 $3.0928 ALL Aristocrat Leisure Limited $13.2042 $7.2623 AMC Amcor Limited $7.0337 $3.8685 AMP AMP Limited $6.8524 $3.7688 ANN Ansell Limited $9.8791 $5.4335 ASX Australian Stock Exchange Limited $25.6753 $14.1214 AWC Alumina Limited $6.1068 $3.3587 AXA AXA Asia Pacific Holdings Limited $4.5173 $2.4845 BBG Billabong International Limited $13.6304 $7.4967 BHP BHP Billiton Limited $20.6501 $11.3576 BIL Brambles Industries Limited $8.6271 $4.7449 BLD Boral Limited.