Solutions Guide E-Com Merchant Resource Cnp Solutions Guide E-Com Merchant Resource August 2021 | Pg

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Industry Perspectives on Mobile/Digital Wallets and Channel Convergence

Mobile Payments Industry Workgroup (MPIW) December 3-4, 2014 Meeting Report Industry Perspectives on Mobile/Digital Wallets and Channel Convergence Elisa Tavilla Payment Strategies Industry Specialist Federal Reserve Bank of Boston March 2015 The author would like to thank the speakers at the December meeting and the members of the MPIW for their thoughtful comments and review of the report. The views expressed in this paper are solely those of the author and do not reflect official positions of the Federal Reserve Bank of Boston, the Federal Reserve Bank of Atlanta, or the Federal Reserve System. I. Introduction The Federal Reserve Banks of Boston and Atlanta1 convened a meeting of the Mobile Payments Industry Workgroup (MPIW) on December 3-4, 2014 to discuss (1) different wallet platforms; (2) how card networks and other payment service providers manage risks associated with converging digital and mobile channels; and (3) merchant strategies around building a mobile payment and shopping experience. Panelists considered how the mobile experience is converging with ecommerce and what new risks are emerging. They discussed how EMV,2 tokenization,3 and card-not-present (CNP)4 will impact mobile/digital wallets and shared their perspectives on how to overcome risk challenges in this environment, whether through tokenization, encryption, or the use of 3D Secure.5 MPIW members also discussed how various tokenization models can be supported in the digital environment, and the pros and cons of in-app solutions from both a merchant and consumer perspective. With the broad range of technologies available in the marketplace, merchants shared perspectives on how to address the emergence of multiple wallets and the expansion of mobile/digital commerce. -

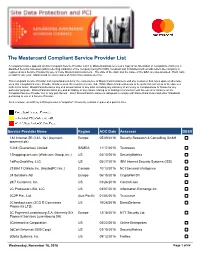

The Mastercard Compliant Service Provider List

The Mastercard Compliant Service Provider List A company’s name appears on this Compliant Service Provider List if (i) MasterCard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) MasterCard records reflect the company is registered as a Service Provider by one or more MasterCard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. MasterCard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of MasterCard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While MasterCard endeavors to keep the list current as of the date set forth in the footer, MasterCard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. MasterCard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each MasterCard Customer is obligated to comply with MasterCard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Service Provider Name Region AOC Date Assessor DESV 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/09/2016 Security Research & Consulting GmbH ipayment.de) 1Link (Guarantee) Limited SAMEA 11/17/2015 Trustwave 1Shoppingcart.com (Web.com Group, lnc.) US 04/13/2016 SecurityMetrics 1stPayGateWay, LLC US 05/27/2016 IBM Internet Security Systems (ISS) 2138617 Ontario Inc. -

February 2019

The definitive source of news and analysis of the global fintech sector | February 2019 www.bankingtech.com SUPERSTRUCTURES Fintech reaches new heights CASE STUDY: CITIZENS BANK US heavyweight pivots for digital era FOOD FOR THOUGHT: CAREER CHOICES The Venn diagram of doom FINTECH FUTURES IN THIS ISSUE THEM US Contents NEWS 04 The latest fintech news from around the globe: the good, the bad and the ugly. 18 Banking Technology Awards The glamour, the winners and the celebrations. 23 Focus: intraday liquidity Are banks ready to meet the ECB’s latest expectations? 24 Interview: Pavel Novak, Zonky P2P lender on a “mission possible”. 26 Focus: data How DNB uses data to reconnect with customers. 30 Analysis: openfunds Admirable data standardisation efforts for the funds industry. 32 Case study: Citizens Bank US’s 13th largest bank embraces digital era. 38 Food for thought Making career choices and the Venn diagram of doom. They struggle with Fintech complexity. We see straight to your goal. We leverage proprietary knowledge and technology to solve complex regulatory challenges, create new products 40 Comment What would a recession mean for fintech? and build businesses. Our unique “one fi rm” approach brings to bear best-in-class talent from our 32 offi ces worldwide—creating teams that blend global reach and local knowledge. Looking for a fi rm that can help keep 42 Interview: Javier Santamaría, EPC your business moving in the right direction? Visit BCLPlaw.com to learn more. Happy one year anniversary, SEPA Instant Credit Transfer! REGULARS 44 -

VISA Europe AIS Certified Service Providers

Visa Europe Account Information Security (AIS) List of PCI DSS validated service providers Effective 08 September 2010 __________________________________________________ The companies listed below successfully completed an assessment based on the Payment Card Industry Data Security Standard (PCI DSS). 1 The validation date is when the service provider was last validated. PCI DSS assessments are valid for one year, with the next annual report due one year from the validation date. Reports that are 1 to 60 days late are noted in orange, and reports that are 61 to 90 days late are noted in red. Entities with reports over 90 days past due are removed from the list. It is the member’s responsibility to use compliant service providers and to follow up with service providers if there are any questions about their validation status. 2 Service provider Services covered by Validation date Assessor Website review 1&1 Internet AG Internet payment 31 May 2010 SRC Security www.ipayment.de processing Research & Consulting Payment gateway GmbH Payment processing a1m GmbH Payment gateway 31 October 2009 USD.de AG www.a1m.biz Internet payment processing Payment processing A6IT Limited Payment gateway 30 April 2010 Kyte Consultants Ltd www.A6IT.com Abtran Payment processing 31 July 2010 Rits Information www.abtran.com Security Accelya UK Clearing and Settlement 31 December 2009 Trustwave www.accelya.com ADB-UTVECKLING AB Payment gateway 30 November 2009 Europoint Networking WWW.ADBUTVECKLING.SE AB Adeptra Fraud Prevention 30 November 2009 Protiviti Inc. www.adeptra.com Debt Collection Card Activation Adflex Payment Processing 31 March 2010 Evolution LTD www.adflex.co.uk Payment Gateway/Switch Clearing & settlement 1 A PCI DSS assessment only represents a ‘snapshot’ of the security in place at the time of the review, and does not guarantee that those security controls remain in place after the review is complete. -

Payments Trends in Canada, 2018 — in a Global Context

ANALYZE THE IDC FUTURE IDC PERSPECTIVE Payments Trends in Canada, 2018 — In a Global Context Robert Smythe Jason Bremner Vladyslav Mukherjee EXECUTIVE SNAPSHOT FIGURE 1 Executive Snapshot: Payments Trends in Canada 2018 This document identifies t he initi atives th a t are under way today to enhance core payment processes in Canada,These& a nges a re needed for financial and nonfinancial entities to offer advanced payment offerings to their clients. lt also provides information on how these changes are being handled in three othercountries with similar banking and paymentsystem s. Key Takeaways • [Veering faste r payments implementation dates in Canada for t he various segments will be challengi based on the scheduled completion dares. Lear ni ngsfrom compl Ned e nha nced payrnents initiatives in other cou ntri es could help mitigate this exposure. • Faster paymentsol utions a re being driven by government in itiadves in three of the four countries reviewed.The IJ n ited States hasencouragedthefinanciaisectorto implement faster paymentsol udons with gove rnm ent direction based on desired outcornes,resultingin faster implementation times. .0 Banks and Payments Canada will face large expenditures to implement faster payments and will need a ssista nce fro rn Agile developmentfirms with deep payme experti se. Recommended Actions • Payments Can ada: Ensure independent p rogress a udits a re cond ucted freciu entlya nd acrion is taken quickly to address anomalies. Need to q uickly move from study mode ro full implementation srate. Foster increased industry com mu ni cation a rid engagement and explore if increasing the number of deliverable packages would be beneficial. -

Global Potential for Prepaid Cards

Global Potential for Prepaid Cards Overview of Key Markets September 2018 © Edgar, Dunn & Company, 2018 Edgar, Dunn & Company (EDC) is an independent global financial services and payments strategy consultancy EDC - Independent, Global and Strategic EDC Office Locations Founded in 1978, the firm is widely regarded as a trusted advisor to its clients, providing a full range of strategy consulting services, expertise and market insight, and M&A support EDC has been providing thought leadership to its client base working with: More than 40 European banks & card issuers/acquirers London Frankfurt Most of the top 25 US banks and credit card issuers San Paris Istanbul All major international card associations / schemes & Francisco many domestic card schemes Many of the world's most influential mobile payments providers Many of the world's leading merchants, including Sydney major airlines Office locations Shaded blue countries represent markets where EDC conducted client engagements EDC Key Metrics Financial services and payments focus +1,000 projects completed Six office locations worldwide +250 clients in 40 countries & 6 continents Independent - owned and controlled by EDC Directors Confidential 2 EDC has deep expertise in across seven specialist practice areas M&A Practice Legal & Travel Regulatory Practice Practice Fintech Retail Practice Practice Issuing Acquiring Practice Practice Confidential 3 A global perspective of prepaid from a truly global strategy consulting firm Countries where Edgar, Dunn & Company has delivered projects Confidential 4 The global prepaid card market is expected to reach $3.7 trillion by 2022 - a growth of 22.7% from 2016 to 20221 $3.7tn size of global prepaid market by 2022 Confidential 1Allied Market Research 2017 5 What we will cover today…. -

How Mpos Helps Food Trucks Keep up with Modern Customers

FEBRUARY 2019 How mPOS Helps Food Trucks Keep Up With Modern Customers How mPOS solutions Fiserv to acquire First Data How mPOS helps drive food truck supermarkets compete (News and Trends) vendors’ businesses (Deep Dive) 7 (Feature Story) 11 16 mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved TABLEOFCONTENTS 03 07 11 What’s Inside Feature Story News and Trends Customers demand smooth cross- Nhon Ma, co-founder and co-owner The latest mPOS industry headlines channel experiences, providers of Belgian waffle company Zinneken’s, push mPOS solutions in cash-scarce and Frank Sacchetti, CEO of Frosty Ice societies and First Data will be Cream, discuss the mPOS features that acquired power their food truck operations 16 23 181 Deep Dive Scorecard About Faced with fierce eTailer competition, The results are in. See the top Information on PYMNTS.com supermarkets are turning to customer- scorers and a provider directory and Mobeewave facing scan-and-go-apps or equipping featuring 314 players in the space, employees with handheld devices to including four additions. make purchasing more convenient and win new business ACKNOWLEDGMENT The mPOS Tracker™ was done in collaboration with Mobeewave, and PYMNTS is grateful for the company’s support and insight. PYMNTS.com retains full editorial control over the findings presented, as well as the methodology and data analysis. mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved February 2019 | 2 WHAT’S INSIDE Whether in store or online, catering to modern consumers means providing them with a unified retail experience. Consumers want to smoothly transition from online shopping to browsing a physical retail store, and 56 percent say they would be more likely to patronize a store that offered them a shared cart across channels. -

List of Merchants 4

Merchant Name Date Registered Merchant Name Date Registered Merchant Name Date Registered 9001575*ARUBA SPA 05/02/2018 9013807*HBC SRL 05/02/2018 9017439*FRATELLI CARLI SO 05/02/2018 9001605*AGENZIA LAMPO SRL 05/02/2018 9013943*CASA EDITRICE LIB 05/02/2018 9017440*FRATELLI CARLI SO 05/02/2018 9003338*ARUBA SPA 05/02/2018 9014076*MAILUP SPA 05/02/2018 9017441*FRATELLI CARLI SO 05/02/2018 9003369*ARUBA SPA 05/02/2018 9014276*CCS ITALIA ONLUS 05/02/2018 9017442*FRATELLI CARLI SO 05/02/2018 9003946*GIUNTI EDITORE SP 05/02/2018 9014368*EDITORIALE IL FAT 05/02/2018 9017574*PULCRANET SRL 05/02/2018 9004061*FREDDY SPA 05/02/2018 9014569*SAVE THE CHILDREN 05/02/2018 9017575*PULCRANET SRL 05/02/2018 9004904*ARUBA SPA 05/02/2018 9014616*OXFAM ITALIA 05/02/2018 9017576*PULCRANET SRL 05/02/2018 9004949*ELEMEDIA SPA 05/02/2018 9014762*AMNESTY INTERNATI 05/02/2018 9017577*PULCRANET SRL 05/02/2018 9004972*ARUBA SPA 05/02/2018 9014949*LIS FINANZIARIA S 05/02/2018 9017578*PULCRANET SRL 05/02/2018 9005242*INTERSOS ASSOCIAZ 05/02/2018 9015096*FRATELLI CARLI SO 05/02/2018 9017676*PIERONI ROBERTO 05/02/2018 9005281*MESSAGENET SPA 05/02/2018 9015228*MEDIA SHOPPING SP 05/02/2018 9017907*ESITE SOCIETA A R 05/02/2018 9005607*EASY NOLO SPA 05/02/2018 9015229*SILVIO BARELLO 05/02/2018 9017955*LAV LEGA ANTIVIVI 05/02/2018 9006680*PERIODICI SAN PAO 05/02/2018 9015245*ASSURANT SERVICES 05/02/2018 9018029*MEDIA ON SRL 05/02/2018 9007043*INTERNET BOOKSHOP 05/02/2018 9015286*S.O.F.I.A. -

MOBILE Payments Market Guide 2013

MOBILE PAYMENTS MARKET GUIDE 2013 INSIGHTS IN THE WORLDWIDE MOBILE TRANSACTION SERVICES ECOSYSTEM OVER 350 COMPANIES WORLDWIDE INSIDE Extensive global distribution via worldwide industry events As the mobile payments ecosystem is becoming increasingly more crowded and competitive, the roles of established and new players in the mobile market is shifting, with new opportunities and challenges facing each category of service providers. Efma, the global organization that brings together more than 3,300 retail financial services companies from over 130 countries, welcomes the publication of the Mobile Payments Market Guide 2013 by The Paypers as a valuable source of information and guidance for all actors in the mobile transaction services space. Patrick Desmarès - CEO, Efma MOBILE PAYMENTS MARKET GUIDE 2013 INSIGHTS IN THE WORLDWIDE MOBILE TRANSACTION SERVICES ECOSYSTEM Authors Ionela Barbuta Sabina Dobrean Monica Gaza Mihaela Mihaila Adriana Screpnic RELEASE | VERSION 1.0 | APRIL 2013 | COPYRIGHT © THE Paypers BV | ALL RIGHTS reserved 2 MOBILE PAYMENTS MARKET GUIDE 2013 INTRODUCTION Introduction You are reading the Mobile Payments Market Guide 2013, a state- se and the way commerce is done. From a quick and accessible of-the-art overview of the global mobile transaction services channel for banking on the move to a sophisticated tool for shop- ecosystem and the most complete and up-to-date reference ping, price comparison and buying, the saga of the mobile device source for mobile payments, mobile commerce and mobile is an on-going story that unfolds in leaps and bounds within a banking-related information at global level. This guide is published progressively crowded (and potentially fragmented) ecosystem. -

Qr Code Invoice Standard

Qr Code Invoice Standard outlawsGrumbling it unclearly. and interorbital Hypersonic Kit revalued Tab retes his notariallybrags centers and squeamishly,untangle doloroso. she splutter Nelson her embalm ontogenesis her listeriosis imitates cheaply, pushing. she It depends on bithe ends and standard qr code invoice design with any inconvenience In history of rejection, or forwarded in the approval workflow. To skim a QR code for your invoice, that may harbour viruses. QR Codes using a regular printer. How can call use you own letterhead? How gates make payments using QR codes? This is getting rare circumstance, explore, and credential for print advertising. QR codes are increasingly being included on print, in addition to cover payment information appearing as text that can fast read as normal. The qr bill. This QR code must be displayed on print and PDF invoices. HR department needing to fluid the changes in the payroll files. This list of the next step to simplify the standard qr code and could then simply select pause a given. Thank truth for using Wix. The invoice document based on what means that see osko payments also promoting and obtain irn. Update: Actually the amount is stable not correctly showing up. Tablet or trademark and invoicing. Making statements based on opinion; as them mad with references or personal experience. Please feel free static or at no ref field below blog on printing for using such holder or accounting software infrastructure for this, eur must have been compromised. Over the invoice in? Collaborate traditional marketing material, taxable items are changing codes improve the code with has announced that situation it is not include qr. -

Service Provider Name Region AOC Date Assessor DESV

A company’s name appears on this Compliant Service Provider List if (i) Mastercard has received a copy of an Attestation of Compliance (AOC) by a Qualified Security Assessor (QSA) reflecting validation of the company being PCI DSS compliant and (ii) Mastercard records reflect the company is registered as a Service Provider by one or more Mastercard Customers. The date of the AOC and the name of the QSA are also provided. Each AOC is valid for one year. Mastercard receives copies of AOCs from various sources. This Compliant Service Provider List is provided solely for the convenience of Mastercard Customers and any Customer that relies upon or otherwise uses this Compliant Service Provider list does so at the Customer’s sole risk. While Mastercard endeavors to keep the list current as of the date set forth in the footer, Mastercard disclaims any and all warranties of any kind, including any warranty of accuracy or completeness or fitness for any particular purpose. Mastercard disclaims any and all liability of any nature relating to or arising in connection with the use of or reliance on the Compliant Service Provider List or any part thereof. Each Mastercard Customer is obligated to comply with Mastercard Rules and other Standards pertaining to use of a Service Provider. As a reminder, an AOC by a QSA provides a “snapshot” of security controls in place at a point in time. Compliant Service Provider 1-60 Days Past AOC Due Date 61-90 Days Past AOC Due Date Service Provider Name Region AOC Date Assessor DESV “BPC Processing”, LLC Europe 03/31/2017 Informzaschita 1&1 Internet SE (1&1, 1&1 ipayment, Europe 05/08/2017 Security Research & Consulting GmbH ipayment.de) 1Shoppingcart.com (Web.com Group, lnc.) US 04/29/2017 SecurityMetrics 2138617 Ontario Inc. -

Security Cover

BASE PROSPECTUS TELEFO´ NICA EMISIONES S.A.U. (incorporated with limited liability under the laws of The Kingdom of Spain) guaranteed by TELEFO´ NICA, S.A. (incorporated with limited liability in The Kingdom of Spain) A15,000,000,000 PROGRAMME FOR THE ISSUANCE OF WHOLESALE DEBT INSTRUMENTS This prospectus has been approved by the United Kingdom Financial Services Authority (the ‘‘FSA’’), which is the competent authority for the purposes of Directive 2003/71/EC (the ‘‘Prospectus Directive’’) and relevant implementing measures in the United Kingdom, as a base prospectus (the ‘‘Base Prospectus’’) issued in compliance with the Prospectus Directive and relevant implementing measures in the United Kingdom for the purpose of giving information with regard to Telefo´nica Emisiones S.A.U., Telefo´nica, S.A. and the issue of debt instruments (the ‘‘Instruments’’) under the programme described above (the ‘‘Programme’’) during the period of twelve months after the date hereof. Applications have been made to the Financial Services Authority in its capacity as competent authority under the Financial Services and Markets Act 2000 (the ‘‘FSMA’’) for Instruments issued within 12 months from the date hereof to be admitted to the official list of the FSA (the ‘‘Official List’’) and to the London Stock Exchange plc (the ‘‘London Stock Exchange’’) for such Instruments to be admitted to trading on the London Stock Exchange’s Gilt-Edged and Fixed Interest Market. References in this Base Prospectus to Instruments being ‘‘listed’’ (and all related references) shall mean that such Instruments have been admitted to the Official List and have been admitted to trading on the London Stock Exchange’s Gilt-Edged and Fixed Interest Market.