Facsimile Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Our Businesses 237 KB

Strategic Report Operating Business Reviews B2B Summary Outlook Our B2B companies operate in five sectors, namely Insurance Risk, Our B2B companies are collectively expected Property Information, Education Technology (EdTech), Energy Information, to deliver low single-digit underlying revenue Events and Exhibitions. growth in FY 2018, although revenues will be adversely affected by the disposals that have taken place in the past year and the planned disposal of EDR. In the Insurance Risk sector, 2016 RMS will continue to expand the client 2017 Pro formaΩ Movement Underlying^ Total B2B £m £m % % base for the RMS(one) software platform and associated applications, laying the Revenue# 976 899 +9% +2% groundwork for revenue acceleration Operating profit* 152 160 (5)% (15)% in FY 2019 and beyond. In the Property Operating margin* 16% 18% Information sector, the European businesses # Revenue from continuing and discontinued operations. are expected to continue to experience * Adjusted operating profit and operating margin; see pages 29 to 31 for details. relatively subdued market conditions and ^ Underlying growth rates give a like-for-like comparison; see page 31 for details. Ω Pro forma FY 2016 figures have been restated to treat Euromoney as a c.67% owned subsidiary during the first three months the remaining US businesses to continue and as a c.49% owned associate during the nine months to September 2016, consistent with the ownership profile during to deliver growth. Following the disposal FY 2017. See reconciliation on page 28. of Hobsons’ Admissions and Solutions businesses, the remaining EdTech business is expected to benefit from increased focus Euromoney of Group corporate costs, were £152 million, and to continue to deliver growth. -

Daily Mail and General Trust Plc

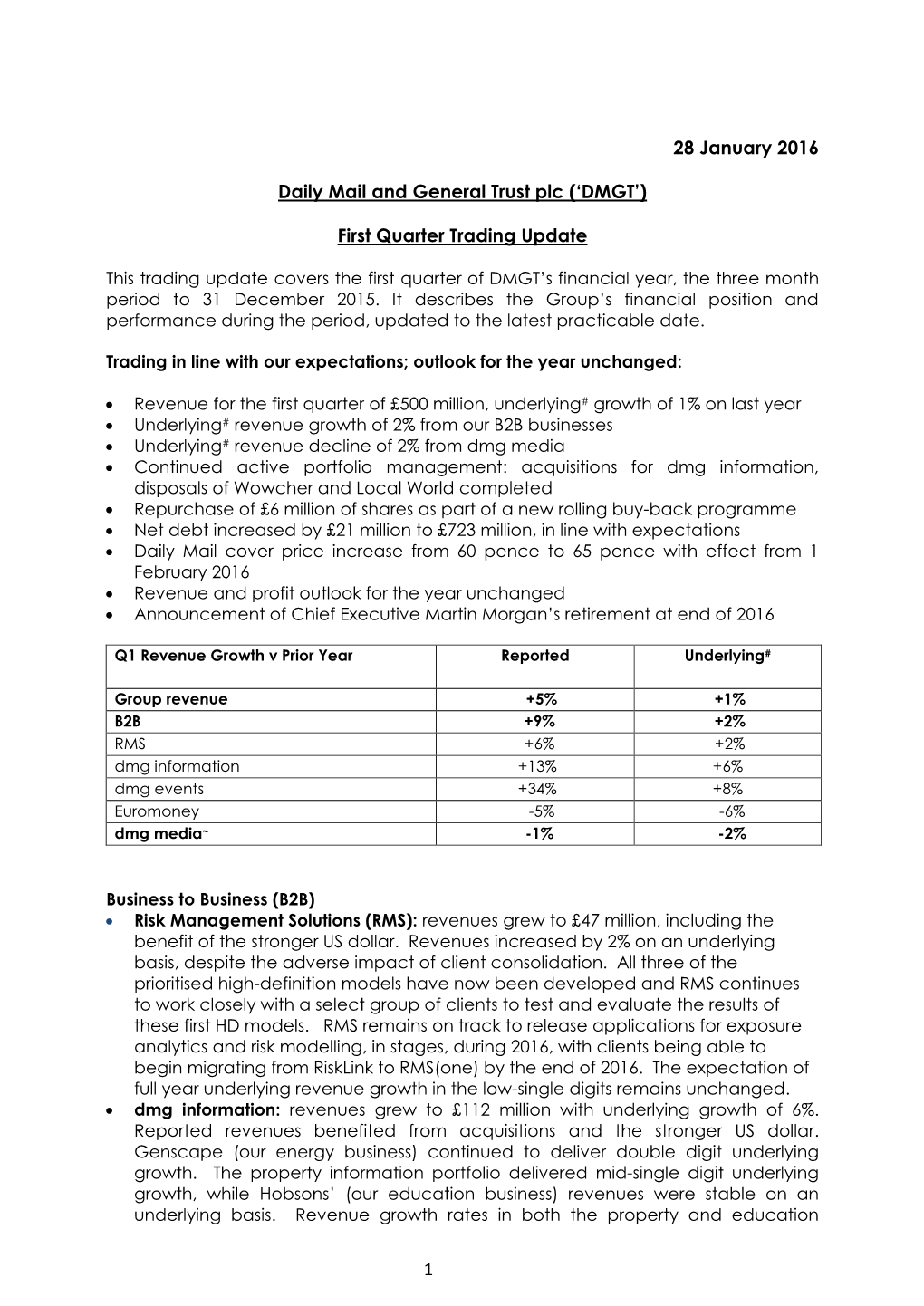

Daily Mail and General Trust plc Thursday 28th January 2016, 08:00 GMT Q1 Trading Update Stephen Daintith, Finance Director Morning ladies and gentlemen and welcome to the conference call covering our first quarter trading update. I am Stephen Daintith, DMGT’s Finance Director, and I am joined by Adam Webster, Head of Management Information and Investor Relations. So today’s conference call is a chance to pull together the key dynamics behind our trading over the first quarter of our financial year, to the end of December 2015. As usual, there will be an opportunity at the end of the call for you to ask any questions. So, overall trading over the first three months of our financial year has been in line with our expectations. The revenue and profit outlook for the full year, provided as guidance at our Full Year Results in November, remains unchanged. Group revenues for the period were up by 1% on an underlying basis. Reported revenues were up 5%, mainly due to factors influencing our B2B businesses. Overall, our B2B companies generated 2% underlying revenue growth in the quarter. Our reported B2B revenues, which were up 9%, have benefited from the strengthening US dollar, acquisitions and timing of events over the period. More detail on B2B dynamics to follow. In summary for DMG media, underlying revenues were 2% lower in the first quarter, with declines in circulation and print advertising being partly offset by digital advertising growth. Portfolio management activity has continued in the new financial year, with bolt-on acquisitions, primarily for DMGI, totalling around £20m, and further refinements to the consumer media portfolio. -

Facsimile Template

25 January 2018 Daily Mail and General Trust plc (‘DMGT’) First Quarter Trading Update FY 2018 DMGT reports revenue up 2% on an underlying# basis in the first three months of FY 2018. Outlook for the year unchanged and in line with current market expectations~. Q1 Revenue Growth v Prior Year Pro Forma* reported Underlying# Group revenue -6% +2% B2B -8% +4% Insurance Risk (RMS) -3% +5% Property Information -3% +0% EdTech -40% +12% Energy Information -2% +4% Events and Exhibitions (dmg events) -7% +7% Consumer (dmg media)† -3% -1% * Pro forma reported growth rates are calculated after restating prior year revenues to exclude Euromoney, the B2B business, which ceased to be a subsidiary at the end of December 2016. Business to Business (B2B) Underlying# revenue growth of 4%, with continued growth delivered from Insurance Risk, EdTech, Energy Information and Events and Exhibitions. Pro forma* reported revenue reduction of 8%, reflecting disposals and the weaker US dollar, which affected each of the B2B divisions. Full Year guidance maintained: low-single digit underlying revenue growth with the adjusted operating profit margin in the mid-teens. Insurance Risk (RMS) Underlying revenue growth of 5% was delivered. The roll-out of applications on the RMS(one) platform continued, with encouraging response from clients. Property Information Revenue was stable on an underlying basis, as growth from the US businesses was offset by reductions in Europe, given low volumes in the UK property market. Active portfolio management continued with the disposal process for EDR, the US business, ongoing. As announced on 14 December 2017, the Board of Xceligent, the loss-making US business, filed to liquidate the company. -

The Media System

3.3 The media system The growth of ‘semi-democracies’ across the world, where elections are held but are rigged by state power-holders, has brought into ever-sharper focus how much a country’s media system conditions the quality of its democracy. Free elections without some form of media diversity and balance clearly cannot hope to deliver effective liberal democracy.Ros Taylor and the Democratic Audit team look at how well the UK’s media system operates to support or damage democratic politics, and to ensure a full and effective representation of citizens’ political views and interests. What does liberal democracy require of a media system? ✦ The media system should be diverse and pluralistic, including different media types, operating under varied systems of regulation, designed to foster free competition for audiences and attention, and a strong accountability of media producers to citizens and public opinion. ✦ Taken as a whole, the regulatory set-up should guard against the distortions of competition introduced by media monopolies or oligopolies (dominance of information/content ‘markets’ by two or three owners or firms), and against any state direction of the media. ✦ A free press is a key part of media pluralism – that is, privately owned newspapers, with free entry by competitors and only normal forms of business regulation (those common to any industry) by government and the law. ✦ Because of network effects, state control of bandwidth, and the salience of TV/radio for citizens’ political information, a degree of ‘special’ regulation of broadcasters to ensure bipartisan or neutral coverage and balance is desirable, especially in election campaign periods. -

27 May 2021 Daily Mail and General Trust Plc ('DMGT') Half Yearly

27 May 2021 Daily Mail and General Trust plc (‘DMGT’) Half Yearly Financial Report for the six months ended 31 March 2021 Performance as expected given market conditions; realisation of value through portfolio activity • Group operating performance reflects B2B Information Services growth offset by B2B Events & Exhibitions and Consumer Media: o Revenue down 12% underlying o Cash operating income² down 13% underlying; 11% margin o Adjusted³ operating profit down 19% underlying; 9% margin o Adjusted profit before tax down 20% underlying o Adjusted EPS up 12% • Interim dividend increased +1% to 7.6p • Statutory4: revenue £547m; profit before tax £42m, down 45%; EPS 111.3p, up 24% • Active portfolio management strategy delivering value creation: o Increased investment in Cazoo in October 2020; proposed transaction values stake at c.US$1.35bn5 vs £117m total investment o Disposal of EdTech (Hobsons) for c.US$410m in March 2021 o Acquisition of New Scientist for £67m in March 2021 • Strong financial position maintained: pro forma net cash £293m6 and £362m of committed undrawn bank facilities; statutory net cash £199m • Outlook: o B2B Information Services: positioned for continued growth o Events & Exhibitions: physical events scheduled for H2 but risk of further postponements or cancellations o Consumer Media: advertising depends on business confidence and remains unpredictable Adjusted Results3 Statutory Results4 (from continuing and discontinued operations) Half Year Half Year Change~ Half Year Half Year 2021 2020 Reported Underlying¹ 2021 2020 Revenue £580m £690m -16% -12% £547m £642m Cash operating income £66m £75m -11% -13% Operating profit £55m £65m -17% -19% £44m £35m Profit before tax £47m £56m -17% -20% £42m £77m Earnings per share 16.8p 15.0p +12% 111.3p 89.7p Dividend per share 7.6p 7.5p Page 1 Paul Zwillenberg, CEO, commented: “We created significant value for our shareholders during the first half, through active management of the portfolio and continued strong operational execution. -

UK Newspaper Companies, Johnston Press Perhaps Best Exemplifies the Conundrum of Newspaper Finances in the 21St Century

Are UK newspapers really dying? A financial analysis of newspaper publishing companies Marc Edge, PhD Associate Professor Department of Media and Communications University of Malta [email protected] A PAPER FOR PRESENTATION TO THE EUROPEAN MEDIA MANAGEMENT ASSOCIATION CONFERENCE, GHENT, BELGIUM, MAY 11-12 The demise of the daily newspaper as a medium has long been foretold. H.G. Wells declared in 1943 that newspapers were ‘dead as mutton’ and predicted that people would one day receive news over their telephone lines instead (BBC.com, undated). The emergence of another new technology in the late 20th Century accelerated predictions for the demise of newspapers. The Economist ran a cover article in 2006 headlined ‘Who Killed the Newspaper?’ which pointed to the Internet as the main suspect. ‘Even the most confident of newspaper bosses now agree that they will survive in the long term only if . they can reinvent themselves on the internet and on other new-media platforms’ (Anonymous, 2006). In the depths of the ensuing global recession in 2009, media analyst Claire Enders predicted that up to half of the UK’s 1,300 local and regional newspapers would close within five years. ‘Many titles are already running at losses and are being sustained by the good graces of their owners, and that may not last’, Enders told a Commons committee (Brook, 2009). An article on the Guardian’s website by American media critic Bob Garfield (2013) repeated the claim that newspapers were losing money. ‘The news industry has gone from being obscenely profitable to slightly profitable to – at least, in the case of newspapers – largely unprofitable’, wrote the author of the apocalyptic 2009 book The Chaos Scenario. -

Clearance Decision

Completed acquisition by Reach Plc of certain assets of Northern & Shell Media Group Limited Decision on relevant merger situation and substantial lessening of competition ME/6741/18 The CMA’s decision on reference under section 22(1) of the Enterprise Act 2002 given on 20 June 2018. Full text of the decision published on 20 June 2018. Please note that [] indicates figures or text which have been deleted or replaced in ranges at the request of the parties for reasons of commercial confidentiality. SUMMARY 1. On 28 February 2018, Trinity Mirror plc (since renamed Reach plc (Reach)) acquired certain assets (the Target Assets) of Northern & Shell Media Group Limited (Northern & Shell) (the Merger). Reach and the Target Assets are together referred to as the Parties.1 2. The Competition and Markets Authority (CMA) believes that it is or may be the case that the Parties’ enterprises have ceased to be distinct and that the turnover test is met. The four-month period for a decision has not yet expired. The CMA therefore believes that it is or may be the case that a relevant merger situation has been created. 3. The Parties overlap in the publishing of national print newspapers and the supply of online news, the supply of advertising in national print newspapers and digital advertising, and the printing of newspapers. The CMA has therefore assessed the impact of the Merger in relation to the following frames of reference: 1 For consistency, the CMA refers in this report to Reach rather than to Trinity Mirror plc, irrespective of whether the events or submissions referred to occurred before or after the renaming of the company. -

Irish Times/Sappho (Examiner)

DETERMINATION OF MERGER NOTIFICATION M/17/068 - IRISH TIMES/SAPPHO (EXAMINER) Dated 24 April 2018 M-17-068 Irish Times Sappho Phase 2 DET Public Version.docx 1. INTRODUCTION Introduction 1.1 On 14 December 2017, in accordance with section 18(1)(a) of the Competition Act 2002, as amended (“the Act”), the Competition and Consumer Protection Commission (the “Commission”) received notification of a proposed transaction whereby The Irish Times Designated Activity Company (“ITD”), through its wholly-owned subsidiary Palariva Limited (“Palariva”), would acquire sole control of Sappho Limited (“Sappho”) from Landmark Media Investments Limited (“LMI”) (the “Proposed Transaction”). 1.2 Given that both ITD and Sappho carry on a “media business” within the State (as defined in section 28A(1) of the Act), the Proposed Transaction constitutes a “media merger” for the purposes of Part 3A of the Act. 1.3 The Proposed Transaction is to be implemented pursuant to a Share Purchase Agreement (“SPA”) dated 5 December 2017 between LMI and Palariva. The Undertakings Involved The Acquirer - ITD 1.4 ITD is engaged in the following business activities in the State: • the publication of The Irish Times, a daily national newspaper, and its website irishtimes.com; • the operation of the following three websites: myhome.ie, irishracing.com and myantiques.ie; • the sale of newspaper advertising in its print edition of The Irish Times; • the sale of online advertising on irishtimes.com, myhome.ie, irishracing.com and myantiques.ie; • the hosting of a number of podcasts; • the provision of contract printing services to third party newspaper publishers;1 and • the provision of training courses. -

1 Daily Mail and General Trust Plc Half Yearly Financial Report for the Si

Report for the half year ended 1st April, 2012 Not for public release until 7am on 24th May, 2012 Daily Mail and General Trust plc Half Yearly Financial Report for the six months ended 1st April, 2012 Financial Highlights Adjusted results* Adjusted Statutory results 2012 2011 Change† 2012 2011 Revenue £973m £991m -2% £973m £991m Operating profit £133m £144m -8% £73m £98m Profit before tax £105m £121m -14% £46m £73m Earnings per share 19.5p 23.6p -17% 15.8p 13.0p Dividend per share 5.6 p 5.3p SOLID UNDERLYING PERFORMANCE; FULL YEAR OUTLOOK UNCHANGED • Solid Group revenue performance, up 3% on an underlying basis. • Underlying operating profit flat; reported Group profits in line with expectations. • Good performance from B2B; underlying revenue up 9% and underlying profit* up 14%. • Resilient revenues at Associated: strong digital advertising (up 21%) and circulation (up 4%), offsetting print advertising decline (down 10%) • Northcliffe operating profit* up 34%. • Profit before tax lower due to various one-off items. • Active portfolio management; targeted acquisitions and disposal of non-core assets. • Net debt up £90m to £809m, but is expected to reduce in the second half. • Outlook for the year remains unchanged. • Dividend increased by 6%. Martin Morgan, Chief Executive, said: “We have delivered a solid underlying performance in the first half reflecting the strength of our B2B companies and the resilience of our national consumer titles. As expected, disposals and certain one- off factors have led to lower reported half year results. Our international B2B companies have increased their underlying revenues and profits* by 9% and 14% respectively. -

The Annual Report 2016

Welcome to the Annual Report 2016 This interactive pdf allows you to find information and navigate around this document easily. It also links you to useful information on the web that is not part of the Annual Report. Go to main Search Print pdf Previous Go to Go to home this pdf view specific contents page page page Full screen mode Links This PDF is set up to view in full screen mode. To turn this Dynamic links within the text are indicated when the user off, e.g. to zoom in or to print, press esc and the full rolls over hyperlinks and the mouse cursor changes to toolbar is revealed. a pointed hand as below. Daily Mail and General Trust plc Satisfying the need to know Annual Report 2016 OVERVIEW DMGT is an international business built on entrepreneurship and innovation. DMGT manages a balanced multinational portfolio of entrepreneurial companies, with total revenues of almost £2 billion, that provide a diverse range of businesses and consumers with compelling information, analysis, insight, news and entertainment. Financial highlights Revenue# Operating margin*# Adjusted profit before tax* # Statutory profit before tax † £1,917m 14% £260m £247m 2015: £1,845m 2015: 16% 2015: £281m 2015: £216m Adjusted earnings Dividend per share Net debt §/EBITDA Organic investments per share*# 22.0p 1.8x as % of revenues 56.0p 2015: 21.4p 2015: 1.8x 9% 2015: 59.7p 2015: 7% International share Digital share Subscriptions share of revenues# of revenues# of revenues# 53% 51% 33% 2015: 49% 2015: 47% 2015: 31% £ million FY 2016 FY 2015 Explanation Statutory profit before tax 247 216 Discontinued operations – 1 i Exceptional operating charges 58 20 ii Tangible fixed assets impairment – 2 iii Impairment and amortisation 107 68 iv Profit on sale of assets (138) (82) v Bond redemption premium – 40 vi Pension finance charge 5 7 vii Exceptional dividend income – (3) viii Other adjustments (19) 12 ix Adjusted profit before tax 260 281 For more detailed tables and explanations please refer to pages 35 and 36. -

Overview of Recent Dynamics in the UK Press Market

Department for Digital, Culture, Media & Sport Overview of recent dynamics in the UK press market April 2018 Mediatique Limited 65 Chandos Place London WC2N 4HG www.mediatique.co.uk DCMS: Overview of the Press Market Contents of this report Executive Summary ......................................................................................................................................... 4 1. Introduction ........................................................................................................................................ 7 Background ...................................................................................................................................................................... 7 2. Current market structure and players ................................................................................................. 11 Newspaper market structure and main ownership / business models ......................................................................... 11 News provision – TV and radio ....................................................................................................................................... 21 News consumption ......................................................................................................................................................... 29 The role of digital intermediaries in the consumption and dissemination of news ....................................................... 33 Contribution to editorial investment ............................................................................................................................ -

British Media Coverage of the Press Reform Debate Journalists Reporting Journalism

British Media Coverage of the Press Reform Debate Journalists Reporting Journalism Binakuromo Ogbebor British Media Coverage of the Press Reform Debate Binakuromo Ogbebor British Media Coverage of the Press Reform Debate Journalists Reporting Journalism Binakuromo Ogbebor Journalism Studies The University of Sheffield Sheffield, UK ISBN 978-3-030-37264-4 ISBN 978-3-030-37265-1 (eBook) https://doi.org/10.1007/978-3-030-37265-1 © The Editor(s) (if applicable) and The Author(s) 2020. This book is an open access publication. Open Access This book is licensed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence and indicate if changes were made. The images or other third party material in this book are included in the book’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the book’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. The use of general descriptive names, registered names, trademarks, service marks, etc. in this publication does not imply, even in the absence of a specific statement, that such names are exempt from the relevant protective laws and regulations and therefore free for general use.