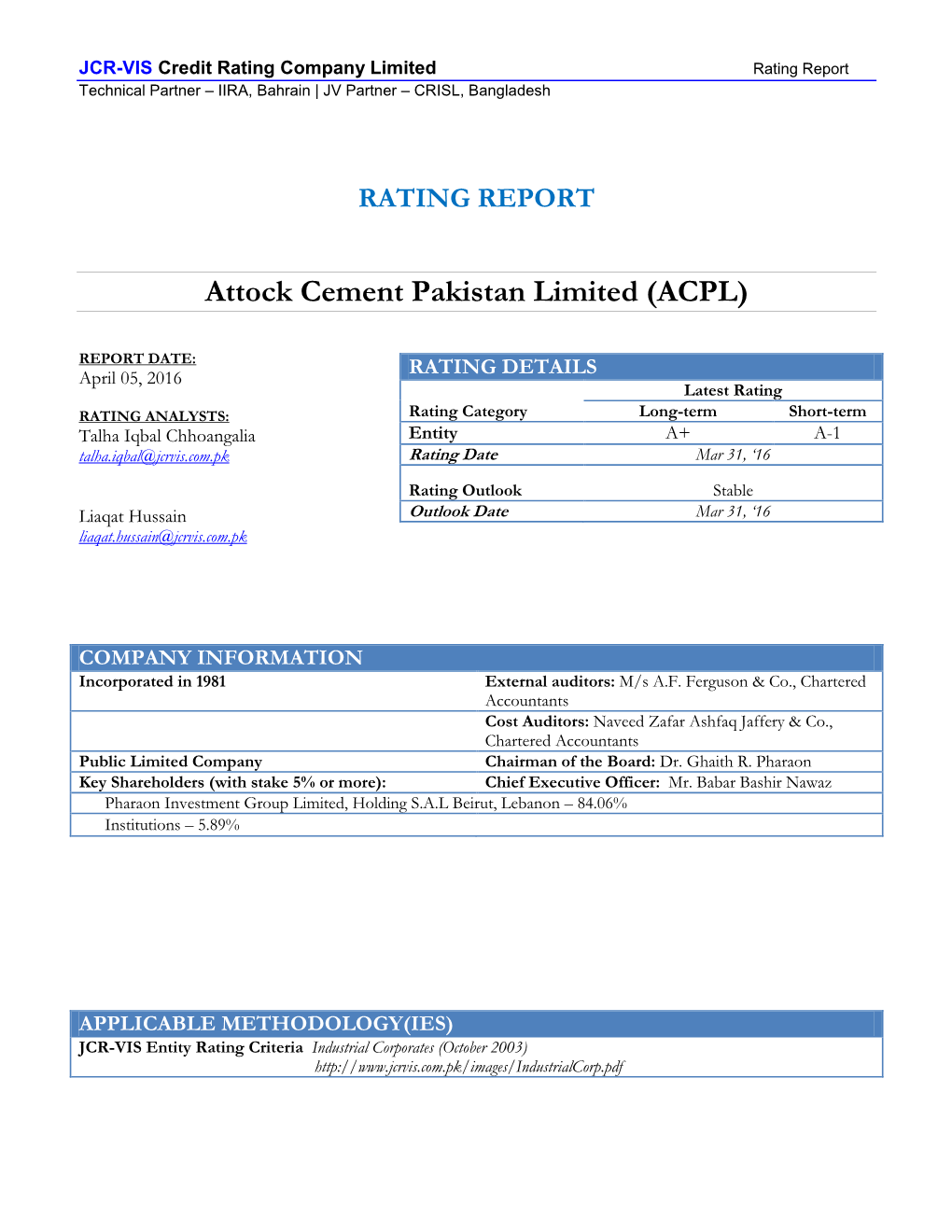

Attock Cement Pakistan Limited (ACPL)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dynamics Shaking Total Factor Productivity in Manufacturing Sector of Pakistan: a Panel Data Analysis

European Online Journal of Natural and Social Sciences 2019; www.european-science.com Vol.8, No 1 pp. 109-117 ISSN 1805-3602 Dynamics Shaking Total Factor Productivity in Manufacturing Sector of Pakistan: A Panel Data Analysis Samara Haroon, Dong Hui Zhang* School of Economics, Shandong University, Jinan, PR China *Email. [email protected] Tel.: +8613708926062 Received for publication: 24 July 2018. Accepted for publication: 19 November 2018. Abstract This research article investigates how explanatory variables are responsible for change in to- tal factor productivity in manufacturing sector of Pakistan. Panel data of selected fifteen manufac- turing firms of Pakistan from 2005 to 2013 are used to capture time and space affects. Considering data set of fifteen selected manufacturing firms consistently, it was found that explanatory variables (like size of firm, leverage, cash flows and Ownership) were responsible for changed in TFP growth. Empirical results suggest that explanatory variables appear to be most dominating factors in order to influence the TFP growth over a period of time and over a firm also. Research study further will provide a guide for Pakistan policy makers to set priorities to improve TFP growth for their manu- facturing firms especially in Punjab. Keywords: Total Factor Productivity, Manufacturing Sector, Punjab, Pakistan Introduction TFP growth sets opportunity towards society to increase the welfare of people by increasing the production of manufacturing sector. Further productive efficiency plays an important role in economic planning and development. It is core objectives of any government to enhance the overall growth and development of the economy in order to enhance the GDP. -

Pakistan Stock Exchange Limited CLOSING RATE SUMMARY from : 09:15 AM to 05:15 PM Pageno: 1 Friday August 09,2019 Flu No:152/2019 P

Pakistan Stock Exchange Limited CLOSING RATE SUMMARY From : 09:15_AM_TO_05:15_PM PageNo: 1 Friday August 09,2019 Flu No:152/2019 P. Vol.: 109097620 P.KSE100 Ind: 29737.98 P.KSE 30 Ind: 13993.91 Plus : 170 C. Vol.: 76410570 C.KSE100 Ind: 29429.07 C.KSE 30 Ind: 13793.17 Minus: 134 Total 321 Net Change : -308.91 Net Change : -200.74 Equal: 17 Company Name Turnover Prv.Rate Open Rate Highest Lowest Last Rate Diff. ***CLOSE - END MUTUAL FUND*** HIFA HBL Invest Fund 500 3.01 3.00 3.00 3.00 3.00 -0.01 TSMF Tri-Star Mutual 25500 3.01 2.16 2.16 2.01 2.04 -0.97 ***MODARABAS*** AWWAL Awwal Modaraba 1000 11.60 11.40 11.40 11.40 11.40 -0.20 BRR B.R.R.Guardian 1000 6.81 7.00 7.00 7.00 7.00 0.19 FECM Elite Cap.Mod 500 1.33 1.60 1.60 1.60 1.60 0.27 FHAM Habib Modaraba 21000 9.00 8.77 8.77 8.50 8.51 -0.49 FPJM Punjab Mod 6000 1.88 1.97 1.97 1.90 1.93 0.05 FUDLM U.D.L.Modaraba 1500 5.23 6.00 6.00 5.90 5.90 0.67 ORIXM Orix Modaraba 500 14.25 14.50 14.50 14.50 14.50 0.25 PMI Prud Mod.1st 2000 0.80 0.99 0.99 0.66 0.99 0.19 ***LEASING COMPANIES*** OLPL Orix Leasing 5000 21.30 21.75 22.36 21.75 22.34 1.04 ***INV. -

United Engineering Services

United Engineering Services Electrical Consultant, Technical Training, Instrumentation, Energy Audit, Maintenance Management System 2-C, Mezzanine Floor, 15th Commercial Street, Phase II (Ext.) DHA Karachi. 75500. Tel: (021)-35805163, 36010208, 35405495 Fax: (021)-35313968 Mobile: 0300-9232276 UES E-mail: [email protected], Web: www.ues-electrical.com All About Us… UES is consultancy firm providing services to Oil & Gas , Refinery and Industrial Sector. It started its work in 1999 & in a short time grew into major design, energy audit & maintenance consultancy concern. The industrial sector responded well to our work & services. The development is speeded up further when we organized ourselves to execute & monitor project with reputable background. UES has a complete team of Engineers & highly qualified, motivated members who provide quality work. UES Services • Electrical & Instrumentation Design Services • Energy Audit • Quality System Requirement Instrumentation & Calibration • Maintenance Management • Plant Maintenance • Auto CAD Services • Field Installation • Trouble Shooting • Detailed Engineering • Documentation & Printing • Programmable Logic Control (PLC) • Power Quality Analysis • Load Flow Analysis • Instruments Calibration • Inspection Services UES • Machinery Risk Assessment Different Disciplines • Maintenance Consultancy • Electrical Design Consultancy • Detailed Engineering • Process Instruments Design Consultancy • Process Instrument Calibration • Maintenance Management System • Energy Conservation Consultancy • -

Attock Petroleum Limited Financial Highlights

ATTOCK PETROLEUM LIMITED FINANCIAL HIGHLIGHTS EARNINGS PER SHARE Rs. 39.79 PROFIT AFTER TAX Rs. 3,961 Million OPERATING PROFIT Rs. 5,708 Million GROSS PROFIT Rs. 8,221 Million NET SALES REVENUE Rs. 223,054 Million 212 ANNUAL REPORT 2019 TABLE OF CONTENTS Introduction (2-23) Calendar of Major Events (112) Our Vision, Our Mission (2) Information Technology Governance (114) Corporate Strategy (3) Organizational Chart (116) Core Values (4) Review Report on Statement of Compliance Management’s Objectives & Strategies (6) with the Code of Corporate Governance (118) Code of Conduct (8) Statement of Compliance with the Code of Geographical Presence of APL Business Unit (14) Corporate Governance (119) APL Group Structure (15) Value Chain (16) Financial Analysis (121-135) Brief Company Profile (18) DuPont Analysis (122) Product Portfolio (19) Key Operating and Financial Data for Six Years (123) Chairman’s Review (24-25) Vertical Analysis (126) Chairman’s Review (24) Horizontal Analysis (127) Graphical Presentation (128) Governance (26-120) Comments on Financial Analysis (131) Board of Directors (28) Statement of Economic Value Added (133) Profile of Board of Directors (30) Analysis of Variation in Results of Board Committees and Corporate Interim Reports (134) Information (34) Statement of Charity Account (134) Whistle Blower Protection Statement of Value Added (135) Mechanism Policy (35) Board Committees and their Terms Financial Statements (137-206) of Reference (36) Independent Auditor’s Report to the Management Committees (39) Members (139) -

Companies Listed On

Companies Listed on KSE SYMBOL COMPANY AABS AL-Abbas Sugur AACIL Al-Abbas CementXR AASM AL-Abid Silk AASML Al-Asif Sugar AATM Ali Asghar ABL Allied Bank Limited ABLTFC Allied Bank (TFC) ABOT Abbott (Lab) ABSON Abson Ind. ACBL Askari Bank ACBL-MAR ACBL-MAR ACCM Accord Tex. ACPL Attock Cement ADAMS Adam SugarXD ADMM Artistic Denim ADOS Ados Pakistan ADPP Adil Polyprop. ADTM Adil Text. AGIC Ask.Gen.Insurance AGIL Agriautos Ind. AGTL AL-Ghazi AHL Arif Habib Limited AHSL Arif Habib Sec. AHSM Ahmed Spining AHTM Ahmed Hassan AIBL Asset Inv.Bank AICL Adamjee Ins. AJTM Al-Jadeed Tex AKDCL AKD Capital Ltd AKDITF AKD Index AKGL AL-Khair Gadoon ALFT Alif Tex. ALICO American Life ALNRS AL-Noor SugerXD ALQT AL-Qadir Tex ALTN Altern Energy ALWIN Allwin Engin. AMAT Amazai Tex. AMFL Amin Fabrics AMMF AL-Meezan Mutual AMSL AL-Mal Sec. AMZV AMZ Ventures ANL Azgard Nine ANLCPS Azg Con.P.8.95 Perc.XD ANLNCPS AzgN.ConP.8.95 Perc.XD ANLPS Azgard (Pref)XD ANLTFC Azgard Nine(TFC) ANNT Annoor Tex. ANSS Ansari Sugar APL Attock Petroleum APOT Apollo Tex. APXM Apex Fabrics AQTM Al-Qaim Tex. ARM Allied Rental Mod. ARPAK Arpak Int. ARUJ Aruj Garments ASFL Asian Stocks ASHT Ashfaq Textile ASIC Asia Ins. ASKL Askari Leasing ASML Amin Sp. ASMLRAL Amin Sp.(RAL) ASTM Asim Textile ATBA Atlas Battery ATBL Atlas Bank Ltd. ATFF Atlas Fund of Funds ATIL Atlas Insurance ATLH Atlas Honda ATRL Attock Refinery AUBC Automotive Battery AWAT Awan Textile AWTX Allawasaya AYTM Ayesha Textile AYZT Ayaz Textile AZAMT Azam Tex AZLM AL-Zamin Mod. -

LIST of MEMBERS - ELEGIBLE for VOTING in ELECTION 2020 29-Nov-19

LIST OF MEMBERS - ELEGIBLE FOR VOTING IN ELECTION 2020 29-Nov-19 SL.NO. OM # ALPHA COMPANY CEO NAME NTN # SALES TAX REGISTRATION NO. 1 OM-551 3 3M PAKISTAN (PRIVATE) LIMITED NAZAR UR REHMAN 0817125-4 02--16-6805-001-73 2 OM-616 A ABB POWER & AUTOMATION (PRIVATE) LIMITED NAJEEB AHMAD 4233180-3 03-00-4233-180-17 3 OM-383 A ABBOTT LABORATORIES (PAKISTAN) LIMITED SYED ANIS AHMED 1347561-4 02-04-3302-002-91 4 OM-661 A ABUDAWOOD TRADING COMPANY PAKISTAN (PRIVATE) LIMITED AGHA TARIQUE 3039736-7 17-00-9998-007-19 5 OM-680 A AISHA STEEL MILLS LIMITED MUNIR AHMED (DR.) 2486644-0 17-50-7210-001-91 6 OM-676 A AKZO NOBEL PAKISTAN LIMITED SAAD MAHMOOD RASHID 3804142-1 S3804142-1 7 OM-584 A AL BARAKA BANK (PAKISTAN) LIMITED AHMED SHUJA KIDWAI 2554922-7 17-00-9813-031-46 8 OM-640 A AL-HAJ PAKISTAN EXPLORATION LIMITED TAJ MOHAMMAD AFRIDI 0657090-9 07-01-2711-034-73 9 OM-693 A ALLIANZ EFU HEALTH INSURANCE LIMITED KAMRAN ANSARI 1163080-9 17-50-9805-057-82 10 OM-613 A ARABIAN SEA ENTERPRISES LIMITED SIKANDER MEHMOOD 0700949-6 02-10-9801-002-46 11 OM-579 A ARCHROMA PAKISTAN LIMITED MUJTABA RAHIM 0816040-6 12-00-2900-783-46 12 OM-672 A ARYSTA LIFESCIENCE PAKISTAN (PRIVATE) LIMITED MUHAMMAD ALI NAEEM 1126945-6 12-00-2800-297-64 13 OM-696 A ASIA PETROLEUM LIMITED MIR SHAHZAD KHAN TALPUR 0709724-7 32-77-8761-358-7 14 OM-699 A ASIAN CONSUMER CARE PAKISTAN (PVT) LIMITED NAUMAN KHAN 2631418-5 17-00-2100-037-82 15 OM-470 A ASPIN PHARMA (PVT) LTD TAREK M. -

W I T H P R O G R E

Annual Report 2016 WITH PROGRESS Contents Vision & Mission -------------------------------------------------------------------------------------------02 Company Information ------------------------------------------------------------------------------------04 Board of Directors -----------------------------------------------------------------------------------------06 Quality, Health, Safety & Environmental Policy ---------------------------------------------------------09 Core Values -----------------------------------------------------------------------------------------------10 Whistle Blowing Policy Statement -----------------------------------------------------------------------11 Corporate Social Responsibility -------------------------------------------------------------------------12 Corporate Strategy ----------------------------------------------------------------------------------------24 Management ----------------------------------------------------------------------------------------------26 Awards and Certificates ----------------------------------------------------------------------------------28 Chairman’s Review ----------------------------------------------------------------------------------------30 Directors’ Report -----------------------------------------------------------------------------------------32 Shareholders’ Information --------------------------------------------------------------------------------44 Notice of the Thirty-Seventh (37th) Annual General Meeting ------------------------------------------56 -

Pakistan Stock Exchange Limited Stock Exchange Building, Stock Exchange Road, Karachi Phone: (021) 111-001-122

PAKISTAN STOCK EXCHANGE LIMITED STOCK EXCHANGE BUILDING, STOCK EXCHANGE ROAD, KARACHI PHONE: (021) 111-001-122 PSX/N-1356 N O T I C E Dated: December 04, 2020 RE-COMPOSITION OF KSE-MEEZAN 30 INDEX (KMI-30) It is hereby informed that the Pakistan Stock Exchange Limited has carried-out the exercise of re- composition of KSE-Meezan 30 Index for the review period from January 01, 2020 to June 30, 2020. The re-composition has been carried out on the basis of the criteria of selection of companies as detailed in the Brochure of KSE-Meezan 30 Index, which can be downloaded from the website of the Exchange: www.psx.com.pk. As a result, 6 companies would be affected due to re composition process as given hereunder: - Sr.no. Incoming Companies Outgoing Companies Exclusion Reason 1 GlaxoSmithKline Pakistan Ltd Lotte Chemical Pakistan Ltd. Non-Compliant* 2 Kohat Cement Company Ltd Hascol Petroleum Ltd. Non-Compliant* 3 ICI Pakistan Limited Indus Motor Company Ltd. Non-Compliant* 4 Abbott Lab (Pakistan) Ltd Systems Limited. Non-Compliant* 5 Packages Limited National Refinery Ltd. Ranks 32** 6 International Industries Ltd NetSol Technologies Ltd. Ranks 38** * Shariah Non-Compliant ** Does not fall in list of top 30 Shariah Compliant stocks The recomposed index will be implemented w.e.f. Monday, 21th December, 2020, list of companies included in the recomposed Index and the list of sharia screen companies are also attached. – sd – Hassan Raza General Manager Product Management & Research Copy to: PSX Website Notice Board LIST OF COMPANIES INCLUDED IN THE KMI-30 INDEX ON THE BASIS OF RECOMPOSITION AS ON JUNE 30, 2020, EFFECTIVE FROM MONDAY, 21th DECEMEBER, 2020 Sr.no Symbol Companies 1 ENGRO Engro Corporation Limited 2 LUCK Lucky Cement Limited 3 OGDC Oil & Gas Development Company Limited 4 PPL Pakistan Petroleum Limited 5 POL Pakistan Oilfields Limited 6 PSO Pakistan State Oil Company Limited 7 EFERT Engro Fertilizers Limited 8 MARI Mari Petroleum Company Limited 9 MEBL Meezan Bank Limited 10 SEARL The Searle Company Limited 11 DGKC D.G. -

Attock Cement.Fh9

Half Yearly Report December 31, 2005 Company Information 2 Directors’ Review 3 Auditors’ Review Report to the Members 5 Balance Sheet 6 Profit and Loss Account 8 Cash Flow Statement 9 Statement of Changes in Equity 10 Notes to the Financial Statements 11 10 Board of Directors Auditors Dr. Ghaith R. Pharaon A.F. Ferguson & Co. Chairman Chartered Accountants Babar Bashir Nawaz Cost Auditors Chief Executive Siddiqi & Co Cost & Management Accountants Laith G. Pharaon Wael G. Pharaon Shuaib A. Malik Registered Office Abdul Nayeem 5th Floor, P.N.S.C. Building Bashir Ahmad M.T. Khan Road, Karachi. Abdus Sattar Plant Alternate Directors Hub Chowki, Lasbella Sajid Nawaz Baluchistan Fakhrul Islam Baig Irfan Amanullah Legal Advisor Audit Committee of the Board Sattar & Sattar Attorneys at Law Abdus Sattar Chairman Share Registrar Sajid Nawaz Noble Computer Services (Pvt.) Ltd. Fakhrul Islam Baig 2nd Floor, Sohni Centre, BS 5 & 6 Members Main Karimabad, Block-4 Federal B. Area, Karachi-75950 Company Secretary Tel: 6801880-82 Fax: 6801129 Irfan Amanullah Bankers Faysal Bank Ltd. Habib Bank Ltd. National Bank of Pakistan Allied Bank Ltd. KASB Bank Ltd. Pak Kuwait Investment Co. (Pvt) Ltd. The Bank of Punjab Bank Al Habib First Women Bank Ltd. First Credit & Discount Corporation Ltd. NIB Bank Ltd. Meezan Bank Ltd. MCB Bank Ltd. Bank Al-Falah Ltd. 2 ATTOCK CEMENT PAKISTAN LIMITED DIRECTORS’ REVIEW The directors are pleased to present the un-audited accounts of the Company for the half year ended December 31, 2005. OPERATIONAL RESULTS Production and sales volume figures for the first half of 2005-2006 are as follows: July-Dec. -

Pakistan Oilfields Limited

PAKISTAN OILFIELDS LIMITED Chairman’s Statement It gives me great pleasure to present the Company’s Annual Report and Audited Financial Statements for the year ended June 30, 2018. Results In this year the Company has earned profit after tax of Rs 11.38 billion (2017: Rs.9.679 billion) which is higher by 17.6% in comparison to last year. The Earnings per share is Rs.48.13 (2017: Rs. 40.92). Increase in profit is mainly because of higher crude oil prices and production volumes. In this year production of crude oil, gas and LPG increased by 7.83%, 12.33% and 6.36% respectively. The results of the Company’s operations are dealt with in further detail in the annexed Directors’ Report and Financial Statements. Outlook During this year the Company has made four new exploratory successes in own, operated and non-operated joint ventures including Jandial, Khaur North, Joyamair and Adhi South X-1. In addition to above three development wells were also successful. All new discoveries are under evaluation/appraisal to know full extent of reserves and I am hopeful that these will increase our reserve base. Presently, two wells are under drilling out of which one well is exploratory. In the year 2018-19 six more wells will be spudded out of which two wells are exploratory. The Company is investing a substantial amount to increase its reserve base and with the Grace of Allah we are pretty much hopeful to get new successes. We are driven by our vision to be the leading oil and gas exploration and production company of Pakistan with ever increasing proven hydrocarbon reserves and continuous and improved production. -

Details of Ordinary & Preference Shares

DETAILS OF ORDINARY & PREFERENCE SHARES % of Shares Paid-up Capital/Total Paid-up Capital/Total Shares in CDS available with ref: to % of Shares available with Short S. No. Security Id Security Name Live / Setup Date Issue incl. GOP holding paid up capital Issue excl. GOP holding ref: to paid up capital Name Available Market Value Shares/Units including GoP Shares/Units excluding GoP holding holding 1 PK0061101017 786 INVESTMENT LIMITED 786 17/Jun/1998 13,740,553 152,245,327 14,973,750 91.76 14,973,750 91.76 2 PK0119001011 1LINK (PRIVATE) LIMITED 1LPL 20/Nov/2018 - - 11 - 11 - 3 PK0050501011 AL-ABBAS SUGAR MILLS LIMITED AABS 28/Nov/1998 17,098,700 5,805,179,637 17,362,300 98.48 17,362,300 98.48 4 PK0015401018 AGRO ALLIANZ LIMITED - FREEZE *** AAL 7/Aug/2014 - - 1,183,294 - 1,183,294 - 5 PK0096201014 ATLAS ASSET MANAGEMENT LIMITED AAML 3/Apr/2009 25,000,000 250,000,000 25,000,000 100.00 25,000,000 100.00 6 PK0036101019 AL-ABID SILK MILLS LIMITED - Freeze *** AASM 16/Sep/1998 12,066,260 - 13,409,550 89.98 13,409,550 89.98 7 PK0011501019 ALI ASGHAR TEXTILE MILLS LIMITED - FREEZE *** AATM 18/May/2004 926,222 - 44,426,694 2.08 44,426,694 2.08 8 PK0095901010 ALPHA BETA CAPITAL (PRIVATE) LIMITED ABCPL 26/May/2009 - - 875,000 - 875,000 - 9 PK0083501012 ALLIED BANK LIMITED ABL 7/Apr/2005 1,134,854,283 94,056,722,975 1,145,073,830 99.11 1,145,073,830 99.11 10 PK0092701017 ABL ASSET MANAGEMENT COMPANY LIMITED ABLAMCL 18/Apr/2008 50,000,000 500,000,000 50,000,000 100.00 50,000,000 100.00 11 PK0025701019 ABBOTT LABORATORIES (PAKISTAN) LIMITED ABOT -

Teaming up for Success

. Real business . Real people . Real experience Teaming Up for Success Reward Advisory Services AFGHANISTAN: Remuneration Benchmarking Survey 2007 February 2007 A. F. Ferguson & Co. , A member firm of Chartered Accountants 2 AFGHANISTAN Remuneration Benchmarking Survey 2007 PwC would like to invite your organization to participate in the Remuneration Benchmarking Survey 2007 which will be conducted once every year. This survey will cover all multinational organizations and local companies in AFGHANISTAN, regardless of any particular industry/ sector. This effort is being formulated so as to bring organizations at par with other players in market-resulting by bringing sanity to management and HRM practice in Afghanistan especially during reconstruction era. The survey will comprise of two parts: • Part A – remuneration to personnel in managerial and executive cadres (excluding CEOs/ Country Heads) • Part B – remuneration to CEOs/ Country Heads (international and local nationals separately) • Part C – remuneration to non-management cadre Each report is prepared separately, and participants may choose to take part in either one or all three sections of the survey. Job benchmarking and data collection from the participating organizations will be done through personal visits by our consultants. A structured questionnaire will be used to record detailed information on salaries, allowances, all cash and non-cash benefits and other compensation policies. The collected information will be treated in strict confidence and the findings of the survey will be documented in the form of a report, which will be coded. Each participating organization will be provided a code number with which they can identify their own data and the report will only be available to the participant pool.