New Castle Airport Business Plan Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

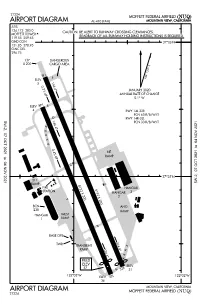

KNUQ Procedures

21224 MOFFETT FEDERAL AIRFIELD (NUQ) AIRPORT DIAGRAM AL-410 (FAA) MOUNTAIN VIEW, CALIFORNIA ATIS 124.175 283.0 CAUTION: BE ALERT TO RUNWAY CROSSING CLEARANCES. MOFFETT TOWER READBACK OF ALL RUNWAY HOLDING INSTRUCTIONS IS REQUIRED. 119.55 259.65 GND CON 37°26'N 121.85 278.95 CLNC DEL 296.75 137 DANGEROUS X 200 CARGO AREA E ° 3 . 3 14 1 L R F VA ELEV 144 5 0 . 3 4 % ° JANUARY 2020 U P ANNUAL RATE OF CHANGE 0.1° W 14 R ELEV E 4 RWY 14L-32R PCN 63 R/B/W/T D RWY 14R-32L SW-2, 07 OCT 2021 to 04 NOV 144 PCN 33 R/B/W/T . 4 x ° x x x x 0 . 4 % NE U RAMP P C 37°25'N 211 Z SW-2, 07 OCT 2021 to 04 NOV RAMP 8122 FIRE 9197 HANGAR STATION 3 X HANGAR 200 X 2 Y 200 BCN ANG 238 RAMP HANGAR WEST 1 RAMP B BASE OPS 324 TWR TRANSIENT x . 4 324 RAMP ° x . 4 x ° x FIELD ELEV ELEV 37 R A 32 31 122°03'W L 122°02'W ELEV 32 36 MOUNTAIN VIEW, CALIFORNIA AIRPORT DIAGRAM MOFFETT FEDERAL AIRFIELD (NUQ) 21224 (HOOKS2.HOOKS)21168 MOFFETT FEDERAL AIRFIELD (NUQ) HOOKS TWO DEPARTURE AL-410 (FAA) MOUNTAIN VIEW, CALIFORNIA ATIS TOP ALTITUDE: 124.175 283.0 ASSIGNED BY ATC CLNC DEL 296.75 GND CON 121.85 278.95 MOFFETT TOWER 119.55 (CTAF) 259.65 NORCAL DEP CON 120.1 290.25 MOFFETT Chan 123 NUQQUN (117.6) 141 ° SW-2, 07 OCT 2021 to 04 NOV NOTE: TACAN required. -

Delaware River and Bay Authority Recognized for Environmental

About the Working with Building for Economic DRBA the DRBA the Future Development View Article Current Articles | Archives | Search Delaware River and Bay Authority Recognized for Environmental Sustainability By JSalmon on 11/07/2019: Delaware River and Bay Authority Recognized for Environmental Sustainability NEW CASTLE, Del. – The Delaware River and Bay Authority was recently honored with the Northeast Recycling Council’s (NERC) Environmental Sustainability Leadership Award at NERC’s 2019 Fall Conference held in Providence, Rhode Island. The Northeast Recycling Council (NERC) presented its 2019 Environmental Sustainability Leadership Awards to three outstanding programs in the northeast region. Each of the winners was selected for its particularly high level of environmental achievement that supports NERCs mission. Awards were presented to: · Advisory Member Award - the Delaware River & Bay Authority’s (DRBA) Regional Environmental Leadership and Enhanced Recycling Program · Public Sector award - Danvers, Massachusetts Recycling Contamination Reduction Campaign. · Private Sector award - The Armstrong® Ceilings Recycling Program “We’re pleased that NERC recognized our efforts to enhance our recycling program and materials management practices,” said Al Fralinger, Environmental Compliance & Safety Manager for the DRBA. “It’s a credit to our employees who have embraced our environmental sustainability efforts and to our partners for their assistance in building on past successes. We will continue to pursue opportunities and initiatives that reduce our carbon footprint, having positive impact on our environment.” The DRBA was recognized for the following: Partnered with Waste Management to provide recycling containers to each employee and rolled out new and enhanced recycling practices across all of its facilities. Expanded environmentally preferable purchasing practices, including furnishing the Lewes, Delaware ferry with 100% recycled plastic products, such as Adirondack chairs and picnic tables. -

PRESERVING MILITARY AVIATION HERITAGE Www

www.castleairmuseum.org CONTRAILS FALL 2019 - PRESERVING MILITARY AVIATION HERITAGE ON APPROACH By: Joe Pruzzo, CEO The Museum has been a beehive of activity thus far in 2019 on all fronts. Our beautiful Lockheed MC-130 P Hercules Aircraft was moved from the Castle Airport Tarmac area to the Museum this past July. As you can image this was quite an undertaking! Many Museum departments, plus municipalities and utility companies were involved to facilitate this move. Personally, and on behalf of the entire Museum thank you to all who participated to make this move a resounding success! The dedication of this aircraft was held on Saturday Oct. 26, 2019. While on the subject of grounds and facilities, they have never looked better! Thank you Tim, Larry, Ed, ADM-20 Quail Decoy Missle and Brian for all of your hard work and dedication. For the first time we took our television campaign North to the Sacramento market, while pouring more into our Fresno television campaign, which resulted in an Open Cockpit Day larger than ever experienced by the Museum! Aviation Pavilion to host events, both private and community Approximately 5,000 plus in attendance on Monday, yes events, along with the prospect of having the option of hosting Monday Memorial Day May 27. I must thank our exceptional traveling, cultural exhibits for our region and beyond. Our staff and volunteers for shifting the day from Sunday to marketing and promotion campaigns have been critical in the Monday, a mere 48 hours prior due to inclement weather. We growth of Museum awareness and getting more people to are diligently working towards our long desired goal of an come be amazed!! Hope to see you soon at the Museum! HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH Moving the C130 HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH HANGAR HAPPENINGS By: Jeff Heyer, Restoration Manager all has welcomed us with some better weather, and a note I started in 2003 and restoration was a lot smaller group new set of 24 UC Merced inters for the semester. -

Merced County Regional Waste Management Authority Landfill-Gas-To-Energy Project

Initial Study/Proposed Mitigated Negative Declaration Merced County Regional Waste Management Authority Landfill-Gas-to-Energy Project June 2019 PREPARED FOR: Merced Regional Waste Management Authority Merced County Regional Waste Management Authority 7040 North Highway 59 Merced, California 95348 (209) 723-4481 Initial Study/Proposed Mitigated Negative Declaration for the Merced County Regional Waste Management Authority Landfill-Gas-to-Energy Project Prepared for: Merced Regional Waste Management Authority Merced County Regional Waste Management Authority 7040 North Highway 59 Merced, California 95348 (209) 723-4481 Contact: Jerry Lawrie, Environmental Resource Manager [email protected] Prepared By: Ascent Environmental, Inc. 455 Capitol Mall, Suite 300 Sacramento, California 95814 916/444-7301 Contact: Chris Mundhenk June 2019 18010098.02 TABLE OF CONTENTS Section Page LIST OF ABBREVIATIONS .......................................................................................................................................................................... iii 1 INTRODUCTION ........................................................................................................................................................................ 1-1 1.1 Introduction and Regulatory Guidance ................................................................................................................... 1-1 1.2 Why this Document? .................................................................................................................................................... -

Chapter 2 - Draft October 2019

Delaware Aviation System Plan Chapter 2 - Draft October 2019 ANALYSIS OF EXISTING SYSTEM HE PURPOSE OF THIS CHAPTER IS TO provide the necessary database for subsequent phases of the System Plan. Pertinent data, regarding each airport/heliport and the area it serves was T collected from each airport and the appropriate State and local agencies. In addition to the data provided by these sources, information published by the Federal government and other sources required for comprehensive understanding of the existing aviation system was collected, tabulated, and reviewed. Maximum use was made of the existing system planning work, various existing airport master plans, and environmental studies that have been completed. From these data, the analysis of the existing system was developed. Inventory items included: Airport and Heliport Facilities Aeronautical Activity Fuel Sales by Airport Land Use Around System Airports Socioeconomic Base Statutes and Regulations Future Technology Of these items, the examination of State Aviation Regulations was used to determine whether an update is needed to accommodate funding for private airport development. 1. AIRPORT AND HELIPORT FACILITIES HE FACILITY INVENTORY RECORDS OF DELDOT (WHICH are used for the FAA Form 5010), were used as T one source of inventory data for airport and heliport facilities. Figure 2‐1 presents a map of Delaware showing the locations of each of the existing public‐use airports and heliports. Additional data and information were obtained through review of existing completed airport master plans, and those that are in progress. In addition to the data from published records, on‐site inspections of some of the system airports were necessary to inspect runway and taxiway pavement conditions. -

Aviation in California: Benefits to Our Economy and Way of Life

Aviation in California: Benefits to Our Economy and Way of Life JUNE 2003 PUBLIC USE AIRPORTS BY FUNCTIONAL CLASSIFICATION Commercial/Primary (29) Metropolitan (20) Regional (66) Community (102) Limited Use (33) Joint Use — Military/Commercial (2) The contents of this report reflect the views of the author who is responsible for the facts and accuracy of the data presented herein. The contents do not necessarily reflect the official views or policies of the State of California or the Federal Highway Administration. This report does not constitute a standard, specification, or regulation. This report was prepared with funds from a grant provided by the United States Government (80%) and funds from the State of California (20%). Aviation in California: Benefits to Our Economy and Way of Life FINAL REPORT Prepared for BUSINESS,TRANSPORTATION AND HOUSING AGENCY CALIFORNIA DEPARTMENT OF TRANSPORTATION DIVISION OF AERONAUTICS Submitted by Economics Research Associates JUNE 2003 ECONOMIC IMPACT STUDY ADVISORY COMMITTEE Nancy Benjamin Alan R. Tubbs Study Project Manager District Field Services Manager California Department of Transportation Airborne Express, Mather Field Division of Aeronautics Chuck Oldham R. Austin Wiswell Robert Chung Chief California Transportation Commission California Department of Transportation Division of Aeronautics Carl Williams Senior Policy Director Michael Armstrong California Space Authority, Inc. (CSA) Senior Lead Planner Southern California Association of Governments Bonnie Cornwall (SCAG) Program Manager Division -

RCED-83-98 Potential Joint Civil and Military Use of Military Airfields

I 3 @gT73f; ‘ii THECOMPTROLLER GENERAL Report To The Congress OF THEUNITED STATES Potential Joint Civil And Military Use Of Military Airfields GAO’s evaluation of joint civilian and military use of military airfields shows the concept to be feasible. Currently, 23 military airfields are operating under joint use agreements. Whether joint use can be expanded to other military airfields depends on over- coming problems unique to each airfield and on the full cooperation of the military and civilian parties involved. Some of the problems are --military concerns about impacts on mission, operations, and/or security; --lack of available land to house civilian operations; and --lack of support by a civilian sponsor resulting from community opposition or the lack of a real need for joint use of the airfield. The Congress directed the Secretaries of Defense and Transportation to submit a plan by September 1983 for making domestic military airfields avail- able for joint military and civilian use. GAO recommends action the Secretaries should take in developing this plan. 120738 GAO/RCED-83-88 MARCH 1,1983 Request for copies of GAO reports should be sent to: U.S. General Accounting Office Document Handling and Information Services Facility P.O. Box 6015 Gaithersburg, Md. 20760 Telephone (202) 2756241 The first five copies of individual reports are free of charge. Additional copies of bound audit reports are $3.25 each. Additional copies of unbound report (i.e., letter reports) and most other publications are $1.00 each. There will be a 25% discount on all orders for 100 or more copies mailed to a single address. -

2019 CASTLE AIR MUSEUM BOARD of DIRECTORS OFFICERS: Chairman

CONTRAILSwww.castleairmuseum.org WINTER 2019 - PRESERVING MILITARY AVIATION HERITAGE ON APPROACH By: Joe Pruzzo, CEO he time for Holiday cheer is once again here, I must in 2018, which make such an immense difference! admit in what seems to be in a blink of an eye! To me I view this in terms of the Museum having so many good Christmas came early for the Museum this year with a special T delivery in the form of a Lockheed MC-130 P Hercules Search and positive achievements that we simply lost track of time in th 2018. I feel blessed to lead such a wonderful team of talented and Rescue Aircraft from the 129 Air Rescue Wing. This staff, and volunteers that move the Museum forward. All of particular aircraft has significant historical provenance as it this of course takes funding to sustain this historic treasure. led the raid on the Son Tay Prison in November 1970 in North We sometimes feel we run a small city with various Vietnam to liberate American POWs. We plan on getting this departments, all with one common goal. To propel us forward aircraft moved from the Castle Airport Ramp over to the and continue “to preserve military aviation heritage for future Museum hopefully by the end of January 2019. generations.” With a vision to acquire, preserve, and educate. Wishing everyone a Merry Christmas and Happy New Year. I would also like to pause, reflect, and thank all of the generous We look forward to each of you visiting the Museum in 2019! donors who have donated monetarily and with needed product HANGAR HAPPENINGS By: Jeff Heyer ince our last update we have had a great group of 21 UC for welcoming and teaching our intern partners. -

National Plan of Integrated Airport Systems (NPIAS) (2011-2015)

NPIAS 2011-2015 Illustrated by GRA, Incorporated Federal Aviation Administration U.S. Department of Transportation National Plan of Integrated Airport Systems (NPIAS) (2011-2015) Report of the Secretary of Transportation to the United States Congress Pursuant to Section 47103 of Title 49, United States Code The NPIAS 2011-2015 report is available online at http://www.faa.gov/airports/planning_capacity/npias/reports Table of Contents EXECUTIVE SUMMARY .............................................................................................................. VI Development Estimates .......................................................................................................... vii Estimates by Airport Type......................................................................................... viii Estimates by Type of Development...............................................................................x Status of the Industry .............................................................................................................. xii CHAPTER 1: SYSTEM COMPOSITION.......................................................................................1 Overview....................................................................................................................................1 U.S. Department of Transportation................................................................................2 Federal Aviation Administration ...................................................................................2 -

Delaware River & Bay Authority

50 @ D elaware River & Bay Authority DRBA 50 Years of Service to the People of Delaware & New Jersey 1 2012 Annual Report • Vol. II 50 Delaware River & Bay Authority Celebrating 50 Years of Service 2012 Annual Report 1 50 The Delaware River and Bay Authority: 50 years of serving the residents of Delaware and New Jersey On September 20, 1962, United In the 50 years since, the bi-state agency States President John F. Kennedy signed has evolved into a dynamic organization that legislation that created the Delaware River continues to provide not only the benefits and Bay Authority Compact which opened foreseen by President Kennedy but also oth- the doors to the establishment of the ers not thought of five decades ago. Delaware River &Delaware Bay Authority’s River and Bay InitialAuthority Commission and its — 1963 The Authority in 2012 is responsible for Commission. The Legislative record reported the operations and maintenance of the Dela- that President Kennedy noted at that time ware Memorial Bridge Twin Span and the that: “These crossings, (the second bridge Cape May-Lewes Ferry, just as the Presi- at the head of the Delaware Bay and the dent foretold. But it has also taken re- establishment of a ferry at the mouth of the sponsibiity for the Delaware City-Salem Bay) will provide great benefit to the people Ferry (formerly the Three Forts Ferry) and of the two states. In addition, they will benefit five regional airports: New Castle Airport, many residents of other states by expanding Civil Air Terminal, and Delaware Airpark in the the vital connecting links in the routes of State of Delaware, and the Millville Airport highway travel and transportation along the and Cape May Airport in the State of New eastern seaboard.” Jersey, as well as other properties in the two states that add value to the region through the stewardship of the Authority. -

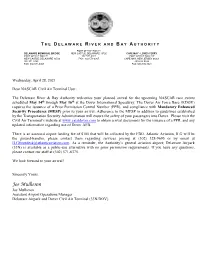

Joe Mulheron Joe Mulheron Assistant Airport Operations Manager Delaware Airpark and Dover Civil Air Terminal (33N/DOV)

T HE D ELAWARE R IVER AND B A Y A UTHORITY POST OFFICE BOX 71 DELAWARE MEMORIAL BRIDGE NEW CASTLE, DELAWARE 19720 CAPE MAY - LEWES FERRY POST OFFICE BOX 71 302-571-6303 POST OFFICE BOX 827 NEW CASTLE, DELAWARE 19720 FAX: 302-571-6367 CAPE MAY, NEW JERSEY 08204 302-571-6303 609-886-9699 FAX: 302-571-6367 FAX: 609-886-1021 Wednesday, April 28, 2021 Dear NASCAR Civil Air Terminal User: The Delaware River & Bay Authority welcomes your planned arrival for the upcoming NASCAR race events scheduled May 14th through May 16th at the Dover International Speedway. The Dover Air Force Base (KDOV) requires the issuance of a Prior Permission Control Number (PPR), and compliance with Mandatory Enhanced Security Procedures (MESP) prior to your arrival. Adherence to the MESP in addition to guidelines established by the Transportation Security Administration will ensure the safety of your passengers into Dover. Please visit the Civil Air Terminal’s website at www.catatdover.com to obtain arrival documents for the issuance of a PPR, and any updated information regarding use of Dover AFB. There is an assessed airport landing fee of $100 that will be collected by the FBO. Atlantic Aviation, ILG will be the ground-handler, please contact them regarding services pricing at (302) 328-9695 or by email at [email protected]. As a reminder, the Authority’s general aviation airport; Delaware Airpark (33N) is available as a public-use alternative with no prior permission requirements. If you have any questions, please contact our staff at (302) 571-6375. -

Chapter 10 Transportation

Chapter 10 Transportation Overview______________________________________________________________________________ Land use, growth management, and transportation planning are inextricably linked and have to evolve and grow together. Despite the fact that Kent County is not responsible for maintenance of public roads, it is responsible for land use policy and the ultimate demands on those roads. Transportation systems affect most significant aspects of human society including: Settlement patterns; Land development and land use; Economic activity; Goods movement and trade; Jobs and wages; Energy and resource allocation; Access to places of work, education, health care, social life, and commerce; General social equity; Environmental quality; and Overall livability of communities. Community outreach revealed that maintaining existing infrastructure, improving traffic flow, and improving safety are clear priorities. Given the wide reaching impacts of transportation systems, how well they function in turn affects the quality of the built and natural environment as well as the quality of life of citizens. A quality transportation system is also an essential element of attracting economic development. When developing a transportation plan, the overall net benefit with respect to environmental quality, growth management, land use, housing affordability, social equity, urban design, and economic development must be considered. Transportation systems encompass a wide variety of modes including automobiles, bus transit, bicycle, pedestrian, airplanes, trucks, rails, and boats. These modes are not necessarily mutually exclusive and, in fact, should be considered complimentary. Walking is the most basic form of transportation and when road improvements for vehicular traffic are contemplated, multi-modal paths for bike and pedestrian traffic should be included in the design. System improvements and expansion are expensive and complicated undertakings that are designed, constructed, and maintained through a combination of public and private funding.