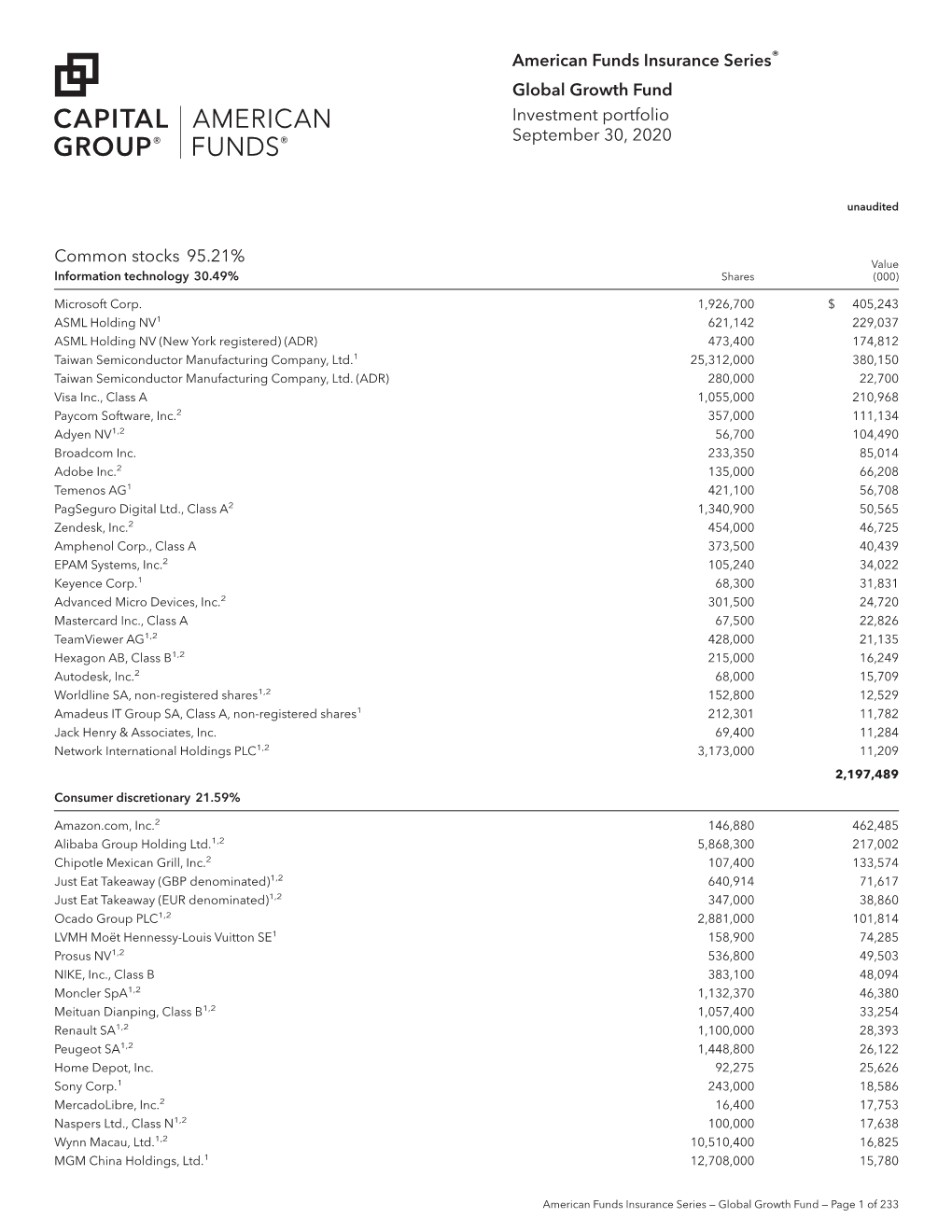

American Funds IS 3Rd Quarter Holdings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Art Matters with You Art Can Change a Life

art matters With you art can change a life. Allied Arts Quarterly Newsletter Volume 13, Issue 2, Winter 2020 2021 Campaign for the Arts With the new year quickly approaching, Allied Arts is the Allied Arts gearing up for the 2021 campaign for the arts. As we entertainment also embark on the Allied Arts 50th anniversary in 2021, discount card, and a your continued support is more important than ever as 7-inch steel sculpture COVID-19 continues to have a devastating impact on our created by Allied art nonprofits. Between April and the end of July alone, Arts artist of the year, Oklahoma creative industries lost more than $606 million Joe Slack. You can and 19,500 jobs according to a recent study released by read more about the Brookings Institution. Additionally, our community has Slack on page 2 of lost two cultural nonprofits due to the effects of COVID-19. this e-newsletter. Your support can help ensure that we do not lose any more Companies that organizations that are making a difference. commit to hosting 1971-2021 an employee giving In this challenging year, your generosity and commitment campaign before to the arts have been critical in enabling the Allied Arts January 20 will receive special recognition as Headliners. network to meet pandemic-related challenges head-on To join them and the more than 100 companies that and to continue providing enlightening, educational and annually engage their employees in the arts, email inspiring programming. Their ability to pivot quickly has [email protected]. been incredible - from new digital youth-oriented web episodes to socially-distanced, outdoor performances. -

General Counsel Compensation Ranked by 2009 Total Cash

GC6 • GC Mid-Atlantic TUESDAY, SEPTEMBER 14, 2010 September 2010 General Counsel Compensation Ranked by 2009 Total Cash GC Salary + Bonus + Non-Equity Total Stock Option Change in All Other Total ank R Company Incentive Plan Cash 2009 Awards Awards Pension Compensation Comp. = Value 1 Carol Ann Petren $565,000 $0 $1,880,000 $2,445,000 $1,500,009 $263,261 $59,360 $7,482 $4,275,112 CIGNA Corp. 2 Jon D. Walton $428,000 $0 $1,636,267 $2,064,267 $1,530,152 $0 $203,648 $152,658 $3,950,725 Allegheny Technologies Inc. 3 Arthur R. Block $846,036 $0 $799,696 $1,645,732 $2,452,295 $1,388,789 $650,077 $14,700 $6,151,593 Comcast Corp. 4 Burton H. Snyder $485,000 $0 $486,484 $971,484 $330,692 $357,469 $454,397 $38,142 $2,152,184 Hershey Co. 5 Gerald J. Pappert $551,300 $0 $402,400 $953,700 $841,050 $896,017 $0 $41,849 $2,732,616 Cephalon Inc. 6 Nancy M. Snyder (1) $458,450 $415,200 $0 $873,650 $1,168,757 $276,250 $0 $68,768 $2,387,424 Penn Virginia Corp. 7 P. Jerome Richey $414,258 $0 $420,000 $834,258 $322,031 $143,840 $206,778 $38,739 $1,545,646 Consol Energy Inc. 8 David M. Feinberg $400,000 $90,000 $265,500 $755,500 $680,649 $257,122 $95,769 $10,071 $1,799,111 Allegheny Energy Inc. 9 Laurence G. Miller $372,500 $58,110 $317,370 $747,980 $176,588 $314,603 $7,091 $77,091 $1,323,353 Teleflex Inc. -

Top 50 by Tenure CEO and Chairman Tenures at Singapore-Listed Firms with Billion-Dollar Market Cap Or More

Top 50 by tenure CEO and chairman tenures at Singapore-listed firms with billion-dollar market cap or more COMPANY CEO (EFFECTIVE)* YEAR CEO COMPANY CHAIRMAN CHAIRMAN BOARD APPOINTED TENURE TYPE TENURE Hotel Properties Ong Beng Seng 1980 36 Jardine Matheson Henry Keswick Executive 49 UOB Kay Hian Holdings Wee Ee Chao 1981 35 City Developments Kwek Leng Beng Executive 47 Osim International Ron Sim Chye Hock 1983 33 UOL Group Wee Cho Yaw Non-executive 43 Wing Tai Holdings Cheng Wai Keung 1985 31 Haw Par Corp Wee Cho Yaw Non-executive 41 Sheng Siong Group Lim Hock Chee 1985 31 Osim International Ron Sim Chye Hock Executive 33 Venture Corp Wong Ngit Liong 1986 30 Wing Tai Hldgs Cheng Wai Keung Executive 31 Olam International Sunny George Verghese 1989 27 Genting Singapore Lim Kok Thay Executive 30 Fragrance Group James Koh Wee Meng 1991** 25 Ho Bee Land Chua Thian Poh Executive 29 Wilmar International Kuok Khoon Hong 1991 25 Jardine Strategic Henry Keswick Executive 28 United Industrial Corp Lim Hock San 1992 24 Venture Corp Wong Ngit Liong Executive 27 Yanlord Land Group Zhong Sheng Jian 1993 23 Fragrance Group James Koh Wee Meng Executive 25 * UOL Group Gwee Lian Kheng 1995 21 United Industrial Corp Wee Cho Yaw Non-executive 24 Golden Agri-Resources Franky Oesman Widjaja 1996 20 Yanlord Land Group Zhong Sheng Jian Executive 23 Raffles Medical Group Loo Choon Yong 1997 19 Noble Group Richard Samuel Elman Executive 22 Ho Bee Land Chua Thian Poh 1999 17 Golden Agri-Resources Franky Oesman Widjaja Executive 20 ARA Asset Management Lim Hwee Chiang -

The Journey East 5 the JOURNEY EAST

No3 T H E J O U R N E Y E A S T NOTION INSIGHTS Build. Scale. Succeed. Notion Insights is published by Notion, 91 Wimpole Street, London W1G 0EF. The Journet East is Registered address: Third Floor, 1 New Fetter Lane, London EC4A 1AN. proudly brought to you by: For opportunities to contribute to future editions of Notion Insights please contact Kate Hyslop. [email protected] Design SunnySideUp: [email protected] Notion (OC364955) is Authorised and Regulated by the Financial Conduct Authority. ALLISON+ PARTNERS Reproduction in whole or in part without written permission is strictly prohibited. © 2018 Notionl. All rights reserved. 4 Notion Insights The Journey East 5 THE JOURNEY EAST There comes a time for every European tech entrepreneur when they need to weigh up the challenges of international expansion. This type of high-growth business can expand across Europe, but in many They have proven they are solving a problem cases the heterogeneous nature of the market, plus the relatively small sizes that is worth solving. They are solving it well of the European countries, makes that unattractive. in their home market and are confident that they know how to find, acquire and retain their Clearly the next choice is the US - and for many that is the most obvious ideal customers efficiently and predictably. place to go on the route to category domination. It’s a massive market They are building a company that can scale. and, as we detailed in “Crossing the Atlantic”, there is a wealth of advice and resources available. -

Templeton Global Equity Income Fund August 31, 2021

FTIF - Templeton Global Equity Income Fund August 31, 2021 FTIF - Templeton Global Equity August 31, 2021 Income Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date B4TX8S1 AIA GROUP LTD 70,295 $839,367 1.10% N/A N/A 012653101 ALBEMARLE CORP 7,404 $1,752,822 2.31% N/A N/A 025816109 AMERICAN EXPRESS CO 12,293 $2,040,146 2.68% N/A N/A BYPBS67 ARCELORMITTAL SA 14,303 $479,701 0.63% N/A N/A 0989529 ASTRAZENECA PLC 11,321 $1,323,868 1.74% N/A N/A 084670702 BERKSHIRE HATHAWAY INC 2,308 $659,557 0.87% N/A N/A 09857L108 BOOKING HOLDINGS INC 520 $1,195,828 1.57% -

State of New Jersey Board of Public Utilities I/M/O

STATE OF NEW JERSEY BOARD OF PUBLIC UTILITIES I/M/O THE PETITION OF ATLANTIC ) CITY ELECTRIC COMPANY FOR ) APPROVAL OF AN INFRASTRUCTURE ) BPU DOCKET NO. EO18020196 INVESTMENT PROGRAM, AND ) RELATED COST RECOVERY ) MECHANISM, PURSUANT TO ) N.J.A.C. 14:3-2A.1 et. seq. ) ______________________________________________________________________________ DIRECT TESTIMONY OF MARLON F. GRIFFING, PH.D. ON BEHALF OF THE DIVISION OF RATE COUNSEL ______________________________________________________________________________ STEFANIE A. BRAND, ESQ. DIRECTOR, DIVISION OF RATE COUNSEL DIVISION OF RATE COUNSEL 140 East Front Street, 4th Floor P. O. Box 003 Trenton, New Jersey 08625 Phone: 609-984-1460 Email: [email protected] FILED: September 4, 2018 TABLE OF CONTENTS I. INTRODUCTION ................................................................................................... 1 II. ACE IIP BACKGROUND ....................................................................................... 6 III. ACCELERATED RECOVERY AND RISK ........................................................... 9 IV. BOARD TREATMENT OF A CLAUSE RECOVERY MECHANISM IN A PRIOR DOCKET ............................................................................................ 13 V. FINDING THE APPROPRIATE ROE FOR THE ACE IIP .................................... 14 VI. ROE ANALYSIS ..................................................................................................... 15 VII. SELECTING THE COMPARISON GROUP ......................................................... -

VT Multi Asset Absolute Returnannual Report

Putnam Variable Trust Putnam VT Multi-Asset Absolute Return Fund Annual report 12 | 31 | 20 Message from the Trustees February 12, 2021 Dear Shareholder: The world welcomed 2021 with high hopes for improvement in the global economy and public health. Although COVID-19 infections have reached new levels, distribution of vaccines is underway, boosting optimism about a return to normal in the not-too-distant future. In the United States, new proposals to rebuild the economy are anticipated from the Biden administration. The stock and bond markets started the year in good shape, indicating that investors are willing to look beyond current challenges and see the potential for renewed economic growth. Putnam continues to employ active strategies that seek superior investment performance for you and your fellow shareholders. Putnam’s portfolio managers and analysts take a research-intensive approach that includes risk management strategies designed to serve you through changing conditions. As always, thank you for investing with Putnam. Respectfully yours, Robert L. Reynolds President and Chief Executive Officer Putnam Investments Kenneth R. Leibler Chair, Board of Trustees Performance summary (as of 12/31/20) Investment objective ICE Data Indices, LLC (“ICE BofA”), used with permission. ICE BofA permits use Positive total return of the ICE BofA indices and related data on an “as is” basis; makes no warran- ties regarding same; does not guarantee the suitability, quality, accuracy, Net asset value December 31, 2020 timeliness, and/or completeness of the ICE BofA indices or any data included in, related to, or derived therefrom; assumes no liability in connection with the Class IA: $9.45 Class IB: $9.29 use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments, or any of its products or services. -

Area Companies Offering Matching Gifts Below Is a Partial List of Area Companies Offering Matching Gifts

Area Companies Offering Matching Gifts Below is a partial list of area companies offering matching gifts. Please check to see if your employer is on the list and/or check with your company if they offer the program. If your employer offers a matching gift program, please request a matching gift form from your employer or fill out their online form. Matching gifts can be made to the Tredyffrin Township Libraries, Paoli Library or Tredyffrin Public Library. Aetna FMC Corporation PNC Financial Services AIG GATX PPG Industries Air Products and Chemicals, Inc. GE Foundation PQ Corporation Allstate Foundation GlaxoSmithKline Procter & Gamble Altria Group, Inc. Glenmede Prudential Financial American Express Company Hillman Company PVR Partners, L.P. American International Group, Inc. Houghton Mifflin Quaker Chemical Corporation AmeriGas Propane, Inc. IBM Corporation Quest Diagnostics AON J.P. Morgan Chase Ross Arkema Inc. John Hancock Saint-Gobain Corporation Automatic Data Processing Johnson & Johnson Sandmeyer Steel Company AXA Foundation, Inc. JP Morgan Chase SAP Matching Gift Program Axiom Data, Inc. Kaplan Inc. Schering-Plough Foundation Bank of America Kellogg Schroder Investment Management Bemis Company Foundation KPMG LLP Shell Oil Company Berwind Corporation Liberty Mutual State Farm Companies Foundation BlackRock Lincoln Financial Group Subaru of America Boeing Company May Department Stores Sun Life Financial BP McDonald's Sun Microsystems, Inc Bristol-Myers Squibb Company McKesson Foundation Sunoco, Inc. C. R. Bard, Inc. Merck & Co., Inc. Tenet Healthcare Foundation CertainTeed Merrill Lynch Texas Instruments Charles Schwab Merrill Lynch ACE INA Foundation Chevron Corporation Microsoft AXA Foundation Chubb Group of Insurance Companies Minerals Technologies Inc. Dow Chemical Company CIGNA Foundation Mobil Foundation Inc. -

Response: Just Eat Takeaway.Com N. V

NON- CONFIDENTIAL JUST EAT TAKEAWAY.COM Submission to the CMA in response to its request for views on its Provisional Findings in relation to the Amazon/Deliveroo merger inquiry 1 INTRODUCTION AND BACKGROUND 1. In line with the Notice of provisional findings made under Rule 11.3 of the Competition and Markets Authority ("CMA") Rules of Procedure published on the CMA website, Just Eat Takeaway.com N.V. ("JETA") submits its views on the provisional findings of the CMA dated 16 April 2020 (the "Provisional Findings") regarding the anticipated acquisition by Amazon.com BV Investment Holding LLC, a wholly-owned subsidiary of Amazon.com, Inc. ("Amazon") of certain rights and minority shareholding of Roofoods Ltd ("Deliveroo") (the "Transaction"). 2. In the Provisional Findings, the CMA has concluded that the Transaction would not be expected to result in a substantial lessening of competition ("SLC") in either the market for online restaurant platforms or the market for online convenience groceries ("OCG")1 on the basis that, as a result of the Coronavirus ("COVID-19") crisis, Deliveroo is likely to exit the market unless it receives the additional funding available through the Transaction. The CMA has also provisionally found that no less anti-competitive investors were available. 3. JETA considers that this is an unprecedented decision by the CMA and questions whether it is appropriate in the current market circumstances. In its Phase 1 Decision, dated 11 December 20192, the CMA found that the Transaction gives rise to a realistic prospect of an SLC as a result of horizontal effects in the supply of food platforms and OCG in the UK. -

Surrounding Business Sales

Business Locator 3935 NW 39th St, Warr Acres, Oklahoma, Prepared by Esri R73in112gs: 1, 3, 5 mile radii Latitude: 35.51152 Longitude: -97.58755 2010 Residential Population: 207,035 2016 Total Sales ($000) $57,731,127 2016 Residential Population: 219,413 2016 Total Employees 219,589 2021 Residential Population: 234,464 Employee/Residential Population Ratio: 1.00:1 Annual Population Growth 2016 - 2021 1.34% Total Number of Businesses: 16,116 SIC Distance From Code Business Name Franchise Site in Miles Employees Sales ($000) 551103 BEST PRICE AUTO 0.06 SE 2 $1,411 NW 39TH ST OKLAHOMA CITY, OK 73112 521121 EXCALIBUR CAST STONE 0.10 SE 20 $6,308 NW 39TH ST OKLAHOMA CITY, OK 73112 754901 SUPERIOR RESCUE 0.10 SE 4 $341 NW 39TH ST OKLAHOMA CITY, OK 73112 863101 SHEET METAL WORKERS JATC 0.11 SE 8 $0 WILLOW SPRINGS AVE OKLAHOMA CITY, OK 73112 358901 L B HALEY'S FLOOR STORE 0.11 SW 4 $1,283 NW 39TH ST OKLAHOMA CITY, OK 73112 171131 HEARTLAND ENERGY OPTIONS 0.11 SW 10 $1,641 NW 39TH ST OKLAHOMA CITY, OK 73112 571305 HALEY'S CARPET 0.11 SW 5 $1,382 NW 39TH ST OKLAHOMA CITY, OK 73112 581208 JIMMY'S EGG 0.13 NE 12 $475 NW 39TH ST OKLAHOMA CITY, OK 73112 864108 SPORTSMAN'S COUNTRY CLUB X 0.14 NW 35 $0 NW 39TH ST OKLAHOMA CITY, OK 73112 602103 ATM 0.14 SE 0 $0 NW 39TH ST OKLAHOMA CITY, OK 73112 541105 SPICES OF INDIA 0.14 SE 6 $1,551 NW 39TH ST OKLAHOMA CITY, OK 73112 171117 LIEBERT CORP 0.16 SE 3 $492 WILLOW SPRINGS AVE OKLAHOMA CITY, OK 73112 602103 ATM 0.17 SE 0 $0 NW 39TH ST OKLAHOMA CITY, OK 73112 554101 FLASH MART V 0.17 SE 5 $3,209 NW 39TH ST OKLAHOMA CITY, OK 73112 Data Note: Businesses are listed based on their proximity to the study area location. -

Federal Railroad Administration Fiscal Year 2017 Enforcement Report

Federal Railroad Administration Fiscal Year 2017 Enforcement Report Table of Contents I. Introduction II. Summary of Inspections and Audits Performed, and of Enforcement Actions Recommended in FY 2017 A. Railroad Safety and Hazmat Compliance Inspections and Audits 1. All Railroads and Other Entities (e.g., Hazmat Shippers) Except Individuals 2. Railroads Only B. Summary of Railroad Safety Violations Cited by Inspectors, by Regulatory Oversight Discipline or Subdiscipline 1. Accident/Incident Reporting 2. Grade Crossing Signal System Safety 3. Hazardous Materials 4. Industrial Hygiene 5. Motive Power and Equipment 6. Railroad Operating Practices 7. Signal and train Control 8. Track C. FRA and State Inspections of Railroads, Sorted by Railroad Type 1. Class I Railroads 2. Probable Class II Railroads 3. Probable Class III Railroads D. Inspections and Recommended Enforcement Actions, Sorted by Class I Railroad 1. BNSF Railway Company 2. Canadian National Railway/Grand Trunk Corporation 3. Canadian Pacific Railway/Soo Line Railroad Company 4. CSX Transportation, Inc. 5. The Kansas City Southern Railway Company 6. National Railroad Passenger Corporation 7. Norfolk Southern Railway Company 8. Union Pacific Railroad Company III. Summaries of Civil Penalty Initial Assessments, Settlements, and Final Assessments in FY 2017 A. In General B. Summary 1—Brief Summary, with Focus on Initial Assessments Transmitted C. Breakdown of Initial Assessments in Summary 1 1. For Each Class I Railroad Individually in FY 2017 2. For Probable Class II Railroads in the Aggregate in FY 2017 3. For Probable Class III Railroads in the Aggregate in FY 2017 4. For Hazmat Shippers in the Aggregate in FY 2017 5. -

STOXX Emerging Markets 1500 Last Updated: 02.01.2018

STOXX Emerging Markets 1500 Last Updated: 02.01.2018 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Large 236.0 1 1 TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Large 155.9 2 2 ZAE000015889 6622691 NPNJn.J ZA004D Naspers Ltd ZA ZAR Large 88.4 3 3 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Large 65.7 4 4 INE040A01026 B5Q3JZ5 HDBK.BO IN00CH HDFC Bank Ltd IN INR Large 49.9 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Large 47.5 6 7 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Large 47.2 7 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Large 44.6 8 11 INE002A01018 6099626 RELI.BO IN0027 Reliance Industries Ltd IN INR Large 41.8 9 8 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Large 40.2 10 10 INE001A01036 6171900 HDFC.BO IN00EJ Housing Development Finance Co IN INR Large 35.6 11 12 BRITUBACNPR1 B037HR3 ITUB4.SA BR0035 ITAU UNIBANCO HOLDING SA -PREF BR BRL Large 34.5 12 13 KR7000660001 6450267 000660.KS KR00EP SK HYNIX INC KR KRW Large 34.3 13 9 RU0009029540 4767981 SBER.MM EV023 SBERBANK RU RUB Large 33.5 14 14 BRVALEACNOR0 2196286 VALE3.SA BR0024 Vale SA BR BRL Large 31.2 15 28 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Large 31.1 16 15 INE009A01021 6205122 INFY.BO IN006B Infosys Ltd IN INR Large 28.8 17 17 BRBBDCACNPR8 B00FM53 BBDC4.SA BR0079 BANCO BRADESCO SA - PREF BR BRL