Small SUV Are Big Winners in 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Typenliste Passform Gummifußmatten

H. Seehase GmbH Co. KG Stand 09/2021 Typenliste Passform Gummifußmatten Art.-Nr. Modell 385478 Alfa Romeo Giulia (952) (2016-2020) 393172 Alfa Romeo Giulia Facelift (952) (2020-) 385171 Alfa Romeo Giulietta (10-) 385188 Alfa Romeo Mito (08-) 391406 Alfa Romeo Stelvio (17- / 20-) 380015 Audi A1 (8X) (10-18) 392601 Audi A1 (GB) (18-) 380039 Audi A3 / A3 Sportback (8PA) (5-türer) (03-13) 380022 Audi A3 / A3 Sportback (8V) (12-20) 393240 Audi A3 / A3 Sportback (8Y) (20-) 380046 Audi A4 (B6/B7 8E/8H) (00-08) 380053 Audi A4 (B8 8K) (07-) 385089 Audi A4 (B9) (16-) 380060 Audi A5 (8T) (07-16) / A5 Sportback (8T) 09-11 392199 Audi A5 (F5) (16-) 380077 Audi A6 (C6 4F) (04-08) 380084 Audi A6 Facelift (C6 4F) (08-11) 380091 Audi A6 (C7 4G) (11-18) 392489 Audi A6 (C8 4A) (18-) 383870 Audi A7 (C7 4G) (10-18) 392496 Audi A7 (C8 4K) (18-) 385423 Audi Q2 (GA) (16-) 380107 Audi Q3 (8U) (11-18) 392571 Audi Q3 (F3) (18-) 380114 Audi Q5 (8R) (08-16) 385416 Audi Q5 (FY) (17-) 380121 Audi Q7 (4L) (06-) 384716 Audi Q7 (4M) (15-) 392465 Audi Q8 (4M) (17-) 380138 BMW 1-er Schrägheck (E81) (3-türer) / Coupe (E82) (2-türer) (07-13) 380145 BMW 1-er Schrägheck (E87) (5-türer) (04-11) 380152 BMW 1-er Schrägheck (F20) (5-türer) / Schrägheck (F21) (3-türer) (11-) 393035 BMW 1-er (F40) (19-) 384372 BMW 2-er Active Tourer (F45) (14-) 393042 BMW 2-er Gran Coupé (F44) (20-) 383962 BMW 3-er (E46) (98-06) 380176 BMW 3-er (E90/E91) (04-) 380169 BMW 3-er Limousine (F30) (4-türer) / Touring/Kombi (F31) (5-türer) (12-) 392205 BMW 3-er GT (F34) (13-) 392694 BMW 3-er Limousine (G20) / Touring/Kombi (G21) (19-) 385126 BMW 4-er (F32, F33, F36) (12-) 384532 BMW 5-er (E39) (95-04) 380183 BMW 5-er (E60, E61) (03-10) 384310 BMW 5-er Limousine (F10 LCI) / Touring/Kombi (F11 LCI) (14-) 380190 BMW 5-er Limousine (F10) / Touring/Kombi (F11) (10-) 391420 BMW 5-er (G30, G31) (17-) 392281 BMW 6-er Grand Turismo (G32) (17-) 380206 BMW X1 (E84) (09-) Seite 1 von 15 H. -

Global Monthly Is Property of John Doe Total Toyota Brand

A publication from April 2012 Volume 01 | Issue 02 global europe.autonews.com/globalmonthly monthly Your source for everything automotive. China beckons an industry answers— How foreign brands are shifting strategies to cash in on the world’s biggest auto market © 2012 Crain Communications Inc. All rights reserved. March 2012 A publication from Defeatglobal spurs monthly dAtA Toyota’s global Volume 01 | Issue 01 design boss Will Zoe spark WESTERN EUROPE SALES BY MODEL, 9 MONTHSRenault-Nissan’sbrought to you courtesy of EV push? www.jato.com February 9 months 9 months Unit Percent 9 months 9 months Unit Percent 2011 2010 change change 2011 2010 change change European sales Scenic/Grand Scenic ......... 116,475 137,093 –20,618 –15% A1 ................................. 73,394 6,307 +67,087 – Espace/Grand Espace ...... 12,656 12,340 +316 3% A3/S3/RS3 ..................... 107,684 135,284 –27,600 –20% data from JATO Koleos ........................... 11,474 9,386 +2,088 22% A4/S4/RS4 ..................... 120,301 133,366 –13,065 –10% Kangoo ......................... 24,693 27,159 –2,466 –9% A6/S6/RS6/Allroad ......... 56,012 51,950 +4,062 8% Trafic ............................. 8,142 7,057 +1,085 15% A7 ................................. 14,475 220 +14,255 – Other ............................ 592 1,075 –483 –45% A8/S8 ............................ 6,985 5,549 +1,436 26% Total Renault brand ........ 747,129 832,216 –85,087 –10% TT .................................. 14,401 13,435 +966 7% RENAULT ........................ 898,644 994,894 –96,250 –10% A5/S5/RS5 ..................... 54,387 59,925 –5,538 –9% RENAULT-NISSAN ............ 1,239,749 1,288,257 –48,508 –4% R8 ................................ -

Baleno-Brochure

SUZUKI BALENO EXPERIENCE THE DRIVE DRIVE IT. BELIEVE IT. The Suzuki Baleno is the practical hatchback that’s a joy to drive. Thanks to our Boosterjet turbocharged engine, you can enjoy maximum performance whilst maintaining great fuel efficiency. Plus, for such a compact hatchback, it’s got plenty of room and it comes with all the latest tech and spec. But to really understand what the Baleno has to offer, you have to experience the drive for yourself. Models shown includes fitted accessories not available as standard 2 3 3 FEEL THE DIFFERENCE WITH 4 Want a more powerful driving experience? We thought you might, which is why the Baleno comes equipped with our Boosterjet turbocharged engine.* This nifty 1.0 litre engine delivers maximum performance whilst maintaining great fuel efficiency. Plus, every Baleno model has been designed with a lightweight chassis to ensure a driving experience that’s as nimble as it is efficient. The 1.0 litre Boosterjet is available with either 5-speed manual or 6-speed automatic options. *SZ-T and SZ5 models only 5 Cleverly designed to be both spacious and comfortable, the Baleno is the compact car ROOMY with room to spare. Plenty of luggage space (320L) Lots of legroom for passengers Centre console box with armrest* AND RELAXING *SZ5 models only 6 Plenty of luggage space (320L) Lots of legroom for passengers Centre console box with armrest* 7 ALL THE LATEST GEAR DAB digital radio Satellite navigation* Bluetooth hands-free phone connectivity Smartphone linking connectivity** Stylish and user-friendly instrument panel Air conditioning Advanced digital display with fuel efficiency, average speed, power, torque and more† * SZ-T and SZ5 models only ** Speak to your local Suzuki Dealer for smartphone specifications and compatibility † SZ5 models only 8 9 SAFETY YOU CAN COUNT ON 10 11 Safety is everything. -

India's First and Exclusive Auto Accessories Store

India's First And Exclusive Auto Accessories Store Wish List (0) My Account Checkout Login | Register € Rs. £ $ Shopping Cart Search 0 item(s) - Rs.0 Contact Us-+91-9953583123 Home » Maruti Suzuki » Baleno 2015-20 » Maruti Suzuki Baleno 2015-2020 LED Tail Lights - RED Glass, AGMSB616M ‹ › Maruti Suzuki Baleno 2015-2020 LED Tail Lights - RED Glass, AGMSB616M 1 Reviews | Write a review Rs.16,450 Brand: Made in Taiwan Product Code: AGMSB616M Availability: In Stock How to Order: Please read description for details Shipping: FREE Doorstep Delivery in 3-5 days anywhere in India Warranty: 1 Year Warranty Qty: 1 Buy Now ADD TO CART ENQUIRY NOW ADD TO WISH LIST Tags: #MarutiSuzukiBalenoledtaillights DESCRIPTION VIDEO SPECIFICATION REVIEWS (1) AUTOGLAM IS ONLY BASED IN NEW DELHI, INDIA. WE DO NOT HAVE ANY BRANCH. ITEM SPECIFICS: Fits all for Maruti Suzuki Baleno 2015-2020 Premium Quality Tail Lights Life Span – 50,000 Hrs EURO 4 Certification. Approved by ARAI and Legal on Road. INSTALLATION: Installation can be done by any Car Accessories Shop. These Taillights are Replacement of Company Fitted Taillights. Simply remove your Existing Taillights and Install AUTOGLAM TAILLIGHTS Same Taillight Placement - No Alteration to Car Body. Same Socket Fitting - No Wire Cutting. Just Plug & Play. PRICE & PACKAGE INCLUDES: 1 Pair of Autoglam Taillights (Right + Left) Connecting Wire with Relay & Connectors. Installation Manual. Free Doorstep Delivery across India. 1 Year Complete Warranty for all Components. ORDER MODE FOR DELHI & NCR CUSTOMERS Visit Autoglam store at Mayur Vihar Phase 1Extn, New Delhi. Please Call or Whatsapp us at +91 9953583123 for our Store Location. -

Tata Motors Annual Report

68th Annual Report 2012-13 CONTENTS FINANCIAL HIGHLIGHTS FINANCIAL STATEMENTS 36 Financial Performance Standalone Financial Statements 40 Summarised Balance Sheet 116 Independent Auditors’ Report and Statement of Profit and 120 Balance Sheet Loss Standalone 121 Profit and Loss Statement 42 Summarised Balance Sheet and Statement of Profit and 122 Cash Flow Statement Loss Consolidated 124 Notes to Accounts 44 Fund Flow Statement Consolidated Financial Statements 160 Independent Auditors’ Report STATUTORY REPORTS 162 Balance Sheet 45 Notice 163 Profit and Loss Statement 52 Directors’ Report 164 Cash Flow Statement 66 Management Discussion and 166 Notes to Accounts Analysis CORPORATE OVERVIEW Subsidiary Companies 98 Report on Corporate 02 Corporate Information Governance 197 Financial Highlights 03 Mission, Vision and Values 115 Secretarial Audit Report 200 Listed Securities 04 Chairman’s Statement 201 Financial Statistics 08 Board of Directors 12 Delivering Experiences Attendance Slip & Proxy Form 14 Key Performance Indicators 16 Products and Brands 18 Global Presence 20 Milestones 22 Driving Accountability 24 Focusing on Customers & Products 26 Emphasising Excellence 28 Delivering with Speed 30 Sustainability 34 Awards and Achievements ANNUAL GENERAL MEETING Date: Wednesday, August 21, 2013 Time: 3.00 p.m. Venue: Birla Matushri Sabhagar, 19, Sir Vithaldas Thackersey Marg, Mumbai 400 020 ANTICIPATING NEEDS. DELIVERING EXCITEMENT. At Tata Motors, we believe that our Our renewed commitment to these mobility needs of our customers. We are strengths stem from an organisation- pillars drives us to achieve our mission engaging with them at our dealerships wide culture which rests on four of anticipating and providing the best and adopting processes to ensure that pillars – Accountability, Customer & vehicles and experiences to excite our industry-leading practices form a key part Product Focus, Excellence and customers. -

India's New-Age Jeep

MOBILITY ENGINEERINGTM AUTOMOTIVE, AEROSPACE, OFF-HIGHWAY A quarterly publication of and Alt-fuels for aircraft India’s new-age Jeep What lies ahead IC’s next big thing Tata to build Safari Storme Achates Power’s opposed-piston for Indian Armed Forces engine heads for production Volume 4, Issue 2 June 2017 ME AR Associates Ad 0617.qxp_Mobility FP 4/4/17 5:07 PM Page 1 Why AR Solid State Pulsed Amplifi ers Should Be On Your Radar For automotive and military EMC radiated immunity susceptibility testing, as well as radar and communication applications, there is now a very attractive alternative to Traveling Wave Tube Amplifi ers (TWTA’s). AR’s new offerings include various frequency ranges and output power levels to meet several standards, or Nine New designs can be tailored to suit your specifi c application. These amplifi ers feature a touchscreen control panel, Amplifi ers GPIB interface, TTL gating, fault monitoring, and forced air cooling. Recently Added! Features & Benefi ts For These Rugged Amplifi ers Are: t Octave Frequencies: 1-2 GHz and 2-4 GHz t Narrowband Frequencies: 1.2-1.4 GHz & 2.7-3.1 GHz t Power Levels: 1 kW to 150 kW Watch Our Pulsed Amps Video Visit www.arworld.us/pavid or t Harmonic Distortion of -18dBc @ 1dB compression point scan this page with the Layar app t Pulse Widths to 100 μsec. & Duty Cycles to 10% to watch on your mobile device. t High Mean Time To Failure (MTTF) t Mismatch Tolerance - Will operate without damage or oscillation with any magnitude and phase of source and load impedance t Numerous Applications Possible - Automotive, MIL STD 464, DO-160 and Military Radar To learn more, visit www.arworld.us/pulsedamps and download Application Note #72A or call us at 215-723-8181. -

PV-Dealer-Application-Form.Pdf

APPLICATION FOR TATA MOTORS PASSENGER VEHICLE DEALERSHIP Tata Motors Ltd. designs, develops, manufactures and markets a wide range of cars and utility vehicles. The Company’s dealerships handle one or more of its brands: Tiago, Tigor, Nexon, Hexa, Harrier and many more. This Application Form is for a dealership in India only. This Application Form is not an offer document or contract. INSTRUCTIONS 1. This Application Form has 20 numbered pages. The Applicant is advised to carefully read the entire Form 2. The application must be made by: a. an existing entity proposing to operate the dealership (Applicant), or b. if a new entity is proposed to be set up to operate the dealership, the application should be made by an existing entity (Applicant) which shall provide all or most of the funding for the new entity 3. This Application Form has 4 sections. All sections must be filled by the Applicant. Information that does not fit into space provided in the Application Form should be attached in a numbered Enclosure, with all such Enclosures filed with the Application Form. All Enclosures should be referenced from this Application Form. 4. All financial statements provided with the Application Form must be audited statements, complete with all schedules, notes forming part of accounts and the auditor’s report. 5. Applicant to ensure that the Application is signed on pages 17 and 18 and on any copies of the same. 6. The filled in and signed copy of the Application Form and Enclosures, should be sent by mail / courier to: Dealer Development Cell Tata Motors Ltd. -

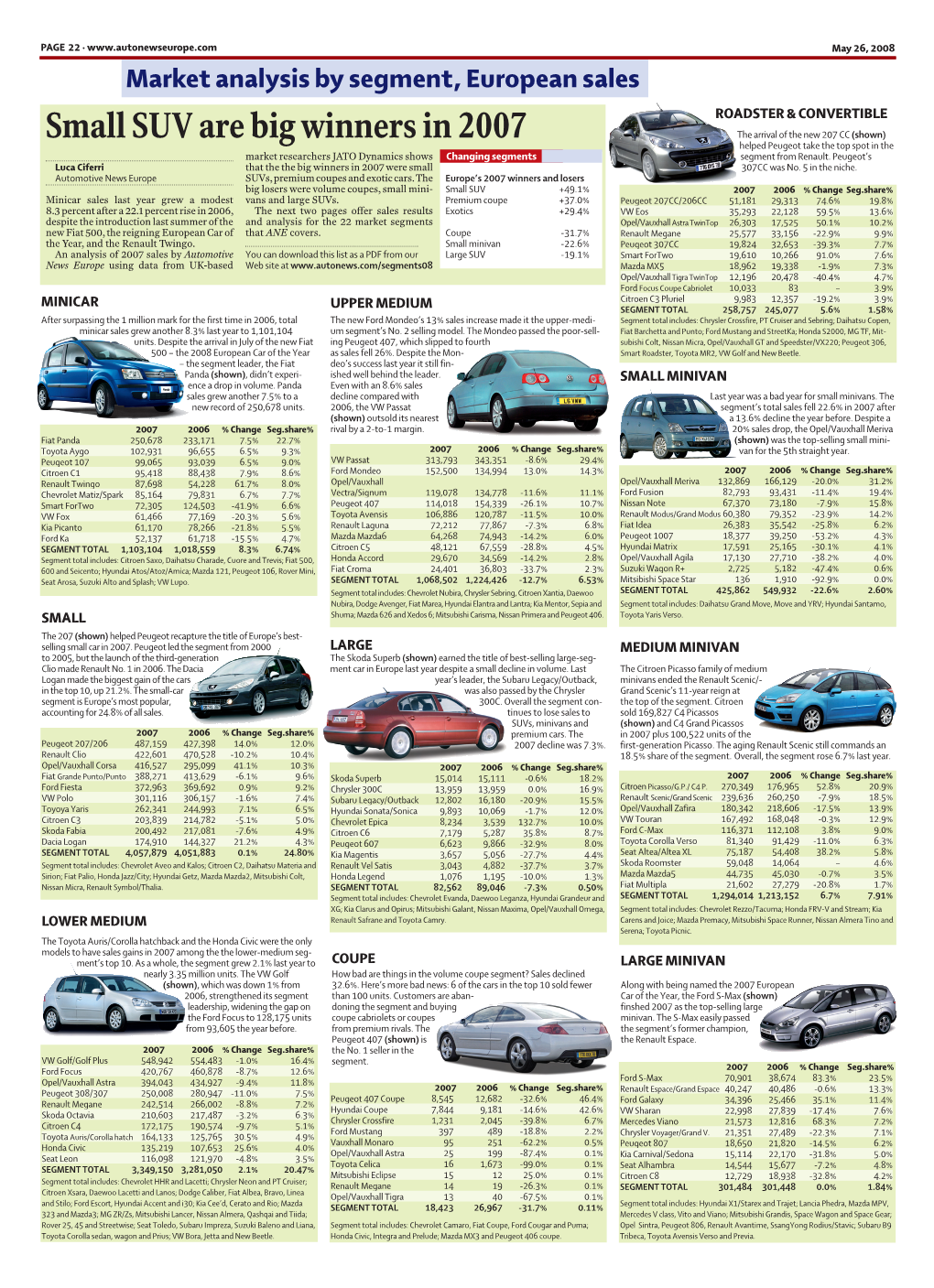

Europe Swings Toward Suvs, Minivans Fragmenting Market Sedans and Station Wagons – Fell Automakers Did Slightly Better Than Cent

AN.040209.18&19.qxd 06.02.2004 13:25 Uhr Page 18 ◆ 18 AUTOMOTIVE NEWS EUROPE FEBRUARY 9, 2004 ◆ MARKET ANALYSIS BY SEGMENT Europe swings toward SUVs, minivans Fragmenting market sedans and station wagons – fell automakers did slightly better than cent. The only new product in an cent because of declining sales for 656,000 units or 5.5 percent. mass-market automakers. Volume otherwise aging arena, the Fiat the Honda HR-V and Mitsubishi favors the non-typical But automakers boosted sales of brands lost close to 2 percent of vol- Panda, was on sale for only four Pajero Pinin. over familiar sedans unconventional vehicles – coupes, ume last year, compared to 0.9 per- months of the year. In terms of brands leading the roadsters, minivans, sport-utility cent for luxury marques. European buyers seem to pro- most segments, Renault is the win- LUCA CIFERRI vehicles exotic cars and multi- Traditional European-brand gressively walk away from large ner with four. Its Twingo leads the spaces such as the Citroen Berlingo automakers dominate the tradi- sedans, down 20.3 percent for the minicar segment, but Renault also AUTOMOTIVE NEWS EUROPE – by 16.8 percent last year to nearly tional car, minivan and premium volume makers and off 11.1 percent leads three other segments that it 3 million units. segments, but Asian brands control in the upper-premium segment. created: compact minivan, Scenic; TURIN – Automakers sold 428,000 These non-traditional vehicle cat- virtually all the top spots in small, large minivan, Espace; and multi- more specialty vehicles last year in egories, some of which barely compact and large SUV segments. -

Vehicle Running Costs 2020

VEHICLE RUNNING COSTS 2020 OWNERSHIP EXPENSES (avg $ per month) TOTAL EXPENSES CALCULATED CALCULATED RESIDUAL ESTIMATED ESTIMATED PRICE ON ROAD LOAN REPAYMENTS REGISTRATION, & INSURANCE MEMBERSHIP FUEL SERVICING TYRES MONTHLY ANNUAL 5 YEAR TOTAL CALCULATED RESIDUAL LIGHT CARS Honda Jazz VTi $20,650.00 $402.98 $149.67 $102.73 $57.48 $40.42 $753.28 $9,039.32 $45,196.62 $7,400.00 1.5L CVT hatch Kia Rio S $23,281.00 $454.32 $146.25 $109.82 $38.55 $37.92 $786.85 $9,442.23 $47,211.16 $7,350.00 1.4L 4sp auto hatch Mazda2 G15 Pure $26,723.80 $521.51 $148.30 $92.11 $48.59 $37.92 $848.42 $10,180.99 $50,904.96 $10,100.00 1.5L 6sp auto hatch Suzuki Baleno GL $20,144.80 $393.12 $147.94 $95.65 $30.08 $40.41 $707.21 $8,486.47 $42,432.34 $6,000.00 1.4L 4sp auto hatch Suzuki Swift GL Navigator $22,100.40 $431.28 $142.76 $85.02 $27.58 $53.92 $740.56 $8,886.71 $44,433.56 $7,850.00 1.2L CVT hatch Toyota Yaris Ascent $20,401.80 $398.13 $151.83 $113.36 $41.23 $40.42 $744.97 $8,939.63 $44,698.16 $7,100.00 1.3L 4sp auto hatch Volkswagen Polo Trendline $25,665.00 $500.84 $129.77 $96.94 $44.37 $37.92 $809.83 $9,717.96 $48,589.78 $8,800.00 1.0L turbo 7DSG hatch Most affordable to own/run Private Ownership Costs, New – 5 years @ 15,000km per year VEHICLE RUNNING COSTS 2020 OWNERSHIP EXPENSES (avg $ per month) TOTAL EXPENSES CALCULATED CALCULATED RESIDUAL ESTIMATED ESTIMATED PRICE ON ROAD LOAN REPAYMENTS REGISTRATION, & INSURANCE MEMBERSHIP FUEL SERVICING TYRES MONTHLY ANNUAL 5 YEAR TOTAL CALCULATED RESIDUAL SMALL CARS Hyundai i30 GO $29,095.00 $567.78 $148.98 $85.54 -

Small Suvs, Minicars Make Big Gains in 2006 the Renault Megane CC (Shown) Ended Peugeot’S 5-Year Reign at the Top of Luca Ciferri the Fastest-Growing Segment

AN_070402_18&19good.qxd 13.04.2007 8:58 Uhr Page 18 PAGE 18 · www.autonewseurope.com April 2, 2007 Market analysis by segment, European sales ROADSTER & CONVERTIBLE Small SUVs, minicars make big gains in 2006 The Renault Megane CC (shown) ended Peugeot’s 5-year reign at the top of Luca Ciferri the fastest-growing segment. Changing segments the roadster and convertible seg- Automotive News Europe Minicars, the No. 3 segment last year in ment. Peugeot’s 307 CC was No. 1 in terms of growth, increased 22.1 percent to Europe’s 2006 winners and losers 2004; the 206 CC led the other years. Rising fuel costs, growing concerns about 992,227 units thanks largely to strong Small SUV +63.6 2006 2005 % Change Seg. share % CO2 and a flurry of new products sparked sales of three cars built at Toyota and Upper premium +26.4 Renault Megane 32,344 42,514 -23.9% 13.4% a sales surge for small SUVs and minicars PSA/Peugeot-Citroen’s plant in Kolin, Minicar +22.1 Peugeot 307CC/306C 31,786 39,640 -19.8% 13.1% in Europe last year. Czech Republic. Peugeot 206 CC 29,833 43,518 -31.4% 12.3% The arrival of three new small SUVs Europe’s largest segment, small cars, Small minivan -13.6 VW Eos 21,759 59 – 9.0% helped the segment grow 63.6 percent to rose 7.0 percent to 3,811,009 units. The Premium roadster & convertible -10.9 Opel/Vauxhall Tigra TwinTop 20,406 32,633 -37.5% 8.4% 94,153 units in 2006, according to UK- second-biggest segment – lower-medium Lower medium -8.2 Mazda MX-5 19,288 9,782 97.2% 8.0% based market researcher JATO Dynamics. -

![[En]=> (LV-CAN200)](https://docslib.b-cdn.net/cover/8156/en-lv-can200-1458156.webp)

[En]=> (LV-CAN200)

[en]=> (LV-CAN200) year program № from Engine is working on CNG Front left door Front right door Rear right door Trunk cover Oil pressure / level Total mileage of the vehicle (dashboard) Total fuel consumption Fuel level (in percent) Fuel level (in liters) Engine temperature Vehicle speed Acceleration pedal position Total CNG consumption - (counted) CNG level (in percent) CNG level (in kilograms) Rear left door Engine cover (Hood) Vehicle mileage - (counted) Total fuel consumption - (counted) Engine speed (RPM) Total CNG use 1 ABARTH 124 SPIDER 2016 → 12259 2020-06-30 + + + + + + + + + + + + + 2 ABARTH 595 2016 → 12687 2019-05-30 + + + + + + + + + + + + + 3 ABARTH 695 2017 → 12687 2019-05-30 + + + + + + + + + + + + + 4 ACURA RDX 2010 → 11113 2017-09-01 + + + + + + + + + + + + + + + 5 ACURA RDX 2007 → 11113 2017-09-01 + + + + + + + + + + + + + + + 6 ACURA TL 2004 → 11167 2017-09-01 + + + + + + + + + + + 7 ACURA TLX 2015 → 12363 2019-05-19 + + + + + + + + + + + + + + + 8 ACURA TSX 2009 → 12578 2019-01-16 + + + + + + + + + + + + + + + 9 ACURA TSX 2004 → 11167 2017-09-01 + + + + + + + + + + + 10 ALFA ROMEO 159 2005 → 11128 2017-09-01 + + + + + + + + + + + + + 11 ALFA ROMEO BRERA 2008 → 11128 2017-09-01 + + + + + + + + + + + + + 12 ALFA ROMEO GIULIA 2017 → 12242 2019-05-22 + + + + + + + + + + + + + + 13 ALFA ROMEO GIULIETTA 2013 → 11127 2019-04-10 + + + + + + + + + + + + + 14 ALFA ROMEO GIULIETTA 2010 → 11127 2017-09-01 + + + + + + + + + + + + + 15 ALFA ROMEO GT 2005 → 11128 2017-09-01 + + + + + + + + + + + 16 ALFA ROMEO MITO 2014 → 11127 2017-09-01 -

Ssangyong-Actyon-Sports-2013-INT

New Actyon Sports Delivers More Power A new, more powerful engine, dynamic styling and better fuel efficiency are all yours with this exciting SUT from Ssangyong Motor. New Actyon Sports is equipped to boost your performance at work and at play. And More Fun The great utility, comfort and versatility of New Actyon Sports bring greater enjoyment to your leisure. That translates into a better quality of life. This New Look Sets a New Standard New Actyon Sports lets you stand apart from the crowd in any environment. The sharp front hood character line, hexagonal radiator grille and chic black bezel blend dynamism with refinement. Wide and straightforward character lines on the hood elicit stateliness and charismatic appeal, accentuated by the mesh radiator grille finished in chrome high-gloss black. Fog lamps and daytime running lamps are standard. All the controls are oriented toward the driver, and the switches are grouped by function to facilitate their location by the driver. The gauge cluster has six illumination settings for optimal visibility day and night, and energy-efficient LEDs that make the gauges easy to read at a glance. The center fascia is now black, providing a refined and progressive appearance. In addition, the air vents and digital clock have been redesigned for greater ease of operability. The Spruced-up Driver’s Space Offers Lots of Extras The new trip computer in the gauge cluster tracks your travel distance, travel time and fuel consumption, while the speed-sensitive power steering system self-adjusts the amount of steering assist necessary to enhance driving stability and control at any speed.