Uzbekistan Country Profile96

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

UZBEKISTAN In-Depth Review

UZBEKISTAN In-Depth Review of the Investment Climate and Market Structure in the Energy Sector 2005 Energy Charter Secretariat ENERGY CHARTER SUMMARY AND MAIN FINDINGS OF THE SECRETARIAT Uzbekistan, a Central Asian country located at the ancient Silk Road, is rich in hydrocarbon resources, especially natural gas. Proved gas reserves amount to about 1.85 trillion cubic meters, exceeding the confirmed oil reserves of about 600 million barrels nearly 20-fold on energy equivalent basis. Most of the existing oil and gas fields are in the Bukhara-Kiva region which accounts for approximately 70 percent of Uzbekistan’s oil production. The second largest concentration of oil fields is in the Fergana region. Natural gas comes mainly from the Amudarya basin and the Murabek area in the southwest of Uzbekistan, making up almost 95 percent of total gas production. The endowment with oil and gas offers considerable potential for further economic development of Uzbekistan. Its recent economic performance has been promising, with a GDP growth of above 7 percent in 2004, and an outlook for continuous robust growth in 2005 and beyond. To what extent it can be realised depends crucially on how the government will pursue its policies concerning investment liberalisation and market restructuring, including privatisation, in the energy sector. While the Uzbek authorities recognize the critical role that foreign investment plays for the exploitation of the hydrocarbon resources and the overhaul of the existing energy infrastructure progress has been relatively slow concerning the establishment of a favourable investment climate for many years. However, the Government has recently adopted a far more positive stance that has already brought about tangible results. -

A CITIZEN's GUIDE to NATIONAL OIL COMPANIES Part a Technical Report

A CITIZEN’S GUIDE TO NATIONAL OIL COMPANIES Part A Technical Report October 2008 Copyright © 2008 The International Bank for Reconstruction and Development/The World Bank 1818 H Street, NW Washington, DC 20433 and The Center for Energy Economics/Bureau of Economic Geology Jackson School of Geosciences, The University of Texas at Austin 1801 Allen Parkway Houston, TX 77019 All rights reserved. This paper is an informal document intended to provide input for the selection of a sample of representative national oil companies to be analyzed within the context of the Study on National Oil Companies and Value Creation launched in March 2008 by the Oil, Gas, and Mining Policy Division of The World Bank. The manuscript of this paper has not been prepared in accordance with the procedures appropriate to formally edited texts. Some sources cited in this paper may be informal documents that are not readily available. The findings, interpretations, and conclusions expressed herein are those of the author(s) and do not necessarily reflect the views of the International Bank for Reconstruction and Development/The World Bank and its affiliated organizations, or those of the Executive Directors of The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. This report may not be resold, reprinted, or redistributed for compensation of any kind without prior written permission. For free downloads of this paper or to make inquiries, please contact: Oil, Gas, and Mining Policy Division Center for Energy Economics The World Bank Bureau of Economic Geology 2121 Pennsylvania Avenue, NW Jackson School of Geosciences Washington DC, 20433 The University of Texas at Austin Telephone: 202-473-6990 Telephone: +1 281-313-9753 Fax: 202-522 0395 Fax: +1 281-340-3482 Email: [email protected] E-mail: [email protected] Web: http://www.worldbank.org/noc. -

Caspian Oil and Gas Complements Other IEA Studies of Major Supply Regions, Such As Middle East Oil and Gas and North African Oil and Gas

3 FOREWORD The Caspian region contains some of the largest undeveloped oil and gas reserves in the world. The intense interest shown by the major international oil and gas companies testifies to its potential. Although the area is unlikely to become “another Middle East”, it could become a major oil supplier at the margin, much as the North Sea is today. As such it could help increase world energy security by diversifying global sources of supply. Development of the region’s resources still faces considerable obstacles. These include lack of export pipelines and the fact that most new pipeline proposals face routing difficulties due to security of supply considerations,transit complications and market uncertainties. There are also questions regarding ownership of resources, as well as incomplete and often contradictory investment regimes. This study is an independent review of the major issues facing oil and gas sector developments in the countries along the southern rim of the former Soviet Union that are endowed with significant petroleum resources: Azerbaijan, Kazakstan,Turkmenistan and Uzbekistan. Caspian Oil and Gas complements other IEA studies of major supply regions, such as Middle East Oil and Gas and North African Oil and Gas. It also expands on other IEA studies of the area, including Energy Policies of the Russian Federation and Energy Policies of Ukraine. The study was undertaken with the co-operation of the Energy Charter Secretariat, for which I would like to thank its Secretary General, Mr. Peter Schütterle. Robert Priddle Executive Director 5 ACKNOWLEDGEMENTS The IEA wishes to acknowledge the very helpful co-operation of the Energy Charter Secretariat, with special thanks to Marat Malataev, Temuri Japaridze, Khamidulah Shamsiev and Galina Romanova. -

Executive Meeting in Uzbekistan

Topics Executive Meeting in Uzbekistan Mr. Masataka Sase, Executive Director of JCCP, many as 10 have already completed their training at visited Uzbekistan from October 14 to 18, 2012, to hold JCCP this year, while another 26 candidates are presently policy dialogues with the top management of state-run being selected for future training. oil companies in the country as part of his mission Mr. Sase also thanked Uzbekneftegaz for its to strengthen mutual understanding and cooperation cooperation in maintaining good relations with through personal exchanges in oil-producing countries. JCCP, and explained how he is taking the occasion of JCCP’s 30th anniversary to visit various counterpart 1. Uzbekneftegaz National Holding countries and ask for their continued cooperation, as Company well as expressed JCCP’s intent to provide training that specifically responds to needs in Uzbekistan for Uzbekneftegaz is a national holding company that customized programs. He also gave a general description controls oil and gas businesses in Uzbekistan through of the aftermath of the Great East Japan Earthquake and its six operating companies. JCCP received participants nuclear accident, and provided reassurance that JCCP from Uzbekistan for the first time in 1998, and thereafter is now operating without any repercussions from the began receiving participants on a full scale from 2004. disaster. Approximately 80 participants from Uzbekistan have Mr. Fayzullaev, in return, offered words of condolence attended JCCP training programs to date. to the victims of the disaster, and stressed his belief that On his recent visit to Uzbekistan, Mr. Sase paid a the Japanese people are a resilient people who can call on the Head Office of Uzbekneftegaz in Tashkent continue to move forward even after such devastation. -

Chronology of the Aral Sea Events from the 16Th to the 21St Century

Chronology of the Aral Sea Events from the 16th to the 21st Century Years General Events 16th century 1558 An English merchant and diplomat, Anthony Jenkinson, travels through Central Asia and observes the medieval desiccation of the Aral Sea. He writes that ‘‘the water that serveth all to country is drawn by ditches out of the river Oxus [old name for Amudarya] into the great destruction of the said river, for which it falleth not into the Caspian Sea as it gath done in times past, and in short time all land is like to be destroyed, and to become a wilderness foe want of water when the river Oxus shall fail.’’ A. Jenkinson crosses the Ustyurt and visits Khiva and Bukhara, preparing a map of Central Asia. 1573 ‘‘Turn’’ of the Amudarya from the Sarykamysh to the Aral; in other words, the rather regular flow of part of its waters into the Sarykamysh ceases, the waters from this time running only to the Aral. 17th century 1627 In the book, ‘‘Knigi, glagolemoy Bolshoy Chertezh’’ (‘‘the big sketch’’), the Aral Sea is named ‘‘The dark blue sea.’’ 1670 German geographer Johann Goman publishes the map ‘‘Imperium pereicum,’’ on which the Aral is represented as a small lake located 10 German miles from the northeastern margin of the Caspian Sea. 1697 On Remezov’s map of the Aral Sea (more Aral’sko), it is for the first time represented as an internal lake completely separated from the Caspian Sea and into which the Amundarya (Amu Darya, Oxus), the Syrt (Syr Darya, Yaksart), and many small rivers flow. -

Central Asia Oil and Gas Industry - the External Powers’ Energy Interests in Kazakhstan, Turkmenistan and Uzbekistan

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Raimondi, Pier Paolo Working Paper Central Asia Oil and Gas Industry - The External Powers’ Energy Interests in Kazakhstan, Turkmenistan and Uzbekistan Working Paper, No. 006.2019 Provided in Cooperation with: Fondazione Eni Enrico Mattei (FEEM) Suggested Citation: Raimondi, Pier Paolo (2019) : Central Asia Oil and Gas Industry - The External Powers’ Energy Interests in Kazakhstan, Turkmenistan and Uzbekistan, Working Paper, No. 006.2019, Fondazione Eni Enrico Mattei (FEEM), Milano This Version is available at: http://hdl.handle.net/10419/211165 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen -

Brand Launch Uzbekistan

WELCOME BY SASOL’S CHIEF EXECUTIVE OFFICER, DAVID E. CONSTABLE BRAND LAUNCH UZBEKISTAN MONDAY, 23 JULY 2012 AS DELIVERED Page 1 of 5 Office of the CEO Copyright @ 2012 Sasol Limited As-Salam Alaykum. Good afternoon. Dobrey djen. Deputy Prime Minister Ibragimov of the Republic of Uzbekistan Minister Saidova, Minister of Economy of the Republic of Uzbekistan Minister Ganiev, Minister of Foreign Economic Relations, Investments and Trade of the Republic of Uzbekistan Mr Fayzullaev, Chairman of the Board, Uzbekneftegaz Representatives of the Government of Uzbekistan Distinguished guests, ladies and gentlemen. Shukran. It’s wonderful to be back in Uzbekistan - a culturally rich and dynamic country! As the CEO of Sasol, it is a great honour for me to join you here this afternoon . to celebrate the launch of the new brand name of our joint venture gas-to-liquids project. Before I begin, I would like to congratulate you, Mr Deputy Prime Minister Ibragimov, and the people of Uzbekistan, for the economic success your country is enjoying. Uzbekistan is blessed with a wealth of natural gas. Gas-to-liquids, or GTL as we refer to it, provides an innovative way to monetise natural gas resources in Uzbekistan to feed into your country’s large and growing market. We are delighted to be associated with a country that is modernising its economy and securing its position on the world’s stage. Page 2 of 5 Office of the CEO Copyright @ 2012 Sasol Limited This afternoon, I would, first of all, like to acknowledge the importance of working together in partnership - government and business - to achieve shared goals and lasting success. -

The Petroleum Industry: Mergers, Structural Change, and Antitrust

Federal Trade Commission TIMOTHY J. MURIS Chairman MOZELLE W. THOMPSON Commissioner ORSON SWINDLE Commissioner THOMAS B. LEARY Commissioner PAMELA JONES HARBOUR Commissioner Bureau of Economics Luke M. Froeb Director Mark W. Frankena Deputy Director for Antitrust Paul A. Pautler Deputy Director for Consumer Protection Timothy A. Deyak Associate Director for Competition Analysis Pauline M. Ippolito Associate Director for Special Projects Robert D. Brogan Assistant Director for Antitrust Louis Silvia Assistant Director for Antitrust Michael G. Vita Assistant Director for Antitrust Denis A. Breen Assistant Director for Economic Policy Analysis Gerard R. Butters Assistant Director for Consumer Protection This is a report of the Bureau of Economics of the Federal Trade Commission. The views expressed in this report are those of the staff and do not necessarily represent the views of the Federal Trade Commission or any individual Commissioner. The Commission has voted to authorize staff to publish this report. Acknowledgments This report was prepared by the Bureau of Economics under the supervision of David T. Scheffman, former Director; Mary T. Coleman, former Deputy Director and Mark Frankena, Deputy Director; and Louis Silvia, Assistant Director. Bureau economists who researched and drafted this report were Jay Creswell, Jeffrey Fischer, Daniel Gaynor, Geary Gessler, Christopher Taylor, and Charlotte Wojcik. Bureau Research Analysts who worked on this project were Madeleine McChesney, Joseph Remy, Michael Madigan, Paul Golaszewski, Matthew Tschetter, Ryan Toone, Karl Kindler, Steve Touhy, and Louise Sayers. Bureau of Economics staff also acknowledge the review of drafts and many helpful comments and suggestions from members of the staff of the Bureau of Competition, in particular Phillip L. -

Gas-To-Liquids (GTL): a Review of an Industry Offering Several Routes for Monetizing Natural Gas David A

1 Gas-to-Liquids (GTL): a Review of an Industry Offering Several Routes for Monetizing Natural Gas David A. Wood DWA Energy Limited, Lincoln, United Kingdom Chikezie Nwaoha Independent Researcher, Nigeria Brian F. Towler Professor and CEAS Fellow for Hydrocarbon Energy Resources, Department of Chemical and Petroleum Engineering, University of Wyoming, USA Draft of Article published in Journal of Natural Gas Science and Engineering Volume 9, November 2012, Pages 196–208 Abstract Gas-to-liquids (GTL) has emerged as a commercially-viable industry over the past thirty years offering market diversification to remote natural gas resource holders. Several technologies are now available through a series of patented processes to provide liquid products that can be more easily transported than natural gas, and directed into high value transportation fuel and other petroleum product and petrochemical markets. Recent low natural gas prices prevailing in North America are stimulating interest in GTL as a means to better monetise isolated shale gas resources. This article reviews the various GTL technologies, the commercial plants in operation, development and planning, and the range of market opportunities for GTL products. The Fischer-Tropsch (F-T) technologies dominate both large-scale and small-scale projects targeting middle distillate liquid transportation fuel markets. The large technology providers have followed strategies to scale-up plants over the past decade to provide commercial economies of scale, which to date have proved to be more costly than originally forecast. On the other hand, some small-scale technology providers are now targeting GTL at efforts to eliminate associated gas flaring in remote producing oil fields. -

Unconventional Gas

World Petroleum Council Guide Unconventional Gas www.world-petroleum.org World Petroleum Council Guide Unconventional Gas Published by International Systems and Communications Limited (ISC) in conjunction with the World Petroleum Council (WPC). Copyright © 2012. The entire content of this publication is protected by copyright, full details of which are available from the publisher. All rights reserved. No part of this publication may be reproduced, stored in retrieval systems or transmitted in any form or by any means – electronic, mechanical, photocopying, recording or otherwise – without the prior permission of the copyright owner. World Petroleum Council International Systems and Fourth Floor, Suite 1 Communications Limited 1 Duchess Street Park Place London W1W 6AN 12 Lawn Lane England London SW8 1UD England Telephone: + 44 20 7637 4958 Facsimile: + 44 20 7637 4965 Telephone: + 44 20 7091 1188 E-mail: [email protected] Facsimile: + 44 20 7091 1198 Website: www.world-petroleum.org E-mail: [email protected] Website: www.isyscom.com PRODUCTION ENHANCEMENT Seen side by side, there’s no doubt which will be the superior producer. The only service of its kind, the Halliburton AccessFrac™ stimulation service reliably delivers maximized propped fracture volume for improved long- term production. To do it, the AccessFrac service provides full access to complex fracture networks in unconventional formations—significantly increasing your reservoir contact. Indeed, better proppant distribution can reduce the amount of proppant required and improve efficiency. In addition, the customizable conductivity of the AccessFrac service—made possible by unique pumping and diversion technology—allows for maximum oil and gas flow to the wellbore. What’s your fracturing challenge? For solutions, go to halliburton.com/AccessFrac Solving challenges.™ © 2012 Halliburton. -

China National Petroleum Corporation Energize ∙ Harmonize ∙ Realize

China National Petroleum Corporation Energize ∙ Harmonize ∙ Realize China National Petroleum Corporation (CNPC) is an integrated international energy company, with businesses covering oil and gas operations, oilfield services, engineering and construction, equipment manufacturing, financial services and new energy development. Contents Message from the Chairman 03 Report of the President 04 Operation Highlights 06 Board of Directors • Top Management • Organization 07 Comprehensively Deepen Corporate Reforms to Boost Steady and Sound Growth 10 Deepening International Oil and Gas Cooperation Under the Belt and Road Initiative 12 Phase I of Yamal LNG Project Became Operational 13 2017 Industry Review and Outlook 14 Safety and Environmental Protection 16 Human Resources 20 Technology and Innovation 24 Annual Business Overview 28 Financial Statements 52 Major Events 62 Glossary 64 2017 Annual Report 02 Message from the Chairman 2017 Annual Report In 2017, the company reviewed and launched a range of key reform initiatives and made new progress in reforms with regards to corporate governance, work process of the Board of Directors, specialized restructuring and mixed ownership etc. Meanwhile, the company pushed forward the reform of its R&D system and implemented the innovation strategy, resulting in a wide range of achievements in technology development and application. The reform of overseas operation systems, ongoing restructuring of oilfield services and optimization of headquarters functions moved forward as scheduled. The ownership reform towards the structure of a limited liability company was successfully completed. The pilot program for promoting autonomy in management advanced steadily. China Petroleum Engineering Co., Ltd. (CPEC) and CNPC Capital Co., Ltd. were publicly listed. During the convening of Belt and Road Forum for International Cooperation in Beijing in May 2017, CNPC held the first Belt and Road Roundtable for Oil and Gas Cooperation to share ideas and promote international cooperation in the oil and gas circle. -

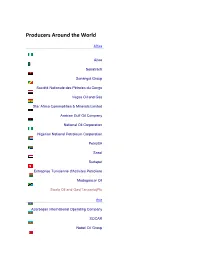

Producers Around the World

Producers Around the World Africa Aiteo Sonatrach Sonangol Group Société Nationale des Pétroles du Congo Vegas Oil and Gas Star Africa Commodities & Minerals Limited Arabian Gulf Oil Company National Oil Corporation Nigerian National Petroleum Corporation PetroSA Sasol Sudapet Entreprise Tunisienne d'Activites Petroliere Madagascar Oil Swala Oil and Gas(Tanzania)Plc Asia Azerbaijan International Operating Company SOCAR Nobel Oil Group Bahrain Petroleum Company Petrobangla Myanma Oil and Gas Enterprise CEFC China Energy CNOOC China National Petroleum Corporation CITIC Resources Geo-Jade Petroleum Shaanxi Yanchang Petroleum Sinochem Sinopec Towngas United Energy Pakistan Gujarat State Petroleum Corporation Oil and Natural Gas Corporation Oil India Essar Oil Reliance Industries Cairn India MedcoEnergi Pertamina Energi Mega Persada National Iranian Oil Company National Iranian South Oil Company Iranian Central Oil Fields Company Iranian Offshore Oil Company North Oil Company South Oil Company Missan Oil Company Midland Oil Company Delek Isramco Modiin Energy Inpex JAPEX Nippon Oil KazMunayGas Kuwait Oil Company Consolidated Contractors Company Petronas Petroleum Development Oman Oil and Gas Development Company Pakistan Petroleum Pakistan Oilfields Mari Petroleum Company Limited Petron Corporation Philippine National Oil Company Qatar Petroleum Saudi Aramco KrisEnergy Singapore Petroleum Company Ceylon Petroleum Corporation Korea National Oil Corporation Korea Gas Corporation CPC Corporation PTT Thai Oil Türkiye Petrolleri Anonim Ortaklığı Çalık Enerji Abu Dhabi National Oil Company Emirates National Oil Company Uzbekneftegaz Petrovietnam Vietsovpetro Europe OMV RAG Petrol AD INA – Industrija Nafte Moravské naftové doly DONG Energy Atlantic Petroleum Total S.A. Engie DEA AG Wintershall Hellenic Petroleum MOL Group Maxol Anonima Petroli Italiana Edison Edoardo Raffinerie Garrone Eni Saras S.p.A.