Corporate Clout 2013: Time for Responsible Capitalism

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ohio Major Employers

Policy Research and Strategic Planning Office A State Affiliate of the U.S. Census Bureau Ohio Major Employers September 2011 John R. Kasich, Governor of Ohio Christiane Schmenk, Director of Development TABLE OF CONTENTS Section One: Employers Ranked by Ohio Employment: Summary Findings Table 01. Ohio's Top Employers Table 02. Ohio's Leading Manufacturing Employers Table 03. Ohio's Leading Financial Employers Table 04. Ohio's Leading University Employers Section Two: Ohio-Based Companies Ranked by Sales: Map 01. Location of Ohio based Fortune 1000 Table 05. Fortune 1000 Companies Based in Ohio Table 06. Ohio-Based Forbes 500 Companies Table 07. Standard & Poor’s 500 / Ohio Based Corporations Table 08. Forbes 200 Largest Private Companies / Ohio Based Table 09. INC. 500 Private Companies / Ohio Based Section Three: Ohio Top Employers – Historic Section Top Employers in Ohio: 1995-2010 Fortune 1000 Companies Headquartered in Ohio Applied Industrial Technologies Medical Mutual of Ohio TravelCenters of America American Greetings Cliffs Natural Resources Sherwin-Williams Eaton KeyCorp Toledo Ferro !( Owens Corning ! !( !( !( !( Lubrizol Andersons !(!( Cleveland Lincoln Electric Dana Holding !( !(!( !( !(!( PolyOne !(!( Progressive Owens-Illinois !( !(! !( NACCO Industries !( Parker Hannifin Invacare Aleris International RPM International !( !( Jo-Ann Stores FirstEnergy !(!( Youngstown! !( Cooper Tire ! Goodyear Tire & Rubber Akron & Rubber Diebold !( !( J. M. Canton Smucker !!( Timken Thor Industries !( Scotts Greif Miracle-Gro !( !( !( Mettler-Toledo -

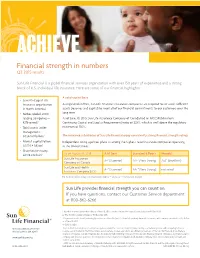

Financial Strength in Numbers Q2 2015 Results

ACHIEVE Financial strength in numbers Q2 2015 results Sun Life Financial is a global financial services organization with over 150 years of experience and a strong block of U.S. individual life insurance. Here are some of our financial highlights: A solid capital base • Seventh-largest life insurance organization As regulated entities, Sun Life Financial’s insurance companies are required to set aside sufficient in North America1 assets (reserves and capital) to meet all of our financial commitments to our customers over the • Forbes Global 2000 long term. leading companies— As of June 30, 2015, Sun Life Assurance Company of Canada had an MCCSR (Minimum #276 overall2 Continuing Capital and Surplus Requirements) ratio of 223%, which is well above the regulatory • Total assets under minimum of 150%. management: US$646.9 billion3 The insurance subsidiaries of Sun Life Financial enjoy consistently strong financial strength ratings. • Market capitalization: Independent rating agencies place us among the highest-rated insurance companies operating US$20.4 billion1 in the United States. • Shareholder equity: US$14.2 billion3 As of August 10, 2015 A.M. Best Standard & Poor’s Moody’s Sun Life Assurance A+4 (Superior) AA-4 (Very Strong) Aa34 (Excellent) Company of Canada Sun Life and Health A+4 (Superior) AA-4 (Very Strong) not rated Insurance Company (U.S.) For the most current ratings, visit www.sunlife.com/us --> About us --> Our financial strength. Sun Life provides financial strength you can count on. If you have questions, contact our Customer Service department at 800-862-6266. 1. Based on market capitalization data as of June 30, 2015, compiled by Sun Life Financial using data provided by IPREO. -

Wal-Mart's Data Warehouse

Wal-Mart’s Data Warehouse SCODAWA 2006 Patrick Ohlinger¨ Vienna University of Technology June 19, 2006 Abstract Wal-Mart is an exceptional company. As professor Strassmann [Stra06] says,”Mal-Mart really is a an information system integrator. Not a merchandising company. They are just selling goods as a byprod- uct. Fundamentally when you look at the value added by Wal-Mart, it is knowledge assets and how they are able to establish a global infor- mation network.” Wal-Mart’s data warehouse, the biggest in the world, enabled it to become a very successful company. Contents 1 About Wal-Mart 2 1.1 Where did Wal-Mart’s success come from? . 2 1.2 The Key to Always Low Prices. Always. ............ 3 2 Wal-Mart’s data warehouse provides Business Value 5 3 Focus on the Business 6 4 Build a Team 6 5 Apply Technology 8 5.1 Retail Link . 8 5.2 RFID . 8 1 1 About Wal-Mart Just getting read about in Austria, Wal-Mart is omnipresent in the U.S. It is the biggest retailer in the world and in many aspects just as well the biggest company in the world. Wal-Mart has 1,700,000 employes and their 5500 stores cannot be ignored. Wal-Mart is the second biggest private company in the world. With sales of $312 billion, this retailer is just behind ExxonMobil. While ExxonMobil is holding this position because of record oil prices, Wal-Mart is here to stay. As the worlds biggest company 1. Figure 1: Companies ranked by Sales [Forbes2000] Wal-Mart not only is big, with $11 billion in profit, it is also very suc- cessful. -

Pharmaceutical and Life Science Industry Services

PwC Russia’s Pharmaceutical and Life Science industry consulting practice has been operating Pharmaceutical for over 15 years. Thus far, we have assisted over 100 clients, including the largest companies and Life Science in the industry, to meet their business challenges. Industry Services Our knowledge and practical experience in executing projects for clients in the pharmaceutical and life science industry help us to deliver tax and legal services based on PwC best practices and advanced methods. Our services Entry to the Russian market Price regulation Limitation of advertising and communication with medical professionals • Consulting on price regulations for vital • Reviewing and elaborating advertising and essential medicines, including the Operating via representative materials, advising on compliance with registration of maximum selling prices, statutory limitations on advertising and offices and Russian legal application of maximum trade mark-ups, entities promotion of medicines, medical products and provision of discounts and rewards and services, representing clients in contact with the Russian Federal Anti-Trust Service • Providing advice on complying with statutory Localising Russian production Drug registration and limitations on communications with medical circulation and pharmaceutical professionals • Consulting on preferences and restrictions • Providing advice on licensing drug production and pharmaceutical activities in drug procurement for state needs, Compliance assessing specific benefits of localisation • Consulting -

Cognizant—Corporate Overview

Corporate Overview Engineering modern businesses DOOR 1 | Corporate Overview Cognizant (Nasdaq-100: CTSH) is one of the world’s leading professional services companies, transforming clients’ business, operating and technology models for the digital era. Our unique industry-based, consultative approach helps many of the best-known organizations in every industry and geography envision, build and run more innovative and efficient businesses. Founded in 1994 as a technology development arm of The Dun & Bradstreet Corporation, we were spun off as an independent company in 1996, and have worked closely with large organizations to help them build stronger businesses ever since. Today, Cognizant engineers modern businesses to improve everyday life, helping some of the world’s most established companies remain the most loved brands. In today’s fast-changing technology landscape, we work with our clients to advance every aspect of how they serve their customers: digitizing their products, services and customer experiences; automating their business processes; and modernizing their technology infrastructures. Put simply, we help clients harness digital to address their daily needs and keep their businesses relevant. As the partner they turn to execute on their digital priorities, we focus on IoT, AI, software engineering and cloud — the technologies that are changing the nature of business. Today, creating value by leveraging technology is very industry-specific, so we continue to deepen our expertise in 20 different industries, including banking and financial services, healthcare, manufacturing and retail. And to help speed clients’ journeys toward becoming digital, we bring our digital capabilities and industry expertise together into horizontal offerings and industry solutions that accelerate the most essential leaps that today’s technology makes possible, and complement those solutions with consulting and services built for the speed of business today. -

Rank Type Name Revenue (USD) 1 Government

Corporations vs governments revenues: 2015 data Rank Type Name Revenue (USD) 1 Government United States 3251000000000 2 Government China 2426000000000 3 Government Germany 1515000000000 4 Government Japan 1439000000000 5 Government France 1253000000000 6 Government United Kingdom 1101000000000 7 Government Italy 876000000000 8 Government Brazil 631000000000 9 Government Canada 585000000000 10 Corporation Walmart 482130000000 11 Government Spain 473600000000 12 Government Australia 425700000000 13 Government Netherlands 336500000000 14 Corporation State Grid 329601000000 15 Corporation China National Petroleum 299271000000 16 Corporation Sinopec Group 294344000000 17 Government Korea, South 291300000000 18 Corporation Royal Dutch Shell 272156000000 19 Government Mexico 259600000000 20 Government Sweden 250800000000 21 Corporation Exxon Mobil 246204000000 22 Corporation Volkswagen 236600000000 23 Corporation Toyota Motor 236592000000 24 Government India 236000000000 25 Corporation Apple 233715000000 26 Government Belgium 226800000000 27 Corporation BP 225982000000 28 Government Switzerland 221900000000 29 Government Norway 220200000000 30 Government Russia 216300000000 31 Corporation Berkshire Hathaway 210821000000 32 Government Venezuela 203400000000 33 Government Saudi Arabia 193000000000 34 Corporation McKesson 192487000000 35 Government Austria 189200000000 36 Corporation Samsung Electronics 177440000000 37 Government Turkey 175400000000 38 Corporation Glencore 170497000000 39 Corporation Industrial & Commercial Bank of China 167227000000 -

Forbes Top 500

Advances Newsletter, May, 2015 Vol. 5, #4, May 2015, No. 48 Forbes Top 500 The group has entered Forbes’ list of the world’s top 500 public companies 1 Advanceswww.midea.com Newsletter, May, 2015 ADVANCES Newsletter Contents NEWSLINE US$800 million to Be Spent on Language Group Enters the Forbes 500 Automation in 5 Years PAGE 8 PAGE 3 To Use or Not to Use a Dic- Magazine Publishes in-Depth tionary? PAGE 13-14 Report about Xiaomi Deal Midea App Available on PAGE 9 Big Picture Apple Watch PAGE 4 CAC Global Technical Concepcion Midea to Training Held in Shunde PAGE The Fast Food Wars PAGE 15 Double Sales Year-On-Year 10 PAGE 4 Innovative Cooking Solutions Idea Tasting the Home of the Fu- for Homes and Businesses Idea of the Month: Social ture PAGE 5 PAGE 11-12 Skills PAGE 16 Belarus JV to Diversify Prod- uct Range PAGE 6 People DDB Shanghai Wins RAC The Brains Behind the Brazil Contract PAGE 6 Brand PAGE 17-19 Official Sponsor of Indian Premier League Cricket Team PAGE 7 RAC Dominates Central Chinese City PAGE 7 Midea Advances Newsletter is published monthly Managing Editor: by the International Strategy Department of Midea Group. We welcome all comments, Kevin McGeary suggestions and contribution of articles, as well as Regular Correspondents: requests for subscription to our newsletter. You can reach us by email at: [email protected] Javier Romano John Baker Kelvin Wu Address: Lemon Lin ADVANCES, International Strategy Department Shirley Liu Midea HQ No. 6 Midea Road Beijiao, Shunde, Foshan, Guangdong P.R.C. -

In Focus 11Mar 2014

www.capsindia.org IN FOCUS 11MAR 2014 THE BIG QUESTION: IS CHINA FACING A FINANCIAL CRISIS, OR NOT? Prerna Gandhi Research Associate, CAPS In a first for Chinese Banks, four of them made history recently. The Industrial and Commercial Bank of China (ICBC) unseated Exxon Mobil last year to take the top spot on the Forbes Global 2000i as the world’s largest company. China Construction Bank moved up 11 spots to number 2 on the list. Agricultural Bank of China stood at number 8 and Bank of China with its double digit growth in sales and profits, improved its ranking by 10 places to number 11ii. However what is more interesting is that ICBC, world’s largest and most profitable bank was itself on the verge of defaulting until it was bailed out in January this year. A 3 billion Yuan (around US$500 million) product issued by China Credit Trust Co., a shadow bank and marketed through ICBC was underpinned by a loan to a mining operation of Shanxi Zhenfu Energy Group that later collapsed as the price of coal fell. Investors who had been promised a hefty 10% annual return over three years were told in January not to expect payment. Upset investors, some of whom had reportedly put as much as $500,000 each into the fund, sought reimbursement from the ICBC, who in turn, argued that it had never guaranteed the product, and had no legal responsibility to pay investors. However, the situation was retrieved by a bailout by an unnamed third party that ensured investors that they would recover their initial investment, though interest will not be paidiii. -

Edit Calendar

DIGITAL MOBILE SITE SOCIAL 1.55M Monthly UVs 450K monthly UVs Weixin:200K Fans 7.3M Monthly PVs 700K monthly PVs Weibo:150K Fans Linkedin: 100K Fans EDIT CALENDAR ISSUE DATE FEATURE LIFE AT THE TOP CHINESE BUSINESSMAN OF THE YEAR* An annual review of the most influential business leaders in China during the past year, with the background stories on their achievements, the challenges they faced and a glimpse at the road ahead Jan/Feb FORTUNE GLOBAL FORUM SPECIAL REPORT * Wine and Spirits Special report from the 2017 FORTUNE Global Forum in Guangzhou. A roundup of editors’ interviews and business leaders’ most impressive viewpoints. CSR * FORTUNE China was a pioneer among business magazines in providing in depth coverage of CSR’s evolution in China. Given rapid changes in the landscape involving SOEs, MNCs and NGOs, our editors will search out best Mar practices and changing strategies among corporates as well as NGOs. Spring Style BUSINESS BY DESIGN The cross disciplinary approach to rethinking the role of design in today’s business and society. THE 50 MOST POWERFUL PEOPLE IN BUSINESS IN CHINA * China’s 50 most powerful business leaders: what makes them great; how they got to the top; and the organizations they lead. Apr BUSINESS NEXT Cool Cars The community of revolutionaries who will change the business landscape in the next decade and the lessons they can teach many big-company CEOs in a heartbeat. PLUS, a guide for investing in entrepreneurial companies. WORLD'S MOST ADMIRED COMPANIES The most authoritative corporate reputation survey worldwide. In today’s tough global business climate, to be big is not enough for a company. -

INSIGHT-The Changing Headquarters Landscape for Fortune Global 500

11/15/2019 INSIGHT: The Changing Headquarters Landscape for Fortune Global 500 Companies Daily Tax Report: State INSIGHT: The Changing Headquarters Landscape for Fortune Global 500 Companies By Brandon Pizzola, Robert Carroll, and James Mackie III Nov. 15, 2019, 3:01 AM The headquarters of the world’s largest companies by revenue continue to shift away from the U.S. Brandon Pizzola, Robert Carroll, and James Mackie III of EY’s Quantitative Economics and Statistics group analyze the latest statistics. Bloomberg Law News 2019-11-15T13:46:56242-05:00 2019-11-15T03:01:12000-05:00 The headquarters of the world’s largest companies by revenue continue to shift away from the U.S. and other G7 countries, driven largely by China’s growth in the world economy. Specifically, the number of Fortune Global 500 (FG500) companies–the 500 largest companies by revenue in the world—that are headquartered in the G7 (Canada, France, Germany, Italy, Japan, the U.K. and the U.S.), declined from 420 in 2000 to 269 in 2019. A significant driver of the FG500 changes in headquarters locations is the growing presence of China. Between 2000 and 2019, the number of FG500 companies with their headquarters in China grew from 10 to 119. Much of this is due to the growth of China’s state-owned enterprises (SOEs), 82 of which were in the FG500 in 2019 compared to 9 in 2000. Many factors can affect a company’s choice of headquarters location, such as a country’s regional economic growth and stability, local infrastructure, regulatory environment, labor availability and productivity, transportation and other input costs, and tax policies. -

13 Malaysian Companies Listed on Forbes Global 2000

Headline 13 Malaysian companies listed on Forbes Global 2000 MediaTitle The Malaysian Reserve Date 08 Jun 2018 Language English Circulation 12,000 Readership 36,000 Section Money Page No 9 ArticleSize 666 cm² Journalist FARA AISYAH PR Value RM 18,485 13 Malaysian companies listed on Forbes Global 2000 Maybank takes the lead China Construction Bank Corp remains in the second spot. The although falls 4 spots to other two of China's "Big Four" 394th place with TNB banks — Agricultural Bank of at 503, CIMB (620) and China Ltd and Bank of China (BoC) — remain in the top ten, which Public Bank (646) is evenly split between China and the US. by FARA AISYAH JPMorgan Chase & Co is now the largest company in the US, moving THIRTEEN Malaysian companies « up one spot to number three and asaKii are listed in the Forbes' 16th annual overtaking Berkshire Hathaway Inc Global 2000 list this year, which is (four). based on a combination of sales, Rounding out the top 10 are Agri- profits, assets and market value. cultural Bank of China Ltd (five), " Malayan Banking Bhd (Maybank) Bank of America Corp (six), Wells once again leads local companies in Fargo & Co (seven), Apple Inc (eight), the list with a US$29.6 billion BoC (nine) and Ping An Insurance (RM117.68 billion) market capitalisa- Co of China Ltd (10). tion and US$9.13 billion of sales as at As a group, the Global 2000 June 2018. The bank fell four spots accounts for US$39.1 trillion in sales, from its 390th place last year to 394 in US$3.2 trillion in profit, US$189 tril- this year's list. -

Comparative Study on the Fortune Global 500—Basing on the 2005-2015 Ranking

Open Journal of Business and Management, 2016, 4, 763-777 http://www.scirp.org/journal/ojbm ISSN Online: 2329-3292 ISSN Print: 2329-3284 Comparative Study on the Fortune Global 500—Basing on the 2005-2015 Ranking Xiaojiao Long School of Business Administration, South China University of Technology, Guangzhou, China How to cite this paper: Long, X.J. (2016) Abstract Comparative Study on the Fortune Global 500—Basing on the 2005-2015 Ranking. Based on the analysis of the world’s top 500 companies list from 2005 to 2015, com- Open Journal of Business and Management, parative research was conducted between six countries including the United States, 4, 763-777. China, Japan, Britain, France and Germany, which were representative in both reve- http://dx.doi.org/10.4236/ojbm.2016.44074 nue and profit among the Fortune Global 500. This paper analyzed the quantity, Received: August 11, 2016 revenue, profit, margin profit and industrial distribution of these corporations from Accepted: September 30, 2016 above-mentioned countries. The existing problems of Chinese enterprises were iden- Published: October 28, 2016 tified, and corresponding suggestions were given. Copyright © 2016 by author and Scientific Research Publishing Inc. Keywords This work is licensed under the Creative Commons Attribution International Fortune Global 500, Chinese Enterprises, Comparative Research License (CC BY 4.0). http://creativecommons.org/licenses/by/4.0/ Open Access 1. Introduction Fortune magazine have published the list of the world’s largest 500 companies annually since 1954. Based on total revenues of an enterprise, this list, also called Fortune Global 500, not only reflects an enterprise’s development and business performance, but also is an important indicator to assess their business strength and international competitive- ness.