Gpoc 2018 Global Powers of Construction Gpoc Is an Annual Publication Produced by Deloitte Spain and Distributed Free of Charge

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ohio Major Employers

Policy Research and Strategic Planning Office A State Affiliate of the U.S. Census Bureau Ohio Major Employers September 2011 John R. Kasich, Governor of Ohio Christiane Schmenk, Director of Development TABLE OF CONTENTS Section One: Employers Ranked by Ohio Employment: Summary Findings Table 01. Ohio's Top Employers Table 02. Ohio's Leading Manufacturing Employers Table 03. Ohio's Leading Financial Employers Table 04. Ohio's Leading University Employers Section Two: Ohio-Based Companies Ranked by Sales: Map 01. Location of Ohio based Fortune 1000 Table 05. Fortune 1000 Companies Based in Ohio Table 06. Ohio-Based Forbes 500 Companies Table 07. Standard & Poor’s 500 / Ohio Based Corporations Table 08. Forbes 200 Largest Private Companies / Ohio Based Table 09. INC. 500 Private Companies / Ohio Based Section Three: Ohio Top Employers – Historic Section Top Employers in Ohio: 1995-2010 Fortune 1000 Companies Headquartered in Ohio Applied Industrial Technologies Medical Mutual of Ohio TravelCenters of America American Greetings Cliffs Natural Resources Sherwin-Williams Eaton KeyCorp Toledo Ferro !( Owens Corning ! !( !( !( !( Lubrizol Andersons !(!( Cleveland Lincoln Electric Dana Holding !( !(!( !( !(!( PolyOne !(!( Progressive Owens-Illinois !( !(! !( NACCO Industries !( Parker Hannifin Invacare Aleris International RPM International !( !( Jo-Ann Stores FirstEnergy !(!( Youngstown! !( Cooper Tire ! Goodyear Tire & Rubber Akron & Rubber Diebold !( !( J. M. Canton Smucker !!( Timken Thor Industries !( Scotts Greif Miracle-Gro !( !( !( Mettler-Toledo -

DXE Liquidity Provider Registered Firms

DXE Liquidity Provider Program Registered Securities European Equities TheCboe following Europe Limited list of symbols specifies which firms are registered to supply liquidity for each symbol in 2021-09-28: 1COVd - Covestro AG Citadel Securities GCS (Ireland) Limited (Program Three) DRW Europe B.V. (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) Jump Trading Europe B.V. (Program Three) Qube Master Fund Limited (Program One) Societe Generale SA (Program Three) 1U1d - 1&1 AG Citadel Securities GCS (Ireland) Limited (Program Three) HRTEU Limited (Program Two) Jane Street Financial Limited (Program Three) 2GBd - 2G Energy AG Citadel Securities GCS (Ireland) Limited (Program Three) Jane Street Financial Limited (Program Three) 3BALm - WisdomTree EURO STOXX Banks 3x Daily Leveraged HRTEU Limited (Program One) 3DELm - WisdomTree DAX 30 3x Daily Leveraged HRTEU Limited (Program One) 3ITLm - WisdomTree FTSE MIB 3x Daily Leveraged HRTEU Limited (Program One) 3ITSm - WisdomTree FTSE MIB 3x Daily Short HRTEU Limited (Program One) 8TRAd - Traton SE Jane Street Financial Limited (Program Three) 8TRAs - Traton SE Jane Street Financial Limited (Program Three) Cboe Europe Limited is a Recognised Investment Exchange regulated by the Financial Conduct Authority. Cboe Europe Limited is an indirect wholly-owned subsidiary of Cboe Global Markets, Inc. and is a company registered in England and Wales with Company Number 6547680 and registered office at 11 Monument Street, London EC3R 8AF. This document has been established for information purposes only. The data contained herein is believed to be reliable but is not guaranteed. None of the information concerning the services or products described in this document constitutes advice or a recommendation of any product or service. -

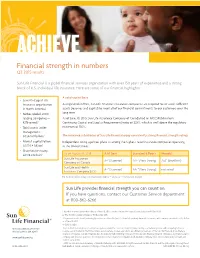

Financial Strength in Numbers Q2 2015 Results

ACHIEVE Financial strength in numbers Q2 2015 results Sun Life Financial is a global financial services organization with over 150 years of experience and a strong block of U.S. individual life insurance. Here are some of our financial highlights: A solid capital base • Seventh-largest life insurance organization As regulated entities, Sun Life Financial’s insurance companies are required to set aside sufficient in North America1 assets (reserves and capital) to meet all of our financial commitments to our customers over the • Forbes Global 2000 long term. leading companies— As of June 30, 2015, Sun Life Assurance Company of Canada had an MCCSR (Minimum #276 overall2 Continuing Capital and Surplus Requirements) ratio of 223%, which is well above the regulatory • Total assets under minimum of 150%. management: US$646.9 billion3 The insurance subsidiaries of Sun Life Financial enjoy consistently strong financial strength ratings. • Market capitalization: Independent rating agencies place us among the highest-rated insurance companies operating US$20.4 billion1 in the United States. • Shareholder equity: US$14.2 billion3 As of August 10, 2015 A.M. Best Standard & Poor’s Moody’s Sun Life Assurance A+4 (Superior) AA-4 (Very Strong) Aa34 (Excellent) Company of Canada Sun Life and Health A+4 (Superior) AA-4 (Very Strong) not rated Insurance Company (U.S.) For the most current ratings, visit www.sunlife.com/us --> About us --> Our financial strength. Sun Life provides financial strength you can count on. If you have questions, contact our Customer Service department at 800-862-6266. 1. Based on market capitalization data as of June 30, 2015, compiled by Sun Life Financial using data provided by IPREO. -

Liste Des Actions Concernées Par L'interdiction De Positions Courtes Nettes

Liste des actions concernées par l'interdiction de positions courtes nettes L’interdiction s’applique aux actions listées sur une plate-forme française et relevant de la compétence de l’AMF au titre du règlement 236/2012 (information disponible dans les registres ESMA). Cette liste est fournie à titre informatif. L'AMF n'est pas en mesure de garantir que le contenu disponible est complet, exact ou à jour. Compte tenu des diverses sources de données sous- jacentes, des modifications pourraient être apportées régulièrement. Isin Nom FR0010285965 1000MERCIS FR0013341781 2CRSI FR0010050773 A TOUTE VITESSE FR0000076887 A.S.T. GROUPE FR0010557264 AB SCIENCE FR0004040608 ABC ARBITRAGE FR0013185857 ABEO FR0012616852 ABIONYX PHARMA FR0012333284 ABIVAX FR0000064602 ACANTHE DEV. FR0000120404 ACCOR FR0010493510 ACHETER-LOUER.FR FR0000076861 ACTEOS FR0000076655 ACTIA GROUP FR0011038348 ACTIPLAY (GROUPE) FR0010979377 ACTIVIUM GROUP FR0000053076 ADA BE0974269012 ADC SIIC FR0013284627 ADEUNIS FR0000062978 ADL PARTNER FR0011184241 ADOCIA FR0013247244 ADOMOS FR0010340141 ADP FR0010457531 ADTHINK FR0012821890 ADUX FR0004152874 ADVENIS FR0013296746 ADVICENNE FR0000053043 ADVINI US00774B2088 AERKOMM INC FR0011908045 AG3I ES0105422002 AGARTHA REAL EST FR0013452281 AGRIPOWER FR0010641449 AGROGENERATION CH0008853209 AGTA RECORD FR0000031122 AIR FRANCE -KLM FR0000120073 AIR LIQUIDE FR0013285103 AIR MARINE NL0000235190 AIRBUS FR0004180537 AKKA TECHNOLOGIES FR0000053027 AKWEL FR0000060402 ALBIOMA FR0013258662 ALD FR0000054652 ALES GROUPE FR0000053324 ALPES (COMPAGNIE) -

FISCAL 2012 ANNUAL REPORT Fiscal 2012 Annual Publications

FISCAL 2012 ANNUAL REPORT Fiscal 2012 annual publications FISCAL 2012 ANNUAL REPORT SUMMARY Message from Michel Landel, Chief Executive Officer, Sodexo page 2 Our Group PROFILE page 6 HISTORY page 11 CORPORATE GOVERNANCE page 13 FINANCIAL PERFORMANCE page 22 Our strategy THE FUNDAMENTAL PRINCIPLES OF OUR DEVELOPMENT page 34 OUR AMBITION page 39 Our Quality of Life Services OUR ON-SITE SERVICES page 42 OUR BENEFITS AND REWARDS SERVICES page 89 OUR PERSONAL AND HOME SERVICES page 101 Glossary page 106 Fiscal 2012 annual publications Annual Report Message from Michel Landel, Sodexo’s Chief Executive Officer. November 8, 2012 In a very difficult economic environment, I am pleased to confirm that Sodexo continues to be a growth company, demonstrating the effectiveness of our strategy and the strength of our unique positioning as an integrator of Quality of Life services. During the just completed fiscal year, we have maintained the investments necessary to support Sodexo’s continued transformation. In a complicated economic environment, Sodexo’s growth continues In 2012, the global economic climate remained particularly troubled: Europe appears locked in a vicious recessionary circle, the U.S. is still vulnerable under the weight of its debt and the so-called “emerging” countries have felt the effects of the overall slowdown. Despite this uncertain environment, Sodexo has continued to grow and is maintaining its medium-term objectives. We can be confident in our Group’s future for three main reasons: Our positioning is at the heart of societal change Services are driving development in modern societies. They play an increasingly important role in economic activity, employment and responding to individual needs. -

SCOR FUNDS Société D'investissement À Capital Variable R.C.S

SCOR FUNDS Société d'Investissement à Capital Variable R.C.S. Luxembourg B215175 Unaudited Semi-Annual Report as at June 30, 2020 SCOR FUNDS SCOR FUNDS - EURO SHORT TERM DURATION HIGH YIELD SCOR FUNDS - EUROPE HIGH YIELD SCOR FUNDS - SUSTAINABLE BOND No subscription can be received on the basis of financial reports. Subscriptions are only valid if made on the basis of the current prospectus and KIID which will be accompanied by a copy of the latest available Annual Report including audited annual statements and copy of the latest available Semi-Annual Report, if published after such Annual Report. SCOR FUNDS Table of Contents Organisation 2 General Information 4 Statistics 5 Combined Statement of Net Assets as at June 30, 2020 6 Combined Statement of Operations and Changes in Net Assets for the period ended June 30, 2020 6 SCOR FUNDS - EURO SHORT TERM DURATION HIGH YIELD Statement of Net Assets as at June 30, 2020 7 Statement of Operations and Changes in Net Assets for the period ended June 30, 2020 7 Statement of Changes in Number of Shares 7 Securities Portfolio as at June 30, 2020 8 SCOR FUNDS - EUROPE HIGH YIELD Statement of Net Assets as at June 30, 2020 10 Statement of Operations and Changes in Net Assets for the period ended June 30, 2020 10 Statement of Changes in Number of Shares 10 Securities Portfolio as at June 30, 2020 11 Financial derivative instruments as at June 30, 2020 15 SCOR FUNDS - SUSTAINABLE BOND Statement of Net Assets as at June 30, 2020 17 Statement of Operations and Changes in Net Assets for the period ended June 30, 2020 17 Statement of Changes in Number of Shares 17 Securities Portfolio as at June 30, 2020 18 Financial derivative instruments as at June 30, 2020 19 Notes to the Financial Statements 20 1 SCOR FUNDS Organisation Registered office 60, avenue J.F. -

Wal-Mart's Data Warehouse

Wal-Mart’s Data Warehouse SCODAWA 2006 Patrick Ohlinger¨ Vienna University of Technology June 19, 2006 Abstract Wal-Mart is an exceptional company. As professor Strassmann [Stra06] says,”Mal-Mart really is a an information system integrator. Not a merchandising company. They are just selling goods as a byprod- uct. Fundamentally when you look at the value added by Wal-Mart, it is knowledge assets and how they are able to establish a global infor- mation network.” Wal-Mart’s data warehouse, the biggest in the world, enabled it to become a very successful company. Contents 1 About Wal-Mart 2 1.1 Where did Wal-Mart’s success come from? . 2 1.2 The Key to Always Low Prices. Always. ............ 3 2 Wal-Mart’s data warehouse provides Business Value 5 3 Focus on the Business 6 4 Build a Team 6 5 Apply Technology 8 5.1 Retail Link . 8 5.2 RFID . 8 1 1 About Wal-Mart Just getting read about in Austria, Wal-Mart is omnipresent in the U.S. It is the biggest retailer in the world and in many aspects just as well the biggest company in the world. Wal-Mart has 1,700,000 employes and their 5500 stores cannot be ignored. Wal-Mart is the second biggest private company in the world. With sales of $312 billion, this retailer is just behind ExxonMobil. While ExxonMobil is holding this position because of record oil prices, Wal-Mart is here to stay. As the worlds biggest company 1. Figure 1: Companies ranked by Sales [Forbes2000] Wal-Mart not only is big, with $11 billion in profit, it is also very suc- cessful. -

Itraxx Europe & Crossover Series 35 Final Membership List

iTraxx Europe & Crossover Series 35 Final Membership List March 2021 Copyright © 2021 IHS Markit Ltd T180614 iTraxx Europe & Crossover Series 35 Final Membership List 1 iTraxx Europe Series 35 Final Membership List......................................... 3 2 iTraxx Europe Series 35 Final vs. Series 34.............................................. 7 3 iTraxx Crossover Series 35 Final Membership List ................................... 8 4 iTraxx Crossover Series 35 Final vs. Series 34........................................11 5 Further information ...................................................................................12 Copyright © 2021 IHS Markit Ltd | 2 T180614 iTraxx Europe & Crossover Series 35 Final Membership List 1 iTraxx Europe Series 35 Final Membership List iTraxx Sector IHS Markit Ticker IHS Markit Long Name Autos & Industrials AIRBSE AIRBUS SE Autos & Industrials VLVY AKTIEBOLAGET VOLVO Autos & Industrials AKZO AKZO NOBEL N.V. Autos & Industrials ALSTOM ALSTOM Autos & Industrials AAUK ANGLO AMERICAN PLC Autos & Industrials AZN ASTRAZENECA PLC Autos & Industrials BAPLC BAE SYSTEMS PLC Autos & Industrials BASFSE BASF SE Autos & Industrials BYIF BAYER AKTIENGESELLSCHAFT Autos & Industrials BMW BAYERISCHE MOTOREN WERKE AKTIENGESELLSCHAFT Autos & Industrials BOUY BOUYGUES Autos & Industrials CNHIND CNH INDUSTRIAL N.V. Autos & Industrials STGOBN COMPAGNIE DE SAINT-GOBAIN Autos & Industrials COMPFIAG COMPAGNIE FINANCIERE MICHELIN SA Autos & Industrials CONTI CONTINENTAL AKTIENGESELLSCHAFT Autos & Industrials DAMLR DAIMLER -

Flyer Ambition4climate

Ambition4Climate.com platform AFEP large member companies invest in climate action with concrete projects The Ambition4Climate Internet platform initiated in 2021 by AFEP (the French Association of Large Companies) illustrates the solutions concretely implemented by large companies to meet the challenge of climate neutrality. Low carbon • Recent operational solutions projects? • Mostly replicable • Resulting in significant greenhouse gas emission reductions • In all sectors of activity • Make actions more easily understandable Objectives ? for experts and the general public • Share good practices • Communicate the characteristics of concrete projects (investment and profitability data) • Foster informed dialogue between companies and interested parties Analytical • Factual and quantified sheets to assess the carbon framework? impact of each project • Systematic identification and quantification of greenhouse gas emissions according to different parameters (emissions induced by the project, avoided emissions, emission removals) More information on ambition4climate.com Climate action is a strategic issue for large French companies The 7 levers to reduce carbon dependency Energy Energy efficiency Improvement Decarbonisation improvement of non-energy resource efficiency Examples Examples Examples • Development of hydrogen mobility • New generation ventilation • Use of solar and wind energy systems • Energy renovation • Development of bio-based • Use of biofuels • Installation of buildings • Monitoring and materials • Development of low of biomass -

Factset-Top Ten-0521.Xlsm

Pax International Sustainable Economy Fund USD 7/31/2021 Port. Ending Market Value Portfolio Weight ASML Holding NV 34,391,879.94 4.3 Roche Holding Ltd 28,162,840.25 3.5 Novo Nordisk A/S Class B 17,719,993.74 2.2 SAP SE 17,154,858.23 2.1 AstraZeneca PLC 15,759,939.73 2.0 Unilever PLC 13,234,315.16 1.7 Commonwealth Bank of Australia 13,046,820.57 1.6 L'Oreal SA 10,415,009.32 1.3 Schneider Electric SE 10,269,506.68 1.3 GlaxoSmithKline plc 9,942,271.59 1.2 Allianz SE 9,890,811.85 1.2 Hong Kong Exchanges & Clearing Ltd. 9,477,680.83 1.2 Lonza Group AG 9,369,993.95 1.2 RELX PLC 9,269,729.12 1.2 BNP Paribas SA Class A 8,824,299.39 1.1 Takeda Pharmaceutical Co. Ltd. 8,557,780.88 1.1 Air Liquide SA 8,445,618.28 1.1 KDDI Corporation 7,560,223.63 0.9 Recruit Holdings Co., Ltd. 7,424,282.72 0.9 HOYA CORPORATION 7,295,471.27 0.9 ABB Ltd. 7,293,350.84 0.9 BASF SE 7,257,816.71 0.9 Tokyo Electron Ltd. 7,049,583.59 0.9 Munich Reinsurance Company 7,019,776.96 0.9 ASSA ABLOY AB Class B 6,982,707.69 0.9 Vestas Wind Systems A/S 6,965,518.08 0.9 Merck KGaA 6,868,081.50 0.9 Iberdrola SA 6,581,084.07 0.8 Compagnie Generale des Etablissements Michelin SCA 6,555,056.14 0.8 Straumann Holding AG 6,480,282.66 0.8 Atlas Copco AB Class B 6,194,910.19 0.8 Deutsche Boerse AG 6,186,305.10 0.8 UPM-Kymmene Oyj 5,956,283.07 0.7 Deutsche Post AG 5,851,177.11 0.7 Enel SpA 5,808,234.13 0.7 AXA SA 5,790,969.55 0.7 Nintendo Co., Ltd. -

Pharmaceutical and Life Science Industry Services

PwC Russia’s Pharmaceutical and Life Science industry consulting practice has been operating Pharmaceutical for over 15 years. Thus far, we have assisted over 100 clients, including the largest companies and Life Science in the industry, to meet their business challenges. Industry Services Our knowledge and practical experience in executing projects for clients in the pharmaceutical and life science industry help us to deliver tax and legal services based on PwC best practices and advanced methods. Our services Entry to the Russian market Price regulation Limitation of advertising and communication with medical professionals • Consulting on price regulations for vital • Reviewing and elaborating advertising and essential medicines, including the Operating via representative materials, advising on compliance with registration of maximum selling prices, statutory limitations on advertising and offices and Russian legal application of maximum trade mark-ups, entities promotion of medicines, medical products and provision of discounts and rewards and services, representing clients in contact with the Russian Federal Anti-Trust Service • Providing advice on complying with statutory Localising Russian production Drug registration and limitations on communications with medical circulation and pharmaceutical professionals • Consulting on preferences and restrictions • Providing advice on licensing drug production and pharmaceutical activities in drug procurement for state needs, Compliance assessing specific benefits of localisation • Consulting -

Euro Stoxx® Sustainability Index

EURO STOXX® SUSTAINABILITY INDEX Components1 Company Supersector Country Weight (%) ASML HLDG Technology Netherlands 5.92 LVMH MOET HENNESSY Consumer Products & Services France 4.52 SAP Technology Germany 3.23 LINDE Chemicals Germany 3.12 SANOFI Health Care France 2.51 SIEMENS Industrial Goods & Services Germany 2.50 L'OREAL Consumer Products & Services France 2.39 ALLIANZ Insurance Germany 2.24 SCHNEIDER ELECTRIC Industrial Goods & Services France 1.87 AIR LIQUIDE Chemicals France 1.71 IBERDROLA Utilities Spain 1.57 ENEL Utilities Italy 1.57 DEUTSCHE TELEKOM Telecommunications Germany 1.43 VINCI Construction & Materials France 1.39 DEUTSCHE POST Industrial Goods & Services Germany 1.39 Kering Retail France 1.38 ADYEN Industrial Goods & Services Netherlands 1.35 ANHEUSER-BUSCH INBEV Food, Beverage & Tobacco Belgium 1.34 ADIDAS Consumer Products & Services Germany 1.34 BAYER Health Care Germany 1.30 AXA Insurance France 1.14 ESSILORLUXOTTICA Health Care France 1.11 INTESA SANPAOLO Banks Italy 1.07 HERMES INTERNATIONAL Consumer Products & Services France 1.07 INFINEON TECHNOLOGIES Technology Germany 1.06 PHILIPS Health Care Netherlands 0.98 DANONE Food, Beverage & Tobacco France 0.95 Prosus Technology Netherlands 0.94 PERNOD RICARD Food, Beverage & Tobacco France 0.92 BCO BILBAO VIZCAYA ARGENTARIA Banks Spain 0.87 Industria de Diseno Textil SA Retail Spain 0.85 MUENCHENER RUECK Insurance Germany 0.83 CRH Construction & Materials Ireland 0.83 SAINT GOBAIN Construction & Materials France 0.74 BMW Automobiles & Parts Germany 0.73 Vonovia SE