Compilation of Statistical Material and Requested Data

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ims List Sanitation Compliance and Enforcement Ratings of Interstate Milk Shippers April 2017

IMS LIST SANITATION COMPLIANCE AND ENFORCEMENT RATINGS OF INTERSTATE MILK SHIPPERS APRIL 2017 U.S. Department of Health and Human Services Public Health Service Food and Drug Administration Rules For Inclusion In The IMS List Interstate milk shippers who have been certified by State Milk sanitation authorities as having attained the milk sanitation compliance ratings are indicated in the following list. These ratings are based on compliance with the requirements of the USPHS/FDA Grade A Pasteurized Milk Ordinance and Grade A Condensed and Dry Milk Products and Condensed and Dry Whey and were made in accordance with the procedures set forth in Methods of Making Sanitation Rating of Milk Supplies. *Proposal 301 that was passed at 2001 NCIMS conference held May 5-10, 2001, in Wichita, Kansas and concurred with by FDA states: "Transfer Stations, Receiving Stations and Dairy Plants must achieve a sanitation compliance rating of 90 or better in order to be eligible for a listing in the IMS List. Sanitation compliance rating scores for Transfer and Receiving Stations and Dairy Plants will not be printed in the IMS List". Therefore, the publication of a sanitation compliance rating score for Transfer and Receiving Stations and Dairy Plants will not be printed in this edition of the IMS List. THIS LIST SUPERSEDES ALL LISTS WHICH HAVE BEEN ISSUED HERETOFORE ALL PRECEDING LISTS AND SUPPLEMENTS THERETO ARE VOID. The rules for inclusion in the list were formulated by the official representatives of those State milk sanitation agencies who have participated in the meetings of the National Conference of Interstate Milk Shipments. -

List of the Top Dairy Processors in the Dairy 100

DAIRY 100 In Millions Code to Type: C=Cooperative; Pr=Privately-held company; Pu=Publicly-traded company; S=Subsidiary; An asterisk on a sales figure denotes a Dairy Foods estimate. SALES SALES COMPANY LOCATION DAIRY EXECUTIVE TYPE PARENT COMPANY, LOCATION FY END ‘11 ‘10 1. Dean Foods Co. Dallas, TX Gregg Engles, Chairman/CEO Pu 12/31/2011 $12,700 $12,123 Brands: Alpro (Europe), Alta Dena, Arctic Splash, Atlanta Dairies, Barbers, Barbe’s, Berkeley Farms, Broughton, Borden (licensed brand), Brown Cow, Brown’s Dairy, Bud’s Ice Cream, Chug, Country Charm, Country Churn, Country Delite, Country Fresh, Country Love, Creamland, Dairy Fresh, Dean’s, Dipzz, Fieldcrest, Foremost (licensed brand), Friendship, Gandy’s, Garelick Farms, Hershey’s (licensed brand), Horizon Organic, Hygeia, International Delight, Jilbert, Knudsen (licensed brand), LAND O LAKES (licensed brand), Land-O-Sun & design, Lehigh Valley Dairy Farms, Liberty, Louis Trauth Dairy Inc, Maplehurst, Mayfield, McArthur, Meadow Brook, Meadow Gold, Mile High Ice Cream, Model Dairy, Morning Glory, Nature’s Pride, Nurture, Nutty Buddy, Oak Farms, Over the Moon, Pet (licensed brand), Pog (licensed brand), Price’s, Provamel (Europe), Purity, Reiter, Robinson, Saunders, Schenkel’s All*Star, Schepps, Shenandoah’s Pride, Silk, Silk Pure Almond, Silk Pure Coconut, Stok, Stroh’s, Swiss Dairy, Swiss Premium, Trumoo, T.GLee, Tuscan, Turtle Tracks, Verifine, Viva. Products: Milk, cultured dairy, juice/drinks, water, creamers, whipping cream, ice cream mix, ice cream novelties. Plants: Fresh Dairy -

DEAN FOODS CO Form 10-K Annual Report Filed 2019-02-28

SECURITIES AND EXCHANGE COMMISSION FORM 10-K Annual report pursuant to section 13 and 15(d) Filing Date: 2019-02-28 | Period of Report: 2018-12-31 SEC Accession No. 0000931336-19-000007 (HTML Version on secdatabase.com) FILER DEAN FOODS CO Mailing Address Business Address 2711 N. HASKELL AVENUE 2711 N. HASKELL AVENUE CIK:931336| IRS No.: 752559681 | State of Incorp.:DE | Fiscal Year End: 1231 SUITE 3400 SUITE 3400 Type: 10-K | Act: 34 | File No.: 001-12755 | Film No.: 19643430 DALLAS TX 75204 DALLAS TX 75204 SIC: 2020 Dairy products 2143033400 Copyright © 2019 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K (Mark One) þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For The Fiscal Year Ended December 31, 2018 OR ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to Commission File Number 001-12755 Dean Foods Company (Exact name of Registrant as specified in its charter) Delaware 75-2559681 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 2711 North Haskell Avenue Suite 3400 Dallas, Texas 75204 (214) 303-3400 (Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices) Securities Registered Pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $.01 par value New York Stock Exchange Securities Registered Pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Location Supply Loyalty Store Go

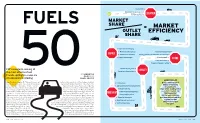

High traffic• Good ingress and egress • LOCATION GO Sizable acreage • • Sophisticated buying • Below-market prices Focus on foodservice • SUPPLY • Guaranteed volumes Strong product assortment and variety • • Supply advantages Friendly staff • STORE Clean restrooms • Traveler-friendly “extras”• CSP’s inaugural ranking of Rewards programs • LOYALTY the most effective fuel Social-media presence • BY SAMANTHA brands spotlights a new era OLLER AND of convenience retailing ANGEL ABCEDE HOW TO PLAY Gasoline is one tough sell. ¶ It is purely functional— market efficiency, which OPIS calculates by divid- Fuel variety Use a combination of not fun. It is a necessity—not a choice. It is noxious, ing a brand’s market share by its outlet share. The • buying and pricing toxic and highly flammable. And the typical higher a brand’s market efficiency, the higher its • Adequate number of dispensers buying experience? Being forced to watch your per-store fuel volumes. ¶ While major oil dom- strategies and Bright lighting money disappear gallon by gallon, cent by cent. inates in market share, the Fuels 50 ranking is • retail offers to attract fuel ¶ And despite a short-term goose from low pric- topped by many of the industry’s “new era” re- Well-maintained pumps customers to your site. es, gasoline demand is hardwired to be flat or tail heavyweights: Wawa, QuikTrip, Sheetz and FORECOURT • The brands that diminishing in the long term, thanks to tough RaceTrac. These are private brands that recog- • Competitive prices sell the most gasoline fuel-economy standards and demographic nize and maximize the critical link between the Room to maneuver per location generate the trends. -

Dean Foods Company (Exact Name of Registrant As Specified in Its Charter)

The goodness of dairy 2015 Annual Report 42805 Merrill_Cover_A240821.indd 3 3/24/16 11:20 PM Dear Fellow Stockholders: 2015 was a year of substantial success and accomplishments and I’m excited to share with you our progress from the past year. We exited the year with great financial results and entered 2016 with significant momentum. It was a year where we accomplished several of our previous goals and we continue to sharpen our focus. Financially, 2015 was a year of opportunity. • We experienced significant improvement • We returned approximately $79 million in our P&L. in cash to our shareholders in the form of • We improved our liquidity, extended debt dividends and share repurchases. maturities and increased flexibility with • We generated strong free cash flow of modified debt facilities providing up to approximately $246 million. $1 billion in liquidity. • We invested approximately $163 million in • We fortified our balance sheet with total our business through capital expenditures. leverage declining over two full turns in 2015 to 1.89 net debt to EBITDA. DairyPure® was the big news of the year. The April 2015 launch of our national white milk brand is off to a great start. Consumers are telling us they’re asking for DairyPure by name and that the 5 Point Purity Promise™ is important to them when making their choice for their family’s milk. We expect great things from DairyPure and are looking forward to sharing more news with you next year. Expansion of the DairyPure brand With the successful launch of DairyPure, one national brand endorsed by our local brands, Dean Foods is embarking on the expansion of DairyPure products: • School milk has transitioned to DairyPure, allowing our youngest consumers to have the daily opportunity to drink our milk at school. -

EXHIBIT ITEM 1 SMA010 Proponent Cooperatives

EXHIBIT ITEM 1 SMA010 Proponent Cooperatives February 2004 Arkansas Dairy Cooperative Association, Inc. Floyd Wiedower, Manager P.O. Box 507 Damascus, Arkansas 72039 501-335-7204 501-335-7705 fax Dairy Farmers of America, Inc. Gary Hanman, Pres. & CEO P.O. Box 909700 Kansas City, Missouri 64190 816-801-6422 816-801-6423 fax Dairymen's Marketing Cooperative, Inc. Don Allen, General Manager 421 East State Street Mountain Grove, Missouri 65711 417-962-7460 417-962-6159 fax Lone Star Milk Producers, Inc. Jim Baird, Manager Route 1, Box 59B Windthorst, Texas 76389 940-378-2311 940-378-2751 fax Maryland & Virginia Milk Producers Cooperative Association, Inc. Jay Bryant, General Manager 1985 Isaac Newton Square West Reston, Virginia 20190 703-742-6800 703-742-7459 fax Southeast Milk, Inc. Calvin Covington, CEO P.O. Box 3790 Belleview, Florida 34421 352-245-2~,37 352-245-9434 fax EXHIBIT ITEM 2 SMA020 Producer Milk Deliveries Proponent Cooperatives and Others November 2003 F.O. 5 F.O. 7 Combined Total Order Producer Milk 507,412,336 593,836,792 1,101,249,128 Member Producer Milk Arkansas Dairy Coop. 13,933,382 13,933,382 Dairy Farmers of America 222,978,642 319,174,550 542,153,192 Dairymen's Marketing Coop. 6,235,057 6,235,057 Lone Star Milk Prod. 16,453,108 34,839,125 51,292,233 MD & VA Milk Prod. 80,473,502 22,119,702 102,593,204 / Southeast Milk 17,401,087 17,401,087 Tota___/I 319,905,252 413,702,903 733,608,155 Percent of Order Total 63.046% 69.666% 66.616% Other Cooperative Producer Milk Marketed Arkansas Dairy Coop. -

Federal Milk Order Distributing Plant Information for 2019 NOTE: "DIP" Indicates Debtor in Possession

Federal Milk Order Distributing Plant Information For 2019 NOTE: "DIP" indicates debtor in possession Pool Distributing Plants State County Plant Name City State ZipCode FIPS FIPS Cl. I Dftl. Jan-19 Feb-19 Mar-19 Apr-19 May-19 Jun-19 Jul-19 Aug-19 Sep-19 Oct-19 Nov-19 Dec-19 Agropur Grand Rapids MI 49548 26 081 1.80 33 33 33 33 33 33 33 33 33 33 33 33 Agropur Maplewood MN 55113 27 123 1.70 30 30 30 30 30 30 30 30 30 30 Alpenrose Dairy Portland OR 97298 41 051 1.90 124 124 124 124 124 124 124 124 124 124 124 124 Andersen Dairy Battle Ground WA 98604 53 011 1.90 124 124 124 124 124 124 124 124 124 124 124 124 Anderson-Erickson Dairy Des Moines IA 50317 19 153 1.80 32 32 32 32 32 32 32 32 32 32 32 32 Aurora Organic Dairy Platteville CO 80651 08 123 2.45 32 32 32 32 32 32 32 32 32 32 32 32 Blue Kingfisher dba Walmart Fort Wayne IN 46819 18 003 1.80 33 33 33 33 33 33 33 33 33 33 33 33 Boice Brothers Dairy Kingston NY 12401 36 111 2.80 1 1 1 1 1 1 1 1 Borden Dairy Cowarts AL 36321 01 069 4.30 7 7 7 7 7 7 7 7 7 7 7 7 Borden Dairy Miami FL 33164 12 025 6.00 6 6 6 6 6 6 6 6 6 6 6 6 Borden Dairy Winter Haven FL 33881 12 105 5.40 6 6 6 6 6 6 6 6 6 6 6 6 Borden Dairy London KY 40743 21 125 2.90 5 5 5 5 5 5 5 5 5 5 5 5 Borden Dairy Lafayette LA 70596 22 055 3.80 7 7 7 7 7 7 7 7 7 7 7 7 Borden Dairy Hattiesburg MS 39404 28 035 3.80 7 7 7 7 7 7 7 7 7 7 7 7 Borden Dairy Cincinnati OH 45215 39 061 2.20 33 33 33 33 33 33 33 33 33 33 33 33 Borden Dairy Cleveland OH 44111 39 035 2.00 33 33 33 33 33 33 33 33 33 33 33 33 Borden Dairy Charleston SC 29419 45 019 4.30 5 5 5 5 5 5 5 5 5 5 5 5 Borden Dairy Austin TX 78702 48 453 3.30 126 126 126 126 126 126 126 126 126 126 126 126 Borden Dairy Conroe TX 77305 48 339 3.60 126 126 126 126 126 126 126 126 126 126 126 126 Borden Dairy Dallas TX 75221 48 113 3.00 126 126 126 126 126 126 126 126 126 126 126 126 Braum's Tuttle OK 73089 40 051 2.60 32 32 32 32 32 32 32 32 32 32 32 32 Broadacre Dairies Powell TN 37849 47 093 3.20 5 5 5 5 5 5 5 5 5 5 5 5 Byrne Dairy Syracuse NY 13220 36 067 2.50 1 1 1 1 1 1 1 1 1 1 1 C. -

October 4, 2019

d's Dairy orl In W du e st h r t y g W n i e e v Since 1876 k r e l y S Outshred Your Competition CHEESE REPORTER www.URSCHEL.com Vol. 144, No. 16 • Friday, October 4, 2019 • Madison, Wisconsin US To Impose 25% Tariffs On Cheese Production Rose 2.2% In August; Cheese, Dairy Imports From EU Cheddar Output Washington—The US has won tariffs being applied to imports butter substitutes, dairy spreads, Increased 3.3% what the Office of the US Trade from France, Germany, Spain, fats and oils derived from milk, and Washington—US cheese produc- Representative (USTR) is calling and the United Kingdom — the other products. tion during August totaled 1.11 the largest arbitration award in four countries responsible for the Since 2010, the value of US billion pounds, up 2.2 percent from World Trade Organization (WTO) illegal subsidies, the USTR noted. dairy imports from the EU has August 2018, USDA’s National history, and plans to impose tar- Although USTR has the author- ranged from $1.02 billion in 2010 Agricultural Statistics Service iffs on imports of cheese and other ity to apply a 100 percent tariff on to $1.7 billion in 2018. During the (NASS) reported Thursday. dairy products, among other things, affected products, at this time the first seven months of this year, the Cheese production during the from the European Union (EU). tariff increases will be limited to value of US dairy imports from the first eight months of 2019 totaled The WTO decision involves a 10 percent on large civil aircraft EU was $1.04 billion, up 10 per- 8.68 billion pounds, up 0.9 per- US dispute with the EU over ille- and 25 percent on agricultural and cent from the first seven months of cent from the first eight months gal subsidies to Airbus. -

Dealer Listing Pennsylvania Milk Marketing Board

Dealer Listing Pennsylvania Milk Marketing Board 190 Active Dealers in Listing 10002919 ACF ORGANICS LLC 409 MINNISINK ROAD - SUITE 106 TOTOWA, NJ 07512 973-256-7676 1057900 ACME MARKETS INC 75 VALLEY STREAM PARKWAY MALVERN, PA 19355 610-889-4239 1078400 ADDISON MILK PROD COOP ASSOC INC 12 NORTH PARK STREET SENECA FALLS, NY 13148 315-568-2750 10003634 ANTONIO MOZZARELLA FACTORY INC 631 FRELINGHUYSEN AVENUE NEWARK, NJ 07114 973-353-9411 10002193 APPLE VALLEY CREAMERY LLC 541 GERMANY ROAD EAST BERLIN, PA 17316 717-528-4520 10004793 BACHMAN, MELANIE A 439 PUSHERSIDING RD ULYSSES, PA 16948 814-848-7262 DBA GOD'S COUNTRY CREAMERY 10003750 BAILYS DAIRY OF POCOPSON MEADOW FARM LLC1821 LENAPE UNIONVILLE RD WEST CHESTER, PA 19382 610-793-1151 1068300 BEAVER MEADOW CREAMERY INC 409 MAPLE AVE - P O BOX 484 DU BOIS, PA 15801-0484 814-371-3711 1062706 BERKSHIRE DAIRY AND FOOD PRODUCTS LLC 850 N WYOMISSING BLVD - STE 1 WYOMISSING, PA 19610 484-334-7755 10003061 BEST VALUE KOSHER FOODS INC 475 MOLA BLVD ELMWOOD, NJ 07407 718-887-9997 ex 104 1082300 BETHGE, KENNETH J 34 S MARKET ST SHAMOKIN, PA 17872 570-644-1316 DBA MAURERS ICE CREAM SHOPPE 10001319 BIAZZO DAIRY PRODUCTS INC 1145 EDGEWATER AVENUE RIDGEFIELD, NJ 07657 201-941-6800 EXT 12 10002913 BLENDHOUSE LLC 61 VAN GUARD DRIVE READING, PA 19606 610-582-2170 ex 2151 10002787 BLUE COW DAIRY LLC 144 PENNROSE AVE BLANDON, PA 19510 610-223-1526 1067000 BLUE RIBBON FARM DAIRY INC 827 EXETER AVE WEST PITTSTON, PA 18643 570-655-5579 1063000 BORDEN DAIRY COMPANY OF OHIO LLC 3068 W 106TH ST CLEVELAND, OH 44111 -

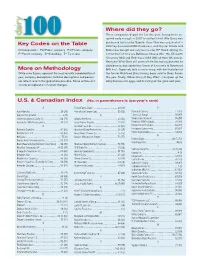

Key Codes on the Table More on Methodology Where Did They

Where did they go? Three companies depart the list this year, having been ac- quired early enough in 2007 to not be listed. Alto Dairy was Key Codes on the Table purchased last year by Saputo, Cass Clay was acquired at in 2007 by Associated Milk Producers, and Crystal Cream and C=Cooperative Pu=Public company Pr=Private company Butter was bought out early last year by HP Hood. Joining the P=Parent company S=Subsidiary T= Tie in rank list for the first time are BelGioso Cheese (No. 75), Ellsworth Creamery (84) and Roth Kase USA (96) all from Wisconsin. Next year Winn-Dixie will come off the list, having divested its dairy processing capabilities (some of it recently to Southeast More on Methodology Milk Inc.). Supervalu tells a similar story, with the final plant of While sales figures represent the most recently completed fiscal the former Richfood Dairy having been sold to Dean Foods year, company descriptions, facilities descriptions and person- this year. Finally, Wilcox Dairy of Roy, Wash., has given up the nel reflect recent changed where possible. Some entries will dairy business for eggs, and its listing will be gone next year. include an explanation of recent changes. U.S. & Canadian Index (No. in parentheses is last year’s rank) A Foster Farms Dairy ....................................... 50 (48) P Agri-Mark Inc. .............................................. 29 (29) Friendly Ice Cream Corp. ...............................55 (56) Parmalat Canada .........................................12 (13) Agropur Cooperative .........................................6 (9) G Perry’s Ice Cream ........................................ 97 (97) Anderson Erickson Dairy Co. ......................... 66 (71) Glanbia Foods Inc. ........................................ 23 (32) Plains Dairy Products ....................................95 (99) Associated Milk Producers Inc. -

Milkweed May 2006 Salvage

The Milkweed “Float like a butterfly, Dairy’s best information and insights sting like a bee.” Issue No. 475 • February 2019 This issue mailed on February 13 — Muhammad Ali Lost Export Markets Boost U.S. Cheese Inventories & Erode Prices by Jan Shepel focus on American-style cheeses, which include Cheese inventories in warehouses across the Cheddar – dairy’s price-setting benchmark variety. United States were being lowered in the early part of American cheese inventories started last year 2018, but after retaliatory tariffs were imposed by below 2017 levels – a perceived good indicator for trading partners late in 2018’s second quarter, those rising milk prices in the country. American cheese inventories jumped to levels significantly above year- inventories climbed less dramatically than in the pre- earlier levels. vious year, up to a July peak. American cheese in- The critical data for cheese inventories must ventories then dipped in August, before rising significantly above 2017 levels through November, Table 1 which is the last month for which data was available. Inventory numbers for 2014, 2015 and 2016 Cheese Inventories Versus were well below both 2017 and 2018 for the entire Exports After Tariffs year. In terms of total U.S. cheese production, 2018 data shows the numbers to be higher throughout the 2017 2018 year than all of those preceding years. But that’s not (Mill. lbs) (Mill. lbs) necessarily a a problem – due to solid, demand-driven output gains posted by Mozzarella and pizza cheese Jan. 752 740 during 2018. Comparing total January production in Roundup® herbicide’s active ingredient is Feb. -

APPALACHIAN MARKETING AREA Federal Order No. 5 HANDLERS and PLANTS SUBJECT to FEDERAL ORDER NO

TABLE 19 APPALACHIAN MARKETING AREA Federal Order No. 5 HANDLERS AND PLANTS SUBJECT TO FEDERAL ORDER NO. 5 - 2003 Pool Distributing Plants - Sec. 1005.7(a) JFMAMJJASOND Broadacre Dairies P.O. Box 650 xxxxxxxxxxxx Powell, TN 37849 Chattanooga Dairy, LLC 3411 Vinewood Ave. xx Chattanooga, TN 37416 Coburg Dairy, LLC P.O. Box 63448 xxxxxxxxxxxx Charleston, SC 29419-3448 Dairy Fresh, LLC P.O. Box 4009 xxxxxxxxxxxx Winston-Salem, NC 27115-4009 Dean Foods Company 4420 Bishop Lane xxxxxxxxxxxx Louisville, KY 40218-4506 Flav-O-Rich, Inc. P.O. Box 40 xxxxxxxxxxxx London, KY 40743-0040 Golden Gallon, LLC P. O. Box 181600 xxxxxxxxxx Chattanooga, TN 37416-7600 Hoosier Dairy, Inc. P. O. Box 70 xxxxxxxxxxxx Holland, IN 47541-0070 Hunter Farms, Inc. 1900 North Main St. xxxxxxxxxxxx High Point, NC 27262 Ideal American Dairy P. O. Box 4038 xxxxxxxxxxxx Evansville, IN 47724-0038 Land-O-Sun Dairies, Inc. P.O. Box 12860 xxxxxxxxxxxx Florence, SC 29504-2860 Land-O-Sun Dairies, Inc. DBA Pet Dairy xxxxxxxxxxxx P.O. Box 1349 Kingsport, TN 37662-1349 Land-O-Sun Dairies, Inc. DBA Pet Dairy xxxxxxxxxxxx P.O. Box 4527, Station B Spartanburg, SC 29305-4527 Land-O-Sun Dairies, Inc. 103 North Cherry St. xxxxxxxxxxxx Wilkesboro, NC 28697 Maola Milk and Ice Cream Co. P.O. Drawer S xxxxxxxxxxxx New Bern, NC 28560-3113 JFMAMJJASOND Mayfield Dairy Farms, Inc. P.O. Box 310 xxxxxxxxxxxx Athens, TN 37371-0310 Milkco, Inc. P.O. Box 16160 xxxxxxxxxxxx Asheville, NC 28816-0160 Regis Milk Co. 578 Meeting St. xxxxxxxxxxxx Charleston, SC 29403-4537 Southern Belle Dairy, Inc.