United States Securities and Exchange Commission Form

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Green Parties and Elections to the European Parliament, 1979–2019 Green Par Elections

Chapter 1 Green Parties and Elections, 1979–2019 Green parties and elections to the European Parliament, 1979–2019 Wolfgang Rüdig Introduction The history of green parties in Europe is closely intertwined with the history of elections to the European Parliament. When the first direct elections to the European Parliament took place in June 1979, the development of green parties in Europe was still in its infancy. Only in Belgium and the UK had green parties been formed that took part in these elections; but ecological lists, which were the pre- decessors of green parties, competed in other countries. Despite not winning representation, the German Greens were particularly influ- enced by the 1979 European elections. Five years later, most partic- ipating countries had seen the formation of national green parties, and the first Green MEPs from Belgium and Germany were elected. Green parties have been represented continuously in the European Parliament since 1984. Subsequent years saw Greens from many other countries joining their Belgian and German colleagues in the Euro- pean Parliament. European elections continued to be important for party formation in new EU member countries. In the 1980s it was the South European countries (Greece, Portugal and Spain), following 4 GREENS FOR A BETTER EUROPE their successful transition to democracies, that became members. Green parties did not have a strong role in their national party systems, and European elections became an important focus for party develop- ment. In the 1990s it was the turn of Austria, Finland and Sweden to join; green parties were already well established in all three nations and provided ongoing support for Greens in the European Parliament. -

Influence on the U.S. Environmental Movement

Australian Journal of Politics and History: Volume 61, Number 3, 2015, pp.414-431. Exemplars and Influences: Transnational Flows in the Environmental Movement CHRISTOPHER ROOTES Centre for the Study of Social and Political Movements, School of Social Policy, Sociology and Social Research, University of Kent, Canterbury, UK Transnational flows of ideas are examined through consideration of Green parties, Friends of the Earth, and Earth First!, which represent, respectively, the highly institutionalised, the semi- institutionalised and the resolutely non-institutionalised dimensions of environmental activism. The focus is upon English-speaking countries: US, UK and Australia. Particular attention is paid to Australian cases, both as transmitters and recipients of examples. The influence of Australian examples on Europeans has been overstated in the case of Green parties, was negligible in the case of Friends of the Earth, but surprisingly considerable in the case of Earth First!. Non-violent direct action in Australian rainforests influenced Earth First! in both the US and UK. In each case, the flow of influence was mediated by individuals, and outcomes were shaped by the contexts of the recipients. Introduction Ideas travel. But they do not always travel in straight lines. The people who are their bearers are rarely single-minded; rather, they carry and sometimes transmit all sorts of other ideas that are in varying ways and to varying degrees discrepant one with another. Because the people who carry and transmit them are in different ways connected to various, sometimes overlapping, sometimes discrete social networks, ideas are not only transmitted in variants of their pure, original form, but they become, in these diverse transmuted forms, instantiated in social practices that are embedded in differing institutional contexts. -

Letter to US Senator Ron Wyden from 85

June 30, 2013 Chairman Ron Wyden U.S. Senate Committee on Energy and Natural Resources 405 Dirksen Senate Building, Washington, D.C. 20510 CC: Senate Majority Leader Harry Reid, Senate Minority Leader Mitch McConnell U.S. Senate Speaker John Boehner, Minority Leader Nancy Pelosi, Energy and Commerce Committee Ranking Member Henry Waxman Natural Resources Committee Ranking Member Ed Markey U.S. House of Representatives Dear Chairman Ron Wyden and Members of Congress: In a January 30, 2013 letter to President Obama, you and fifteen of your colleagues in the U.S. Senate wrote that “pollution can cause asthma attacks, heart and lung disease, cancer, damage to the reproductive system, strokes, and premature death.” 1 You said that you “stand ready to work with [the President] to use available tools to provide stronger safeguards that will address dangerous air pollution.” With your clearly stated intentions on the public record, we, the undersigned, are writing to ask you to expand upon your laudable efforts on behalf of the health and well-being of all Americans by ending your support for the expansion of polluting industrial-scale biomass energy. While receiving many of the same taxpayer subsidies as genuinely clean energy sources which emit no pollutants, such as solar and wind, electricity-generating biomass facilities emit large quantities of health-damaging air pollution. For example, the latest U.S. Environmental Protection Agency data shows that biomass incinerators emit 98% as much nitrogen oxides (NOx) as burning bituminous coal and higher levels of the most dangerous particulate matter (PM 2.5 , including ultrafine and nano particulates). -

January 10, 2019 Re: Legislation to Address the Urgent Threat Of

January 10, 2019 Re: Legislation to Address the Urgent Threat of Climate Change Dear Representative: On behalf of our millions of members and supporters, we are writing today to urge you to consider the following principles as the 116th Congress debates climate change legislation and momentum around the country builds for a Green New Deal. As the Intergovernmental Panel on Climate Change recently warned, if we are to keep global warming below 1.5°C, we must act aggressively and quickly. At a minimum, reaching that target requires visionary and affirmative legislative action in the following areas: Halt all fossil fuel leasing, phase out all fossil fuel extraction, and end fossil fuel and other dirty energy subsidies. The science is clear that fossil fuels must be kept in the ground. Pursuing new fossil fuel projects at this moment in history is folly. Most immediately, the federal government must stop selling off or leasing publicly owned lands, water, and mineral rights for development to fossil fuel producers. The government must also stop approving fossil fuel power plants and infrastructure projects. We must reverse recent legislation that ended the 40-year ban on the export of crude oil, end the export of all other fossil fuels, and overhaul relevant statutes that govern fossil fuel extraction in order to pursue a managed decline of fossil fuel production. Further, the federal government must immediately end the massive, irrational subsidies and other financial support that fossil fuel, and other dirty energy companies (such as nuclear, waste incineration and biomass energy) continue to receive both domestically and overseas. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended June 30, 2021 or ☐ TRANSITION REPORT PURSUANT TO Section 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . Commission file number: 001-39120 US ECOLOGY, INC. (Exact name of registrant as specified in its charter) Delaware 84-2421185 (State or other jurisdiction of incorporation or (I.R.S. Employer Identification No.) organization) 101 S. Capitol Blvd., Suite 1000 Boise, Idaho 83702 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (208) 331-8400 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, par value $0.01 per share ECOL Nasdaq Global Select Market Warrants to Purchase Common Stock ECOLW Nasdaq Capital Market Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ⌧ No ◻ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

The Politics of the Environment: Ideas, Activism, Policy, 2Nd Edition

This page intentionally left blank The Politics of the Environment Ideas, Activism, Policy 2nd Edition The continuous rise in the profile of the environment in politics reflects growing concern that we may be facing a large-scale ecological crisis. The new edition of this highly acclaimed textbook surveys the politics of the environment, providing a comprehensive and comparative introduction to its three components: ideas, activism and policy. Part I explores environmental philosophy and green political thought; Part II considers parties and environmental movements; and Part III analyses policy-making and environmental issues at international, national and local levels. This second edition has been thoroughly updated with new and revised discussions of many topics including the ecological state, ecological citizenship, ecological modernisation and the Greens in government and also includes an additional chapter on ‘Globalisation, trade and the environment’. As well as considering a wide variety of examples from around the world, this textbook features a glossary, guides to further study, chapter summaries and critical questions throughout. NEIL CARTER is Senior Lecturer in the Department of Politics at the University of York. He is co-author of How Organisations Measure Success: The Use of Performance Indicators in Government (with Rudolf Klein and Patricia Day, 1992) and joint editor of the journal Environmental Politics. The Politics of the Environment Ideas, Activism, Policy 2nd Edition NEIL CARTER Department of Politics, University of York CAMBRIDGE UNIVERSITY PRESS Cambridge, New York, Melbourne, Madrid, Cape Town, Singapore, São Paulo Cambridge University Press The Edinburgh Building, Cambridge CB2 8RU, UK Published in the United States of America by Cambridge University Press, New York www.cambridge.org Information on this title: www.cambridge.org/9780521868020 © Neil Carter 2007 This publication is in copyright. -

2010/10/12-NRC Staff Answer to Progress Energy Florida's Motion

October 12, 2010 UNITED STATES OF AMERICA NUCLEAR REGULATORY COMMISSION BEFORE THE ATOMIC SAFETY AND LICENSING BOARD In the Matter of ) ) PROGRESS ENERGY FLORIDA, INC. ) ) Docket Nos. 52-029 and 52-030 ) (Combined License Application for ) Levy County Nuclear Plant, Units 1 and 2) ) NRC STAFF ANSWER TO PROGRESS ENERGY FLORIDA’S MOTION TO DISMISS AS MOOT CERTAIN ASPECTS OF CONTENTION 4 INTRODUCTION Pursuant to 10 C.F.R. § 2.1205(b), and the Atomic Safety and Licensing Board’s (Board) Initial Scheduling Order, Progress Energy Florida, Inc. (Levy County Nuclear Power Plant, Units 1 and 2), LBP-09-22, 70 NRC __ (slip op. at 8) (August 27, 2009), the NRC staff (Staff) hereby files its Response to Progress Energy Florida, Inc.’s (Applicant) September 30, 2010, Motion to Dismiss as Moot the Aspects of Contention 4 Related to Active Dewatering During Levy Nuclear Plant Operations (Motion). For the reasons discussed below, the Staff agrees that portions of Contention 4 are moot; however, the Joint Intervenors1 still have an opportunity to timely amend Contention 4 to challenge the Staff’s analysis in the draft Environmental Impact Statement. (DEIS), or to file a new contention on this topic. BACKGROUND On July 28, 2008, the Applicant filed an application for a combined construction permit and operating license (COL) for two new reactors in Levy County, Florida. On February 6, 1 The Joint Intervenors are the Ecology Party of Florida, the Green Party of Florida, and Nuclear Information and Resource Service. 2009, the Joint Intervenors collectively filed a petition to intervene and several contentions.2 On July 8, 2009, the Board issued a Memorandum and Order, granting the hearing request and admitting, among others, Contention 4 that included a challenge to the Applicant’s analysis of active dewatering during operations. -

An Overview of Local Environmental Activism in Britain

Loughborough University Institutional Repository Thinking globally acting locally : an overview of local environmental activism in Britain This item was submitted to Loughborough University's Institutional Repository by the/an author. Additional Information: • A Doctoral Thesis. Submitted in partial fullment of the requirements for the award of Doctor of Philosophy of Loughborough University. Metadata Record: https://dspace.lboro.ac.uk/2134/12165 Publisher: c Robert Vickers Please cite the published version. This item was submitted to Loughborough University as a PhD thesis by the author and is made available in the Institutional Repository (https://dspace.lboro.ac.uk/) under the following Creative Commons Licence conditions. For the full text of this licence, please go to: http://creativecommons.org/licenses/by-nc-nd/2.5/ • • Loughborough ., University I University Library AuthorlFihng. Title .........................................................V / C k:'£ RS . Class Mark ....................................................................T . Please note that fines are charged on ALL overdue items. 0403910978 11111111111111111111 I 1111111111111 Thinking Globallv Acting Locally: An overview of local environmental activism in Britain. By Rob Vickers Doctoral Thesis Submitted in partial fulfillment of the requirements for the award of Doctor of Philosophy of Loughborough University December 2010 © by Robert Vickers 2010 ~!:1;:3,10'_":' ft",""'-nn"""l"-'I") .'., . :-;'1" Univcl''''( v Cv!\ • Piikin~lcm Ubr:1ry Date ZS-/ID/lj Class -,- Ace OLf03Q 109,'3 No, , For H, B & G Abstract Over the last four decades national environmental groups have become an important means of political participation for many British citizens. Since the mid-1980s these organizations have established a number of local groups. There are still some gaps in our understanding of these groups, particularly relating to participation at the grass-roots level. -

The Greens and the Tax on Rent DAVID RICHARDS

7 The Greens and the Tax on Rent DAVID RICHARDS I WE HUMANS are worried about the damage we are doing to our environment. This concern has now been formalised by Green political parties in many countries, or by more loosely-based move- ments, as in the United States and Australia. But on present evidence it seems that politically active ecologists are, on the whole, failing to articulate policies that systematically alter the fundamental relation- ship between our species and its habitat. Our habitat is classed in the study of economics as natural resources, or 'land'. Though it is basic to all economic activity it has yet to be accorded much room in economic discourse. The value of natural resources has yet to be adequately reflected in economic decision-making (Dasgupta 1990; Brundtland 1987). Though Green politicians emphasise this shortcoming, they tend to recognise it only where natural - resources are being rapidly depleted, and to overlook it where renewable land uses are taking place. In other words, they do not have a systematic view of the place of land in economic calculations. It is our claim that a systematic view that appropriately relates ecology and economics was expounded over a century ago by the outspoken economist Henry George. In Part II we shall review the economic policies that are deemed on this view to be needed to meet the ecological challenge. In Part III we shall offer some remarks on the general acceptability of these policies. Then in Part IV we shall look more closely at the Green parties and movements to see to what extent they incorporate Henry George's message. -

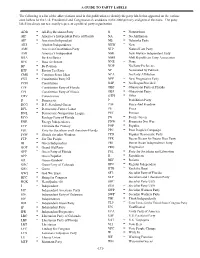

A GUIDE to PARTY LABELS -171- the Following Is a List of the Abbreviations Used in This Publication to Identify the Party Labels

A GUIDE TO PARTY LABELS The following is a list of the abbreviations used in this publication to identify the party labels that appeared on the various state ballots for the U.S. Presidential and Congressional candidates in the 2008 primary and general elections. The party label listed may not necessarily represent a political party organization. ADB = All-Day Breakfast Party N = Nonpartisan AIF = America’s Independent Party of Florida NA = No Affiliation AIP = American Independent NB = Nebraska Party AKI = Alaskan Independence NEW = New AMC = American Constitution Party NLP = Natural Law Party AMI = America’s Independent NMI = New Mexico Independent Party BBA = Back to Basics NMR = NMI Republican Party Association BFS = Boss for Senate NNE = None BP = By Petition NOP = No Party Preference BTP = Boston Tea Party NP = Nominated by Petition CMS = Common Sense Ideas NPA = No Party Affiliation CNJ = Constitution Party NJ NPP = New Progressive Party CON = Constitution NSP = No Slogan Provided CPF = Constitution Party of Florida OBF = Objectivist Party of Florida CPI = Constitution Party of Illinois OBJ = Objectivist Party CRV = Conservative OTH = Other D = Democratic P = Prohibition Party DCG = D.C. Statehood Green PAF = Peace And Freedom DFL = Democratic-Farmer Labor PE = Peace DNL = Democratic-Nonpartisan League PET = Petition ECO = Ecology Party of Florida PG = Pacific Green ENE = Energy Independence PNW = Prosperity Not War ETP = Eliminate the Primary POP = Populist FSL = Party for Socialism and Liberation-Florida PPC = Poor People's Campaign -

January 10, 2019 Re: Legislation to Address the Urgent Threat of Climate Change Dear Representative: on Behalf of Our Millions

January 10, 2019 Re: Legislation to Address the Urgent Threat of Climate Change Dear Representative: On behalf of our millions of members and supporters, we are writing today to urge you to consider the following principles as the 116th Congress debates climate change legislation and momentum around the country builds for a Green New Deal. As the Intergovernmental Panel on Climate Change recently warned, if we are to keep global warming below 1.5°C, we must act aggressively and quickly. At a minimum, reaching that target requires visionary and affirmative legislative action in the following areas: Halt all fossil fuel leasing, phase out all fossil fuel extraction, and end fossil fuel and other dirty energy subsidies. The science is clear that fossil fuels must be kept in the ground. Pursuing new fossil fuel projects at this moment in history is folly. Most immediately, the federal government must stop selling off or leasing publicly owned lands, water, and mineral rights for development to fossil fuel producers. The government must also stop approving fossil fuel power plants and infrastructure projects. We must reverse recent legislation that ended the 40-year ban on the export of crude oil, end the export of all other fossil fuels, and overhaul relevant statutes that govern fossil fuel extraction in order to pursue a managed decline of fossil fuel production. Further, the federal government must immediately end the massive, irrational subsidies and other financial support that fossil fuel, and other dirty energy companies (such as nuclear, waste incineration and biomass energy) continue to receive both domestically and overseas. -

Left-Wing Party Orientation and Environmentalism

LSE Research Online Article (refereed) Eric Neumayer The environment, left-wing political orientation and ecological economics Originally published in Ecological economics, 51 (3-4). pp. 167-175 © 2004 Elsevier B.V. You may cite this version as: Neumayer, Eric (2004). The environment, left-wing political orientation and ecological economics [online]. London: LSE Research Online. Available at: http://eprints.lse.ac.uk/archive/00000714 Available online: April 2006 LSE has developed LSE Research Online so that users may access research output of the School. Copyright © and Moral Rights for the papers on this site are retained by the individual authors and/or other copyright owners. Users may download and/or print one copy of any article(s) in LSE Research Online to facilitate their private study or for non-commercial research. You may not engage in further distribution of the material or use it for any profit-making activities or any commercial gain. You may freely distribute the URL (http://eprints.lse.ac.uk) of the LSE Research Online website. This document is the author’s final manuscript version of the journal article, incorporating any revisions agreed during the peer review process. Some differences between this version and the publisher’s version remain. You are advised to consult the publisher’s version if you wish to cite from it. http://eprints.lse.ac.uk Contact LSE Research Online at: [email protected] The Environment, Left-wing Political Orientation and Ecological Economics FINAL VERSION Eric Neumayer, London School of Economics and Political Science, Department of Geography and Environment and Centre for Environmental Policy and Governance, Houghton Street, London WC2A 2AE, UK, +44-207-9557598.