Riding out the Storm

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investor Relations Presentation

Investor Relations Presentation 1 DISCLAIMER Disclaimer: Commercial in Confidence. Not to be shared or reproduced without the authority of Cashwerkz Limited (ACN: 010 653 862). Cashwerkz Group I Cashwerkz Limited ABN 42 010 653 862 AFSL 260033 | Cashwerkz Technologies Pty Ltd ABN 70 164 806 357 AFSL 459645 | RIM Securities Ltd ABN 86 111 273 048 AFSL 283119 | Trustees Australia Limited ABN 63 010 579 058 AFSL 260038. This Presentation contains general information only and is, or is based upon, information that has been released to ASX. This document is not an invitation, offer or recommendation (expressed or implied) to apply for or purchase or to take any other action in respect of securities and is not a prospectus, product disclosure statement or disclosure document for the purposes of the Corporations Act 2001 (Cth) and has not been lodged with ASIC. Investment Risk An investment in Cashwerkz Limited (‘CWZ’ or ‘Group’), is subject to known and unknown risks both specific to CWZ and of a general nature, some of which are beyond the control of the Group. Such risks either may individually or in combination adversely affect the future operating and financial performance of CWZ, its investment return and value of its securities. There can be no guarantee, and the directors and management give no assurances, (notwithstanding that they will use their conscientious best endeavours), that CWZ will achieve its stated objectives or that any forward-looking statement or forecast will eventuate. Forward-Looking Statements This Presentation contains certain statements that may constitute forward-looking statements or information (“forward-looking statements”), including statements regarding the use of proceeds of any funds available to the Group. -

Stepping Forward in Private Credit When Others Step Back Introduction

Current Key Investment Themes JANUARY 2021 THOUGHT LEADERSHIP: STEPPING FORWARD IN PRIVATE CREDIT WHEN OTHERS STEP BACK INTRODUCTION One of the reasons the COVID-19 pandemic hit In this article we review the potential for Australia’s developed economies so hard was that it struck superannuation funds to provide credit to support the parts of economies that until that point had the nation’s SMEs, mid-market and large remained resilient, notwithstanding the geopolitical corporates, real estate developments and other turmoil of Brexit and the US/China trade tensions borrowers, while earning attractive risk adjusted of 2018. The part we are referring to is of course, returns for their members – many of whom are in the consumer. turn the employees or owners of these borrowers. The consumer accounted for 54% of GDP in Australia’s superannuation system is the fourth Australia in 2019, and 68% in the US1, and can be largest pension asset pool globally, with US$1.9 likened to the heart of many developed trillion (A$2.7 trillion) in assets at the end of 2019, economies. The consumer’s resilience changed representing just shy of 4% of OECD pension dramatically with the outbreak of COVID-19 with assets2 - more than the Netherlands, Japan and the lockdowns and travel restrictions decimating Switzerland. consumers' ability to spend. Spending by Australia’s superannuation funds have a well- consumers is also intertwined with the financial known home bias in equity exposure, with the health of their employers, be they small and largest of Australia’s balanced funds holding medium enterprises (SMEs) or mid and large approximately half of their equity assets in corporates. -

Australia's Best Banking Methodology Report

Mozo Experts Choice Awards Australia’s Best Banking 2021 This report covers Mozo Experts Choice Australia’s Best Banking Awards for 2021. These awards recognise financial product providers who consistently provide great value across a range of different retail banking products. Throughout the past 12 months, we’ve announced awards for the best value products in home loans, personal loans, bank accounts, savings and term deposit accounts, credit cards, kids’ accounts. In each area we identified the most important features of each product, grouped each product into like-for-like comparisons, and then calculated which are better value than most. The Mozo Experts Choice Australia's Best Banking awards take into account all of the analysis we've done in that period. We look at which banking providers were most successful in taking home Mozo Experts Choice Awards in each of the product areas. But we also assess how well their products ranked against everyone else, even where they didn't necessarily win an award, to ensure that we recognise banking providers who are providing consistent value as well as areas of exceptional value. Product providers don’t pay to be in the running and we don’t play favourites. Our judges base their decision on hard-nosed calculations of value to the consumer, using Mozo’s extensive product database and research capacity. When you see a banking provider proudly displaying a Mozo Experts Choice Awards badge, you know that they are a leader in their field and are worthy of being on your banking shortlist. 1 Mozo Experts Choice Awards Australia’s Best Banking 2021 Australia’s Best Bank Australia’s Best Online Bank Australia's Best Large Mutual Bank Australia's Best Small Mutual Bank Australia’s Best Credit Union Australia’s Best Major Bank 2 About the winners ING has continued to offer Australians a leading range of competitively priced home and personal loans, credit cards and deposits, earning its place as Australia's Best Bank for the third year in a row. -

The World's Most Active Banking Professionals on Social

Oceania's Most Active Banking Professionals on Social - February 2021 Industry at a glance: Why should you care? So, where does your company rank? Position Company Name LinkedIn URL Location Employees on LinkedIn No. Employees Shared (Last 30 Days) % Shared (Last 30 Days) Rank Change 1 Teachers Mutual Bank https://www.linkedin.com/company/285023Australia 451 34 7.54% ▲ 4 2 P&N Bank https://www.linkedin.com/company/2993310Australia 246 18 7.32% ▲ 8 3 Reserve Bank of New Zealand https://www.linkedin.com/company/691462New Zealand 401 29 7.23% ▲ 9 4 Heritage Bank https://www.linkedin.com/company/68461Australia 640 46 7.19% ▲ 9 5 Bendigo Bank https://www.linkedin.com/company/10851946Australia 609 34 5.58% ▼ -4 6 Westpac Institutional Bank https://www.linkedin.com/company/2731362Australia 1,403 73 5.20% ▲ 16 7 Kiwibank https://www.linkedin.com/company/8730New Zealand 1,658 84 5.07% ▲ 10 8 Greater Bank https://www.linkedin.com/company/1111921Australia 621 31 4.99% ▲ 0 9 Heartland Bank https://www.linkedin.com/company/2791687New Zealand 362 18 4.97% ▼ -6 10 ME Bank https://www.linkedin.com/company/927944Australia 1,241 61 4.92% ▲ 1 11 Beyond Bank Australia https://www.linkedin.com/company/141977Australia 468 22 4.70% ▼ -2 12 Bank of New Zealand https://www.linkedin.com/company/7841New Zealand 4,733 216 4.56% ▼ -10 13 ING Australia https://www.linkedin.com/company/387202Australia 1,319 59 4.47% ▲ 16 14 Credit Union Australia https://www.linkedin.com/company/784868Australia 952 42 4.41% ▼ -7 15 Westpac https://www.linkedin.com/company/3597Australia -

Customer Successstory Beyon

CUSTOMER SUCCESS STORY HOURS PER MONTH SAVED BY ELIMINATING IMPROVING RESPONSE TIME SLA FROM 90% INCREASE IN COMMUNITY MANUAL LABOR FOR THE COMMUNITY MANAGER IN 30 MINUTES TO 90% IN 15 MINUTES ENGAGEMENT RATES 30+ 90% 50% With more than 200,000 customers and assets under management in excess of $5 billion, Beyond Bank Australia is one of the nation's largest 100% customer-owned financial institutions. It operates across South Australia, Western Australia, Australian Capital Territory, and the Riverina and Hunter Valley regions of New South Wales. Beyond Bank Australia also supports a range of community endeavors via its Community Development Program and the Beyond Bank Australia Foundation. In 2017, Beyond Bank Australia was awarded Best Bank in Corporate Social Responsibility at the Australian Retail Banking Awards. In 2016, the Bank was awarded Roy Morgan’s Best in Customer Satisfaction award. Goal Solution To implement more effective, detailed social media A Lithium Social Media Management all-in-one reporting and eradicate wasted time and inefficiency platform that caters to the needs of the marketing, caused by manual reporting, and to use a platform that customer service, and compliance teams. It also provides effective notifications and workflows for the integrates with their CRM–Microsoft Dynamics. customer service team in order to improve response times and ensure correct governance of their social media platforms. CUSTOMER SUCCESS STORY “Lithium has saved me at least eight hours per week of manual activities.” -Aimee Iannone, Social Media Specialist, Beyond Bank Australia How has your Lithium solution addressed Was it easy to train people to use the platform? your goals? It was an extremely quick and easy process. -

2017 National Mutual Economy Report Incorporating the Top 100 2 | 2017 National Mutual Economy Report | 2017 Report Partner

2017 NATIONAL MUTUAL ECONOMY REPORT Incorporating the Top 100 2 | 2017 NATIONAL MUTUAL ECONOMY REPORT | 2017 Report Partner 3 | 2017 NATIONAL MUTUAL ECONOMY REPORT | 2017 National Mutual Economy Report Incorporating the Top 100 Providing the latest research on the economic and social contribution of Australia’s co-operative, mutual and member-owned firms. With the research collaboration of the University of Western Australia For more information on the co-operative and mutual sector i www.bccm.coop www.getmutual.coop Published November 2017 by the Business Council of Co-operatives and Mutuals (BCCM) | GPO Box 5166, Wynyard, Sydney 2001 | www.bccm.coop © Business Council of Co-operatives and Mutuals (BCCM) This work is licensed under the Creative Commons Attribution 3.0 Australia Licence (CCBY 3.0). This licence allows you to copy, distribute and adapt this work, provided you attribute the work and do not suggest that BCCM endorses you or your work. To view a full copy of the terms of this licence, visit: http://www.creativecommons.org/licenses/by/3.0/au/ Disclaimer: While the BCCM endeavours to ensure the quality of this publication, the BCCM does not accept any responsibility for the accuracy, completeness or currency of the material included in this publication, and will not be liable for any loss or damage arising out of any use of, or reliance on, this publication. 4 | 2017 NATIONAL MUTUAL ECONOMY REPORT | ABOUT THE BCCM Despite representing some of the largest businesses The Business Council of Co-operatives and Mutuals in their sectors and being found across a wide- (BCCM) is the national peak body representing range of industries, the overall size, structure co-operative and mutual models of enterprise. -

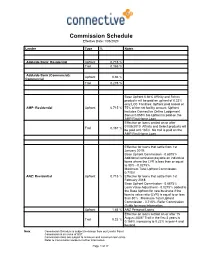

Commission Schedule Effective Date: 1/06/2020

Commission Schedule Effective Date: 1/06/2020 Lender Type % Notes Adelaide Bank: Residential Upfront 0.715 % Trail 0.165 % Adelaide Bank (Commercial): Upfront 0.66 % Commercial Trail 0.275 % Base Upfront 0.66% Affinity and Select products will be paid an upfront of 0.33% only LOC Facilities: Upfront paid based on AMP: Residential Upfront 0.715 % 75% of the net facility amount Upfront includes Connective Online Lodgement Bonus 0.055% No Upfront is paid on the AMP First Home Loan. Effective on loans settled on or after 01/05/2010 Affinity and Select products will Trail 0.187 % be paid at 0.165% No trail is paid on the AMP First Home Loan Effective for loans that settle from 1st January 2019: Base Upfront Commission - 0.6875% Additional comission payable on individual loans where the LVR is less than or equal to 80% - 0.0275% Maximum Total Upfront Commission: 0.715% ANZ: Residential Upfront 0.715 % Effective for loans that settle from 1st February 2018: Base Upfront Commission - 0.6875% Loan Value Adjustment - 0.0275% added to the Base Upfront for new business if the loan to value ratio (LVR) is equal to or less than 80% . Maximum Total Upfront Commission - 0.715%. Refer Commission Guide for more information. Upfront 1.65 % ANZ Personal Loans Effective on loans settled on or after 15 August 2008* Trail in the first 3 years is Trail 0.22 % 0.165% increasing to 0.22% in year 4 and beyond. Note: Commission Schedule is subject to change from our Lender Panel. Commission is inclusive of GST. -

List of Participating Lenders - Phase 2

List of Participating lenders - Phase 2 The Government is currently considering applications from lenders interested in participating in Phase 2 of the Scheme. The following lenders have been approved to participate in Phase 2. ANZ Banjo Bank Australia Bank of Queensland Bendigo and Adelaide Bank Ltd Bigstone Lending Commonwealth Bank of Australia Community First Credit Union Limited Credabl Earlypay Fifo Capital Finstro Securities Pty Ltd Flexirent Capital Get Capital Heritage Bank Limited Hume Bank Limited IQumulate Premium Funding Judo Bank Pty Ltd Liberty Financial Metro Finance Pty Ltd Moneytech Finance Moula Money National Australia Bank Limited Prospa Queensland Country Bank Limited / Regional Australia Bank Ltd Social Enterprise Finance Australia Southern Cross Credit Union South West Credit Union Speedy Finance Suncorp-Metway Limited TrailBlazer Finance Unity Bank Volkswagen Financial Services Australia Westpac Banking Corporation Zip Business List of Participating Lenders - Phase 1 The Government approved 44 lenders to participate in the Coronavirus SME Guarantee Scheme Phase 1. The following lenders were approved to participate in the Scheme. Phase 1 of the Scheme commenced on 23 March 2020 and closed for new loans on 30 September 2020. ANZ Australian Mutual Bank Limited Banjo Bank Australia Bank of Queensland Bank of us Bendigo and Adelaide Bank Ltd Commonwealth Bank of Australia Community First Credit Union Credabl Fifo Capital Australia Pty Ltd First Choice Credit Union Get Capital / Goulburn Murray Credit Union Heritage -

Beyond Bank Annual Report 2020

Annual Report 2020 2 Contents Snapshot 4 Board of Directors 9 Directors’ Report Financial Reports 12 Lead Auditor’s Independence Declaration and Directors’ Declaration 13 Independent Auditor’s Report 14 Statements of Profit or Loss and Other Comprehensive Income 15 Statements of Financial Position 16 Statements of Changes in Equity 17 Statements of Cash Flows 18 Notes to the Financial Statements 57 Glossary of Terms and Acronyms Environmental Sustainability Beyond Bank Australia cares about the community and is committed to environmental sustainability. This leaflet has been printed on Monza Recycled, manufactured by an ISO 14001 certified mill, and contains 99% recycled fibre and elemental chlorine free pulp. All virgin pulp is derived from well-managed forests and controlled sources. To help us save precious resources, please contact us to receive future correspondence in an electronic format. 3 Board of Directors SANDRA (SAM) ANDERSEN GEOFFREY JAMES KNUCKEY CHAIR DIRECTOR Residence: Melbourne, VIC Residence: Canberra, ACT Sandra (Sam) was appointed to the Beyond Bank Australia Board in Geoff was appointed to the Beyond Bank Australia Board in July November 2013 and appointed Chair in 2018. She has more than 19 2012. He had a 32 year career with accounting firm Ernst & Young years’ experience in the finance sector and 11 years’ experience as and retired as a partner in December 2009. He was partner in an executive in the technology and health services industries. charge of EY’s Audit and Assurance group from 2003 until 2008 and was Canberra Office Managing Partner from 2003 to 2006. She is an experienced executive and Non-Executive Director in the listed, unlisted and government sectors and is currently Chair of Geoff’s career included specialising in financial statements and the Australian Packaging Covenant Organisation Limited, Chair auditing of entities of all sizes across all types of industries of Agriculture Victoria Services Pty Ltd, Non-Executive Director including the financial services sector. -

Senate Select Committee on Australia As a Technology and Financial Centre

Thursday, 24 June 2021 TO: SENATE SELECT COMMITTEE ON AUSTRALIA AS A TECHNOLOGY AND FINANCIAL CENTRE Dear Senators RESPONSE TO ISSUES PAPER 3 – FINANCIAL INCLUSION ISSUES We would like to offer comments on the topics of debanking, neobanking and regulation from the perspective of financial inclusion. As a member of Fintech Australia, we have also contributed collaboratively to their submission. Who are we? Financial Inclusion By Design is a Sydney-based consultancy with a regtech focus. We provide information and advice to financial services businesses - including fintechs - about the fairness & inclusivity of their products and services. We also work with financial counsellors, consumer groups and charities to raise awareness of financial inclusion issues. We are proactive and positive. We advocate for solutions. Increasingly, our advice is being sought by financial services businesses in order to be compliant with new ASIC regulations such as RG271 Internal Dispute Resolution and RG 274 Product Design and Distribution Obligations. Our core mission is to advocate for the design of fair & inclusive financial services and products enabled by technology. What is financial inclusion? In the context of a developed nation like Australia, financial inclusion is measured by the availability, ease and equality of opportunities for consumers and small to medium-sized businesses (SMBs) to access appropriate, affordable and timely financial products and services such as payments, savings, wealth (including retirement investments), loans and insurance. Financial inclusion will be achieved when all Australian consumers and SMBs can access: 1. The right product or service 2. At the right time 3. For the right price 4. In the right way, and 5. -

Lessons Learned the Australian and New Zealand Securitisation Markets Displayed Impressive Resilience in 2020, Aided in Part by Knowledge Acquired in Previous Crises

Incorporating Australian and New Zealand Securitisation and Covered Bonds >> Issue 19 • 2021 Lessons learned The Australian and New Zealand securitisation markets displayed impressive resilience in 2020, aided in part by knowledge acquired in previous crises. Australia’s No.1 Non-Bank* Over 65 years' experience of Looking out for you® Since establishment in 1952, La Trobe Financial has grown to be one of Australia’s leading Non-Banks with over $11 billion in assets under management. We are dedicated to providing financial solutions to meet the needs of our borrowers and investors whose financial needs are under-served by traditional institutions. Our experience, platforms and people make investing in residential and commercial mortgages readily accessible to investors, with consistent, risk adjusted returns.^ To learn more visit Martin Barry Richard Parry Paul Brown www.latrobef inancial.com Chief Financial Officer Deputy Treasurer Head of Group Portfolio or call our treasury team +61 2 8046 1502 +61 3 8610 2847 +61 3 8610 2397 [email protected] [email protected] [email protected] 15D_001_11012021 La Trobe Financial Services Pty Limited ACN 006 479 527 Australian Credit Licence 392385 ^An investment in the Credit Fund is not a bank deposit, and investors risk losing some or all of their principal investment. Past performance is not a reliable indicator of future performance. Withdrawal rights are subject to liquidity and may be delayed or suspended. La Trobe Financial Asset Management Limited ACN 007 332 363 Australian Financial Services Licence 222213 Australian Credit Licence 222213 is the issuer and manager of the La Trobe Australian Credit Fund ARSN 088 178 321. -

Member Information Document

Member Information Document This package contains important information to assist members in considering the proposed total transfer of business (‘transfer’) of My Credit Union Limited ACN 087 650 584 (‘MYCU’) to Community CPS Australia Limited ACN 087 651 143, trading as Beyond Bank Australia (‘Beyond Bank’) under the Financial Sector (Business Transfer and Group Restructure) Act 1999 (Cth). Disclaimer: The Australian Prudential Regulation Authority (‘APRA’) has approved this Member Information Document pursuant to Rule 9 of the Transfer Rules No 1 of 2015, for the purposes of the Financial Sector (Business Transfer and Group Restructure) Act 1999 (Cth). In deciding whether to approve this Information Statement, APRA has consulted with the Australian Securities and Investments Commission (‘ASIC’). Neither APRA nor ASIC accept any responsibility for the accuracy or otherwise, of any matter contained in, attached to, or accompanying this Member Information Document. Page 1 of 44 Table of Contents 1. Executive Summary ............................................................................................................................. 4 2. Why Merge? ........................................................................................................................................ 5 3. Key Dates............................................................................................................................................. 5 4. About Beyond Bank ............................................................................................................................