Gloucester Diocesan Board of Finance Annual Report & Accounts 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE ACTS and MONUMENTS of the CHRISTIAN CHURCH by JOHN FOXE

THE ACTS AND MONUMENTS OF THE CHRISTIAN CHURCH by JOHN FOXE Commonly known as FOXE'S BOOK OF MARTYRS Volume 12 The Reign of Queen Mary I. – Part IV. Published by the Ex-classics Project, 2010 http://www.exclassics.com Public Domain VOLUME 12 Portrait of Thomas Cranmer as a Young Man -2- FOXE'S BOOK OF MARTYRS CONTENTS 329. Thomas Whittle, Bartlet Green, John Tudson, John Went, Thomas Browne; Isabel Foster, and Joan Warne, alias Lashford. 5 330. John Lomas, Anne Albright, Joan Catmer, Agnes Snoth, and Joan Sole. 49 331. Thomas Cranmer 52 332. Agnes Porter and Joan Trunchfield. 149 333. John Maundrel, William Coberley, and John Spicer. 151 334. Robert Drakes, William Tyms, Richard Spurge, Thomas Spurge, John Cavel, George Ambrose 154 335. The Norfolk Supplication 176 336. John Harpole and Joan Beach 188 337. John Hullier. 190 338. Christopher Lyster, John Mace, John Spencer, Simon Joyne, Richard Nichols and John Hamond. 203 339. Hugh Laverock, John Apprice, Katharine Hut, Elizabeth Thackvel, and Joan Horns 206 340. Thomas Drowry and Thomas Croker. 211 341. Persecution in Suffolk 214 342. Sailors Saved Through the Power of Faith. 217 343. Other Martyrs, June 1556. 221 344. Thirteen Martyrs Burned at Stratford-Le-Bow. 223 345. Trouble and Business in the Diocese of Lichfield and Elsewhere, June-July 1556 230 346. John Fortune, Otherwise Cutler. 235 347. The Death of John Careless, in the King's Bench. 240 348. Julius Palmer, John Gwin and Thomas askin 291 349. Persecution in Ipswich. 312 350. Katharine Cawches, Guillemine Gilbert, Perotine Massey, and An Infant, the Son of Perotine Massey. -

The Reverend John Michael Blakeley

The Licensing of The Reverend John Michael Blakeley by the Bishop of Southwell and Nottingham The Right Reverend Paul Williams and the Installation by the Archdeacon of Nottingham The Venerable Phil Williams in the presence of The Bishop of Beverley The Right Reverend Glyn Webster Photo credit Jordan Dawson as Priest-in-Charge of St Stephen’s with St Matthias, Sneinton th on Tuesday 15 June 2021 at 7.30pm About this service This is a special service of celebration that marks the beginning of a new phase of ministry both for John and for the people of this community. Although a more limited gathering, necessitated by the requirement to be Covid-19 safe, this service gives the community an opportunity to welcome the priest to their new role, and allows both priest and people to commit themselves to the ministry ahead, praying for God’s leading in it. We are immensely grateful to many who, whilst not able to form part of this evening’s formal welcome, are upholding John and the parish in prayer at this time. The ministry to which John is being appointed is to the local parish and the wider community. The role of the Anglican parish priest is to care for the whole community and to nurture the faithful. They work with all those in the local community, whether they are people of faith or not. Therefore, within this service, the welcome is made by both church and representatives of the wider community. In this service, John is presented to the Bishop and then presented to the community by the Bishop. -

AD CLERUM: 11 July 2018

AD CLERUM: 11 July 2018 Dear Colleagues There can be few better days in the Church’s calendar than the Feast of St Benedict to announce the appointment of the Venerable Jackie Searle as the next Bishop of Crediton. The announcement was made from Downing Street this morning. Prior to her ordination, Jackie trained as a Primary School teacher, specialising in English. Following her ordination and two curacies in London, Jackie became a Lecturer in Applied Theology at Trinity College, Bristol. From there she moved to the Diocese of Derby becoming Vicar of Littleover, Rural Dean and Dean of Women’s Ministry. In 2012 she moved to her current appointment as Archdeacon of Gloucester and Canon Residentiary of Gloucester Cathedral. She is married to David Runcorn and they have two grown up children, Joshua and Simeon. Jackie is a person of wide sympathies with a deep love of Christ. She has been a Training Partner with Bridge Builders for several years, specialising in conflict transformation, and will bring to her new role the same mixture of compassion, integrity and professionalism that has characterised all her work. She understands the challenges and opportunities of rural ministry well and will enrich the life of the church in Devon in all sorts of ways. I look forward to welcoming her to the Diocese this autumn. She will be consecrated in London on the Feast of St Vincent de Paul, Thursday 27th September, and her welcome service will be in Exeter Cathedral at 4pm on Sunday 14th October. More details about both services will follow in due course. -

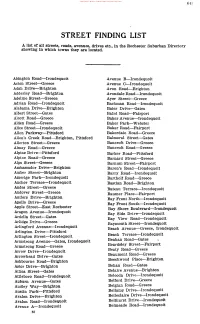

Street Finding List

Central Library of Rochester and Monroe County · Miscellaneous Directories STREET FINDING LIST A list of all streets, roads, avenues, drives etc., in the Rochester Suburban Directory showing in which towns they are located. Abington Road Irondequoit Avenue B Irondequoit Acton Street Greece Avenue C Irondequoit Adah Drive Brighton Avon Road Brighton Adderley Road Brighton Avondale Road Irondequoit Adeline Street Greece Ayer Street Greece Adrian Road Irondequoit Bachman Road Irondequoit Alabama Drive Brighton Baier DriveGates Albert Street Gates Baird Road Fairport Alcott Road Greece Baker Avenue Irondequoit Alden Road Greece Baker Park Webster Alice Street Irondequoit Baker Road Fairport Allen Parkway Pittsford Bakerdale Road Greece Allen's Creek RoadBrighton, Pittsford Balmoral Street Gates Allerton Street Greece Bancroft Drive Greece Almay Road Greece Bancroft Road Greece Alpine Drive Pittsford Barker RoadPittsford Alpine Road Greece Barnard Street Greece Alps Street Greece Barnum Street Fairport Ambassador Drive Brighton Baron's Road Irondequoit Amber Street Brighton Barry RoadIrondequoit Amerige Park Irondequoit Bartholf Road Greece Anchor Terrace Irondequoit Bastian Road Brighton Andes Greece Street Bateau Terrace Irondequoit Andover Greece Street Baumer Place Fairport Antlers Drive Brighton Bay Front North Irondequoit Apollo Drive Greece Bay Front South Irondequoit Street East Rochester Apple Bay Shore Boulevard Irondequoit Avenue Aragon Irondequoit Bay Side Drive Irondequoit Ardella Street Gates Bay View Road Irondequoit Drive Greece -

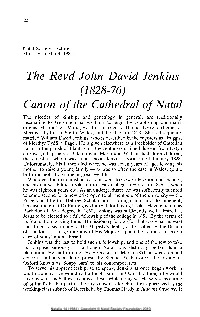

The Revd John David Jenkins (1828-76)

22 Natal Society Lecture, Monday, 5 March 1984 The Revd John David Jenkins (1828-76) Canon of the Cathedral of Natal The niceties of kinship, and genealogy in general, are traditionally fascinating to Welshmen, so we havc to begin by establishing our man's origins. His mother, Maria, was first married to Thomas Dyke, a chemist at Merthyr Tydfil in South Wales, but he died in 1823. She subsequently married William David Jenkins, who is described in the registers as 'druggist of Merthyr Tydfil village'. He is given elsewhere as a freeholder of Castellau Fach, in the parish of Llantrisant; the Jenkinses claimed descent from lestyn ap Gwrgant, prince of Glamorgan. Maria and William had three children, the eldest of whom was John David Jenkins, born on 30 January 1828. Unfortunately, his father died when he was seven years of age, leaving his mother to raise a young family - as was so often the case in Wales, gentle birth did not always mean great wealth. Whatever their circumstances, John went to Cowbridge Grammar School, and his native abilities took him to Jesus College, Oxford, in 1846 - when he was eighteen years old. As an undergraduate, he was sufficiently talented to come second for a new prize open to all members of the university - the Pusey and Ellerton Hebrew Scholarship. It brought him into the limelight, because the great Dr Pusey gave him £10 for buying books. Having taken his Bachelor of Arts degree in 1850, Jenkins was sufficiently well admired at Jesus to be elected to a full fellowship of the college in 1851. -

Remembrance Sunday

Remembrance Sunday 8 November 2020 10.45am Preacher: The Bishop of Crediton Welcome to this online act of worship at Exeter Cathedral The Cathedral Church of St. Peter in Exeter, founded in 1050, has been the seat (cathedra) of the bishop of Exeter, the symbol of his spiritual and teaching authority, for nearly 1000 years. As such the Cathedral is a centre of worship and mission for the whole of Devon. A centuries-old pattern of daily worship continues, sustained by the best of the Anglican choral tradition. The cathedral is a place of outreach, learning, and spirituality, inviting people into a richer and more engaged discipleship. The Cathedral is a destination for many pilgrims and visitors who come from near and far, drawn by the physical and spiritual heritage of this place. Exeter Cathedral belongs to all the people of Devon, and we warmly welcome you to this online service. Ministers President: The Very Revd Jonathan Greener - Dean Preacher: The Rt Revd Jackie Searle - Bishop of Crediton Giving We rely significantly upon the generosity of our congregations and the people of Devon to sustain the Cathedral’s worship and ministry. We are grateful for any donations or gifts in support of the Cathedral. For more information about planned and regular giving, please go to: https://www.exeter-cathedral.org.uk/support-us/how-to-donate/ Music The Cathedral’s Choristers are rehearsing and recording music for Advent and Christmas during this month of lockdown. The Cathedral’s Consort, its professional adult singers will be singing at this act of worship. -

Around the Spire: September 2013 - 1

The Parish Magazine for Mitcheldean & Abenhall September 2013 Around Spire the Around the Spire: September 2013 - 1 Welcome to ‘Around the Spire’ Welcome to this September edition of the Parish Magazine. As you will see, the format of the magazine is changing. We would love to hear your feedback on the changes and would like to know what you’d be interested in seeing in the magazine in the future. You can speak to either Fr. David, Michael Heylings or Hugh James or by emailing us at [email protected]. Alongside the paper copies, this magazine is now also available on our website and can be emailed directly to you. Speak to us to find out how this can be done for you. Whether you are reading this on paper or on your computer, please consider passing it on to a friend so together we can share the church’s news around the community. Worship with Us St Michael and All Angels, Mitcheldean 1st Sunday of each month: 10.00 am Family Service Remaining Sundays: 10.00 am Sung Eucharist Tuesdays: 10.30 am Holy Communion (said) (Children and families are very welcome at all our services) St Michael’s, Abenhall 1st and 3rd Sundays of the month: 3.00 pm Holy Communion 2nd and 4th Sundays of the month: 3.00 pm Evensong For Saints Days and other Holy Day services, please see the porch noticeboards or view the website: www.stmichaelmitcheldean.co.uk The church is pleased to bring Holy Communion to those who are ill or housebound. -

Fang Family San Francisco Examiner Photograph Archive Negative Files, Circa 1930-2000, Circa 1930-2000

http://oac.cdlib.org/findaid/ark:/13030/hb6t1nb85b No online items Finding Aid to the Fang family San Francisco examiner photograph archive negative files, circa 1930-2000, circa 1930-2000 Bancroft Library staff The Bancroft Library University of California, Berkeley Berkeley, CA 94720-6000 Phone: (510) 642-6481 Fax: (510) 642-7589 Email: [email protected] URL: http://bancroft.berkeley.edu/ © 2010 The Regents of the University of California. All rights reserved. Finding Aid to the Fang family San BANC PIC 2006.029--NEG 1 Francisco examiner photograph archive negative files, circa 1930-... Finding Aid to the Fang family San Francisco examiner photograph archive negative files, circa 1930-2000, circa 1930-2000 Collection number: BANC PIC 2006.029--NEG The Bancroft Library University of California, Berkeley Berkeley, CA 94720-6000 Phone: (510) 642-6481 Fax: (510) 642-7589 Email: [email protected] URL: http://bancroft.berkeley.edu/ Finding Aid Author(s): Bancroft Library staff Finding Aid Encoded By: GenX © 2011 The Regents of the University of California. All rights reserved. Collection Summary Collection Title: Fang family San Francisco examiner photograph archive negative files Date (inclusive): circa 1930-2000 Collection Number: BANC PIC 2006.029--NEG Creator: San Francisco Examiner (Firm) Extent: 3,200 boxes (ca. 3,600,000 photographic negatives); safety film, nitrate film, and glass : various film sizes, chiefly 4 x 5 in. and 35mm. Repository: The Bancroft Library. University of California, Berkeley Berkeley, CA 94720-6000 Phone: (510) 642-6481 Fax: (510) 642-7589 Email: [email protected] URL: http://bancroft.berkeley.edu/ Abstract: Local news photographs taken by staff of the Examiner, a major San Francisco daily newspaper. -

John B. Gough: the Apostle of Cold Water

JOHN B. GOUGH The Apostle of Cold Water BY CARLOS MARTYN Editor of "American Reformers ," anil Author of " Wendell Phillips: the Agitator" etc. , etc. PRINTED IN THE UNITED STATES. TSttto Forft FUNK & WAGNALLS COMPANY London and Toronto i893 ALL RIGHTS RESERVED. Copyright, 1893, by the FUNK & WAGNALLS COMPANY. [Registered at Stationers' Hall, London, England.] ^ -*9*. s&tL S- 0>*^ /rue mite, ADerce&es jferrer flDartsn, Gbis ffiooft, Encourages bg bet Counsels, and pruned bs ber Criticisms, Us Xovinflls ano ©ratefullg dedicated. CONTENTS. PACK. Preface xi-xiv PART I. SANDGATE BY THE SEA. I. Beside the Cradle 17-20 II. Early Scenes and Incidents 21-29 PART II. THE EMIGRANT. I. Departure from Home .'..... 33-37 II. The Farmer's Boy 38-42 III. The Young Bookbinder 43-46 IV. The Pauper Funeral 47~5Z viii CONTENTS. PART III. THE INFERNO. PACK. I. Adrift 55-57 II. On the Stage 58-63 III. The Adventures of a Drunkard . 64-70 IV. Delirium Tremens 7 1—76 PART IV. RECOVERY AND RELAPSE. I. The Kind Touch on the Shoulder . 79-83 II. Small Beginnings of a Great Career . 84-91 III. Tempted 92-96 PART V. IN THE ARENA. I. On the Platform 99-109 II. The " Doctored " Soda- Water .... 110-114 III. " Footprints on the Sands of Time " . 1 15-135 PART VI. THE FIRST VISIT TO GREAT BRITAIN. I. The Debut in London 139-151 II. " How Dear to My Heart Are the Scenes of My Childhood" 152-155 III. Here, There, and Yonder, in the British Isles 156-165 CONTENTS. -

JULY/AUGUST 2015 3.00Pm Choral Evensong

DAILY SERVICES AT GLOUCESTER CATHEDRAL SUNDAY NEWS 7.40am Morning Prayer 8.00am Holy Communion 10.15am Sung Eucharist with Children’s Church JULY/AUGUST 2015 3.00pm Choral Evensong Wishing you Every Happiness MONDAY - SATURDAY for your Retirement, 8.00am Holy Communion Neil. 8.30am Matins 12.30pm Holy Communion 5.30pm Choral Evensong (said Evening Prayer on Mondays) (4.30pm on Saturdays) See our website for details of services and any changes or closures. A Gift Aid scheme operates at the Cathedral, which allows the Chapter to claim back 25p per £1 for donations. Many of you do so already, and we are grateful, but if you are a visitor who pays Income Tax in the UK, you could make your donation go further by doing this. There is a Donorpoint at the West end of the Cathedral where you can use your credit card to give a donation, and this can be gift- aided as well From the Printed by Perpetua Press, 20 Culver Street, Newent, Glos. GL18 1DA Gloucester Cathedral News Editorial Team. Tel: 01531 820816 32 Gloucester Cathedral News The Editorial Team consists of: Richard Cann, Sandie Conway, Pat Foster, Barrie Glover, Mission Statement: Stephen Lake, Christopher and Maureen Smith. ‘We aim to produce a Christian magazine which is widely accessible and which informs, involves and inspires its readers.’ Editor: Maureen Smith Cathedral Chapter The next Editorial meeting is on Wednesday 12th August at 10.30am at 35 Colin Road for the October Edition. Dean: The Very Reverend Stephen Lake "We are happy to receive articles, handwritten or typed. -

Around the Spire: May 2014 - 1 Around the Spire: May 2014 - 22

The Ministry Team of Mitcheldean & Abenhall The Parish Magazine for Mitcheldean & Abenhall Parish Priest Father David Gill St Michael’s Rectory, Hawker Hill, Mitcheldean, GL17 0BS May 2014 Tel: 01594 542952 Email: [email protected] Reader Emeritus Around Spire Mr Peter Grevatt the 21 Oakhill Road, Mitcheldean, GL17 0BN Tel: 01594 542912 Churchwardens for Churchwardens for Mitcheldean Abenhall Mrs Pam Martin Ms Sheila Baker Rosedean, Tibbs Cross, The Fuchsias, New Road, Littledean, GL14 3LJ Mitcheldean, GL17 0EP Tel: 01594 826115 Tel: 01594 543522 Ms Helen Dunsford Mrs Kath Fisher 7 Wintles Close, Laburnum Cottage, Plump Hill, Mitcheldean,GL17 0JP Mitcheldean, GL17 0ET Tel: 01594 543146 Tel: 01594 543584 For more information on the magazine, please contact one of the Churchwardens or email: [email protected] Around the Spire: May 2014 - 1 Around the Spire: May 2014 - 22 Welcome to ‘Around the Spire’ Sleepy Hollow Welcome to our May edition. In addition to our regular contributors, Helen Wigpool Mitcheldean Dunsford has provided us with an interesting article on her trip to Quarr Gloucestershire Abbey and Chris Wagstaff prepares us for Christian Aid week. If you have any GL17 0JN contributions for the magazine, please speak to Mike Heylings or Hugh James. You can also email [email protected]. We are a small, high-quality boarding cattery which is family-owned and managed, situated in a rural location within the Forest Of Dean. Whether you are reading this on paper or on your computer, please consider Whether you're moving house, booking a holiday, planning a business trip, or any personal difficulties, Celtic Cattery offers a professional, quiet and caring service with competitive daily rates. -

September 2016

DAILY SERVICES AT GLOUCESTER CATHEDRAL SUNDAY NEWS 7.40am Morning Prayer (said) 8.00am Holy Communion 10.15am Sung Eucharist with Children’s Church 3.00pm Choral Evensong SEPTEMBER 2016 MONDAY - SATURDAY 8.00am Holy Communion 8.30am Morning Prayer (said) 12.30pm Holy Communion 5.30pm Choral Evensong (said Evening Prayer on Mondays) (4.30pm on Saturdays) See our website for details of services and any changes or closures. A Gift Aid scheme operates at the Cathedral, which allows the Chapter to claim back 25p per £1 for donations. Many of you do so already, and we are grateful, but if you are a visitor who pays Income Tax in the UK, you could make your donation go further by doing this. There is a Donorpoint at the West end of the Cathedral where you can use your credit card to give a donation, and this can be gift- aided as well Printed by Perpetua Press, 20 Culver Street, Newent, Glos. GL18 1DA Tel: 01531 820816 32 Gloucester Cathedral News The Editorial Team consists of: Richard Cann, Sandie Conway, Pat Foster, Barrie Glover, Mission Statement: Stephen Lake, Christopher and Maureen Smith. ‘We aim to produce a Christian magazine which is widely accessible and which informs, involves and inspires its readers.’ Editor: Maureen Smith Cathedral Chapter The next Editorial meeting is on Monday 12th September at 10.30am. Dean: The Very Reverend Stephen Lake Canons: Lay Canons: Nikki Arthy John Coates "We are happy to receive articles, handwritten or typed. We regret that, due to the limited space available, and to enable us to Dr Andrew Braddock Paul Mason continue to produce a lively, varied and informative magazine, we Jackie Searle Dame Janet Trotter can normally only accept articles of 400 words or less.