Revenue Department Policy Note 2010-2011 I. Periasamy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Irrigation Infrastructure – 21 Achievements During the Last Three Years

INDEX Sl. Subject Page No. 1. About the Department 1 2. Historic Achievements 13 3. Irrigation infrastructure – 21 Achievements during the last three years 4. Tamil Nadu on the path 91 of Development – Vision 2023 of the Hon’ble Chief Minister 5. Schemes proposed to be 115 taken up in the financial year 2014 – 2015 (including ongoing schemes) 6. Inter State water Issues 175 PUBLIC WORKS DEPARTMENT “Ú®ts« bgU»dhš ãyts« bgUF« ãyts« bgU»dhš cyf« brê¡F«” - kh©òäF jäœehL Kjyik¢r® òu£Á¤jiyé m«kh mt®fŸ INTRODUCTION: Water is the elixir of life for the existence of all living things including human kind. Water is essential for life to flourish in this world. Therefore, the Great Poet Tiruvalluvar says, “ڮϋW mikahJ cybfå‹ ah®ah®¡F« th‹Ï‹W mikahJ xG¡F” (FwŸ 20) (The world cannot exist without water and order in the world can exists only with rain) Tamil Nadu is mainly dependent upon Agriculture for it’s economic growth. Hence, timely and adequate supply of “water” is an important factor. Keeping the above in mind, I the Hon’ble Chief Minister with her vision and intention, to make Tamil Nadu a “numero uno” State in the country with “Peace, Prosperity and Progress” as the guiding principle, has been guiding the Department in the formulation and implementation of various schemes for the development and maintenance of water resources. On the advice, suggestions and with the able guidance of Hon’ble Chief Minister, the Water Resources Department is maintaining the Water Resources Structures such as, Anicuts, Tanks etc., besides rehabilitating and forming the irrigation infrastructure, which are vital for the food production and prosperity of the State. -

District Statistical Handbook 2018-19

DISTRICT STATISTICAL HANDBOOK 2018-19 DINDIGUL DISTRICT DEPUTY DIRECTOR OF STATISTICS DISTRICT STATISTICS OFFICE DINDIGUL Our Sincere thanks to Thiru.Atul Anand, I.A.S. Commissioner Department of Economics and Statistics Chennai Tmt. M.Vijayalakshmi, I.A.S District Collector, Dindigul With the Guidance of Thiru.K.Jayasankar M.A., Regional Joint Director of Statistics (FAC) Madurai Team of Official Thiru.N.Karuppaiah M.Sc., B.Ed., M.C.A., Deputy Director of Statistics, Dindigul Thiru.D.Shunmuganaathan M.Sc, PBDCSA., Divisional Assistant Director of Statistics, Kodaikanal Tmt. N.Girija, MA. Statistical Officer (Admn.), Dindigul Thiru.S.R.Arulkamatchi, MA. Statistical Officer (Scheme), Dindigul. Tmt. P.Padmapooshanam, M.Sc,B.Ed. Statistical Officer (Computer), Dindigul Selvi.V.Nagalakshmi, M.Sc,B.Ed,M.Phil. Assistant Statistical Investigator (HQ), Dindigul DISTRICT STATISTICAL HAND BOOK 2018-19 PREFACE Stimulated by the chief aim of presenting an authentic and overall picture of the socio-economic variables of Dindigul District. The District Statistical Handbook for the year 2018-19 has been prepared by the Department of Economics and Statistics. Being a fruitful resource document. It will meet the multiple and vast data needs of the Government and stakeholders in the context of planning, decision making and formulation of developmental policies. The wide range of valid information in the book covers the key indicators of demography, agricultural and non-agricultural sectors of the District economy. The worthy data with adequacy and accuracy provided in the Hand Book would be immensely vital in monitoring the district functions and devising need based developmental strategies. It is truly significant to observe that comparative and time series data have been provided in the appropriate tables in view of rendering an aerial view to the discerning stakeholding readers. -

Branch Library Address 1 Librarian, 2 Librarian, 3 Librarian, District Central Library, Branch Library, Branch Library

DINDIGUL DISTRICT Branch Library Address 1 Librarian, 2 Librarian, 3 Librarian, District Central Library, Branch Library, Branch Library,. Spencer Compound. 64 Salai Street. 251, Madurai Road, Near busstand. Vedasandur-624 710 Fire Station Back side, Dindigul Dindigul Dist Natham-624 406 Dindigul Dist. 4 Librarian, 5 Librarian, 6 Librarian, Branch Library, Branch Library, Branch Library, 1/4/19 main Road. Mariamman Kovil Sidha Nagar Nilakkottai-624 208 South Sangiligate Near, Dindigul Dist Batlagundu-624 202 Palani-624601 Dindigul Dist Dindigul Dist. 7 Librarian, 8 Librarian, 9 Librarian, Branch Library, Branch Library, Branch Library, Kavi Thiyagarajar Salai Balakrishnapuram, 29 c Nagal Pudhur 4 th Kodaikkanal N.G.O.Colony, Lane Dindigul Dist. Dindigul-624 005 Dindigul-3 Dindigul Dist. Dindigul Dist. 10 Librarian, 11 Librarian, 12 Librarian, Branch Library, Branch Library, Branch Library, A P Memorial Buldings Government Hospital 6.10.72 Kamarajar salai Anthoniyar St Bus Stand Near, Chinnalapatty-624 301 Butlagundu Road Dindigul Dindigul Dist. Begampur, Dindigul Dist. Dindigul Dist. 13 Librarian, 14 Librarian, 15 Librarian, Branch Library, Branch Library, Branch Library, Melamanthai, Darapuram Road, Palani East Authoor-624 701 P.Palaniappa nagar, Sriram Flaza, DindigulDist. Oddanchathram State Bank road, Dindigul Dist-624 619. Palani Dindigul Dist. 16 Librarian, 17 Librarian, 18 Librarian, Branch Library, Branch Library, Branch Library, Abirami Nagar Extension, Sennamanaikkanpatti, 28. Railway Station Karur Salai, Dindigul Dist-624 008 Road, Dindigul 624 001 Vadamadurai-624 802 Dindigul Dist. Dindigul Dist. 19 Librarian, 20 Librarian, 21 Librarian, Branch Library, Branch Library, Branch Library, Town panchat Compound Government High Busstand Near Thadikombu -624 709 School Near Chithaiyankottai-624 Dindigul Dist N. -

Tamil Nadu Government Gazette

© [Regd. No. TN/CCN/467/2012-14. GOVERNMENT OF TAMIL NADU [R. Dis. No. 197/2009. 2018 [Price: Rs. 13.60 Paise. TAMIL NADU GOVERNMENT GAZETTE PUBLISHED BY AUTHORITY No. 32] CHENNAI, WEDNESDAY, AUGUST 8, 2018 Aadi 23, Vilambi, Thiruvalluvar Aandu–2049 Part II—Section 2 Notifications or Orders of interest to a section of the public issued by Secretariat Departments. NOTIFICATIONS BY GOVERNMENT CONTENTS Pages. Pages. COMMERCIAL TAXES AND REGISTRATION HHOMEOME DDEPARTMENTEPARTMENT DEPARTMENT IIndianndian CChristianhristian MarriageMarriage Act.—GrantAct.—Grant ofof LicenceLicence Indian Stamp Act——Provisions for the Consolidation ttoo GGrantrant CCertiertifi ccatesates ooff MMarriagesarriages bbetweenetween of Duty Chargeable in respect of issue of IIndianndian CChristianshristians .... .... .... .... 776666 Policies by Life Insurance Corporation of India Southern Zonal Offi ce, Chennai-2 for certain PProtectionrotection ooff HHumanuman RightsRights Act.Act.——AppointmentAppointment ooff period etc., .. .. .. .. .. 7742-74342-743 ccertainertain Offi ccialial aass SSpecialpecial PublicPublic ProsecutorProsecutor forfor cconductingonducting casescases atat DistrictDistrict SessionsSessions Court,Court, ENVIRONMENT AND FORESTS CCoimbatoreoimbatore DistrictDistrict oonn TenureTenure basisbasis forfor certaincertain DEPARTMENT pperioderiod .... .... .... .... .... 776666 Tamil Nadu Forest Act.——Declaration of DDelhielhi SpecialSpecial PolicePolice EstablishmentEstablishment Act.—Act.— Summadukuttu Forest Block in Melur Taluk, IInvestigationnvestigation -

DEPARTMENT of GEOLOGY and MINING DINDIGUL DISTRICT Contents S.No Chapter Page No

DEPARTMENT OF GEOLOGY AND MINING DINDIGUL DISTRICT Contents S.No Chapter Page No. 1.0 Introduction 1 2.0 Overview of Mining Activity in the District; 4 3.0 General profile of the district 6 4.0 Geology of the district; 9 5.0 Drainage of irrigation pattern 13 6.0 Land utilisation pattern in the district; Forest, Agricultural, 14 Horticultural, Mining etc 7.0 Surface water and ground water scenario of the district 19 8.0 Rainfall of the district and climate condition 20 9.0 Details of the mining lease in the district as per following 22 format 10.0 Details of Royalty / Revenue received in the last three years 46 (2015-16 to 2017-18) 11.0 Details of Production of Minor Mineral in last three Years 47 12.0 Mineral map of the district 48 13.0 List of letter of intent (LOI) holder in the district along with its 49 validity 14.0 Total mineral reserve available in the district. 72 15.0 Quality / Grade of mineral available in the district 73 16.0 Use of mineral 73 17.0 Demand and supply of the mineral in the lase three years 74 18.0 Mining leases marked on the map of the district 75 19.0 Details of the area where there is a cluster of mining leases viz., 77 number of mining leases, location (latitude & longitude) 20.0 Details of eco-sensitive area 77 21.0 Impact on the environment due to mining activity 79 22.0 Remedial measure to mitigate the impact of mining on the 81 environment 23.0 Reclamation of mined out area (best practice already 83 implemented in the district, requirement as per rules and regulations, proposed reclamation plan 24.0 Risk assessment & disaster management plan 83 25.0 Details of occupational health issue in the district (last five – 85 year data of number of patients of silicosis & tuberculosis is also needs to be submitted) 26.0 Plantation and green belt development in respect of leases 85 already granted in the district 27.0 Any other information 85 List of Figure Chapter Page S.No No. -

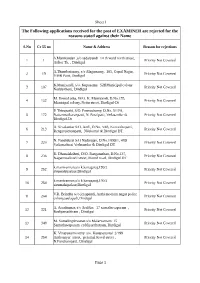

The Following Applications Received for the Post of EXAMINER Are Rejected for the Reasons Stated Against Their Name

Sheet1 The Following applications received for the post of EXAMINER are rejected for the reasons stated against their Name S.No Cr 55 no Name & Address Reason for rejections S.Manikandan ,s/o sadaiyandi 10 th ward north street, 1 1 Priority Not Covered Atthor Tk. , Dindigul A.Thandonisamy, s/o Alagarsamy, 163, Gopal Nagar, 2 19 Priority Not Covered YMR Patti, Dindigul K.Muniyandi, s/o. Kupusamy. 52BMunicipal colony 3 107 Priority Not Covered Neddu theru, Dindigul M. HemaLatha, W/O. K. Muniyandi, D.No.155, 4 132 Priority Not Covered Municipal colony, Nettu street, Dindigul-Dt P. Thirupathi, S/O. Ponnuchamy, D.No. 5/18A, 5 172 Nattanmaikaranpatti, N. Paraipatti, Vedasandur tk Priority Not Covered Dindigul-Dt A. Sivakumar S/O. Andi, D.No. 3/48, Kunoothupatti, 6 213 Priority Not Covered Renganaickanpatti, Nilakottai tk Dindigul DT N. Pandidurai S/O Nadarajan, D.No.109B/1, 48B 7 220 Priority Not Covered Vadamadurai Vedasandur tk Dindigul DT R. Dhanalakshmi, D/O. Ranganathan, D.No.137, 8 236 Priority Not Covered Nagammalkovil street, Round road, Dindigul DT k.manivannan,s/o k.kanagaraj,190/2 9 252 Priority Not Covered sirumalaipalaur,Dindigul k.manivannan,s/o k.kanagaraj,190/2 10 254 Priority Not Covered sirumalaipalaur,Dindigul V.R. Brindha w/o jeyapandi, Aathi moolam nagar police 11 264 Priority Not Covered colony,seelapadi,Dindigul A. Arunkumar, s/o Aruldas 17 samathuvapuram , 12 321 Priority Not Covered Rediyarsathiram , Dindigul M. Somalingshwaran s/o Malarvarnam 15 13 348 Priority Not Covered Samathuvapuram reddiyarchatram, Dindigul K. Vinayakamoorthy s/o. Kanaperumal 2/199 14 354 Anthoniyar street, perumal Kovil street , Priority Not Covered N.Panchampatti, Dindigul Page 1 Sheet1 M. -

Pre-Feasibility Report

Pre-Feasibility Report PRE – FEASIBILTY REPORT OF EARTH QUARRY OVER AN EXTENT OF 1.52.0 HECTARES AT S.F.Nos. 175(P), 176(P), 177(P), 193(P) and 195(P) KAITHIANKOTTAI VILLAGE VEDASANDUR TALUK, DINDIGUL DISTRICT LESSEE: A.LATHA, (PROPRIETOR) 1 Pre-Feasibility Report CONTENTS 1.EXECUTIVE SUMMARY ................................................... 1 2.INTRODUCTION OF THE PROJECT / BACKGROUND INFORMATION ..................................................................1 3.PROJECT DESCRIPTION .................................................. 3 4.SITE ANALYSIS ...................................................... ........6 5. PLANNING BRIEF ........................................................ ..8 6. PROPOSED INFRASTRUCTRE ....................... ..................9 7.REHABILITATION & RESETTLEMENT PLAN ( R & R PLAN) ..13 8.PROJECT SCHEDULE & COST ESTIMATES ........................ 13 9.ANALYSIS OF PROPOSAL & FINAL RECOMENDATIONS .... 14 ANNEXURES (ENCLOSED IN THE MINING PLAN) 1. PLATE - 1D . PROJECT LOCATION MAP 2. PLATE - 1B. SATELLITE IMAGE OF THE LOCATION 3. PLATE - 5 . PROJECT SITE IMAGE 2 Pre-Feasibility Report EXECUTIVE SUMMARY This project is for Quarrying Earth (Mining of Minor Minerals other than Granite) in S.F.NOs.175(P), 176(P), 177(P), 193(P) and 195(P) in Kaithiankottai Village, Vedasandur Taluk, Dindigul District over an area of 1.52.0 Hect. by A.Latha, (Proprietor) . The mine lease application was meritoriously processed and the District Collector Dindigul passed an order vide Letter No. 486/2017 (Mines) dated 06.11.2017 -

District Survey Report Dindigul District, Tamil Nadu

DISTRICT SURVEY REPORT DINDIGUL DISTRICT, TAMIL NADU JULY, 2017 GEOLOGICAL SURVEY OF INDIA GOVERNMENT OF TAMIL NADU SU: TAMIL NADU & PUDUCHERRY DEPARTMENT OF GEOLOGY AND MINING, DINDIGUL DISTRICT SURVEY REPORT-DINDIGUL DISTRICT SURVEY REPORT DINDIGUL DISTRICT, TAMIL NADU ………………………………………………………………………………….... CONTENTS Sl. No. CHAPTERS Page No. 1 Introduction 1 2 Overview of mining activity in the district 2 3 List of mining leases in the district 3 4 Details of royalty or revenue received in last three years - Details of production of sand or Bajri or minor minerals in last three - 5 years 6 Process of deposition of river sediments in the district 38 7 General profile of the district 42 8 Land utilization pattern in the district 45 9 Physiography of the district 46 10 Rainfall month wise 48 11 Geology and mineral wealth 49 Conclusion and Recommendation 66 Sl. No. LIST OF FIGURES Page No. Fig.1.1 Dindigul District map 1 Fig.6.3.1. Schematic picture of meandering and deposition of sediments 40 Fig.6.3.2. River map of Dindigul 41 Fig.6.3.3. Ground water level of Dindigul from 1991 - 2016 41 Fig.8.1. Land Use & Utilisation map of Dindigul 46 Fig. 9.1. Geomorphology and Geohydrology map of Dindigul 47 Fig. 11.1. Geology of Tamil Nadu 49 Fig. 11.2. Geology of Dindigul district 51 Sl. No. LIST OF PHOTOGRAPHS Page No. 1 Charnockite quarry at Kothapulli, Dindigul (West) Taluk 54 2 Charnockite quarry at Thummalapatti, Palani Taluk 55 3 Layerred Charnockite quarry at Thimmananallur, Dindigul (East) 55 4 Limestone quarry at Alambadi, Vedasandur taluk 56 5 Limestone quarry at Panniyamalai, Natham taluk 56 6 Quartz & Feldspar quarry at Mulaiyur, Natham taluk 58 7 Quartz & Feldspar quarry at Kuttam, Vedasandur taluk 58 i DISTRICT SURVEY REPORT-DINDIGUL 8 Granite quarry at Eriyodu, Vedasandur taluk 59 9 Gravel excavation at Ellapatti, Oddanchatram taluk 60 10 Brick earth excavation at Tasiripatti, Oddanchatram taluk 61 Sl. -

The Anti-Kallar Movement of 1896 / 1

The anti-Kallar movement of 1896 / 1 Securing the rural citizen: The anti-Kallar movement of 1896 Anand Pandian Visiting Assistant Professor of History and Anthropology Hamilton College This article concerns the politics of security and caste difference in the late nineteenth century Madras Presidency. Relying on a vernacular principle of interpretation emerging from the colonial archive itselfa Sanskrit Law of Coincidencethe article makes a case for collective identity in colonial India as a conjunctural attribution. I closely examine the trajectory of a widespread peasant movement that sought in 1896 to evict a single caste from hundreds of settlements altogether. The article tracks an intimate traffic between administrative sociology and native stereotype that converged on an assessment of this caste as thieving and predatory by nature. This racialised politics of intrinsic character enabled a popular programme of violent eviction. At the same time, peasant efforts to secure property and territory from threat may be understood as an alternative project of rural government, one that marked a crucial turn in the development of a moral order in the southern Tamil countryside. [T]he Power of Protection ... Constitutes Sovereignty, in as much as reciprocal Obedience of the Subject is the result. George Parish, Madura District Collector, 18051 Protectionof property, life and welfarewas a foundational fiction of colonial rule in India. Natives were subject to European governance inasmuch as they posed a threat to themselves. At the close of the nineteenth century, caste provided Acknowledgements: I am grateful to Donald Moore, Lawrence Cohen, M.S.S. Pandian and the editors of The Indian Economic and Social History Review for their invaluable comments on prior drafts of this article, and to Sanchita Balachandran for assistance with mapmaking. -

Dindigul District District Rural Development and Panchayat Raj Dindigul District Level

1 Dindigul District District Rural Development and Panchayat Raj Dindigul District Level. Respective subject and functions assigned to these officers Name of the Designation STD Phone No. Name Designation Fax E-Mail Office Address Office Unit under the Act Code Office Home 1 2 3 4 5 6 7 8 9 10 Information S.Gomathinay Dy.BDO/ 0451 2461925 0451- 0451- [email protected] Project Office, Project Office, Officer agam Superintendent 2460134 2460087 DRDA, DRDA, Dindigul Appellate Arivarasu APO (R) 0451 2461925 9443 2460087 [email protected] Collectorate, Authority 072920 Dindigul Information T.Anotnysamy Superintendent / 0451 2460094 9814 - - District District Officer Statistical 2138357 Panchayat Panchayat Inspector Office, Office, Dindigul Appellate G.Jeyaraman District 0451 2460094 9842 - - Collectorate, Authority Secretary 148733 Dindigul Information Murugesan Dy.BDO/ 0451 2427392 04545- - - Assistant Assistant Officer Superintendent 255123 Director (Pts) Director (Pts) Appellate KR.Alagiri Assistant 0451 2427392 9894 - - Office, Near Office, Dindigul Authority samy Director (Pts) 434016 Bus-stand , Dindigul Information B.Nagarajan Dy.BDO/ 0451 2460043 92454707 - - Assistant Officer Superintendent 71 Director Assistant Appellate R.Chinnasamy Assistant 0451 2460043 9842 - - (Audit) Office, Director (Audit) Authority Director 192482 Collectorate, Office, Dindigul (Audit), Dindigul Dindigul Information N.Raveendran H.S(PD) / BDO 0451 2460088 04522563 0451- Collectorate, Development Officer 603 2460088 Development Section, Appellate P.Gopala -

Simvattukadu Kombai: a Conservation Strategy in the Western Ghats And

Siruvattukadu Kombai: A Conservation Strategy in the Western Ghats and Palni Hills CYNTHIA CARON TAMILNADU, India June 1995 "...where this cursed modern civilization has not reached, India remains as it was before. The inhabitants of that part of India will very properly laugh at your new-fangled notions. The English do not rule over them, nor will you ever rule over them Those in whose name we speak we do not know, nor do they know us. I would certainly advise you and those like you who love the moth- erland to go into the interior that has yet been not polluted by the railways and to live there for six months; you might then be patri- otic..." Mahatma Gandhi wrote this in 1909 to defend Home Rule and to criticize modern civilization. agree. There is just something about living in a rural village enclosed by a thick forest that pierces the heart and makes one yearn for and reflect on an India that is vanishing. The past five months have based myself in Kodaikanal. This summer resort in the Palni Hills is a far cry from the interior that Gandhi described. The village where have been conducting my re- search, however, still holds many of the attributes of Gandhi's inter- ior village. Kombai is not polluted by railways, diesel-powered scooters or electronic media. The villagers are poor, but cannot state with certainty that they have been "dissuaded [as their ancestors] from luxuries and pleasures." To facilitate the marketing of their ag- ricultural produce, villagers request that a proper road be built con- necting their settlement to the main road. -

Status of Farmer Producer Companies – Sep '2017

STATUS OF FARMER PRODUCER COMPANIES – SEP ‘2017 Share capital (Rs. In S. Shareholders (Gender) Board of Directors Geographic Location Name lakhs) No. Male Female Total Male Female Total Authorized Paid-up A. FPCs Supported by CIKS Marutham Sustainable 11 villages in Uthiramerur and Madhuranthakam 1 Agriculture Producer 1,586 2,282 3,868 6 9 15 50 27.80 Taluks of Kancheepuram District and 27 villages in Company Limited Vandavasi Taluk of Tiruvannamalai District Valanadu Sustainable Nagapattinam district – three taluks – Sirkazhi 2 Agriculture Producer 1,532 1,108 2,640 10 2 12 25 12.00 Mayiladuthurai and Vedaranyam 44 panchayats Company Limited* Sub-Total 3,118 3,390 6,508 16 11 27 75 39.80 B. FPCs Supported by NABARD POPI Chenngam Sustainable 9 Panchayats in Chengam Taluk Tiruvannamali 3 Agriculture Producer 445 79 524 4 1 5 20 5.20 District Company Limited Kanchi Sustainable 16 Panchayats in Uthiramerur and 4 Agriculture Producer 132 634 766 4 1 5 20 15.60 Madhuranthakam Taluk in in Kancheepuram Company Limited District Kuriniji Sustainable 5 Agriculture Producer 356 569 925 5 6 11 20 13.60 6 Panchayats in Natham Taluk of Dindigul District Company Limited Managiri Sustainable 14 villages in Kalasapakkam Taluk in 6 Agriculture Producer 315 196 511 4 1 5 20 9.40 Tiruvannamalai District Company Limited Mullai Sustainable Agriculture 5 Panchayats in Attur and Dindigul Taluk of 7 450 184 634 7 2 9 20 8.80 Producer Company Limited Dindigul District Share capital (Rs. In S. Shareholders (Gender) Board of Directors Geographic Location Name lakhs) No.