Investing Through a Low Tax Jurisdiction Structure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A New Consideration About the Almopia-Paikon Boundary Based on the Geological Mapping in the Area of Nerostoma-Lakka (Central Macedonia, Greece)

Δελτίο της Ελληνικής Γεωλογικής Εταιρίας τομ. ΧΧΧΧ, Bulletin of the Geological Society of Greece vol. XXXX, 2007 2007 Proceedings of the 11th International Congress, Athens, May, Πρακτικά 11ou Διεθνούς Συνεδρίου, Αθήνα, Μάιος 2007 2007 A NEW CONSIDERATION ABOUT THE ALMOPIA-PAIKON BOUNDARY BASED ON THE GEOLOGICAL MAPPING IN THE AREA OF NEROSTOMA-LAKKA (CENTRAL MACEDONIA, GREECE) Tranos M. D. \ Plougarlis A. P.!, and Mountrakis D. Μ.l 1 Aristotle University of Thessaloniki, School of Geology, Department of Geology, GR-54124 Thessaloniki, Greece, [email protected], [email protected], [email protected] Abstract Geological mapping along the boundary of Almopia and Paikon zone in the 'Nerostoma' region, NNW of Lakka village defines mafic volcanogenic rocL·, meta-pelites and radiolarites, thick-bedded to massive micritic limestones and flysch meta-sediments that dip mainly towards SW. Middle-Late Cretaceous fossiliferous limestones overlie unconformably the flysch meta-sediments and are characterised only by a primary foliation SO that dips at shallow angles to the NNW-N. Secondary foliations SI (sub-parallel to SO) and S2 are observed in the meta-clastic rocks. A Dl event caused Fl and progressively F2 folds to which S2 is the axial plane schistosity dipping to SW. This event which has not affected the fossiliferous limestones is related to an oblique convergence or inclined transpression during the Late Jurassic-Early Cretaceous. A D2 event dated in Early Tertiary caused an intense NE-thrusting and S-C cataclastic fabric defining top-to-the NE sense-of-shear. At many parts, the unconformity contact between the fossiliferous limestones and the underlying flysch is obliterated by this thrusting event. -

For Municipal Solid Waste Management in Greece

Journal of Open Innovation: Technology, Market, and Complexity Article Description and Economic Evaluation of a “Zero-Waste Mortar-Producing Process” for Municipal Solid Waste Management in Greece Alexandros Sikalidis 1,2 and Christina Emmanouil 3,* 1 Amsterdam Business School, Accounting Section, University of Amsterdam, 1012 WX Amsterdam, The Netherlands 2 Faculty of Economics, Business and Legal Studies, International Hellenic University, 57001 Thessaloniki, Greece 3 School of Spatial Planning and Development, Aristotle University of Thessaloniki, 54124 Thessaloniki, Greece * Correspondence: [email protected]; Tel.: +30-2310-995638 Received: 2 July 2019; Accepted: 19 July 2019; Published: 23 July 2019 Abstract: The constant increase of municipal solid wastes (MSW) as well as their daily management pose a major challenge to European countries. A significant percentage of MSW originates from household activities. In this study we calculate the costs of setting up and running a zero-waste mortar-producing (ZWMP) process utilizing MSW in Northern Greece. The process is based on a thermal co-processing of properly dried and processed MSW with raw materials (limestone, clay materials, silicates and iron oxides) needed for the production of clinker and consequently of mortar in accordance with the Greek Patent 1003333, which has been proven to be an environmentally friendly process. According to our estimations, the amount of MSW generated in Central Macedonia, Western Macedonia and Eastern Macedonia and Thrace regions, which is conservatively estimated at 1,270,000 t/y for the year 2020 if recycling schemes in Greece are not greatly ameliorated, may sustain six ZWMP plants while offering considerable environmental benefits. This work can be applied to many cities and areas, especially when their population generates MSW at the level of 200,000 t/y, hence requiring one ZWMP plant for processing. -

The Statistical Battle for the Population of Greek Macedonia

XII. The Statistical Battle for the Population of Greek Macedonia by Iakovos D. Michailidis Most of the reports on Greece published by international organisations in the early 1990s spoke of the existence of 200,000 “Macedonians” in the northern part of the country. This “reasonable number”, in the words of the Greek section of the Minority Rights Group, heightened the confusion regarding the Macedonian Question and fuelled insecurity in Greece’s northern provinces.1 This in itself would be of minor importance if the authors of these reports had not insisted on citing statistics from the turn of the century to prove their points: mustering historical ethnological arguments inevitably strengthened the force of their own case and excited the interest of the historians. Tak- ing these reports as its starting-point, this present study will attempt an historical retrospective of the historiography of the early years of the century and a scientific tour d’horizon of the statistics – Greek, Slav and Western European – of that period, and thus endeavour to assess the accuracy of the arguments drawn from them. For Greece, the first three decades of the 20th century were a long period of tur- moil and change. Greek Macedonia at the end of the 1920s presented a totally different picture to that of the immediate post-Liberation period, just after the Balkan Wars. This was due on the one hand to the profound economic and social changes that followed its incorporation into Greece and on the other to the continual and extensive population shifts that marked that period. As has been noted, no fewer than 17 major population movements took place in Macedonia between 1913 and 1925.2 Of these, the most sig- nificant were the Greek-Bulgarian and the Greek-Turkish exchanges of population under the terms, respectively, of the 1919 Treaty of Neuilly and the 1923 Lausanne Convention. -

Sofia Bournazi Dynamic Marketing Pro for Northern Greece by Maralyn D

Sofia Bournazi Dynamic Marketing Pro For Northern Greece By Maralyn D. Hill 32 Travel arly October of 2012, I had the pleasure of meeting Sofia Bournazi via e-mail. She was Marketing Director for the Halkidiki Tourism EOrganization and was interested in sponsoring a press trip. As the committee I co-chaired worked putting together this trip, Sofia became a friend and our first trip was organized in May of 2013. Due to the success of the first trip, we worked on a second one for June 2014. This time, my husband Norm and I were fortunate to be part of the group attending. Sofia and I clicked and developed a great appreciation for her marketing ability, work ethic, love of country, and sense of life. Sofia thinks outside the box and has the ability Thessaloniki Photo to pull people together to provide by Maralyn D. Hill successful business and personal relationships and associations. country ends and the other begins; Maralyn: Can you tell us about vice versa. Most people who visit Maralyn: Sofia, what prompted you all we care about is how easy it is how you’ve seen Halkidiki tourism Greece fly from Athens to Santorini to focus on tourism as your career? to travel from one place to another demographics grow since you or Mykonos islands. This means that Sofia: The idea of visiting and if we have something interesting have started that collaboration they already have at least one cosmopolitan places and being part to see or do in a close distance. for tourism? internal flight. -

Travertine Caves in Almopia, Greece

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/320310627 Travertine caves in Almopia, Greece Article in Cave and Karst Science · October 2017 CITATIONS READS 0 169 3 authors, including: Georgios Lazaridis Konstantinos Trimmis Aristotle University of Thessaloniki Cardiff University 29 PUBLICATIONS 47 CITATIONS 14 PUBLICATIONS 1 CITATION SEE PROFILE SEE PROFILE Some of the authors of this publication are also working on these related projects: Using LEGO to explore Archaeology and acquire Modern Greek Vocabulary View project Exploring Archaeology in Museums through the 3E method View project All content following this page was uploaded by Konstantinos Trimmis on 10 October 2017. The user has requested enhancement of the downloaded file. Cave and Karst Science, Vol.44, No.2, (2017) 58–63 © British Cave Research Association 2017 Transactions of the British Cave Research Association ISSN 1356-191X Travertine caves in Almopia, Greece Georgios LAZARIDIS 1, Konstantinos P TRIMMIS 2 and Spyridoula PAPPA 3 1 Department of Geology, Laboratory of Geology and Palaeontology, Aristotle University of Thessaloniki, 54124, Thessaloniki, Greece. E-mail: [email protected] 2 Department of Archaeology and Conservation, Cardiff University, Cardiff, Wales, UK. E-mail: [email protected] 3 Department of Earth Sciences, The Natural History Museum, Cromwell Road, London, SW7 5BD, UK. E-mail: [email protected] Abstract: Seven caves have been explored and surveyed within two travertine terraces (Aspri Petra and Baina) in the Almopia region, Greece. The Aspri Petra terrace is less faulted than the Baina and the caves of each terrace demonstrate differences that could be related to the degree of faulting. -

Military Entrepreneurship in the Shadow of the Greek Civil War (1946–1949)

JPR Men of the Gun and Men of the State: Military Entrepreneurship in the Shadow of the Greek Civil War (1946–1949) Spyros Tsoutsoumpis Abstract: The article explores the intersection between paramilitarism, organized crime, and nation-building during the Greek Civil War. Nation-building has been described in terms of a centralized state extending its writ through a process of modernisation of institutions and monopolisation of violence. Accordingly, the presence and contribution of private actors has been a sign of and a contributive factor to state-weakness. This article demonstrates a more nuanced image wherein nation-building was characterised by pervasive accommodations between, and interlacing of, state and non-state violence. This approach problematises divisions between legal (state-sanctioned) and illegal (private) violence in the making of the modern nation state and sheds new light into the complex way in which the ‘men of the gun’ interacted with the ‘men of the state’ in this process, and how these alliances impacted the nation-building process at the local and national levels. Keywords: Greece, Civil War, Paramilitaries, Organized Crime, Nation-Building Introduction n March 1945, Theodoros Sarantis, the head of the army’s intelligence bureau (A2) in north-western Greece had a clandestine meeting with Zois Padazis, a brigand-chief who operated in this area. Sarantis asked Padazis’s help in ‘cleansing’ the border area from I‘unwanted’ elements: leftists, trade-unionists, and local Muslims. In exchange he promised to provide him with political cover for his illegal activities.1 This relationship that extended well into the 1950s was often contentious. -

UCLA Electronic Theses and Dissertations

UCLA UCLA Electronic Theses and Dissertations Title Cremation, Society, and Landscape in the North Aegean, 6000-700 BCE Permalink https://escholarship.org/uc/item/8588693d Author Kontonicolas, MaryAnn Emilia Publication Date 2018 Peer reviewed|Thesis/dissertation eScholarship.org Powered by the California Digital Library University of California UNIVERSITY OF CALIFORNIA Los Angeles Cremation, Society, and Landscape in the North Aegean, 6000 – 700 BCE A dissertation submitted in partial satisfaction of the requirements for the degree Doctor of Philosophy in Archaeology by MaryAnn Kontonicolas 2018 © Copyright by MaryAnn Kontonicolas 2018 ABSTRACT OF THE DISSERTATION Cremation, Society, and Landscape in the North Aegean, 6000 – 700 BCE by MaryAnn Kontonicolas Doctor of Philosophy in Archaeology University of California, Los Angeles, 2018 Professor John K. Papadopoulos, Chair This research project examines the appearance and proliferation of some of the earliest cremation burials in Europe in the context of the prehistoric north Aegean. Using archaeological and osteological evidence from the region between the Pindos mountains and Evros river in northern Greece, this study examines the formation of death rituals, the role of landscape in the emergence of cemeteries, and expressions of social identities against the backdrop of diachronic change and synchronic variation. I draw on a rich and diverse record of mortuary practices to examine the co-existence of cremation and inhumation rites from the beginnings of farming in the Neolithic period -

Inhabited Places in Aegean Macedonia

Inhabited Places in Aegean Macedonia By Todor Hristov Simovski (Edited by Risto Stefov) Inhabited Places in Aegean Macedonia Published by: Risto Stefov Publications [email protected] Toronto, Canada All rights reserved. No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording or by any information storage and retrieval system without written consent from the author, except for the inclusion of brief and documented quotations in a review. Copyright 2019 by Todor Hristov Simovski e-book edition ************** January 20, 2019 ************** 2 Contents PREFACE ......................................................................................4 IN PLACE OF AN INTRODUCTION..........................................5 I - REPERCUSSIONS DURING THE BALKAN WARS (1912- 1913) ..............................................................................................7 II - MIGRATORY MOVEMENTS IN AEGEAN (GREEK OCCUPIED) MACEDONIA DURING THE FIRST WORLD WAR ............................................................................................10 III - MIGRATORY MOVEMENTS IN AEGEAN (GREEK OCCUPIED) MACEDONIA (1919-1940)..................................12 1. Migration of Macedonians to Bulgaria and the Kingdom of the Serbs, Croats and Slovenes ..............................................................12 2. Resettlement of Macedonian Emigrants in Bulgaria ...................15 3. Emigration of Macedonians to Overseas Countries.....................18 -

The GEOLOGY of ALMOPIA SPELEOPARK

Scientific Annals, School of Geology Special volume 98 27-31 Thessaloniki, 2006 Aristotle University of Thessaloniki (AUTH) THE GEOLOGY OF ALMOPIA SPELEOPARK George ElEftHEriadis1 Abstract: The Almopia Speleopark is located on the boundary of two geological zones: the Almopia (Axios) zone eastwards and the Pelagonian zone westwards. The Almopia zone in the area of study is comprised of metamorphic rocks (schists, marbles and cipolines), ophiolites, limestones and clastic formations whereas the Pelagonian zone consist of carbonate rocks of Triassic-Jurassic age, sediments of Upper Cretaceous age and flysch of Upper Maastrictian-Lower Paleocene. In the area there are also travertine deposits of signifi- cant quantity and excellent quality. The seismicity in the area can be considered as not significant. Key words: Almopia, Speleopark, geology, volcanology, seismicity. INTRODUCTION The Almopia area geotectonicaly belongs to the Almopia zone, which together with the Peonia and Paikon zones constitute the old Axios (Vardar) zone (Μercier, 1968). The Axios zone Kossmat,( 1924) is situated between the Pelagonian massif to the west and the Serbo-Macedonian massif to the east. The Almopia and Peonia zones, con- stituting the westernmost and easternmost parts of the Axios zone, respectively, were deep-water oceans sepa- rated by the shallow ocean of the Paikon zone, consisting of thick carbonate rocks of mainly Triassic to Cretaceous age.The Almopia zone is characterized by huge masses of ophiolites (Bebien et al., 1994). The Almopia zone was deformed during two oro- genic periods: the Upper Jurassic-Lower Cretaceous and the Upper Cretaceous-Middle Eocene. During the first period the Almopia ocean closed, the Almopia zone emerged temporary until the Middle-Upper Cretaceous transgression and the ophiolitic rocks overthrusted on the Pelagonian platform westwards (Μercier, 1968). -

Gogousi Maria Eleni

"How potential damage to natural resources of Chalkidiki can be minimized whilst maintaining the economic benefits of welcoming visitors" Gogousi Maria Eleni SCHOOL OF ECONOMICS, BUSINESS ADMINISTRATION & LEGAL STUDIES A thesis submitted for the degree of Master of Science (MSc) in Environmental Management and Sustainability January, 2019 Thessaloniki – Greece Student Name: Maria Eleni Gogousi SID: 110510003 Supervisor: Prof. Eleni Mavragani I hereby declare that the work submitted is mine and that where I have made use of another’s work, I have attributed the source(s) according to the Regulations set in the Student’s Handbook. January, 2019 Thessaloniki - Greece 1 Abstract Tourism Industry the last years in the most successful, profitable and productive industry in Greece. It is reassuring to have a brand that attracts visitors, investments that help the economy by creating job positions and profits that are more that welcome in country that suffers from economic crisis. On the other hand, the tourism product is totally based on the natural resources. Visitors come in Greece for the beautiful, clean beaches, the unique landscape, to visit the archaeological sites and experience things that cannot be found anywhere in the world. It is really important, in order to preserve your product, which in this case is the Greek nature, to take all the necessary measures in order to keep the image and the quality of the product high. It is a challenge that next year needs to be won. To attract tourists from all over the world, but at the same time to keep and protect the nature clean, untouched and protected. -

Wetlands Management in Northern Greece: an Empirical Survey

water Article Wetlands Management in Northern Greece: An Empirical Survey Eleni Zafeiriou 1,* , Veronika Andrea 2 , Stilianos Tampakis 3 and Paraskevi Karanikola 2 1 Department of Agricultural Development, Democritus University of Thrace, GR68200 Orestiada, Greece 2 Department of Forestry and Management of the Environment and Natural Resources, Democritus University of Thrace, GR68200 Orestiada, Greece; [email protected] (V.A.); [email protected] (P.K.) 3 School of Forestry, Department of Forestry and Natural Environment, Faculty of Agriculture, Aristotle University of Thessaloniki, 54124 Thessaloniki, Greece; [email protected] * Correspondence: [email protected]; Tel.: +30-6932-627-501 Received: 29 September 2020; Accepted: 9 November 2020; Published: 13 November 2020 Abstract: Water management projects have an important role in regional environmental protection and socio-economic development. Environmental policies, strategies, and special measures are designed in order to balance the use and non-use values arising for the local communities. The region of Serres in Northern Greece hosts two wetland management projects—the artificial Lake Kerkini and the re-arrangement of Strymonas River. The case study aims to investigate the residents’ views and attitudes regarding these two water resources management projects, which significantly affect their socio-economic performance and produce several environmental impacts for the broader area. Simple random sampling was used and, by the application of reality and factor analyses along with the logit model support, significant insights were retrieved. The findings revealed that gender, age, education level, and marital status affect the residents’ perceived values for both projects and their contribution to local growth and could be utilized in policy making for the better organization of wetland management. -

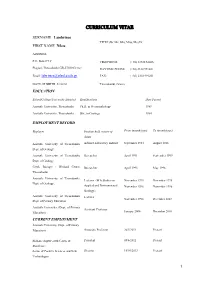

SURNAME DONERT FIRST NAME(S) Karl

CURRICULUM VITAE SURNAME Lambrinos TITLE (Dr. Mr, Mrs, Miss, Ms) Dr. FIRST NAME Nikos ADDRESS P.O. Box 277 C TELEPHONE (+30) 23920 62806 Plagiari, Thessaloniki GR-57500 Greece DAYTIME PHONE (+30) 2310 991201 Email: [email protected] FAX: (+30) 2310 991201 DATE OF BIRTH 21/12/61 Thessaloniki, Greece EDUCATION School/College/University Attended Qualifications Date Passed Aristotle University, Thessaloniki Ph.D. in Geomorphology 1989 Aristotle University, Thessaloniki BSc. in Geology 1984 EMPLOYMENT RECORD Employer Position held, nature of From (month/year) To (month/year) duties Aristotle University of Thessaloniki, Adjunct Laboratory Instruct. September 1984 August 1988 Dept. of Geology Aristotle University of Thessaloniki, Researcher April 1991 September 1999 Dept. of Geology Greek Biotope / Wetland Center, Researcher April 1995 May 1996 Thessaloniki Aristotle University of Thessaloniki, Lecturer (MA Studies in November 1995 November 1995 Dept. of Geology, Applied and Environmental November 1996 November 1996 Geology) Aristotle University of Thessaloniki, Lecturer November 1998 December 2003 Dept. of Primary Education Aristotle University (Dept. of Primary Assistant Professor Education) January 2004 December 2010 CURRENT EMPLOYMENT Aristotle University (Dept. of Primary Education) Associate Professor 26/5/2011 Present Hellenic digital-earth Centre of President 08/6/2012 Present Excellence Sector of Positive Sciences and New Director 10/01/2013 Present Technologies 1 Courses Taught: General Geography Photo-interpretation in geosciences GIS and Environment Didactics in Geography Physical Geography Study of the Physical and Social Environment Teaching Geography issues at Primary school Interdisciplinary approach of the Environmental Education . In June 2000, I gave two lectures in Kansas State University, Kansas, and Newmann University, Kansas State, USA.