Loan Portfolio As at 31.12.2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Disposition of Remains Report

Disposition of Remains Report The report below describes local requirements for burial, cremation, embalming, preparation of remains for shipment, transportation to the United States, exhumation of remains, and the price range for each service. Part I. Name of Country Kingdom of Norway Part II. U.S. Embassy or Consulate Information U.S. Embassy, American Citizen Services Mailing: P.O. Box 4075 AMB, 0244 Oslo, Norway Visiting: Morgedalsvegen 36, 0368 Oslo, Norway Telephone (+47) 21 30 85 40 Fax: (+47) After Hours Emergencies: (+47) 21 30 85 40 Country Information and Travel Advisory: https://travel.state.gov/content/travel/en/legal/Judicial-Assistance-Country- Information/Norway.html Register with the U.S. Embassy: https://step.state.gov/ Part III. Profile of Religions of the Host Country and Religious Services Available to Visitors Host Country Religions: Norway is a predominately Christian country, with more than 70 percent of the population being members of the Evangelical Lutheran Church of Norway, although regular church attendance is low. Other major religions include Roman Catholic, other Christian, and Muslim. Other religions account for less than 2 percent of the population. Religious Activities for Visitors: There are a number of houses of worship in Norway, and especially Oslo, offering services in English, including Lutheran, Catholic, Baptist, Pentecostal, Anglican, and Muslim. There are also houses of worship for Jewish, Orthodox and Methodist believers, but services are not in English. LSD services are in Norwegian but translations services are provided. Part IV. Funeral Directors, Morticians and Related Services Available in the Host Country DISCLAIMER: The U.S. Embassy in Oslo, Norway assumes no responsibility or liability for the professional ability or reputation of, or the quality of services provided by, the following persons or firms. -

Vertically-Averaged CO2 Migration with Residual-Trapping And

Practical Models for Large-Scale CO2 Injection, Migration and Trapping Sarah Gasda Uni Research CIPR, Bergen, Norway [email protected] +47 555 83394 EU Emissions Objectives • 2030 Framework for climate and energy policies calls for emissions reduction under 1990 levels of 40% by 2030 and 80% by 2050. • By 2050, 80 Gt CO2 should be kept out of atmosphere by a combination of renewables, conservation and CCS. • IEA 2013 road map assumes that Europe should be able to capture and store 12.2 Gt of CO2 by 2050, at a rate of ~400 Mt of CO2/yr. EU Commission, 2014 North Sea Storage Evaluation • North Sea is the likely target for Europe’s emissions • 45 Gt capacity estimated in Norwegian sector. • Additional 5.6 Gt capacity in the Norwegian and Barents Sea. • Most capacity is in the Utsira/Skade and Bryne/Sandnes formations. Reaching Storage Potential • Reaching target capacity is largely determined by trapping mechanisms and mechanical integrity. • How much can we realistically inject? • How efficient is trapping? • How sensitive are estimates to parameter uncertainty? IPCC 2005 • What data do we need and Focus is on process which models are better suited? understanding, • What factors can help increase modeling, and robust and reliable simulation storage potential? 20 Mt injected over 20 yrs into a homogeneoust=25000 dipping aquifert=35000 t=100000 t=200000 0 0 0 0 0 yr mobile 8000 8000 mobile 8000 8000 0 16000 0 16000 0 16000 0 16000 t=25000 t=35000 t=99500 t=200000 600 yr 0 0 0 0 2500 yr 8000 8000 8000 8000 0 16000 0 16000 0 16000 0 16000 6250 yr 12,500 yr Residual 22,000 yr and Residual dissolved mobile mobile Weak Residually Strong convective- trapped convective- dissolution Residually Solubility dissolution trapped trapped Gasda et al., WRR, 2011. -

Quarterly Presentation SRBNK Q4 2020

• Disclaimer This presentation contains forward-looking statements that reflect management’s current views with respect to certain future events and potential financial performance. Although SpareBank 1 SR-Bank believes that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of various factors. Important factors that may cause such a difference for SpareBank 1 SR-Bank include, but are not limited to: (i) the macroeconomic development, (ii) change in the competitive climate, (iii) change in the regulatory environment and other government actions and (iv) change in interest rate and foreign exchange rate levels. This presentation does not imply that SpareBank 1 SR- Bank has undertaken to revise these forward-looking statements, beyond what is required by applicable law or applicable stock exchange regulations if and when circumstances arise that will lead to changes compared to the date when these statements were provided. 2 Digitalization and growth makes SR-Bank a finance group for the Åsane Bergen Sotra South of Norway Fana +1% Nydalen Oslo 134 134 Ensjø 132 Husnes Stord Ølen +20% Aksdal 35 32 Haugesund 29 Kopervik +19% Åkra +43% Finnøy 21 22 20 Jørpeland 18 18 Randaberg 15 Stavanger* +3% Sola Sandnes Ålgård 7 8 7 Bryne Varhaug Egersund Grimstad Rogaland Vestland Agder Oslo and Viken Other Flekkefjord (Lending volume in NOK billion ) Dec.18 Dec.19 Dec.20 Kristiansand Lyngdal Farsund Mandal *Included in Stavanger is office; 3 Domkirkeplassen, Hundvåg, Madla and Mariero A stronger quarterly result, with higher income and lower impairment losses Result 4. -

Rennesøy Finnøy Bokn Utsira Karmøy Tysvær Haugesund Vindafjord

227227 ValevValevåg Breiborg 336 239239 Ekkje HellandsbygHellandsbygd 236236 Hellandsbygda Utbjoa SaudaSauda 335 Etne Sauda Bratland 226226 Espeland VihovdaVihovda Åbødalen Brekke Sandvikdal Roaldkvam 240240 241241 Kastfosskrys 334 Egne Hjem UtbjoaUtbjoa Saunes 236 Skartland sør EtneEtne en TTråsavikikaaNærsonersone set 225225 Saua Førderde Gard Kvame Berge vest Ølen kirke Ølen Ørland Hytlingetong Gjerdevik ø EiodalenØlen skule den 332 SveioSveio 222222 Ølensvåg 235235 333 st Hamrabø Bråtveit Saudafjor 237237 224224 Øvrevre VatsVats SvandalSvandal MaldalMaldal 223223 Vindafjord SandeidSandeid Ulvevne Øvre Vats Skole Bjordalsveien Sandeid Fjellgardsvatnet Hylen Landa Løland Tengesdal 223 331 Knapphus Hordaland Østbø Hylen Blikrabygd 238238 Sandvik VanvikVanvik 328328 Vindafjord Hylsfjorden Skrunes SuldalseidSuldalseid Skjold 216216 218218 Sandeidfjorden 230230 Suldal NordreNordre VikseVikse Ørnes 228228 RopeidRopeid Isvik SkjoldSkjold Hustoft VikedalVikedal 217217 Slettafjellet Nesheim Vikedal Helganes 228 330330 Vikse kryss VestreVestre Skjoldafjo Eskedalen 221221 Suldalseid SuldalsosenSuldalsosen Haugesund Stølekrossen Førland Åmsoskrysset Åmsosen IlsvIlsvåg Stole Ølmedal Kvaløy Ropeid Skipavåg Sand Suldalsosen rden 230 Byheiene 229229 Roopeid 327 327327 Stakkestad SkipevSkipevåg kryss SandSand Kariås Røvær kai Nesheim Eikanes kryss Lindum Årek 329329 camping 602 VasshusVasshus Røvær 200200 220220 Suldalsl HaugesundHaugesund ågen Haraldshaugen 205205 Kvitanes Grindefjorden NedreNedre VatsVats Vindafjorden Kvamen Haugesund Gard skole -

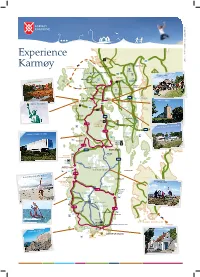

Experience Karmøy

E39 E134 Experience BUS SERVICE TO E134 VANDVIK ØRJAN B. IVERSEN, CAMILLA APPEX.NO / PHOTOS: OSLO, BERGEN, AKSDAL STAVANGER HAUGESUND DYRAFJELLET 172 M.A.S.L Karmøy FAST FERRY: N HAUGESUND - FEØY 20 MIN 9-HOLES HAUSKE GÅRD MINIGOLF 18-HOLES E134 VIKING FARM VISNES MINE AREA KVEITEVIKEN THE FIVE POOR MAIDENS E39 FV47 OLAV’S CHURCH E134 STATUE OF LIBERTY HAUGESUND AIRPORT, E134 KARMØY FV47 HÅVIK HØYEVARDE BUS SERVICE 19 KM K AR TO STAVANGER MØYTUNNELEN AND BERGEN NORDVEGEN HISTORY CENTRE FV47 16 KM Haugalands- KARMØY FISHERY MUSEUM vatnet VEAVÅGEN 12 KM FV47 KOPERVIK ÅKREHAMN COASTAL MUSEUM FV511 ÅKREHAMN 4 KM BEAUTIFUL SILKY BEACHES B SÅLEFJELL PEAK UR MA VE GE BOATHOUSES N AT HOP 8 KM E39 13 KM 8 KM 9-HOLES GREAT SURFING BEACHES FERRY: ARSVÅGEN - MORTAVIKA 20 MIN SKUDENESHAVN JUNGLE PARK STAVANGER HISTORIC SKUDENESHAVN SYRENESET FORT THE MUSEUM IN MÆLANDSGÅRDEN SKUDENESHAVN VIKEHOLMEN GEITUNGEN SIGHTSEEING HIKING AND BIKING TRAILS ACCOMMODATION COMMUNICATIONS Avaldsnes Viking Farm. Follow in the foot- The Karmøy countryside is attractive and diverse Park Inn, Haugesund Airport Hotel Airlines steps of the ancient kings through the historic with many opportunities to get outdoors and Helganesveien 24, 4262 Avaldsnes RyanAir: T: +47 52 85 78 00, www.ryanair.com landscape at Avaldsnes. Bukkøy island features be active or simply relax: T: +47 52 86 10 90 Norwegian: T: +47 815 21 815, www.norwegian.no many reconstructed Viking buildings. Meet www.haugalandet.friskifriluft.no E-mail: [email protected] SAS: T: +47 05400, www.sas.no Vikings for activities and tours in the summer www.parkinnhotell.no/hotell-haugesund Widerøe: T: +47 810 01 200, www.wideroe.no season. -

Norway Maps.Pdf

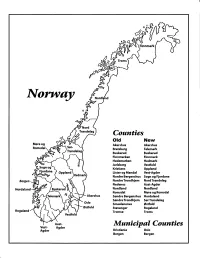

Finnmark lVorwny Trondelag Counties old New Akershus Akershus Bratsberg Telemark Buskerud Buskerud Finnmarken Finnmark Hedemarken Hedmark Jarlsberg Vestfold Kristians Oppland Oppland Lister og Mandal Vest-Agder Nordre Bergenshus Sogn og Fjordane NordreTrondhjem NordTrondelag Nedenes Aust-Agder Nordland Nordland Romsdal Mgre og Romsdal Akershus Sgndre Bergenshus Hordaland SsndreTrondhjem SorTrondelag Oslo Smaalenenes Ostfold Ostfold Stavanger Rogaland Rogaland Tromso Troms Vestfold Aust- Municipal Counties Vest- Agder Agder Kristiania Oslo Bergen Bergen A Feiring ((r Hurdal /\Langset /, \ Alc,ersltus Eidsvoll og Oslo Bjorke \ \\ r- -// Nannestad Heni ,Gi'erdrum Lilliestrom {", {udenes\ ,/\ Aurpkog )Y' ,\ I :' 'lv- '/t:ri \r*r/ t *) I ,I odfltisard l,t Enebakk Nordbv { Frog ) L-[--h il 6- As xrarctaa bak I { ':-\ I Vestby Hvitsten 'ca{a", 'l 4 ,- Holen :\saner Aust-Agder Valle 6rrl-1\ r--- Hylestad l- Austad 7/ Sandes - ,t'r ,'-' aa Gjovdal -.\. '\.-- ! Tovdal ,V-u-/ Vegarshei I *r""i'9^ _t Amli Risor -Ytre ,/ Ssndel Holt vtdestran \ -'ar^/Froland lveland ffi Bergen E- o;l'.t r 'aa*rrra- I t T ]***,,.\ I BYFJORDEN srl ffitt\ --- I 9r Mulen €'r A I t \ t Krohnengen Nordnest Fjellet \ XfC KORSKIRKEN t Nostet "r. I igvono i Leitet I Dokken DOMKIRKEN Dar;sird\ W \ - cyu8npris Lappen LAKSEVAG 'I Uran ,t' \ r-r -,4egry,*T-* \ ilJ]' *.,, Legdene ,rrf\t llruoAs \ o Kirstianborg ,'t? FYLLINGSDALEN {lil};h;h';ltft t)\l/ I t ,a o ff ui Mannasverkl , I t I t /_l-, Fjosanger I ,r-tJ 1r,7" N.fl.nd I r\a ,, , i, I, ,- Buslr,rrud I I N-(f i t\torbo \) l,/ Nes l-t' I J Viker -- l^ -- ---{a - tc')rt"- i Vtre Adal -o-r Uvdal ) Hgnefoss Y':TTS Tryistr-and Sigdal Veggli oJ Rollag ,y Lvnqdal J .--l/Tranbv *\, Frogn6r.tr Flesberg ; \. -

Nordic Health Care Systems Pb:Nordic Health Care Systems Pb 11/8/09 14:04 Page 1

Nordic Health Care Systems pb:Nordic Health Care Systems pb 11/8/09 14:04 Page 1 Nordic Health Care Systems Recent Reforms and Current Policy Challenges European Observatory on Health Systems and Policies Series “The book is very valuable as actual information about the health systems in the Nordic countries and the changes that have been made during the last two decades. It informs well both about the similarities within the ‘Nordic Health Model’ and the important differences that exist between the countries.” Bo Könberg, County Governor, Former Minister of Health and Social Insurance in Sweden (1991-1994) “The publishing of this book about the Nordic health care systems is a major Nordic Health Care Systems event for those interested not only in Nordic health policy and health systems but also for everybody interested in comparative health policy and health systems. It is the first book in its kind. It covers the four “large” Nordic countries, Denmark, Norway, Sweden and Finland, and does so in a very systematically comparative way. The book is well organized, covers “everything” and is analytically sophisticated.” Ole Berg, Professor of Health Management, University of Oslo This book examines recent patterns of health reform in Nordic health care systems, and the balance between stability and change in how these systems have developed. Nordic Health Care Systems The health systems in Norway, Denmark, Sweden and Finland are investigated through detailed comparisons along a variety of policy-driven parameters. The following themes are explored: Recent Reforms and Current Policy Challenges • Politicians, patients, and professions Financing, production, and distribution • &Saltman Magnussen,Vrangbaek • The role of the primary health sector • The role of public health • Internal management mechanisms • Impact of the European Union The book probes the impact of these topics and then contrasts the development across all four coumntries, allowing the reader to gain a sense of perspective both on the individual systems as well as on the region as a whole. -

Rural Infant Mortality in Nineteenth Century Norway1

Rural Infant Mortality in Nineteenth Century Norway1 Gunnar Thorvaldsen uch previous research on the Norwegian mortality decline has focused on specific localities, employing databases with linked microdata. One Mgood choice is Rendalen, a parish on the Swedish border, representative of the world record low Norwegian mortality rates. The focus on the role of women, given their access to more abundant material resources towards the end of the eighteenth century, is a most interesting explanation for the declining level of infant mortality.2 Another well-researched locality is the fjord-parish Etne, south of Bergen, where infant mortality was significantly higher – also an area where the role of women is highlighted. More recent studies have been done on Asker and Bærum, south of Oslo, with infant mortality levels closer to the national average. The present article will not attempt to match these penetrating studies of well- researched rural localities, nor William Hubbard’s insights into many aspects of urban mortality.3 Rather it broadens the scope to include the whole country. My study is limited primarily to Norway’s sparsely populated rural areas, where 90 percent of the population lived in 1801, a figure that was declining towards 60 percent by 1900, when the national infant mortality rate (IMR) had fallen below ten percent.4 My basic aim is to track the development of infant mortality rates in Norway over time, and, where possible, to say something about regional differences in the proportion of children who died before they reached their first birthday. The 1 Another version of this article will also be published inStudies in Mortality Decline. -

Karmøy-Kopervik

Karmøy - Kopervik Prisant: 20 000 000 + omk Gofarnes, 4250 Kopervik Meglerhuset Rele er i dag ledende aktør innen nærings- megling på Haugalandet, Sunnhordland, Sauda og Odda og distriktene rundt, og utfører tjenester innen salg, utleie, verdivurdering og rådgivning. Vi har lang erfaring, unik kompetanse og svært god kjennskap til markedet, hvilke er avgjørende suksessfaktorer ved kjøp og salg av nærings- eiendom. Som kunde hos Meglerhuset Rele kan en være trygg på at en blir ivaretatt på en profesjonell måte. Meglerhuset Rele - det komplette meglerhuset 2KOPERVIK GOFARNES DIN MEGLER PÅ DENNE EIENDOMMEN: Jan Audun Lutro Næringsmegler T: 90 22 22 91 [email protected] Jan Audun Lutro er daglig leder og næringsmegler i Meglerhuset Rele. Han har jobbet med næringseiendom i mange år, og er en engasjert og profilert figur i næringslivet på Haugalandet og omegn. Med sin brede erfaring, lune vesen og sjarmerende Hardingmål er Jan Audun det naturlige samarbeidsvalget for mange. KOPERVIK GOFARNES 3 4KOPERVIK GOFARNES Del 1 -Gofarnes Eiendommen Bilder - Eiendomsinfo KOPERVIK GOFARNES 5 Nøkkelinfo 6KOPERVIK GOFARNES EIENDOMSTYPE: PRISANTYDNING: Boligtomt Kr.20 000 000 + omk. EIENDOMSBETEGNELSE: TOMT: Gnr.66 Bnr.26 iKarmøy Areal: 26474 m2 KOPERVIK GOFARNES 7 Høydepunkter Regulert tomteområde til sjø til salgs Gofarnes er et boligprosjekt med praktfull beliggenhet med utsikt mot Karmsundet. Tomten som selges er nevnt i regulering som B1a, B1b, B1c og B2 og er på totalt 26.474 m2. B1a: 3,1 daa, 35% BYA, mønehøyde 12 m, gesimshøyde 9 m. Mulig utbygging pr plan 1085 m2, over 3,5 plan. Totalt ca 3.800 m2 B1b: 5,4 daa, 35% BYA, mønehøyde 12 m, gesimshøyde 9 m. -

Administrative and Statistical Areas English Version – SOSI Standard 4.0

Administrative and statistical areas English version – SOSI standard 4.0 Administrative and statistical areas Norwegian Mapping Authority [email protected] Norwegian Mapping Authority June 2009 Page 1 of 191 Administrative and statistical areas English version – SOSI standard 4.0 1 Applications schema ......................................................................................................................7 1.1 Administrative units subclassification ....................................................................................7 1.1 Description ...................................................................................................................... 14 1.1.1 CityDistrict ................................................................................................................ 14 1.1.2 CityDistrictBoundary ................................................................................................ 14 1.1.3 SubArea ................................................................................................................... 14 1.1.4 BasicDistrictUnit ....................................................................................................... 15 1.1.5 SchoolDistrict ........................................................................................................... 16 1.1.6 <<DataType>> SchoolDistrictId ............................................................................... 17 1.1.7 SchoolDistrictBoundary ........................................................................................... -

Nord-Stokkeslekten På Karmøy Av Erling Haaland

Årbok for Karmsund HAUGESUND MUSEUM Årshefte 1961 - 1965 Museums- og historielaget for Haugesund og bygdene 1966 Nord-Stokke-s,ekten på Karmøy Av Erling Haaland Under tittelen «Gamle slekter i Stangaland og Kopervik» skrev forfatteren i Rogaland Ættesogelags årshefte nr. l, 1941 en kort over sikt over en slekt som har spredt seg fra gården Nord-Stokke i Stanga land ut over Karmøy og videre. Her følger en omarbeidd og utvidet ætteliste over den samme slekt med sidegrener. • • • NORHEIM/ERØY-LINJEN I. Tolleiv Norheim, Etne, nevnt 1518-19 i Etne. IL Bjørn Norheim, Etne, nevnt 1561, 1585, 1591, 1597/98. Han var tilstede ved kongehy Ilingen 15 91. III. T ollef Bjørnsen Nor heim, g.m. Birgitte Nilsdtr. Bugge, datter av sokneprest Nils Pedersen Bugge i Etne. Tollef mØtte som bøndenes utsending til kongehyllingen i Oslo 1610. Deres barn: l. Sakarias Tollefsen f. 1623, skifte 13/6 1670. g.m. Anne Jonsdtr. Tøtland. 2. Johannes Tollefsen Erøy i Erfjord, nevnt 1667, g.m. Ingeborg Bjørnsdtr. 3. Rasmus Tollefsen, Ølen. 4. Bjørn Tollefsen Helgeland, Sandeid. Han er oppfØrt i mann tallet 1665, var g.m. Karen Larsdtr. Opsal, datter av Lars Larsen Opsal i Vikedal og h. Marta Jonsdtr. 50 5. Nils Tollefsen på Milje, Skånevik. 6. Lisbet (?) Tollefsdtr. g.m. Odd Jonsen Hauge i Hjelmeland. 7. Anna Tollefsdtr. g.m. Tjerand Torsen Hauge. IV. Toll'ef Johannesen Bog i Erfjord f. 1659, g.m. Marta Østensdtr. fra Jelsa. Deres barn: l. }oren g.m. Ole Olsen Skiftun. V. 2. Ingeborg Tollefsdtr. Bog, som var gift med Jone Sigvesen Skeie. De bodde senere på Helgeland i Sandeid. -

Årsmelding for Stavanger & Haugaland 2020

ÅRSMELDING FOR STAVANGER OG HAUGALAND REGION 2020 Ingeborg Ellingsen (f.v.) og Margit Brekke serverte deilig kake på koronavennlig vis under 150-års jubileet til Koparvik Sjømannskirkeforening 28. september 2020. 1. OMRÅDE Bispedømme/prostier: Stavanger og Haugaland prosti Region (fylker): Stavanger 2. REGIONSTYRET Leder: Øyvind Alsaker Medlemmer: Sissel Mjølhus Sveinsson, Møyfrid Ferking Birkeland, Ruth Oddrun Gudmestad, Grethe Wesnes, Maria Misje Varamedlemmer: Inger Elise Kolstø, Torfinn Roland Valg av regionstyre og delegater til GF ble gjort digitalt på grunn av koronasituasjonen. GF- delegater fra regionen: Øyvind Alsaker og Randi Winger-Dahl. Vara for Randi er Anne Lise Auestad. 3. MEDLEMMER– ARRANGEMENT – GIVERE 2017 2018 2019 2020 Foreningsmedl. pr.31.12: 165 164 160 153 Individuelle medl. pr.31.12 187 175 142 149 Totalt antall medl. pr.31.12 352 339 302 303 Antall arrangement: 29 26 28 7 Møter med mennesker: 3082 6240 1517 229 Antall givere i regionen: 935 848 Giverbeløp: 969 589 1.396.083 Minnegave beløp: 2000 4. FORENINGER (pr 31.12) De unges misjonsforening 5574 SKJOLD Fyrglimt sjømannskirkeforening 4362 VIGRESTAD Fyrlykten sjømannskirkeforening 5580 ØLEN Havbrus sjømannskirkeforening 5532 HAUGESUND Kirkekretsen 5570 AKSDAL sjømannskirkeforening Kopervik sjømannskirkeforening 4262 AVALDSNES Kvalavåg & Kalstø misjonsforening 4264 KVALAVÅG Røvær sjømannskirkekontakt 5549 RØVÆR Sandhåland & Hemnes 4275 SÆVELANDSVIK kvinneforening Sauda mannsforening 4208 SAUDASJØEN Skåra og Puntervoll kvinneforening 4372 EGERSUND Slettevoll