Positioning Eritrea T

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

East and Central Africa 19

Most countries have based their long-term planning (‘vision’) documents on harnessing science, technology and innovation to development. Kevin Urama, Mammo Muchie and Remy Twingiyimana A schoolboy studies at home using a book illuminated by a single electric LED lightbulb in July 2015. Customers pay for the solar panel that powers their LED lighting through regular instalments to M-Kopa, a Nairobi-based provider of solar-lighting systems. Payment is made using a mobile-phone money-transfer service. Photo: © Waldo Swiegers/Bloomberg via Getty Images 498 East and Central Africa 19 . East and Central Africa Burundi, Cameroon, Central African Republic, Chad, Comoros, Congo (Republic of), Djibouti, Equatorial Guinea, Eritrea, Ethiopia, Gabon, Kenya, Rwanda, Somalia, South Sudan, Uganda Kevin Urama, Mammo Muchie and Remy Twiringiyimana Chapter 19 INTRODUCTION which invest in these technologies to take a growing share of the global oil market. This highlights the need for oil-producing Mixed economic fortunes African countries to invest in science and technology (S&T) to Most of the 16 East and Central African countries covered maintain their own competitiveness in the global market. in the present chapter are classified by the World Bank as being low-income economies. The exceptions are Half the region is ‘fragile and conflict-affected’ Cameroon, the Republic of Congo, Djibouti and the newest Other development challenges for the region include civil strife, member, South Sudan, which joined its three neighbours religious militancy and the persistence of killer diseases such in the lower middle-income category after being promoted as malaria and HIV, which sorely tax national health systems from low-income status in 2014. -

Ethiopia and Eritrea: Border War Sandra F

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by University of Richmond University of Richmond UR Scholarship Repository Political Science Faculty Publications Political Science 2000 Ethiopia and Eritrea: Border War Sandra F. Joireman University of Richmond, [email protected] Follow this and additional works at: http://scholarship.richmond.edu/polisci-faculty-publications Part of the African Studies Commons, and the International Relations Commons Recommended Citation Joireman, Sandra F. "Ethiopia and Eritrea: Border War." In History Behind the Headlines: The Origins of Conflicts Worldwide, edited by Sonia G. Benson, Nancy Matuszak, and Meghan Appel O'Meara, 1-11. Vol. 1. Detroit: Gale Group, 2001. This Book Chapter is brought to you for free and open access by the Political Science at UR Scholarship Repository. It has been accepted for inclusion in Political Science Faculty Publications by an authorized administrator of UR Scholarship Repository. For more information, please contact [email protected]. Ethiopia and Eritrea: Border War History Behind the Headlines, 2001 The Conflict The war between Ethiopia and Eritrea—two of the poorest countries in the world— began in 1998. Eritrea was once part of the Ethiopian empire, but it was colonized by Italy from 1869 to 1941. Following Italy's defeat in World War II, the United Nations determined that Eritrea would become part of Ethiopia, though Eritrea would maintain a great deal of autonomy. In 1961 Ethiopia removed Eritrea's independence, and Eritrea became just another Ethiopian province. In 1991 following a revolution in Ethiopia, Eritrea gained its independence. However, the borders between Ethiopia and Eritrea had never been clearly marked. -

Djibouti–Eritrea Background

1 Djibouti–Eritrea Background: A crisis occurred between Djibouti and Eritrea over the disputed border region of Ras Doumeira from 7 April to the end of June 2008. Djibouti and Eritrea share a border of 110 km which was initially drawn by Italy and France in 1900, following a dispute in 1898. Although Djibouti and Eritrea had a skirmish and a two-month standoff in 1996, the relations between the two had improved after 2000. More than 1,200 US troops and 2,850 French troops are stationed in Djibouti. Eritrea also has an unresolved border conflict with Ethiopia that has resulted in three crises (cases #424, #446, and #456) since 1998. PRE-CRISIS: According to a Djiboutian report, Eritrea started to deploy military equipment in their common border region in early 2008, in the name of road construction. Summary: The crisis began on 7 April 2008 when Eritrean armed forces penetrated into Djiboutian territory, dug trenches on both sides of the border, and occupied Ras-Doumeira. This triggered a crisis for Djibouti. Eritrea denied the charge. The Djiboutian army made a request to probe the situation, which Eritrea also denied. From 7 to 22 April, the two sides pursued negotiations. This also constituted Djibouti’s major response to the crisis trigger. Several rounds of futile negotiations followed. Presidents Isaias Afwerki of Ethiopia and Ismaïl Omar Guelleh of Djibouti were involved in these efforts. On 22 April, Djibouti sent its troops to the border area, and negotiations between the two sides ceased. On 5 May, Djibouti took the case to the United Nations Security Council (UNSC), the African Union (AU), and the Arab League, all of which urged Djibouti and Eritrea to exercise restraint. -

The Foreign Military Presence in the Horn of Africa Region

SIPRI Background Paper April 2019 THE FOREIGN MILITARY SUMMARY w The Horn of Africa is PRESENCE IN THE HORN OF undergoing far-reaching changes in its external security AFRICA REGION environment. A wide variety of international security actors— from Europe, the United States, neil melvin the Middle East, the Gulf, and Asia—are currently operating I. Introduction in the region. As a result, the Horn of Africa has experienced The Horn of Africa region has experienced a substantial increase in the a proliferation of foreign number and size of foreign military deployments since 2001, especially in the military bases and a build-up of 1 past decade (see annexes 1 and 2 for an overview). A wide range of regional naval forces. The external and international security actors are currently operating in the Horn and the militarization of the Horn poses foreign military installations include land-based facilities (e.g. bases, ports, major questions for the future airstrips, training camps, semi-permanent facilities and logistics hubs) and security and stability of the naval forces on permanent or regular deployment.2 The most visible aspect region. of this presence is the proliferation of military facilities in littoral areas along This SIPRI Background the Red Sea and the Horn of Africa.3 However, there has also been a build-up Paper is the first of three papers of naval forces, notably around the Bab el-Mandeb Strait, at the entrance to devoted to the new external the Red Sea and in the Gulf of Aden. security politics of the Horn of This SIPRI Background Paper maps the foreign military presence in the Africa. -

Eritreans in Egypt at Risk of Forcible Return

UA: 321/11 Index: MDE 12/055/2011 Egypt Date: 2 November 2011 URGENT ACTION ERITREANS IN EGYPT AT RISK OF FORCIBLE RETURN A group of 118 male asylum-seekers face imminent forcible return from Egypt to Eritrea, where they would be at grave risk of torture and arbitrary detention. After being arrested and detained in and around the city of Aswan, southern Egypt, 118 male Eritrean asylum- seekers have been recently transferred to a compound in Shallal, a town south of the city. Security forces have reportedly beaten some detainees, including on the legs and head, to force them to fill in papers provided by Eritrean diplomatic representatives to arrange their deportation. The reported involvement of Eritrean government representatives in documenting the detainees increases the likelihood that the group will be at risk if returned. Amnesty International considers that there is a significant risk that if the group is forcibly returned to Eritrea they will be tortured or otherwise ill-treated and detained without charge or trial in appalling conditions. Eritrean nationals forcibly returned to Eritrea have been detained incommunicado and tortured upon return, particularly those who had fled the country to avoid conscription. Large numbers of those detained in Shallal are reported to be young adults of national service age, many of whom fled Eritrea to escape military service. As in previous cases documented by Amnesty International in recent years, despite requesting it, none of the Eritrean asylum-seekers has been allowed access to representatives from the UN High Commissioner for Refugees (UNHCR) in Cairo. Amnesty International is concerned at increased reports of forcible returns of Eritrean nationals in recent weeks, as well as reports that further groups of Eritreans in detention are at risk of forcible removal to Eritrea. -

History of Eritrea Indigenousindigenous�Africans�Africans�Toward�Toward�New�New��Solarsolar��Cellcell� Technologytechnology

History of Eritrea IndigenousIndigenousAfricansAfricanstowardtowardNewNewsolarsolarcellcell technologytechnology MussieMussieMussieMussieAlemseghed,Alemseghed,Alemseghed,Alemseghed,Ph.D.Ph.D.Ph.D.Ph.D. UniversityUniversityofofCincinnati/OakCincinnati/OakRidgeRidgeNationalNationalLabLab UniversityUniversityofofCincinnati/OakCincinnati/OakRidgeRidgeNationalNationalLabLab NanoPowerNanoPowerAfricaAfrica NanoPowerNanoPowerAfricaAfrica 11/08/201111/08/2011 11/08/201111/08/2011 The Scramble for Africa • One of the major reasons for bad relations amongst the nations of Europe in the years before 1914 was that they were engaged in a struggle to obtain overseas colonies. • Although this happened in several areas of the world, the most dramatic changes took place in Africa. Many nations took part in what became known as the “Scramble for Africa”. • The following pages will show the territory gained by each nation, and will explain why the race to gain colonies played a part in the build-up of international tensions which eventually resulted in World War One. This map shows Africa in 1914 and shows how much land the major nations had taken over. There is so much detail that it is a little difficult to see exactly what has happened. To get a better idea of how much of Africa was controlled by each European power, click on any of the links below. BRITAIN FRANCE GERMANY ITALY BELGIUM NEXT PAGE British Colonies Britain had managed to get some of the most valuable land in Africa. EGYPT The most important gain was Egypt SUDAN because of the Suez NIGERIA Canal. BRITISH EAST AFRICA This provided a much quicker and safer route to India – the RHODESIA “Jewel in the Crown” of the British Empire. BECHUANALAND SOUTH AFRICA French Colonies France had also built up a large colonial ALGERIA empire, mostly in the MOROCCO TUNIS north west of Africa. -

Ethiopia Eritrea Somalia Djibouti

COUNTRY REPORT Ethiopia Eritrea Somalia Djibouti December 2000 The Economist Intelligence Unit 15 Regent St, London SW1Y 4LR United Kingdom The Economist Intelligence Unit The Economist Intelligence Unit is a specialist publisher serving companies establishing and managing operations across national borders. For over 50 years it has been a source of information on business developments, economic and political trends, government regulations and corporate practice worldwide. The EIU delivers its information in four ways: through our digital portfolio, where our latest analysis is updated daily; through printed subscription products ranging from newsletters to annual reference works; through research reports; and by organising conferences and roundtables. The firm is a member of The Economist Group. London New York Hong Kong The Economist Intelligence Unit The Economist Intelligence Unit The Economist Intelligence Unit 15 Regent St The Economist Building 25/F, Dah Sing Financial Centre London 111 West 57th Street 108 Gloucester Road SW1Y 4LR New York Wanchai United Kingdom NY 10019, US Hong Kong Tel: (44.20) 7830 1007 Tel: (1.212) 554 0600 Tel: (852) 2802 7288 Fax: (44.20) 7499 9767 Fax: (1.212) 586 1181/2 Fax: (852) 2802 7638 E-mail: [email protected] E-mail: [email protected] E-mail: [email protected] Website: http://www.eiu.com Electronic delivery This publication can be viewed by subscribing online at http://store.eiu.com Reports are also available in various other electronic formats, such as CD-ROM, Lotus Notes, online databases and as direct feeds to corporate intranets. For further information, please contact your nearest Economist Intelligence Unit office London: Jan Frost Tel: (44.20) 7830 1183 Fax: (44.20) 7830 1023 New York: Dante Cantu Tel: (1.212) 554 0643 Fax: (1.212) 586 1181 Hong Kong: Amy Ha Tel: (852) 2802 7288/2585 3888 Fax: (852) 2802 7720/7638 Copyright © 2000 The Economist Intelligence Unit Limited. -

UNODC Signs Partnership Framework with Eritrea

NEWSLETTER Volume 1 – July-September 2019 U NODC SIGNS PARTNERSHIP FRAMEWORK WITH SUMMARY ERITREA In the third quarter of UNODC ROEA signs momentous document with the State of 2019, UNODC ROEA Eritrea paving the way for further continued to upscale collaboration. presence in Eritrea, signing a momentous AFRICAN REGIONAL document to this HIGH -LE V E L CONFERENCE ON effect. In conjunction, COUNTER TERRORISM existing projects continued to flourish, Attended by the Secretary-General, UNODC assists in the facilitation with particular of crucial Nairobi-based conference with specific regional relevance. progress being made on UNODC’s flagship KE N YA ’S PLEAD project. In the PROSECUTION context of events, S E RV ICE S UNODC was an integral STRENGTHENED part of the African THROUGH PLEAD Regional High-Level UNODC’s landmark PLEAD Conference on Counter- project continues to help Kenya Terrorism. enhance its prosecutorial capacity. ERITREA - Partnership Framework Eritrea, Asmara -On 25 July 2019, UNODC and the Government of State of Eritrea momentously signed a Partnership Framework on further cooperation. The Signature was led by UNODC Director for Operations Ms. Miwa Kato, alongside Government of the State of Eritrea (GoSE) Minister for Foreign Affairs Mr. Osman Saleh and Eritrea Resident Coordinator Ms. Susan Namondo Ngongi. The document stands as the first partnership of this kind between the United Nations and Eritrea. The Government of the State of Eritrea intends to partner with UNODC on three areas of interventions; Crime Prevention and Criminal Justice, Administration of Justice and Combating Transnational Organized Crime and International Cooperation. These areas are set to pave the way to help Eritrea realize Sustainable Development Goal (SDG) 16 which aims to expand access to justice for all and build effective and accountable institutions at all levels. -

THE LEAST DEVELOPED COUNTRIES REPORT 2013 Growth with Employment for Inclusive and Sustainable Development

UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT THE LEAST DEVELOPED COUNTRIES REPORT 2013 Growth with employment for inclusive and sustainable development EMBARGO The contents of this Report must not be quoted or summarized in the print, broadcast or electronic media before 20 November 2013, 17:00 hours GMT UNITED NATIONS CONFERENCE ON TRADE AND DEVELOPMENT THE LEAST DEVELOPED COUNTRIES REPORT 2013 Growth with employment for inclusive and sustainable development New York and Geneva, 2013 Note Symbols of United Nations documents are composed of capital letters with figures. Mention of such a symbol indicates a reference to a United Nations document. The designations employed and the presentation of the material in this publication do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations concerning the legal status of any country, territory, city or area, or of its authorities, or concerning the delimitation of its frontiers or boundaries. Material in this publication may be freely quoted or reprinted, but full acknowledgement is requested. A copy of the publication containing the quotation or reprint should be sent to the UNCTAD secretariat at: Palais des Nations, CH-1211 Geneva 10, Switzerland. The overview of this report can also be found on the Internet, in all six official languages of the United Nations, at www.unctad.org/ldcr UNCTAD/LDC/2013 UNITED NATIONS PUBLICATION Sales No. E.13.II.D.1 ISBN 978-92-1-112864-2 eISBN 978-92-1-054116-9 ISSN 0257-7550 Copyright © United Nations, 2013 All rights reserved “Don’t let your past dictate your future” Proverb from Sierra Leone What are the least developed countries? Forty-nine countries are currently designated by the United Nations as “least developed countries” (LDCs). -

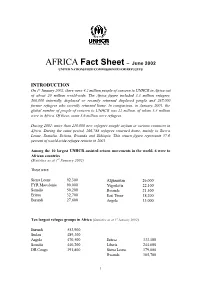

AFRICA Fact Sheet – June 2002 INTRODUCTION

AFRICA Fact Sheet – June 2002 UNITED NATIONS HIGH COMMISSIONER FOR REFUGEES INTRODUCTION On 1st January 2002, there were 4.2 million people of concern to UNHCR in Africa out of about 20 million world-wide. The Africa figure included 3.3 million refugees, 500,000 internally displaced or recently returned displaced people and 267,000 former refugees who recently returned home. In comparison, in January 2001, the global number of people of concern to UNHCR was 22 million, of whom 5.3 million were in Africa. Of these, some 3.6 million were refugees. During 2001, more than 210,000 new refugees sought asylum in various countries in Africa. During the same period, 266,788 refugees returned home, mainly to Sierra Leone, Somalia, Eritrea, Rwanda and Ethiopia. This return figure represents 57.6 percent of world-wide refugee returns in 2001. Among the 10 largest UNHCR-assisted return movements in the world, 6 were to African countries (Statistics as at 1st January 2002) These were: Sierra Leone 92,300 Afghanistan 26,000 FYR Macedonia 90,000 Yugoslavia 22,100 Somalia 50,200 Rwanda 21,500 Eritrea 32,700 East Timor 18,200 Burundi 27,600 Angola 13,000 Ten largest refugee groups in Africa (Statistics as at 1st January 2002) Burundi 553,900 Sudan 489,300 Angola 470,500 Eritrea 333,100 Somalia 440,200 Liberia 244,600 DR Congo 391,800 Sierra Leone 179,000 Rwanda 105,700 1 Ethiopia 58,900 2 I. West and Central Africa At the beginning of 2002, there were 890,000 people of concern to UNHCR in 19 countries of West and Central Africa. -

New Issues in Refugee Research

NEW ISSUES IN REFUGEE RESEARCH Research Paper No. 254 Refugees and the Rashaida: human smuggling and trafficking from Eritrea to Sudan and Egypt Rachel Humphris Ph.D student COMPAS University of Oxford Email: [email protected] March 2013 Policy Development and Evaluation Service Policy Development and Evaluation Service United Nations High Commissioner for Refugees P.O. Box 2500, 1211 Geneva 2 Switzerland E-mail: [email protected] Web Site: www.unhcr.org These papers provide a means for UNHCR staff, consultants, interns and associates, as well as external researchers, to publish the preliminary results of their research on refugee-related issues. The papers do not represent the official views of UNHCR. They are also available online under ‘publications’ at <www.unhcr.org>. ISSN 1020-7473 Introduction Eritreans have been seeking asylum in east Sudan for more than four decades and the region now hosts more than 100,000 refugees1. East Sudan has also become a key transit region for those fleeing Eritrea. One route, from East Sudan to Egypt, the Sinai desert and Israel has gained increasing attention. According to UNHCR statistics, the number of Eritreans crossing the border from Sinai to Israel has increased from 1,348 in 2006 to 17,175 in 2011. Coupled with this dramatic growth in numbers, the conditions on this route have caused great concern. Testimonies from Eritreans have increasingly referred to kidnapping, torture and extortion at the hands of human smugglers and traffickers. The smuggling route from Eritrea to Israel is long, complex and involves many different actors. As such, it cannot be examined in its entirety in a single paper. -

Fact Sheet #2, Fiscal Year (Fy) 2020 April 20, 2020

EAST AFRICA - DESERT LOCUST CRISIS FACT SHEET #2, FISCAL YEAR (FY) 2020 APRIL 20, 2020 NUMBERS AT HIGHLIGHTS HUMANITARIAN FUNDING A GLANCE FOR THE DESERT LOCUST RESPONSE IN FY 2020 Locust swarms continue to form and mature across East Africa USAID/OFDA1 $19,068,232 8 USG declares disaster for projected impact of desert locusts in Sudan Countries Affected in East $19,068,232 Africa2 Late March rainfall generates FAO – March 2020 conditions conducive for further breeding in the Ethiopia, Kenya, and Somalia; additional swarms will begin 24.8 forming in June, threatening food security and livelihoods million People Already KEY DEVELOPMENTS Experiencing Severe Acute Food Insecurity in The desert locust situation in East Africa remains concerning, as bands of hoppers— Affected Countries3 immature, wingless locusts—and an increasing number of new swarms continue to FAO – March 2020 form. Breeding in areas outside the region—including in the Arabian Peninsula and along the Iran–Pakistan border—could also result in additional invasions unless new generations of locusts are adequately controlled, relief actors report. 2.5 To date, the impact of the pest has remained limited and localized, as most crops were harvested by the time swarms initially arrived in Ethiopia, Kenya and Somalia—the million most affected countries—in late 2019. However, widespread rainfall in late March has Acres of Land Targeted been conducive to further breeding in the three countries in recent weeks. The for Rapid Surveillance and formation of new swarms, expected in late June and July, will coincide with the start of Control Measures FAO – February 2020 the harvest season, underscoring the urgent need for effective control measures in affected areas, according to the UN Food and Agriculture Organization (FAO).