India Online 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

AKSHAYA DIGINET CABLE VISION PRIVATE LIMITED Broadcasters Bouquets

AKSHAYA DIGINET CABLE VISION PRIVATE LIMITED Broadcasters Bouquets TOTAL BROADCASTER BOUQUET NAME CHANNELS DRP CHANNELS SUN TV, SUN NEWS, SUN MUSIC, SUN LIFE, KTV, CHUTTI TV, TAMIL BASIC 7 ₹ 40.00 ADITHYA TV KUSHI TV, GEMINI TV, GEMINI NEWS, GEMINI MUSIC, TELUGU BASIC 7 ₹ 30.00 GEMINI MOVIES, GEMINI LIFE, GEMINI COMEDY SUN TV, KUSHI TV, KTV, GEMINI TV, GEMINI NEWS, GEMINI TELUGU PRIME 9 ₹ 40.00 MUSIC, GEMINI MOVIES, GEMINI LIFE, GEMINI COMEDY SURYA TV, SURYA MUSIC, SURYA MOVIES, SURYA COMEDY, KERALA BASIC 5 ₹ 20.00 KOCHU TV UDAYA TV, SURYA TV, SURYA MUSIC, SURYA MOVIES, KERALA PRIME 8 ₹ 35.00 SURYA COMEDY, SUN TV, KTV, KOCHU TV UDAYA TV, UDAYA NEWS, UDAYA MUSIC, UDAYA MOVIES, KANNDA BASIC 6 ₹ 30.00 UDAYA COMEDY, CHINTU TV SUN UDAYA TV, UDAYA NEWS, UDAYA MUSIC, UDAYA MOVIES, KANNADA PRIME 9 ₹ 45.00 UDAYA COMEDY, SUN TV, KTV, GEMINI TV, CHINTU TV SUN TV, KTV, ADITHYA, SUN MUSIC, CHUTTI, SUN NEWS, SUN LIFE, GEMININ TV, GEMINI MOVIES, GEMINI COMEDY, GEMINI MUSIC, KUSHI TV, GEMINI LIFE, UDAYA TV, UDAYA SUN ULTIMATE 23 ₹ 65.00 MOVIES, UDAYA COMEDY, UDAYA MUSIC, CHINTU TV, SURYA TV, SURYA MOVIES, KOCHU TV, SURYA MUSIC, SURYA COMEDY. SUN TV HD, KTV HD, ADITYA TV, SUN MUSIC HD, CHUTTI TAMIL BASIC HD 7 ₹ 70.00 TV, SUN NEWS, SUN LIFE SUN TV, KTV, ADITHYA, SUN MUSIC, CHUTTI TV, SUN NEWS, TAMIL SUPER SUN LIFE, GEMINI TV, GEMINI MOVIES, SURYA TV, SURYA 11 ₹ 50.00 MOVIES JAYA BOUQUET-1 JAYA TV, JAYA PLUS, JAYA MAX, J MOVIE 4 ₹ 10.50 MEGA BOUQUET-1 MEGA TV, MEGA MUSIC, MEGA 24 3 ₹ 02.80 RAJ BOUQUET-1 RAJ TV, RAJ MUSIX, RAJ DIGITAL PLUS, -

Press Release HK SUN TV Network and Amagi Start a Partnership

Press Release HK SUN TV Network and Amagi start a partnership June 08, 2017, Bangalore: Sun TV Network Limited, one of the largest television broadcasters in the country with the reach of more than 95 million households in India is commencing its business association with Amagi Media Labs, a leader in targeted TV advertising and cloud-based TV broadcast infrastructure. Amagi Media Labs is expanding their offerings by adding new HD channels of SUN TV Network Ltd. to its bouquet of channels offering targeted advertising solutions; namely Sun TV HD, KTV HD, Sun Music HD, Gemini TV HD, Gemini Movies HD, Gemini Music HD Udaya TV HD & Surya TV HD, to help advertisers reach out to the niche Southern India audience. All HD channels from SUN TV network carry the same content as their SD counterpart. Using Amagi's technology, SUN TV network will monetize HD feed by separating HD feed from SD feed for which Amagi will have exclusive rights to sell. Sun TV (SD) is leading Tamil GEC channel garners over 1 billion impressions every week with close to 90% reach across TN. Sun TV HD has 40% viewership from Chennai, 17% from Bangalore and 43% from Rest of TN. KTV is a 24-hour Tamil movie television channel featuring Tamil films. KTV HD has 37% viewers from Chennai, 15% from Bangalore and 48% from rest of TN Sun Music is a 24-hour music channel that features popular Tamil film music. Sun Music HD has 32% viewers from Chennai, 2% from Bangalore and 66% from rest of TN Gemini TV is the leading Telugu television channel which is part of the Sun TV Network. -

Standing Committee on Information Technology (2016-17)

STANDING COMMITTEE ON INFORMATION TECHNOLOGY (2016-17) 34 SIXTEENTH LOK SABHA MINISTRY OF INFORMATION AND BROADCASTING DEMANDS FOR GRANTS (2017-18) THIRTY-FOURTH REPORT LOK SABHA SECRETARIAT NEW DELHI March, 2017/ Phalguna, 1938 (Saka) THIRTY-FOURTH REPORT STANDING COMMITTEE ON INFORMATION TECHNOLOGY (2016-17) (SIXTEENTH LOK SABHA) MINISTRY OF INFORMATION AND BROADCASTING DEMANDS FOR GRANTS (2017-18) Presented to Lok Sabha on 09.03.2017 Laid in Rajya Sabha on 10.03.2017 LOK SABHA SECRETARIAT NEW DELHI March, 2017/ Phalguna, 1938 (Saka) CONTENTS Page COMPOSITION OF THE COMMITTEE (iii) ABBREVIATIONS (iv) INTRODUCTION (v) REPORT PART I I. Introductory 1 II. Mandate of the Ministry of Information and Broadcasting 1 III. Implementation status of recommendations of the Committee contained in the 2 Twenty-third Report on Demands for Grants (2016-17) IV. Twelfth Five Year Plan Fund Utilization 3 V. Budget (2016-17) Performance and Demands for Grants 2017-18) 4 VI. Broadcasting Sector 11 a. Allocation to Prasar Bharati and its Schemes 12 b. Grant in aid to Prasar Bharati for Kisan Channel 21 c. Financial Performance of AIR and DD (2016-17) 23 d. Action taken on Sam Pitroda Committee Recommendations 28 e. Main Secretariat Schemes under Broadcasting Sector 31 VII. Information Sector 48 a. Indian Institute of Mass Communication (IIMC) 51 b. Directorate of Advertising and Visual Publicity (DAVP) 56 c. Direct Contact Programme by Directorate of Field Publicity 65 VIII. Film Sector 69 a. National Museum of Indian Cinema (Film Division) 73 b. Infrastructure Development Programmes Relating to Film sector 75 c. Development Communication & Dissemination of Filmic Content 79 d. -

S.NO CHANNEL NAME 1 SUN TV 2 KTV 3 Adithya TV 4 Sun Music 5

DIGICON TAMIL MAXX - Rs.101.99+GST S.NO CHANNEL NAME 1 SUN TV 2 KTV 3 Adithya TV 4 Sun Music 5 Chutti TV 6 Sun News 7 SUN Life 8 Vijay TV 9 Vijay Super 10 Star Sports 1 Tamil 11 Star Sports 2 12 Star Sports 3 13 Star Sports First 14 National Geographic 15 Nat Geo Wild 16 CNN News 18 17 Colors Tamil 18 FY1 TV18 19 The History Channel 20 News 18 Tamil Nadu 21 News 18 Urdu 22 NICK 23 NICK JR 24 SONIC 25 VH 1 26 Zee Action 27 Zee News 28 Zee Hindustan 29 Living Foodz 30 Zee ETC 31 WION 32 Zee Tamil 33 Zee Keralam 34 Raj TV 35 Raj Digital Plus 36 Raj News 37 Raj Musix 38 Mega TV 39 Mega Musiq 40 Mega 24 41 Jaya TV 42 Jaya Plus 43 Jaya Max 44 J Movies DIGICON TAMIL BASIC - Rs.70+GST S.NO CHANNEL NAME 1 ADITHYA TV 2 CHUTTI TV 3 COLORS TAMIL 4 K TV 5 NEWS18 TN 6 SUN LIFE 7 SUN MUSIC 8 SUN NEWS 9 SUN TV 10 STAR TAMIL 11 WION 12 ZEE ACTION 13 ZEE ETC 14 ZEE HINDUSTAN 15 ZEE KERALAM 16 ZEE NEWS 17 ZEE TAMIL DIGICON FAMILY PACK-Rs.126+GST S.NO CHANNEL NAME 1 AAJ TAK 38 SONIC 2 AAJ TAK TEZ 39 SONY BBC EARTH 3 ADITHYA TV 40 SONY YAY 4 BBC 41 SUN LIFE 5 CARTOON NETWORK 42 SUN MUSIC 6 CHUTTI TV 43 SUN NEWS 7 CNN 44SUN TV 8 CNN NEWS 18 45 TIMES NOW 9 COLORS TAMIL 46 VH1 10 DISNEY 47 VIJAY 11 DISNEY HD 48 WB 12 DISNEY JUNIOR 49 WION 13 DISNEY XD 50 ZEE ACTION 14 ET NOW 51 ZEE ETC 15 FYI 52 ZEE HINDUSTAN 16 HBO 53 ZEE KERALAM 17 HISTORY 54 ZEE NEWS 18 HUNGAMA 55 ZEE TAMIL 19 INDIA TODAY 56 ZOOM 20 K TV 21 MEGA 24 22 MEGA MUSIQ 23 MEGA TV 24 MIRROR NOW 25 MNX 26 MOVIES NOW 27 MTV BEATS HD 28 NEWS 18 TAMIL 29 NEWS 18 URDU 30 NICK 31 NICK JUNIOR 32 POGO 33 -

SUN | Bouquet Name → TAMIL BASIC ( SD Bouquet ) Channel Count = 7 DRP= RS 40.00

SUN | Bouquet Name → TAMIL BASIC ( SD Bouquet ) Channel Count = 7 DRP= RS 40.00 SUN TV,KTV,ADITHYA TV,SUN MUSIC ,CHUTTI TV,SUN NEWS ,SUN LIFE SUN | Bouquet Name → TAMIL PRIME ( SD Bouquet ) Channel Count = 9 DRP= RS 45.00 SUN TV,KTV,ADITHYA TV,SUN MUSIC ,CHUTTI TV,SUN NEWS ,SUN LIFE,GEMINI TV,SURYA TV SUN | Bouquet Name → TAMIL SUPER ( SD Bouquet ) Channel Count = 11 DRP= RS 50.00 SUN TV,KTV,ADITHYA TV,SUN MUSIC ,CHUTTI TV,SUN NEWS ,SUN LIFE,GEMINI TV,GEMINI MOVIES,SURYA TV,SURYA MOVIES SUN | Bouquet Name → TELUGU BASIC ( SD Bouquet ) Channel Count = 6 DRP= RS 30.00 GEMINI TV,GEMINI MOVIES,GEMINI COMEDY,GEMINI MUSIC,KUSHI TV,GEMINI LIFE SUN | Bouquet Name → TELUGU PRIME ( SD Bouquet ) Channel Count = 8 DRP= RS 40.00 GEMINI TV,GEMINI MOVIES,GEMINI COMEDY,GEMINI MUSIC,KUSHI TV,GEMINI LIFE,SUN TV,KTV SUN | Bouquet Name → TELUGU SUPER ( SD Bouquet ) Channel Count = 11 DRP= RS 50.00 GEMINI TV, GEMINI MOVIES, GEMINI COMEDY, GEMINI MUSIC, KUSHI TV, GEMINI LIFE, SUN TV, KTV, UDAYA TV, UDAYA MOVIES, SURYA TV SUN | Bouquet Name → KANNADA BASIC ( SD Bouquet ) Channel Count = 5 DRP= RS 30.00 UDAYA TV, UDAYA MOVIES, UDAYA COMEDY, UDAYA MUSIC, CHINTU TV SUN | Bouquet Name → KANNADA PRIME ( SD Bouquet ) Channel Count= 8 DRP= RS 45.00 UDAYA TV, UDAYA MOVIES, UDAYA COMEDY, UDAYA MUSIC, CHINTU TV, SUN TV, KTV, GEMINI TV SUN | Bouquet Name → KANNADA SUPER ( SD Bouquet ) Channel Count= 10 DRP= RS 50.00 UDAYA TV, UDAYA MOVIES, UDAYA COMEDY, UDAYA MUSIC, CHINTU TV, SUN TV, KTV, SUN MUSIC, GEMINI TV, GEMINI MOVIES SUN | Bouquet Name → KERALA BASIC ( SD Bouquet -

India Radio 14-66

(PAPfRS'l~ bE L~LD bN TM~ T-PrBL~ 1)(: LbkSAPJf1A )R.IiJ'j~j Pr&t(f) AUTH eNTIc..A:rI2]) 1\ ~\~5- (LbL R.A-'TVAVARD hAN Q.PrTH D~e ( f2.-e.kP)) M t N J ~ Tl2" ~ () C- ST ATE Po (( 1N H> r<. 10 Ii-T IoN A-N !) . Col Rajyava~~~a(I:;tore (Retd) e, ·t<o t+j) LA--! T J ~ ~ 2- I I I II I Prasar Bharati –India’s Public Service Broadcaster 03-13 All India Radio 14-66 Doordarshan 67-120 Annual Plans 121-140 All India Radio 121-135 Doordarshan 136-140 Audited Annual Accounts 141-163 Prasar Bharati – The Corporation INTRODUCTION Prasar Bharati being the only public service broadcaster in the country reaching remote parts of the country ensures that it carries forward the social responsibility of informing, educating and entertaining the people of India. It has the widest network through both Radio and TV, with All India Radio and Doordarshan as its constituents. Prasar Bharati came into being on November 23, 1997 by an Act of the Parliament. The Act gave Prasar Bharati the mandate to organize and conduct public broadcasting services to inform, educate and entertain the public while ensuring balanced development of broadcasting in the country. Prasar Bharati has a phenomenal reach, covering even the remote and far-flung areas of the country. To do this, it maintains one of the largest broadcasting infrastructure networks in the world. It has about 1968 terrestrial transmitters for 450 TV and Radio stations of Doordarshan and All India Radio as well as 40 Earth Stations. -

Audio Production Techniques (206) Unit 1

Audio Production Techniques (206) Unit 1 Characteristics of Audio Medium Digital audio is technology that can be used to record, store, generate, manipulate, and reproduce sound using audio signals that have been encoded in digital form. Following significant advances in digital audio technology during the 1970s, it gradually replaced analog audio technology in many areas of sound production, sound recording (tape systems were replaced with digital recording systems), sound engineering and telecommunications in the 1990s and 2000s. A microphone converts sound (a singer's voice or the sound of an instrument playing) to an analog electrical signal, then an analog-to-digital converter (ADC)—typically using pulse-code modulation—converts the analog signal into a digital signal. This digital signal can then be recorded, edited and modified using digital audio tools. When the sound engineer wishes to listen to the recording on headphones or loudspeakers (or when a consumer wishes to listen to a digital sound file of a song), a digital-to-analog converter performs the reverse process, converting a digital signal back into an analog signal, which analog circuits amplify and send to aloudspeaker. Digital audio systems may include compression, storage, processing and transmission components. Conversion to a digital format allows convenient manipulation, storage, transmission and retrieval of an audio signal. Unlike analog audio, in which making copies of a recording leads to degradation of the signal quality, when using digital audio, an infinite number of copies can be made without any degradation of signal quality. Development and expansion of radio network in India FM broadcasting began on 23 July 1977 in Chennai, then Madras, and was expanded during the 1990s, nearly 50 years after it mushroomed in the US.[1] In the mid-nineties, when India first experimented with private FM broadcasts, the small tourist destination ofGoa was the fifth place in this country of one billion where private players got FM slots. -

A Study Onbrand Equity of Sun Tv Network with Special

PROJECT REPORT “A STUDY ONBRAND EQUITY OF SUN T.V NETWORK WITH SPECIAL REFERENCE TO ITS CHANNELS, BANGALORE” SUBMITTED BY Mr.S.DILIP KUMAR 15P35G0103 UNDER THE GUIDANCE OF Ms.SREEJA.K NEW HORIZON COLLEGE MASTERS OF BUSINESS ADMINISTRATION BHARATHIAR UNIVERSITY COLLEGE CODE: KA 11 B 131 2016-2017 GUIDE CERTIFICATE This is to certify that the project report entitled“A STUDY ON BRAND EQUITY OF SUN NETWORK” submitted by DILIP KUMAR S bearing registration number 15P35G0103 to Bharathiar University for the partial fulfillment of master degree in business management is an outcome of genuine research work carried under my guidance and it has been submitted for the award of any degree, diploma or prize. DATE Ms. SREEJA K Bangalore ASSISTANT PROFESSOR PRINCIPAL’S CERTIFICATE This is to certify that DILIP KUMAR S bearing registration no 15P35G0103 is a bonafide student of this college. The project entitled “A STUDY ON BRAND EQUITY OF SUN NETWORK” is a work carried out by him in partial fulfillment of the requirements for master degree in Business management of Bharathiar University along the year 2016-17 DATE Dr. R BODHISATVAN Bangalore HOD CERTIFICATE This is to certify that DILIP KUMAR S bearing registration number 15P35G0103 is a bonafide student of this college. The project work entitled “A STUDY ON BRAND EQUITY OF SUN NETWORK” is a work carried out by him for partial fulfillment of the requirements for Master Degree in Business management of Bharathiar University during the year 2016-17. It is certified that all the corrections/suggestions have been incorporated in the project report and a copy is deposited in the department library. -

Hathway Fta Pack

HATHWAY FTA PACK DELHI DELHI FTA Total Channels 142 SD + 0 HD LANG - GENRE CHANNEL_NAME SD/HD Assamese - Gec DD ArunPrabha SD Assamese - Gec DD ASSAM SD Assamese - News PRAG NEWS SD Bengali - Gec AAKASH AATH SD Bengali - Gec DD BANGLA SD Bengali - Gec RUPASI BANGLA SD Bengali - Movie ENTERR10 MOVIES SD Bengali - Music SANGEET BANGLA SD Bengali - News ABP ANANDA SD Bhojpuri - Gec DANGAL SD Bhojpuri - Movie BHOJPURI CINEMA SD Bhojpuri - Movie PITAARA SD Bhojpuri - Movie SURYA BHOJPURI SD Bhojpuri - Music SANGEET BHOJPURI SD English - Devotional PEACE OF MIND SD English - Lifestyle FASHION TV SD English - News REPUBLIC TV SD Gujarati - Gec DD GIRNAR SD Haryanvi - Gec RAGNI SPECIAL SD Haryanvi - Music APNA HARYANA SD Hindi - Devotional AASTHA SD Hindi - Devotional AASTHA BHAJAN SD Hindi - Devotional ARIHANT SD Hindi - Devotional DIVINE SD Hindi - Devotional HARE KRSNA TV SD Hindi - Devotional HINDU DHARMAM SD Hindi - Devotional LORD BUDDHA TV SD Hindi - Devotional PARAS SD Hindi - Devotional SANSKAR SD Hindi - Devotional SATSANG SD Hindi - Devotional SHRADDHA MH ONE SD Hindi - Devotional SHUBHSANDESH SD Hindi - GEC A1TV SD Page 1 of 47 Hindi - Gec ABZY COOL SD Hindi - Gec CCC SD Hindi - Gec DD BIHAR SD Hindi - Gec DD MADHYA PRADESH SD Hindi - Gec DD NATIONAL SD Hindi - Gec DD RAJASTHAN SD Hindi - Gec DD UTTAR PRADESH SD Hindi - GEC DISHUM SD Hindi - Gec ENTERR10 SD Hindi - Gec HATHWAY HARYANVI SD Hindi - GEC KISHORE MANCH SD Hindi - GEC PANINI SD Hindi - GEC SHARDA SD Hindi - GEC SHEMAROO TV SD Hindi - Infotainment DD BHARATI SD Hindi - Infotainment -

SL NO. AGENCY NAME STATE 1 BIG FM Tirupati ANDHRA PRADESH 2 SFM Tirupathi ANDHRA PRADESH 3 SFM Vijaywada ANDHRA PRADESH 4 SFM Ra

List of Pvt FM to whom BOC issued advertisement during 2016-17 SL NO. AGENCY NAME STATE 1 BIG FM Tirupati ANDHRA PRADESH 2 SFM Tirupathi ANDHRA PRADESH 3 SFM Vijaywada ANDHRA PRADESH 4 SFM Rajamundri ANDHRA PRADESH 5 Radio Mirchi-Vijaywada ANDHRA PRADESH 6 Radio City Vizag ANDHRA PRADESH 7 Radio Mirchi 98.3, Vishakhapatnam ANDHRA PRADESH 8 Gup-Shup 94.3 FM Guwahati ASSAM 9 BIG FM Guwahati ASSAM 10 Red FM Guwahati ASSAM 11 Radio Mirchi-Patna BIHAR 12 Radio Dhamaal - Muzaffarpur BIHAR 13 My FM - Chandigarh CHANDIGARH 14 Radio Mirchi-Rajkot CHHATTISGARH 15 My FM Bilaspur CHHATTISGARH 16 My Fm 94.3 Raipur CHHATTISGARH 17 Radio Tadka Raipur CHHATTISGARH 18 ISHQ FM - DELHI DELHI 19 Hit 95 FM Delhi DELHI 20 Fever 104 FM Bangalore DELHI 21 BIG FM Vishakhapatnam DELHI 22 Best FM Thrissur DELHI 23 Best FM, Kannur DELHI 24 Radio City Surat DELHI 25 Rangila Raipur DELHI 26 RED FM Cochin DELHI 27 Fever 104- Delhi DELHI 28 Radio City-Nagpur DELHI 29 Radio City-jalgaon DELHI 30 Aamar FM- Kolkatta DELHI 31 Power FM- Kolkatta DELHI 32 Radio One -Delhi DELHI 33 Suryan FM Tirunelveli DELHI 34 Visakha FM Suryan DELHI 35 RADIO MIRCHI, DELHI DELHI 36 SURYAN FM Chennai DELHI 37 RED FM, DELHI DELHI 38 Radio City Delhi DELHI 39 BIG FM Panaji GOA 40 Indigo Panaji GOA 41 My FM 94.3 Ahmedabad GUJARAT 42 Red FM Ahmedabad GUJARAT 43 Radio One 94.3 FM, Ahmedabad GUJARAT 44 BIG FM Rajkot GUJARAT 45 Big FM Baroda GUJARAT 46 RADIO MIRCHI, AHMEDABAD GUJARAT 47 Radio City-Baroda GUJARAT 48 Radio Mirchi Surat GUJARAT 49 Radio Mirchi-Baroda GUJARAT 50 Radio Mirchi-Raipur -

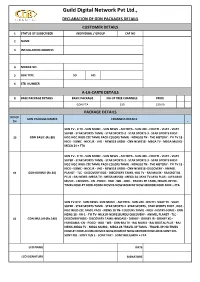

Customer Application Form

Guild Digital Network Pvt Ltd., DECLARATION OF GDN PACKAGES DETAILS CUSTOMER DETAILS 1 STATUS OF SUBSCRIBER INDIVIDUAL / GROUP CAF NO 2 NAME 3 INSTALLATION ADDRESS 4 MOBILE NO 5 BOX TYPE SD HD 6 STB NUMBER A-LA-CARTE DETAILS 8 BASE PACKAGE DETAILS BASIC PACKAGE NO OF FREE CHANNELS PRICE GDN FTA 230 130.00 PACKAGE DETAILS NO OF GDN PACKAGE NAMES CHANNELS DETAILS CH P SUN TV - K TV - SUN MUSIC - SUN NEWS - ADITHYA - SUN LIFE - CHUTTI - VIJAY - VIJAY SUPER - STAR SPORTS TAMIL - STAR SPORTS 2 - STAR SPORTS 3 - STAR SPORTS FIRST- 20 GDN BASIC-(Rs.80) NGC-NGC WILD-ZEE TAMIL PACK-COLORS TAMIL - NEWS18 TN - THE HISTORY - FYI TV 18 - NICK - SONIC - NICK JR - VH1 - NEWS18 URDU - CNN NEWS18 - MEGA TV - MEGA MUSIQ - MEGA 24 + FTA SUN TV - K TV - SUN MUSIC - SUN NEWS - ADITHYA - SUN LIFE - CHUTTI - VIJAY - VIJAY SUPER - STAR SPORTS TAMIL - STAR SPORTS 2 - STAR SPORTS 3 - STAR SPORTS FIRST- NGC-NGC WILD-ZEE TAMIL PACK-COLORS TAMIL - NEWS18 TN - THE HISTORY - FYI TV 18 - NICK - SONIC - NICK JR - VH1 - NEWS18 URDU - CNN NEWS18 -DISCOVERY - ANIMEL 62 GDN KURINJI-(Rs.10) PLANET - TLC - DISCOVERY KIDS - DISCOVERY TAMIL -RAJ TV - RAJ MUSIX - RAJ DIGITAL PLUS - RAJ NEWS -MEGA TV - MEGA MUSIQ - MEGA 24 -JAYA TV-JAYA PLUS - JAYA MAX MUSIC - J MOVIES - CN - POGO - HBO - WB - CNN - TRAVEL XP TAMIL,TRAVEL XP HD - TIMES NOW-ET NOW-ZOOM-MOVIES NOW-ROMEDY NOW-MIRROR NOW-MNX + FTA SUN TV-KTV - SUN NEWS- SUN MUSIC - ADITHYA - SUN LIFE -CHUTTI- VIJAY TV - VIJAY SUPER - STAR SPORTS TAMIL - STAR SPORTS 2 -STAR SPORTS , STAR SPORTS FIRST , NGC - NGC WILD-ZEE TAMIL PACK -

India - Indonesia Relations

India - Indonesia Relations India and Indonesia have shared two millennia of close cultural and commercial contacts. The Hindu, Buddhist and later Muslim faith travelled to Indonesia from the shores of India. The Indonesian folk art and dramas are based on stories from the great epics of Ramayana and Mahabharata. The shared culture, colonial history and post-independence goals of political sovereignty, economic self-sufficiency and independent foreign policy have unifying effect on the bilateral relations. Political Relations During our respective struggles for independence, the national leaderships of India and Indonesia led by Jawaharlal Nehru and President Sukarno collaborated closely in supporting the cause of Asian and African independence and later laid the foundation of the Afro-Asian and Non-Aligned Movements at the Bandung Conference in 1955. Since the adoption of India’s ‘Look East Policy’ in 1991, there has been a rapid development of bilateral relations in political, security, defence, commercial and cultural fields. The current Government wants to further deepen the relationship with East Asia and has therefore rightly titled its policy as “Act East”. State Visit of President Yudhoyono in January 2011: During the State Visit of President Mr S. B. Yudhoyono to India in 2005, the two countries signed a Joint Declaration on Establishing a Strategic Partnership. In January 2011, President Yudhoyono visited India as the Chief Guest on the occasion of India’s Republic Day. During the visit, 16 Inter- Governmental Agreements were signed which included an Extradition Treaty, Mutual Legal Assistance Treaty, an MoU on Establishing a Biennial Trade Ministers’ Forum, an MoU on Cooperation in Oil and Gas, an MoU on Science and Technology Cooperation, and a Cultural Exchange Programme.