Equity Market Volatility on August 24, 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

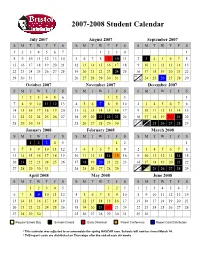

Approved Student Calendar

2007-2008 Student Calendar July 2007 August 2007 September 2007 SMTWT F S SMTWT F S SMTWT F S 1234567 1234 1 8910111213145678910 11 2 3 45678 15 16 17 18 19 20 21 12 13 14 15 16 17 18 9 10 11 12 13 14 15 22 23 24 25 26 27 28 19 20 21 22 23 24 25 16 17 18 19 20 21 22 23 29 30 31 26 27 28 29 30 31 30 24 25 26 27 28 29 October 2007 November 2007 December 2007 SMTWT F S SMTWT F S SMTWT F S 123456 123 1 7891011 12 134567 89102345678 14 15 16 17 18 19 20 11 12 13 14 15 16 17 9 10 11 12 13 14 15 21 22 23 24 25 26 27 18 19 20 21 22 23 24 16 17 18 19 20 21 22 23 24 28 29 30 31 25 26 27 28 29 30 30 31 25 26 27 28 29 January 2008 February 2008 March 2008 SMTWT F S SMTWT F S SMTWT F S 12345 12 1 67891011123456789 2345678 13 14 15 16 17 18 19 10 11 12 13 14 1516 9 1011121314 15 20 21 22 23 24 25 26 17 18 19 20 21 22 23 16 17 18 19 20 21 22 23 24 27 28 29 30 31 24 25 26 27 28 29 30 31 25 26 27 28 29 April 2008 May 2008 June 2008 SMTWT F S SMTWT F S SMTWT F S 12345 123 1234567 6789 10111245678910891011121314 13 14 15 16 17 18 19 11 12 13 14 15 16 17 15 16 17 18 19 20 21 20 21 22 23 24 25 26 18 19 20 21 22 23 24 22 23 24 25 26 27 28 27 28 29 30 25 26 27 28 29 30 31 29 30 Regular School Day Schools Closed Early Dismissal Parent Conference Report Card Distribution * This calendar was adjusted to accommodate the spring NASCAR race. -

2021-2022 Custom & Standard Information Due Dates

2021-2022 CUSTOM & STANDARD INFORMATION DUE DATES Desired Cover All Desired Cover All Delivery Date Info. Due Text Due Delivery Date Info. Due Text Due May 31 No Deliveries No Deliveries July 19 April 12 May 10 June 1 February 23 March 23 July 20 April 13 May 11 June 2 February 24 March 24 July 21 April 14 May 12 June 3 February 25 March 25 July 22 April 15 May 13 June 4 February 26 March 26 July 23 April 16 May 14 June 7 March 1 March 29 July 26 April 19 May 17 June 8 March 2 March 30 July 27 April 20 May 18 June 9 March 3 March 31 July 28 April 21 May 19 June 10 March 4 April 1 July 29 April 22 May 20 June 11 March 5 April 2 July 30 April 23 May 21 June 14 March 8 April 5 August 2 April 26 May 24 June 15 March 9 April 6 August 3 April 27 May 25 June 16 March 10 April 7 August 4 April 28 May 26 June 17 March 11 April 8 August 5 April 29 May 27 June 18 March 12 April 9 August 6 April 30 May 28 June 21 March 15 April 12 August 9 May 3 May 28 June 22 March 16 April 13 August 10 May 4 June 1 June 23 March 17 April 14 August 11 May 5 June 2 June 24 March 18 April 15 August 12 May 6 June 3 June 25 March 19 April 16 August 13 May 7 June 4 June 28 March 22 April 19 August 16 May 10 June 7 June 29 March 23 April 20 August 17 May 11 June 8 June 30 March 24 April 21 August 18 May 12 June 9 July 1 March 25 April 22 August 19 May 13 June 10 July 2 March 26 April 23 August 20 May 14 June 11 July 5 March 29 April 26 August 23 May 17 June 14 July 6 March 30 April 27 August 24 May 18 June 15 July 7 March 31 April 28 August 25 May 19 June 16 July 8 April 1 April 29 August 26 May 20 June 17 July 9 April 2 April 30 August 27 May 21 June 18 July 12 April 5 May 3 August 30 May 24 June 21 July 13 April 6 May 4 August 31 May 25 June 22 July 14 April 7 May 5 September 1 May 26 June 23 July 15 April 8 May 6 September 2 May 27 June 24 July 16 April 9 May 7 September 3 May 28 June 25. -

Peoria Unified School District 6-Day Rotation Schedule

Peoria Unified School District 2020 – 2021 School Year Six-Day Rotation Schedule August 2020 January 2021 Day 1: August 17, 19 AM, 26 PM and 27 Day 1: January 6 PM, 11 and 22 Day 2: August 18 and 28 Day 2: January 12, 13 AM, 20 PM and 25 Day 3: August 23 and 31 Day 3: January 4, 14, 26 and 27 AM Day 4: August 21 Day 4: January 5, 15 and 28 Day 5: August 24 Day 5: January 7, 19 and 29 Day 6: August 25 Day 6: January 8 and 21 September 2020 February 2021 Day 1: September 8, 18 and 29 Day 1: February 2, 12 and 25 Day 2: September 2 AM, 9 PM, and 21 Day 2: February 4, 16 and 26 Day 3: September 11, 16 AM and 23 PM Day 3: February 3 PM, 5 and 18 Day 4: September 1, 14, 24 and 30 AM Day 4: February 8, 10 AM, 17 PM and 19 Day 5: September 3, 15 and 25 Day 5: February 9, 22 and 24 AM Day 6: September 4, 17 and 28 Day 6: February 1, 11 and 23 October 2020 March 2021 Day 1: October 9 and 22 Day 1: March 8, 25 and 31 AM Day 2: October 1, 13 and 23 Day 2: March 9 and 26 Day 3: October 2, 15 and 26 Day 3: March 1, 11 and 29 Day 4: October 5, 7 PM, 16 and 27 Day 4: March 2, 12 and 30 Day 5: October 6, 14 AM, 21 PM and 29 Day 5: March 3 PM, 4 and 22 Day 6: October 8, 20, 28 AM and 30 Day 6: March 5, 10 AM, 23 and 24 PM November 2020 April 2021 Day 1: November 2, 12 and 20 Day 1: April 5, 7 PM, 15 and 27 Day 2: November 3, 13 and 30 Day 2: April 6, 14 AM, 16, 21 PM and 29 Day 3: November 5 and 16 Day 3: April 8, 19, 28 AM and 30 Day 4: November 6 and 17 Day 4: April 9 and 20 Day 5: November 9 and 18 Day 5: April 1, 12 and 22 Day 6: November 4 PM, 10 and 19 Day 6: April 2, 13 and 26 December 2020 May 2021 Day 1: December 7, 15 and 16 AM Day 1: May 7 and 18 Day 2: December 8 and 17 Day 2: May 10 and 19 Day 3: December 1 and 9 Day 3: May 5 PM, 11 and 20 Day 4: December 2 and 10 Day 4: May 3, 12 AM, 13 Day 5: December 3 and 11 Day 5: May 4 and 14 Day 6: December 4 and 14 Day 6: May 6 and 17 EARLY RELEASE or MODIFIED WEDNESDAY • Elementary schools starting at 8 a.m. -

9/11 Report”), July 2, 2004, Pp

Final FM.1pp 7/17/04 5:25 PM Page i THE 9/11 COMMISSION REPORT Final FM.1pp 7/17/04 5:25 PM Page v CONTENTS List of Illustrations and Tables ix Member List xi Staff List xiii–xiv Preface xv 1. “WE HAVE SOME PLANES” 1 1.1 Inside the Four Flights 1 1.2 Improvising a Homeland Defense 14 1.3 National Crisis Management 35 2. THE FOUNDATION OF THE NEW TERRORISM 47 2.1 A Declaration of War 47 2.2 Bin Ladin’s Appeal in the Islamic World 48 2.3 The Rise of Bin Ladin and al Qaeda (1988–1992) 55 2.4 Building an Organization, Declaring War on the United States (1992–1996) 59 2.5 Al Qaeda’s Renewal in Afghanistan (1996–1998) 63 3. COUNTERTERRORISM EVOLVES 71 3.1 From the Old Terrorism to the New: The First World Trade Center Bombing 71 3.2 Adaptation—and Nonadaptation— ...in the Law Enforcement Community 73 3.3 . and in the Federal Aviation Administration 82 3.4 . and in the Intelligence Community 86 v Final FM.1pp 7/17/04 5:25 PM Page vi 3.5 . and in the State Department and the Defense Department 93 3.6 . and in the White House 98 3.7 . and in the Congress 102 4. RESPONSES TO AL QAEDA’S INITIAL ASSAULTS 108 4.1 Before the Bombings in Kenya and Tanzania 108 4.2 Crisis:August 1998 115 4.3 Diplomacy 121 4.4 Covert Action 126 4.5 Searching for Fresh Options 134 5. -

COVID-19 Cases in Vaccinated Individuals

Massachusetts Department of Public Health COVID-19 Vaccine Data – Tuesday, August 24, 2021 COVID-19 Cases in Fully Vaccinated Individuals The COVID-19 Cases in Fully Vaccinated Individuals Report is updated weekly and posted on Tuesday. Additional data on vaccines are published in the Daily Vaccine Report (posted Monday-Friday) and the Weekly Vaccination Dashboard (posted on Thursday). Please note: Identification of cases in vaccinated people relies on matching data between the system of record for cases and vaccinations. The number of cases in vaccinated people may be undercounted due to discrepancies in the names and dates of birth of individuals, resulting in an inability to match records across systems. Hospitalization data is likely also undercounted as identification and reporting of hospitalized cases relies on that information being obtainable by case investigators through patient interview. *Vaccination began December 14, 2020; the earliest date at which individuals would be considered fully vaccinated is January 19, 2021 COVID-19 Cases in Fully Vaccinated Individuals . COVID-19 cases in vaccinated people are counted as those who test positive more than 14 days after the final dose of vaccine* . As of August 21, 2021 there were 4,449,267 fully vaccinated people and there were 15,739 cases in vaccinated people . 571 of those 15,739 cases resulted in hospitalization and 131 cases resulted in death based on information reported to date Cumulative Cumulative % of All Fully count through count this Vaccinated last week week Individuals* (reported 8/14) (reported 8/21) Cases 12,641 15,739 0.35% Hospitalizations among cases 496 571 0.01% Deaths among cases 124 131 0.003% Note: Identification of cases in vaccinated people relies on matching data between the system of record for cases and vaccinations. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

9-11 and Terrorist Travel- Full

AND TERRORIST TRAVEL Staff Report of the National Commission on Terrorist Attacks Upon the United States 9/11 AND TERRORIST TRAVEL Staff Report of the National Commission on Terrorist Attacks Upon the United States By Thomas R. Eldridge Susan Ginsburg Walter T. Hempel II Janice L. Kephart Kelly Moore and Joanne M. Accolla, Staff Assistant Alice Falk, Editor Note from the Executive Director The Commission staff organized its work around specialized studies, or monographs, prepared by each of the teams. We used some of the evolving draft material for these studies in preparing the seventeen staff statements delivered in conjunction with the Commission’s 2004 public hearings. We used more of this material in preparing draft sections of the Commission’s final report. Some of the specialized staff work, while not appropriate for inclusion in the report, nonetheless offered substantial information or analysis that was not well represented in the Commission’s report. In a few cases this supplemental work could be prepared to a publishable standard, either in an unclassified or classified form, before the Commission expired. This study is on immigration, border security and terrorist travel issues. It was prepared principally by Thomas Eldridge, Susan Ginsburg, Walter T. Hempel II, Janice Kephart, and Kelly Moore, with assistance from Joanne Accolla, and editing assistance from Alice Falk. As in all staff studies, they often relied on work done by their colleagues. This is a study by Commission staff. While the Commissioners have been briefed on the work and have had the opportunity to review earlier drafts of some of this work, they have not approved this text and it does not necessarily reflect their views. -

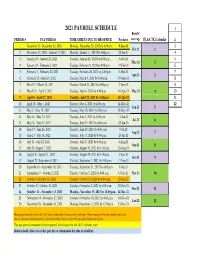

Payroll Calendar 2021

2021 PAYROLL SCHEDULE 1 Benefit PERIOD # PAY PERIOD TIME SHEETS DUE TO HR OFFICE Paydates coverage FLSA 7K Calendar 2 1 December 13- December 26, 2020 Monday, December 28, 2020 by 4:00 p.m. 8-Jan-21 3 Feb-21 1 2 December 27, 2020 - Janurary 9, 2021 Monday, January 11, 2021 by 4:00 p.m. 22-Jan-21 4 3 January 10 - January 23, 2021 Tuesday, January 26, 2021 by 4:00 p.m. 5-Feb-21 5 Mar-21 2 4 January 24 - February 6, 2021 Tuesday, February 9, 2021 by 4:00 p.m. 19-Feb-21 6 5 February 7 - February 20, 2021 Tuesday, February 26, 2021 by 4:00 p.m. 5-Mar-21 7 Apr-21 3 6 February 21 - March 6, 2021 Tuesday, March 9, 2021 by 4:00 p.m. 19-Mar-21 8 7 March 7 - March 20, 2021 Tuesday, March 23, 2021 by 4:00 p.m. 2-Apr-21 9 8 March 21 - April 3, 2021 Tuesday, April 6, 2021 by 4:00 p.m. 16-Apr-21 May-21 4 10 9 April 4 - April 17, 2021 Tuesday, April 20, 2021 by 4:00 p.m. 30-Apr-21 11 10 April 18 - May 1, 2021 Tuesday, May 4, 2021 by 4:00 p.m. 14-May-21 12 Jun-21 5 11 May 2 - May 15, 2021 Tuesday, May 18, 2021 by 4:00 p.m. 28-May-21 12 May 16 - May 29, 2021 Tuesday, June 1, 2021 by 4:00 p.m. 11-Jun-21 Jul-21 6 13 May 30 - June 12, 2021 Tuesday, June 15, 2021 by 4:00 p.m. -

2020-2021 Academic Calendar Revised 9.18.20

FRANCISCAN UNIVERSITY OF STEUBENVILLE 2020-2021 ACADEMIC CALENDAR REVISED 9.18.20 FALL 2020 SEMESTER SPRING 2021 SEMESTER August 24 25-December 11 January 11-May 5 New Student Orientation August 20-23 (Thurs-Sun) January 7-10 (Thurs-Sun) Convocation & Opening of School Mass August 24 (Mon) (4 pm; 3 pm classes January 11 (Mon) (mass only, 10:30 am) shortened & 4:30 pm classes cancelled) Classes begin August 24 (Mon) January 11 (Mon) (10 a.m. classes shortened) Last day for late registration August 28 (Fri) January 15 (Fri) Last day for adding/dropping courses September 2 (Wed) January 20 (Wed) Labor Day (class day) September 7 (Mon) (class day) N/A March for Life N/A January 29 (no day classes) Last day for audit changes September 11 (Fri) January 22 (Fri) Incomplete grades due to registrar September 25 (Fri) February 12 (Fri) Feast of St. Francis October 4 (Sun) N/A Homecoming weekend October 2-4 (Fri-Sun) N/A Midterm deficiencies due to registrar October 14 (Wed) March 5 (Fri) Spring Break N/A March 8-12 (Mon-Fri) (classes resume Mon, March 15) Last day for course withdrawal November 2 (Mon) March 26 (Fri) Tentative Class Make-up Days November 14, 21 (Sat) Thanksgiving vacation November 25-29 (Wed-Sun) N/A (classes resume Mon, Nov 30) Holy Thursday April 1 (no evening classes) Easter recess (Friday & Monday day classes N/A April 2-April 5 (day) canceled; *Monday evening classes do meet) (classes resume Mon evening, April 5, Tuesday day, April 6) Classes Resume Evening: Mon, April 5; Day: Tues, April 6 Last day of classes December 1 (Tues) -

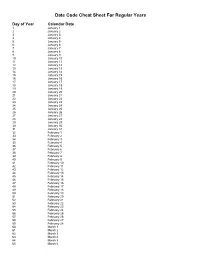

Julian Date Cheat Sheet for Regular Years

Date Code Cheat Sheet For Regular Years Day of Year Calendar Date 1 January 1 2 January 2 3 January 3 4 January 4 5 January 5 6 January 6 7 January 7 8 January 8 9 January 9 10 January 10 11 January 11 12 January 12 13 January 13 14 January 14 15 January 15 16 January 16 17 January 17 18 January 18 19 January 19 20 January 20 21 January 21 22 January 22 23 January 23 24 January 24 25 January 25 26 January 26 27 January 27 28 January 28 29 January 29 30 January 30 31 January 31 32 February 1 33 February 2 34 February 3 35 February 4 36 February 5 37 February 6 38 February 7 39 February 8 40 February 9 41 February 10 42 February 11 43 February 12 44 February 13 45 February 14 46 February 15 47 February 16 48 February 17 49 February 18 50 February 19 51 February 20 52 February 21 53 February 22 54 February 23 55 February 24 56 February 25 57 February 26 58 February 27 59 February 28 60 March 1 61 March 2 62 March 3 63 March 4 64 March 5 65 March 6 66 March 7 67 March 8 68 March 9 69 March 10 70 March 11 71 March 12 72 March 13 73 March 14 74 March 15 75 March 16 76 March 17 77 March 18 78 March 19 79 March 20 80 March 21 81 March 22 82 March 23 83 March 24 84 March 25 85 March 26 86 March 27 87 March 28 88 March 29 89 March 30 90 March 31 91 April 1 92 April 2 93 April 3 94 April 4 95 April 5 96 April 6 97 April 7 98 April 8 99 April 9 100 April 10 101 April 11 102 April 12 103 April 13 104 April 14 105 April 15 106 April 16 107 April 17 108 April 18 109 April 19 110 April 20 111 April 21 112 April 22 113 April 23 114 April 24 115 April -

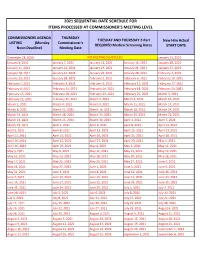

2021 Sequential Date List

2021 SEQUENTIAL DATE SCHEDULE FOR ITEMS PROCESSED AT COMMISSIONER'S MEETING LEVEL COMMISSIONERS AGENDA THURSDAY TUESDAY AND THURSDAY 2-Part New Hire Actual LISTING (Monday Commissioner's REQUIRED Medical Screening Dates START DATE Noon Deadline) Meeting Date December 28, 2020 NO MEETING SCHEDULED January 13, 2021 January 4, 2021 January 7, 2021 January 12, 2021 January 14, 2021 January 20, 2021 January 11, 2021 January 14, 2021 January 19, 2021 January 21, 2021 January 27, 2021 January 18, 2021 January 21, 2021 January 26, 2021 January 28, 2021 February 3, 2021 January 25, 2021 January 28, 2021 February 2, 2021 February 4, 2021 February 10, 2021 February 1, 2021 February 4, 2021 February 9, 2021 February 11, 2021 February 17, 2021 February 8, 2021 February 11, 2021 February 16, 2021 February 18, 2021 February 24, 2021 February 15, 2021 February 18, 2021 February 23, 2021 February 25, 2021 March 3, 2021 February 22, 2021 February 25, 2021 March 2, 2021 March 4, 2021 March 10, 2021 March 1, 2021 March 4, 2021 March 9, 2021 March 11, 2021 March 17, 2021 March 8, 2021 March 11, 2021 March 16, 2021 March 18, 2021 March 24, 2021 March 15, 2021 March 18, 2021 March 23, 2021 March 25, 2021 March 31, 2021 March 22, 2021 March 25, 2021 March 30, 2021 April 1, 2021 April 7, 2021 March 29, 2021 April 1, 2021 April 6, 2021 April 8, 2021 April 14, 2021 April 5, 2021 April 8, 2021 April 13, 2021 April 15, 2021 April 21, 2021 April 12, 2021 April 15, 2021 April 20, 2021 April 22, 2021 April 28, 2021 April 19, 2021 April 22, 2021 April 27, 2021 April -

RG 01.01: Board of Trustees Stored in Black Filing Cabinets in HCC Archives Room # = Some Electronic Files; ! = Missing Minutes

RG 01.01: Board of Trustees Stored in Black Filing Cabinets in HCC Archives Room # = some electronic files; ! = missing minutes Background Information Dates: 1981-present Extent: 6 filing cabinet drawers, 86 MB Name of Creator: Members of the HCC Board of Trustees Language: English Conditions Governing Access: Unrestricted Scope & Content: This sub-series contains meeting agendas, minutes, and associated materials. Administrative/Biographical History: The Board of Trustees was formed in 1981 with the authority of the Board of Regents. The first Chairman of the Board was John T. Hickey. The first meeting of the Board was on March 13, 1981. Originally the board was to meet on the fourth Tuesday of every month. System of Arrangement: Chronologically by year, and then by month. Access Points (keywords): BOT, Board of Trustees, John T. Hickey, David M. Bartley Meeting Minutes and Associated Material 1981 1982 1983 1984 January 5 January 25 January 24 February 23 February 22 February 28 March 13 March 23 March 22 March 27 April 28 April 27 April 26 April 24 May 26 May 25 May 22 June 23 June 22 July 28 July 27 August 25 August 24 August 9 August 7 September 22 September 28 September 27 September 25 October 27 October 26 October 25 October 23 November 23 November 22 November 27 December 22 December 29 1985 1986 1987 1988 January 22 January 28 !January 27 January 26 February 26 February 25 February 24 February 23 March 26 March 25 March 24 March 22 April 23 April 22 April 28 April 26 May 28 May 27 May 26 May 24 June 25 June 24 June 23 June 28