Annual Report 2020 Promoting the Big Screen 2020 UK Cinema Association

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Cinema Media Guide 2017

Second Edition THE CINEMA MEDIA GUIDE 2017 1 WELCOME TO OUR WORLD CONTENTS. Our vision 1 ABC1 Adults 41 Foreword 2 War for the Planet of the Apes 43 Fast facts 3 Dunkirk 44 The cinema audience 5 American Made 45 The WOW factor 6 Victoria and Abdul 46 Cinema’s role in the media mix 7 Goodbye Christopher Robin 47 Building Box Office Brands 8 Blade Runner 2049 48 The return on investment 9 The Snowman 49 How to buy 11 Murder on the Orient Express 50 Buying routes 12 Suburbicon 51 Optimise your campaign 16 16-34 Men 53 Sponsorship opportunities 17 Spider-Man: Homecoming 55 The production process 19 Atomic Blonde 56 Our cinemas 21 The Dark Tower 57 Our cinema gallery 22 Kingsman: The Golden Circle 58 Cineworld 23 Thor: Ragnarok 59 ODEON 24 Justice League 60 Vue 25 16-34 Women 61 Curzon Cinemas 26 The Beguiled 63 Everyman Cinemas 27 It 64 Picturehouse Cinemas 28 Flatliners 65 Independents 29 A Bad Mom’s Christmas 66 2017 films by audience Mother! 67 Coming soon to a cinema near you 31 Pitch Perfect 3 68 Adults 33 Main Shoppers with Children 69 Valerian and the City of Cars 3 71 a Thousand Planets 35 Captain Underpants: The First Epic Movie 72 Battle of the Sexes 36 The LEGO Ninjago Movie 73 Paddington 2 37 My Little Pony: The Movie 74 Daddy’s Home 2 38 Ferdinand 75 Star Wars: The Last Jedi 39 Coming in 2018 77 Jumanji: Welcome to the Jungle 40 OUR VISION. FOREWORD. -

Cineworld/City Screen Merger Inquiry

APPENDIX A Terms of reference and conduct of the inquiry Terms of reference 1. On 30 April 2013, the OFT sent the following reference to the CC: 1. In exercise of its duty under section 22(1) of the Enterprise Act 2002 (‘the Act’) to make a reference to the Competition Commission (‘the CC’) in relation to a completed merger the Office of Fair Trading (‘the OFT’) believes that it is or may be the case that – a. a relevant merger situation has been created in that: i. enterprises carried on by or under the control of Cineworld Group plc have ceased to be distinct from enterprises carried on by or under the control of City Screen Limited; and ii. the condition specified in section 23(4) of the Act is satisfied; and b. the creation of that situation has resulted, or may be expected to result in a substantial lessening of competition within any market or markets in the UK for goods or services, including the supply of film services. 2. Therefore, in exercise of its duty under section 22 of the Act, the OFT hereby refers to the CC, for investigation and report within a period ending on 14 October 2013, on the following questions in accordance with section 35 of the Act— a. whether a relevant merger situation has been created; and b. if so, whether the creation of that situation has resulted, or may be expected to result, in a substantial lessening of competition within any market or markets in the UK for goods and services. -

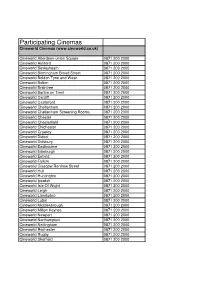

Participating Cinemas 2013 Excel

Participating Cinemas Cineworld Cinemas (www.cineworld.co.uk) Cineworld Aberdeen-union Square 0871 200 2000 Cineworld Ashford 0871 200 2000 Cineworld Bexleyheath 0871 200 2000 Cineworld Birmingham Broad Street 0871 200 2000 Cineworld Boldon Tyne and Wear 0871 200 2000 Cineworld Bolton 0871 200 2000 Cineworld Braintree 0871 200 2000 Cineworld Burton on Trent 0871 200 2000 Cineworld Cardiff 0871 200 2000 Cineworld Castleford 0871 200 2000 Cineworld Cheltenham 0871 200 2000 Cineworld Cheltenham Screening Rooms 0871 200 2000 Cineworld Chester 0871 200 2000 Cineworld Chesterfield 0871 200 2000 Cineworld Chichester 0871 200 2000 Cineworld Crawley 0871 200 2000 Cineworld Didcot 0871 200 2000 Cineworld Didsbury 0871 200 2000 Cineworld Eastbourne 0871 200 2000 Cineworld Edinburgh 0871 200 2000 Cineworld Enfield 0871 200 2000 Cineworld Falkirk 0871 200 2000 Cineworld Glasgow Renfrew Street 0871 200 2000 Cineworld Hull 0871 200 2000 Cineworld Huntington 0871 200 2000 Cineworld Ipswich 0871 200 2000 Cineworld Isle Of Wight 0871 200 2000 Cineworld Leigh 0871 200 2000 Cineworld Llandudno 0871 200 2000 Cineworld Luton 0871 200 2000 Cineworld Middlesbrough 0871 200 2000 Cineworld Milton Keynes 0871 200 2000 Cineworld Newport 0871 200 2000 Cineworld Northampton 0871 200 2000 Cineworld Nottingham 0871 200 2000 Cineworld Rochester 0871 200 2000 Cineworld Rugby 0871 200 2000 Cineworld Sheffield 0871 200 2000 Cineworld Shrewbury 0871 200 2000 Cineworld Solihull 0871 200 2000 Cineworld St Helens 0871 200 2000 Cineworld Stevenage 0871 200 2000 Cineworld Wakefield -

Exhibition, Authenticity, and Film Audiences at the Prince Charles Cinema

. Volume 13, Issue 1 May 2016 ‘Watch like a grown up … enjoy like a child’: Exhibition, authenticity, and film audiences at the Prince Charles Cinema Richard McCulloch, University of Huddersfield, UK Virginia Crisp, Coventry University, UK Abstract: It is tempting to view the rise of event-led cinema as a symptom of shifting audience preferences – the inevitable result of cinemagoers increasingly seeking out ‘immersive’, ‘participatory’ and ‘experiential’ film screenings. The research presented within this particular article aimed to explore the appeal of such screenings by focusing on audiences at the Prince Charles Cinema (PCC) in London – a venue that is widely known for hosting sing- alongs, quote-alongs, and other participatory events. Our results, however, were surprising. Respondents to our questionnaire readily subscribed to a form of cinephilia that embraces a wide variety of tastes, but largely rejects participatory aspects of event-led cinema in favour of what they deemed to be a more authentic cinematic experience. Audiences repeatedly emphasised the superiority of the silent, reverential film screening, and many felt that the PCC’s greatest quality was the way in which it reminded them of how cinemas used to be, not what they might one day become. Ultimately, the article demonstrates that cinematic events are by no means the only option available to audiences who crave alternatives to ‘mainstream’ cinemas. We call for a reconsideration of the immersive and experiential dimensions of traditional cinemagoing, and a greater emphasis on the viewing conditions that facilitate an affective bond between audience and film. To us, the search for alternative cinema experiences seems to be more about the desire for cinema to get better at what it already does, not for it to change into something entirely different. -

1468-Q-171031 Pre-Feasibility Study Proposal.Docx

Tenterden Cinema Proposal to Tenterden Town Council for carrying out a Pre-feasibility Study and Site Options Appraisal by Ron Inglis of Craigmount Consulting Stefanie Fischer of Burrell Foley Fischer LLP Chris Goucher of Greenwood Projects 31 October 2017 1468-Q-171031 Pre-feasibility Study Proposal.docx 1 General Information 1.1 Introduction Cinema and arts consultant Ron Inglis (Craigmount Consulting), architect Stefanie Fischer (Burrell Foley Fischer LLP) and Quantity Surveyor, Chris Goucher of Greenwood Projects are pleased to submit proposals for the pre-feasibility study and site options appraisal for the Tenterden cinema. It is envisaged that Craigmount Consulting, Burrell Foley Fischer LLP and Greenwood Projects would can be directly appointed under separate contracts, but the proposals for services and fees are linked in terms of methodology. Together we bring a wealth of experience from many cinema, multi-arts and media venue developments as well as extensive expertise in the cinema and media sectors. Capital developments which we have worked on, or continue to work on, include: • Shetland cinema and music venue – 2 screen digital cinema and live performance venue with associated facilities. • * Scala Cinema & Arts Centre, Prestatyn, North Wales – opened February 2009. 2 screen digital cinema with live performance capabilities. • Kino, Hawkhurst – The first all-digital cinema in the UK. Single screen with café bar. • Harbour Lights, Southampton – 2 screen cinema. • Stratford East Picturehouse, London – 4 screen cinema and restaurant. • Ciné Lumière, Institut Français, London – redevelopment of specialist cinema. • * Limerick Film & Media Centre – Pre-feasibility and feasibility study for 3 screen specialist cinema and education facilities. • Broadway, Nottingham’s Media Centre. -

Picturehouse Cinemas Limited General Manager Designate, London, August 2018

Picturehouse Cinemas Limited General Manager Designate, London, August 2018 Picturehouse Cinemas operate 10 Cinemas in London and this role can be based at any Cinema that can accommodate. LONDON REGION Central Clapham Crouch End East Dulwich Gate Greenwich Hackney Ritzy Stratford East West Norwood and any future cinemas. In addition to a diverse programme of films, ranging from quality blockbusters to independent, classic, foreign-language and art-house, the cinemas also show live HD broadcasts of productions from world-class arts venues, such as the New York Metropolitan Opera and the Bolshoi Ballet, theatre productions such as the Royal Shakespeare Company Live from Stratford-upon-Avon and National Theatre Live, art exhibitions and filmmaker Q&As. In addition to a diverse programme of films, food and drink are integral parts of the experience here at Picturehouse with Cafés, Bars and Restaurants in many of the venues, making each cinema an exciting social hub within the communities. https://www.picturehouses.com/cinemas The role We are currently recruiting for a General Manager Designate to work across various London cinemas, with a long term view to place in a site-based General Manager role should one arise. Please note there is a requirement to work 40 hours per week over any of the seven days with regular work at evenings and weekends. We offer a salary of circa £35,000-£40,000 dependant on experience plus bonus opportunities. Office The General Manager Designate will have full mobility across London cinemas. 1 2 Application To apply for this position please send your CV and covering letter to [email protected] with “GMD, London” in the subject line by Friday 31st August 2018 Job Description: General Manager Designate Job Purpose To take overall responsibility for the day to day management of the cinema and to provide leadership to maximise the cinema’s growth and profitability. -

Dementia Friendly Screenings: a Guide for Cinemas a Guide for Cinemas for a Guide

Dementia Friendly Screenings: Screenings: Friendly Dementia Dementia Friendly Screenings: A guide for cinemas A guide for cinemas In partnership with DFS-Guide for cinemas-12-COVER ONLY.indd 1 06/10/2017 12:47 Contents 00 Foreword ............................................................ 1 06 Promoting screenings ....................................... 20 01 Understanding dementia ................................... 3 Getting started – make contact .................... 20 Dementia statistics ............................................4 Advertising the event ...................................... 21 02 What is dementia? ............................................... 5 07 Best practice guidance on delivering 03 First steps to becoming dementia friendly ..... 6 dementia friendly screenings .......................... 22 Understand your audience ............................. 6 Customer arrival to cinema ........................... 22 Conduct an audit ...............................................7 In the cinema .................................................. 23 Support people with dementia Lighting ............................................................ 24 in your venue .................................................... 9 Sound ............................................................... 24 Train your staff to be dementia friendly .........11 Preshow ........................................................... 25 04 How to make your cinema Additional activities ........................................ 26 dementia friendly -

A Report on the Completed Acquisition by Cineworld Group Plc of City Screen Limited

Cineworld Group plc and City Screen Limited A report on the completed acquisition by Cineworld Group plc of City Screen Limited 8 October 2013 Competition Commission 2013 Website: www.competition-commission.org.uk Members of the Competition Commission who conducted this inquiry Alasdair Smith (Chairman of the Group) Rosalind Hedley-Miller Jon Stern John Wotton Chief Executive and Secretary of the Competition Commission David Saunders The Competition Commission has excluded from this published version of the report information which the inquiry group considers should be excluded having regard to the three considerations set out in section 244 of the Enterprise Act 2002 (specified information: considerations relevant to disclosure). The omissions are indicated by []. Some numbers have been replaced by a range. These are shown in square brackets. Non-sensitive wording is also indicated in square brackets. iii Contents Page Summary .............................................................................................................................. 3 Findings ................................................................................................................................ 6 Appendices A Terms of reference and conduct of the inquiry B Financial background C Price-concentration analysis D Customer surveys E Likelihood of entry or expansion F Pricing incentive analysis G Competitive effects H Description of the behavioural remedy proposals Glossary iv Table of contents Page Summary ............................................................................................................................ -

Completed Acquisition by Cineworld Group Plc of City Screen Limited

CINEWORLD/CITY SCREEN MERGER INQUIRY Completed acquisition by Cineworld Group plc of City Screen Limited Provisional findings report Notified: 20 August 2013 The Competition Commission has excluded from this published version of the provisional findings report information which the inquiry group considers should be excluded having regard to the three considerations set out in section 244 of the Enterprise Act 2002 (specified information: considerations relevant to disclosure). The omissions are indicated by []. Some numbers have been replaced by a range. These are shown in square brackets. Non-sensitive wording is also indicated in square brackets. Contents Page Summary .............................................................................................................................. 2 Provisional findings ............................................................................................................... 6 1. The reference .................................................................................................................. 6 2. The companies ................................................................................................................ 6 Cineworld ........................................................................................................................ 6 City Screen Limited ......................................................................................................... 8 3. The merger and the relevant merger situation .............................................................. -

Cinema Subtitling in the UK – a New Way Forward the Problem

Cinema subtitling in the UK – a new way forward The problem The aim of the Technology Challenge Fund is to stimulate innovation in technology that will allow people with hearing loss to have access to an inclusive cinema experience. The ideal solution must: • Allow deaf and hearing-impaired people to have an integrated cinema experience with the wider audience; • Be easy to use for both the cinema and audience member. It must be robust enough to withstand repeated use, and capable of straightforward maintenance and/or be suitable for single use; • Be financially viable for venues to install and use; the solution cannot be prohibitively expensive; • Utilise subtitling files that align with current workstreams and are affordable for film distribution companies; and • Be compatible with existing cinema infrastructure and technology. 2 Technology Challenge Fund The business case Potential audience reach 170.6m 57.8% 73% admissions to UK cinemas of adults in the UK visit of adult cinema-goers will in 2017 the cinema each year visit the cinema at least three times per annum 14.5% 26m £80-100m of the cinema-going audience cinema visits from disabled estimated annual spending power are disabled customers to UK cinemas of disabled adults in the UK per year – potentially major spenders in the entertainment sector 1in 6 2035 50,000 16% (11m) of the UK population it is estimated that this children with hearing loss in the have hearing loss will rise to one in five UK. Around half are born with (15.6m people) by 2035 hearing loss; the other half lose their hearing during childhood 900,000 40% 71% people in the UK have severe of 50+ year olds have of 70+ year olds will develop or profound hearing loss hearing loss hearing loss While UK legislation requires that cinemas make what are called ‘reasonable adjustments’ to enable disabled customers to attend the cinema, it is the application of best practice that underpins all of the work undertaken by the UK Cinema Association and its members in ensuring that the UK sector does all it can to meet the needs of disabled customers. -

Unlimited Card Terms and Conditions Valid from 24.05.2018 Until 09.05.2021 (Inclusive) 1

Unlimited Card Terms and Conditions valid from 24.05.2018 until 09.05.2021 (inclusive) 1. Introduction 1.1 These written terms and conditions (Conditions) and the Privacy Policy apply to the Cineworld Unlimited Card membership scheme and all Unlimited Cards. You will be required to confirm that You (and if You are buying an Unlimited Card for someone else, the Unlimited Member) agree to be bound by these Conditions during the purchase process. Please read them carefully and make sure that You understand them before You register. They do not affect your legal rights. 1.2 Cineworld may change these Conditions at any time as described in clause 10 below. 1.3 These Conditions were last updated 24 May 2018. We recommend that You print and keep a copy of these Conditions for future reference. 1.4 Your agreement with Cineworld You: the person who enters into an Agreement for the purchase of an Unlimited Card. PLEASE NOTE: where you purchase the Unlimited Card for someone else, these Conditions will also apply to them as an Unlimited Member, so please ensure that You have their permission to agree to these Conditions on their behalf. Cineworld/Us: If your residential address is in: (i) the UK or the Channel Islands, the Agreement will be with Cineworld Cinemas Limited, a company registered in England and Wales under company number 01915767 with registered address at 8th Floor Vantage London, Great West Road, Brentford, TW8 9AG, United Kingdom and VAT number 606197048; (ii) the Republic of Ireland, the Agreement will be with Adelphi-Carlton Limited (trading as Cineworld Cinemas), a company registered in the Republic of Ireland under company number 7640 with registered address at 8th Floor, Block E, Iveagh Court, Harcourt Road, Dublin 2, Republic of Ireland and VAT number 8B41247E. -

The Best Place to Watch a Movie

Cineworld Group plc Group Cineworld Annual Report and Accounts 2014 and Accounts Annual Report The best place to watch a movie Annual Report and Accounts 2014 We are a business with a simple philosophy Our Vision… To be the best place to watch a movie Our Strategy is to… 1 Deliver a great cinema experience 4 Be leaders in the industry by for all cinemagoers, every time offering customers the latest audio and visual technology 2 Continue to expand our estate and look for profitable opportunities 5 Drive shareholders value by to grow delivering our growth plans in an efficient and effective way 3 Ensure that we enhance our existing estate so we deliver a consistent level of quality across the Group Contents Strategic Report Governance Financial Statements 1 Highlights 32 Directors 73 Consolidated Statement 2 At a Glance 34 Corporate Governance Statement of Profit or Loss 4 Chairman’s Statement 34 Chairman’s Introduction 74 Consolidated Statement of 35 Compliance Statement 10 Market Overview Other Comprehensive Income 36 Leadership 12 Business Model 75 Consolidated Statement 37 Effectiveness of Financial Position 14 Strategy and KPIs 38 Nomination Committee Report 76 Consolidated Statement 16 Resources and Relationships Accountability 39 of Changes in Equity 18 Chief Executive Officer’s Review 40 Audit Committee Report 77 Consolidated Statement 26 Risks and Uncertainties 44 Remuneration Committee Relations with Shareholders of Cash Flows 30 Corporate Responsibility 44 45 Directors’ Remuneration Report 78 Notes to the Consolidated 46 Annual