A Report on the Completed Acquisition by Cineworld Group Plc of City Screen Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Cinema Media Guide 2017

Second Edition THE CINEMA MEDIA GUIDE 2017 1 WELCOME TO OUR WORLD CONTENTS. Our vision 1 ABC1 Adults 41 Foreword 2 War for the Planet of the Apes 43 Fast facts 3 Dunkirk 44 The cinema audience 5 American Made 45 The WOW factor 6 Victoria and Abdul 46 Cinema’s role in the media mix 7 Goodbye Christopher Robin 47 Building Box Office Brands 8 Blade Runner 2049 48 The return on investment 9 The Snowman 49 How to buy 11 Murder on the Orient Express 50 Buying routes 12 Suburbicon 51 Optimise your campaign 16 16-34 Men 53 Sponsorship opportunities 17 Spider-Man: Homecoming 55 The production process 19 Atomic Blonde 56 Our cinemas 21 The Dark Tower 57 Our cinema gallery 22 Kingsman: The Golden Circle 58 Cineworld 23 Thor: Ragnarok 59 ODEON 24 Justice League 60 Vue 25 16-34 Women 61 Curzon Cinemas 26 The Beguiled 63 Everyman Cinemas 27 It 64 Picturehouse Cinemas 28 Flatliners 65 Independents 29 A Bad Mom’s Christmas 66 2017 films by audience Mother! 67 Coming soon to a cinema near you 31 Pitch Perfect 3 68 Adults 33 Main Shoppers with Children 69 Valerian and the City of Cars 3 71 a Thousand Planets 35 Captain Underpants: The First Epic Movie 72 Battle of the Sexes 36 The LEGO Ninjago Movie 73 Paddington 2 37 My Little Pony: The Movie 74 Daddy’s Home 2 38 Ferdinand 75 Star Wars: The Last Jedi 39 Coming in 2018 77 Jumanji: Welcome to the Jungle 40 OUR VISION. FOREWORD. -

A Filmmakers' Guide to Distribution and Exhibition

A Filmmakers’ Guide to Distribution and Exhibition A Filmmakers’ Guide to Distribution and Exhibition Written by Jane Giles ABOUT THIS GUIDE 2 Jane Giles is a film programmer and writer INTRODUCTION 3 Edited by Pippa Eldridge and Julia Voss SALES AGENTS 10 Exhibition Development Unit, bfi FESTIVALS 13 THEATRIC RELEASING: SHORTS 18 We would like to thank the following people for their THEATRIC RELEASING: FEATURES 27 contribution to this guide: PLANNING A CINEMA RELEASE 32 NON-THEATRIC RELEASING 40 Newton Aduaka, Karen Alexander/bfi, Clare Binns/Zoo VIDEO Cinemas, Marc Boothe/Nubian Tales, Paul Brett/bfi, 42 Stephen Brown/Steam, Pamela Casey/Atom Films, Chris TELEVISION 44 Chandler/Film Council, Ben Cook/Lux Distribution, INTERNET 47 Emma Davie, Douglas Davis/Atom Films, CASE STUDIES 52 Jim Dempster/bfi, Catharine Des Forges/bfi, Alnoor GLOSSARY 60 Dewshi, Simon Duffy/bfi, Gavin Emerson, Alexandra FESTIVAL & EVENTS CALENDAR 62 Finlay/Channel 4, John Flahive/bfi, Nicki Foster/ CONTACTS 64 McDonald & Rutter, Satwant Gill/British Council, INDEX 76 Gwydion Griffiths/S4C, Liz Harkman/Film Council, Tony Jones/City Screen, Tinge Krishnan/Disruptive Element Films, Luned Moredis/Sgrîn, Méabh O’Donovan/Short CONTENTS Circuit, Kate Ogborn, Nicola Pierson/Edinburgh BOXED INFORMATION: HOW TO APPROACH THE INDUSTRY 4 International Film Festival, Lisa Marie Russo, Erich BEST ADVICE FROM INDUSTRY PROFESSIONALS 5 Sargeant/bfi, Cary Sawney/bfi, Rita Smith, Heather MATERIAL REQUIREMENTS 5 Stewart/bfi, John Stewart/Oil Factory, Gary DEALS & CONTRACTS 8 Thomas/Arts Council of England, Peter Todd/bfi, Zoë SHORT FILM BUREAU 11 Walton, Laurel Warbrick-Keay/bfi, Sheila Whitaker/ LONDON & EDINBURGH 16 article27, Christine Whitehouse/bfi BLACK & ASIAN FILMS 17 SHORT CIRCUIT 19 Z00 CINEMAS 20 The editors have made every endeavour to ensure the BRITISH BOARD OF FILM CLASSIFICATION 21 information in this guide is correct at the time of GOOD FILMS GOOD PROGRAMMING 22 going to press. -

February's Films

Hello all, Happy New Year everyone! Here are our films for the end of January and February 2017. January’s films Sing at selected ODEON cinemas* on Sunday 29th January at 10:15am. Please note ODEON’s new start time. ODEON* trial screenings for older audiences: La La Land (12A) on Monday 30th January at 6pm. This is at nine selected cinemas**. Please check our website for updates. Storks at selected Vue cinemas on Sunday 29th January at 10:15am. Please note Vue’s new starting time. ___ February’s films Sing at selected Cineworld cinemas on Sunday 5th February at 11am. Sing at selected Showcase cinemas on Sunday 12th February at 10am. The LEGO Batman Movie at selected ODEON cinemas* on Sunday 26th February at 10:15am. Please note ODEON’s new start time. ODEON* trial screenings for older audiences: The Great Wall (12A) on Monday 27th February at 6pm. This is at nine selected cinemas**. Please check our website for updates. Trolls at selected Vue cinemas on Sunday 26th February at 10:15am. Please note Vue’s new starting time. ___ As always, adjustments will be in place for all of the screenings. These include: lights being left on low, no adverts, lower sound levels, people being able to move around the cinema and able to take their own food. Please note: *ODEON tickets may be subject to a £1 Blockbuster charge if the film is a new release. **Please remember ODEON’s trial of Autism Friendly Screenings for older audiences are screened at 6pm on the Monday following ODEON’s usual Autism Friendly Screening, at nine cinemas selected to run the trial. -

Thesis Final S R Perrin Pdf Version 1.Pdf

A critical analysis of the effect of copyright infringement on the UK film and cinema industries Stephen R Perrin Submitted in partial fulfilment for the degree LLM by Research School of Law University of Sheffield September 2017 ABSTRACT Film studios and major cinema operators strongly contend that copyright infringement, commonly known as piracy, is costing the worldwide industry many billions of dollars in lost revenue. A number of senior industry figures, as well as other commentators, foresee the industry’s slow death due to illegal consumption. Consequently, for the past two decades the industry has lobbied governments and legislators to provide legislation that restricts illegal online access to their product. During this period, however, the industry has witnessed significant growth in worldwide box office returns, admissions, film production investment and in the number and quality of cinema available for the exhibition of films. These two observations appear to be at odds. Arguing that film, and especially cinemas, provide socio-cultural as well as economic benefits, this thesis critically examines the industry and academic evidence pointing to the quantum of revenue loss, as well as academic evidence examining the effectiveness of the legal measures that the industry has been successful in establishing. The thesis reaches two conclusions. First, the equivocal nature of research findings regarding revenue losses suggests that estimates of infringement revenue effects appear to have been overstated. Second, the effectiveness of legal measures appears to be in doubt, with any positive effects being short-lived. However, it is argued that the equivocality of the evidence does not permit the counterfactual conclusion that the industry is totally unaffected by copyright infringement, or that legal measures are totally ineffective. -

BULLETIN Vol 50 No 1 January / February 2016

CINEMA THEATRE ASSOCIATION BULLETIN www.cta-uk.org Vol 50 No 1 January / February 2016 The Regent / Gaumont / Odeon Bournemouth, visited by the CTA last October – see report p8 An audience watching Nosferatu at the Abbeydale Sheffield – see Newsreel p28 – photo courtesy Scott Hukins FROM YOUR EDITOR CINEMA THEATRE ASSOCIATION (founded 1967) You will have noticed that the Bulletin has reached volume 50. How- promoting serious interest in all aspects of cinema buildings —————————— ever, this doesn’t mean that the CTA is 50 years old. We were found- Company limited by guarantee. Reg. No. 04428776. ed in 1967 so our 50th birthday will be next year. Special events are Registered address: 59 Harrowdene Gardens, Teddington, TW11 0DJ. planned to mark the occasion – watch this space! Registered Charity No. 1100702. Directors are marked ‡ in list below. A jigsaw we bought recently from a charity shop was entitled Road —————————— PATRONS: Carol Gibbons Glenda Jackson CBE Meets Rail. It wasn’t until I got it home that I realised it had the As- Sir Gerald Kaufman PC MP Lucinda Lambton toria/Odeon Southend in the background. Davis Simpson tells me —————————— that the dome actually belonged to Luker’s Brewery; the Odeon be- ANNUAL MEMBERSHIP SUBSCRIPTIONS ing built on part of the brewery site. There are two domes, marking Full Membership (UK) ................................................................ £29 the corners of the site and they are there to this day. The cinema Full Membership (UK under 25s) .............................................. £15 Overseas (Europe Standard & World Economy) ........................ £37 entrance was flanked by shops and then the two towers. Those Overseas (World Standard) ........................................................ £49 flanking shops are also still there: the Odeon was demolished about Associate Membership (UK & Worldwide) ................................ -

Und Übernahmegesetz Aktionäre Der Cinemaxx Ak

Pflichtveröffentlichung gemäß §§ 34, 14 Absätze 2 und 3 Wertpapiererwerbs- und Übernahmegesetz Aktionäre der CinemaxX Aktiengesellschaft, insbesondere mit Wohnsitz, Sitz oder gewöhnlichem Aufenthalt außerhalb der Bundesrepublik Deutschland, sollten die Hinweise in Abschnitt 1 "Allgemeine Hinweise zur Durchführung des Angebots, insbesondere für Aktionäre mit Wohnsitz, Sitz oder gewöhnlichem Aufenthalt außerhalb der Bundesrepublik Deutschland" auf den Seiten 5 bis 7 sowie im Abschnitt 21 "Zusätzliche Hinweise für US-Aktionäre" auf Seite 60 besonders beachten. ANGEBOTSUNTERLAGE Freiwilliges öffentliches Übernahmeangebot (Barangebot) der Vue Beteiligungs AG An der Welle 3, 60322 Frankfurt am Main, Deutschland an die Aktionäre der CinemaxX Aktiengesellschaft Valentinskamp 18-20, 20354 Hamburg, Deutschland zum Erwerb ihrer auf den Inhaber lautenden Stückaktien der CinemaxX Aktiengesellschaft gegen Zahlung einer Geldleistung in Höhe von EUR 6,45 je Aktie Annahmefrist: 06. August 2012 bis 03. September 2012, 24:00 Uhr Börsennotierte Aktien der CinemaxX Aktiengesellschaft: International Securities Identification Number ("ISIN") DE0005085708 / Wertpapierkennnummer ("WKN") 508570 Nicht börsennotierte Aktien der CinemaxX Aktiengesellschaft: ISIN DE0005155154 / WKN 515515 Zum Verkauf eingereichte börsennotierte Aktien der CinemaxX Aktiengesellschaft: ISIN DE000A1PG4W5 / WKN A1P G4W Zum Verkauf eingereichte nicht börsennotierte Aktien der CinemaxX Aktiengesellschaft: ISIN DE000A1PG441 / WKN A1P G44 Nachträglich zum Verkauf eingereichte börsennotierte -

Cineworld/City Screen Merger Inquiry

APPENDIX A Terms of reference and conduct of the inquiry Terms of reference 1. On 30 April 2013, the OFT sent the following reference to the CC: 1. In exercise of its duty under section 22(1) of the Enterprise Act 2002 (‘the Act’) to make a reference to the Competition Commission (‘the CC’) in relation to a completed merger the Office of Fair Trading (‘the OFT’) believes that it is or may be the case that – a. a relevant merger situation has been created in that: i. enterprises carried on by or under the control of Cineworld Group plc have ceased to be distinct from enterprises carried on by or under the control of City Screen Limited; and ii. the condition specified in section 23(4) of the Act is satisfied; and b. the creation of that situation has resulted, or may be expected to result in a substantial lessening of competition within any market or markets in the UK for goods or services, including the supply of film services. 2. Therefore, in exercise of its duty under section 22 of the Act, the OFT hereby refers to the CC, for investigation and report within a period ending on 14 October 2013, on the following questions in accordance with section 35 of the Act— a. whether a relevant merger situation has been created; and b. if so, whether the creation of that situation has resulted, or may be expected to result, in a substantial lessening of competition within any market or markets in the UK for goods and services. -

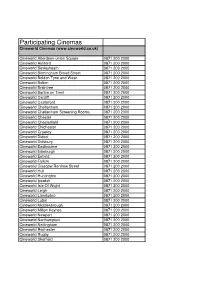

Participating Cinemas 2013 Excel

Participating Cinemas Cineworld Cinemas (www.cineworld.co.uk) Cineworld Aberdeen-union Square 0871 200 2000 Cineworld Ashford 0871 200 2000 Cineworld Bexleyheath 0871 200 2000 Cineworld Birmingham Broad Street 0871 200 2000 Cineworld Boldon Tyne and Wear 0871 200 2000 Cineworld Bolton 0871 200 2000 Cineworld Braintree 0871 200 2000 Cineworld Burton on Trent 0871 200 2000 Cineworld Cardiff 0871 200 2000 Cineworld Castleford 0871 200 2000 Cineworld Cheltenham 0871 200 2000 Cineworld Cheltenham Screening Rooms 0871 200 2000 Cineworld Chester 0871 200 2000 Cineworld Chesterfield 0871 200 2000 Cineworld Chichester 0871 200 2000 Cineworld Crawley 0871 200 2000 Cineworld Didcot 0871 200 2000 Cineworld Didsbury 0871 200 2000 Cineworld Eastbourne 0871 200 2000 Cineworld Edinburgh 0871 200 2000 Cineworld Enfield 0871 200 2000 Cineworld Falkirk 0871 200 2000 Cineworld Glasgow Renfrew Street 0871 200 2000 Cineworld Hull 0871 200 2000 Cineworld Huntington 0871 200 2000 Cineworld Ipswich 0871 200 2000 Cineworld Isle Of Wight 0871 200 2000 Cineworld Leigh 0871 200 2000 Cineworld Llandudno 0871 200 2000 Cineworld Luton 0871 200 2000 Cineworld Middlesbrough 0871 200 2000 Cineworld Milton Keynes 0871 200 2000 Cineworld Newport 0871 200 2000 Cineworld Northampton 0871 200 2000 Cineworld Nottingham 0871 200 2000 Cineworld Rochester 0871 200 2000 Cineworld Rugby 0871 200 2000 Cineworld Sheffield 0871 200 2000 Cineworld Shrewbury 0871 200 2000 Cineworld Solihull 0871 200 2000 Cineworld St Helens 0871 200 2000 Cineworld Stevenage 0871 200 2000 Cineworld Wakefield -

Exhibition, Authenticity, and Film Audiences at the Prince Charles Cinema

. Volume 13, Issue 1 May 2016 ‘Watch like a grown up … enjoy like a child’: Exhibition, authenticity, and film audiences at the Prince Charles Cinema Richard McCulloch, University of Huddersfield, UK Virginia Crisp, Coventry University, UK Abstract: It is tempting to view the rise of event-led cinema as a symptom of shifting audience preferences – the inevitable result of cinemagoers increasingly seeking out ‘immersive’, ‘participatory’ and ‘experiential’ film screenings. The research presented within this particular article aimed to explore the appeal of such screenings by focusing on audiences at the Prince Charles Cinema (PCC) in London – a venue that is widely known for hosting sing- alongs, quote-alongs, and other participatory events. Our results, however, were surprising. Respondents to our questionnaire readily subscribed to a form of cinephilia that embraces a wide variety of tastes, but largely rejects participatory aspects of event-led cinema in favour of what they deemed to be a more authentic cinematic experience. Audiences repeatedly emphasised the superiority of the silent, reverential film screening, and many felt that the PCC’s greatest quality was the way in which it reminded them of how cinemas used to be, not what they might one day become. Ultimately, the article demonstrates that cinematic events are by no means the only option available to audiences who crave alternatives to ‘mainstream’ cinemas. We call for a reconsideration of the immersive and experiential dimensions of traditional cinemagoing, and a greater emphasis on the viewing conditions that facilitate an affective bond between audience and film. To us, the search for alternative cinema experiences seems to be more about the desire for cinema to get better at what it already does, not for it to change into something entirely different. -

Modern Slavery and Human Trafficking Statement

Modern Slavery and Human Trafficking Statement This statement, made in accordance with section 54 of the Modern Slavery Act 2015, sets out the policies adopted and steps taken by Vue International to: • assess the risk of modern slavery or human trafficking occurring within our business or supply chain; • prevent any instances of modern slavery or human trafficking occurring within our own business; and • ensure that every supplier with whom we do business is taking appropriate steps to ensure that modern slavery or human trafficking does not occur within their business (or their own supply chain). In this statement, the term “Vue International” refers to Vue International Holdco Limited and all of its subsidiaries. Our business, structure and supply chain Vue International is one of the world's leading cinema operators, managing a number of the most respected brands in major European markets and Taiwan, spanning nine countries, 226 sites and 1,980 screens (as at July 2020). Vue International has leading positions in the United Kingdom, Ireland, Germany, Denmark, the Netherlands, Italy, Poland, Lithuania and Taiwan. Each of our brands operates as a separate business unit, with local management in each jurisdiction reporting to the Vue International head office located in London. Our suppliers and contractors include providers of food, drinks, uniforms, technical equipment, cleaning and facilities management services, property maintenance and construction services, and other professional service providers (such as architects, lawyers, accountants and auditors). Vue International policy statement Vue International does not and will not tolerate modern slavery or human trafficking in any aspect of our business, and expects its suppliers to uphold the same zero-tolerance standard (regardless of the nature, scale or jurisdiction of their business). -

1468-Q-171031 Pre-Feasibility Study Proposal.Docx

Tenterden Cinema Proposal to Tenterden Town Council for carrying out a Pre-feasibility Study and Site Options Appraisal by Ron Inglis of Craigmount Consulting Stefanie Fischer of Burrell Foley Fischer LLP Chris Goucher of Greenwood Projects 31 October 2017 1468-Q-171031 Pre-feasibility Study Proposal.docx 1 General Information 1.1 Introduction Cinema and arts consultant Ron Inglis (Craigmount Consulting), architect Stefanie Fischer (Burrell Foley Fischer LLP) and Quantity Surveyor, Chris Goucher of Greenwood Projects are pleased to submit proposals for the pre-feasibility study and site options appraisal for the Tenterden cinema. It is envisaged that Craigmount Consulting, Burrell Foley Fischer LLP and Greenwood Projects would can be directly appointed under separate contracts, but the proposals for services and fees are linked in terms of methodology. Together we bring a wealth of experience from many cinema, multi-arts and media venue developments as well as extensive expertise in the cinema and media sectors. Capital developments which we have worked on, or continue to work on, include: • Shetland cinema and music venue – 2 screen digital cinema and live performance venue with associated facilities. • * Scala Cinema & Arts Centre, Prestatyn, North Wales – opened February 2009. 2 screen digital cinema with live performance capabilities. • Kino, Hawkhurst – The first all-digital cinema in the UK. Single screen with café bar. • Harbour Lights, Southampton – 2 screen cinema. • Stratford East Picturehouse, London – 4 screen cinema and restaurant. • Ciné Lumière, Institut Français, London – redevelopment of specialist cinema. • * Limerick Film & Media Centre – Pre-feasibility and feasibility study for 3 screen specialist cinema and education facilities. • Broadway, Nottingham’s Media Centre. -

Media Group Plc

MEDIA GROUP PLC Everyman Media Group PLC Cover.indd 1 09/10/2013 10:21 THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt about the contents of this document or as to what action you should take, you are recommended immediately to seek your own financial advice from your stockbroker, bank manager, solicitor or other independent adviser who specialises in advising on the acquisition of shares and other securities and is authorised under the Financial Services and Markets Act 2000 (as amended) (“FSMA”) if you are resident in the UK or, if you are not resident in the UK, from another authorised independent adviser. The whole of this document should be read. Yo u r attention is drawn in particular to the section entitled “Risk Factors” in Part II of this document that describes certain risks associated with an investment in the Company. The Directors of Everyman Media Group plc (the “Company”), whose names, business addresses and functions appear on page 7 of this document, and the Company accept responsibility, individually and collectively, in accordance with the AIM Rules for Companies (“AIM Rules”), for the information contained in this document. To the best of the knowledge and belief of the Directors and the Company (who have taken all reasonable care to ensure that such is the case), the information contained in this document is in accordance with the facts and does not omit anything likely to affect the import of such information. This document, which comprises an admission document drawn up in accordance with the AIM Rules, has been issued in connection with the proposed admission of the issued Ordinary Shares to trading on AIM, a market operated by the London Stock Exchange plc (“AIM”).