Section Name: Employee Relations Effective Date: January 1, 2021 Section Number: 400 Policy Number: 453

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Quick Guide – DSP & Supervisor Increases Effective January 1, 2021

NJ Department of Human Services Division of Developmental Disabilities Quick Guide – DSP & Supervisor Increases Effective January 1, 2021 Service Service Procedure FY20 FY21 FY21 Rate FY21 FY21 Rate Description / Tier Code Rate Rate Total Rate DSP Supervisor Increase Increase Increase Career Planning Career Planning H2014HI 13.83 14.25 0.42 0.31 0.11 Community Tier A H2015HIU1 2.54 2.63 0.09 0.07 0.02 Inclusion Services Tier B H2015HIU2 3.23 3.35 0.12 0.09 0.03 Tier C H2015HIU3 4.00 4.14 0.14 0.10 0.04 Tier D H2015HIU4 5.93 6.14 0.21 0.16 0.05 Tier E H2015HIU5 7.87 8.15 0.28 0.21 0.07 Tier F H2015HIU7 11.80 12.22 0.42 0.31 0.11 Community-Based CBS H2021HI 7.41 7.83 0.42 0.31 0.11 Supports CBS (Acuity) H2021HI22 12.43 12.85 0.42 0.31 0.11 Day Habilitation Tier A T2021HIUS 2.54 2.63 0.09 0.07 0.02 Tier A/Acuity T2021HIU1 3.67 3.75 0.08 0.06 0.02 Differentiated Tier B T2021HIUR 3.23 3.35 0.12 0.09 0.03 Tier B /Acuity T2021HIU2 4.67 4.78 0.11 0.08 0.03 Differentiated Tier C T2021HIUQ 4.00 4.14 0.14 0.10 0.04 Tier C/Acuity T2021HIU3 5.78 5.92 0.14 0.10 0.04 Differentiated Tier D T2021HIUP 5.93 6.14 0.21 0.16 0.05 Tier D/Acuity T2021HIU4 8.56 8.77 0.21 0.16 0.05 Differentiated Tier E T2021HIUN 7.87 8.15 0.28 0.21 0.07 Tier E/Acuity T2021HIU5 11.36 11.64 0.28 0.21 0.07 Differentiated Tier F T2021HI22 11.80 12.22 0.42 0.31 0.11 Tier F/Acuity T2021HIU7 17.04 17.46 0.42 0.31 0.11 Differentiated Individual Supports Individual H2016HI 7.41 7.83 0.42 0.31 0.11 Supports Individual H2016HI22 12.43 12.87 0.44 0.33 0.11 Supports Acuity Tier A H2016HI52 -

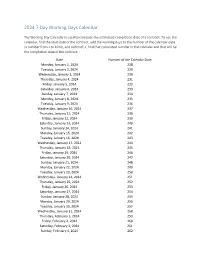

2024 7 Day Working Days Calendar

2024 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Monday, January 1, 2024 228 Tuesday, January 2, 2024 229 Wednesday, January 3, 2024 230 Thursday, January 4, 2024 231 Friday, January 5, 2024 232 Saturday, January 6, 2024 233 Sunday, January 7, 2024 234 Monday, January 8, 2024 235 Tuesday, January 9, 2024 236 Wednesday, January 10, 2024 237 Thursday, January 11, 2024 238 Friday, January 12, 2024 239 Saturday, January 13, 2024 240 Sunday, January 14, 2024 241 Monday, January 15, 2024 242 Tuesday, January 16, 2024 243 Wednesday, January 17, 2024 244 Thursday, January 18, 2024 245 Friday, January 19, 2024 246 Saturday, January 20, 2024 247 Sunday, January 21, 2024 248 Monday, January 22, 2024 249 Tuesday, January 23, 2024 250 Wednesday, January 24, 2024 251 Thursday, January 25, 2024 252 Friday, January 26, 2024 253 Saturday, January 27, 2024 254 Sunday, January 28, 2024 255 Monday, January 29, 2024 256 Tuesday, January 30, 2024 257 Wednesday, January 31, 2024 258 Thursday, February 1, 2024 259 Friday, February 2, 2024 260 Saturday, February 3, 2024 261 Sunday, February 4, 2024 262 Date Number of the Calendar Date Monday, February 5, 2024 263 Tuesday, February 6, 2024 264 Wednesday, February -

State Daily Infections Per 100K Effective Dates

Chicago Emergency Travel Order State by State List The list is updated every other Tuesday and goes into effect the following Friday at 12:01 a.m. Daily Infections Effective Dates – Effective Dates – State Per 100k Red List Orange List December 14 – January January 11 – 10 Arizona November 13 – December 95.6 13 January 1 – January 10 January 11 – South Carolina November 13 – December 83.6 31 December 4 – January January 11 – 10 Rhode Island November 13 – December 71.4 3 January 1 – January 10 January 11 – Georgia November 13 – December 68.5 31 January 1 – January 10 January 11 – New York November 13 – December 67.9 31 December 14 – January January 11 – 10 Kentucky November 13 – December 63.7 13 December 4 – January January 11 – 10 Oklahoma November 13 – December 63.4 3 December 14 – January January 11 – 10 Delaware November 13 – December 62.8 13 January 1 – January 10 January 11 – North Carolina November 13 – December 62.4 31 December 14 – January January 11 – Arkansas 61.3 10 November 13 – December 13 December 14 – January January 11 – 10 California November 13 – December 60.3 13 January 1 – January 10 January 11 – Texas November 20 – December 60.2 31 December 14 – January 11 – December 31 Connecticut November 13 – December 57.7 13 December 14 – January January 11 – 10 New Hampshire November 20 – December 57.5 13 December 14 – January January 11 – 10 Massachusetts November 13 – December 57.2 13 January 1 – January 10 January 11 – New Jersey November 13 – December 57.2 31 November 13 – January January 11 – Utah 56 10 December 14 –January -

Monday, April 5, 2021

Monday, April 5, 2021 WHERE WE ARE TODAY 3 April 5, 2021 OUR PROGRESS ON VACCINATIONS 4 # DC residents partially or fully vaccinated January 1 5,846 February 1 40,839 March 1 74,811 April 1 162,669 (Apr 2) Data source: DC Health, using received data through 4/2/2021. Data subject to change. April 5, 2021 5 We have more work to do to get all residents vaccinated. Make sure you’re signed up to get your COVID-19 shot. Go to: Call: vaccinate.dc.gov 1-855-363-0333 April 5, 2021 PRE-REGISTRATION SNAPSHOT 6 Approximately 190,621 people have pre-registered for a vaccination appointment and are awaiting an appointment. April 5, 2021 7 If you pre-registered for a vaccination appointment but already received your vaccine elsewhere you can email [email protected] to remove yourself from the pre-registration list. April 5, 2021 NEW AND UPCOMING CLINICS 8 This week, the vaccine clinic at the Convention Center will expand through a partnership with Safeway. Appointment invitations will be sent on April 6. On Friday, April 9, a new high-capacity vaccination site will open at Arena Stage. The site will be operated in partnership with DC Health and MedStar Health. Appointments will be made through vaccinate.dc.gov and the District’s call center. April 5, 2021 THE PATH FORWARD FIVE FACTORS DETERMINING AN ACTIVITY’S RE-OPEN POTENTIAL 10 1. MASKS - Can and is the activity completed with or without wearing a mask? Highest Risk Unmasked, Indoors, Long Time, Very Dense 2. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

Printable 2023-2024 Calendar

LINCOLN MEMORIAL UNIVERSITY Undergraduate Academic Calendar 2023 - 2024 Official University Holidays (Offices closed/no classes): 2023: September 4; November 22 - 24; December 25-29 2024: January 1; March 29; May 27 and July 4. Faculty/Staff Conference Week: August 7-11 Fall Semester 2023 – 76 class days – 5 exam days Final Registration before classes begin ........................................ August 10 Welcome Weekend ...................................................................... August 10 Matriculation Ceremony (2 p.m.) ................................................. August 10 Residence halls open (8 a.m.) ...................................................... August 13 Classes begin ................................................................................ August 14 Last day to complete registration/add classes ............................... August 23 Labor Day (no classes, residence halls remain open) ............... September 4 Last day to drop course without “WD” ............................ September 11 Mid-term ............................................................................... October 9 - 13 Homecoming (classes held as scheduled) ............................. October 12-15 Last day to drop course without “F” ..................................... October 20 Early registration begins ............................................................. October 30 Thanksgiving holiday (no classes) .................................. November 22 - 24 Residence halls open (1 p.m.) .................................................November -

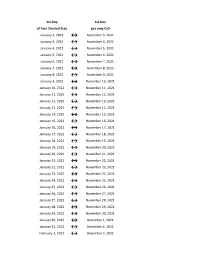

Flex Dates.Xlsx

1st Day 1st Day of Your Desired Stay you may Call January 2, 2022 ↔ November 3, 2021 January 3, 2022 ↔ November 4, 2021 January 4, 2022 ↔ November 5, 2021 January 5, 2022 ↔ November 6, 2021 January 6, 2022 ↔ November 7, 2021 January 7, 2022 ↔ November 8, 2021 January 8, 2022 ↔ November 9, 2021 January 9, 2022 ↔ November 10, 2021 January 10, 2022 ↔ November 11, 2021 January 11, 2022 ↔ November 12, 2021 January 12, 2022 ↔ November 13, 2021 January 13, 2022 ↔ November 14, 2021 January 14, 2022 ↔ November 15, 2021 January 15, 2022 ↔ November 16, 2021 January 16, 2022 ↔ November 17, 2021 January 17, 2022 ↔ November 18, 2021 January 18, 2022 ↔ November 19, 2021 January 19, 2022 ↔ November 20, 2021 January 20, 2022 ↔ November 21, 2021 January 21, 2022 ↔ November 22, 2021 January 22, 2022 ↔ November 23, 2021 January 23, 2022 ↔ November 24, 2021 January 24, 2022 ↔ November 25, 2021 January 25, 2022 ↔ November 26, 2021 January 26, 2022 ↔ November 27, 2021 January 27, 2022 ↔ November 28, 2021 January 28, 2022 ↔ November 29, 2021 January 29, 2022 ↔ November 30, 2021 January 30, 2022 ↔ December 1, 2021 January 31, 2022 ↔ December 2, 2021 February 1, 2022 ↔ December 3, 2021 1st Day 1st Day of Your Desired Stay you may Call February 2, 2022 ↔ December 4, 2021 February 3, 2022 ↔ December 5, 2021 February 4, 2022 ↔ December 6, 2021 February 5, 2022 ↔ December 7, 2021 February 6, 2022 ↔ December 8, 2021 February 7, 2022 ↔ December 9, 2021 February 8, 2022 ↔ December 10, 2021 February 9, 2022 ↔ December 11, 2021 February 10, 2022 ↔ December 12, 2021 February -

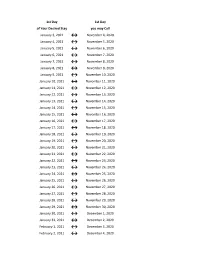

Flex Dates.Xlsx

1st Day 1st Day of Your Desired Stay you may Call January 3, 2021 ↔ November 4, 2020 January 4, 2021 ↔ November 5, 2020 January 5, 2021 ↔ November 6, 2020 January 6, 2021 ↔ November 7, 2020 January 7, 2021 ↔ November 8, 2020 January 8, 2021 ↔ November 9, 2020 January 9, 2021 ↔ November 10, 2020 January 10, 2021 ↔ November 11, 2020 January 11, 2021 ↔ November 12, 2020 January 12, 2021 ↔ November 13, 2020 January 13, 2021 ↔ November 14, 2020 January 14, 2021 ↔ November 15, 2020 January 15, 2021 ↔ November 16, 2020 January 16, 2021 ↔ November 17, 2020 January 17, 2021 ↔ November 18, 2020 January 18, 2021 ↔ November 19, 2020 January 19, 2021 ↔ November 20, 2020 January 20, 2021 ↔ November 21, 2020 January 21, 2021 ↔ November 22, 2020 January 22, 2021 ↔ November 23, 2020 January 23, 2021 ↔ November 24, 2020 January 24, 2021 ↔ November 25, 2020 January 25, 2021 ↔ November 26, 2020 January 26, 2021 ↔ November 27, 2020 January 27, 2021 ↔ November 28, 2020 January 28, 2021 ↔ November 29, 2020 January 29, 2021 ↔ November 30, 2020 January 30, 2021 ↔ December 1, 2020 January 31, 2021 ↔ December 2, 2020 February 1, 2021 ↔ December 3, 2020 February 2, 2021 ↔ December 4, 2020 1st Day 1st Day of Your Desired Stay you may Call February 3, 2021 ↔ December 5, 2020 February 4, 2021 ↔ December 6, 2020 February 5, 2021 ↔ December 7, 2020 February 6, 2021 ↔ December 8, 2020 February 7, 2021 ↔ December 9, 2020 February 8, 2021 ↔ December 10, 2020 February 9, 2021 ↔ December 11, 2020 February 10, 2021 ↔ December 12, 2020 February 11, 2021 ↔ December 13, 2020 -

MLN Connects for Thursday, January 21, 2021

Thursday, January 21, 2021 News • Hospital IPPS: FAQs on Market-Based MS-DRG Relative Weights • MLN Web-Based Training: Complete Training & Save Certificates by January 31 • Intensity-Modulated Radiation Therapy: Comparative Billing Report in January • 2020 MIPS Extreme & Uncontrollable Circumstances Exception Application: Deadline February 1 • Give Flu Shots through January & Beyond Compliance • SNF 3-Day Rule: Bill Correctly Events • COVID-19 Listening Sessions with CMS Office of Minority Health — January 22, 26, & 28 • Physicians, Nurses & Allied Health Professionals Open Door Forum — January 27 Claims, Pricers, & Codes • ESRD Facilities: Machine Reported Dialysis Treatment Time on the 072X Bill Type • Therapy Claims: Reprocessing Dates of Service from January 1 through February 15 • Home Health RAP Workaround MLN Matters® Articles • Implementation of Changes in the End-Stage Renal Disease (ESRD) Prospective Payment System (PPS) and Payment for Dialysis Furnished for Acute Kidney Injury (AKI) in ESRD Facilities for Calendar Year (CY) 2021 — Revised Multimedia • Quality Reporting Programs: From Data Elements to Quality Measures Web-Based Training • Section M: Assessment and Coding of Pressure Ulcers & Injuries Web-Based Training News Hospital IPPS: FAQs on Market-Based MS-DRG Relative Weights On January 15, CMS released a series of FAQs on the market-based Medicare Severity Diagnosis Related Group (MS-DRG) relative weight data collection policy. We issued this policy in the FY 2021 hospital Inpatient Prospective Payment System (IPPS) final rule. While we believe that hospitals currently have the capacity to report this data on the Medicare cost report, these FAQs provide acceptable approaches to calculate and report median payer-specific negotiated charges by MS-DRG for reporting periods ending on or after January 1, 2021. -

Spring 2021 Academic Calendar

Spring 2022 Academic Calendar Payment Deadlines Regular 16-week Term January 11 Payment deadline. All students (undergraduate and graduate) who have not paid, or made payment arrangements, by 5 p.m. on this date will be charged a $100 LATE fee. January 27 All students (undergraduate and graduate) who have not made payment arrangements by 5 p.m. on this date will be charged $100 LATE fee. February 2 Students who are still unpaid at 5 p.m. on this date will be removed from their 16-week classes. (Census) First 8-week Term (B5) January 11 Payment deadline for courses in the First 8-week term. All students (undergraduate and graduate) who have not made payment arrangements by 5 p.m. on this date will be charged $100 LATE fee. January 25 All students (undergraduate and graduate) who have not made payment arrangements by 5 p.m. on (Census) this date will be charged a $100 LATE fee and will be removed from their First 8-week classes Second 8-week Term (B6) March 15 Payment deadline for courses in the Second 8-week term. All students (undergraduate and graduate) who have not made payment arrangements by 5 p.m. on this date will be charged $100 LATE fee. March 28 All students (undergraduate and graduate) who have not made payment arrangements by 5 p.m. on (Census) this date will be charged a $100 LATE fee and will be removed from their Second 8-week classes Calendar November 1, 2021 Spring 2022 registration begins. December 24–26 Winter Holiday. -

2018 - 2019 Days of Rotation Calendar

2018 - 2019 DAYS OF ROTATION CALENDAR Day # Date Rotation Day Type Notes Day # Date Rotation Day Type Notes Saturday, October 13, 2018 Sunday, October 14, 2018 Monday, September 3, 2018 Holiday/Vaca Labor Day 27 Monday, October 15, 2018 Day 3 In Session 1 Tuesday, September 4, 2018 Day 1 In Session 28 Tuesday, October 16, 2018 Day 4 In Session 2 Wednesday, September 5, 2018 Day 2 In Session 29 Wednesday, October 17, 2018 Day 5 In Session 3 Thursday, September 6, 2018 Day 3 In Session 30 Thursday, October 18, 2018 Day 6 In Session 4 Friday, September 7, 2018 Day 4 In Session 31 Friday, October 19, 2018 Day 1 In Session Saturday, September 8, 2018 Saturday, October 20, 2018 Sunday, September 9, 2018 Sunday, October 21, 2018 Monday, September 10, 2018 Day Holiday/Vaca Rosh Hashanah 32 Monday, October 22, 2018 Day 2 In Session 5 Tuesday, September 11, 2018 Day 5 In Session 33 Tuesday, October 23, 2018 Day 3 In Session 6 Wednesday, September 12, 2018 Day 6 In Session 34 Wednesday, October 24, 2018 Day 4 In Session 7 Thursday, September 13, 2018 Day 1 In Session 35 Thursday, October 25, 2018 Day 5 In Session 8 Friday, September 14, 2018 Day 2 In Session 36 Friday, October 26, 2018 Day 6 In Session Saturday, September 15, 2018 Saturday, October 27, 2018 Sunday, September 16, 2018 Sunday, October 28, 2018 9 Monday, September 17, 2018 Day 3 In Session 37 Monday, October 29, 2018 Day 1 In Session 10 Tuesday, September 18, 2018 Day 4 In Session 38 Tuesday, October 30, 2018 Day 2 In Session Wednesday, September 19, 2018 Day Holiday/Vaca Yom Kippur 39 Wednesday, October 31, 2018 Day 3 In Session 11 Thursday, September 20, 2018 Day 5 In Session 40 Thursday, November 1, 2018 Day 4 In Session 12 Friday, September 21, 2018 Day 6 In Session 41 Friday, November 2, 2018 Day 5 In Session Saturday, September 22, 2018 Saturday, November 3, 2018 Sunday, September 23, 2018 Sunday, November 4, 2018 13 Monday, September 24, 2018 Day 1 In Session 42 Monday, November 5, 2018 Day 6 In Session 14 Tuesday, September 25, 2018 Day 2 In Session Tuesday, November 6, 2018 Prof Dev. -

Husson Stock Index Week Ended January 1, 2021 for the Week Ending January 1, 2021, the Husson Stock Index (HSI) Finished the Week At

Husson Stock Index Week Ended January 1, 2021 For the week ending January 1, 2021, the Husson Stock Index (HSI) finished the week at 206.07, up 0.02% from last week’s close of 206.04. In comparison to the HSI, the S&P 500 finished the week at 3,756.07, up 1.43% from last week’s close of 3,703.06. Summary The stock with the largest percentage change for the week was Rite Aid Corporation (RAD: NYSE) which decreased 10.97% or $1.95, despite Zacks Equity Research rating the stock as a Strong Buy. The stock with the second-largest percentage change for the week was Covetrus, Inc. (CVET: NASDAQ), which decreased 8.99% or $2.84, despite Zacks Equity Research indicating that the stock is a great momentum pick for the near-term. Overview The HSI was developed by Marie Kenney, while a student at Husson University, in consultation with Associate Professor J. Douglas Wellington. The HSI tracks and analyzes the stocks of 29 companies that are considered to have an effect on the Maine economy. These companies are either based in Maine or have an influence on the Maine economy through employment or consumer spending. This price-weighted index offers a numerical breakdown of Maine’s economy. The analysis looks into the events of the week and finds the likely reasons the index went up or down. This index and analysis help provide a better understanding of Maine’s economy as well as explain significant changes in stock prices of the companies that comprise the HSI.