2018/12/06 SEGA SAMMY Management Meeting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

11Eyes Achannel Accel World Acchi Kocchi Ah! My Goddess Air Gear Air

11eyes AChannel Accel World Acchi Kocchi Ah! My Goddess Air Gear Air Master Amaenaideyo Angel Beats Angelic Layer Another Ao No Exorcist Appleseed XIII Aquarion Arakawa Under The Bridge Argento Soma Asobi no Iku yo Astarotte no Omocha Asu no Yoichi Asura Cryin' B Gata H Kei Baka to Test Bakemonogatari (and sequels) Baki the Grappler Bakugan Bamboo Blade Banner of Stars Basquash BASToF Syndrome Battle Girls: Time Paradox Beelzebub BenTo Betterman Big O Binbougami ga Black Blood Brothers Black Cat Black Lagoon Blassreiter Blood Lad Blood+ Bludgeoning Angel Dokurochan Blue Drop Bobobo Boku wa Tomodachi Sukunai Brave 10 Btooom Burst Angel Busou Renkin Busou Shinki C3 Campione Cardfight Vanguard Casshern Sins Cat Girl Nuku Nuku Chaos;Head Chobits Chrome Shelled Regios Chuunibyou demo Koi ga Shitai Clannad Claymore Code Geass Cowboy Bebop Coyote Ragtime Show Cuticle Tantei Inaba DFrag Dakara Boku wa, H ga Dekinai Dan Doh Dance in the Vampire Bund Danganronpa Danshi Koukousei no Nichijou Daphne in the Brilliant Blue Darker Than Black Date A Live Deadman Wonderland DearS Death Note Dennou Coil Denpa Onna to Seishun Otoko Densetsu no Yuusha no Densetsu Desert Punk Detroit Metal City Devil May Cry Devil Survivor 2 Diabolik Lovers Disgaea Dna2 Dokkoida Dog Days Dororon EnmaKun Meeramera Ebiten Eden of the East Elemental Gelade Elfen Lied Eureka 7 Eureka 7 AO Excel Saga Eyeshield 21 Fight Ippatsu! JuudenChan Fooly Cooly Fruits Basket Full Metal Alchemist Full Metal Panic Futari Milky Holmes GaRei Zero Gatchaman Crowds Genshiken Getbackers Ghost -

Valkyriachronicles Steam Man

HEALTH ISSUES Thank you for purchasing Valkyria Chronicles™. Please note that this software is designed for use with a PC running Windows Vista or above. Be sure to read this software manual thoroughly Use this software in a well-lit room, staying a good distance away from the monitor or TV screen to not before you start playing. overtax your eyes. Take breaks of 10 to 20 minutes every hour, and do not play when you are tired or short on sleep. Prolonged use or playing too close to the monitor or television screen may cause a decline in visual acuity. Story In rare instances, stimulation from strong light or flashing when staring at a monitor or television screen can In the 1930’s EC, Europa is split from the Empire and the Federation, the two dominant military cause temporary muscular convulsions or loss of consciousness for some people. If you experience any of these powers that divide the continent. symptoms, consult a doctor before playing this game. If you experience any dizziness, nausea, or motion-sickness while playing this game, stop the game immediately. Consult a doctor when any discomfort continues. The two powers struggled for ultimate supremacy, inevitably starting the Second Europan War (E.W.II) involving all of Europa. PRODUCT CARE Gallia, a small independent nation Handle the game disc with care to prevent scratches or dirt on either side of the disc. Do not bend the disc situated between the two super powers or enlarge the centre hole. now faces attacks from the Imperial Army. Clean the disc with a soft cloth, such as a lens cleaning cloth. -

Sega Sammy Holdings Integrated Report 2019

SEGA SAMMY HOLDINGS INTEGRATED REPORT 2019 Challenges & Initiatives Since fiscal year ended March 2018 (fiscal year 2018), the SEGA SAMMY Group has been advancing measures in accordance with the Road to 2020 medium-term management strategy. In fiscal year ended March 2019 (fiscal year 2019), the second year of the strategy, the Group recorded results below initial targets for the second consecutive fiscal year. As for fiscal year ending March 2020 (fiscal year 2020), the strategy’s final fiscal year, we do not expect to reach performance targets, which were an operating income margin of at least 15% and ROA of at least 5%. The aim of INTEGRATED REPORT 2019 is to explain to stakeholders the challenges that emerged while pursuing Road to 2020 and the initiatives we are taking in response. Rapidly and unwaveringly, we will implement initiatives to overcome challenges identified in light of feedback from shareholders, investors, and other stakeholders. INTEGRATED REPORT 2019 1 Introduction Cultural Inheritance Innovative DNA The headquarters of SEGA shortly after its foundation This was the birthplace of milestone innovations. Company credo: “Creation is Life” SEGA A Host of World and Industry Firsts Consistently Innovative In 1960, we brought to market the first made-in-Japan jukebox, SEGA 1000. After entering the home video game console market in the 1980s, The product name was based on an abbreviation of the company’s SEGA remained an innovator. Representative examples of this innova- name at the time: Service Games Japan. Moreover, this is the origin of tiveness include the first domestically produced handheld game the company name “SEGA.” terminal with a color liquid crystal display (LCD) and Dreamcast, which In 1966, the periscope game Periscope became a worldwide hit. -

SCMS 2011 MEDIA CITIZENSHIP • Conference Program and Screening Synopses

SCMS 2011 MEDIA CITIZENSHIP • Conference Program and Screening Synopses The Ritz-Carlton, New Orleans • March 10–13, 2011 • SCMS 2011 Letter from the President Welcome to New Orleans and the fabulous Ritz-Carlton Hotel! On behalf of the Board of Directors, I would like to extend my sincere thanks to our members, professional staff, and volunteers who have put enormous time and energy into making this conference a reality. This is my final conference as SCMS President, a position I have held for the past four years. Prior to my presidency, I served two years as President-Elect, and before that, three years as Treasurer. As I look forward to my new role as Past-President, I have begun to reflect on my near decade-long involvement with the administration of the Society. Needless to say, these years have been challenging, inspiring, and expansive. We have traveled to and met in numerous cities, including Atlanta, London, Minneapolis, Vancouver, Chicago, Philadelphia, and Los Angeles. We celebrated our 50th anniversary as a scholarly association. We planned but unfortunately were unable to hold our 2009 conference at Josai University in Tokyo. We mourned the untimely death of our colleague and President-Elect Anne Friedberg while honoring her distinguished contributions to our field. We planned, developed, and launched our new website and have undertaken an ambitious and wide-ranging strategic planning process so as to better position SCMS to serve its members and our discipline today and in the future. At one of our first strategic planning sessions, Justin Wyatt, our gifted and hardworking consultant, asked me to explain to the Board why I had become involved with the work of the Society in the first place. -

Sega Sammy Holdings Integrated Report 2019

SEGA SAMMY HOLDINGS INTEGRATED REPORT 2019 Challenges & Initiatives Since fiscal year ended March 2018 (fiscal year 2018), the SEGA SAMMY Group has been advancing measures in accordance with the Road to 2020 medium-term management strategy. In fiscal year ended March 2019 (fiscal year 2019), the second year of the strategy, the Group recorded results below initial targets for the second consecutive fiscal year. As for fiscal year ending March 2020 (fiscal year 2020), the strategy’s final fiscal year, we do not expect to reach performance targets, which were an operating income margin of at least 15% and ROA of at least 5%. The aim of INTEGRATED REPORT 2019 is to explain to stakeholders the challenges that emerged while pursuing Road to 2020 and the initiatives we are taking in response. Rapidly and unwaveringly, we will implement initiatives to overcome challenges identified in light of feedback from shareholders, investors, and other stakeholders. INTEGRATED REPORT 2019 1 Introduction Cultural Inheritance Innovative DNA The headquarters of SEGA shortly after its foundation This was the birthplace of milestone innovations. Company credo: “Creation is Life” SEGA A Host of World and Industry Firsts Consistently Innovative In 1960, we brought to market the first made-in-Japan jukebox, SEGA 1000. After entering the home video game console market in the 1980s, The product name was based on an abbreviation of the company’s SEGA remained an innovator. Representative examples of this innova- name at the time: Service Games Japan. Moreover, this is the origin of tiveness include the first domestically produced handheld game the company name “SEGA.” terminal with a color liquid crystal display (LCD) and Dreamcast, which In 1966, the periscope game Periscope became a worldwide hit. -

09062299296 Omnislashv5

09062299296 omnislashv5 1,800php all in DVDs 1,000php HD to HD 500php 100 titles PSP GAMES Title Region Size (MB) 1 Ace Combat X: Skies of Deception USA 1121 2 Aces of War EUR 488 3 Activision Hits Remixed USA 278 4 Aedis Eclipse Generation of Chaos USA 622 5 After Burner Black Falcon USA 427 6 Alien Syndrome USA 453 7 Ape Academy 2 EUR 1032 8 Ape Escape Academy USA 389 9 Ape Escape on the Loose USA 749 10 Armored Core: Formula Front – Extreme Battle USA 815 11 Arthur and the Minimoys EUR 1796 12 Asphalt Urban GT2 EUR 884 13 Asterix And Obelix XXL 2 EUR 1112 14 Astonishia Story USA 116 15 ATV Offroad Fury USA 882 16 ATV Offroad Fury Pro USA 550 17 Avatar The Last Airbender USA 135 18 Battlezone USA 906 19 B-Boy EUR 1776 20 Bigs, The USA 499 21 Blade Dancer Lineage of Light USA 389 22 Bleach: Heat the Soul JAP 301 23 Bleach: Heat the Soul 2 JAP 651 24 Bleach: Heat the Soul 3 JAP 799 25 Bleach: Heat the Soul 4 JAP 825 26 Bliss Island USA 193 27 Blitz Overtime USA 1379 28 Bomberman USA 110 29 Bomberman: Panic Bomber JAP 61 30 Bounty Hounds USA 1147 31 Brave Story: New Traveler USA 193 32 Breath of Fire III EUR 403 33 Brooktown High USA 1292 34 Brothers in Arms D-Day USA 1455 35 Brunswick Bowling USA 120 36 Bubble Bobble Evolution USA 625 37 Burnout Dominator USA 691 38 Burnout Legends USA 489 39 Bust a Move DeLuxe USA 70 40 Cabela's African Safari USA 905 41 Cabela's Dangerous Hunts USA 426 42 Call of Duty Roads to Victory USA 641 43 Capcom Classics Collection Remixed USA 572 44 Capcom Classics Collection Reloaded USA 633 45 Capcom Puzzle -

Found in Translation: Evolving Approaches for the Localization of Japanese Video Games

arts Article Found in Translation: Evolving Approaches for the Localization of Japanese Video Games Carme Mangiron Department of Translation, Interpreting and East Asian Studies, Universitat Autònoma de Barcelona, 08193 Bellaterra, Barcelona, Spain; [email protected] Abstract: Japanese video games have entertained players around the world and played an important role in the video game industry since its origins. In order to export Japanese games overseas, they need to be localized, i.e., they need to be technically, linguistically, and culturally adapted for the territories where they will be sold. This article hopes to shed light onto the current localization practices for Japanese games, their reception in North America, and how users’ feedback can con- tribute to fine-tuning localization strategies. After briefly defining what game localization entails, an overview of the localization practices followed by Japanese developers and publishers is provided. Next, the paper presents three brief case studies of the strategies applied to the localization into English of three renowned Japanese video game sagas set in Japan: Persona (1996–present), Phoenix Wright: Ace Attorney (2005–present), and Yakuza (2005–present). The objective of the paper is to analyze how localization practices for these series have evolved over time by looking at industry perspectives on localization, as well as the target market expectations, in order to examine how the dialogue between industry and consumers occurs. Special attention is given to how players’ feedback impacted on localization practices. A descriptive, participant-oriented, and documentary approach was used to collect information from specialized websites, blogs, and forums regarding localization strategies and the reception of the localized English versions. -

Sega Sammy Holdings Integrated Report 2019

SEGA SAMMY HOLDINGS INTEGRATED REPORT 2019 Challenges & Initiatives Since fiscal year ended March 2018 (fiscal year 2018), the SEGA SAMMY Group has been advancing measures in accordance with the Road to 2020 medium-term management strategy. In fiscal year ended March 2019 (fiscal year 2019), the second year of the strategy, the Group recorded results below initial targets for the second consecutive fiscal year. As for fiscal year ending March 2020 (fiscal year 2020), the strategy’s final fiscal year, we do not expect to reach performance targets, which were an operating income margin of at least 15% and ROA of at least 5%. The aim of INTEGRATED REPORT 2019 is to explain to stakeholders the challenges that emerged while pursuing Road to 2020 and the initiatives we are taking in response. Rapidly and unwaveringly, we will implement initiatives to overcome challenges identified in light of feedback from shareholders, investors, and other stakeholders. INTEGRATED REPORT 2019 1 Introduction Cultural Inheritance Innovative DNA The headquarters of SEGA shortly after its foundation This was the birthplace of milestone innovations. Company credo: “Creation is Life” SEGA A Host of World and Industry Firsts Consistently Innovative In 1960, we brought to market the first made-in-Japan jukebox, SEGA 1000. After entering the home video game console market in the 1980s, The product name was based on an abbreviation of the company’s SEGA remained an innovator. Representative examples of this innova- name at the time: Service Games Japan. Moreover, this is the origin of tiveness include the first domestically produced handheld game the company name “SEGA.” terminal with a color liquid crystal display (LCD) and Dreamcast, which In 1966, the periscope game Periscope became a worldwide hit. -

New Medium-Term Plan (FY2022/3-FY2024/3)

SEGA SAMMY HOLDINGS INC. New Medium-Term Plan (FY2022/3-FY2024/3) 2021/5/13 Market forecasts, operating results forecast, and other information contained in these materials are based on judgements and projections of the Company’s Disclaimer managements from currently available information. Therefore, please understand that the contents herein involve risks and uncertainties, and the actual results could differ materially depending on various factors. © SEGA SAMMY HOLDINGS INC. All Rights Reserved. Long-term vision Value (Mindset and DNA) “Creation is Life” × Mission (Raison d’être) “Always Proactive, “Constantly Creating, Forever Captivating” Always Pioneering” —Making life more colorful— Vision (Ideal self) Be a Game Changer Pachislot and Entertainment Pachinko Resort Sustainability Global Leading No.1 in Sales Opening Contents Provider and Utilization of IR Environment Empathy Edge Economics share -37- © SEGA SAMMY HOLDINGS INC. All Rights Reserved. New Medium-Term Plan (3 years) Beyond the Status Quo Goal -Breaking the Current Situation and Target Becoming a Sustainable Company- FY2024/3: Ordinary income 45.0 billion yen, ROE Over 10% Consumer area Pachislot and Pachinko Strategy Certification as a Investment Solidification of business operator Key Strategy in growth earnings base of IR -38- © SEGA SAMMY HOLDINGS INC. All Rights Reserved. New Medium-Term Plan (3 years): Management Policies and KPIs Improvement of ROE by shifting to the management focusing on capital efficiency ROE 2.9% 0.9% 4.6% 0.4% 5% 7% 10% (Forecast) (Forecast) (Forecast) 800 4,000 (Unit: Billion yen) 366.5 350.0 700 3,500 331.6 337.0 323.6 312.0 600 3,000 277.7 45.0 500 2,500 400 2,000 30.0 Sales1,500 25.2 300 20.0 1,000 14.5 200 Ordinary 7.4 100 Income 500 1.7 0 0 FY2018/3 FY2019/3 FY2020/3 FY2021/3 FY2022/3 FY2023/3 FY2024/3 Previous Mid-term Plan period (Road to 2020) Structural reform New Mid-term Plan -39- © SEGA SAMMY HOLDINGS INC. -

FY Ending March 2018 3Rd Quarter Results Presentation

FY Ending March 2018 3rd Quarter Results Presentation February 7th, 2018 SEGA SAMMY HOLDINGS INC. [Disclaimer] The contents of this material and comments made during the questions and answers etc of this briefing session are the judgment and projections of the Company’s management based on currently available information. These contents involve risk and uncertainty and the actual results may differ materially from these contents/comments. © SEGA SAMMY HOLDINGS INC. All Rights Reserved. 【Content】 1. FY Ending March 2018 3rd Quarter Results/ Forecasts 3. Supplementary Information on the Market Pachislot and Pachinko Machines Major Business Measures 4 25 Overview of revision to the rules Results Highlights 5 Pachinko and Pachislot Machine Markets 30 Consolidated Income Statements 6 (Summary) Pachislot Pachinko Sales Share 33 Costs and Expenses 7 Packaged and Digital Game Market Data 34 Consolidated Balance Sheet (Summary) 8 Amusement Market Data 35 2. Segment Results / Forecasts 4. Past Operating Results / Company Profile Pachislot and Pachinko Machines 10 Past Operating Results 37 Entertainment Contents Business 13 Company Profile 40 Resort Business 19 - 2 - © SEGA SAMMY HOLDINGS INC. All Rights Reserved. 1.FY Ending March 2018 3rd Quarter Results / Forecasts © SEGA SAMMY HOLDINGS INC. All Rights Reserved. Major Business Measures ■Revised full-year operating results forecast (announced on November 30) (Unit:JPY Billion) Previously Amount of Adjusted Pachislot and Pachinko Machines Business publicized increase or forecast → Number of titles -

2020/11/06 Fiscal Year Ending March 2021 2Q Results Presentation

Fiscal Year Ending March 2021 2Q Results Presentation Nov 6, 2020 [Disclaimer] Market forecasts, operating results forecast, and other information contained in this materials are based on judgements and projections of the Company’s managements based on currently available information. Therefore, please understand that the contents herein involve risks and uncertainties and that actual results could differ materially depending on various factors. © SEGA SAMMY HOLDINGS INC. All Rights Reserved. 1. Fiscal Year ending Mar 2021 2Q Results, Overview of Revised Full-Year Forecasts FY2021/3 2Q Results, Full-Year Forecast Summary (JPY Billion) 2020/3 2021/3 Revised Full Year Full Year FY2021/3 2Q Results Through Through Through Forecast Forecast 2Q 4Q 2Q (announced (announced on Aug 5) ◆ Significant decline in sales YoY and recording of losses on Nov 6) Sales 165.5 366.5 110.2 277.0 283.0 ✓ The negative impact of COVID-19 bottomed out in Pachislot and Pachinko Machines 44.2 108.5 10.7 56.0 60.0 Entertainment Contents 115.7 247.6 97.0 214.0 216.0 1Q and recorded ordinary income in 2Q accounting Resort 5.5 10.4 2.2 6.5 6.5 period. Other / Elimination 0.0 0.0 0.3 0.5 0.5 Operating Income 14.6 27.6 -3.0 -15.0 -1.5 ✓ Recorded extraordinary losses associated with the Pachislot and Pachinko Machines 7.3 23.2 -12.0 -9.5 -10.0 Entertainment Contents 13.2 16.5 14.9 9.0 21.5 structural reform in Amusement Center Operations Resort -1.5 -3.6 -2.6 -6.5 -5.5 area. -

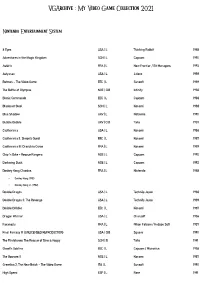

Vgarchive : My Video Game Collection 2021

VGArchive : My Video Game Collection 2021 Nintendo Entertainment System 8 Eyes USA | L Thinking Rabbit 1988 Adventures in the Magic Kingdom SCN | L Capcom 1990 Astérix FRA | L New Frontier / Bit Managers 1993 Astyanax USA | L Jaleco 1989 Batman – The Video Game EEC | L Sunsoft 1989 The Battle of Olympus NOE | CiB Infinity 1988 Bionic Commando EEC | L Capcom 1988 Blades of Steel SCN | L Konami 1988 Blue Shadow UKV | L Natsume 1990 Bubble Bobble UKV | CiB Taito 1987 Castlevania USA | L Konami 1986 Castlevania II: Simon's Quest EEC | L Konami 1987 Castlevania III: Dracula's Curse FRA | L Konami 1989 Chip 'n Dale – Rescue Rangers NOE | L Capcom 1990 Darkwing Duck NOE | L Capcom 1992 Donkey Kong Classics FRA | L Nintendo 1988 • Donkey Kong (1981) • Donkey Kong Jr. (1982) Double Dragon USA | L Technōs Japan 1988 Double Dragon II: The Revenge USA | L Technōs Japan 1989 Double Dribble EEC | L Konami 1987 Dragon Warrior USA | L Chunsoft 1986 Faxanadu FRA | L Nihon Falcom / Hudson Soft 1987 Final Fantasy III (UNLICENSED REPRODUCTION) USA | CiB Square 1990 The Flintstones: The Rescue of Dino & Hoppy SCN | B Taito 1991 Ghost'n Goblins EEC | L Capcom / Micronics 1986 The Goonies II NOE | L Konami 1987 Gremlins 2: The New Batch – The Video Game ITA | L Sunsoft 1990 High Speed ESP | L Rare 1991 IronSword – Wizards & Warriors II USA | L Zippo Games 1989 Ivan ”Ironman” Stewart's Super Off Road EEC | L Leland / Rare 1990 Journey to Silius EEC | L Sunsoft / Tokai Engineering 1990 Kings of the Beach USA | L EA / Konami 1990 Kirby's Adventure USA | L HAL Laboratory 1993 The Legend of Zelda FRA | L Nintendo 1986 Little Nemo – The Dream Master SCN | L Capcom 1990 Mike Tyson's Punch-Out!! EEC | L Nintendo 1987 Mission: Impossible USA | L Konami 1990 Monster in My Pocket NOE | L Team Murata Keikaku 1992 Ninja Gaiden II: The Dark Sword of Chaos USA | L Tecmo 1990 Rescue: The Embassy Mission EEC | L Infogrames Europe / Kemco 1989 Rygar EEC | L Tecmo 1987 Shadow Warriors FRA | L Tecmo 1988 The Simpsons: Bart vs.