Handbook for Alabama County Commissioners

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

From the Desk of Commissioner Director Shanel Y. Robinson

Commissioners eNewsletter March 12, 2021 COUNTY COMMISSIONERS | COVID INFO | HUMAN SERVICES | PUBLIC HEALTH & SAFETY | PUBLIC WORKS | CONTACT US From the Desk of Commissioner Director Shanel Y. Robinson Volume 13, Issue 6 | March 12, 2021 The next meeting of the Somerset County Board of County Commissioners will be March 23. View and submit questions online. Commissioners Declare Somerset Using New March 2021 as J&J Allocations to Women's History Ensure Seniors Are Month in Somerset Vaccinated County To add a resident who is 65 or older to Somerset County is taking advantage the Somerset County Senior Citizen Commissioner Deputy Director Sara of its first shipment of 700 Johnson & Vaccination Waiting List please Sooy recently presented Nancy Johnson (J&J) COVID vaccine doses call (908) 231-7155 or visit D'Andrea, chair of the Somerset to ensure that seniors who have had http://www.co.somerset.nj.us/covidQs . County Commission on the Status of difficulty obtaining vaccination Women, with a proclamation appointments are protected during the The list is not a scheduled declaring March 2021 as Women’s pandemic. The county held its first appointment, but a list that will be used History Month. The proclamation mobile clinic geared toward seniors as more vaccine is available. We have celebrates the visionary women who this morning at the Somerville Senior been told that no more J&J doses will have helped build our county, state Citizens Housing complex in arrive until at least April. and country, including those whose downtown Somerville where the contributions have not been residents received the single-dose adequately recognized and celebrated vaccine, and is now implementing a by urging all citizens of Somerset waiting list for seniors and the County to join in the numerous events homebound interested in being scheduled this month in Somerset vaccinated. -

History of Medicine in the City of London

[From Fabricios ab Aquapendente: Opere chirurgiche. Padova, 1684] ANNALS OF MEDICAL HISTORY Third Series, Volume III January, 1941 Number 1 HISTORY OF MEDICINE IN THE CITY OF LONDON By SIR HUMPHRY ROLLESTON, BT., G.C.V.O., K.C.B. HASLEMERE, ENGLAND HET “City” of London who analysed Bald’s “Leech Book” (ca. (Llyn-din = town on 890), the oldest medical work in Eng the lake) lies on the lish and the textbook of Anglo-Saxon north bank of the leeches; the most bulky of the Anglo- I h a m e s a n d Saxon leechdoms is the “Herbarium” stretches north to of that mysterious personality (pseudo-) Finsbury, and east Apuleius Platonicus, who must not be to west from the confused with Lucius Apuleius of Ma- l ower to Temple Bar. The “city” is daura (ca. a.d. 125), the author of “The now one of the smallest of the twenty- Golden Ass.” Payne deprecated the un nine municipal divisions of the admin due and, relative to the state of opin istrative County of London, and is a ion in other countries, exaggerated County corporate, whereas the other references to the imperfections (super twenty-eight divisions are metropolitan stitions, magic, exorcisms, charms) of boroughs. Measuring 678 acres, it is Anglo-Saxon medicine, as judged by therefore a much restricted part of the present-day standards, and pointed out present greater London, but its medical that the Anglo-Saxons were long in ad history is long and of special interest. vance of other Western nations in the Of Saxon medicine in England there attempt to construct a medical litera is not any evidence before the intro ture in their own language. -

Nottingham Investigation Opening Statement

1.Introduction - Counsel 1. Good morning Chair and Panel. I am Patrick Sadd, lead Counsel to the Nottinghamshire investigations. Next to me sit Paul Livingston, Olinga Tahzib and Imogen Egan junior counsel to this investigation. 2. Today the Inquiry begins the substantive public hearings into Nottinghamshire Investigation. In line with the published scope of the investigation we will be looking at the nature and extent of, and institutional responses to the sexual abuse of children in the care of the councils. 3. The Nottinghamshire investigation is one of 13 investigations so far launched by the Inquiry and is one of three investigations looking at the response of local authorities - the others being Rochdale which was heard in 2017 and Lambeth due to be heard in late 2019. 4. In the early part of this decade, local media in Nottinghamshire began to report that a number of people who had spent time in children’s homes in the 1970s-1990s alleged that they had been sexually abused by care staff at these homes. A growing number of allegations continued to be reported and in 2011, Nottinghamshire Police opened a dedicated investigation into allegations relating to the Beechwood complex and other homes in the City area - operation Daybreak. Subsequently, Operations 1 Xeres and Equinox were launched, to include homes in the Nottinghamshire County area. 5. In 2014 and 2015 media reporting began to focus on the apparent lack of any visible outcome from the investigations or action from the local Councils. 6. In response to public demand for action, Nottinghamshire County Council and Nottingham City Council had announced an Independent Review. -

Florida County Government Guide 2014 Update

Florida County Government Guide 2014 Update a publication of the Florida Association of Counties sponsored by the Florida Counties Foundation University of Florida/IFAS Extension with assistance from the John Scott Dailey Florida Institute of Government The Florida County Government Guide is published every four years, but is reviewed and updated for content every two years. In 2014, the Guide was reviewed and two chapters were completely updated to incorporate the most recent legislative changes. In 2016, each chapter of the Guide will be completely reviewed and revised. The mission of the Florida Association of Counties helps counties effectively serve and represent Floridians by strengthening and preserving county home rule through advocacy, education and collaboration. Published by the Florida Association of Counties © 2014 Office Location: 100 South Monroe Street, Tallahassee, Florida 32301 Telephone: (850) 922-4300 FAX: (850) 488-7501 To order this guide or for more information about FAC including the latest legislative updates, dates for our upcoming events, and contact information for the entire FAC staff go to: www.fl-counties.com. Introduction: Congratulations on Being Elected County Commissioner…Now Get To Work! Vincent Long Congratulations! You have been elected county commissioner. You may be feeling like the dog that caught the bus: exhausted, overwhelmed, and asking yourself, “now what?” You can take comfort in the fact that you are not the first newly elected county commissioner to ask this question. In fact, as a county commissioner you will undoubtedly ask yourself variations of this question throughout your tenure in office. Whether you are dealing with a new state mandate or a seemingly impossible local issue, you will often ask yourself, “What do I do now?” There is no standard answer to this question. -

Another Status Quo Year for New Jersey Women CAWP's 2021 New

Center for American Women and Politics www.cawp.rutgers.edu Rutgers University–New Brunswick [email protected] 191 Ryders Lane 848-932-9384 New Brunswick, New Jersey 08901-8557 Fax: 732-932-6778 June 22, 2021 Contact: Daniel De Simone For Immediate Release 760.703.0948 Chelsea Hill Stalled Progress: Another Status Quo Year for New Jersey Women CAWP’s 2021 New Jersey County Report Card New Jersey has shown minimal progress over the past year for women’s representation in local and county offices, according to a new analysis from the Center for American Women and Politics (CAWP), a unit of the Eagleton Institute of Politics at Rutgers University. Union County retains the top spot in an overall ranking based on an average rank of women’s representation on local councils, mayoralties, and commissionerships. Mercer, which shared the top rank with Union in 2020, dropped to fourth place in the overall rankings, while continuing to lead New Jersey in women’s representation on town councils. Union also leads the state in women’s share of mayoralties and county commissionerships. The state continues to see incremental progress in women’s overall representation in these offices. Women gained eight mayoralties between 2020 and 2021, an identical change as 2019 to 2020, while women gained two seats on county commissions, one more than in the previous report card. As for seats on city councils and similar offices, women gained just 15 seats since the last time CAWP compiled this data; CAWP’s 2020 New Jersey County Report Card showed a gain of 68 council seats. -

05/13/2021 Agenda

BOARD OF COUNTY COMMISSIONERS FAYETTE COUNTY, GEORGIA Lee Hearn, Chairman Steve Rapson, County Administrator Edward Gibbons, Vice Chairman Dennis A. Davenport, County Attorney Eric K. Maxwell Tameca P. Smith, County Clerk Charles W. Oddo Marlena Edwards, Chief Deputy County Clerk Charles D. Rousseau 140 Stonewall Avenue West Public Meeting Room Fayetteville, GA 30214 AGENDA May 13, 2021 6:30 p.m. Welcome to the meeting of your Fayette County Board of Commissioners. Your participation in County government is appreciated. All regularly scheduled Board meetings are open to the public and are held on the 2nd and 4th Thursday of each month at 6:30 p.m. Call to Order Invocation and Pledge of Allegiance by Chairman Lee Hearn Acceptance of Agenda PROCLAMATION/RECOGNITION: 1. Recognition of Katye Vogt and Anita Godbee for completion of the Association County Commission of Georgia County Official Certification program. 2. Recognition of Vice Chairman Edward Gibbons for completion of the Association County Commission of Georgia CORE Certification program. PUBLIC HEARING: PUBLIC COMMENT: Speakers will be given a five (5) minute maximum time limit to speak before the Board of Commissioners about various topics, issues, and concerns. Speakers must direct comments to the Board. Responses are reserved at the discretion of the Board. CONSENT AGENDA: 3. Ratification of emergency repair Contract #1968-S, Data Center HVAC Repair, to Estes Mechanical Services in the amount of $19,092.00, and approval to transfer funds from CIP #191AG (Fire Suppression System for the Data Center) to pay for the repairs. (pages 3-5) 4. Approval of staff's recommendation to award Contract #1861-S, Change Order #4 to Sound Principles, Pro Multi Media, Inc. -

A Guide to the Historic Counties for the Press and Media

Our counties matter! A guide to the historic counties for the Press and Media Be County-Wise and get to know the Historic Counties county-wise.org.uk First Edition Visit county-wise.org.uk for more information about the Historic Counties 1 Be County-Wise and get to know the Historic Counties abcounties.com/press-and-media [email protected] Contents Introduction ............................................................................................................................. 2 About the Association of British Counties ....................................................................... 2 About County-Wise .............................................................................................................. 2 Top ten county facts ........................................................................................................... 6 Quick county quotes .......................................................................................................... 9 Where to find a county – quickly and easily ................................................................... 10 Frequently asked questions about the counties ............................................................... 11 First published in the United Kingdom in 2014 by the Association of British Counties. Copyright © The Association of British Counties 2014 County-Wise county-wise.org.uk A guide to the historic counties for the Press and Media 2 Introduction The identity of the historic counties has become confused by the use of the term -

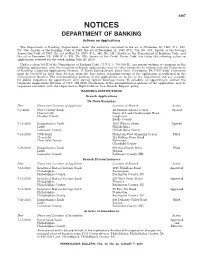

NOTICES DEPARTMENT of BANKING Actions on Applications

4397 NOTICES DEPARTMENT OF BANKING Actions on Applications The Department of Banking (Department), under the authority contained in the act of November 30, 1965 (P. L. 847, No. 356), known as the Banking Code of 1965; the act of December 14, 1967 (P. L. 746, No. 345), known as the Savings Association Code of 1967; the act of May 15, 1933 (P. L. 565, No. 111), known as the Department of Banking Code; and the act of December 19, 1990 (P. L. 834, No. 198), known as the Credit Union Code, has taken the following action on applications received for the week ending July 20, 2010. Under section 503.E of the Department of Banking Code (71 P. S. § 733-503.E), any person wishing to comment on the following applications, with the exception of branch applications, may file their comments in writing with the Department of Banking, Corporate Applications Division, 17 North Second Street, Suite 1300, Harrisburg, PA 17101-2290. Comments must be received no later than 30 days from the date notice regarding receipt of the application is published in the Pennsylvania Bulletin. The nonconfidential portions of the applications are on file at the Department and are available for public inspection, by appointment only, during regular business hours. To schedule an appointment, contact the Corporate Applications Division at (717) 783-2253. Photocopies of the nonconfidential portions of the applications may be requested consistent with the Department’s Right-to-Know Law Records Request policy. BANKING INSTITUTIONS Branch Applications De Novo Branches Date Name -

The Role and Effectiveness of Parish Councils in Gloucestershire

CORE Metadata, citation and similar papers at core.ac.uk Provided by University of Worcester Research and Publications The Role and Effectiveness of Parish Councils in Gloucestershire: Adapting to New Modes of Rural Community Governance Nicholas John Bennett Coventry University and University of Worcester April 2006 Thesis submitted in fulfillment of the requirements for the Degree of Master of Philosophy 2 3 TABLE OF CONTENTS CHAPTER TITLE PAGE NO. ACKNOWLEDGEMENTS 8 ABSTRACT 9 1 INTRODUCTION – Research Context, Research Aims, 11 Thesis Structure 2 LITERATURE REVIEW I: RURAL GOVERNANCE 17 Section 2.1: Definition & Chronology 17 Section 2.2 : Theories of Rural Governance 27 3 LITERATURE REVIEW II: RURAL GOVERNANCE 37 Section 3.1: The Role & Nature of Partnerships 37 Section 3.2 : Exploring the Rural White Paper 45 Section 3.3 : The Future Discourse for Rural Governance 58 Research 4 PARISH COUNCILS IN ENGLAND/INTRODUCTION TO 68 STUDY REGION 5 METHODOLOGY 93 6 COMPOSITION & VIBRANCY OF PARISH COUNCILS 106 IN GLOUCESTERSHIRE 7 ISSUES & PRIORITIES FOR PARISH COUNCILS 120 8 PARISH COUNCILS - ROLES, NEEDS & CONFLICTS 138 9 CONCLUSIONS 169 BIBLIOGRAPHY 190 ANNEXES 1 Copy of Parish Council Postal Questionnaire 200 2 Parish Council Clerk Interview Sheet & Observation Data 210 Capture Sheet 3 Listing of 262 Parish Councils in the administrative 214 county of Gloucestershire surveyed (Bolded parishes indicate those who responded to survey) 4 Sample population used for Pilot Exercise 217 5 Listing of 10 Selected Case Study Parish Councils for 218 further observation, parish clerk interviews & attendance at Parish Council Meetings 4 LIST OF MAPS, TABLES & FIGURES MAPS TITLE PAGE NO. -

Know Your County Government

KNOW YOUR COUNTY GOVERNMENT A COUNTY EMPLOYEE’S GUIDE TO MIAMI-DADE COUNTY GOVERNMENT Presented by: HUMAN RESOURCES DEPARTMENT TRAINING & DEVELOPMENT UNIT Know Your County Government 1 TABLE OF CONTENTS INTRODUCTION ..................................................................................................... 2 HISTORY OF MIAMI-DADE COUNTY GOVERNMENT ......................................... 3 MIAMI-DADE COUNTY GOVERNMENT STRUCTURE ......................................... 4 MIAMI-DADE COUNTY OFFICIALS ....................................................................... 7 STRATEGIC PLAN ............................................................................................... 11 WEB SITE PORTAL .............................................................................................. 16 TRAINIING & DEVELOPMENT ............................................................................. 17 ADMINISTRATIVE ORDERS ................................................................................ 19 FREQUENTLY CALLED NUMBERS .................................................................... 27 “WHAT TO REMEMBER” ..................................................................................... 28 GLOSSARY OF TERMS ....................................................................................... 29 Human Resources, Training & Development January 2021 Know Your County Government 2 INTRODUCTION What will I learn from this course? • Prepares Miami-Dade County employees to be ambassadors for the County. • Familiarizes -

The Drivers of Collaboration in Two-Tier Areas

The drivers of collaboration Working in partnership across local government Executive summary Delivering an effective response to changes in leadership can create the coronavirus means collaboration between conditions for closer joint working. Even in county and district councils is more areas where relationships are good, they important than ever. require continuing time and attention. This was the key message in an article in 2. Formal structures. Formal structures the Local Government Chronicle written by such as leaders’ groups, joint committees, the chairs of the County Councils’ Network growth boards, collaboration agreements (CCN) and District Councils’ Network (DCN) in and district deals are important in March 2020. Councillors John Fuller and David providing a robust framework for Williams wrote: “One thing is for sure: we stand collaboration and collective decision- the best possible chance of success and making. It is also important to create then recovery by working together during this the space and opportunities for informal period of national emergency.” meetings and real discussion. In this report, which was commissioned well 3. Joint posts and double hatting. Joint before the first outbreak of coronavirus, we posts and more extensive joint officer have set out the results of our research into arrangements deliver benefits for the the factors which drive collaboration between councils directly involved and wider district and county councils. district/county relationships. Members with roles in both types of council can Our evidence is drawn from a combination of also bring benefits to wider collaboration. attributable and non-attributable interviews in 12 areas with county and district councils. 4. -

Children and Young People's Committee Monday, 17 December 2018 at 10:30 County Hall, West Bridgford, Nottingham, NG2 7QP

Children and Young People's Committee Monday, 17 December 2018 at 10:30 County Hall, West Bridgford, Nottingham, NG2 7QP AGENDA 1 Minutes of the last meeting held on 19 November 2018 3 - 8 2 Apologies for Absence 3 Declarations of Interests by Members and Officers:- (see note below) (a) Disclosable Pecuniary Interests (b) Private Interests (pecuniary and non-pecuniary) 4 Annual Refresh of Local Transformation Plan for Children and 9 - 16 Young People's Emotional and Mental Health 5 Elective Home Education - Update 17 - 28 6 Update on Supporting Improvements in Children's Social Care 29 - 34 7 Proposed Changes to Staffing Structures Arising from the 35 - 38 Establishment of the Regional Adoiption Agency, Adoption East Midlands 8 Local Authority Governor Appointments to School Governing Bodies 39 - 42 During the Period 1 September to 31 December 2018 9 Promoting and Improving the Health of Looked After Children 43 - 72 10 Work Programme 73 - 78 Page 1 of 78 Notes (1) Councillors are advised to contact their Research Officer for details of any Group Meetings which are planned for this meeting. (2) Members of the public wishing to inspect "Background Papers" referred to in the reports on the agenda or Schedule 12A of the Local Government Act should contact:- Customer Services Centre 0300 500 80 80 (3) Persons making a declaration of interest should have regard to the Code of Conduct and the Council’s Procedure Rules. Those declaring must indicate the nature of their interest and the reasons for the declaration. Councillors or Officers requiring clarification on whether to make a declaration of interest are invited to contact Martin Gately (Tel.