EDSD18919 Dollarway School District

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Final FY 2016-17 Title I Allocations Arkansas Department of Education

Arkansas Department of Education Final FY 2016-17 Title I Allocations Source Code 6505 Revenue Code is 45114 Grant Award Fain Grant Award FAIN S010A150004 S010A160004 DUNS LEA District Building LEA Building Funding Source 1 Funding Source 2 Total Allocation 100002336 4101000 Ashdown SD 4101001 L.F. HENDERSON INTERM. SCH. 170.64 24,172.14 24,342.78 4939013 7401000 Augusta SD 7401001 AUGUSTA ELEMENTARY SCHOOL 136.79 19,377.62 19,514.41 4939013 7401000 Augusta SD 7401003 AUGUSTA HIGH SCHOOL 205.47 29,106.01 29,311.48 70767454 4702000 Blytheville SD 4702006 BLYTHEVILLE ELEMENTARY SCHOOL 290.96 41,215.18 41,506.14 70767454 4702000 Blytheville SD 4702706 BLYTHEVILLE HIGH-A NEW TECH SCHOOL 740.82 104,940.32 105,681.14 70767454 4702000 Blytheville SD 4702012 BLYTHEVILLE MIDDLE SCHOOL 529.80 75,048.51 75,578.31 70767454 4702000 Blytheville SD 4702008 BLYTHEVILLE PRIMARY SCHOOL 391.35 55,437.12 55,828.47 100002518 4801000 Brinkley SD 4801003 BRINKLEY HIGH SCHOOL 137.56 19,485.85 19,623.41 4936167 5204000 Camden Fairview SD 5204023 CAMDEN FAIRVIEW HIGH SCHOOL 356.72 50,530.53 50,887.25 4936167 5204000 Camden Fairview SD 5204028 CAMDEN FAIRVIEW MIDDLE SCHOOL 295.04 41,793.36 42,088.40 800159829 1702000 Cedarville SD 1702009 CEDARVILLE HIGH SCHOOL 144.62 20,486.59 20,631.21 127971646 4802000 Clarendon SD 4802010 CLARENDON HIGH SCHOOL 157.28 22,279.87 22,437.15 809888022 6044000 Covenant Keepers Charter School 6044702 COVENANT KEEPERS CHARTER 242.21 34,309.55 34,551.76 4918330 402000 Decatur SD 402009 DECATUR HIGH SCHOOL 79.10 11,204.91 11,284.01 4918330 402000 Decatur SD 402008 DECATUR NORTHSIDE ELEMENTARY 190.21 26,943.47 27,133.68 800166378 5106000 Deer-Mt. -

Congratulations to All of the Family Members of Ahtd Employees Who

ASHLEIGH REINSCHMIEDT KAYLA REINSCHMIEDT HOLLY REYNOLDS MICHAEL RITCHIE CODY ROGERS THE University of Texas - Arlington University of North Texas Smackover High School Russellville High School Magnolia High School Granddaughter of Karen Peters Granddaughter of Karen Peters Granddaughter of Jim Reynolds Son of Kyle Ritchie Son of Joseph & Dee Rogers System Information & Research System Information & Research District 7 District 8 District 7 GRADUATES2016 CONGRATULATIONS TO ALL OF THE FAMILY MEMBERS OF AHTD EMPLOYEES WHO ASHLYNN RUHL MARTEZ SAIN MORGAN SCHAFER JENNI SHAW AUSTIN SLATER GRADUATED FROM HIGH SCHOOL AND COLLEGE THIS SPRING. Greene County Tech Jonesboro High School Waldron High School University of Arkansas Woodlawn High School High School Grandson of Joyce Davenport Daughter of Brent Riddle Daughter of Latina Shaw Son of Kelly Slater Daughter of Tony Ruhl District 1 District 4 Fiscal Services District 2 District 10 CHELSEY SMITH KENDALL COURTNEY DAKOTA TOLLETT ZACHARY MORRIS WILLIAM LEWIS LAKE BENSON SAMANTHA BOSWELL ALEXANDER BOYD Arkansas State University STAIN Joe T. Robinson WEBSTER WHARTON, II Wynne High School Bryant High School University of Arkansas Daughter of Lyon College High School Conway High School U.S. Navy Officer Son of Ricky Benson Daughter of Bart Boswell Son of Mike & Pam Boyd Paul & Theresa Nedelman Daughter of Shamae Stain Son of Carma Tollett Son of Brian Bynum Candidate School District 5 District 6 Fiscal Services District 10 District 2 Program Management Facilities Management Son of William L. & Rhonda Wharton Legal Division WHITNEY WILLIAMS HEATHER WITCHER LAURA RYAN ARKANSAS STATE HIGHWAY AND ABBEY CLARK ALLISON CLARK COURTNEY COLE Greene County Tech University of Arkansas ELIZABETH WRIGHT TRANSPORTATION DEPARTMENT University of Arkansas University of Arkansas Louisiana State University High School Daughter of Ted English Dollarway High School Daughter of Barry Clark for Medical Sciences Son of Rod Cole Daughter of Sister of Elaine English Niece of Tangela Washington P.O. -

2018-2019 Geographic Shortage Areas

2018-2019 Geographic Shortage Areas County School District School Bradley HERMITAGE SCHOOL DISTRICT HERMITAGE ELEMENTARY SCHOOL HERMITAGE HIGH SCHOOL HERMITAGE MIDDLE SCHOOL WARREN SCHOOL DISTRICT EASTSIDE PRIMARY SCHOOL EASTSIDE NEW VISION ELEM. CHARTER SCHOOL THOMAS C. BRUNSON ELEM. SCHOOL WARREN HIGH SCHOOL WARREN MIDDLE SCHOOL Chicot DERMOTT SCHOOL DISTRICT DERMOTT ELEMENTARY SCHOOL DERMOTT HIGH SCHOOL LAKESIDE SCHOOL DISTRICT EUDORA ELEMENTARY SCHOOL LAKESIDE HIGH SCHOOL LAKESIDE LOWER ELEM. SCHOOL LAKESIDE MIDDLE SCHOOL LAKESIDE UPPER ELEM. SCHOOL WONDER JR HIGH SCHOOL Columbia EMERSON-TAYLOR-BRADLEY SCHOOL DISTRICT EMERSON ELEMENTARY SCHOOL EMERSON HIGH SCHOOL TAYLOR ELEMENTARY SCHOOL TAYLOR HIGH SCHOOL MAGNOLIA SCHOOL DISTRICT CENTRAL ELEMENTARY SCHOOL EAST-WEST ELEMENTARY SCHOOL MAGNOLIA JUNIOR HIGH SCHOOL MAGNOLIA HIGH SCHOOL Desha DUMAS SCHOOL DISTRICT CENTRAL ELEMENTARY SCHOOL REED ELEMENTARY SCHOOL DUMAS JUNIOR HIGH SCHOOL DUMAS NEW TECH HIGH SCHOOL MCGEHEE SCHOOL DISTRICT MCGEHEE ELEMENTARY MCGEHEE JUNIOR HIGH SCHOOL MCGEHEE HIGH SCHOOL Fulton HIGHLAND SCHOOL DISTRICT CHEROKEE ELEMENTARY SCHOOL HIGHLAND MIDDLE SCHOOL HIGHLAND HIGH SCHOOL MAMMOTH SPRING SCHOOL DISTRICT MAMMOTH SPRING ELEMENTARY SCHOOL MAMMOTH SPRING HIGH SCHOOL SALEM SCHOOL DISTRICT SALEM ELEMENTARY SCHOOL SALEM HIGH SCHOOL VIOLA SCHOOL SISTRICT VIOLA ELEMENTARY SCHOOL VIOLA HIGH SCHOOL Izard IZARD COUNTY SCHOOL DISTRICT IZARD COUNTY ELEMENTARY IZARD COUNTY MIDDLE SCHOOL IZARD COUNTY HIGH SCHOOL Jackson JACKSON COUNTY SCHOOL DISTRICT TUCKERMAN ELEMENTARY SCHOOL SWIFTON MIDDLE SCHOOL TUCKERMAN HIGH SCHOOL NEWPORT SCHOOL DISTRICT NEWPORT HIGH SCHOOL NEWPORT ELEMENTARY SCHOOL NEWPORT JUNIOR HIGH SCHOOL CASTLEBERRY ELEM. SCHOOL GIBBS ALBRIGHT ELEM. SCHOOL Jefferson CORRECTIONS SCHOOL SYSTEM DELTA REGIONAL UNIT CENTRAL ARKANSAS CORRECTION CENTER CUMMINS UNIT DIAGNOSTIC UNIT EAST ARKANSAS REGIONAL UNIT GRIMES UNIT J. -

School District School Name Alma School

SCHOOL DISTRICT SCHOOL NAME ALMA SCHOOL DISTRICT 30 ALMA HIGH SCHOOL ALMA INTERMEDIATE SCHOOL ALMA MIDDLE SCHOOL ALMA PRIMARY SCHOOL ARKADELPHIA SCHOOL DISTRICT 1 ARKADELPHIA HIGH SCHOOL CENTRAL PRIMARY SCHOOL GOZA MIDDLE SCHOOL PEAKE ELEMENTARY SCHOOL PERRITT PRIMARY SCHOOL ARKANSAS DEPT OF EDUCATION ARKANSAS SCHOOL MATH & SCIENCE ARKANSAS STATE UNIV TECH CTR IMBODEN AREA CHARTER SCHOOL NATIONAL PARK CC FOR ADULTS NORTH CENTRAL CAREER CENTER OSCEOLA CMTY SCHOOL OUACHITA AREA HS CAREER CEMTER RIVER VALLEY TECH CENTER SCHOOL OF EXCELLENCE ATKINS SCHOOL DISTRICT ATKINS ELEMENTARY SCHOOL ATKINS HIGH SCHOOL ATKINS MIDDLE SCHOOL BALD KNOB SCHOOL DISTRICT BALD KNOB HIGH SCHOOL BALD KNOB MIDDLE SCHOOL H L LUBKER ELEMENTARY SCHOOL BATESVILLE SCHOOL DISTRICT BATESVILLE HIGH SCHOOL BATESVILLE JUNIOR HIGH SCHOOL CENTRAL MAGNET MATH & SCI SCH EAGLE MOUNTAIN ELEM SCHOOL NEW HORIZONS ALT SCHOOL SULPHUR ROCK MAGNET SCHOOL WEST MAGNET ELEMENTARY SCHOOL BENTON SCHOOL DISTRICT 8 ANGIE GRANT ELEMENTARY SCHOOL BENTON JUNIOR HIGH SCHOOL BENTON MIDDLE SCHOOL BENTON SENIOR HIGH SCHOOL CALDWELL ELEMENTARY SCHOOL HOWARD PERRIN ELEM SCHOOL RINGGOLD ELEMENTARY SCHOOL BISMARCK SCHOOL DISTRICT BISMARCK ELEMENTARY SCHOOL BISMARCK HIGH SCHOOL BISMARCK MIDDLE SCHOOL BOONEVILLE SCHOOL DISTRICT BOONEVILLE ELEMENTARY SCHOOL BOONEVILLE HIGH SCHOOL BOONEVILLE JR HIGH SCHOOL BRADFORD SCHOOL DISTRICT BRADFORD ELEMENTARY SCHOOL BRADFORD HIGH SCHOOL 1 BRYANT SCHOOL DISTRICT 25 PARON ELEMENTARY SCHOOL SALEM ELEMENTARY SCHOOL CALICO ROCK SCHOOL DISTRICT CALICO ROCK ELEMENTARY SCHOOL -

Dollarway School District

Dollarway School District Robert F. Morehead Middle School 5th – 8th Grades 2016-2017 Parent/Student Handbook Diane Boyd-Emelife, Principal Martese Henry, Dean of Students Mrs. Barbara Warren, Superintendent 870-534-4185 Office Phone www.dollarwayschools.org 2601 Fluker Street 870-534-0186 Fax Pine Bluff, AR 71601 1 Dear Students, Families and Community Members, “It’s a New Day in Dollarway!” Welcome to Robert F. Morehead Middle School, My name is Ms. Diane Boyd- Emelife, your new principal. I am elated to be working with you as we start a new day here in the Dollarway School District. I want you to know that we are here to serve the students, families, and the community by providing to you the best education resources available to prepare our students for academic success here at RFMMS. I am looking forward to meeting and serving you throughout this school year. Diane Boyd-Emelife High School Principal FOREWORD The Dollarway School District strives to provide a safe and orderly environment that supports all aspects of learning through communication and high expectations of appropriate behavior. The critical component of effective, positive discipline is that it protects the time needed for meaningful instruction for all students. The 20152016 Dollarway School District Parent/Student handbook for Student Conduct and Discipline is designed for students, parents, principals, and teachers. Its main purpose is to set clear standards and limits for behavior established by state law and the Dollarway School District’s Board of Education. It also describes the administrative actions taken when standards of behavior are violated. -

AGENDA STATE BOARD of EDUCATION June 10, 2016 Arkansas Department of Education ADE Auditorium 9:00 AM

AGENDA STATE BOARD OF EDUCATION June 10, 2016 Arkansas Department of Education ADE Auditorium 9:00 AM Back Print Reports Report-1 Chair's Report Presenter: Chair Report-2 Commissioner's Report Presenter: Commissioner Johnny Key Report-3 2015 ATOY Report The 2015 Arkansas Teacher of the Year will present a component of her professional development project. Presenter: 2015 Arkansas Teacher of the Year Ms. Ouida Newton Report-4 2014-2015 Grade Inflation Report Presenter: Elbert Harvey Report-5 ForwARd Arkansas Report Presenter: Susan Harriman, Executive Director of ForwARd Report-6 Learning Services Report This information is provided to keep the State Board of Education apprised of the Department's work activities associated with college and career readiness. Presenter: Stacy Smith Report-7 Computer Science Report This information is provided to keep the State Board of Education apprised of the Department's work activities associated with Computer Science. Presenter: Anthony Owen Arkansas Social Studies Standards “A people without the knowledge of their past history, origin and culture is like a tree without roots.” – Marcus Garvey. The importance of the Social Studies Curriculum Frameworks to Arkansas K-12 education cannot be overlooked. Parents and educators readily agree on the importance of developing reading, writing and math skills. They even agree in our technological society on the importance of teaching science, but what about social studies? It is through the study of social studies that students become aware of the world around them and how that world directly impacts their lives. By learning about economics, civics and government, geography and history, students are able to develop core beliefs and values, an understanding of how the past has shaped the present and will shape the future, and the interconnectedness of the content areas. -

Candice Jones FREE HAIRCUTS Dollarway Cardinals EAST Program Have Partnered Wi

Candice Jones July 29, 2019 at 10:43 AM Author: Candice Jones FREE HAIRCUTS Dollarway Cardinals EAST program have partnered with a number of community barbershops and will be offering FREE haircuts to students on Monday, Aug. 12, from 10am-5pm on the campus of Robert Moorehead Middle School (Choir Room). Bring Dollarway ID, if ID can't be found, come anyway...we look forward to seeing you! Candice Jones July 24, 2019 at 8:55 AM Author: Candice Jones SUPPLY LIST & UNIFORM POLICY PER CAMPUS Don't forget to attend our Back to School Family Day on Saturday, Aug. 10th, 9am-1pm at the Pine Bluff Convention Center. This year we've partnered with the Pine Bluff, Black Firefighters Organization (B.R.A.V.E.) for their Project Fresh Start Back to School Bash. See you there!!! TO VIEW UNIFORMS & POLICY PER CAMPUS USE THE LINKS BELOW: JMES: http://www.dollarwayschools.org/o/elementary-school/page/jmes-school-uniforms JMES SUPPLY LIST: http://www.dollarwayschools.org/article/121504 RMMS: http://www.dollarwayschools.org/o/middle-school/page/rfmms-school-uniforms DHS: http://www.dollarwayschools.org/o/high-school/page/dhs-school-uniforms Candice Jones July 3, 2019 at 12:52 PM Author: Candice Jones BACK TO SCHOOL FAMILY DAY Giveaways Will Be Made on a First-Come, First-Serve Basis Starting with the Earliest Grade Level. !!!ARRIVE EARLY!!! (This Event is Free & Open to the Public) Candice Jones July 22, 2019 at 12:54 PM Author: Candice Jones OPEN HOUSE & REGISTRATION DATES IT'S ALMOST THAT TIME OF YEAR AGAIN!!! Candice Jones July 17, 2019 at 5:36 PM Author: Candice Jones DOLLARWAY SEEKING COMMUNITY ADVISORY BOARD Hello Dollarway Family, Please review the information below and share with anyone you know that might be interested in serving. -

Mike Ross Papers

Mike Ross papers This finding aid was produced using the Archivists' Toolkit April 04, 2019 Ouachita Baptist University Library 410 Ouachita Street Box 3742 Arkadelphia, Arkansas, 71998 870.245.5332 [email protected] Mike Ross papers Table of Contents Summary Information ................................................................................................................................. 3 Collection Inventory...................................................................................................................................... 5 Arkansas General Assembly records.......................................................................................................5 United States Congress records.............................................................................................................20 Campaign records................................................................................................................................ 416 Newsclippings...................................................................................................................................... 501 Awards/Memorabilia............................................................................................................................531 Books and printed material................................................................................................................. 563 Maps.....................................................................................................................................................578 -

The Arkansas Family Historian

THE ARKANSAS FAMILY HISTORIAN VOLUME 48, NUMBER 2 June 2010 Arkansas Genealogical Society P.O. Box 26374 Little Rock, AR 72221-6374 Publications: [email protected] Membership: [email protected] AGS E-Zine: [email protected] Questions: [email protected] Website: www.agsgenealogy.org Officers and Board Members President Susan Gardner Boyle Little Rock 2011 1st Vice-president Jan Hearn Davenport No. Little Rock 2011 2nd Vice-president Linda Fischer Stuttgart 2012 Recording Secretary Lynda Suffridge No. Little Rock 2010 Treasurer Whitney McLaughlin Little Rock 2012 Membership Secretary Rebecca Wilson Little Rock 2012 Parliamentarian Bob Edwards Russellville 2012 Gloria Futrell Little Rock 2012 Rita Benafield Henard Little Rock 2010 Wensil Clark Little Rock 2010 Russell P. Baker Mabelvale 2012 Suzanne Jackson No. Little Rock 2012 William T. Carter Pine Bluff 2010 Kaye Holmes Paragould 2010 Richard Butler Little Rock 2011 Rufus Buie Rison 2012 William Lindsey Little Rock 2012 Euna Beavers Morrilton 2012 George Mitchell Pine Bluff 2011 Editorial Board Susan Gardner Boyle, Editor Rebecca Wilson, Technical Editor Rita Benafield Henard, Contributing Editor Whitney McLaughlin, Contributing Editor Bob Edwards, Contributing Editor Russell P. Baker, Contributing Editor On the Cover: Margaret Shackelford, a woman of color and the common-law wife of James Russell Winn. They are the main subjects of "Brown or White Sugar: the Story of a Mixed-Race Plantation Family in Nineteenth-Century Arkansas." Part 2 begins on p. 83. The ARKANSAS FAMILY HISTORIAN _______________________________ Volume 48 Number 2 June 2010 Contents BROWN OR WHITE SUGAR: THE STORY OF A MIXED- RACE PLANTATION FAMILY IN NINETEENTH-CENTURY ARKANSAS, PART 2 William D. -

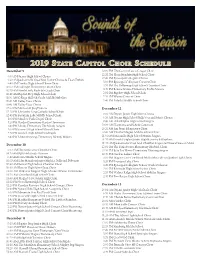

2019 State Capitol Choir Schedule

2019 STATE CAPITOL CHOIR SCHEDULE December 9 12:00 PM The Carolyn Lewis Cougar Choir 12:20 PM Sloan-Hendrix High School Choir 9:00 AM Searcy High School Choirs 12:40 PM Episcopal Collegiate Chorus 9:20 AM Jacksonville Vocal Soul Honor Chorus & Titan Trebles 1:00 PM Episcopal Collegiate Concert Choir 9:40 AM Lonoke High School Honor Choir 10:00 AM Fulbright Elementary Falcon Choir 1:20 PM The Dollarway High School Chamber Choir 10:20 AM North Little Rock 6th Grade Choir 1:40 PM Bonnie Grimes Elementary Treble Makers 10:40 AM Baptist Prep High School Choir 2:00 PM Bigelow High School Choir 11:00 AM College Hill 6th Grade Middle Melodies 2:20 PM Wynne Concert Choir 11:20 AM Valley View Choirs 2:40 PM Pulaski Middle School Choir 11:40 AM Valley View Choirs 12:00 PM Marissa & Jacq Dancers December 12 12:20 PM Christ the King Catholic School Choir 12:40 PM Fountain Lake Middle School Choir 9:00 AM Bryant Junior High Men’s Chorus 1:00 PM Meadow Park Gospel Choir 9:20 AM Bryant High School Bella Voce and Men’s Chorus 1:20 PM Hardin Elementary Hardin Harmonies 9:40 AM Arkadelphia High School Singers 1:40 PM Moody Elementary The Moody Singers 10:00 AM Harmonia and Schola Cantorum 2:00 PM Gosnell High School Mixed Choir 10:20 AM Jim Stone Elementary Choir 2:20 PM Gosnell High School Madrigals 10:40 AM Dunbar Magnet Middle School Choir 2:40 PM Mineral Springs Elementary Melody Makers 11:00 AM Maumelle High School Hornet Singers 11:20 AM North Heights Junior High Razorback Rhythms 11:40 AM Jacksonville Vocal Soul Chamber Singers & Natural State of -

Gr9 Math Admin FINAL.Indd

A TAAP Arkansas Comprehensive Testing, Assessment, and Accountability Program Arkansas Alternate Portfolio Assessment System for Ninth-Grade Mathematics for Students with Disabilities ADMINISTRATION MANUAL 2006–2007 The success of the Arkansas Alternate Portfolio Assessment System depends upon you. The Arkansas Department of Education thanks you for your valuable assistance in implementing the Alternate Portfolio Assessment System. Arkansas Department of Education 2006–2007 TABLE OF CONTENTS PAGE GENERAL INFORMATION Introduction ................................................................................................................................................... 1 Alternate Portfolio Assessment System Contacts ......................................................................................... 1 Schedule ........................................................................................................................................................ 2 This Administration Manual .......................................................................................................................... 2 Student Identification Numbers ..................................................................................................................... 2 DUTIES AND RESPONSIBILITIES OF DISTRICT AND SCHOOL PERSONNEL General Duties and Responsibilities .............................................................................................................. 3 Special Education Coordinators ................................................................................................................... -

Workforce Training Initiative Higher Education Survey Report 2 Year Colleges

Workforce Training Initiative Higher Education Survey Report 2 Year Colleges Bureau of Legislative Research Survey Report for the JOINT PERFORMANCE REVIEW COMMITTEE Distributed: July 25, 2014 Due: August 15, 2014 Reported: September 2014 2014 Higher Education Workforce Training Initiative Survey 2 Year Colleges Abbr. Page 2 Arkansas Northeastern College ANC 1 4 Arkansas State University - Beebe ASUB 3 2 Arkansas State University - Mt. Home ASUMH 7 2 Arkansas State University - Newport ASUN 9 2 Black River Technical College BRTC 11 2 College of the Ouachita COTO 13 2 Cossatot Community College UA CCCUA 15 4 East Arkansas Community College EACC 17 8 Mid-South Community College MSCC 19 4 National Park Community College NPCC 45 2 North Arkansas College NAC 49 2 Northwest Ark Community College NWACC 51 2 Ozarka College OZC 53 2 Phillips Community College UA PCCUA 55 6 Pulaski Technical College PTC 57 2 Rich Mountain Community College RMCC 63 4 South Arkansas Community College SACC 65 2 Southeast Arkansas College SEAC 69 2 Southern Arkansas University Tech SAUT 71 2 UA Community College at Batesville UACCB 73 2 UA Community College at Hope UACCH 75 2 UA Community College at Morrilton UACCM 77 2014 Higher Education Workforce Training Initiative Survey Institution Name: Arkansas Northeastern College Respondent Name: Dr. James R. Shemwell, President Phone: 870-762-3193 Email: [email protected] 1. What industry/business partnerships does your institution have? ANC has numerous industry/business partnerships including Steel Industry Technology internships (Nucor-Yamato Steel & Tenaris), the Workforce Orientation & Retraining Keys (WORK) basic entry skills training program (American Greetings, Tenaris, Kagome-Creativ eFoods, & DENSO), and various advisory councils that serve multiple discipline areas (workforce development, business, computer information systems, office techology, criminal justice, and secondary center programs).