Precious Metals Transaction Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Precious Metals Ira Investment Overview

PRECIOUS METALS IRA INVESTMENT OVERVIEW The trend of adding alternative assets to retirement portfolios has been steadily increasing throughout the fi rst decade of the 21st century. During volatile economic times, some investors seek to further diversify their portfolios by adding physical assets such as gold, silver, platinum and palladium. These investors may also be looking toward investing in gold and other precious metals as a hedge against infl ation or as stability during challenging economic climates. Although the Internal Revenue Code states that collectibles cannot be held in IRAs, certain precious metals that meet the requirements specifi ed in Section 408 of the Code may be held in individual retirement accounts and they are: Gold Coins Silver Coins Platinum Coins • American Buffalo • America the Beautiful • American Eagle • American Eagle • American Eagle • Australian Koala • Australian Kangaroo/Nugget • Australian Kookaburra • Canadian Maple Leaf • Austrian Philharmonic • Austrian Vienna Philharmonic • Isle of Man Noble • Canadian Maple Leaf • Canadian Maple Leaf • Mexican Libertad In addition to these coins certain gold, silver, platinum and Minimum fi neness required: palladium bars and rounds produced by a manufacturer Gold .995+ Silver .999+ accredited by NYMEX/COMEX, NYSE/LIffe, LME, LBMA, Platinum .9995+ Palladium .9995+ LPPM, TOCOM, ISO 9000 or a national government mint and meeting minimum fi neness may also be held in an IRA. GETTING STARTED WITH A PRECIOUS • E-mail a completed Precious Metals Purchase/Sale METALS IRA Direction, and a signed copy of the dealer Investors seeking to add gold, silver, platinum or invoice with payment instructions to palladium to their retirement portfolio are encouraged [email protected]. -

INFORMATION BULLETIN #50 SALES TAX JULY 2017 (Replaces Information Bulletin #50 Dated July 2016) Effective Date: July 1, 2016 (Retroactive)

INFORMATION BULLETIN #50 SALES TAX JULY 2017 (Replaces Information Bulletin #50 dated July 2016) Effective Date: July 1, 2016 (Retroactive) SUBJECT: Sales of Coins, Bullion, or Legal Tender REFERENCE: IC 6-2.5-3-5; IC 6-2.5-4-1; 45 IAC 2.2-4-1; IC 6-2.5-5-47 DISCLAIMER: Information bulletins are intended to provide nontechnical assistance to the general public. Every attempt is made to provide information that is consistent with the appropriate statutes, rules, and court decisions. Any information that is inconsistent with the law, regulations, or court decisions is not binding on the department or the taxpayer. Therefore, the information provided herein should serve only as a foundation for further investigation and study of the current law and procedures related to the subject matter covered herein. SUMMARY OF CHANGES Other than nonsubstantive, technical changes, this bulletin is revised to clarify that sales tax exemption for certain coins, bullion, or legal tender applies to coins, bullion, or legal tender that would be allowable investments in individual retirement accounts or individually-directed accounts, even if such coins, bullion, or legal tender was not actually held in such accounts. INTRODUCTION In general, an excise tax known as the state gross retail (“sales”) tax is imposed on sales of tangible personal property made in Indiana. However, transactions involving the sale of or the lease or rental of storage for certain coins, bullion, or legal tender are exempt from sales tax. Transactions involving the sale of coins or bullion are exempt from sales tax if the coins or bullion are permitted investments by an individual retirement account (“IRA”) or by an individually-directed account (“IDA”) under 26 U.S.C. -

Nineteenth Century Platinum Coins an EARLY INDUSTRIAL USE of POWDER METALLURGY by Hans-Gert Bachmann and Hermann Renner Degubsa AG, Frankfurt Am Main, West Germanv

Nineteenth Century Platinum Coins AN EARLY INDUSTRIAL USE OF POWDER METALLURGY By Hans-Gert Bachmann and Hermann Renner Degubsa AG, Frankfurt am Main, West Germanv Powder metallurgy is the metallurgist’s platinum sponge which he was able to shape answer to the production of ductile metals of into objects, such as crucibles. This process high melting point by methods differing from remained in use until I 8 10. conventional melting and casting. The history In the meantime Wollaston produced the first of platinum, extensively and vividly recorded malleable platinum by a “wet” method. As early by McDonald and Hunt (I), gives examples of as I 80 I he solved the problem of how to get rid how platinum was worked into objects from of the impurities normally accompanying earliest times onwards. However, the first real naturally occurring placer platinum. By careful melting of platinum was achieved only as late as adjustment of the proportions of hydrochloric I 782, when Lavoisier successfully reached the and nitric acid in aqua regia, and later by using temperature of 1769OC necessary to melt this more dilute mixtures, he separated platinum metal on a very small scale with the aid of an from its associated palladium and rhodium. The oxygen torch (2). Three years earlier, Franz solution, containing only hexachloroplatinate, Karl Achard (1753--1821), whose contributions H2FtCI6, was subsequently treated with sal to metallurgy have only recently been fully ammoniac, resulting in a precipitate of realised (3), made use of the property of ammonium hexachloroplatinate, (NH4)dPtC16]. platinum to form low-melting point alloys with On heating this decomposed to platinum elements such as phosphorus, mercury and sponge, and thus an economical method was arsenic. -

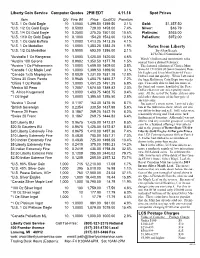

Notes from Liberty *U.S.*U.S

LibertyLiberty Coin Coin Service Service Computer Computer Quotes Quotes 2PM 2PM EDT EDT 4.11.184.11.18 Spot Spot Prices Prices Item Item Qty Qty Fine Fine Wt Wt Price Price Cost/Oz Cost/Oz Premium Premium *U.S.*U.S. 1 1 Oz Oz Gold Gold Eagle Eagle 1010 1.00001.0000 1,399.501,399.501399.501399.50 3.1%3.1% Gold:Gold: $1,357.50$1,357.50 *U.S.*U.S. 1/2 1/2 Oz Oz Gold Gold Eagle Eagle 1010 0.50000.5000 729.00729.001458.001458.00 7.4%7.4% Silver:Silver: $16.79$16.79 *U.S.*U.S. 1/4 1/4 Oz Oz Gold Gold Eagle Eagle 1010 0.25000.2500 375.25375.251501.001501.00 10.6%10.6% Platinum:Platinum: $935.00$935.00 *U.S.*U.S. 1/10 1/10 Oz Oz Gold Gold Eagle Eagle 1010 0.10000.1000 154.20154.201542.001542.00 13.6%13.6% Palladium:Palladium: $972.00$972.00 *U.S.*U.S. 1 1 Oz Oz Gold Gold Buffalo Buffalo 1010 1.00001.0000 1,413.251,413.251413.251413.25 4.1%4.1% *U.S.*U.S. 1 1 Oz Oz Medallion Medallion 1010 1.00001.0000 1,383.251,383.251383.251383.25 1.9%1.9% Notes from Liberty *U.S.*U.S. 1/2 1/2 Oz Oz Medallion Medallion 1010 0.50000.5000 693.00693.001386.001386.00 2.1%2.1% By Allan Beegle LCS Chief Numismatist *Australia*Australia 1 1 Oz Oz Kangaroo Kangaroo 1010 1.00001.0000 1,420.001,420.001420.001420.00 4.6%4.6% March’s bullion and numismatic sales *Austria*Austria 100 100 Corona Corona 1010 0.98020.9802 1,350.501,350.501377.781377.78 1.5%1.5% soared from a dismal February. -

Direction of Investment – Precious Metals

T: 602.899.9396 www.directedira.com Direction of Investment – Precious Metals IMPORTANT INFORMATION Please ensure that your Account contains sufficient cash to cover: *All precious metals are held at Delaware Depository 1. Investment Service Company (“DDSC”) and should never be sent 2. Minimum cash balance requirement and; directly to Directed Trust Company. 3. Any applicable transaction fees. Purchasing/Liquidating Precious Metals Directed Trust Company is not a precious metals dealer. If you are interested in purchasing approved precious metals with your account, you must find a qualified precious metals dealer. Once you have identified the dealer you would like to work with and you have negotiated a purchase with a dealer (metal type, weight, etc.) please submit this form to Directed Trust Company and we will forward funds to complete the transaction. All precious metals are held at DDSC. At the time funds are transferred, Directed Trust Company will also include shipping instructions to the dealer so the precious metals can be shipped to DDSC and held by your account. Please be sure the amount indicated on this form includes any dealer commission, shipping, handling and insurance costs. Directed Trust Company will pass through any costs associated with precious metals storage to your Directed Trust Company Account. Value Reporting for Statements and Tax Purposes Directed Trust Company does not investigate the value of assets but will update the values quarterly and at year-end for tax reporting purposes. The Fair Market Value we provide on your account, on statements, and on IRS Form 5498 for your account is a bid price based on third party industry market data from CME Group, www.bullionvalues.org. -

Precious Metals IRA

CUSTODY SERVICES Precious Metals IRA Frequently Asked Questions The following Questions and Answers pertain to investing in precious metals in an IRA. They are not tax or investment advice, but are presented to help you identify issues (and opportunities) which can arise when investing in non-publicly traded alternative assets such as precious metals. Any specific IRA investment should be discussed with your tax or legal advisor. Is it possible to use IRA funds to invest in precious metals such Are there any limitations on as gold to further diversify my retirement portfolio? the amount of precious metals Yes. According to Internal Revenue Code (IRC) Section 408(m)(3)(A)(i-iv) and 408(m)(3)B) IRAs that can be held in my IRA? may invest in certain precious metal coins and bullion as listed below: It is entirely up to the individual to determine how much of a retirement portfolio to allocate GOLD COINS SILVER COINS PLATINUM COINS to physical precious metals. • American Buffalo • America the Beautiful • American Eagle • American Eagle • American Eagle • Australian Koala Can I contribute gold coins • Australian Kangaroo/ • Australian Kookaburra • Canadian Maple Leaf I already own to my IRA? Nugget • Austrian Vienna • Isle of Man Noble • Austrian Philharmonic Philharmonic No, nor can your IRA purchase any precious metals that you personally own. You are only • Canadian Maple Leaf • Canadian Maple Leaf allowed to contribute cash to your IRA in the • Mexican Libertad form of annual contributions or through Note: Gold and Silver coins that have undergone ‘certification’ also known as ‘slabbed coins’ rollovers from former 401(k) plans or transfers are not permitted to be held in IRAs. -

Retirement and Precious Metals

ZANER METALS Retirement and Precious Metals Another part of Pete Thomas’s white paper reports on gold bars and coins designed to help the first-time consumers entering the Precious Metals asset class make the safest purchases. I owe a great deal to Matt Sorensen JD for writing such a great book on tax code and the usage of precious metals* in a qualified account. Between racing in the smaller formula car class, to being a Weapons Master for Paramount Pictures Studio, reading tax code somehow slipped by me, so I am very fortunate to have people around me that kept their nose to the grind stone. This aside, the hard and fast reality of the real world taught me that the tax man cometh and I must be prepared. Bearing this in mind, finding this tax book saved me a tremendous amount of research. The following excerpt is straight from the attorney that wrote the book on tax code and metals a Mr. Sorensen. Precious Metals must be stored with a licensed financial institution or trust company. Personal storage of precious metals owned by an IRA is not allowed. The Zaner Group – 150 S. Wacker Dr. Suite 2350 Chicago IL 60606 – 312.277.0050 Futures and/or OTC Market Trading Involves Substantial Risk of Loss ZANER METALS A broker-dealer, third-party administrator, or any company not licensed as a bank, credit union, or trust company may not store precious metals owned by an IRA. IRS Private Letter Ruling # 200217059. The most important idea that I want you to come away with from this article is that you cannot store your precious metals at home for your IRA and /or a 401K. -

Precious Metals Investment Authorization

Toll Free: 800-962-4238 PacificPremierTrust.com Precious Metals Investment / Transfer Authorization IMPORTANT INFORMATION Sending incomplete documents will delay the funding/transfer process. Please make sure the Pacific Premier Trust Account (“Account”) contains sufficient cash to cover the investment, minimum cash requirement and all applicable transaction fees. Before closing: Depository Trust Company of Delaware, LLC provides precious metals safekeeping and shipping services as an independent contractor of Pacific Premier Trust. Depository Trust Company of Delaware, LLC is not affiliated with Pacific Premier Trust. PURCHASING/LIQUIDATING PRECIOUS METALS: Pacific Premier Trust is not a precious metals dealer. If you are interested in investing in precious metals within your IRA, you must utilize one from the list of precious metals’ dealer’s. If the metals dealer is not on the list, your request may be delayed or rejected. Once you have identified the dealer you would like to work with and you have negotiated a purchase with the dealer (metal type, weight, etc.) please submit this form to Pacific Premier rustT so we can forward the appropriate funds to complete the transaction. Please accompany this Pacific Premier Trust form with the selected metals dealer invoice for the purchase. At the time funds are transferred, Pacific Premier Trust will also forward shipping instructions to the dealer so the metals will be shipped and deposited into your newly established Depository Trust Company of Delaware account. Please be sure the amount listed on this form is inclusive of any dealer commission, shipping, handling and insurance costs. Pacific Premier Trust will pass through any costs associated with precious metals storage to your Account. -

CONTINENTAL IMITATIONS of the ROSE NOBLE of EDWARD IV VERY Little Is Known in This Country About the Large Class of Rose Nobles

CONTINENTAL IMITATIONS OF THE ROSE NOBLE OF EDWARD IV By ANTHONY THOMPSON VERY little is known in this country about the large class of rose nobles bearing the name of Edward IV, but of larger module and coarser execution than usual. Their style and fabric, as well as their average weight (about 1x6 grains), stamps them as of foreign manu- facture, and they are called "Flemish" because there is a convenient historical explanation for their issue—Edward's seven months' exile in Flanders between October 1470 and April 1471. They are held to be Flemish because they resemble the pieces copied from Henry VI's noble, whose origin is also assumed to be Flemish. The identification of the rose nobles rests solely upon this resemblance, for there is, so far, no documentary evidence in support of an emergency coinage in Flanders—Deschamps de Pas prints no document in his exhaustive studies of the Flemish issues of Charles the Bold which might indicate that the Burgundian mints of Flanders were put at Edward's dis- posal.1 Even the fundamental point about the origin of the "Henry" nobles is by no means certain, for there is a suspicion that some of them may have been coined at or near Cologne in the sixteenth century.2 In this country the "Flemish" rose nobles of Edward IV have always been regarded (and rightly) as a side-line of English numis- matics, but this attitude neglects an important aspect of our numis- matic history—the commercial value of the rose noble abroad, which led to its imitation.3 Montagu saw this clearly when he postulated a -

SOL-5202* Metals in Your IRA, You Must Find a Qualified Metals Dealer

Toll Free: 1-800-962-4238 www.pensco.com SOLO(K) PRECIOUS METALS INVESTMENT/TRANSFER AUTHORIZATION IMPORTANT REMINDER Sending incomplete documents will delay the review and funding/transfer process. Please make sure the Account contains sufficient cash to cover the investment, minimum cash requirement and all applicable transaction fees. All precious metal holdings are held at Delaware Depository Service Company (“DDSC”) and should never be sent directly to PENSCO Trust Company (PENSCO). PURCHASING/ LIQUIDATING PRECIOUS METALS PENSCO Trust Company (PENSCO) is not a precious metals dealer. If you are interested in investing in approved precious *SOL-5202* metals in your IRA, you must find a qualified metals dealer. Once you have identified the dealer you would like to work with and you have negotiated a purchase with the dealer (metal type, weight, etc.) please submit this form to PENSCO so we can forward the appropriate funds to complete the transaction. All metals are held at DDSC. At the time funds are transferred, PENSCO will also forward shipping instructions to the dealer so the metals will be shipped and placed in your Account. Please be sure the amount listed on this form is inclusive of any dealer commission, shipping, handling and insurance costs. PENSCO will pass through any costs associated with precious metals storage to your PENSCO Account. Permissible Precious Metals: • Gold • Silver o American Eagle coins(1) o American Eagle coins(1) o Australian Kangaroo/Nugget coins o Australian Kookaburra coins o Austrian Philharmonic coins o Austrian Vienna Philharmonic coins o Canadian Maple Leaf coins o Canadian Maple Leaf coins o Credit Suisse — Pamp Suisse Bars .999 o Mexican Liberated coins o U.S. -

Gold & Silver Guide

GOLD & SILVER GUIDE “Your Trusted Gold Investment Experts” Online: noblegoldinvestments.com Tel: 877-646-5347 Noble Gold Investments Noble Gold Investments Noble Gold CONTENTS 04 Introduction 05 About Us 14 Gold IRA - How To Start Gold & Silver 06 Empowering Wealth 16 IRA Approved Coins Investment Guide 08 Historic Role of Gold 18 IRA Approved Bars 10 Gold Production 20 IRA Approved Proofs 12 Gold IRA 22 Depository 2 3 24 Rules and FAQ CONGRATULATIONS! If you are reading this you will have already embarked on a journey that not too many ever take. It is thought (because people keep quiet about this) that only 3% to 9% of the US population hold any precious metals in their financial armory. Deciding to investigate this choice for your money, means you are already part of an exceptional opportunity. Noble Gold Investments Noble Gold Investments Noble Gold ABOUT US WE ARE EXPERTS Noble Gold has more than 20 years of combined experience in its founders, securing more than $200 million in precious metals assets, and making sure of our clients OUR TRUSTWORTHY REPUTATION continued financial security. To talk to us about how you can join this exciting journey and keep yourself, and your family safe, Call our team now and see what we can do for you. Our number is (877) 646-5347. Reviews are everything - great reviews are always FASTEST SHIPPING amazing - bad reviews are also good - you can learn a 4 lot from them. 5 OUR VISION There is nothing worse - when In our own business we rely on our clients leaving We love gold and silver, and we want you to take you have spent a lot of money on reviews about our performance. -

Eighth Session, Commencing at 2.30 Pm GREAT BRITAIN GOLD COINS

Eighth Session, Commencing at 2.30 pm GREAT BRITAIN GOLD COINS 2267* Elizabeth I, (1558-1603), milled coinage, 1561-70, gold half pound, mm lis (S.2543). Very fi ne and rare. $13,000 2263* Edward IV, (fi rst reign, 1461-1470), Flemish imitation of gold ryal (S.1952). Well struck, full fl an, good very fi ne and rare. $5,000 2268* James I, (1603-1625), gold laurel, mm trefoil, fourth head, issued 1624, (S.2638B, N.2114). Attractive round specimen, superb portrait, weak in places, otherwise extremely fi ne and very scarce. $2,400 2264* Henry VII, (1485-1509), angel, type III, mm greyhound's head, 1498-9, (S.2183). Slightly crinkled, otherwise good fi ne. $1,200 2269* Anne, After the Union, guinea, third bust, 1714 (S.3574). Some mint bloom, extremely fi ne and rare in this condition. $3,500 2265* Henry VIII, (1509-1547), angel, fi rst coinage 1509-1526, London mint, (5.07 grams), mm portcullis, obv. with VIII, (S.2265, N.1760). Round, very fi ne and attractive. $1,250 2270* George II, old head, fi ve guineas, 1748 (S.3666). Nearly extremely fi ne and rare. $20,000 2266* Elizabeth I, (1558-1603), sixth issue, gold pound, mm tun (S.2534). Good very fi ne and rare. $16,000 167 2277* George III, sixth head half guinea, 1810 (S.3737). Good very fi ne. 2271* $350 George II, young head, two guineas, 1738 (S.3667B). Good very fi ne. $1,500 2278* George III, second head, third guinea, 1808 (S.3740). Possibly removed from coin frame, surface marking, nearly fi ne.