Press Release Shareholder Value Creation Through Elimination Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Case No COMP/M.2951 - A.S

EN Case No COMP/M.2951 - A.S. WATSON / KRUIDVAT Only the English text is available and authentic. REGULATION (EEC) No 4064/89 MERGER PROCEDURE Article 6(1)(b) NON-OPPOSITION Date: 27/09/2002 Also available in the CELEX database Document No 302M2951 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 27.09.2002 SG (2002) D/231850 In the published version of this decision, some PUBLIC VERSION information has been omitted pursuant to Article 17(2) of Council Regulation (EEC) No 4064/89 concerning non-disclosure of business secrets and other confidential information. The omissions are MERGER PROCEDURE shown thus […]. Where possible the information ARTICLE 6(1)(b) DECISION omitted has been replaced by ranges of figures or a general description. To the notifying party Dear Sir/Madam, Subject: Case No COMP/M.2951 - A.S. Watson/Kruidvat Notification of 29.08.2002 pursuant to Article 4 of Council Regulation No 4064/891 1. On 29 August 2002, the Commission received a notification of a proposed concentration whereby A.S. Watson & Co., Limited (“A.S. Watson”), which belongs to the Hong Kong based group Hutchison Whampoa Limited (“Hutchison”), intends to acquire within the meaning of Article 3(1)(b) of the Council Regulation (EEC) No 4064/89 (“the Merger Regulation”) control over Dutch companies Kruidvat Holding B.V., and Kruidvat Superdrug B.V. (hereinafter ”Kruidvat”). The companies are presently controlled by Kruidvat Beheer B.V. (”Kruidvat Beheer”). 2. After examination of the notification, the Commission has concluded that the notified operation falls within the scope of the Merger Regulation and does not raise serious doubts as to its compatibility with the common market and the functioning of the EEA Agreement. -

CK HUTCHISON HOLDINGS LIMITED (“CK Hutchison”) And

HUTCHISON WHAMPOA INTERNATIONAL (03/33) LIMITED (the “Issuer”) US$1,500,000,000 7.45% Guaranteed Notes due 2033 (the “Notes”) (ISIN: US44841SAC35/CUSIP: 44841SAC3/Common Code: 018124572 for Rule 144A Notes) (ISIN: USG4672CAC94/CUSIP: G4672CAC9/Common Code: 018124629 for Regulation S Notes) unconditionally and irrevocably guaranteed by CK HUTCHISON HOLDINGS LIMITED (“CK Hutchison”) and HUTCHISON WHAMPOA LIMITED In accordance with Regulation (EU) No. 596/2014 on market abuse and the law of 11 January 2008 on transparency requirements, as amended, the Issuer is filing with the Commission de Surveillance du Secteur Financier, storing with the Officially Appointed Mechanism and publishing the attached unaudited results for the six months ended 30 June 2019 of CK Hutchison, a guarantor of the Notes issued by the Issuer. The attached document was also published by CK Hutchison at 4:31 pm and 4:32 pm (Hong Kong time), 1 August 2019 on the websites of Hong Kong Exchanges and Clearing Limited and CK Hutchison, respectively. Hutchison Whampoa International (03/33) Limited Edith Shih Director and Company Secretary 1 August 2019 Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. UNAUDITED RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2019 HIGHLIGHTS -

Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD

UOB KAY HIAN (SINGAPORE) PRIVATE LIMITED MARGIN STOCK LIST - HONG KONG MARKET 1 April 2021 Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD. SA HK 2 CLP HOLDINGS LTD. A HK 3 HONG KONG AND CHINA GAS CO. LTD. A HK 4 WHARF (HOLDINGS) LTD. A HK 5 HSBC HOLDINGS PLC SA HK 6 POWER ASSETS HOLDINGS LTD. SA HK 8 PCCW LTD. C HK 10 HANG LUNG GROUP LTD. A HK 11 HANG SENG BANK LTD. SA HK 12 HENDERSON LAND DEVELOPMENT CO. LTD. A HK 14 HYSAN DEVELOPMENT CO. LTD. B HK 16 SUN HUNG KAI PROPERTIES LTD. SA HK 17 NEW WORLD DEVELOPMENT CO. LTD. A HK 19 SWIRE PACIFIC LTD. 'A' A HK 23 BANK OF EAST ASIA, LTD. A HK 27 GALAXY ENTERTAINMENT GROUP LTD. A HK 38 FIRST TRACTOR CO LTD. - H SHARES D HK 41 GREAT EAGLE HOLDINGS LTD. C (Max Net Loan H$10M) HK 45 HONGKONG AND SHANGHAI HOTELS, LTD. B (Max Net Loan H$10M) HK 53 GUOCO GROUP LTD. B (Max Net Loan H$10M) HK 56 ALLIED PROPERTIES (HK) LTD. D HK 62 TRANSPORT INTERNATIONAL HOLDINGS LTD. D (Max Net Loan H$1M) HK 66 MTR CORPORATION LTD. SA HK 69 SHANGRI-LA ASIA LTD. A HK 81 CHINA OVERSEAS GRAND OCEANS GROUP LTD. C HK 83 SINO LAND CO. LTD. A HK 86 SUN HUNG KAI & CO. LTD. D HK 87 SWIRE PACIFIC LTD. 'B' A (Max Net Loan H$10m) HK 101 HANG LUNG PROPERTIES LTD. A HK 107 SICHUAN EXPRESSWAY CO. -

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Board and Senior Management (PDF)

BOARD AND SENIOR MANAGEMENT Executive Committee Front (from left to right) Andrew Hunter, H L Kam, Victor Li, Edmond Ip Back (from left to right) Joanna Chen, Pak Lam Lun, Lambert Leung, Dominic Chan, Ivan Chan, Victor Luk, Wendy Tong Barnes DIRECTORS’ BIOGRAPHICAL INFORMATION LI Tzar Kuoi, Victor aged 45, has been the Chairman of the Company since its incorporation in May 1996. He is the Chairman of the Remuneration Committee of the Company since March 2005. He is also the Managing Director and Deputy Chairman of Cheung Kong (Holdings) Limited, Deputy Chairman of Hutchison Whampoa Limited, the Chairman of CK Life Sciences Int’l., (Holdings) Inc., an Executive Director of Hongkong Electric Holdings Limited, Co-Chairman of Husky Energy Inc. and a Director of The Hongkong and Shanghai Banking Corporation Limited (“HSBC”). Except for HSBC, all the companies mentioned above are listed companies. Mr. Victor Li serves as a member of the Standing Committee of the 11th National Committee of the Chinese People’s Political Consultative Conference of the People’s Republic of China. He is also a member of the Commission on Strategic Development, the Greater Pearl River Delta Business Council and the Council for Sustainable Development of the Hong Kong Special Administrative Region, and Vice Chairman of the Hong Kong General Chamber of Commerce. Mr. Victor Li is also the Honorary Consul of Barbados in Hong Kong. He is a director of certain substantial shareholders of the Company within the meaning of Part XV of the Securities and Futures Ordinance (“SFO”). He also holds directorships in certain companies controlled by certain substantial shareholders of the Company. -

75 Watson Cover

th Anniversary Quarter 2 • 2008 A.S. Watson quarterly75 family magazine "PARIS", the backbone of ICI PARIS XL's philosophy Marionnaud to change Hong Kong beauty retail Shining stars at Drogas Student fever Light the Passion & Share the Dream Relief forces mobilise Wats Our Aroundthe world Focusstory Home Ourcommunity Hutchstory tents With a history dating back to 1828, the A.S. Watson Group (ASW) has evolved into an international retail and manufacturing businessn with operations in 36 Co Record year of profit for "PARIS" the backbone of Light the Passion & Share Relief forces Li Ka Shing Center for markets worldwide. Today, the Group owns more than 8,000 retail stores ASW...... ICI PARIS XL's philosophy ...... the Dream...... mobilise...... Learning & Knowledge...... running the gamut from health & beauty chains, luxury perfumeries & cosmetics to food, electronics, fine wine and airport retail arms. An established player 19 33 in the beverage industry, ASW provides a full range of beverages from bottled water, fruit juices, soft drinks and tea products to the world's finest wine labels 28 40 via its international wine wholesaler and distributor. 05 ASW employs over 80,000 staff and is a member of the world renowned Hong Kong-based conglomerate Hutchison Whampoa Limited, which has five core businesses - ports and related services; property and hotels; retail; energy, About A.S. Watson Group About A.S. Watson infrastructure, investments and others; and telecommunications in 57 countries. Editorial committee Published by • Adviser : Dominic Lai • Members : A.S. Watson & Co., Limited Wats On is the quarterly family magazine of the A.S. -

Annual Report 2006 Annual Report2006

(incorporated in the Cayman Islands with limited liability) (Stock Code: 8222) Better Health Better Life Annual Report 2006 Annual Report2006 2 Dai Fu Street, Tai Po Industrial Estate, Hong Kong Tel: (852) 2126 1212 Fax: (852) 2126 1211 www.ck-lifesciences.com Characteristics of the Growth Enterprise Market (”GEM”) of The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) GEM has been established as a market designed to accommodate companies to which a high investment risk may be attached. In particular, companies may list on GEM with neither a track record of profi tability nor any obligation to forecast future profi tability. Furthermore, there may be risks arising out of the emerging nature of companies listed on GEM and the business sectors or countries in which the companies operate. Prospective investors should be aware of the potential risks of investing in such companies and should make the This annual report (“Annual Report”) is available in both decision to invest only after due and careful consideration. English and Chinese. Shareholders who have received either The greater risk profi le and other characteristics of GEM the English or the Chinese version of the Annual Report mean that it is a market more suited to professional and other may request a copy in the language different from that has sophisticated investors. been received by writing to: Computershare Hong Kong Investor Services Limited, 46th Floor, Hopewell Centre, 183 Given the emerging nature of companies listed on GEM, there Queen’s Road East, Hong Kong. is a risk that securities traded on GEM may be more susceptible to high market volatility than securities traded on the Main The Annual Report (in both English and Chinese versions) Board and no assurance is given that there will be a liquid has been posted on the Company’s website at market in the securities traded on GEM. -

CK Hutchison Highlights of the Unaudited Results for the Six Months Ended 30 June 2015

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. Highlights of the Unaudited Results for the six months ended 30 June 2015 CKHH six months statutory results (1) For the six months ended 30 June 2015 HK$ millions Total Revenue 117,250 Profit attributable to ordinary shareholders from continuing business 21,477 Profit attributable to ordinary shareholders from discontinued business 80,381 Profit attributable to ordinary shareholders 101,858 Earnings per share – statutory (2) HK$39.87 CKHH six months management pro forma results (3) (compared to HWL results for businesses continued by CKHH) CKHH Results HWL Results for the six for the six months ended months ended 30 June 2015 30 June 2014 HK$ millions HK$ millions Change Total Revenue (4) 197,019 196,671 - Total EBITDA (4) 46,165 42,587 +8% Total EBIT (4) 30,677 26,815 +14% Profit attributable to ordinary shareholders before profits on disposal of investments & others (5) 14,938 10,220 +46% Profits on disposal of investments & others (482) 14,921 -103% Total profit attributable to ordinary shareholders (6) 14,456 25,141 -43% Recurring earnings per share – pro forma (7) HK$3.87 For the six months ended 30 June 2015 Interim dividend per share HK$0.70 CKHH 2015 Interim Results Page 1 of 98 Note (1) Statutory results of CK Hutchison Holdings Limited (“CKHH” or the “Group”) for the six months ended 30 June 2015 include the one-time effects of the Reorganisation that occurred on 3 June 2015. -

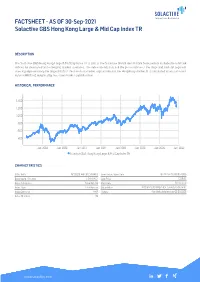

FACTSHEET - AS of 30-Sep-2021 Solactive GBS Hong Kong Large & Mid Cap Index TR

FACTSHEET - AS OF 30-Sep-2021 Solactive GBS Hong Kong Large & Mid Cap Index TR DESCRIPTION The Solactive GBS Hong Kong Large & Mid Cap Index TR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Hong Kong market. It is calculated as a totalreturn index in HKD and weighted by free-float market capitalization. HISTORICAL PERFORMANCE 1,400 1,200 1,000 800 600 400 Jan-2008 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive GBS Hong Kong Large & Mid Cap Index TR CHARACTERISTICS ISIN / WKN DE000SLA4H36 / SLA4H3 Base Value / Base Date 462.12 Points / 08.05.2006 Bloomberg / Reuters / .SHKLMCT Last Price 1256.93 Index Calculator Solactive AG Dividends Reinvested Index Type Total Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency HKD History Available daily back to 08.05.2006 Index Members 52 FACTSHEET - AS OF 30-Sep-2021 Solactive GBS Hong Kong Large & Mid Cap Index TR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -6.80% -10.27% -11.73% 9.67% -4.51% 171.99% Performance (p.a.) - - - - - 6.71% Volatility (p.a.) 21.54% 18.63% 16.63% 17.91% 18.51% 20.09% High 1364.34 1419.58 1482.24 1493.61 1493.61 1493.61 Low 1228.29 1228.29 1228.29 1115.51 1228.29 287.41 Sharpe Ratio -2.67 -1.91 -1.34 0.55 -0.32 0.33 Max. -

1 Abundant Glory Limited British Virgin Islands Executive

Appendix B Present Directorships of Edith SHIH as at effective date of appointment Role Name of Company Place of Incorporation (Executive / Non-Executive) 1 Abundant Glory Limited British Virgin Islands Executive 2 Actionfirm Limited British Virgin Islands Executive 3 AICT Advisory Limited British Virgin Islands Executive Alexandria International Container Terminals 4 Egypt Executive Company S.A.E. 5 Alpha Metrics Limited British Virgin Islands Executive 6 Americas Intermodal Services SA/NV Belgium Executive 7 Americas Shipyard SA/NV Belgium Executive 8 Amsterdam Container Terminals B.V. Netherlands Executive 9 Amsterdam Marine Terminals B.V. Netherlands Executive 10 Amsterdam Port Holdings B.V. Netherlands Executive 11 Anovio Holdings Limited Cyprus Executive 12 APM Terminals Dachan Company Limited Hong Kong Executive 13 Aqaba Terminal Services Limited British Virgin Islands Executive 14 Asia Pacific Honour Holdings Limited British Virgin Islands Executive 15 Bajacorp, S.A. de C.V. Mexico Executive 16 Barcelona Europe South Terminal, S.A. Spain Executive 17 Best Fortune S.a r.l. Luxembourg Executive 18 Best Month Profits Limited British Virgin Islands Executive 19 Best Oasis Holdings Limited British Virgin Islands Executive 20 Best People Resources Limited British Virgin Islands Executive 21 Beyond Excel Investments Limited British Virgin Islands Executive 22 Brightease Profits Limited British Virgin Islands Executive 23 Brisbane Container Terminals Pty Limited Australia Executive Appendix B 24 Buenos Aires Container Terminal Services S.A. Argentina Alternate Director 25 Cape Fortune B.V. Netherlands Executive 26 Central America Shipyard SA/NV Belgium Executive 27 China Terminal Services Holding Company Limited Bermuda Executive 28 Clivedon Limited British Virgin Islands Executive 29 CLK Limited British Virgin Islands Executive 30 Coastal Work Logistics Limited British Virgin Islands Executive 31 Container Security Inc. -

Sphere No.43 (Oct 2017).Pdf

#43 2017 MAN MACHINE: CYBORG RETAIL The Cradle of Civilisations 09 50 Years of Boxing 16 Happy Anniversary Hong Kong 15 To Do and To Be 18 Download Sphere online Our connection to the places we live and work … is something we rightly treasure. Sphere Magazine #43 WELCOME October 2017 Cover Illustration Jessica Li A FUTURE WORTH Sometimes invisible, sometimes in your face, new technology in retail is changing this CELEBRATING venerable business. Our artist captures the online and offline future, but uses warm colours to For millennia the Middle East has been the The Port of Felixstowe also celebrates the remind us that shopping is still a very human place where East meets West. Going to the adoption of new technology that changed experience. region’s bazaars, you can feel the immense the world. The introduction of containers richness of the history in those markets. 50 years ago revolutionised logistics The Group is expanding its long-standing and put the Port at the centre of Britain’s presence in the area and that growth, economy, an event worth celebrating. from ports to water technology, can be discovered in these pages. Celebration has been very much a part of the Group’s experience lately, with Mr Li Those bazaars, while they may now celebrating the annual awards ceremony accept cashless payments, still embody for Shantou University graduates, this year the essence of ancient practices. Shoppers with Nobel laureate Mo Yan. want to see and feel the goods. Ancient merchants connected with far-away Our connection to the places we live and customers just as their modern descendants work – from Felixstowe to Hong Kong, in do now, although today it is perhaps ports and stores, from now and into the through email and apps instead of by future – is something we rightly treasure galleon. -

CK Hutchison Holding(1

Equity Market Hong Kong Equity Morning note Martin Ma (SFC CE:BOB758) (852) 3519 1055 Friday, September 25,2020 Market Wrap HSI▼1.82% HSCEI▼1.96% Turnover HK$117.16 bn ▼9% (30-day average) SSE Composite▼1.72% SZSE Component ▼2.24% Sector tracking Stock tracking 1D ▲% 1Y ▲% 1D ▲% 1Q ▲% Utilities 0.5 Automobiles 88.6 SOLARGIGA ENERGY(757) 38.0 NEXION TECHNOLOG(8420) 339.6 Real Estate 1.0 Durable & Tech 54.9 GOLDWAY EDUCATIO(8160) 21.4 HAINAN MEILAN IN(357) 286.2 GOLDWAY EDUCATIO HAINAN MEILAN IN Consumer Goods Health Care IN TECHNICAL PRO(8446) 1.4 49.8 CORNERSTONE FINA(8112) 20.0 227.1 CORNERSTONE FINA IN TECHNICAL PRO Capital Goods 1.4 Consumer Goods 29.2 CHINA ALUMINUM C(6898) 19.5 KNK HOLDINGS LTD(8039) 222.8 Telecom Services 1.6 Materials 25.6 ROYALCHINA CENTURY ALUMINUM RE(8125) C 18.2 YTOKNK EXPRESS HOLDINGS HOLD LTD(6123) 220.9 MarketROYAL CENTURY Highlight RE YTO EXPRESS HOLD Hong Kong Utilities Series 4 – CKGOLDWAY Hutchison EDUCATIO Holding(1 HK): CORNERSTONE FINA CK Hutchison Holding Limited is a CHINA ALUMINUM C Hutchison Telecommunications HK Holding multinational conglomerate that ROYAL CENTURY RE (0215 HK) operate variety sector of business in around 50 countries and have over CK Infrastructure Holding 300,000 employees around the world. (01038 HK) The business involve including Ports and related services, retail, infrastructure, Energy and Li Ka-shing Telecommunications. CK Hutchison Holding For the year 20201H, Hutchison Group (0001 HK) reported HK$ 189,942 million revenue, with YoY changes of -12%, HK$28,619 of total EBIT, with YoY changes of -21%.