Case 17 Kulula.Com: Now Anyone Can Fly

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Analysis of the Effects of Air Transport Liberalisation on the Domestic Market in Japan

Chikage Miyoshi Analysis Of The Effects Of Air Transport Liberalisation On The Domestic Market In Japan COLLEGE OF AERONAUTICS PhD Thesis COLLEGE OF AERONAUTICS PhD Thesis Academic year 2006-2007 Chikage Miyoshi Analysis of the effects of air transport liberalisation on the domestic market in Japan Supervisor: Dr. G. Williams May 2007 This thesis is submitted in partial fulfilment of the requirements for the degree of Doctor of Philosophy © Cranfield University 2007. All rights reserved. No part of this publication may be reproduced without the written permission of the copyright owner Abstract This study aims to demonstrate the different experiences in the Japanese domestic air transport market compared to those of the intra-EU market as a result of liberalisation along with the Slot allocations from 1997 to 2005 at Haneda (Tokyo international) airport and to identify the constraints for air transport liberalisation in Japan. The main contribution of this study is the identification of the structure of deregulated air transport market during the process of liberalisation using qualitative and quantitative techniques and the provision of an analytical approach to explain the constraints for liberalisation. Moreover, this research is considered original because the results of air transport liberalisation in Japan are verified and confirmed by Structural Equation Modelling, demonstrating the importance of each factor which affects the market. The Tokyo domestic routes were investigated as a major market in Japan in order to analyse the effects of liberalisation of air transport. The Tokyo routes market has seven prominent characteristics as follows: (1) high volume of demand, (2) influence of slots, (3) different features of each market category, (4) relatively low load factors, (5) significant market seasonality, (6) competition with high speed rail, and (7) high fares in the market. -

Punctuality Statistics Economic Regulation Group Aviation Data Unit

Punctuality Statistics Economic Regulation Group Aviation Data Unit Birmingham, Edinburgh, Gatwick, Glasgow, Heathrow, London City, Luton, Manchester, Newcastle, Stansted Full and Summary Analysis March 1998 Disclaimer The information contained in this report will be compiled from various sources and it will not be possible for the CAA to check and verify whether it is accurate and correct nor does the CAA undertake to do so. Consequently the CAA cannot accept any liability for any financial loss caused by the persons reliance on it. Contents Foreword Introductory Notes Full Analysis – By Reporting Airport Birmingham Edinburgh Gatwick Glasgow Heathrow London City Luton Manchester Newcastle Stansted Full Analysis With Arrival / Departure Split – By A Origin / Destination Airport B C – E F – H I – L M – N O – P Q – S T – U V – Z Summary Analysis FOREWORD 1 CONTENT 1.1 Punctuality Statistics: Heathrow, Gatwick, Manchester, Glasgow, Birmingham, Luton, Stansted, Edinburgh, Newcastle and London City - Full and Summary Analysis is prepared by the Civil Aviation Authority with the co-operation of the airport operators and Airport Coordination Ltd. Their assistance is gratefully acknowledged. 2 ENQUIRIES 2.1 Statistics Enquiries concerning the information in this publication and distribution enquiries concerning orders and subscriptions should be addressed to: Civil Aviation Authority Room K4 G3 Aviation Data Unit CAA House 45/59 Kingsway London WC2B 6TE Tel. 020-7453-6258 or 020-7453-6252 or email [email protected] 2.2 Enquiries concerning further analysis of punctuality or other UK civil aviation statistics should be addressed to: Tel: 020-7453-6258 or 020-7453-6252 or email [email protected] Please note that we are unable to publish statistics or provide ad hoc data extracts at lower than monthly aggregate level. -

Emerging Tendencies in the European Airline Industry

Thesis from International Master Program – Strategy and Culture Emerging Tendencies in the European Airline Industry - an investigation of SAS and Ryanair - Mandy Jacob Zuzana Jakešová Supervisor: SuMi ParkDahlgaard The photograph (on reverse side) was taken by Oliver Semrau October 30, 2002 in London, a commercial poster of Lufthansa. It nicely illustrates the motivation of the thesis. Avdelning, Institution Datum Division, Department Date 2003-01-20 Ekonomiska Institutionen 581 83 LINKÖPING Språk Rapporttyp ISBN Language Report category Svenska/Swedish Licentiatavhandling X Engelska/English Examensarbete ISRN Internationella ekonomprogrammet 2003/2 C-uppsats X D-uppsats Serietitel och serienummer ISSN Title of series, numbering Övrig rapport ____ URL för elektronisk version http://www.ep.liu.se/exjobb/eki/2003/iep/002/ Titel Emerging Tendencies in the European Airline Industry - an investigation of SAS and Title Ryanair - Författare Mandy Jacob, Zuzana Jakešová Author Sammanfattning Abstract Background: The airline industry is unique and fascinating. It was protected through government controls until the early 1980s. However, due to deregulation policy the industry opened to free competition. As a result, collaborations and alliances were formed and low budget airlines were able to enter the market. Purpose: The purpose of this thesis is to present the current stage of the European airline industry by investigating the strategies of Ryanair and SAS with the help of strategic management tools. Procedure: Two companies were chosen, Ryanair as a low budget airline and SAS as a mature airline. The investigation was based on secondary data found in financial -, annual -, business - and company reports as well as in independent analyst reports and on the Internet. -

Impact of Low Cost Operation in the Development of Airports and Local Economies 1

IMPACT OF LOW COST OPERATION IN THE DEVELOPMENT OF AIRPORTS AND LOCAL ECONOMIES 1 Rosário Macário 1, 2 José M. Viegas 1, 2 Vasco Reis 1 1 CESUR, Instituto Superior Técnico, Universidade Técnica de Lisboa, Portugal 2 TIS. PT , Consultores em Transportes, Inovação e Sistemas, s.a. 1 Abstract In a matter of a couple of decades, the segment of the low cost companies grew from a few companies operating in Great Britain to several tens operating all over European Union. Nowadays, a dense network of connections links a large number of cities, ranging from the bigger metropolis down to very few populated regions, with relatively affordable prices. Populations enjoy from unprecedent mobility and isolated regions profited from the access to other regions without even perceiving that the current benefits they have developed at the cost of some market casualties. Many of the original low cost companies have meanwhile gone bankrupt along with some of the already established ones. The growth of the low cost segment has definitively changed the air transport landscape in Europe and in the future more changes are expected, similar to what occurred in the United States. Although the impact of these dynamics has been thoroughly researched, from an institutional point of view they remain fairly unknown. This paper presents a part of the results and findings of a research study prepared for the European Parliament, focused on the impacts in the development of the airports and local economies. The purpose of the overall study was to evaluate and assess the consequences of the growing low cost airline sector for transport infrastructure and passenger flows in Europe and to advise the European Parliament on the need for future actions. -

Strategies for Low-Cost Airlines

The strategies and effects of low-cost airlines Simon Smith Contents ■ Who and what are the low cost airlines? ■ What is the market for the low cost airlines? ■ How much ‘lower cost’ are they, and why? ■ What is the impact on long-distance rail? ■ What are the key strategies for success? ■ What is the future for the low cost sector? Who and what are the low cost airlines? Who are the low cost airlines? ■ The main low cost airlines operating to/from the UK are: ■ Globally, the largest and most successful low cost airline is Southwest in the US What are the key characteristics of low cost airlines? ■ The low-cost model was pioneered by Southwest Airlines in the US, and European low-cost carriers have all followed this to an extent: ● high seating density and load factors ● uniform aircraft types (usually the 737-300) ● direct booking (internet/call centre - no sales commissions) ● no frills such as “free” food/drinks, lounges or ‘air miles’ ● simple systems of yield management (pricing) ● use of secondary airports to cut charges and turnaround times Successful low cost airlines are very profitable ■ The successful low cost airlines are more profitable than established carriers ■ Ryanair has a market capitalisation of about £3 billion Operating margins by airline (1999) British Airways 0.9% Air France 3.5% Lufthansa 5.7% KLM 1.5% United Airlines 11.9% Ryanair 22.7% Southwest 21.8% What is the market for the low cost airlines? Entry spurs an increase in demand (often one-off) 260 Time of entry240 of lower cost carrier Data is for passengers on routes to London. -

The Consequences of the Growing European Low-Cost Airline Sector

STUDY Policy Department Structural and Cohesion Policies THE CONSEQUENCES OF THE GROWING EUROPEAN LOW-COST AIRLINE SECTOR TRANSPORT AND TOURISM December 2007 EN Directorate-General for Internal Policies of the Union Policy Department Structural and Cohesion Policies TRANSPORT AND TOURISM THE CONSEQUENCES OF THE GROWING EUROPEAN LOW-COST AIRLINE SECTOR STUDY IP/B/TRAN/IC/2006-185 04/12/2007 PE 397.234 EN This study was requested by the European Parliament's Committee on Transport and Tourism. This paper is published in the following languages: - Original: EN; - Translations: DE, FR. Authors: CESUR, Instituto Superior Técnico, Technical University of Lisbon, Portugal, and Department of Transport and Regional Economics (TPR), University of Antwerp, Belgium* Responsible Official: Nils DANKLEFSEN Directorate B: Policy Department Structural and Cohesion Policy European Parliament Rue Wiertz 60 B-1047 Brussels E-mail: [email protected] Manuscript completed in December 2007. This study is available on Internet: http://www.europarl.europa.eu/activities/expert/eStudies.do?language=EN Brussels, European Parliament, 2007. The opinions expressed in this document are the sole responsibility of the authors and do not necessarily represent the official position of the European Parliament. Reproduction and translation for non-commercial purposes are authorised, provided the source is acknowledged and the publisher is given prior notice and sent a copy. * Rosário MACÁRIO, Vasco REIS, José VIEGAS, Hilde MEERSMAN, Feliciana MONTEIRO, Eddy van de VOORDE, Thierry VANELSLANDER, Peter MACKENZIE-WILLIAMS, Henning SCHMIDT. Directorate-General for Internal Policies of the Union Policy Department Structural and Cohesion Policies TRANSPORT AND TOURISM THE CONSEQUENCES OF THE GROWING EUROPEAN LOW-COST AIRLINE SECTOR STUDY Content: The study provides an analysis of the impact of the changes in air transport market as a consequence of the emergence of low fares airlines. -

Communications Department External Information Services 16 May 2018

Communications Department External Information Services 16 May 2018 Reference: F0003681 Dear I am writing in respect of your amended request of 17 April 2018, for the release of information held by the Civil Aviation Authority (CAA). You requested data on Air Operator Certificate (AOC) holders, specifically a complete list of AOC numbers and the name of the company to which they were issued. Having considered your request in line with the provisions of the Freedom of Information Act 2000 (FOIA), we are able to provide the information attached. The list includes all the AOC holder details we still hold. While it does include some historical information it is not a complete historical list, and the name of the AOC holder is not necessarily the name of the organisation at the time the AOC was issued. If you are not satisfied with how we have dealt with your request in the first instance you should approach the CAA in writing at:- Caroline Chalk Head of External Information Services Civil Aviation Authority Aviation House Gatwick Airport South Gatwick RH6 0YR [email protected] The CAA has a formal internal review process for dealing with appeals or complaints in connection with Freedom of Information requests. The key steps in this process are set in the attachment. Civil Aviation Authority Aviation House Gatwick Airport South Gatwick RH6 0YR. www.caa.co.uk Telephone: 01293 768512. [email protected] Page 2 Should you remain dissatisfied with the outcome you have a right under Section 50 of the FOIA to appeal against the decision by contacting the Information Commissioner at:- Information Commissioner’s Office FOI/EIR Complaints Resolution Wycliffe House Water Lane Wilmslow SK9 5AF https://ico.org.uk/concerns/ If you wish to request further information from the CAA, please use the form on the CAA website at http://publicapps.caa.co.uk/modalapplication.aspx?appid=24. -

Quiz – Defunct Airlines #2 by Sergio Ortega | Published in January 2009 from Questions Published in April 1998

Quiz – Defunct airlines #2 by Sergio Ortega | published in January 2009 from questions published in April 1998 1. Which airline was formed by the merger of 6. Which Belgian airline was in business between Caledonian Airways and Flying Colours? 1996 and 2001 and operated Sabena’s MD-11 A. Air Britain flights? B. British Caledonian A. American Airlines C. JMC Air B. British Airways D. Thomas Cook Airways C. CityBird D. Swissair 2. Which airline, operating Fokker F.28s in the 1980s, had a hub in Utica-Rome, NY and later in 7. Which airport was Western Pacific’s first hub? Syracuse, NY? A. Aspen A. Allegheny Airlines B. Colorado Springs B. Air Oneida C. Denver International Airport C. Altair Airlines D. Eagle County D. Empire Airlines 8. Which short-lived airline (1997-1999) was based 3. Which low-cost subsidiary of KLM uk started at Long Beach Airport? operations in 2000 on BAe-146 aircraft and was A. Air America acquired by Ryanair in 2003? B. Long Beach Jet Express A. AB Airlines C. Royal Airways B. Buzz D. WinAir C. easyJet D. Go Fly 9. Which now defunct airline used IATA code “RC”? 4. Which Caribbean airline had a color scheme with A. Air America the national musical instrument on a solid B. Hughes Airwest turquoise background? C. Republic Airlines A. Air Jamaica D. Southern B. BWIA C. Cayman Airways 10. You probably know that BEA and BOAC merged D. Cubana de Aviacion to form British Airways. Please identify from which of the two airlines BA inherited its two- 5. -

The Airline Business, Second Edition

The Airline Business Airlines have been suffering from severe turbulence. In recent years the industry has faced its longest and deepest crisis ever: many airlines lost billions of US dollars, several collapsed, while others had to be rescued by their respective governments. This crisis, caused initially by a downturn in the world economy, deepened as a result of external shocks such as the 11 September 2001 terrorist attacks, the Iraq war, the SARS epidemic and oil price hikes after 2003. In a period of turbulence and uncertainty, The Airline Business analyses the key issues that continue to impact on the stability and structure of the airline industry. Special attention is paid to the effect of continued liberalisation and ‘open skies’, to the need to cut labour costs, the impact of alliances and consolidation, the growing threat of low-cost carriers, the e-commerce revolution and the problems faced by state-owned airlines. Finally, Rigas Doganis assesses alternative strategies which could help airlines survive and succeed in a period of uncertainty and structural change within the industry. Rigas Doganis is the doyen of commentators on the airline industry and this second edition of his definitive book on the subject brings the story up to date. This book will be of interest and value to all those working in aviation and to students studying transportation economics or business strategy. Rigas Doganis is a non-executive director of South African Airways and a former chairman/CEO of Olympic Airways in Athens. He is a visiting professor in Air Transport at Cranfield University, UK and the author of Flying Off Course: the economics of international airlines and The Airport Business. -

Punctuality Statistics Economic Regulation Group Aviation Data Unit

Punctuality Statistics Economic Regulation Group Aviation Data Unit Birmingham, Edinburgh, Gatwick, Glasgow, Heathrow, London City, Luton, Manchester, Newcastle, Stansted Full and Summary Analysis October 1998 Disclaimer The information contained in this report will be compiled from various sources and it will not be possible for the CAA to check and verify whether it is accurate and correct nor does the CAA undertake to do so. Consequently the CAA cannot accept any liability for any financial loss caused by the persons reliance on it. Contents Foreword Introductory Notes Full Analysis – By Reporting Airport Birmingham Edinburgh Gatwick Glasgow Heathrow London City Luton Manchester Newcastle Stansted Full Analysis With Arrival / Departure Split – By A Origin / Destination Airport B C – E F – H I – L M – N O – P Q – S T – U V – Z Summary Analysis FOREWORD 1 CONTENT 1.1 Punctuality Statistics: Heathrow, Gatwick, Manchester, Glasgow, Birmingham, Luton, Stansted, Edinburgh, Newcastle and London City - Full and Summary Analysis is prepared by the Civil Aviation Authority with the co-operation of the airport operators and Airport Coordination Ltd. Their assistance is gratefully acknowledged. 2 ENQUIRIES 2.1 Statistics Enquiries concerning the information in this publication and distribution enquiries concerning orders and subscriptions should be addressed to: Civil Aviation Authority Room K4 G3 Aviation Data Unit CAA House 45/59 Kingsway London WC2B 6TE Tel. 020-7453-6258 or 020-7453-6252 or email [email protected] 2.2 Enquiries concerning further analysis of punctuality or other UK civil aviation statistics should be addressed to: Tel: 020-7453-6258 or 020-7453-6252 or email [email protected] Please note that we are unable to publish statistics or provide ad hoc data extracts at lower than monthly aggregate level. -

STA/10-WP/9 International Civil Aviation Organization 13/10/09

STA/10-WP/9 International Civil Aviation Organization 13/10/09 WORKING PAPER TENTH SESSION OF THE STATISTICS DIVISION Montréal, 23 to 27 November 2009 Agenda Item 2: Air carrier traffic data and traffic flow statistics DEFINITION AND IDENTIFICATION OF LOW-COST CARRIERS (Presented by the Secretariat) SUMMARY The need for identification of Low-Cost Carriers (LCCs) in ICAO’s statistics programme is gaining importance as a result of their increasing international presence. ICAO has already developed a definition of LCCs in the context of economic regulation of international air transport and there are other definitions and/or identification methods of LCCs adopted by States and international organizations. This paper reviews various methods of identifying LCCs, as well as the issues associated with them, such as a trade-off between the limitation of data on this category of carriers and the application of an element of subjective judgement to determine the categorisation. In order to integrate this new market segment in ICAO’s statistics programme, the paper recommends that ICAO should send a list of carriers identified as being LCCs, as appearing in the Appendix to this working paper, to Contracting States and the aim is to seek their feedback on the appropriateness of the categorization for those carriers on the list, and others not listed, in order to update this list on a regular basis.. Action by the division is in paragraph 5. 1. INTRODUCTION 1.1 The growth of Low-Cost Carriers (LCCs) has had a significant impact on airline competition, airline business models and air travel in general. -

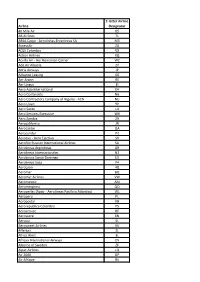

Airline Designator Codes

2-letter Airline Airline Designator 40 Mile Air Q5 AB Airlines 7L ABSA Cargo - Aerolinhas Breseleiras SA M3 AccessAir ZA ACES Colombia VX Action Airlines XQ Acvilla Air - Aor Romanian Carrier WZ Ade Air Albania ZY Adria Airways JP Advance Leasing 4G Aer Arann RE Aer Lingus EI Aero Asia International E4 Aero Continente N6 Aero Contractors Company of Nigeria - ACN NU Aero Lloyd YP Aero Santa UJ Aero Services Executive W4 Aero Zambia Z9 Aerocalifornia JR Aerocaribe QA Aerocondor P2 Aeroexo - Aero Ejectivo SX Aeroflot Russian International Airlines SU Aerolineas Argentinas AR Aerolineas Internacionales N2 Aerolineas Santo Domingo EX Aerolineas Sosa P4 AeroLyon 4Q Aeromar BQ Aeromar Airlines VW Aeromexico AM Aeromexpress QO Aeroperlas (Apair - Aerolineas Pacificio Atlantico) WL Aeroperu PL Aeropostal VH Aerorepublica Colombia P5 Aeroservice BF Aerosucre 6N Aerosur 5L Aerosweet Airlines VV Affertair ZL Africa West 3L African International Airways OY Aiborne of Sweden ZF Aipac Airlines LQ Air 2000 DP Air Afrique RK Air Alaska Cargo 8S Air Alfa H7 Air Algerie AH Air Alliance 3J Air Anatolia TD Air Aruba FQ Air Asia AK Air Atlanta - Atlanta Icelandic Air Transport CC Air Atlantic 9A Air Atlantic Dominicana LU Air Atlantic Spain QD Air Austral UU Air Baltic BT Air BC ZX Air Belgium International AJ Air Berlin AB Air Bosna JA Air Botnia KF Air Botswana BP Air Burkina 2J Air Caledonie TY Air Caledonie International SB Air Canada AC Air Caraibes WS Air Cargo Express 3K Air Carribean C2 Air Carribean - CLTM Airlines XC Air Chathams CV Air China CA