Nexant Complete Report Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MPC for Upstream Oil & Gas Fields a Practical View

MPC for Upstream Oil & Gas Fields a practical view Yahya Al-Naumani A thesis submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy University of Sheffield July 2017 Dedicated to my Parents and Family i ABSTRACT This work aims to improve corporate functional departments’ confidence in adopt- ing modern control approaches in new scenarios and thus presents control structure solutions based on model predictive control (MPC) for two control problems facing ex- isting upstream oil and gas production plants. These are the disturbance growth in the series connected process and the control system dependency on operators. The suggested control solution integrates MPC as a master controller for the existing clas- sical control of each subsystem, with a focus on those with high interaction phenom- ena. The proposed approach simply and inexpensively encompass MPC features such as predictions, optimizations, coordination and constraint handling as well as PID features like simplicity and ease of troubleshoot. In addition, the proposed control concept utilises the process safeguarding information and enhances the plant-wide op- timal performance. The suggested control solution supports the role of control room operators, which is shown to reduce the growth in the impact of process disturbances. Compared with some alternative control structures (centralised MPC, decentralised MPC, distributed MPC (DMPC), and hierarchical DMPC) this proposal is simple, in- expensive to implement, and critically, builds on the local team operational experience and maintenance skills. Three process models were developed that representing the common gas treatment processes in upstream oil and gas plants, gas sweetening, gas dehydration and hydro- carbon dewopointing. -

JODI Oil Manual Is Another Important Milestone on the Road to More Transparent Energy Markets Through Improved Data

1 ASIA PACIFIC ECONOMIC COOPERATION (APEC) APEC is an intergovernmental grouping operating on the basis of non-binding commitments, open dialogue and equal respect for the views of all participants. It was established in 1989 to further enhance economic growth and prosperity for the region and to strengthen the Asia-Paci�ic community. APEC’s 21 Member Economies are Australia; Brunei Darussalam; Canada; Chile; People’s Republic of China; Hong Kong, China; Indonesia; Japan; Republic of Korea; Malaysia; Mexico; New Zealand; Papua New Guinea; Peru; The Republic of the Philippines; The Russian Federation; Singapore; Chinese Taipei; Thailand; The United States of America; and Viet Nam. Since its inception, APEC has worked to reduce tariff s and other trade barriers across the Asia-Paci�ic region, creating ef�icient domestic economies and dramatically increasing exports. Key to achieving APEC’s vision are what are referred to as the ’Bogor Goals’ of free and open trade and investment in the Asia-Paci�ic by 2010 for industrialised economies and 2020 for developing economies. These goals were adopted by Leaders at their 1994 meeting in Bogor, Indonesia. APEC’s energy issues are the responsibilities of the Energy Working Group (EWG), one of its 11 working groups. The development and maintenance of the APEC Energy Database is assigned to EWG’s Expert Group on Energy Data and Analysis (EGEDA) who has appointed the Energy Data and Modelling Centre (EDMC) of the Institute of Energy Economics, Japan (IEEJ) as the Coordinating Agency. One of the objectives of EGEDA is to collect monthly oil data of the APEC economies in support of the Joint Asia Paci�ic Economic Cooperation (APEC) Organisations Data Initiative. -

Teesside Crude Oil Stabilisation Terminal Seal Sands Middlesbrough TS2 1UH

Notice of variation and consolidation with introductory note The Environmental Permitting (England & Wales) Regulations 2010 ConocoPhillips Petroleum Company UK Ltd. Teesside Crude Oil Stabilisation Terminal Seal Sands Middlesbrough TS2 1UH Variation application number EPR/NP3033LN/V005 Permit number EPR/NP3033LN Teesside Crude Oil Stabilisation Terminal Variation and consolidation number EPR/NP3033LN/V005 1 Teesside Crude Oil Stabilisation Terminal Permit number EPR/NP3033LN Introductory note This introductory note does not form a part of the notice. Under the Environmental Permitting (England & Wales) Regulations 2010 (schedule 5, part 1, paragraph 19) a variation may comprise a consolidated permit reflecting the variations and a notice specifying the variations included in that consolidated permit. Schedule 1 of the notice specifies that all the conditions of the permit have been varied and schedule 2 comprises a consolidated permit which reflects the variations being made and contains all conditions relevant to this permit. The requirements of the Industrial Emissions Directive (IED) 2010/75/EU are given force in England through the Environmental Permitting (England and Wales) Regulations 2010 (the EPR) (as amended). This Permit, for the operation of large combustion plant (LCP), as defined by articles 28 and 29 of the Industrial Emissions Directive (IED), is varied by the Environment Agency to implement the special provisions for LCP given in the IED, by the 1 January 2016 (Article 82(3)). The IED makes special provisions for LCP under Chapter III, introducing new Emission Limit Values (ELVs) applicable to LCP, referred to in Article 30(2) and set out in Annex V. As well as implementing Chapter III of IED, the consolidated variation notice takes into account and brings together in a single document all previous variations that relate to the original permit issued. -

Carbon Performance Assessment of Oil & Gas Producers

Carbon Performance assessment of oil & gas producers: note on methodology October 2020 Simon Dietz, Dan Gardiner, Valentin Jahn and Jolien Noels Contents Carbon Performance assessment of oil & gas producers: note on methodology 1 Contents 2 1. Introduction 4 2. The basis for TPI’s Carbon Performance assessment: the Sectoral Decarbonization Approach 5 3. How TPI is applying the SDA 7 3.1. Deriving the benchmark paths 7 3.2. Calculating company emissions intensities 11 3.3. Emissions reporting boundaries 11 3.4. Data sources and validation 12 3.5. Responding to companies 12 3.6. Presentation of assessment on TPI website 13 4. Specific considerations in the assessment of oil & gas producers 14 4.1. Measure of emissions intensity 14 4.2 The Assessed Product 14 4.3 Estimating Scope 3 emissions from use of sold products 16 4.4 Other energy 18 4.5 Estimating Scope 2 emissions 18 4.6 Incomplete disclosure 18 4.7. Coverage of target 19 5. Discussion 21 5.1. General issues 21 5.2. Issues specific to oil & gas producers 21 6. Disclaimer 23 7. Bibliography 24 Annex 1: The emissions and energy content of fossil fuels varies by product 25 Annex 2: The energy content of biofuels 27 Annex 3: IPCC Product Category Definitions 28 Annex 4: Power plant efficiency 34 A4.1 Coal 34 A4.2 Gas 35 A4.3 Other 35 2 3 1. Introduction The Transition Pathway Initiative (TPI) is a global initiative led by asset owners and supported by asset managers. Established in January 2017, TPI is now supported by over 75 investors globally with over $20 trillion of assets under management.1 On an annual basis, TPI assesses how companies are preparing for the transition to a low- carbon economy in terms of their: • Management Quality – all companies are assessed on the quality of their governance/management of greenhouse gas emissions and of risks and opportunities related to the low-carbon transition; • Carbon Performance – in selected sectors, TPI quantitatively benchmarks companies’ carbon emissions against international climate targets made as part of the 2015 UN Paris Agreement. -

General Notes

MONTHLY OIL DATA SERVICE DATABASE DOCUMENTATION Latest update: November 2020 2 - MONTHLY OIL DATA SERVICE: DATABASE DOCUMENTATION TABLE OF CONTENTS 1. DATABASE STRUCTURE………………………………………………….3 2. SUPPLY, DEMAND, BALANCES AND STOCKS PACKAGE…….…...7 Supply (SUPPLY.IVT) ......................................................................................................... 7 Balance: Crude oil (CRUDBAL.IVT) ................................................................................ 14 Balance: Products (PRODBAL.IVT) ................................................................................ 20 Balance: Sub products (PRODSP.IVT) ........................................................................... 26 OECD demand (OECDDEM.IVT) ..................................................................................... 31 Non-OECD Demand (NOECDDEM.IVT) .......................................................................... 33 Stocks (STOCKS.IVT) ...................................................................................................... 34 Summary table (SUMMARY.IVT) ..................................................................................... 38 Refinery throughputs (ref_throughput.csv, ref_throughput.xlsx) ............................... 41 3. TRADE PACKAGE…………………………………………………………42 Imports and exports (IMPORTS.IVT and EXPORTS.IVT) .............................................. 42 4. FIELD BY FIELD PACKAGE……………………………………………..53 Field by field (field_by_field.csv and field_by_field.xlsx) ............................................ -

Co2 Emissions from Fuel Combustion 2020 Edition

CO2 EMISSIONS FROM FUEL COMBUSTION 2020 EDITION DATABASE DOCUMENTATION INTERNATIONAL ENERGY AGENCY 2 - CO2 EMISSIONS FROM FUEL COMBUSTION: DATABASE DOCUMENTATION (2020 edition) This document provides information regarding the 2020 edition of the IEA CO2 emissions from fuel combustion database. This document can be found online at: http://wds.iea.org/wds/pdf/Worldco2_Documentation.pdf. Please address your inquiries to [email protected]. Please note that all IEA data are subject to the following Terms and Conditions found on the IEA’s website: http://www.iea.org/t&c/termsandconditions/. INTERNATIONAL ENERGY AGENCY CO2 EMISSIONS FROM FUEL COMBUSTION: DATABASE DOCUMENTATION (2020 edition) - 3 TABLE OF CONTENTS 1. CHANGES FROM LAST EDITION .............................................................................. 4 2. DATABASE DESCRIPTION ........................................................................................ 7 3. DEFINITIONS ............................................................................................................... 9 4. GEOGRAPHICAL COVERAGE AND COUNTRY NOTES ........................................ 38 5. UNDERSTANDING THE IEA CO2 EMISSIONS ESTIMATES ................................... 66 6. IEA ESTIMATES: CHANGES UNDER THE 2006 IPCC GUIDELINES ..................... 71 7. ESTIMATES FOR YEARS STARTING IN 1751 ........................................................ 78 8. BEYOND CO2 EMISSIONS FROM FUEL COMBUSTION: SOURCES AND METHODS ................................................................................................................ -

B521-1 EXTRACTION, FIRST TREATMENT and LOADING of LIQUID & GASEOUS FOSSIL FUELS Activities 050201 - 050303 Ed050201

EXTRACTION, FIRST TREATMENT AND LOADING OF LIQUID & GASEOUS FOSSIL FUELS ed050201 Activities 050201 - 050303 SNAP CODE : 050200 050201 050202 050301 050302 050303 SOURCE ACTIVITY TITLE: EXTRACTION , 1ST TREATMENT AND LOADING OF LIQUID FOSSIL FUELS Land-based Activities Off-shore Activities EXTRACTION , 1ST TREATMENT AND LOADING OF GASEOUS FOSSIL FUELS Land-based Desulfuration Land-based Activities (other than Desulfuration) Off-shore Activities NOSE CODE: 106.02.01 106.02.02 106.03.01 106.03.02 106.03.03 NFR CODE: 1 B 2 a i 1 B 2 b 1 ACTIVITIES INCLUDED These SNAP codes cover the emissions from sources in connection with the extraction and preliminary treatment of liquid and gaseous fossil fuels. This includes extraction, first treatment and loading of gaseous and liquid fossil fuels from on-shore and offshore facilities. Flaring and combustion of fossil fuels are not included in this section (see SNAP code 090206 and SNAP sectors 1 - 3). The fugitive losses from production facilities, first loading of crude fuels, and gas processing plants prior to the national or international gas distribution systems are also included. Subsequent loading and distribution of fuels are considered under SNAP codes 050400 and 050600. Note that production and transport facilities may not be associated with the same countries as the first treatment facilities. For example a gas production platform may be in a Norwegian field, but the gas received at a terminal in Germany. The current section covers the following activities which may take place on land or -

Process Simulation and Assessment of Crude Oil Stabilization Unit Abstract

Process simulation and assessment of crude oil stabilization unit Item Type Article Authors Rahmanian, Nejat; Aqar, D.Y.; Bin Dainure, M.F.; Mujtaba, Iqbal M. Citation Rahmanian N, Aqar DY, Bin Dainure MF et al (2018) Process simulation and assessment of crude oil stabilization unit. Asia- Pacific Journal of Chemical Engineering. 13(4): e2219. Rights © 2018 Curtin University and John Wiley & Sons, Ltd. This is the peer reviewed version of the following article: Rahmanian N, Aqar DY, Bin Dainure MF et al (2018) Process simulation and assessment of crude oil stabilization unit. Asia-Pacific Journal of Chemical Engineering. 13(4): e2219, which has been published in final form at https://doi.org/10.1002/apj.2219. This article may be used for non-commercial purposes in accordance with Wiley Terms and Conditions for Self-Archiving. Download date 28/09/2021 15:53:08 Link to Item http://hdl.handle.net/10454/16518 Process Simulation and Assessment of Crude Oil Stabilization Unit Nejat Rahmaniana*, Dhia Y. Aqara, Muhammad F. Bin Dainurec, Iqbal M. Mujtabaa a Chemical Engineering Division, School of Engineering, University of Bradford, Bradford, BD7 1DP, UK b Chemical Engineering Department, Universiti Teknologi PETRONAS, Bandar Seri Iskandar, 31750 Tronoh, Perak Darul Ridzuan *Corresponding author: [email protected] Abstract Crude oil is an unrefined petroleum composed of wide range of hydrocarbon up to n-C40+. However, there are also a percentage of light hydrocarbon components present in the mixture. Therefore, to avoid their flashing for safe storage and transportation, the live crude needs to be stabilized beforehand. This paper aims to find the suitable operating conditions to stabilize an incoming live crude feed to maximum True Vapor Pressure (TVPs) of 12 psia (82.7 kPa) at Terengganu Crude Oil Terminal (TCOT), Malaysia. -

Oil Information 2020 Edition Database Documentation

OIL INFORMATION 2020 EDITION DATABASE DOCUMENTATION 2 - OIL INFORMATION: DATABASE DOCUMENTATION (2020 edition) This document provides support information for the IEA Oil Information database. This document can be found online at: http://wds.iea.org/wds/pdf/Oil_documentation.pdf Please address your inquiries to [email protected]. Please note that all IEA data are subject to the Terms and Conditions which can be found on the IEA’s website at: https://www.iea.org/terms. INTERNATIONAL ENERGY AGENCY OIL INFORMATION: DATABASE DOCUMENTATION (2020 edition) - 3 TABLE OF CONTENTS 1. CHANGES FROM LAST EDITION ............................................................................... 4 2. DATABASE STRUCTURE ........................................................................................... 4 3. FLOW DEFINITIONS .................................................................................................... 7 4. PRODUCT DEFINITIONS ........................................................................................... 17 5. GEOGRAPHICAL COVERAGE .................................................................................. 22 6. COUNTRY NOTES AND SOURCES .......................................................................... 39 7. UNITS AND CONVERSIONS ..................................................................................... 64 8. ABBREVIATIONS ....................................................................................................... 68 INTERNATIONAL ENERGY AGENCY 4 - OIL INFORMATION: DATABASE DOCUMENTATION -

Carbon Performance Assessment of Oil & Gas Producers: Note on Methodology

Carbon Performance assessment of oil & gas producers: note on methodology June 2019 Simon Dietz, Dan Gardiner, Valentin Jahn and Jolien Noels Contents 1. Introduction 3 2. The basis for TPI’s Carbon Performance assessment: the Sectoral Decarbonization Approach 4 3. How TPI is applying the SDA 6 3.1. Deriving the benchmark paths 6 3.2. Calculating company emissions intensities 10 3.3. Emissions reporting boundaries 10 3.4. Data sources and validation 11 3.5. Responding to companies 11 3.6. Presentation of assessment on TPI website 12 4. Specific considerations in the assessment of Oil & Gas producers 13 4.1. Measure of emissions intensity 13 4.2 The Assessed Product 13 4.3 Estimating Scope 3 emissions from use of sold products 15 4.4 Other Energy 17 4.5 Estimating Scope 2 emissions 17 4.6 Incomplete disclosure 17 4.7. Coverage of target 18 5. Discussion 20 5.1. General issues 20 5.2. Issues specific to oil & gas producers 20 6. Disclaimer 22 7. Bibliography 23 Annex 1: The emissions and energy content of fossil fuels varies by product 24 Annex 2: The energy content of biofuels 26 Annex 3: IPCC Product Category Definitions 27 Annex 4: Power plant efficiency 33 2 1. Introduction The Transition Pathway Initiative (TPI) is a global initiative led by asset owners and supported by asset managers. Established in January 2017, TPI investors now collectively represent more than 45 supporters with over £8.6/$11 trillion of assets under management.1 On an annual basis, TPI assesses how companies are preparing for the transition to a low-carbon economy in terms of their: Management Quality – all companies are assessed on the quality of their governance/management of greenhouse gas emissions and of risks and opportunities related to the low-carbon transition; Carbon Performance – in selected sectors, TPI quantitatively benchmarks companies’ carbon emissions against international climate targets made as part of the 2015 UN Paris Agreement. -

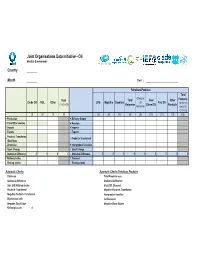

Extended JODI-Oil Questionnaire (PDF)

# Joint Organisations Data Initiative - Oil Monthly Questionnaire Country Month Unit : Petroleum Products Total Of which: Total Total Gas/ Other Products Crude Oil NGL Other LPG Naphtha Gasoline Jet Fuel Oil (1)+(2)+(3) Kerosene Diesel Oil Products (5)+(6)+(7) Kerosene +(8)+(10) +(11)+(12) (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) + Production + Refinery Output + From Other sources + Receipts + Imports + Imports - Exports - Exports Products Transferred + - Products Transferred /Backflows - Direct Use + Interproduct Transfers - Stock Change - Stock Change - Statistical Difference 0000- Statistical Difference 000000000 = Refinery Intake = Demand Closing stocks Closing stocks Automatic Checks Automatic Checks Petroleum Products Total sum Total Products sum Statistical Difference Statistical Difference Stat. Diff./Refinery Intake Stat. Diff. /Demand Products Transferred Negative Products Transferred Negative Products Transferred Interproduct transfers Blocked out cells Jet Kerosene Negative Stock Values Negative Stock Values Refinery Losses 0 Joint Organisations Data Initiative - Oil (Short Definitions) TIME :M-1 is Last Month, or the month previous to the current month. PRODUCTS 1. Crude Oil : Including lease condensate – excluding NGL 2. NGL : Liquid or liquefied hydrocarbons recovered from gas separation plants and gas processing facilities 3. Other : Refinery Feedstocks + Additives/oxygenates + Other Hydrocarbons 4. Total : Sum of categories (1) to (3) Total = Crude Oil + NGL + Other 5. LPG : Comprises propane and butane 6. Naphtha : Comprises naphtha used as feedstocks for producing high octane gasoline and also as feedstock for the chemical/petrochemical industries 7. Gasoline : Comprises motor gasoline and aviation gasoline. Motorgasoline includes biogasoline, e.g. ethanol blends 8. Total Kerosene : Comprises jet kerosene and other kerosene 9. Of which: Jet Kerosene : Aviation fuel used for aviation turbine power units. -

Longford Crude Oil Stabilisation and Gas Plants

Longford Crude Oil Stabilisation and Gas Plants Safety Case Summary Contents 03 Message From The Longford 11 Hazardous Materials Plants Manager 12 Safety Case - Summary 04 Glossary 13 Safety Management System 05 Esso Australia Safety Assessment 06 Safety Policy Hazard Register 07 Introduction Major Incidents 14 Control Measures 08 Occupational Health and Emergency Shutdown Systems Safety Regulations Emergency Response Plan Major Hazard Facilities 16 Community Notification Safety Case and Response Schedule 14 Materials Community Engagement Major Incidents 17 Need More Information? 09 Longford Plants Overview 18 Appendix ii – Licence to Operate 10 Personnel a Major Hazard Facility Locality and Community 2 Message from the Longford Plants Manager Here at Longford Plants, we work to promote a culture of safety, health and operational excellence. We are committed to protecting both the people at our site and those in the surrounding community. Longford Plants is one of the most important and ensure accountability for results. Our highly industrial facilities in Australia. It has been operating skilled workforce rigorously employs this proven for nearly 50 years and in that time the oil and gas management system in all work processes and at passing through its network of pipes and vessels has all levels. contributed significantly to the national economy, fuelling growth in industry and employment. We are continuously striving to improve our personnel safety, process safety, security, health, Longford has been supplying most of Victoria’s gas and environmental performance. requirements since 1969 and today we continue to supply the much needed gas that fuels our stoves We are committed to engaging with the and heats our homes.