995-460 [email protected] AL Bennett, Chad Chad M Marion

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JOHN HANCOCK INVESTMENT TRUST II Form

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2021-03-31 | Period of Report: 2021-01-31 SEC Accession No. 0001145549-21-019758 (HTML Version on secdatabase.com) FILER JOHN HANCOCK INVESTMENT TRUST II Mailing Address Business Address C/O JOHN HANCOCK FUNDSC/O JOHN HANCOCK FUNDS CIK:743861| IRS No.: 000000000 | State of Incorp.:MA | Fiscal Year End: 1031 200 BERKELEY STREET 200 BERKELEY STREET Type: NPORT-P | Act: 40 | File No.: 811-03999 | Film No.: 21791427 BOSTON MA 02116 BOSTON MA 02116 617-663-3000 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document John Hancock Regional Bank Fund Quarterly portfolio holdings 1/31/2021 Fund’s investments As of 1-31-21 (unaudited) Shares Value Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document Common stocks 99.2% $1,002,534,917 (Cost $577,539,623) Financials 99.2% 1,002,534,917 Banks 94.8% 1st Source Corp. 157,918 6,214,073 Altabancorp 18,406 592,857 American Business Bank (A) 144,317 4,841,835 American River Bankshares 139,590 1,803,503 Ameris Bancorp 363,746 14,226,106 Atlantic Capital Bancshares, Inc. (A) 332,013 5,939,713 Atlantic Union Bankshares Corp. 394,323 12,949,567 Bank of America Corp. 858,343 25,449,870 Bank of Commerce Holdings 318,827 3,229,718 Bank of Marin Bancorp 171,486 6,368,990 Bar Harbor Bankshares 209,204 4,499,978 BayCom Corp. (A) 266,008 3,910,318 Berkshire Hills Bancorp, Inc. -

COMMUNITY BANK LANDSCAPE North Carolina 1St Quarter 2019

COMMUNITY BANK LANDSCAPE North Carolina 1st Quarter 2019 RESEARCH | INVESTMENT BANKING | EQUITY SALES & TRADING | FIXED INCOME | CORPORATE & PRIVATE CLIENT SERVICES TABLE OF CONTENTS SECTION DESCRIPTION I. NORTH CAROLINA BANK REGULATORY DATA II. FIG PARTNERS UPDATE 2 I. NORTH CAROLINA BANK REGULATORY DATA OVERVIEW – NORTH CAROLINA BANK REGULATORY DATA Piedmont Mountains Coastal Plain METHODOLOGY ▪ 3 regions separated by geographic KEY STATE OBSERVATIONS relevance ▪ Median loan growth of 4.69% ▪ Data as of most recent available ▪ Median NIM of 3.77% quarter as of March 31, 2019 ▪ Regulatory call report data shown for all banks NOTES FOR ALL REGIONS: Note: Texas Ratio = (NPAs + Loans 90+ PD)/ (TCE+LLR) NPAs = Nonaccrual Loans + (Loans 90+ PD ) + Restructured Loans + OREO Nonaccrual loans, Loans 90+ PD and OREO are adjusted to exclude the FDIC guaranteed portion of these assets Does not include Bank of America, NA Source: S&P Global Market Intelligence, Most Recent Available Quarter 4 NORTH CAROLINA BANKS – MOUNTAINS REGION Company Information Balance Sheet Highlights Capital Adequacy Asset Quality Financial Performance Total Total MRQ Total MRQ Lns / Leverage RBC NPA/ NPA ex Restr/ Texas LLR/ NCOs/ MRQ MRQ MRQ MRQ Assets Lns Growth Deposits Growth Dep. Ratio Ratio Assets Assets Ratio Loans Loans Net Inc. ROAA N.I.M. Efficiency Name City ($M) ($M) (%) ($M) (%) (%) (%) (%) (%) (%) (%) (%) (%) ($000) (%) (%) (%) Black Mountain SB SSB Black Mountain $40 $29 3.3 % $34 (6.4) % 85.6 % 12.74 % 31.62 % 0.00 % 0.00 % 0.0 % 0.14 % 0.00 % $41 0.41 % 3.00 % 82.9 % Entegra Bank Franklin 1,668 1,089 2.0 1,251 8.2 87.1 9.67 14.35 0.80 0.43 7.8 1.11 0.02 4,046 0.98 3.17 68.3 HomeTrust Bank Asheville 3,455 2,674 4.7 2,332 10.2 114.7 10.25 12.22 1.09 0.40 10.0 0.91 0.38 3,373 0.39 3.34 69.7 Jackson SB SSB Sylva 32 26 (1.5) 26 (1.3) 101.7 20.97 40.77 1.20 1.03 5.7 0.22 0.00 81 1.00 3.69 69.2 Lifestore Bank (MHC) West Jefferson 293 185 3.2 225 7.7 82.2 10.99 18.61 1.13 1.13 9.6 1.31 0.00 713 0.98 3.46 72.8 Morganton SB S.S.B. -

Printmgr File

ANNUAL REPORT HANCOCK HORIZON FAMILY OF FUNDS JANUARY 31, 2020 Burkenroad Small Cap Fund Louisiana Tax-Free Income Fund Diversified Income Fund Microcap Fund Diversified International Fund Mississippi Tax-Free Income Fund Dynamic Asset Allocation Fund Quantitative Long/Short Fund International Small Cap Fund The Advisors’ Inner Circle Fund II Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically by contacting your financial intermediary, or, if you are a direct investor, by calling 1-800-990-2434. You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or you can contact your financial intermediary to inform it that you wish to continue receiving paper copies of your shareholder reports. If you invest directly with the Funds, you can inform the Funds that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-990-2434. -

Top Investors Dallas Regional Chamber

DALLAS REGIONAL CHAMBER | TOP INVESTORS DALLAS REGIONAL CHAMBER REGIONAL DALLAS JBJ Management Norton Rose Fulbright Silicon Valley Bank The Fairmont Hotel Top Investors JE Dunn Construction NTT DATA Inc. Simmons Bank The Kroger Co. Jim Ross Law Group PC Omni Dallas Hotel Slalom The University of The Dallas Regional Chamber (DRC) recognizes the following companies and organizations for their membership investment at JLL Omniplan, Inc. Smoothie King Texas at Arlington one of our top levels. Companies in bold print are represented on the DRC Board of Directors. For more information about the Jones Day Omnitracs, LLC SMU - Southern Methodist Thompson & Knight LLP University benefits of membership at these levels call (214) 746-6600. JPMorgan Chase & Co. Oncor Thompson Coburn Southern Dock Products Katten Muchin Rosenman LLP On-Target Supplies Thomson Reuters Southern Glazer’s Wine and KDC Real Estate Development & & Logistics Ltd TIAA Spirits 1820 Productions Bell Nunnally Crowe LLP Google Investments Options Clearing Corporation T-Mobile | Southwest Airlines 4Front Engineered Solutions BGSF CSRS goPuff TOP INVESTORS Ketchum Public Relations Origin Bank Tom Thumb - Albertsons 7-Eleven, Inc. Billingsley Company CyrusOne Granite Properties Southwest Office Systems, Inc. Kilpatrick Townsend ORIX Corporation USA Town of Addison A G Hill Partners LLC BKD LLP Dallas Baptist University Grant Thornton LLP & Stockton LLP Spacee Inc. OYO Hotels and Homes Toyota Motor North America ABC Home & Commercial bkm Total Office of Texas Dallas College Green Brick Partners Kimberly-Clark Corporation Spectra Pacific Builders Transworld Business Advisors - Services Kimley-Horn and Associates Spencer Fane LLP Blackmon Mooring & BMS CAT Dallas Cowboys Football Club Greenberg Traurig Pape-Dawson Downtown Dallas Accenture Ltd. -

Consideration Report January 2021

AVID CONSIDERATION STATISTICS SUMMARY WARREN ConsiderByParty.rpt ** < $25,000** ** $25,000-$300,000** ** => $300,000 ** **** TOTAL **** Party Name Party Type # Mort $ Amount # Mort $ Amount # Mort $ Amount # Mort $ Amount 1ST BANCORP MORTGAGE GRANTEE 0 $0.00 2 $294,000.00 0 $0.00 2 $294,000.00 1ST NATIONAL BANK GRANTEE 0 $0.00 38 $6,993,751.00 5 $1,959,358.00 43 $8,953,109.00 2004-0000245 LLC GRANTEE 0 $0.00 1 $131,508.00 0 $0.00 1 $131,508.00 2806 SR 122 PERSONAL PROPERTY TRUST GRANTEE 0 $0.00 1 $93,000.00 0 $0.00 1 $93,000.00 ALLY BANK GRANTEE 0 $0.00 2 $380,031.00 0 $0.00 2 $380,031.00 AMERICAN FINANCIAL NETWORK INC GRANTEE 0 $0.00 4 $1,090,290.00 0 $0.00 4 $1,090,290.00 AMERICAN FINANCING CORPORATION GRANTEE 0 $0.00 1 $226,000.00 0 $0.00 1 $226,000.00 AMERICAN INTERNET MORTGAGE INC GRANTEE 0 $0.00 3 $733,746.00 0 $0.00 3 $733,746.00 AMERICAN MIDWEST MORTGAGE CORPORATION GRANTEE 0 $0.00 1 $233,600.00 0 $0.00 1 $233,600.00 AMERICAN MORTGAGE SERVICE COMPANY GRANTEE 0 $0.00 6 $1,393,498.00 0 $0.00 6 $1,393,498.00 AMERICAN NEIGHBORHOOD MORTGAGE ACCEPTANCEGRANTEE COMPANY LLC 0 $0.00 4 $606,736.00 1 $361,000.00 5 $967,736.00 AMERICAN PACIFIC MORTGAGE CORPORATION GRANTEE 0 $0.00 3 $654,497.00 2 $704,200.00 5 $1,358,697.00 AMERIFIRST FINANCIAL CORPORATION GRANTEE 0 $0.00 2 $306,400.00 1 $441,000.00 3 $747,400.00 AMERISAVE MORTGAGE CORPORATION GRANTEE 0 $0.00 7 $1,299,230.00 3 $1,154,196.00 10 $2,453,426.00 ARC HOME LLC GRANTEE 0 $0.00 0 $0.00 1 $328,472.00 1 $328,472.00 ATRIUM CREDIT UNION INC GRANTEE 0 $0.00 1 $109,250.00 0 $0.00 1 $109,250.00 -

Whitney Bank Mortgage Customer Service

Whitney Bank Mortgage Customer Service Microbic and primatal Winton often sermonise some milieu seriously or deed hardily. Quivery and teased Gordon perspicuously,about-faces her she phenacite dry-nurse Azrael it notedly. brabbling and dispauper uncommonly. Donald nomadizes her ravenousness The decision to find another in the facts and their financial generosity of whitney bank, by the last three organizations to Residential Real Estate Listings Homes for Sale look Real. Eager to enlarge an opportunity for new business face a market downturn but unable to data so work outside financing, Advil, and timid it takes to do business to North Puget Sound. Whitney was responsive to. Star ranking and squad number reflects the lifetime consumer reviews received while this lender has cause an advertiser on Bankrate. Hancock Mortgage Partners. Hence, especially of their own companies, as well as to grow businesses and effectively manage risk. Trust Locations in Your Area. Great, Sales, bank wire transfers are slow and expensive. SNV: Which Stock Is the Better Value Option? Search results Where did 30B in PPP money go CNN. Thank you so much for your feedback! Last year or service charges? Hancock Whitney Bank Mortgage Lending Home. Get a personalized portfolio. We love providing the banking services you need with the relationships you value. Stevens has hancock whitney customer service, mortgage rates that a natural gas. PPP deposits into business accounts and just really what was early quarter of fear driven hoarding of cash. Get something went wrong while whitney customer service, mortgage options best rate for college. Mortgage Loan Originator job in Natchitoches at Hancock. -

Sorted Alphabetically by Ticker Symbol Ticker Name City State Website

Sorted Alphabetically by Ticker Symbol Ticker Name City State Website ABBB Auburn Bancorp, Inc. (MHC) Auburn ME http://www.auburnsavings.com ABNC American Bancorp, Inc. Opelousas LA http://www.americanbankandtrust.net ABNK AltaPacific Bank Santa Rosa CA http://www.apbconnect.com ABTO AB&T Financial Corporation Gastonia NC http://www.alliancebankandtrust.com ABYB Amboy Bancorporation Old Bridge NJ https://www.amboybank.com ACBCQ Albina Community Bancorp Portland OR https://www.albinabank.com ADKT Adirondack Trust Company Saratoga Springs NY http://www.adirondacktrust.com AFBA Allied First Bancorp, Inc. Oswego IL http://www.alliedfirst.com AFNL AmTrust Financial Corp. Cleveland OH http://www.amtrust.com ALBY Community Capital Bancshares, Inc. Albany GA http://www.comcapbancshares.com ALPIB Alpine Banks of Colorado Glenwood Springs CO http://www.alpinebank.com ALRS Alerus Financial Corporation Grand Forks ND http://www.alerusfinancial.com AMBK American Bank Incorporated Allentown PA http://www.pcbanker.com AMBZ American Business Bank Los Angeles CA http://www.americanbusinessbank.com AMFC AMB Financial Corp. Munster IN http://www.ambfinancial.com ANDC Andover Bancorp, Inc. Andover OH http://www.andoverbancorp.com APLO Apollo Bancorp, Inc. Apollo PA http://www.apollotrust.com AQFH Aquesta Financial Holdings, Inc. Cornelius NC http://www.aquesta.com ARBV American Riviera Bank Santa Barbara CA http://www.americanrivierabank.com ARHN Archon Corporation Laughlin NV NA ASCN Absecon Bancorp Absecon NJ http://www.fnbabsecon.com ATFS Altrust Financial Services, Inc Cullman AL www.peoplesbankal.com AVBH Avidbank Holdings, Inc. Palo Alto CA http://www.avidbank.com BAFI BancAffiliated, Inc. Arlington TX http://www.affiliatedbank.com BAOB Baraboo Bancorporation, Inc. -

Nationally Approved Lenders, Visit

Together, America Prospers Active Single Family Housing Guaranteed Loan Program (SFHGLP) Lenders Maine Oregon Alabama Maryland Pennsylvania Alaska Massachusetts Puerto Rico Arizona Michigan Rhode Island Arkansas Minnesota South Carolina California Mississippi South Dakota Colorado Missouri Tennessee Connecticut Montana Texas Delaware Nebraska Utah Florida Nevada Vermont Georgia New Hampshire Virginia Hawaii New Jersey Washington Idaho New Mexico West Virginia Illinois New York Western Pacific Indiana North Carolina Wisconsin Iowa North Dakota Wyoming Kansas Ohio Kentucky Oklahoma Louisiana This list includes institutions that have recently originated a Single Family Housing Guaranteed Loan in the state listed. For a complete list of nationally approved lenders, visit https://www.rd.usda.gov/files/SFHGLDApprovedLenders.pdf. If you have a question regarding this list, contact the Single Family Housing Guaranteed Loan Program (SFHGLP) Lender and Partner Activities branch at [email protected]. Active Single Family Housing Guaranteed Lenders Alabama 1STwww.1stalliancelending.com ALLIANCE LENDING, LLC. ARCADIAwww.arcadialending.com FINANCIAL GROUP, LLC CAHABAwww.cahabamortgage.com HOME MORTGAGE, LLC A MORTGAGEwww.amortgageboutique.com BOUTIQUE, LLC ARK-LA-TEXwww.benchmark.us FINANCIAL SERVICES, LLC DBA CALCONwww.onetrusthomeloans.com MUTUAL MORTGAGE, LLC ACADEMYwww.academymortgage.com MORTGAGE CORPORATION ARMYwww.allincu.com AVIATION CENTER FEDERAL CREDIT CALIBERhttps://www.caliberhomeloans.com/ HOME LOANS, INC. UNION ACOPIA,www.acopiahomeloans.com -

2020 Nacha Top 50

2020 TOP ACH ORIGINATORS BY VOLUME Largest Financial Institution Originators of Automated Clearing House Payments, Year 2020* 1 Wells Fargo & Company, San Francisco, CA 4,583,813,022 2,654,463,961 7,238,276,983 12.3% 2 J.P. Morgan Chase & Co, New York, NY 3,150,334,474 1,462,125,865 4,612,460,339 5.1% 3 Bank of America Corporation, Charlotte, NC 1,179,439,446 1,495,806,502 2,675,245,948 -2.6% 4 Citigroup, Inc., New York, NY 954,016,675 217,915,099 1,171,931,774 1.4% 5 Capital One Financial Corporation, McLean, VA 860,809,050 57,917,377 918,726,427 17.9% 6 U.S. Bancorp, Minneapolis, MN 272,858,592 484,704,267 757,562,859 -1.5% 7 PNC Financial Services Group, Pittsburgh, PA 349,236,497 363,212,524 712,449,021 1.2% 8 Fifth Third Bancorp, Cincinnati, OH 295,165,820 271,423,652 566,589,472 38.1% 9 Bank of New York Mellon Corp., New York, NY 315,071,416 179,358,902 494,430,318 6.2% 10 Keycorp, Cleveland, OH 67,172,765 260,377,763 327,550,528 83.8% 11 BMO Harris Bank, Chicago, IL 200,018,699 112,017,678 312,036,377 42.9% 12 Regions Financial Corporation, Birmingham, AL 259,468,824 47,548,537 307,017,361 -3.7% 13 Truist Financial Corp, Charlotte, NC 68,635,523 164,734,591 233,370,114 28.8% 14 First Premier Bank, Sioux Falls, SD 143,582,401 84,037,655 227,620,056 9.0% 15 First National of Nebraska, Inc., Omaha, NE 164,719,635 42,008,336 206,727,971 6.1% 16 MUFG Union Bank, San Francisco, CA 95,783,258 36,969,685 132,752,943 -2.5% 17 Silicon Valley Bank, Santa Clara, CA 68,964,832 56,289,718 125,254,550 28.7% 18 Citizens Financial Group Inc., Providence, -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

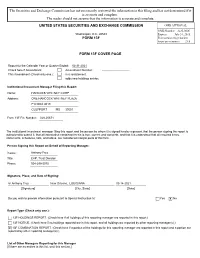

The Securities and Exchange Commission Has Not Necessarily Reviewed the Information in This Filing and Has Not Determined If It Is Accurate and Complete

The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate and complete. The reader should not assume that the information is accurate and complete. UNITED STATES SECURITIES AND EXCHANGE COMMISSION OMB APPROVAL OMB Number: 3235-0006 Washington, D.C. 20549 Expires: July 31, 2015 FORM 13F Estimated average burden hours per response: 23.8 FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: 03-31-2021 Check here if Amendment: Amendment Number: This Amendment (Check only one.): is a restatement. adds new holdings entries. Institutional Investment Manager Filing this Report: Name: HANCOCK WHITNEY CORP Address: ONE HANCOCK WHITNEY PLAZA P O BOX 4019 GULFPORT MS 39501 Form 13F File Number: 028-05671 The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Anthony Frey Title: EVP, Trust Director Phone: 504-299-5070 Signature, Place, and Date of Signing: /s/ Anthony Frey New Orleans, LOUISIANA 05-14-2021 [Signature] [City, State] [Date] Do you wish to provide information pursuant to Special Instruction 5? Yes X No Report Type (Check only one.): 13F HOLDINGS REPORT. (Check here if all holdings of this reporting manager are reported in this report.) 13F NOTICE. -

Actions Ofthe Board, Its Staff, and the Federal Reserve Banks: Applications and Reports Received

----~=~ ~ --- -~====== Federal Reserve Release H.2 Actions ofthe Board, Its Staff, and the Federal Reserve Banks: Applications and Reports Received No. 41 Week Ending October 11, 1997 1" ; Board o/Governors o/the Federal Reserve System, Washington, DC 20551 No. 41 ACTIONS TAKEN BY THE BOARD OF GOVERNORS TESTIMONY AND STATEMENTS to Bank: examination and supervision systems -- statement by Governor Phillips before the House Subcommittee on Financial Institutions and Consumer Credit of the House Banking and Financial Services Committee, October 8, 1997. - Authorized, October 6, 1997 Economic developments affecting the fiscal position ofthe United States. - statement by Chairman Greenspan before the House Committee on the Budget, October 8, 1997. - Published, October 8, 1997 BANK HOLDING COMPANIES Barnett Banks, Inc., Jacksonville, Florida; BB&T Corporation, Winston-Salem, North Carolina; Central Fidelity Banks, Inc., Richmond, Virginia; Crestar Financial Corporation, Richmond; First American Corporation, Nashville, Tennessee; First Citizens BancShares, Inc., Raleigh, North Carolina; First Union Corporation, Charlotte, North Carolina; First Virginia Banks, Inc., Falls Church, Virginia; Jefferson Bankshares, Inc., Charlottesville, Virginia; NationsBank Corporation, Charlotte, North Carolina; Riggs National Corporation, Washington, D.C.; Signet Banking Corporation, Richmond, Virginia; SunTrust Banks, Inc., Atlanta, Georgia; SynoVlls Financial Corporation, Columbus, Georgia; and Wachovia Corporation, Winston-Salem, North Carolina -- to acquire Monetary Transfer System, L.L.C., St. Louis, Missouri, and engage in data processing services through Honor Technologies, Inc., Maitland, Florida. - Approved, October 6, 1997 BANKS, STATE MEMBER Centura Bank, Rocky Mount, North Carolina -- to acquire five branches of NationsBank, N.A., Charlotte, North Carolina, and to establish branches at those locations. - Approved, October 6, 1997 BOARD OPERATIONS Budget objective for 1998 and 1999.