Electronic Services Information and Disclosure

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

General Questions

General Questions What does electronic payment mean to me? An electronic payment means you will receive your funds directly into your account. There is no wait for mailing of the check, no need to make a bank deposit or to pay a check cashing fee to access your funds. Your money is readily available to you as soon as the payment is posted to your account. What options do I have? There are two (2) options for receiving your electronic payment: • Debit card, • Direct deposit to your existing checking account. What is the best option for me? In order to select the option that works best for you and your family, you need to evaluate how you spend your money. The debit card carries the MasterCard logo and can be used wherever MasterCard is accepted. You can use the card to purchase groceries, shoes and clothing, household items, pay for car repairs, school supplies, make monthly online payments, to access cash when needed, etc. If this is how you currently use your subsidy funding, then the debit card would be the right choice for you. If you use your funds to make a lump sum payment such as rent or mortgage, or school tuition payments, then the direct deposit option might be a better option for you. Can I choose to receive a paper check instead of an electronic payment? No. The State of New York, Office of Children and Family Services (OCFS) in partnership with Local District Department of Social Services agencies, has moved to an electronic payment system. -

2018 FINTECH100 Leading Global Fintech Innovators 2017 FINTECH100 ������� ������ ������� ��������

2018 FINTECH100 Leading Global Fintech Innovators 2017 FINTECH100 Leadin loba Fintec nnovators 1 1 2016 2017 Fintech100 Report FINTECH100 Leadin loba Fintec nnovators Company #00 1 | Fintech Innovators 2016 1 2015 Fintech100 Report FINTECH 100 Leading Global “ Fintech Innovators Report 2015 Company Description At a Glance Tag Line Located Year Founded Key People Website Specialisation Staff Enabler or Disruptor Key Investors Ownership Size User Engagement $ $ $ $ $ The 100 Leading Fintech Innovators Report 2016 Fintech100 Report The 50 Best Fintech Innovators Report 2014 Fintech100 Report 2 About the List The Fintech100 is a collaborative effort between H2 Ventures and KPMG. In its fifth year, the Fintech100 uncovers and evaluates the most innovative Fintech companies globally. The Fintech100 comprises a ‘Top 50’ and an ‘Emerging 50’ and highlights those companies globally that are taking advantage of technology and driving disruption within the financial services industry. A judging panel comprised of senior partners from H2 Ventures and KPMG has decided the final composition of the Fintech100 list. H2 Ventures H2 Ventures is a global thought leader in fintech venture capital investment. Founded by brothers Ben and Toby Heap, and based in Sydney, Australia, it invests alongside entrepreneurs and other investors in early stage fintech ventures. H2 Ventures is the manager of the H2 Accelerator – Australia’s only dedicated fintech accelerator – and operates out of Sydney’s dynamic Startup Hub. Twitter @H2_Ventures LinkedIn H2 Ventures Facebook H2 Ventures KPMG Global Fintech The financial services industry is transforming with the emergence of innovative, new products, channels and business models. This wave of disruption is primarily driven by evolving customer expectations, digitalisation, as well as continued regulatory and cost pressures. -

A New Year in Payments

January 9, 2006 • Issue 06:01:01 Inside This Issue: News Industry Update .....................................14 First Data Announces Layoffs, Change in Share Price ........................ 62 2006 Calendar of Events ................. 94 Australia Examines Debit Fees, Network Rules ..................................100 Contactless Payments Advance With Near Field Communication Trial .........100 Features AgenTalkSM: Harvey "Lee" Sullivan Welcome to a From Public Service to Merchant Service ............................22 New Year in Payments A Primer on ISO Agreements ................... 30 An Industry Divided f data security breaches, merchant lawsuits, mergers and acquisitions, By Tracy Kitten, ATMmarketplace.com .... 48 and a "free" terminal program frenzy were the headline-grabbers in 2005, you have to wonder what 2006 holds for the payments indus- Trade Association News: try. We asked The Green Sheet Advisory Board (AB) to provide their Gearing Up for 2006 ........................ 53 I thoughts and strategies for the year ahead: Views • How have the events of the past year shaped your plans for 2006? Transformation Well Under Way • Will you make any major changes to the way you do business? By Paul Rasori ....................................96 If so, what? If not, why? Education • What do you most look forward to in the coming year? What obstacles do you foresee? Street SmartsSM: • And finally, what words of wisdom do you have for merchant Friend or Client? level salespeople (MLSs) as they start a new year? By Ty Rosean ...................................... 74 Their responses, listed in alphabetical order, follow: Turning Promotional Customers Into Lifetime Clients Adam Atlas, By Nancy Drexler and Sam Neuman ...... 84 Attorney at Law What ISOs Should Expect in 2006 "The piece of the merchant acquiring pie that is left for the small ISO or MLS By David H. -

City of St Louis Banking and Depository Services Bid November 16, 2018

City of St Louis Banking and Depository Services Bid November 16, 2018 Presented by: Colleen Lang Vice President, Treasury Management Officer UMB Bank, n.a. (314) 612-8008 office [email protected] Table of Contents 1. Transmittal Letter 2. Summary of UMB 3. Proposal Response • Exhibit B 4. Pricing, Fee Schedule • Exhibit A • Exhibit A-1 5. Additional Products and Services • ACH Filter • Remote Deposit • Purchasing Card • Elavon Merchant Services • Benefits Banking • Netspend Payroll Services • Online Payment Solutions 6. Disaster Recovery Under separate cover One Original Documentation Booklet and Sample Report Section 1 Letter of Transmittal Section 2 Executive Summary UMB Financial Corporation UMB Financial Corporation (Nasdaq: UMBF), founded in 1913, is a diversified financial services holding company aligned into three strategic business segments to best serve our customers and achieve long-term growth opportunities. Our multiple revenue streams give UMB added stability to endure economic cycles and fluctuations in financial markets. As we continue to grow, we recognize the need to enhance operational efficiency and reduce costs—a need which drives our commitment to implementing efficiency measures. We will continue to be focused on the needs of our customers, on the diversity of our business model and on our future. Our business model has proven that it works, and our organization is tuned up to execute on UMB’s potential. The sum of who we are forms a strong and enduring culture that is recognizable as UMB. It is about having the integrity to do the right thing and the wisdom not to go chasing after the herd – this is a strength ingrained in our culture. -

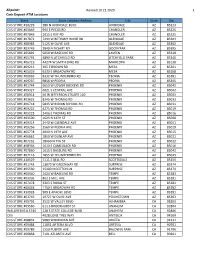

Allpoint+ Cash Deposit ATM Locations Revised 10.21.2020 1 Store Store

Allpoint+ Revised 10.21.2020 1 Cash Deposit ATM Locations Store Store Location Address City State Zip CVS STORE #10229 280 N AVONDALE BLVD AVONDALE AZ 85323 CVS STORE #05849 990 E PECOS RD CHANDLER AZ 85225 CVS STORE #07849 1015 E RAY RD CHANDLER AZ 85225 CVS STORE #07872 7499 W BETHANY HOME RD GLENDALE AZ 85303 CVS STORE #08983 5125 W OLIVE AVE GLENDALE AZ 85302 CVS STORE #03749 2840 N DYSART RD GOODYEAR AZ 85395 CVS STORE #05892 5050 W BASELINE RD LAVEEN AZ 85339 CVS STORE #05791 4890 N LITCHFIELD RD LITCHFIELD PARK AZ 85340 CVS STORE #06719 44274 W SMITH ENKE RD MARICOPA AZ 85138 CVS STORE #09213 305 E BROWN RD MESA AZ 85201 CVS STORE #05029 9230 E BROADWAY RD MESA AZ 85208 CVS STORE #00069 8332 W THUNDERBIRD RD PEORIA AZ 85381 CVS STORE #09237 9856 W PEORIA PEORIA AZ 85345 CVS STORE #01744 6650 W LOWER BUCKEYE RD PHOENIX AZ 85043 CVS STORE #09327 6021 S CENTRAL AVE PHOENIX AZ 85042 CVS STORE #08914 50 W JEFFERSON STSUITE 140 PHOENIX AZ 85003 CVS STORE #03625 8245 W THOMAS RD PHOENIX AZ 85033 CVS STORE #06718 5835 W INDIAN SCHOOL RD PHOENIX AZ 85031 CVS STORE #09222 4275 W THOMAS RD PHOENIX AZ 85019 CVS STORE #09225 2406 E THOMAS RD PHOENIX AZ 85016 CVS STORE #03500 1625 N 44TH ST PHOENIX AZ 85008 CVS STORE #09314 3440 W GLENDALE AVE PHOENIX AZ 85051 CVS STORE #09256 3560 W PEORIA AVE PHOENIX AZ 85029 CVS STORE #05778 4040 N 19TH AVE PHOENIX AZ 85015 CVS STORE #06862 1850 W DUNLAP AVE PHOENIX AZ 85021 CVS STORE #07262 18460 N 7TH ST PHOENIX AZ 85022 CVS STORE #08366 1610 E CAMELBACK RD PHOENIX AZ 85016 CVS STORE #07860 1615 E BASELINE -

Where Cash Meets Commerce

Cardtronics, Inc. 2010 Annual Report and Form 10-K and Form Report Annual 2010 Inc. Cardtronics, Where Cash Meets Commerce Cardtronics 3250 Briarpark Drive, Suite 400 Houston, TX 77042 800.786.9666 cardtronics.com 2010 Annual Report and Form 10-K Corporate Headquarters Cardtronics, Inc. 3250 Briarpark Drive, Suite 400 ‘10 Houston, TX 77042 ‘10 800.786.9666 ‘09 ‘08 ‘09 www.cardtronics.com ‘08 Stock Listing ‘07 Cardtronics, Inc. common stock is listed ‘07 on the NASDAQ Global Market Exchange ‘06 and trades under the ticker symbol CATM. ‘06 Investor Contact Chris Brewster, Chief Financial Officer 832.308.4128 [email protected] 172.8 247.3 358.7 392.4 431.4 $293.6 $378.3 $493.0 $493.4 $532.1 Notice of Annual Meeting Total Transactions Total Revenue The Annual Meeting of Shareholders will be held (in millions) (in millions) at 4:00 p.m. local time on June 15th, 2011 at ‘10 Cardtronics’ headquarters: 3250 Briarpark Drive, ‘09 Suite 400, Houston, TX 77042 ‘06 Transfer Agent ‘07 ‘08 Wells Fargo Shareowner Services 161 North Concord Exchange South St. Paul, MN 55075 800.767.3330 24.6% 22.4% 23.2% 30.2% 32.3% Gross Profit Margin Cautionary Note Regarding Forward-Looking Statements ‘10 ‘10 Except for the historical information and discussions contained herein, statements contained in this annual ‘09 report may constitute “forward-looking statements” within the meaning of the Private Securities Litigation ‘09 Reform Act of 1995. Achieving the results described ‘08 in these statements involves a number of risks, uncertainties and other factors that could cause actual ‘07 results to differ materially, as discussed in Cardtronics’ ‘06 filings with the Securities and Exchange Commission, ‘06 and in the attached Form 10-K. -

A2A (Account-To-Account): the Automatic Transfer of Funds from One Account to Another

Encyclopedia of Terminology for the Acquiring Industry A A2A (Account-to-Account): The automatic transfer of funds from one account to another. An example is the Fedwire or wire transfer transaction. AAV: See Accountholder Authentication Value. ABA: See American Bankers Association. ABA Transit Routing Number: The unique number devised by the American Bankers Association (ABA) in 1910 that identifies the bank issuer of depository accounts. It is a 10‐digit number (nine digits and a verification digit) issued by the Federal Reserve Bank to identify each bank by a bank identification number. This number (also called the ABA number and the routing transit number) has changed over the years to accommodate such things as the Federal Reserve System, the advent of MICR, and the implementation of the Expedited Funds Availability Act (EFAA). It is used both in check processing and in the ACH (Automated Clearing House) routing of electronic checking account debits. The number is usually the first sequence of numbers preceding an account number at the bottom of a check. Acceptance Criteria: The parameters, procedures, and requirements set up by a risk management and underwriting department that must be met before entering into a contract or arrangement. These criteria apply to the merchant as well as the ISO/MSPs. Typical criteria include financial statements, background checks, site visits, credit checks, product review, and web site review. Acceptance Mark: A word, name, symbol, logo, or other device or any combination of devices that identifies the goods or services of one entity from the goods and services of another. A mark that identifies goods is commonly called a trademark. -

Important Information About Your Account

Important Information About Your Account Member FDIC Table of Contents Revised 08/02/2021 SECURITY .............................................................................................................................................................................................. 3 SAFE COMPUTING PRACTICES ................................................................................................................................................................... 3 IDENTITY THEFT ......................................................................................................................................................................................... 3 PROTECTING YOURSELF AT ONE OF OUR ATMS ......................................................................................................................................... 4 CUSTOMER IDENTIFICATION POLICY (CIP) ............................................................................................................................................ 4 ACCOUNT OWNERSHIP ......................................................................................................................................................................... 4 CERTIFYING YOUR TAXPAYER IDENTIFICATION NUMBER .......................................................................................................................... 4 OWNERSHIP OF ACCOUNT ....................................................................................................................................................................... -

Blue Elite Visa® Prepaid Card Terms Of

0326330379 ® described in Section 9 of this document. Your Card must not be used for any unlawful Blue Elite Visa Prepaid Card Other Services Custom Card Purchase $9.95 purpose (for example, to facilitate Internet gambling). You agree not to use your Card Terms of Use 1 Version 1 or funds for any transaction that is illegal. We reserve the right to deny transactions or Card Replacement—Lost/ $10.00 authorizations from merchants apparently engaging in the Internet gambling business Stolen Card or identifying themselves through transaction records or otherwise as engaged in such Expedited Card Replacement $35.00 Comerica Bank (“we”, “us” and “Bank”) is providing you with these terms (“Terms”) business. You may also stop payment on a preauthorized recurring payment by either and the enclosed Visa® (“Card”) because you have agreed to accept certain one time calling us or writing us at least three business days before the date of the payment. Penalties ATM Withdrawal Decline $0.50 or recurring payments by means of this Card. You may accept certain one-time or International ATM $1.00 recurring payments from your employer(s), certain government agencies, or via transfer Please be advised that you may experience difficulties using the Card at: unattended Withdrawal Decline from another cardholder in your cardholder network (each a “Payor”) by means of the vending machines and kiosks; gas station pumps (you may go inside to pay); and Any Purchase Decline $0.50 Card. This agreement describes your rights and obligations with respect to the Card. If certain other merchants, such as rental car companies, where a preauthorized amount you do not agree with these Terms, you should not activate the Card. -

Top U.S. Issuers of Visa & Mastercard Credit Cards

FOR 49 YEARS, THE LEADING PUBLICATION COVERING PAYMENT SYSTEMS WORLDWIDE SEPTEMBER 2019 / ISSUE 1161 Top 150 Merchant Acquirers Worldwide Turn to page 9 for a ranking of the 150 largest merchant Top U.S. Issuers of acquirers of general purpose credit, debit, and prepaid card transactions handled during calendar year 2018. Those acquirers Visa & Mastercard Credit Cards > see p. 8 Based on Spending at Midyear Bl. U.S. General Purpose Card Brands—Midyear 2019 389 Visa, Mastercard, American Express, and Discover brand credit, debit, and prepaid cards generated 54.23 billion purchase 356 transactions from January 1 through June 30, 2019—an increase > see p. 7 Idemia and Zwipe Are Biometric Card Partners 207 The second largest payment card manufacturer in the world, 193 182 174 Idemia, has formed a partnership with Zwipe, a provider of ultra- 176 160 low-power technology used to add biometric authentication > see p. 8 74 70 67 Amazon PayCode/Amazon Cash in the U.S. 64 The U.S. has become the 20th country in which customers of amazon.com can pay cash over the counter at a Western Union (WU) location for purchases made online using Amazon PayCode. ‘18‘19 ‘18‘19 ‘18‘19 ‘18‘19 ‘18‘19 ‘18‘19 > see p. 12 Bank of Capital US Wells Chase Citi Europe Mobile Payment Association Amer. One Bank Fargo The European Mobile Payment Systems Association (Empsa) Note: Midyear spending covers January 1 through June 30. has been formed by companies in Austria, Belgium, Denmark, © 2019 The Nilson Report Finland, Germany, Norway, Portugal, Sweden, and Switzerland. -

Cardholder Agreement

CARDHOLDER AGREEMENT AND USER GUIDE IMPORTANT – PLEASE READ CAREFULLY This Cardholder Agreement contains an Arbitration Clause requiring all claims to be resolved by w ay of binding arbitration. 1. Terms and Conditions/Definitions for the Platinum smiONE™ Visa® Prepaid Card This Cardholder Agreement (“Agreement”) outlines the terms and conditions under w hich the Platinum smiONE Visa Prepaid Card has been issued to you by The Bancorp Bank, Wilmington, Delaw are (“The Bancorp Bank” or “Issuer”). The Issuer is an FDIC insured member institution. “Card” means the Platinum smiONE Visa Prepaid Card issued to you as the Primary Cardholder (“Primary Cardholder” or “Primary Card”), and any eligible Secondary Cardholders (“Secondary Cardholder” or “Secondary Card”) you may designate, by The Bancorp Bank. By accepting and using the Card, you agree to be bound by the terms and conditions contained in this Agreement. “Card Account” means the records we maintain to account for the value of claims associated w ith the Card. “You” and “your” mean the person or persons w ho have received the Card and are authorized to use the Card as provided for in this Agreement. “We,” “us,” and “our” mean the Issuer, our successors, affiliates or assignees. “State Agency” means “The State of Missouri, Department of Social Services, Family Support Division.” SMI Card Services, LLC (“SMI”) is the entity managing the card program. You acknow ledge and agree that the value available in the Card Account is limited to the funds that you have loaded onto the Card Account or that have been loaded onto the Card Account on your behalf. -

I Am Pleased to Invite You to Attend Our Annual Meeting of Stockholders Of

April 2, 2019 Dear Stockholder: I am pleased to invite you to attend our annual meeting of stockholders of The Community Financial Corporation (the “Company”) to be held in the Board Room at the main office of Community Bank of the Chesapeake, located at 3035 Leonardtown Road, Waldorf, Maryland, on Wednesday, May 15, 2019 at 10:00 a.m. The attached notice and proxy statement describe the formal business to be transacted at the annual meeting. Directors and officers of the Company, as well as a representative of the Company’s independent registered public accounting firm, Dixon Hughes Goodman LLP, will be present to respond to any questions stockholders may have. Your vote is important, regardless of the number of shares you own. On behalf of the Board of Directors, I urge you to vote via the Internet, by telephone or by signing, dating and returning a proxy card as soon as possible, even if you plan to attend the annual meeting. Sincerely, Michael L. Middleton Chairman of the Board THE COMMUNITY FINANCIAL CORPORATION 3035 LEONARDTOWN ROAD WALDORF, MARYLAND 20601 (301) 645-5601 NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS TIME AND DATE ..................... 10:00 a.m. on Wednesday, May 15, 2019 PLACE ............................. Board Room Community Bank of the Chesapeake 3035 Leonardtown Road Waldorf, Maryland 20601 ITEMS OF BUSINESS .................. (1) Toelect three directors to serve for a term of three years; (2) To ratify the appointment of Dixon Hughes Goodman LLP as the independent registered public accounting firm for the year ending December 31, 2019; (3) To vote on a non-binding resolution to approve the compensation of the named executive officers; (4) To vote on the frequency of the advisory vote on the compensation of our named executive officers; and (5) To transact such other business as may properly come before the meeting or any adjournments or postponement thereof.