Financial Self-Service Solutions Worldwide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PIN Debit Networks November 7, 2013

Meeting Between Federal Reserve Board Staff and Representatives of PIN Debit Networks November 7, 2013 Participants: Louise Roseman, Stephanie Martin, Jeffrey Marquardt, Susan Foley, David Mills, Samantha Pelosi, Mark Manuszak, Krzysztof Wozniak, Tyler Standage, Aaron Rosenbaum, and Linda Healey (Federal Reserve Board) Terry Maher (Baird Holm LLP); Leah Work (CO-OP Financial Services); Jonathan Genovese and Rob Rankin (Jeanie Network); Cathy Morrissey (NETS); Robert Woodbury (NYCE Payments Network); Judith McGuire (PULSE); Scott Dobesh and Terry Dooley (Shazam Network); Nancy Loomis (Star Network); Paul Tomasofsky (Two Sparrows Consulting) Summary: Representatives of several PIN debit networks met with Federal Reserve Board staff to discuss their observations of market developments related to deployment of EMV (i.e., chip-based) debit cards in the United States. Issues discussed included (i) technological aspects of EMV payment cards with a focus on methods for enabling multiple networks on an EMV card, and (ii) the network participants’ views of issuer, merchant, and payment card network concerns related to EMV deployment, particularly as those concerns pertain to Regulation II’s prohibition on network exclusivity and merchant routing restrictions. In particular, the network representatives stressed the importance of industry adoption of an EMV model that best facilitates merchant routing choice, and expressed concern that the current approach advocated by Visa and MasterCard does not meet this objective. A copy of the presentation the -

AUTOMATED TELLER MACHINE (Athl) NETWORK EVOLUTION in AMERICAN RETAIL BANKING: WHAT DRIVES IT?

AUTOMATED TELLER MACHINE (AThl) NETWORK EVOLUTION IN AMERICAN RETAIL BANKING: WHAT DRIVES IT? Robert J. Kauffiiian Leollard N.Stern School of Busivless New 'r'osk Universit,y Re\\. %sk, Net.\' York 10003 Mary Beth Tlieisen J,eorr;~rd n'. Stcr~iSchool of B~~sincss New \'orl; University New York, NY 10006 C'e~~terfor Rcseai.clt 011 Irlfor~i~ntion Systclns lnfoornlation Systen~sI)epar%ment 1,eojrarcl K.Stelm Sclrool of' Busir~ess New York ITuiversity Working Paper Series STERN IS-91-2 Center for Digital Economy Research Stem School of Business Working Paper IS-91-02 Center for Digital Economy Research Stem School of Business IVorking Paper IS-91-02 AUTOMATED TELLER MACHINE (ATM) NETWORK EVOLUTION IN AMERICAN RETAIL BANKING: WHAT DRIVES IT? ABSTRACT The organization of automated teller machine (ATM) and electronic banking services in the United States has undergone significant structural changes in the past two or three years that raise questions about the long term prospects for the retail banking industry, the nature of network competition, ATM service pricing, and what role ATMs will play in the development of an interstate banking system. In this paper we investigate ways that banks use ATM services and membership in ATM networks as strategic marketing tools. We also examine how the changes in the size, number, and ownership of ATM networks (from banks or groups of banks to independent operators) have impacted the structure of ATM deployment in the retail banking industry. Finally, we consider how movement toward market saturation is changing how the public values electronic banking services, and what this means for bankers. -

GLOBAL PAYMENTS INC. (Exact Name of Registrant As Specified in Charter) Georgia 58-2567903 (State Or Other Jurisdiction of (I.R.S

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K È ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended May 31, 2004 OR ‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to . Commission File No. 001-16111 GLOBAL PAYMENTS INC. (Exact name of registrant as specified in charter) Georgia 58-2567903 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 10 Glenlake Parkway, North Tower, Atlanta, Georgia 30328-3495 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: 770-829-8234 Securities registered pursuant to Section 12(b) of the Act: Name of each exchange Title of each class on which registered Common Stock, No Par Value New York Stock Exchange Series A Junior Participating Preferred Share Purchase Rights New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: NONE (Title of Class) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes È No ‘ Indicate by check mark if disclosure of delinquent filer pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

General Questions

General Questions What does electronic payment mean to me? An electronic payment means you will receive your funds directly into your account. There is no wait for mailing of the check, no need to make a bank deposit or to pay a check cashing fee to access your funds. Your money is readily available to you as soon as the payment is posted to your account. What options do I have? There are two (2) options for receiving your electronic payment: • Debit card, • Direct deposit to your existing checking account. What is the best option for me? In order to select the option that works best for you and your family, you need to evaluate how you spend your money. The debit card carries the MasterCard logo and can be used wherever MasterCard is accepted. You can use the card to purchase groceries, shoes and clothing, household items, pay for car repairs, school supplies, make monthly online payments, to access cash when needed, etc. If this is how you currently use your subsidy funding, then the debit card would be the right choice for you. If you use your funds to make a lump sum payment such as rent or mortgage, or school tuition payments, then the direct deposit option might be a better option for you. Can I choose to receive a paper check instead of an electronic payment? No. The State of New York, Office of Children and Family Services (OCFS) in partnership with Local District Department of Social Services agencies, has moved to an electronic payment system. -

Multi-Lateral Mechanism of Cash Machines: Virtue Or Hassel

International Journal of Engineering Technology Science and Research IJETSR www.ijetsr.com ISSN 2394 – 3386 Volume 4, Issue 10 October 2017 Multi-Lateral Mechanism of Cash Machines: Virtue or Hassel Peeush Ranjan Agrawal1 and Sakshi Misra Shukla2 1 Professor, School of Management studies, MNNIT, Allahabad, Uttar Pradesh,India 2Assistant Professor, Department of MBA, S.P. Memorial Institute of Technology, Allahabad, India ABSTRACT Automated Teller Machines or Cash Machines became an organic constituent of the banking sector. The paper envisionsthe voyage that these cash machines have gone through since their initiation in the foreign banks operating in India. The study revolves around the indispensible factors in the foreign banking environment like availability, connectivity customer base, security, network gateways and clearing houses which were thoroughly reviewed and analyzed in the research paper. The methodology of the research paper includes literature review, derivation of variables, questionnaire formulation, pilot testing, data collectionand application of statistical tools with the help of SPSS software. The paper draws out findings related to the usage, congregation, multi-lateral functioning, security and growth of ATMs in the foreign banks operating in the country. The paper concludes by rendering recommendations to theforeign bankers to vanquish the stumbling blocks of the cash machines functioning. Keywords: ATMs, Cash Machines, Anywhere Banking, Foreign Banking, Online Banking 1. INTRODUCTION The Automated Teller Machine (ATM) has become an integral part of banking operations. Initially perceived as ‘cash machines’, which dispenses cash to depositors, ATMs can accept deposits, sell postage stamps, print statements and be used at institutions where the depositor does not have an account. -

2018 FINTECH100 Leading Global Fintech Innovators 2017 FINTECH100 ������� ������ ������� ��������

2018 FINTECH100 Leading Global Fintech Innovators 2017 FINTECH100 Leadin loba Fintec nnovators 1 1 2016 2017 Fintech100 Report FINTECH100 Leadin loba Fintec nnovators Company #00 1 | Fintech Innovators 2016 1 2015 Fintech100 Report FINTECH 100 Leading Global “ Fintech Innovators Report 2015 Company Description At a Glance Tag Line Located Year Founded Key People Website Specialisation Staff Enabler or Disruptor Key Investors Ownership Size User Engagement $ $ $ $ $ The 100 Leading Fintech Innovators Report 2016 Fintech100 Report The 50 Best Fintech Innovators Report 2014 Fintech100 Report 2 About the List The Fintech100 is a collaborative effort between H2 Ventures and KPMG. In its fifth year, the Fintech100 uncovers and evaluates the most innovative Fintech companies globally. The Fintech100 comprises a ‘Top 50’ and an ‘Emerging 50’ and highlights those companies globally that are taking advantage of technology and driving disruption within the financial services industry. A judging panel comprised of senior partners from H2 Ventures and KPMG has decided the final composition of the Fintech100 list. H2 Ventures H2 Ventures is a global thought leader in fintech venture capital investment. Founded by brothers Ben and Toby Heap, and based in Sydney, Australia, it invests alongside entrepreneurs and other investors in early stage fintech ventures. H2 Ventures is the manager of the H2 Accelerator – Australia’s only dedicated fintech accelerator – and operates out of Sydney’s dynamic Startup Hub. Twitter @H2_Ventures LinkedIn H2 Ventures Facebook H2 Ventures KPMG Global Fintech The financial services industry is transforming with the emergence of innovative, new products, channels and business models. This wave of disruption is primarily driven by evolving customer expectations, digitalisation, as well as continued regulatory and cost pressures. -

Field Guide to Alternative Payments

9TH ANNUAL rewards in ways that would have been unimaginable a few years earlier. It's the new world of alternative payments, and it's pretty much a mobile FIELD GUIDE TOworl d now. That's thanks not only to smart phones but also to clever applica• tion programing interfaces and the relatively recent opening of tech shops to ALTERNATIVE outside developers with smart ideas for integrating payments functionality with new apps (for more on this, see page 2A). PAYMENTS So here we are with our 9th Annual Field Guide to Alternative Payments, The increasing commercialization of mobile and, as you might expect, it bears little resemblance to the first Guide we put payments is showing up in a proliferation together in 2009. Herein, you'll find fully 27 entries that either didn't exist back of so-called Pays from a bevy of banks, then, or that were too nascent to include. tech companies, and merchants. You'll also find more than half a dozen "Pays," more if you count services like BY JOHN STEWART, JIM DALY, AND KEVIN WOODWARD People Pay and Self Pay. The inventors of the smart phone may not have conceived of the device as a payments tool, but in due course that is what it has become. As in prior years, Digital Transactions generally defines an alternative-payment system as any network or consumer interface (a mobile app, for example) that displaces the Visa/MasterCard/ AmEx/Discover networks (seen as one traditional system for this purpose), enables payments in a way that stands apart from that network (even if it ulti• mately uses it), and/or stands between that network and the consumer in an important way. -

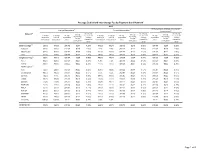

Average Debit Card Interchange Fee by Payment Card Network1

Average Debit Card Interchange Fee by Payment Card Network1 2015 All transactions (exempt and covered Exempt transactions 3 Covered transactions 4 transactions) 5 2 Interchange Interchange Interchange Network Average Average Average % of total % of total Average fee as % of % of total % of total Average fee as % of Average fee as % of interchange interchange interchange number of value of transaction average number of value of transaction average transaction average fee per fee per fee per transactions6 transactions6 value7 transaction transactions10 transactions10 value7 transaction value7 transaction transaction8 transaction8 transaction8 value9 value9 value9 11 Dual-message 38.2% 37.0% $36.49 $0.51 1.39% 61.8% 63.0% $38.38 $0.23 0.60% $37.66 $0.34 0.89% Discover 99.6% 99.5% $41.67 $0.65 1.56% 0.4% 0.5% $43.38 $0.24 0 55% $41.67 $0.65 1.55% MasterCard 50.8% 50.3% $37.98 $0.57 1.50% 49.2% 49.7% $38.77 $0.24 0.61% $38.37 $0.41 1.06% Visa 34.2% 32.7% $35.77 $0.48 1.34% 65.8% 67.3% $38.29 $0.23 0 59% $37.43 $0.31 0.84% Single-message12 35.2% 35.1% $39.04 $0.26 0.65% 64.8% 64.9% $39.36 $0.24 0.60% $39.25 $0.24 0.62% Accel 93.2% 92.8% $43.26 $0.21 0.48% 6.8% 7.2% $45.66 $0.24 0 53% $43.43 $0.21 0.49% AFFN 88.3% 86.9% $34.55 $0.25 0.72% 11.7% 13.1% $39.48 $0.21 0 54% $35.12 $0.25 0.70% Alaska Option13 ATH 14.2% 20.0% $50.58 $0.25 0.50% 85.8% 80.0% $33.44 $0.19 0 57% $35.87 $0.20 0.56% Credit Union 99.5% 99.5% $48.17 $0.23 0.47% 0.5% 0.5% $42.93 $0.20 0.47% $48.14 $0.23 0.47% Interlink 10.2% 9.4% $35.43 $0.35 0.99% 89.8% 90.6% $38.95 $0.24 -

TSB-A-97(86)S:12/97:NYCE Corporation,Petition No. S971015D

New York State Department of Taxation and Finance Taxpayer Services Division TSB-A-97(86)S Technical Services Bureau Sales Tax STATE OF NEW YORK COMMISSIONER OF TAXATION AND FINANCE ADVISORY OPINION PETITION NO.S971015D On October 15, 1997, the Department of Taxation and Finance received a Petition for Advisory Opinion from NYCE Corporation, 300 Tice Boulevard, Woodcliff Lake, New Jersey 07675. The issue raised by Petitioner, NYCE Corporation, is whether the fee it charges members of its banking network per transaction for electronic banking services performed through Automated Teller Machines (ATMs) and other similar machines is subject to New York State and local sales taxes under Section 1105(b) of the Tax Law. Petitioner submitted the following facts as the basis for this Advisory Opinion. Petitioner operates and administers a network through which it handles electronic banking transactions for members of the network. Members include both "banks" and "non-banks." All members pay a one-time initiation fee to join the network, but no annual fee thereafter. Each member participates in the network through a contract with Petitioner that is called a "Participation Agreement." The Participation Agreement incorporates by reference certain "Operating Rules." Petitioner included with its Petition, a copy of the Participation Agreement and the Operating Rules. There are thousands of possible combinations of activities and functions that Petitioner might perform with respect to an individual banking transaction. Petitioner must react to each transaction depending on the circumstances surrounding it. However, a "simple" transaction through the network from start to finish would generally take the following steps. Transaction Acquisition. -

Viewpoint: Contrasting Payments Innovation in Europe and the U.S

Viewpoint: Contrasting Payments Innovation in Europe and the U.S. By Monica Monaco, TrustEUAffairs, and Eric Grover, Intrepid Ventures Pay Before October 14, 2015 America has led Europe in payments innovation. Europe has led in payments regulation. There are significant differences in payments innovation in Europe and the U.S., influenced by policymakers’ views of their roles and the regulatory, tax and competitive climates. These differences affect the cost, quality and choice of payment products Europeans and Americans enjoy and, therefore, ought to be of profound interest to retailers and consumers. Payment providers, too, should be keenly interested in an environment conducive to competition and creating and enhancing services across the value chain. Innovation at a Glance Payments competition in the U.S. is greater than in Europe. Specifically, retail payment network competition in the U.S. is fierce and increasing. American Express, Discover, FIS’s NYCE, Fiserv’s Accel, First Data’s STAR, JCB, MasterCard, PayPal, Visa and increasingly China UnionPay compete. In stark contrast, until 2009, Europe’s third-largest card network, France’s CartesBancaires, enjoyed a domestic monopoly. Until 2011, the Netherlands had a monopoly debit payment scheme. Innovation Snapshot Below is a short history of key developments in electronic payments. Notice that most innovations occurred in the U.S. market, many led by immigrant entrepreneurs seeking a friendlier regulatory and competitive environment. General purpose credit cards were invented in the 1950s in New York City by Diners Club founder Frank McNamara. American Express introduced its charge card in 1958, first in paper, then in plastic the following year. -

A New Year in Payments

January 9, 2006 • Issue 06:01:01 Inside This Issue: News Industry Update .....................................14 First Data Announces Layoffs, Change in Share Price ........................ 62 2006 Calendar of Events ................. 94 Australia Examines Debit Fees, Network Rules ..................................100 Contactless Payments Advance With Near Field Communication Trial .........100 Features AgenTalkSM: Harvey "Lee" Sullivan Welcome to a From Public Service to Merchant Service ............................22 New Year in Payments A Primer on ISO Agreements ................... 30 An Industry Divided f data security breaches, merchant lawsuits, mergers and acquisitions, By Tracy Kitten, ATMmarketplace.com .... 48 and a "free" terminal program frenzy were the headline-grabbers in 2005, you have to wonder what 2006 holds for the payments indus- Trade Association News: try. We asked The Green Sheet Advisory Board (AB) to provide their Gearing Up for 2006 ........................ 53 I thoughts and strategies for the year ahead: Views • How have the events of the past year shaped your plans for 2006? Transformation Well Under Way • Will you make any major changes to the way you do business? By Paul Rasori ....................................96 If so, what? If not, why? Education • What do you most look forward to in the coming year? What obstacles do you foresee? Street SmartsSM: • And finally, what words of wisdom do you have for merchant Friend or Client? level salespeople (MLSs) as they start a new year? By Ty Rosean ...................................... 74 Their responses, listed in alphabetical order, follow: Turning Promotional Customers Into Lifetime Clients Adam Atlas, By Nancy Drexler and Sam Neuman ...... 84 Attorney at Law What ISOs Should Expect in 2006 "The piece of the merchant acquiring pie that is left for the small ISO or MLS By David H. -

City of St Louis Banking and Depository Services Bid November 16, 2018

City of St Louis Banking and Depository Services Bid November 16, 2018 Presented by: Colleen Lang Vice President, Treasury Management Officer UMB Bank, n.a. (314) 612-8008 office [email protected] Table of Contents 1. Transmittal Letter 2. Summary of UMB 3. Proposal Response • Exhibit B 4. Pricing, Fee Schedule • Exhibit A • Exhibit A-1 5. Additional Products and Services • ACH Filter • Remote Deposit • Purchasing Card • Elavon Merchant Services • Benefits Banking • Netspend Payroll Services • Online Payment Solutions 6. Disaster Recovery Under separate cover One Original Documentation Booklet and Sample Report Section 1 Letter of Transmittal Section 2 Executive Summary UMB Financial Corporation UMB Financial Corporation (Nasdaq: UMBF), founded in 1913, is a diversified financial services holding company aligned into three strategic business segments to best serve our customers and achieve long-term growth opportunities. Our multiple revenue streams give UMB added stability to endure economic cycles and fluctuations in financial markets. As we continue to grow, we recognize the need to enhance operational efficiency and reduce costs—a need which drives our commitment to implementing efficiency measures. We will continue to be focused on the needs of our customers, on the diversity of our business model and on our future. Our business model has proven that it works, and our organization is tuned up to execute on UMB’s potential. The sum of who we are forms a strong and enduring culture that is recognizable as UMB. It is about having the integrity to do the right thing and the wisdom not to go chasing after the herd – this is a strength ingrained in our culture.