Master's Thesis Financial Management

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Registration Document

20 REGISTRATION DOCUMENT Including the annual financial report 17 GROUPE PSA - 2017 REGISTRATION DOCUMENT -1 ANALYSIS OF THE BUSINESS AND GROUP OPERATING RESULTS IN 2017 AND OUTLOOK Capital Expenditure in Research & Development 4.4.2. Banque PSA Finance, signature of a framework agreement with the BNP Paribas Group to form a car financing Partnership for Opel Vauxhall vehicles On 6 March 2017, when the Master Agreement was concluded with BNP Paribas Personal Finance, will from an accounting point of view General Motors, the Company simultaneously signed a Framework retain the current European platform and staff of GM Financial. The Agreement with BNP Paribas and BNP Paribas Personal Finance, to Opel Vauxhall finance companies will distribute financial and organise the joint purchase of Opel Vauxhall’s finance companies insurance products over a territory initially including the following and the setting up of a car financing partnership for Opel Vauxhall countries: Germany, United Kingdom, France, Italy, Sweden, Austria, vehicles. Ireland, Netherlands, Belgium, Greece and Switzerland. The The acquisition of Opel Vauxhall’s finance companies will be cooperation may potentially be extended thereafter to other completed through a holding company. This joint venture, owned in countries where Opel Vauxhall has a presence. equal shares and on the same terms by Banque PSA Finance and 4.5. CAPITAL EXPENDITURE IN RESEARCH & DEVELOPMENT Automotive Expertise to deliver useful technologies Innovation, research and development are powerful levers for Every year, Groupe PSA invests in research and development to developing competitive advantages by addressing the major stay ahead, technologically, of environmental and market changes. challenges faced in the automotive industry (environmental, safety, emerging mobility and networking needs, etc.). -

The European Markets and Strategies to Watch for Maximum Opportunity

THE EUROPEAN MARKETS AND STRATEGIES TO WATCH FOR MAXIMUM OPPORTUNITY BRIAN MADSEN ONLINE AUCTIONS IT SOLUTIONS SMART DATA 1 THE SPEED OF CHANGE IS FASTER THAN EVER 2 THE NEW NORMAL 3 CHANGE OF INCREASE IN INCREASES YOUNG DEMAND AND SUPPLY OWMERSHIP PRIVATE LEASINGCHALLENGESUSED CAR INVENTORY 4 WE FIGHT WITH CHANGES AND AGAINST OTHER NEEDS 5 PRODUCT MIX ONLINE OEM SALES NEW PLAYERS 6 CHANGE OF INCREASE IN INCREASES YOUNG DEMAND AND SUPPLY OWMERSHIPHOW TO CREATEPRIVATE OPPORTUNITIES LEASING USED CAROUT INVENTORY OF CHALLENGES 7 USED CAR USE DIGITAL SOLUTIONS TO MOBILE ADAPT COMMUNICATION LEASING MATCH CARS WITH BUYERS SOLUTIONS TO CUSTOMER NEEDS 8 WE ALL NEED TO BE BETTER ONLINE 9 216 MILLION 16 MILLION 45 MILLION 6 MILLION PASSENGERS CARS NEW CARS SOLD USED CARS SOLD CARS FOR SALE ON THE ROAD PER YEAR PER YEAR ONLINE EVERY DAY 10 43% 47% 33% 4% PUBLISHED ONLINE WITHOUT PRICE CHANGE 2 MIO CARS ARE WITHOUT PHOTO FOR MORE FOR MORE MISSING INFORMATION FOR MORE THAN 90 DAYS THAN 30 DAYS THAN 30 DAYS 11 TIME IS IMPORTANT FOR THE RETAIL SELLER 12 TIME STARTS BEFORE AND IS PART OF REMARKETING 13 PRIVATE LEASE INVENTORY TCO MONTHLY COST DEMAND UC PRICE RV SALES USED CARS 14 REMARKETING WORKFLOW MANAGEMENT 15 38 % 6 % 49 % 24% FOUND A BUYER HIGHER PRICES PAID BY USED CARS SOLD BY NON CARS OFFERED OUTSIDE THE COUNTRY NON FRANCHISE DEALERS FRANCHISE DEALERS AND SOLD UPSTREAM AUTOROLA CASE STUDY 16 RETAIL DRIVEN REMARKETING 17 HOW DO WE FIND THE RIGHT BUYER FOR EACH VEHICLE ? 18 GEO PRICING VALUE REMARKETING CHALLENGES RV TCO MORE CHAIN DATA SALES SMART -

On the Morning of Thursday, January 14, 1926 Fire Broke out in The

Found on Ancestry.com (Author Unknown) On the morning of Thursday, January 14, 1926 fire broke out in the company’s sanding machine and spread spontaneously through the blowers to different parts of the room. In the few hours that followed, Onaway’s main means of livelihood went up in smoke and although the city still exists, it has never reached the proportion it was on that historical day. With the presence of the American Wood Rim Co. and its sister company, the Lobdell Emerey Manufacturing Co., Onaway experienced tremendous growth in its early year. The big industry, along with the profitable timber business made Onaway the biggest little town in northern Michigan. According to one report, Onaway had two newspapers, three lawyers, four doctors, three large hotels, 17 saloons, nine churches, two bakeries, a fairgrounds, racetrack and an opera house in the pre-fire days. The figure varies, but Onaway’s population was approximately 4,000 and the two huge industries employed anywhere from 1200 to 1500 persons. The Lobdell Emery Manufacturing co. was involved in lumbering, sawmill operations and the making of such products as dowels, broom handles, and coat hanger stock. The American Wood Rim Co., was the world’s largest and finest producer of automobile steering wheels and bicycle rims. For a number of years the company made all the steering wheels with either malleable iron or aluminum spiders. The alumi- num spiders were all molded and finished in the plant while the malleable iron castings were purchased from outside sour- ces. During its last few years in Onaway, the American Wood Rim Co. -

Murder-Suicide Ruled in Shooting a Homicide-Suicide Label Has Been Pinned on the Deaths Monday Morning of an Estranged St

-* •* J 112th Year, No: 17 ST. JOHNS, MICHIGAN - THURSDAY, AUGUST 17, 1967 2 SECTIONS - 32 PAGES 15 Cents Murder-suicide ruled in shooting A homicide-suicide label has been pinned on the deaths Monday morning of an estranged St. Johns couple whose divorce Victims had become, final less than an hour before the fatal shooting. The victims of the marital tragedy were: *Mrs Alice Shivley, 25, who was shot through the heart with a 45-caliber pistol bullet. •Russell L. Shivley, 32, who shot himself with the same gun minutes after shooting his wife. He died at Clinton Memorial Hospital about 1 1/2 hqurs after the shooting incident. The scene of the tragedy was Mrsy Shivley's home at 211 E. en name, Alice Hackett. Lincoln Street, at the corner Police reconstructed the of Oakland Street and across events this way. Lincoln from the Federal-Mo gul plant. It happened about AFTER LEAVING court in the 11:05 a.m. Monday. divorce hearing Monday morn ing, Mrs Shivley —now Alice POLICE OFFICER Lyle Hackett again—was driven home French said Mr Shivley appar by her mother, Mrs Ruth Pat ently shot himself just as he terson of 1013 1/2 S. Church (French) arrived at the home Street, Police said Mrs Shlv1 in answer to a call about a ley wanted to pick up some shooting phoned in fromtheFed- papers at her Lincoln Street eral-Mogul plant. He found Mr home. Shivley seriously wounded and She got out of the car and lying on the floor of a garage went in the front door* Mrs MRS ALICE SHIVLEY adjacent to -• the i house on the Patterson got out of-'the car east side. -

Y Grant SHERIDAN CHEVROLET CADILLAC LTD., PICKERING

AMËr.- ,. - IHIS TO rloorrrÉ cÈ À LVtá tÈete ee.oz 1 ,4 E TIJEORDER OF L'0RDoit DATED / FAIÎ LÈ Court File No.: CV-14-506635-00CP ßEOISTRAR ONTARIO !uFqnl0ñ 00unr OF JUTTIOI D¡ JUITICE SUPERIOR COURT OF JUSTICE Y Grant BETWEEN: Regis.trar SHERIDAN CHEVROLET CADILLAC LTD., PICKERING AUTO MALL LTD., ANd FADY SAMAHA Plaintiffs -and- DENSO CORPORATION, DENSO INTERNATIONAL AMERICA INC., DENSO MANUFACTURING CANADA, INC., DENSO SALES CANADA, INC., MITSUBA CORPORATION, and AMERICAN MITSUBA CORPORATION Defendants Proceeding under the Clqss Proceedings Ac[ 1992, S.O. 1992, c. C.6 FRESH AS AMENDED STATEMENT OF CLAIM (Fan Motors) TO THE DEFENDANTS: A LEGAL PROCEEDING HAS BEEN COMMENCED AGAINST YOU by the plaintiffs. The claim made against you is set out in the following pages. IF YOU WISH TO DEFEND THIS PROCEEDING, you or an Ontario lawyer acting for you must prepare a statement of defence in Form l8A prescribed by the Rules of Civil Procedure, serve it on the plaintifß' lawyers or, where the plaintiffs do not have a lawyer, serve it on the plaintiffs, and file it, with proof of service, in this court offrce, WITHIN TWENTY DAYS after this statement of claim is served on you, if you are served in Ontario. If you are served in another province or territory of Canada or in the United States of America, the period for serving and filing your statement of defence is forty days. If you are served outside Canada and the United States of America, the period is sixty days. Instead of serving and filing a statement of defence, you may serve and f,rle a notice of intent to defend in Form l8B prescribed by the Rules of Civil Procedure. -

Power Transmission Group Automotive Aftermarket Contents Introduction

WORK BOOK Power Transmission Group Automotive Aftermarket Contents Introduction Page High mechanical output on demand, completely independent of wind or water power – the spread of the steam engine un- Introduction 3 leashed the industrial revolution in the factories. The individual production machines were driven via steel shafts mounted on Timing belts 4 the ceiling of the building, pulleys and flat drive belts made of Function 5 leather. Design/materials 6 Profiles/handling 9 The first cars and motorcycles also used this power transmis- Maintenance and replacement 10 sion principle. However, the flat belts in this application were Changing the timing belt 12 soon replaced by something better: the V-belt with its trapezoi- Timing chains 13 dal cross-section transmitted the necessary forces with a signifi- Tools 14 cantly lower pretension and became the accepted standard for ancillary component drives. Timing belt drive components 18 Idlers and guide pulleys 19 The multi V-belt, a further development of the V-belt, has been Tensioners 20 taking over automotive applications since the early 1990s. Its Water pumps 22 long ribs enable it to transmit even greater loads. Its flat design allows multiple units to be incorporated and driven at the same V-belts and multi V-belts 26 time. This gives new impetus to the ever more compact design Function, handling 27 of engines. Timing belts have been used for synchronous pow- Design, materials, profiles 28 er transmission to drive the camshaft in automotive engines – V-belts since the 1960s. – multi V-belts – Elastic multi V-belts The next generations of the old transmission belts are now Maintenance and replacement 34 high-tech products. -

Opel Gliwice

LKA.410.013.03.2017 P/17/016 WYSTĄPIENIE POKONTROLNE I. Dane identyfikacyjne kontroli Numer i tytuł kontroli P/17/016 – Wykorzystanie przez przedsiębiorców środków publicznych na innowacje i prace badawczo-rozwojowe Jednostka Najwyższa Izba Kontroli przeprowadzająca Delegatura w Katowicach kontrolę Kontroler Mariusz Krynke , główny specjalista kontroli pańs twowej , upoważnienie do kontroli nr LKA/178/2017 z dnia 19 czerwca 2017 r. [Dowód: akta kontroli str. 1-2] Jednostka Opel Manufacturing Poland Sp. z o.o. w Gliwicach 1, kontrolowana ul. Adama Opla 1, 44-121 Gliwice 2 Kierownik jednostki Zarząd OMP w składzie: Andrzej Korpak, Jacek Żarnowiecki, Stefan Moisa kontrolowanej i Michał Jankowiak 3 [Dowód: akta kontroli str. 9] II. Ocena kontrolowanej działalności 4 Ocena ogólna Najwyższa Izba Kontroli ocenia pozytywnie działalność kontrolowanej jednostki w zbadanym zakresie. OMP prawidłowo wywiązywała się z zapisów umowy nr POIG.04.05.01-00-004/10- 00 z 1 lutego 2011 r. zawartej z Ministrem Gospodarki, realizując projekt „Uruchomienie produkcji samochodów Astra IV generacji w wersji trzy- i czterodrzwiowej” 5 w ramach poddziałania 4.5.1 Wsparcie inwestycji w sektorze produkcyjnym, działania 4.5 Wsparcie inwestycji o dużym znaczeniu dla gospodarki, osi priorytetowej 4 Inwestycje w innowacyjne przedsięwzięcia, Programu Operacyjnego „Innowacyjna Gospodarka 2007-2013” . Projekt zakończono w terminie realizując cele zakładane we wniosku o dofinansowanie oraz osiągając zakładane wskaźniki produktu i rezultatu w przyjętych wielkościach. Zakres rzeczowy Projektu obejmujący 54 kategorie wydatków nie zmienił się w trakcie jego realizacji, a wszelkie korekty i przesunięcia pomiędzy tymi kategoriami oraz zmiany umowy o dofinansowanie, m.in. w zakresie kwot nakładów, dokonywane były po uzgodnieniach między stronami w drodze aneksowania i nie miały wpływu na realizację celów Projektu. -

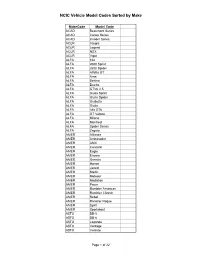

NCIC Vehicle Model Codes Sorted by Make

NCIC Vehicle Model Codes Sorted by Make MakeCode Model Code ACAD Beaumont Series ACAD Canso Series ACAD Invader Series ACUR Integra ACUR Legend ACUR NSX ACUR Vigor ALFA 164 ALFA 2600 Sprint ALFA 2600 Spider ALFA Alfetta GT ALFA Arna ALFA Berlina ALFA Duetto ALFA GTV6 2.5 ALFA Giulia Sprint ALFA Giulia Spider ALFA Giulietta ALFA Giulia ALFA Alfa GT6 ALFA GT Veloce ALFA Milano ALFA Montreal ALFA Spider Series ALFA Zagato AMER Alliance AMER Ambasador AMER AMX AMER Concord AMER Eagle AMER Encore AMER Gremlin AMER Hornet AMER Javelin AMER Marlin AMER Matador AMER Medallion AMER Pacer AMER Rambler American AMER Rambler Classic AMER Rebel AMER Rambler Rogue AMER Spirit AMER Sportabout ASTO DB-5 ASTO DB-6 ASTO Lagonda ASTO Vantage ASTO Volante Page 1 of 22 NCIC Vehicle Model Codes Sorted by Make MakeCode Model Code ASUN GT ASUN SE ASUN Sunfire ASUN Sunrunner AUDI 100 AUDI 100GL AUDI 100LS AUDI 200LS AUDI 4000 AUDI 5000 AUDI 850 AUDI 80 AUDI 90 AUDI S4 AUDI Avant AUDI Cabriolet AUDI 80 LS AUDI Quattro AUDI Super 90 AUDI V-8 AUHE 100 Series AUHE 3000 Series AUHE Sprite AUST 1100 AUST 1800 AUST 850 AUST A99 & 110 AUST A40 AUST A55 AUST Cambridge AUST Cooper "S" AUST Marina AUST Mini Cooper AUST Mini AUST Westminster AVTI Series A AVTI Series B BENT Brooklands BENT Continental Convertible BENT Corniche BENT Eight BENT Mulsanne BENT Turbo R BERO Cabrio BERO Palinuro BERO X19 BMC Princess BMW 2002 Series BMW 1600 Page 2 of 22 NCIC Vehicle Model Codes Sorted by Make MakeCode Model Code BMW 1800 BMW 200 BMW 2000 Series BMW 2500 Series BMW 2.8 BMW 2800 -

Two Killed in Area Accident Federation

ONE SECTION Twelve Pages THIS ISSUE VOLUME 48, NUMBER 25. CASS CITY, MICHIGAN. FRIDAY, OCTOBER 16,1953. TWELVE PAGES Free Maps to All Busy Session Mrs. Mary Thorp Not Guilty of Embezzlement Dies from Gunshot iditor's Corner Plans Completed for Tuscola County Wounds Wednesday At this point, the Cass City Supervisors Set Mrs. Mary Thorp, who lives Christmas decoration project Yuletide Decorations three miles north- and one-half County Jury Tuesday promises to be the greatest since mile west of Kingston, died the event started here a few years The Christmas street lights will Wednesday evening in the Pleasant Frank Rocheleau, former Gagetown village clerk, was ago. be turned on in Cass City Satur-' County Tax Rate Home Hospital from the results of Besides an increase in home day, Dec. 5, and displays are ex- Voters Okay Edison self-inflicted gunshot wounds. found not guilty Tuesday in the Tuscola County Circuit Court decorations, the Kotary Club will pected to be erected and ready for The Tuscola County Sheriff's of charges of embezzling funds\paid to him for water ser- help out this year with an ambi- judging Dec. 12, it was decided by Company Monday The Tuscola .County Board of Department was called to the vice in the village. tious project and the Gavel Club is the Cass City Chamber of Com- Supervisors opened their October home at 5:15 p. m. and found that session Monday and heard reports Mrs. Thorp had shot herself in the In the two-day trial, 48 witnesses were called to the working on twice as many figures merce at a meeting held Monday Cass City voters' approved the •as they erected in 1952. -

2017-03-06-PSA-OPEL.Pdf

PSA & Opel / Vauxhall Alliance: Driving Towards A Better Future A Game-Changing Alliance for PSA & Opel / Vauxhall • Leading European OEM: #1 / #2 Positions Across Key Markets • Complementary Brands • Drive Efficiency on a Higher Scale • Stronger Homebase to Address International Growth Opportunities • Step-Change in Innovation Capability 4.3 MM €55 Bn €4.8 Bn +50% Vehicles Auto Revenue(1) Auto EBITDA(2) R&D Spend Notes 1. 2016A metrics 2. 2016E metrics. Defined as recurring operating income + D&A, assuming 40% of Opel / Vauxhall Auto R&D capitalized 2 Opel / Vauxhall Teams to Drive Turnaround with Full PSA Support 3 Alliance Will Enhance Push-to-Pass and Raise Opel / Vauxhall to Industry Benchmark Current Perimeter Growth(1) by 2018 vs 2015 Group Revenue 10% Additional 15%(1) by 2021E Automotive Average (4) (4) Recurring Operating >4.5% over >6% by 2021E(3) 2% by 2020E 6% by 2026E Margin 2016A-18E Operational Free Positive by 2020E Cash Flow(2) Notes 1. At constant (2015) exchange rate 2. Defined as ROI + D&A – restructuring – capex – Capitalized R&D – Change in NWC 3. vs. initial guidance of 6% by 2021 4 4. Subject to full review of IFRS – US GAAP differences Existing PSA – Opel / Vauxhall OEM Partnership Already Delivering Significant Results Proven Cooperation Model Impact of 3 Joint Vehicle Programs from c.€1.1 Bn Savings Already Based on Three Key Pillars 2017E Onwards Generated With Add. €0.3 Bn p.a. Joint Purchasing Organization Crossland X C3 Aircross PSA Share - In € Bn 220k units (2018E)(1) – Alignment of pricing to benchmark on joint procurement BVH1 platform R&D/ Capex, Joint +0.3 p.a. -

Download PDF, 64 Pages, 11.71 MB

SCAN THIS IMAGE – how to use the augmented reality options Perspective. Augmented reality makes the fascination of Porsche an even more intense experience. Annual and Simply download the Porsche Newsroom app from the App Sustainability Report Store or Google Play, select of Porsche AG the augmented reality function in the menu and look out for 2017 the labels SCAN THIS IMAGE and SCAN THIS PAGE. View the labelled images and pages on the screen of your smartphone or tablet – and bring the SCAN content to life. THIS IMAGE Seventy years ago: the first Porsche “356”. The number 1. Maximisation of minimalism. Devotion to design. Elegance. One: rebel, cult figure, eternally young, alone. The other: magician, legend steeped in contradiction, never without her. Conjunction of opposites, united in passion. The number 130 on the bonnet of James Dean’s Porsche 550 Spyder: symbol of a movement that transcends death. In Salzburg people could tell when Herbert von Karajan was there by the car parked at the offices of its famous festival hall: “God drives a Porsche.” Furrows and flat surfaces, curves and corners, aggression and graciousness, strength and elegance, speed and solidity, focussed concentration and casual playfulness: seemingly disparate forces in precisely calibrated balance. Breaking free of the confluence of automated currents, setting one’s own course, experiencing the pleasure of authenticity beyond efficiency. Refuge for individualists, nonconformists, the avant-garde. Exclusive, yet right in the middle of it all. Targa Florio, Le Mans: dream-like places, built out of triumph and tragedy. One: a victorious hero. The other: still a hero in defeat. -

Preparacion Irmscher De Opel

Éxito por Competencia:Retrato de la casa Irmscher. La historia de la casa Irmscher y del éxito mundial del grupo de empresas Irmscher están íntimamente vinculados al fundador. Günter Irmscher, y a su carrera profesional. Como joven ingeniero de una empresa de la industria de aceites minerales, y como persona de enlace con la industria automovilística, despertóse su pasión por el deporte del motor. Günter Imscher participó en todas las competiciones: Circuitos, montaña, rallyes. En las horas de la tarde y de la noche se preparaban los vehículos, en los fines de semana se tomaba parte en las competiciones. Con una preparación cuidadosa, con pocos medios, pero con alto conocimiento de la conducción, era posible, en aquellos tiempos, lograr éxitos. Günter Imscher lo consiguió, y pronto pasó a ser uno de los mas conocidos deportistas alemanes del motor. En 1964 ganó sobradamente la copa ONS, en 1965 el campeonato de coches de turismo. Con el copiloto Harald Andersen venció Irmscher en 1967 con una ventaja de 26 minutos en la vuelta a Europa. A parte de sus cualidades como deportista del motor, Günter Imscher ganó rápidamente renombre como especialista en motores. En 1968 osó por último establecerse por su cuenta primeramente sin vinculación a ninguna marca. El capital inicial lo obtuvo del producto de la venta de su Kadett de rallye. El know-how (saber como) adquirido por Günter Imscher antes de la fundación de la casa y su consecuente puesta en práctica sigue siendo hoy dia garantia del éxito del grupo de empresas. La casa Irmscher se expansionó rapidamente, especializándose en vehículos de la marca Opel.