Distribution Rules

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

We're Making It Easier to Find Your Favourite Shows

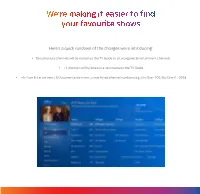

We’re making it easier to find your favourite shows Here’s a quick rundown of the changes we’re introducing: • Documentary channels will be moved up the TV Guide to sit alongside Entertainment channels • +1 channels will be listed in a new menu on the TV Guide • +1s from Entertainment & Documentaries move to new linked channel numbers (e.g, Sky One - 106, Sky One+1 - 206) PAGE 1 Entertainment News, Specialist, Secondary Channels, Movies & Sports & Music International & Adult & Radio & Documentaries Religion, Kids & Shopping Entertainment & Documentaries 101 RTÉ One HD 201 RTÉ One+1 171 Disc.History 271 Disc.History+1 954 BBC One London (AD) 102 RTÉ Two HD 172 Discovery Shed 969 BBC Two Eng (AD) 103 TV3 HD 203 TV3+1 173 BET:BlackEntTv 976 BBC One HD (AD) 104 TG4 HD 174 VH1 994 Sky Atlantic VIP 105 3e HD 175 BEN 995 Sky Atlantic VIP HD 106 Sky One HD 206 Sky One+1 177 Home & Health 277 HomeHealth+1 996 Chl Line-up 107 Sky Living HD 207 Sky Living+1 178 DMAX 278 DMAX+1 998 Sky Intro 108 Sky Atlantic HD 208 Sky Atlantic+1 179 True Ent 279 True Ent+1 999 Channel 999 109 W HD 209 W+1 180 truTV 280 truTV+1 110 GOLD 210 GOLD+1 181 Sony Crime 2 111 Dave HD 211 Dave ja vu 182 GNTV 112 Comedy Central 212 ComedyCent+1 183 VICE 113 Universal 213 Universal+1 184 Horse & Country 114 SYFY HD 214 SYFY+1 185 propeller 116 Be3 187 Blaze 121 SkySp Mix HD 188 Disc.Turbo 288 Disc.Turbo+1 122 Sky Arts HD 189 Property Show 123 Sky Two 190 Animal Planet HD 290 Animal Plnt+1 124 FOX HD 224 FOX+1 191 mytv 125 Discovery 225 Discovery+1 192 Showcase 292 Showcase+1 -

Broadcast Bulletin Issue Number 191 10/10/11

Ofcom Broadcast Bulletin Issue number 191 10 October 2011 1 Ofcom Broadcast Bulletin, Issue 191 10 October 2011 Contents Introduction 4 Notice of Sanction Al Ehya Digital Television Limited Saturday Night Special, 13 November 2010 5 Note to Broadcasters Publication of new guidance and research 7 Standards cases In Breach Aden Live 27 October 2010, 18:20 (16:20 GMT) to 29 October 2010, 19:00 (17:00 GMT) 15 November 2010, 10:00 (08:00 GMT) to 16 November 2010, 10:00 (08:00 GMT) 8 Pro Bull Riders trailer Extreme Sports, 19 July 2011, 13:00 31 Howard Taylor at Breakfast Total Star – Wiltshire, 20 May 2011, 06:00 33 The Baby Borrowers Really, 2 August 2011, 20:00 36 Music video programming Brit Asia TV, 11 June 2011 38 Sponsorship of various programmes B4U Music, 15 June 2011, 21:00 to 22:42 42 Resolved Station promotion 106 Jack FM, 2 August 2011, 10:30 47 Fairness and Privacy cases Upheld Complaint by Mr David Gemmell Grimefighters, ITV1, 12 April 2011 49 2 Ofcom Broadcast Bulletin, Issue 191 10 October 2011 Not Upheld Complaint by Dr Saeb Erakat on his own behalf and on behalf of the Palestine Liberation Organisation The Palestine Papers, Al Jazeera English, 23 to 26 January 2011 53 Other programmes Not in Breach 72 Complaints Assessed, Not Investigated 73 Investigations List 79 3 Ofcom Broadcast Bulletin, Issue 191 10 October 2011 Introduction Under the Communications Act 2003, Ofcom has a duty to set standards for broadcast content as appear to it best calculated to secure the standards objectives1, Ofcom must include these standards in a code or codes. -

PSB Report Definitions

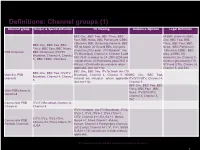

Definitions: Channel groups (1) Channel group Output & Spend definition TV Viewing Audience Opinion Legal Definition BBC One, BBC Two, BBC Three, BBC All BBC channels (BBC Four, BBC News, BBC Parliament, CBBC, One, BBC Two, BBC CBeebies, BBC streaming channels, BBC Three, BBC Four, BBC BBC One, BBC Two, BBC HD (to March 2013) and BBC Olympics News , BBC Parliament Three, BBC Four, BBC News, channels (2012 only). ITV Network* (inc ,CBeebies, CBBC, BBC PSB Channels BBC Parliament, ITV/ITV ITV Breakfast), Channel 4, Channel 5 and Alba, all BBC HD Breakfast, Channel 4, Channel S4C (S4C is added to C4 2008-2009 and channels), the Channel 3 5,, BBC CBBC, CBeebies excluded from 2010 onwards post-DSO in services (provided by ITV, Wales). HD variants are included where STV and UTV), Channel 4, applicable (but not +1s). Channel 5, and S4C. BBC One, BBC Two, ITV Network (inc ITV BBC One, BBC Two, ITV/ITV Main five PSB Breakfast), Channel 4, Channel 5. HD BBC One, BBC Two, Breakfast, Channel 4, Channel channels variants are included where applicable ITV/STV/UTV, Channel 4, 5 (but not +1s). Channel 5 BBC One, BBC Two, BBC Three, BBC Four , BBC Main PSB channels News, ITV/STV/UTV, combined Channel 4, Channel 5, S4C Commercial PSB ITV/ITV Breakfast, Channel 4, Channels Channel 5 ITV+1 Network (inc ITV Breakfast) , ITV2, ITV2+1, ITV3, ITV3+1, ITV4, ITV4+1, CITV, Channel 4+1, E4, E4 +1, More4, CITV, ITV2, ITV3, ITV4, Commercial PSB More4 +1, Film4, Film4+1, 4Music, 4Seven, E4, Film4, More4, 5*, Portfolio Channels 4seven, Channel 4 Paralympics channels 5USA (2012 only), Channel 5+1, 5*, 5*+1, 5USA, 5USA+1. -

Strictly Private and Confidential

The BBC’s distribution arrangements for its UK public services A study examining whether the BBC’s distribution arrangements represent value for money By Mediatique on behalf of the BBC Trust November 2013 Mediatique Limited is a registered limited company in England and Wales. Company No. 4575079. VAT registration 927 5293 00 Contents 1. Overview of key findings and recommendations ........................................................................................ 4 Distribution expenditure measured against universality obligations and commercial benchmarks .................................... 4 Decision-making in relation to key principles and objectives: Governance and internal reporting lines ............................. 7 Fit for future purpose ........................................................................................................................................................... 8 Summary of key recommendations ................................................................................................................................... 10 2 Introduction .............................................................................................................................................. 11 The BBC’s current distribution footprint ............................................................................................................................ 12 Television .......................................................................................................................................................................... -

RAJAR DATA RELEASE Quarter 1, 2020 – May 14 Th 2020

RAJAR DATA RELEASE Quarter 1, 2020 – May 14 th 2020 COMPARATIVE CHARTS 1. National Stations 2. Scottish Stations 3. London Stations 4. Breakfast Shows – National and London stations "Please note that the information contained within this quarterly data release has yet to be announced or otherwise made public and as such could constitute relevant information for the purposes of section 118 of FSMA and non-public price sensitive information for the purposes of the Criminal Justice Act 1993. Failure to comply with this embargo could result in prosecution’’. Source RAJAR / Ipsos MORI / RSMB RAJAR DATA RELEASE Quarter 1, 2020 – May 14 th 2020 NATIONAL STATIONS STATIONS SURVEY REACH REACH REACH % CHANGE % CHANGE SHARE SHARE SHARE PERIOD '000 '000 '000 REACH Y/Y REACH Q/Q % % % Q1 19 Q4 19 Q1 20 Q1 20 vs. Q1 19 Q1 20 vs. Q4 19 Q1 19 Q4 19 Q1 20 ALL RADIO Q 48945 48136 48894 -0.1% 1.6% 100.0 100.0 100.0 ALL BBC Q 34436 33584 33535 -2.6% -0.1% 51.4 51.0 49.7 15-44 Q 13295 13048 13180 -0.9% 1.0% 35.2 35.5 34.4 45+ Q 21142 20535 20355 -3.7% -0.9% 60.2 59.4 57.9 ALL BBC NETWORK RADIO Q 31846 31081 30835 -3.2% -0.8% 44.8 45.0 43.4 BBC RADIO 1 Q 9303 8790 8915 -4.2% 1.4% 5.7 5.6 5.6 BBC RADIO 2 Q 15356 14438 14362 -6.5% -0.5% 17.4 17.0 16.3 BBC RADIO 3 Q 2040 2126 1980 -2.9% -6.9% 1.2 1.4 1.3 BBC RADIO 4 (INCLUDING 4 EXTRA) Q 11459 11416 11105 -3.1% -2.7% 13.1 13.4 12.9 BBC RADIO 4 Q 11010 10977 10754 -2.3% -2.0% 11.9 12.0 11.7 BBC RADIO 4 EXTRA Q 2238 2271 1983 -11.4% -12.7% 1.3 1.4 1.2 BBC RADIO 5 LIVE (INC. -

11. Mumbai & Thane

11. MUMBAI & THANE Service Name City BST Silver Gold Sony Mumbai & Thane N Y Y Sony SAB Mumbai & Thane N Y Y Colors Mumbai & Thane N Y Y Rishtey Mumbai & Thane N Y Y Sony PAL Mumbai & Thane N Y Y Shop CJ Mumbai & Thane N Y Y Home Shop 18 Mumbai & Thane Y Y Y I D Mumbai & Thane N Y Y Zoom Mumbai & Thane N N Y Epic Mumbai & Thane N N N ETV Bihar JH Mumbai & Thane N Y Y ETV MP CG Mumbai & Thane N Y Y ETV Rajasthan Mumbai & Thane N Y Y ETV UP UK Mumbai & Thane N Y Y DEN snapdeal tv-shop Mumbai & Thane Y Y Y Sahara One Mumbai & Thane N Y Y DD National Mumbai & Thane Y Y Y DD Rajasthan Mumbai & Thane Y Y Y DD Uttar Pradesh Mumbai & Thane Y Y Y DD Madhya Pradesh Mumbai & Thane Y Y Y DD Bihar Mumbai & Thane Y Y Y Sony MAX Mumbai & Thane N Y Y SONY MAX 2 Mumbai & Thane N Y Y B4U Movies Mumbai & Thane N Y Y Cinema TV Mumbai & Thane N Y Y Multiplex Mumbai & Thane Y Y Y DEN Cinema Mumbai & Thane Y Y Y Filmy Mumbai & Thane N N Y DEN Movies Mumbai & Thane N Y Y AXN Mumbai & Thane N Y Y Comedy Central Mumbai & Thane N Y Y Colors Infinity Mumbai & Thane N Y Y DSN INFO Mumbai & Thane Y Y Y Sony PIX Mumbai & Thane N Y Y Movies Now Mumbai & Thane N N Y Romedy Now Mumbai & Thane N N Y Discovery Turbo Mumbai & Thane N Y Y TLC Mumbai & Thane N Y Y Fashion TV Mumbai & Thane N N Y Food Food Mumbai & Thane N N Y News 18 India Mumbai & Thane N Y Y India TV Mumbai & Thane Y Y Y News 24 Mumbai & Thane N N N Aajtak Tez Mumbai & Thane N Y Y ABP News Mumbai & Thane Y Y Y Aajtak Mumbai & Thane N Y Y News Nation Mumbai & Thane Y Y Y India News Mumbai & Thane Y Y Y DD -

Response to Ofcom Consultation on the Future of Public Service Media

Response to Ofcom Consultation on the Future of Public Service Media About this submission 1. AudioUK is the trade body for the audio-led production sector in the UK. AudioUK has four core priorities: Business; Representation; Community; and Excellence. As well as producing the annual Audio Production Awards it also runs the successful Audiotrain craft skills training programme, which has so far provided around 2,500 learner days. AudioUK, along with Radiocentre, oversees the administration of the Audio Content Fund which distributes a grant from the UK government to fund public service content on commercial and community radio. As a member of the Government Broadcasting, Film and Production Working Group, AudioUK has produced guidelines for safe working in audio production during the COVID-19 pandemic. 2. We recognise and agree with Ofcom’s reasoning for changing the language around PSB. We believe ‘Public Service Media’ is a better term to describe the content produced, partly to reflect the wider range of media created, as well as the manner in which it is distributed. 3. However, we do here refer to ‘public service broadcasters’ (‘PSBs’) to differentiate between the licenced PSBs – BBC, ITV/STV, Channel 4, S4C, Channel 5 - and other broadcasters also providing content which is officially designated PSM content – the main example being commercial and community stations broadcasting programmes funded by the Audio Content Fund. Audio as part of public service media 4. The UK has a thriving audio content production industry with an independent sector made up of around 200 companies around the UK. These companies create compelling content across a wide range of genres which engages audiences and offers them different voices, perspectives, talent and ideas. -

Media: Industry Overview

MEDIA: INDUSTRY OVERVIEW 7 This document is published by Practical Law and can be found at: uk.practicallaw.com/w-022-5168 Get more information on Practical Law and request a free trial at: www.practicallaw.com This note provides an overview of the sub-sectors within the UK media industry. RESOURCE INFORMATION by Lisbeth Savill, Clare Hardwick, Rachael Astin and Emma Pianta, Latham & Watkins, LLP RESOURCE ID w-022-5168 CONTENTS RESOURCE TYPE • Scope of this note • Publishing and the press Sector note • Film • Podcasts and digital audiobooks CREATED ON – Production • Advertising 13 November 2019 – Financing and distribution • Recorded music JURISDICTION • Television • Video games United Kingdom – Production • Radio – Linear and catch-up television • Social media – Video on-demand and video-sharing services • Media sector litigation SCOPE OF THIS NOTE This note provides an overview of the sub-sectors within the UK media industry. Although the note is broken down by sub-sector, in practice, many of these areas overlap in the converged media landscape. For more detailed notes on media industry sub-sectors, see: • Sector note, Recorded music industry overview. • Sector note, TV and fi lm industry overview. • Practice note, Video games industry overview. FILM Production Total UK spend on feature fi lms in 2017 was £2 billion (up 17% on 2016) (see British Film Institute (BFI): Statistical Yearbook 2018). Film production activity in the UK is driven by various factors, including infrastructure, facilities, availability of skills and creative talent and the incentive of fi lm tax relief (for further information, see Practice note, Film tax relief). UK-produced fi lms can broadly be sub-divided into independent fi lms, UK studio-backed fi lms and non-UK fi lms made in the UK. -

The BBC's Use of Spectrum

The BBC’s Efficient and Effective use of Spectrum Review by Deloitte & Touche LLP commissioned by the BBC Trust’s Finance and Strategy Committee BBC’s Trust Response to the Deloitte & Touche LLPValue for Money study It is the responsibility of the BBC Trust,under the As the report acknowledges the BBC’s focus since Royal Charter,to ensure that Value for Money is the launch of Freeview on maximising the reach achieved by the BBC through its spending of the of the service, the robustness of the signal and licence fee. the picture quality has supported the development In order to fulfil this responsibility,the Trust and success of the digital terrestrial television commissions and publishes a series of independent (DTT) platform. Freeview is now established as the Value for Money reviews each year after discussing most popular digital TV platform. its programme with the Comptroller and Auditor This has led to increased demand for capacity General – the head of the National Audit Office as the BBC and other broadcasters develop (NAO).The reviews are undertaken by the NAO aspirations for new services such as high definition or other external agencies. television. Since capacity on the platform is finite, This study,commissioned by the Trust’s Finance the opportunity costs of spectrum use are high. and Strategy Committee on behalf of the Trust and The BBC must now change its focus from building undertaken by Deloitte & Touche LLP (“Deloitte”), the DTT platform to ensuring that it uses its looks at how efficiently and effectively the BBC spectrum capacity as efficiently as possible and uses the spectrum available to it, and provides provides maximum Value for Money to licence insight into the future challenges and opportunities payers.The BBC Executive affirms this position facing the BBC in the use of the spectrum. -

BBC Trust’S Review of BBC Services for Younger Audiences

Channel 4 submission to the BBC Trust’s review of BBC services for younger audiences 1. Channel 4 welcomes the opportunity to provide its views to the BBC Trust’s review of BBC services for younger audiences. Channel 4 is a publicly-owned, commercially-funded public service broadcaster. Its core public service channel, Channel 4, is a free-to-air service funded predominantly by advertising. Unlike the other commercially-funded public service broadcasters, Channel 4 is not shareholder owned: commercial revenue is only a means to delivering Channel 4’s public purpose end and any surplus revenues are reinvested in the delivery of its public service remit. 2. In recent years, Channel 4 has broadened its portfolio to offer a range of digital services, including the free-to-air, commercially-funded digital television channels Channel 4+1, E4, E4+1, Film4, More4 and 4Music. Channel 4 also offers a video on demand service, 4oD, and it is expanding its range of services at channel4.com. In addition, Channel 4 offers a range of online education projects for 14 to 19 year olds and has launched an innovation pilot fund, 4iP, which seeks to stimulate whole new digital media services across a range of areas, including video games, the arts, democracy and sport. 3. These innovations have allowed Channel 4 to stay in touch with audiences— especially younger viewers—who are rapidly migrating to digital media. Ever since its launch in 1982, Channel 4’s brand has resonated particularly strongly with teenagers and younger adults, and the organisation speaks with an authenticity of voice which is not easily replicated by other public institutions. -

FREEVIEW DTT Multiplexes (UK Inc NI) Incorporating Planned Local TV and Temporary HD Muxes

As at 07 December 2020 FREEVIEW DTT Multiplexes (UK inc NI) incorporating planned Local TV and Temporary HD muxes 3PSB: Available from all transmitters (*primary and relay) 3 COM: From *80 primary transmitters only Temp HD - 25 Transmiters BBC A (PSB1) BBC A (PSB1) continued BBC B (PSB3) HD SDN (COM4) ARQIVA A (COM5) ARQIVA B (COM6) ARQIVA C (COM7) HD ARQIVA D (COM8) HD LCN LCN LCN LCN LCN LCN LCN 1 BBC ONE 65 TBN UK 12 QUEST 11 Sky Arts 22 Ideal World 64 Free Sports BBC RADIO: 1 BBC ONE NI Cambridge, Lincolnshire, 74 Shopping Quarter 13 E4 (Wales only) 17 Really 23 Dave ja vu 70 Quest Red+1 722 Merseyside, Oxford, 1 BBC ONE Scot Solent, Somerset, Surrey, 101 BBC 1 Scot HD 16 QVC 19 Dave 26 Yesterday 83 NOW XMAS Tyne Tees, WM 1 BBC ONE Wales 101 BBC 1 Wales HD 20 Drama 30 4Music 33 Sony Movies 86 More4+1 2 BBC TWO 101 BBC ONE HD 21 5 USA 35 Pick 36 QVC Beauty 88 TogetherTV+1 (00:00-21:00) 2 BBC TWO NI BBC RADIO: 101 BBC ONE NI HD 27 ITVBe 39 Quest Red 37 QVC Style 93 PBS America+1 726 BBC Solent Dorset 2 BBC TWO Wales BBC Stoke 102 BBC 2 Wales HD 28 ITV2 +1 42 Food Network 38 DMAX 96 Forces TV 7 BBC ALBA (Scot only) 102 BBC TWO HD 31 5 STAR 44 Gems TV 40 CBS Justice 106 BBC FOUR HD 9 BBC FOUR 102 BBC TWO NI HD 32 Paramount Network 46 Film4+1 43 HGTV 107 BBC NEWS HD Sony Movies Action 9 BBC SCOTLAND (Scot only) BBC RADIO: 103 ITV HD 41 47 Challenge 67 CBS Drama 111 QVC HD (exc Wales) 734 Essex, Northampton, CLOSED 24 BBC FOUR (Scot only) Sheffield, 103 ITV Wales HD 45 Channel 5+1 48 4Seven 71 Jewellery Maker 112 QVC Beauty HD 201 CBBC -

CONVERGENCE OR COLLISION? Navigating the Creative, Commercial and Regulatory Challenges Facing Media Over the Next Decade

WEDNESDAY 19 JANUARY 2011 SAÏD BUSINESS SCHOOL, UNIVERSITY OF OXFORD CONVERGENCE OR COLLISION? Navigating the creative, commercial and regulatory challenges facing media over the next decade guardian.co.uk/oxfordmediaconvention Event partner Event organisers PROGRAMME 08:50 REGISTRATION AND COFFEE 09:45 INTRODUCTION AND WELCOME Nick Pearce, director, ippr 09:50 A CITIZEN’S COMMUNICATION ACT: WHAT THE PUBLIC WANT FROM OUR MEDIA A short vox pop film 10:00 KEYNOTE SPEECH MEDIA POLICY: THE COALITION’S 10 YEAR PLAN Rt Hon Jeremy Hunt MP, secretary of state, culture, Olympics, media and sport 10:40 PLENARY PANEL MEDIA 2011: WHAT NEEDS TO CHANGE? A conversation between the public and providers In this, the Oxford Media Convention’s ninth year, we ask a panel of public representatives and a panel of providers to discuss and debate the current and future course of Britain’s media and creative industries. • How will public service provision, diversity, plurality and media literacy be preserved and promoted over the next decade? • How can public and private entities secure the UK’s position in the global media market place? • What does the future look like? How will audiences be consuming content, how will businesses be making money and what role will government have in shaping media policy and facilitating the creation of growth and infrastructure? In little over an hour and a half can these figures plot out a blueprint for creating an effective environment for growth and public provision? Moderator: Jon Snow, presenter, Channel 4 News Panel 1: Dawn Airey, president, CLT-UFA UK TV (part of the RTL Group) Richard Halton, chief executive, YouView Ashley Highfield, managing director & vice president, consumer & online UK, Microsoft Caroline Thomson, chief operating officer, BBC Panel 2: Sam Conniff, co-founder, Livity Mark Damazer, master, St.