EMIS Group Plc Annual Report and Accounts 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

D2.1 State of the Art and Requirements Analysis V1 Project Deliverable

Collective Wisdom Driving Public Health Policies Del. no. – D2.1 State of the Art and Requirements Analysis v1 Project Deliverable This project has received funding from the European Union’s Horizon 2020 Programme (H2020-SC1-2016-CNECT) under Grant Agreement No. 727560 D2.1 State of the Art and Requirements 29/09/2017 Analysis v1 D2.1 State of the Art and Requirements Analysis v1 Work Package: WP2 Due Date: 01/09/2017 Submission Date: 29/09/2017 Start Date of Project: 01/03/2017 Duration of Project: 36 Months Partner Responsible of Deliverable: SIEMENS Version: 1.0 Final Draft Ready for internal Review Status: Task Leader Accepted WP leader accepted Project Coordinator accepted Dimosthenis Kyriazis (UPRC), Ilias Maglogiannis (UPRC), Christos Xenakis (UPRC), Argyro Mavrogiorgou (UPRC), Athanasios Kiourtis (UPRC), George Peppas (UPRC), Carlos Cavero (ATOS), Santiago Aso (ATOS), Antonio De Nigro (ENG), Francesco Torelli (ENG), Domenico Martino (ENG), George Moldovan (SIEMENS), Kosmin- Septimiu Nechifor (SIEMENS), Salvador Tortajada Velert (HULAFE), Sokratis Nifakos (KI), Tanja Tomson (KI), Jan Janssen (DFKI), Serge Autexier (DFKI), Petrina Smyrli (BIO), Andreas Menychtas (BIO), Author name(s): Christos Panagopoulos (BIO), Chris Orton (ICE), Usman Wajid (ICE), Thanos Kosmidis (CRA), Ricardo Jimenez-Peris (LXS), Patricio Martinez (LXS), Marta Patino-Martinez (UPM), Rafael Fernandez (UPM), Michael Boniface (IT-INN), Vegard Engen (IT- INN), Daniel Burns (IT-INN), Mitja Lustrek (JSI), Maroje Soric (ULJ), Patrick Weber (EFMI), John Mantas (EFMI), -

Bytes Technology Group

This document comprises a prospectus (the "Prospectus") for the purposes of Regulation (EU) 2017/1129, as amended (the "Prospectus Regulation") relating to Bytes Technology Group plc (the "Company") prepared in accordance with the Prospectus Regulation Rules of the Financial Conduct Authority (the "FCA") made under section 73A of the Financial Services and Markets Act 2000 (the "FSMA") and a pre-listing statement prepared in accordance with the applicable JSE Listings Requirements. A copy of this Prospectus has been filed with, and approved by, the FCA and the JSE and has been made available to the public in accordance with the Prospectus Regulation Rules. The FCA only approves this Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such approval should not be considered as an endorsement of the Company that is, or the quality of the securities that are, the subject of this Prospectus. Investors should make their own assessment as to the suitability of investing in the ordinary shares in the capital of the Company (the "Shares"). Application will be made to the FCA for all of the Shares, issued and to be issued in connection with the Offer to be admitted to the premium listing segment of the Official List of the FCA and to London Stock Exchange plc (the "London Stock Exchange") for all of the Shares to be admitted to trading on the London Stock Exchange's main market for listed securities (the "Main Market") (together, "Admission"). Conditional dealings in the Shares are expected to commence on the Main Market at 8.00 a.m. -

Chapter 11 AC Group's 2007 Annual Report the Digital Medical Office Of

Chapter 11 AC Group’s 2007 Annual Report The Digital Medical Office of the Future Performance A. Methodology The majority of previous EMR evaluations have been limited to self-reported functionality. Although high rankings in this arena often indicate a superior product, the reviewers are aware that in some cases this correlation does not always hold. There may be some highly ranked products offering the full range of functionality that from the end user’s point of view may have features, organization or display that are limiting. The converse may also occur where a product that achieves a lower ranking because it offers less that full functionality nonetheless offers highly innovative features that would be advantageous for all end users. In short, although scores from self-reported functionality are extremely useful, they do not capture rich qualitative information that could significantly influence the practitioner’s decision of which system to choose. The purpose of this document is to help a physician evaluate a vendor’s solution. The document is divided into separate product demonstrations. If the practice is interested in one fully integrated system, then have the vendor complete and interact with this entire document. If the practice is only interested in a Document Image Management solution, complete sections B and D. If the practice is only interested in a comprehensive EMR/EHR application, then complete sections B and E. Speed is essential Time the execution of the tasks and record how long they take. You may be surprised at the significant difference in the results. Speed is extremely important during physician documentation. -

Healthcare It Industry Update │ Q3 2016

HEALTHCARE IT INDUSTRY UPDATE │ Q3 2016 www.harriswilliams.com Investment banking services are provided by Harris Williams LLC, a registered broker-dealer and member of FINRA and SIPC, and Harris Williams & Co. Ltd, which is authorised and regulated by the Financial Conduct Authority. Harris Williams & Co. is a trade name under which Harris Williams LLC and Harris Williams & Co. Ltd conduct business. 0 HEALTHCARE IT INDUSTRY UPDATE | Q3 2016 HEALTHCARE IT PRACTICE OVERVIEW CONTENTS INTRODUCTION . WHAT WE’RE READING Harris Williams & Co. is pleased to present our review of Q3 Healthcare IT . KEY HEALTHCARE MACRO activity. This report provides commentary and analysis on current capital market INDICATORS trends and merger and acquisition dynamics within the Healthcare IT industry. PUBLIC MARKETS . PUBLIC COMPARABLES We hope you find this edition helpful and encourage you to contact us directly if . M&A ACTIVITY you would like to discuss our perspective on current industry trends and M&A . PRIVATE PLACEMENT ACTIVITY opportunities or our relevant industry experience. IPO ACTIVITY OUR PRACTICE CONTACTS Sam Hendler Harris Williams & Co. is a leading advisor to the Healthcare IT industry. Our global Managing Director practice includes professionals across the firm from Harris Williams & Co.’s [email protected] Technology, Media & Telecom Group and Healthcare & Life Sciences Group. +1 (617) 654-2117 Jeff Bistrong HW&Co. Healthcare IT Taxonomy Managing Director [email protected] +1 (617) 654-2102 . Patient-Facing Solutions Mike Wilkins . Care Delivery: Managing Director Operational Efficiency [email protected] +1 (415) 271-3411 . Care Delivery: Clinical / Acute Thierry Monjauze Managing Director . Care Delivery: [email protected] Clinical / Non-Acute +44 20 7518 8901 CARE DELIVERY EMPLOYERS ORGANIZATIONS PATIENTS . -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Lessons from The

Ideas from the NHS Dr. Francis Wong, MBBS, MBA, MPH www.franciswong.com September 2018 Purpose Background: The NHS (National Health System) is the largest single-payer system in the world and was ranked #1 in the Commonwealth Fund’s Health Care System Performance Rankings in 20171 (US placed #11). It achieved particularly high scores in Care Process (prevention, safe care, coordination & patient engagement), Access (timeliness & affordability) and Equity. The NHS is also one of the world’s largest employers with around 1.5m staff nationwide. In 2014, the UK spent 9.8% of GDP on healthcare2. Of course, it is not without shortcomings, but I am immensely proud of the NHS and stand behind its founding principles. As a physician who has worked in both UK and US, I believe there is much that the countries can learn from each other. My goals for this document are: • Outline several examples of successful, promising and even controversial innovations in the UK’s National Health Service with an emphasis on primary care. • Briefly describe their impact on care delivery in the UK. • Hypothesize how these innovations might be applied to a US employer-based model. 1 Commonwealth Fund: Mirror, Mirror 2017 2 NHS spends about EU average as percentage of GDP on health Primary Care as Gatekeeper Overview Impact Relevance In England, there are approximately 340M GP Primary care as a gatekeeper to specialists is The gatekeeping role of primary care in the UK consultations a year with an average of 6 visits not a novel concept in the US and is a defining originated over 100 years ago, prior to the per year. -

Download Thesis

This electronic thesis or dissertation has been downloaded from the King’s Research Portal at https://kclpure.kcl.ac.uk/portal/ Big data approaches to investigating Child Mental Health disorder outcomes Downs, Jonathan Muir Awarding institution: King's College London The copyright of this thesis rests with the author and no quotation from it or information derived from it may be published without proper acknowledgement. END USER LICENCE AGREEMENT Unless another licence is stated on the immediately following page this work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International licence. https://creativecommons.org/licenses/by-nc-nd/4.0/ You are free to copy, distribute and transmit the work Under the following conditions: Attribution: You must attribute the work in the manner specified by the author (but not in any way that suggests that they endorse you or your use of the work). Non Commercial: You may not use this work for commercial purposes. No Derivative Works - You may not alter, transform, or build upon this work. Any of these conditions can be waived if you receive permission from the author. Your fair dealings and other rights are in no way affected by the above. Take down policy If you believe that this document breaches copyright please contact [email protected] providing details, and we will remove access to the work immediately and investigate your claim. Download date: 07. Oct. 2021 BIG DATA APPROACHES TO INVESTIGATING CHILD MENTAL HEALTH DISORDER OUTCOMES JOHNNY DOWNS Thesis submitted for the degree of Doctor of Philosophy September 2017 Department of Psychological Medicine Institute of Psychiatry, Psychology & Neuroscience King’s College London ABSTRACT Background: In the UK, administrative data resources continue to expand across publically funded youth-orientated health, education and social services. -

NHS Data: Maximising Its Impact on the Health and Wealth of the United Kingdom Saira Ghafur, Gianluca Fontana, Jack Halligan James O’Shaughnessy & Ara Darzi Contents

NHS data: Maximising its impact on the health and wealth of the United Kingdom Saira Ghafur, Gianluca Fontana, Jack Halligan James O’Shaughnessy & Ara Darzi Contents 02 ACKNOWLEDGEMENTS 04 FOREWORD 05 EXECUTIVE SUMMARY 08 INTRODUCTION: MAXIMISING THE IMPACT OF NHS DATA 12 PUBLIC OPINION AND ENGAGEMENT 16 DATA GOVERNANCE AND LEGAL FRAMEWORKS 20 DATA QUALITY AND INFRASTRUCTURE 24 CAPABILITIES 26 INVESTMENT SUGGESTED CITATION Ghafur S, Fontana G, Halligan J, O’Shaughnessy J, Darzi A. NHS data: Maximising its impact 28 VALUE SHARING on the health and wealth of the United Kingdom. Imperial College London (2020) doi: 10.25561/76409 34 REFERENCES Acknowledgements We would like to thank the following people who contributed to this document through interviews/ attendance at a round table and have agreed to be acknowledged: NAME ORGANISATION Dr. Natalie Banner * Understanding Patient Data Professor Sir John Bell * The Academy of Medical Sciences Kate Cheema British Heart Foundation Professor Diane Coyle University of Cambridge Douglas de Jager * Human.ai Rachel Dunscombe * NHS Digital Academy Dr. Andrew Elder Albion Capital Lord Valerian Freyberg * House of Lords John Godfrey * Legal & General Joanne Hackett * Genomics England Dr. Hugh Harvey * Hardian Health Eleonora Harwich * Reform A total of 26 one-to-one interviews were held with individuals with a strong Geoff Heyes Mind interest in this topic. Interviewees included representatives from government, Dr. Dominic King Google Health the NHS, academia, industry (technology and life sciences), research Dr. Jack Kreindler * Centre for Health & Human Performance institutions, charities and data privacy organisations. We have not consulted the public or healthcare professionals for the purposes of this paper, as we Michael MacDonnell * Google Health chose to focus on experts in the data policy and governance space. -

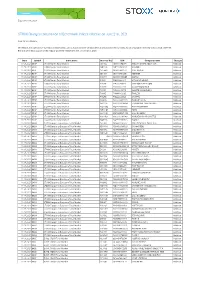

STOXX Changes Composition of Benchmark Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Benchmark Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Benchmark Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 BDXP STOXX Nordic Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. SDR Addition 11.06.2021 BDXP STOXX Nordic Total Market NO112F NO0010823131 KAHOOT! Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10W3 SE0015483276 CINT GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10X4 SE0015671995 HEMNET Addition 11.06.2021 BDXP STOXX Nordic Total Market DK3011 DK0060497295 MATAS Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10JH FI4000480215 SITOWISE GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10HF FI4000049812 VERKKOKAUPPA COM Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10FD FI0009001127 ALANDSBANKEN B Addition 11.06.2021 BDXP STOXX Nordic Total Market FI6036 FI4000048418 AHLSTROM-MUNKSJO Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10IG FI4000062195 TAALERI Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10GE FI4000029905 SCANFIL Addition 11.06.2021 BDXP STOXX Nordic Total Market NO90I2 NO0010861115 NORSKE SKOG Addition 11.06.2021 BDXP STOXX Nordic Total Market NO111E NO0010029804 SPAREBANK 1 HELGELAND Addition 11.06.2021 BDXP STOXX Nordic Total Market NO113G NO0010886625 AKER BIOMARINE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO114H NO0010936792 FROY Addition 11.06.2021 BDXP STOXX Nordic Total Market NO110D BMG9156K1018 2020 BULKERS Addition 11.06.2021 BDXP STOXX Nordic Total Market NO10R3 NO0010196140 NORWEGIAN AIR SHUTTLE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO809S NO0010792625 FJORD1 Deletion 11.06.2021 BKXA STOXX Europe ex Eurozone Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. -

Top Vars 2020 Intros.Indd

Top In association with ARs V 2020 Welcome to Top VARs 2020 Although uncertain times lie ahead, the UK’s top 100 resellers, MSPs and front-line channel partners turned over £17bn in their latest financial years on record, Doug Woodburn discovers This year’s report has a feel of the calm Together, they now turn over before the storm about it. £16.96bn – that’s more than the GDP As a group, the UK’s largest 100 of Botswana and equal to what the resellers and MSPs had a fairly serene government has spent on PPE and and uneventful time of it in their most other COVID-related goods and recent financial years, posting collective services since April. Combined revenues of nearly £17bn – an 8.5 per headcount of over 42,000 means cent annual jump. Profits were also they employ more staff than the roughly flat, depending on how you population of ancient Egyptian city look at it (see p13). Thebes in its pomp. Top VARs charts not current financial When it comes to the rankings, this performance, but the fortunes of these year’s supplement contains more sub- 100 firms in their latest financial years plots than a presidential election. on record – most of which ended The race for top spot has heated before the pandemic hit the industry up, with Softcat just £60m shy of like a force 10 gale. Computacenter’s UK top line (we opted This centuplicate of front-line this year to rank both on their gross channel partners has, however, held up invoiced income, rather than revenue, remarkably well this year. -

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

United Kingdom Small Company Portfolio-Institutional Class As of July 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a feeder fund in a master-feeder structure and the holdings listed below are the investment holdings of the corresponding master fund. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of use in the Legal Notices. -

Digital Health in the UK: an Industry Study for the Office of Life Sciences

Digital Health in the UK An industry study for the Office of Life Sciences September 2015 Contents Foreword 1 Executive summary 2 Part 1. Market introduction 6 Part 2. Telehealthcare 10 Part 3. mHealth 21 Part 4. Data Analytics 32 Part 5. Digitised health systems 39 Part 6. Conclusions on the digital health UK competitive position 45 Monitor Deloitte team 51 References 52 Foreword Welcome to the Monitor Deloitte report on Digital Health. This is one of a series of reports reflecting work commissioned by Office of Life Sciences in March 2015 on key healthcare and life science industry segments in the United Kingdom. Digital Health is an emerging industry arising from the intersection of healthcare services, information technology and mobile technology. Digital health innovations are only just starting to be more widely accepted as necessary for the future of efficient healthcare service delivery. As we address the behaviour, social, legal and technical challenges, over time, digital health advances have the potential to help increase access, decrease healthcare system costs and improve health outcomes. This report analyses trends in the digital health industry based on discussions with stakeholders, literature reviews and our work across the sector. It focuses on the United Kingdom but in the context of the global market and draws on examples from other countries. The report considers the challenges to growth, barriers to adoption, shifting dynamics and how the emergent industry is developing. The intention is to provoke discussion and offer readers an overview of the industry challenges and dynamics in the United Kingdom. We welcome your feedback and comments.