ELECTRONIC TRANSMISSION DISCLAIMER IMPORTANT: You Must Read the Following Before Continuing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Exploring the Secrets of Success

people technolog siness Issue 35 In this issue Exploring the secrets of success 2 Business Insight GS-insight discusses some of the latest trends and Graham Charlton, CFO, Softcat opportunities in the international technology industry, the importance of company culture in business 5 Consulting Insight success and much more … Martin Smith, Executive Director, Sheffield Haworth Welcome to the 35th edition of GS-insight, fit and thereby de-risk the hiring process. Consulting Solutions the magazine of international technology Understandably, investors and Boards are sector Executive Search specialists Gillamor very keen to have a robust assessment of Stephens, part of Sheffield Haworth, the global the strengths and risks associated with 6 International Insight talent consulting and leadership advisory management teams and of their capability to Kelly Kinnard, VP Talent, firm. As a recruitment team, we are fortunate grow, change and adapt to achieve business Battery Ventures to work with companies at all stages of organ- objectives. isational and business development; from This issue of GS-insight explores a wide 8 Investment Insight university “spin-outs” requiring CEOs to help range of themes with leaders across our commercialise “bleeding edge” technology, Mark Boggett, CEO, industry sector. We discuss the importance Seraphim Space Capital through to privately owned and VC/PE of company culture and business growth with funded small-mid size businesses seeking Graham Charlton of Softcat and Russell Sloan the leaders to drive organic and acquisitive of Kainos, two of the most successful and 10 Non-Executive growth/internationalisation strategies to the fastest growing publicly listed technology Insight larger corporate entities hiring executives to businesses. -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Softcat Ltd Annual Report and Accounts 2015

SOFTCAT LTD ANNUAL REPORT AND ACCOUNTS REPORT AND ACCOUNTS ANNUAL LTD SOFTCAT 2015 SOFTCAT LTD ANNUAL REPORT AND ACCOUNTS 2015 SOFTCAT IS A LEADING IT INFRASTRUCTURE PROVIDER We are Softcat. We provide corporate and public sector organisations with software licensing, workplace technology, data centre infrastructure, networking and security combined with all the services they require to design, implement, support and manage these solutions; on premise or in the cloud. We are passionate about what we do and are relentless in our pursuit of excellence; we like enthusiasm, humility, energy and positivity. We try not to take ourselves too seriously but we are a very serious business with revenues approaching £600m and growing very quickly. We care passionately about two things: employee satisfaction and customer service. We believe the former drives the latter. PG04 PG10 PG12 To find more about To read our To read our our Business Model Chairman’s Statement Chief Executive’s Statement CONTENTS Strategic Report Directors’ Report and Financial Statements 1 Financial and Operational Highlights 23 Directors’ Report 2 Company Overview 25 Independent Auditor’s Report 4 Business Model 26 Statement of Profit or Loss and other 6 Our Markets Comprehensive Income 8 Our History 27 Statement of Financial Position 10 Chairman’s Statement 28 Statement of Changes in Equity 12 Chief Executive’s Statement 29 Statement of Cash Flows 16 Financial Review 30 Notes to the Financial Statements 18 Corporate Social Responsibility 20 Board of Directors 22 Statement -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Bytes Technology Group

This document comprises a prospectus (the "Prospectus") for the purposes of Regulation (EU) 2017/1129, as amended (the "Prospectus Regulation") relating to Bytes Technology Group plc (the "Company") prepared in accordance with the Prospectus Regulation Rules of the Financial Conduct Authority (the "FCA") made under section 73A of the Financial Services and Markets Act 2000 (the "FSMA") and a pre-listing statement prepared in accordance with the applicable JSE Listings Requirements. A copy of this Prospectus has been filed with, and approved by, the FCA and the JSE and has been made available to the public in accordance with the Prospectus Regulation Rules. The FCA only approves this Prospectus as meeting the standards of completeness, comprehensibility and consistency imposed by the Prospectus Regulation. Such approval should not be considered as an endorsement of the Company that is, or the quality of the securities that are, the subject of this Prospectus. Investors should make their own assessment as to the suitability of investing in the ordinary shares in the capital of the Company (the "Shares"). Application will be made to the FCA for all of the Shares, issued and to be issued in connection with the Offer to be admitted to the premium listing segment of the Official List of the FCA and to London Stock Exchange plc (the "London Stock Exchange") for all of the Shares to be admitted to trading on the London Stock Exchange's main market for listed securities (the "Main Market") (together, "Admission"). Conditional dealings in the Shares are expected to commence on the Main Market at 8.00 a.m. -

2020 Annual Report

Galliford Try Annual Report and Financial Statements 2020 A progressive business Galliford Try Annual Report and Financial Statements 2020 Strategic report Key developments in the year 1 What makes us different? Successful transition to a well-capitalised, UK-focused 2 Our business at a glance construction group following the strategic disposal of 4 Our business model the housebuilding divisions. 8 Our investment case 10 Chairman’s statement Rapid and effective response to Covid-19 to protect 11 Q&A with the Executive directors the health and wellbeing of our people and supply chain, 14 Market review and enable our business to continue to operate safely 16 Our strategy and sustainably. 18 Operating review 24 People and culture 27 Health and safety Financial performance 29 Risk management Pre-exceptional1 Statutory 35 Operating sustainably Revenue 40 Financial review £1,089.6m -22% £1,121.6m -20% 43 Managing our stakeholder relationships (s172 statement) Continuing -247% +46% (loss) £(59.7)m £(34.6)m Governance before tax 46 Chairman’s review 48 Directors and Executive Board Net cash2 £197.2m +£253.8m £197.2m +£253.8m 50 Governance review 57 Nomination Committee report 58 Audit Committee report Continuing -346% +34% loss per (47.7)p (29.4)p 61 Remuneration Committee report share 63 Directors’ Remuneration Policy report 70 Annual report on remuneration 77 Directors’ report 80 Statement of directors’ responsibilities 3 Financial information Operational performance 81 Independent auditors’ report Order book £3.2bn 88 Consolidated income statement -

Issue Country of Domicile GICS Sector Portfolio Weight (%) AJ BELL United

Issue Country of domicile GICS sector Portfolio weight (%) AJ BELL United Kingdom Financials 3.35% AVAST United Kingdom Information Technology 2.45% CAPITAL FOR COLLEAGUES United Kingdom Financials 0.03% CERES POWER HOLDINGS United Kingdom Industrials 0.76% COMPASS GROUP United Kingdom Consumer Discretionary 1.73% COUNTRYSIDE PROPERTIES United Kingdom Consumer Discretionary 3.84% CREST NICHOLSON HOLDINGS United Kingdom Consumer Discretionary 1.84% DFS FURNITURE United Kingdom Consumer Discretionary 3.08% DISTRIBUTION FINANCE CAPITAL United Kingdom Financials 0.70% ETHICAL PROPERTY CO United Kingdom Real Estate 0.06% FIRST DERIVATIVES United Kingdom Information Technology 2.00% GB GROUP United Kingdom Information Technology 2.58% GENUIT GROUP United Kingdom Industrials 1.04% GREENCOAT UK WIND United Kingdom Utilities 0.96% GYM GROUP United Kingdom Consumer Discretionary 2.75% HALMA United Kingdom Information Technology 2.74% HARGREAVES LANSDOWN United Kingdom Financials 3.53% HELIOS TOWERS United Kingdom Communication Services 2.93% HOME REIT United Kingdom Consumer Discretionary 0.88% INTERTEK GROUP United Kingdom Industrials 3.23% KINGSPAN GROUP Ireland Industrials 2.52% LEARNING TECHNOLOGIES GROUP United Kingdom Information Technology 4.01% LEGAL & GENERAL GROUP United Kingdom Financials 3.72% LONDON STOCK EXCHANGE GROUP United Kingdom Financials 3.78% MORTGAGE ADVICE BUREAU HOLDINGS United Kingdom Financials 1.57% NATIONAL EXPRESS GROUP United Kingdom Industrials 3.35% NATIONAL GRID United Kingdom Utilities 1.30% OXFORD INSTRUMENTS -

Your Guide Directors' Remuneration in FTSE 250 Companies

Your guide Directors’ remuneration in FTSE 250 companies The Deloitte Academy: Promoting excellence in the boardroom October 2018 Contents Overview from Mitul Shah 1 1. Introduction 4 2. Main findings 8 3. The current environment 12 4. Salary 32 5. Annual bonus plans 40 6. Long term incentive plans 52 7. Total compensation 66 8. Malus and clawback 70 9. Pensions 74 10. Exit and recruitment policy 78 11. Shareholding 82 12. Non-executive directors’ fees 88 Appendix 1 – Useful websites 96 Appendix 2 – Sample composition 97 Appendix 3 – Methodology 100 Your guide | Directors’ remuneration in FTSE 250 companies Overview from Mitul Shah It has been a year since the Government announced its intention to implement a package of corporate governance reforms designed to “maintain the UK’s reputation for being a ‘dependable and confident place in which to do business’1, and in recent months we have seen details of how these will be effected. The new UK Corporate Governance Code, to take effect for accounting periods beginning on or after 1 January 2019, includes some far reaching changes, and the year ahead will be a period of review and change for many companies. Remuneration committees must look at how best to adapt to an expanded remit around workforce remuneration, as well as a greater focus on how judgment is used to ensure that pay outcomes are justified and supported by performance. Against this backdrop, 2018 has been a mixed year in the FTSE 250 executive pay environment. In terms of pay outcomes, the picture is relatively stable. Overall pay levels have fallen for FTSE 250 chief executives and we have seen continued momentum in companies adopting executive alignment features such as holding periods, as well as strengthening shareholding guidelines for executives. -

DATABANK INSIDE the CITY SAM CHAMBERS the WEEK in the MARKETS the ECONOMY Consumer Prices Index Current Rate Prev

10 The Sunday Times December 20, 2020 BUSINESS Liam Kelly first. BDO said the RICS’s finished with milder tickings- by Paul Marcuse. This is success of TV drama Strike Bosses of the rickety treasury, reserves and off over interbank transfer where the four NEDs sat. and the West End play Harry investment policies were processes and the Many of the RICS’s 134,000 Potter and the Cursed Child. “not properly version- implementation of actions. members are already The reason for the RICS are on the ropes controlled, appear to be out The report was not shared irritated at having to pay fees dividend damage pre-dated of date and have never been beyond the RICS’s audit to an organisation that seems the pandemic: higher costs The Royal Institution of annual fees of about £540 are communicated to the committee until four NEDs to do little more than chase squeezed pre-tax profits at Chartered Surveyors (RICS) now due — more details of treasury team”, who “just got hold of it, tried to speak them endlessly about “CPD” Brontë — which Rowling runs responded to last weekend’s the report their institution follow instructions ... and to then president Chris — continuing professional with her long-time agent Neil revelation that four non- has strangely failed to share. rely on their own experience Brooke about it — and had development. Those who Blair, 54 — from £7.2m to executive directors had been The 152-year-old body, from previous ... roles”. their contracts terminated pressed £500,000-a-year £4.8m. However, newly filed dismissed for trying to raise which sets professional The second was banking. -

FTSE Russell Publications

2 FTSE Russell Publications 19 August 2021 FTSE 250 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Infrastructure 0.43 UNITED Bytes Technology Group 0.23 UNITED Edinburgh Investment Trust 0.25 UNITED KINGDOM KINGDOM KINGDOM 4imprint Group 0.18 UNITED C&C Group 0.23 UNITED Edinburgh Worldwide Inv Tst 0.35 UNITED KINGDOM KINGDOM KINGDOM 888 Holdings 0.25 UNITED Cairn Energy 0.17 UNITED Electrocomponents 1.18 UNITED KINGDOM KINGDOM KINGDOM Aberforth Smaller Companies Tst 0.33 UNITED Caledonia Investments 0.25 UNITED Elementis 0.21 UNITED KINGDOM KINGDOM KINGDOM Aggreko 0.51 UNITED Capita 0.15 UNITED Energean 0.21 UNITED KINGDOM KINGDOM KINGDOM Airtel Africa 0.19 UNITED Capital & Counties Properties 0.29 UNITED Essentra 0.23 UNITED KINGDOM KINGDOM KINGDOM AJ Bell 0.31 UNITED Carnival 0.54 UNITED Euromoney Institutional Investor 0.26 UNITED KINGDOM KINGDOM KINGDOM Alliance Trust 0.77 UNITED Centamin 0.27 UNITED European Opportunities Trust 0.19 UNITED KINGDOM KINGDOM KINGDOM Allianz Technology Trust 0.31 UNITED Centrica 0.74 UNITED F&C Investment Trust 1.1 UNITED KINGDOM KINGDOM KINGDOM AO World 0.18 UNITED Chemring Group 0.2 UNITED FDM Group Holdings 0.21 UNITED KINGDOM KINGDOM KINGDOM Apax Global Alpha 0.17 UNITED Chrysalis Investments 0.33 UNITED Ferrexpo 0.3 UNITED KINGDOM KINGDOM KINGDOM Ascential 0.4 UNITED Cineworld Group 0.19 UNITED Fidelity China Special Situations 0.35 UNITED KINGDOM KINGDOM KINGDOM Ashmore -

Board of Directors

Board of Directors 1. John McFarlane OBE 2. Tim O’Toole CBE 3. Chris Surch Chairman Chief Executive Group Finance Director Appointed to the Board: 2013 Appointed to the Board: 2009 Appointed to the Board: 2012 Skills and experience: He was appointed to the Skills and experience: He was appointed to Skills and experience: He has a strong track Board in December 2013 and became Chairman the Board in 2009 and became Chief Executive record of financial leadership as well as extensive in January 2014. John has a proven track record in 2010. Tim brings to the Board a wealth of operational, strategic and international experience. of implementing cultural transformation and driving international transport management experience Chris was previously Group Finance Director of through strategic change. He was formerly CEO gained over a number of years in the sector. Prior Shanks Group plc, also for a period of time serving of Australia and New Zealand Banking Group Ltd, to joining the Company, he was Managing Director, as their acting Chief Executive. Following an early Group Executive Director of Standard Chartered plc London Underground, having previously been at career with Price Waterhouse, he joined TI Group and Chairman of Aviva plc. He will step down as Transport for London, and prior to which he was plc in 1995. He held a number of senior roles there Chairman at the conclusion of the forthcoming President and Chief Executive of Consolidated and following the merger of TI Group plc with Annual General Meeting. Rail Corporation. Smiths Group plc he went on to hold further senior Other appointments: Chairman of Barclays plc Other appointments: He is a Non-Executive finance roles, latterly serving as Finance Director of and Barclays Bank plc, and a Non-Executive Director of CSX Corporation, a rail freight their Speciality Engineering division. -

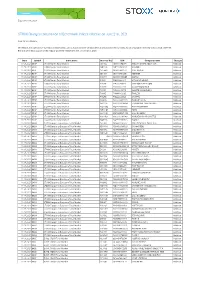

STOXX Changes Composition of Benchmark Indices Effective on June 21St, 2021

Zug, June 11th, 2021 STOXX Changes composition of Benchmark Indices effective on June 21st, 2021 Dear Sir and Madam, STOXX Ltd., the operator of Qontigo’s index business and a global provider of innovative and tradable index concepts, today announced the new composition of STOXX Benchmark Indices as part of the regular quarterly review effective on June 21st, 2021 Date Symbol Index name Internal Key ISIN Company name Changes 11.06.2021 BDXP STOXX Nordic Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU. SDR Addition 11.06.2021 BDXP STOXX Nordic Total Market NO112F NO0010823131 KAHOOT! Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10W3 SE0015483276 CINT GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market SE10X4 SE0015671995 HEMNET Addition 11.06.2021 BDXP STOXX Nordic Total Market DK3011 DK0060497295 MATAS Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10JH FI4000480215 SITOWISE GROUP Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10HF FI4000049812 VERKKOKAUPPA COM Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10FD FI0009001127 ALANDSBANKEN B Addition 11.06.2021 BDXP STOXX Nordic Total Market FI6036 FI4000048418 AHLSTROM-MUNKSJO Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10IG FI4000062195 TAALERI Addition 11.06.2021 BDXP STOXX Nordic Total Market FI10GE FI4000029905 SCANFIL Addition 11.06.2021 BDXP STOXX Nordic Total Market NO90I2 NO0010861115 NORSKE SKOG Addition 11.06.2021 BDXP STOXX Nordic Total Market NO111E NO0010029804 SPAREBANK 1 HELGELAND Addition 11.06.2021 BDXP STOXX Nordic Total Market NO113G NO0010886625 AKER BIOMARINE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO114H NO0010936792 FROY Addition 11.06.2021 BDXP STOXX Nordic Total Market NO110D BMG9156K1018 2020 BULKERS Addition 11.06.2021 BDXP STOXX Nordic Total Market NO10R3 NO0010196140 NORWEGIAN AIR SHUTTLE Addition 11.06.2021 BDXP STOXX Nordic Total Market NO809S NO0010792625 FJORD1 Deletion 11.06.2021 BKXA STOXX Europe ex Eurozone Total Market SE10V2 SE0001174970 MILLICOM INTL.CELU.