ANNUAL REPORT and ACCOUNTS 2019/20 2 University of Leeds Annual Report and Accounts for the Year Ended 31 July 2020 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dfa Investment Trust Co

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2004-10-27 | Period of Report: 2004-08-31 SEC Accession No. 0001104659-04-032148 (HTML Version on secdatabase.com) FILER DFA INVESTMENT TRUST CO Business Address 1299 OCEAN AVE CIK:896162| IRS No.: 000000000 | State of Incorp.:DE | Fiscal Year End: 1130 11TH FLOOR Type: N-Q | Act: 40 | File No.: 811-07436 | Film No.: 041100436 SANTA MONICA CA 90401 3103958005 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-7436 THE DFA INVESTMENT TRUST COMPANY (Exact name of registrant as specified in charter) 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401 (Address of principal executive offices) (Zip code) Catherine L. Newell, Esquire, Vice President and Secretary The DFA Investment Trust Company, 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401 (Name and address of agent for service) Registrant's telephone number, including area code: 310-395-8005 Date of fiscal year end: November 30 Date of reporting period: August 31, 2004 ITEM 1. SCHEDULE OF INVESTMENTS. The DFA Investment Trust Company Form N-Q August 31, 2004 (Unaudited) Table of Contents Schedules of Investments The U.S. Large Company Series The Enhanced U.S. Large Company Series The U.S. Large Cap Value Series The U.S. -

Final Prospectus Intro(A)

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. If you are in any doubt as to what action you should take, you are recommended to seek your own financial advice from your stockbroker, bank LR13.3.1(4) manager, solicitor, accountant or other appropriate independent financial adviser duly authorised under the Financial Services and Markets Act 2000 (as amended) (“FSMA”) if you are resident in the United Kingdom or, if not, another appropriately authorised independent financial adviser. If you sell or have sold or otherwise transferred all of your Existing Ordinary Shares prior to the date the shares are traded “ex” LR13.3.1(6) the entitlement to the Open Offer, you should send this document, and if relevant, the accompanying Application Form and the enclosed Form of Proxy (and reply-paid envelope) at once to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for delivery to the purchaser or transferee. If you have sold or transferred any part of your registered holding of Existing Ordinary Shares, please contact your stockbroker, bank or other agent through whom the sale or transfer was effected immediately and refer to the instructions regarding split applications set out in the Application Form, if relevant. However, no Application Form should be forwarded to or transmitted in or into the United States or any Excluded Territories where doing so may constitute a violation of local securities laws. Please refer to paragraph 7 of Part 2 of this document if you propose to send this document and/or the Application Form outside the United Kingdom. -

XB-4246 Kelda Holdings Acs 2011 V4 Final

Registered Number: 99329 KELDA HOLDINGS LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2016 KELDA HOLDINGS LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2016 Contents Strategic Report ................................................................................................................. 3 Our Business .................................................................................................................. 3 Business Strategy ........................................................................................................... 4 Business Performance .................................................................................................... 5 Group Financial Performance ....................................................................................... 32 Corporate Governance Report ......................................................................................... 37 Audit Committee ............................................................................................................... 45 Directors’ Remuneration Report ....................................................................................... 51 Directors’ Report .............................................................................................................. 70 Independent auditors’ report to the members of Kelda Holdings Limited .......................... 84 Group income statement ................................................................................................. -

Design Index: the Impact of Design on Stock Market Performance Report to December 2004

Design Index: The Impact of Design on Stock Market Performance Report to December 2004 July 2005 Contents Foreword page 03 Executive summary page 05 Findings page 06 1.1 Introduction page 06 1.2 General overview page 06 1.3 Key points from 2004 page 08 Sector Performance page 10 2.1 The importance of retail and banking page 10 2.2 Retail page 10 2.3 Banking page 11 2.4 What lies behind the outperformance? page 12 Charts and tables Chart 1: Ten-year performance 1995-2004 page 06 Table 1: Performance relative to FTSE indices page 07 Table 2: Highs and lows of performance page 08 Chart 2: Recovery performance – 31 March 2003 to 31 December 2004 page 09 Chart 3: Retail performance – 29 November 2003 to 29 December 2004 page 10 Chart 4: Banking Performance – 29 November 2003 to 29 December 2004 page 11 Appendices page 13 Appendix 1: Index constituents page 14 - Design Index page 14 - Emerging Index page 15 Appendix 2: FTSE ‘ground rules’ page 16 Appendix 3: Original selection criteria page 17 Appendix 4: Retail and banking sectors page 20 02 Foreword Good design is good business. We’ve said it for years, and now we have the proof to back that belief – proof that can’t be ignored by anyone who cares about the long-term health of UK plc. This report shows clearly that businesses which invest in design out-perform their peers. We’ve tracked the share prices of the biggest hitters in corporate Britain and the evidence is unequivocal: Design-led companies have produced dramatically better share-price performance for their investors, not just for a few weeks or months but consistently over a solid decade. -

Annual Report and Accounts 2007 Annual Report 2007

Kelda Group plc Annual Report and Accounts Annual Report and Accounts 2007 2007 Kelda Group plc Western House Halifax Road Bradford BD62SZ www.keldagroup.com To create a sustainable business, we balance economic, social and environmental needs Kelda’s customers enjoy some of the highest service levels in the UK By taking our wider Our people generate new This report is produced on material which contains 50% recycled and de-inked pulp from responsibilities seriously ideas to deliver service post-consumer waste. The remaining 50% is made up of Forest Stewardship Council (FSC) we can make a real improvements virgin fibre and pulp. Designed and produced by salterbaxter difference Printed by CTD Group highlights 2006/07 It has been another successful year for the Kelda Group. Our strategy has delivered further value for our shareholders and improved service for our customers. Contents Turnover Operating profit 01 Group highlights 02 Our business 03 Our strategy 04 Chairman’s statement Group and share of associates and Group operating profit from 06 Business review joint ventures from continuing operations continuing operations 06 Chief Executive’s review 09 Yorkshire Water 11 UK Service Operations Profit attributable 12 KeyLand Developments and Aquarion 13 Financial review Group profit to shareholders 15 Looking forward 16 Principal risks and uncertainties 18 Corporate Social Responsibility 25 Board of directors Group profit after tax from continuing operations 26 Directors’ report 29 KPI – Glossary of terms 30 Corporate governance 33 Directors’ -

Yorkshire Water Continued…

KELDA GROUP PLC ANNUAL REPORT AND ACCOUNTS 2004 Keeping our focus. Just one of the many photographs taken by visitors to our land. See more at www.youvebeenrambled.com Contents 2 Chairman’s statement 19 Corporate social responsibility 37 Directors’ responsibilities 5 Chief Executive’s review 19 How we go about our business 38 Report of the auditors 7 Our business 20 Environmental performance 39 Group profit and loss account 8 Our strategy 22 Our role in society 40 Balance sheets 9 What we focus on 24 Our people 41 Group cash flow statement 10 How we’re performing 26 Our customers 43 Notes to the accounts 10 Yorkshire Water and service providers 70 Group companies 13 Aquarion 28 Board of directors 71 Five year financial summary 15 UK Service Operations 29 Directors’ report 72 General information 16 KeyLand 31 Corporate governance IBC Our contact details 17 Financial review 33 Directors’ remuneration report Financial highlights. The top line. The bottom line. anddividends. per share earnings solidoperatingprofits, financial performance, delivering operationaland strong through isbeingachieved that growth the demonstrate dividends. Thesefigures ispaying offocus Our strategy services has helped us to deliver sector leadingperformance. sector deliver services hashelpedusto water andwaste highqualitywater onproviding focus to Our strategy 1 TURNOVER ventures (£822.6m) ventures andjoint of associates KELDA GROUP PLC Annual Report and Accounts 2004 andAccounts AnnualReport PLC GROUP KELDA 2002 799.8 2003 838.1 GROUP group andshare group 2004 822.6 ASSOCIATED ANDJOINTVENTURES ASSOCIATED OPERATING PROFIT OPERATING joint ventures (£292.2m) joint ventures and ofassociates and share 2002 265.3 2003 277.1 2004 292.2 group items (£191.6m) items andexceptional taxation GROUP PROFIT 2002 162.7 2003 175.2 2004 191.6 before taxation (£206.2m) taxation GROUP PROFIT 2002 197.1 2003 164.3 2004 206.2 before deferred tax)(46.2p) deferred (excluding per share ADJUSTED EARNINGS 2002 39.1 2003 42.4 2004 46.2 (26.83p) DIVIDEND 2002 25.5 2003 26.05 per share 2004 26.83 Chairman’s statement. -

XB-4246 Kelda Holdings Acs 2011 V4 Final

Registered Number: 99329 KELDA HOLDINGS LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2015 KELDA HOLDINGS LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 MARCH 2015 Contents Strategic Report Our Business 1 Business Strategy 2 Business Performance 3 Financial Performance 27 Corporate Governance Report for the year ended 31 March 2015 32 Audit Committee Report for the year ended 31 March 2015 40 Directors’ Remuneration Report for the year ended 31 March 2015 45 Directors’ Report for the year ended 31 March 2015 64 Statement of Directors’ Responsibilities for the year ended 31 March 2015 76 Independent auditors’ report to the members of Kelda Holdings Limited 77 Financial Statements 79 Group Income Statement 79 Group Statement of Comprehensive (Expense)/Income 80 Group Balance Sheet 81 Group Statement of Changes in Equity 82 Group Cash Flow statement 83 Notes to the Group Financial Statements 84 Company Balance Sheet 146 Company Statement of Changes in Equity 147 Notes to the Company Financial Statements 148 Independent auditors’ report for the company financial statements 152 to the members of Kelda Holdings Limited Kelda Holdings Limited Strategic Report for the year ended 31 March 2015 OUR BUSINESS Kelda Holdings Limited (the Company) and its subsidiaries, joint ventures and associates (the Group) is made up of several businesses: Yorkshire Water Services Limited (YW) YW is the principal UK subsidiary of the Group, providing water and waste water services to more than 5.0 million people and 135,000 businesses. Every day, YW supplies around 1.3 billion litres of water to homes and businesses in Yorkshire. -

Register of Interest of Members of the University Council, 1996-97

Register of interests of members of the University Council and Senior Officers, 2020-21 Name Remuneration – Identified Directorships – Listed below are the Significant share- Other interests –listed below are any other interests below are any organisations names of any private companies or PLCs holdings – listed below are which might have a bearing on the role of members of from which a salary is currently of which directorships are currently held or the names of any companies or Council; unless they are covered earlier, these should drawn or other remuneration of which directorships have been held at businesses - whether private or include in particular (including honoraria, long-term some point during the last three years publicly-quoted - in which a Any other significant connection (for example, through or regular consultancies, and (whether paid or unpaid). significant share-holding is held. your family) with organisations which are likely - or any directors’ fees or ‘Business’ includes possibly seeking - to do business with the University emoluments from private (E = Executive) consultancies, partnerships and Any unpaid offices held - for example, in a company, companies or PLCs listed in the (NE = Non-Executive) the like; ‘significant share- charity or voluntary or public body - which are next column). Short-term or (T = Trustee) holding’ is deemed if ownership considered to have a bearing on the role of members of one-off consultancies need not constitutes more than 5 per cent the Council be included unless the of the business (normally, 5 per Membership of a union or association (for example, the organisation concerned is likely - cent or more of the issued share Freemasons) which are considered to have a bearing or possibly seeking - to do capital). -

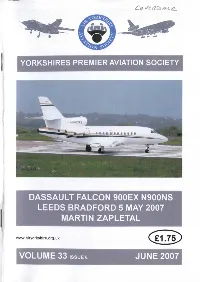

1.75 Volume 33 Issue 6 June 2007

Martin Zapletal YORKSHIRES PREMIER AVIATION SOCIETY DASSAULT FALCON 900EX N900NS LEEDS BRADFORD 5 MAY 2007 MARTIN ZAPLETAL www.alryorkshire.org.uk £1.75 VOLUME 33 ISSUE 6 JUNE 2007 SOCIETY CONTACT^ CHAIR Cliff JAYNE tel: 0113 249 7114 MEETINGS AT L.B.I.A GATE 20 - 14:30hrs SECRETARY Jim STANFIELD tel: 0113 258 9968 David VALENTINE TREASURER 6 St Margaret's Avenue ALL SOCIETY MEMBERS CAN ATTEND THE MONTHLY MEETINGS. Please contact Alan Sinfield if you and MEMBERSHIP Horsforth, Leeds LSI 8 5RY require any further information. Please note that car parking at the monthly meetings is provided at a tel; 0113 228 8143 discounted rate contact a Committee Member for details. Assistant Treasurer Pauline VALENTINE Cliff JAYNE MAGAZINE EDITOR 27 Luxor Road, Leeds LS8 5BJ 3 June Terry Sykes We welcome back Terry, who was a member of the West Riding tel: 0113 249 7114 Branch of Air Britain and has been a member of Air Yorkshire since it started. e-mail: [email protected] Terry has been scanning many of his old Black and White and Colour prints Assistant Editor Sheila JAYNE taken in the 1950's and 60's and will present a slide show of unseen MEETINGS COORDINATOR AlanSINFIELD tel: 01274 619679 photographs of Yeadon during that period which I am sure will be a fascinating e-mail: [email protected] insight into the history of Yeadon Aerodrome. VISITS ORGANISER Paul WINDSOR lei: 0113 250 4424 HONORARY LIFE PRESIDENT MikeWILLINGALE 1 July Sqn Ldr Graham Laurie The History of Royal Flying COMMITTEE MEMBERS: Lawrie COLDBECK, John DALE, Clifford HADWIN, Graham retired in December 2000 after 36 years in the RAF and for the last 20 20062007 Denis STENNING, Geoff WARD years of that career he flew members of the Royal Family and Senior Government Ministers. -

Kelda Group Limited

Kelda Group Limited Annual Report and Financial Statements Registered number 02366627 Year ended 31 March 2021 Kelda Group Limited Annual Report and Financial Statements 31 March 2021 Contents Directors and advisers 1 Strategic report 2 Directors' report 4 Directors' responsibilities statement 6 Independent auditor's report to the members of Kelda Group Limited 7 Profit and loss account 11 Statement of comprehensive income and expense 12 Balance sheet 13 Statement of changes in equity 15 Notes to the Financial Statements 17 Kelda Group Limited Annual Report and Financial Statements 31 March 2021 Directors and advisers Directors E M Barber C I Johns N G Muncaster K O H Smith Company secretary K O H Smith Independent auditor Deloitte LLP Statutory Auditor 1 City Square Leeds LS1 2AL Registered office Western House Halifax Road Bradford West Yorkshire BD6 2SZ Bankers National Westminster Bank PLC Leeds City Office 8 Park Row Leeds LS1 5HD 1 Kelda Group Limited Annual Report and Financial Statements 31 March 2021 Strategic report The directors present their strategic report on Kelda Group Limited (the company) for the year ended 31 March 2021. Principal activities and business review The principal activity of the company during the year continued to be the provision of central head office services and to be a holding company within the Kelda Holdings Limited group (Kelda group). It is expected to continue to operate in this way for the foreseeable future. Financial performance and outlook During the year to 31 March 2021 the company continued to focus on delivering excellent internal services and performed in line with management expectations. -

Drought Plan 2019

Drought Plan 2019 APPENDICES Yorkshire Water May 2020 Yorkshire Water |Drought Plan 2019| Yorkshire Water 2 In accordance with Drought Plan guidance, this statement certifies that Yorkshire Water’s Drought Plan has been reviewed by our security team. Some information has been redacted or edited in this published version for reasons of national security. CONTENTS PAGE Appendix 1 Example control curves plus scenario lines 4 Appendix 1.1: Drought Planning in Weekly Water Situation Report: 1995-96 baseline scenario 1300Ml/d demand 4 Appendix 1.2: Drought Planning in Weekly Water Situation Report: 1929 one season drought scenario at 1460Ml/d demand 6 Appendix 1.3: Drought Planning in Weekly Water Situation Report: 1929 one season drought scenario at 1380 Ml/d demand 10 Appendix 1.4: Drought planning in Weekly Water Situation Report: 2 year drought at 1460Ml/d demand 12 Appendix 1.5: Drought planning in Weekly Water Situation Report: Two year drought at 1380Ml/d demand 16 Appendix 1.6: Drought planning in Weekly Water Situation Report: Three-year drought at 1460Ml/d demand (1995- 1996-1996) 18 Appendix 1.7: Drought response surfaces 23 Appendix 2: Drought Plan Direction 2016 25 Appendix 3: Drought management actions 27 Appendix 3.1: Demand-side drought management actions 27 Phase 1: Prior to implementation of Temporary Use Bans 27 Phase 2: Prior to drought order for restrictions of non-essential use 29 Phase 3: Emergency drought orders 31 Appendix 3.2: Drought permit and order application process 34 Appendix 3.3: Water use restrictions in a -

The Impact of Design on Corporate Performance

The Impact of Design on Stock Market Performance An Analysis of UK Quoted Companies 1994-2003 February 2004 © Design Council February 2004 Contents 1 Foreword 1 2 Main Findings 2 2.1 Overview 2 2.2 Performance Commentary 3 3 Methodology 6 3.1 General Approach 6 3.2 Award and Nomination Schemes 6 3.3 Other Selection Issues 9 3.4 Index Calculation 10 Charts and Tables Chart 1: Performance over ten years 1994-2003 2 Table 1: Portfolio performance against market indices 3 Table 2: Highs and lows of portfolio performance 4 Table 3: Award and nomination schemes 7 Table 4: The standard design categories 8 Table 5: Number of companies included with the portfolios 9 Appendices Appendix 1: Earlier Studies of the Influence of Design on Share 12 Price Performance Appendix 2: Portfolio Companies 14 Design Portfolio 14 Emerging Portfolio 15 Appendix 3: Portfolio Performance, Large Format Charts 16 Chart 1: Full Period Performance 1994-2003 17 Chart 2: Bull Market Performance - 27 March 1995 to 27 March 2000 18 Chart 3: Bear Market Performance - 27 March 2000 to 31 March 2003 19 Chart 4: Recovery Performance - 31 March 2003 to 29 December 2003 20 © Design Council February 2004 1 Foreword Design is a critical component of business performance. We’ve heard designers, commentators and companies say it. But, to date, the evidence for the link between shareholder return and investment in design has been scarce and anecdotal. Companies the world over spend billions every year on design, from product development and packaging to web design and branding.