22 March 2016 • London, UK

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

REAL ESTATE July 2020

LISTED MARKETS – REAL ESTATE July 2020 Leo Zielinski Partner Tel. +44 (0)7980 809031 [email protected] John Rodgers Partner Tel. +44 (0)7810 307422 [email protected] Will Strachan Partner Tel. +44 (0)7929 885859 [email protected] Lloyd Davies We track the share price movement and regulatory announcements Partner of 57 real estate owning listed entities (“Gerald Eve tracked index”). Tel. +44 (0)7767 311254 A summary of the Gerald Eve tracked index in terms of GAV, NAV, [email protected] LTV, Dividend, Share Price, Market Cap, Discount/Premium to NAV and their respective weekly movement is attached. Lorenzo Solazzo Data Analyst We provide a comparison to share price data from 3 February 2020 Tel. +44 (0)783 309 5582 [email protected] (pre-Covid-19 level) to present day to demonstrate the impact across certain entities as a direct result of Covid-19. James Brown Surveyor As at 30 of June, the Gerald Eve tracked index is currently down 30% to pre- Tel. +44 (0)7464 656563 Covid-19 level, under-performing the FTSE350 which is slowly recovering and is [email protected] now down 16%. The tracked listed REITs share price decreased on average 3% since 1 June 2020 (March: -25%, April: +6%, May: -3%). To provide context around the share price movement, the average discount to NAV is currently 31% against 3% pre-Covid-19. It is unsurprising to note that specialist sector entities across Industrial, Healthcare and Supermarkets have out-performed the REIT universe relative to other strategies within the Gerald Eve tracked index. -

COVERAGE LIST GEO Group, Inc

UNITED STATES: REIT/REOC cont’d. UNITED STATES: REIT/REOC cont’d. UNITED STATES: NON-TRADED REITS cont’d. COVERAGE LIST GEO Group, Inc. GEO Sabra Health Care REIT, Inc. SBRA KBS Strategic Opportunity REIT, Inc. Getty Realty Corp. GTY Saul Centers, Inc. BFS Landmark Apartment Trust, Inc. Gladstone Commercial Corporation GOOD Select Income REIT SIR Lightstone Value Plus Real Estate Investment Trust II, Inc. Gladstone Land Corporation LAND Senior Housing Properties Trust SNH Lightstone Value Plus Real Estate Investment Trust III, Inc. WINTER 2015/2016 • DEVELOPED & EMERGING MARKETS Global Healthcare REIT, Inc. GBCS Seritage Growth Properties SRG Lightstone Value Plus Real Estate Investment Trust, Inc. Global Net Lease, Inc. GNL Silver Bay Realty Trust Corp. SBY Moody National REIT I, Inc. Government Properties Income Trust GOV Simon Property Group, Inc. SPG Moody National REIT II, Inc. EUROPE | AFRICA | ASIA-PACIFIC | MIDDLE EAST | SOUTH AMERICA | NORTH AMERICA Gramercy Property Trust Inc. GPT SL Green Realty Corp. SLG MVP REIT, Inc. Gyrodyne, LLC GYRO SoTHERLY Hotels Inc. SOHO NetREIT, Inc. HCP, Inc. HCP Sovran Self Storage, Inc. SSS NorthStar Healthcare Income, Inc. UNITED KINGDOM cont’d. Healthcare Realty Trust Incorporated HR Spirit Realty Capital, Inc. SRC O’Donnell Strategic Industrial REIT, Inc. EUROPE Healthcare Trust of America, Inc. HTA St. Joe Company JOE Phillips Edison Grocery Center REIT I, Inc. GREECE: Athens Stock Exchange (ATH) AFI Development Plc AFRB Hersha Hospitality Trust HT STAG Industrial, Inc. STAG Phillips Edison Grocery Center REIT II, Inc. AUSTRIA: Vienna Stock Exchange (WBO) Babis Vovos International Construction S.A. VOVOS Alpha Pyrenees Trust Limited ALPH Highwoods Properties, Inc. -

Summary of Investments by Type

COMMON INVESTMENT FUNDS Schedule of Investments September 30, 2017 SUMMARY OF INVESTMENTS BY TYPE Cost Market Value Fixed Income Investments $ $ Short-term investments 27,855,310 27,855,310 Bonds 173,219,241 174,637,768 Mortgage-backed securities 29,167,382 28,915,537 Emerging markets debt 9,619,817 11,462,971 Bank loans - high income fund 23,871,833 23,908,105 Total Fixed Income Investments 263,733,583 266,779,691 Equity-Type Investments Mutual funds Domestic 9,284,694 13,089,028 International 18,849,681 21,226,647 Common stocks Domestic 149,981,978 192,057,988 International 225,506,795 259,856,181 Total Equity-Type Investments 403,623,148 486,229,844 Alternative Investments Funds of hedge funds 38,264,990 46,646,700 Real estate trust fund 6,945,440 10,204,969 Total Alternatives Investments 45,210,430 56,851,669 TOTAL INVESTMENTS 712,567,160 809,861,204 Page 1 of 34 COMMON INVESTMENT FUNDS Schedule of Investments September 30, 2017 SUMMARY OF INVESTMENTS BY FUND Cost Market Value Fixed Income Fund $ $ Short-term investments 6,967,313 6,967,313 Bonds 140,024,544 141,525,710 Mortgage-backed securities 27,878,101 27,642,277 Emerging markets debt 9,619,817 11,462,971 Bank loans - high income fund 23,871,833 23,908,105 208,361,608 211,506,377 Domestic Core Equity Fund Short-term investments 4,856,385 4,856,385 Common stocks 131,222,585 167,989,561 Futures - 19,895 Private placement 4,150 4,150 136,083,120 172,869,991 Small Cap Equity Fund Short-term investments 2,123,629 2,123,629 Mutual funds 9,284,694 13,089,028 Common stocks 18,755,243 -

Marten & Co / Quoted Data Word Template

Monthly roundup | Real estate October 2019 Winners and losers in September Best performing companies in price terms in Sept Worst performing companies in price terms in Sept (%) (%) Capital & Regional 37.9 Countrywide (11.7) Hammerson 24.9 Town Centre Securities (7.2) NewRiver REIT 19.1 Aseana Properties (5.1) Inland Homes 15.8 Harworth Group (4.3) Capital & Counties Properties 14.8 Ediston Property Investment Company (4.0) British Land 14.7 GRIT Real Estate Income Group (3.7) Workspace Group 13.2 Daejan Holdings (3.5) Countryside Properties 12.3 Primary Health Properties (2.9) Triple Point Social Housing REIT 11.7 Big Yellow Group (2.9) U and I Group 11.1 Conygar Investment Company (2.6) Source: Bloomberg, Marten & Co Source: Bloomberg, Marten & Co Capital & Regional share price YTD The month of Countrywide share price YTD On the flip side, the September was a UK’s biggest estate 40 12 bumper month for agent group, 30 many property 8 Countrywide, which 20 companies’ share also owns a 4 10 price, dominated by commercial real 0 retail focused 0 estate consultancy, Jan FebMar Apr May Jun Jul Aug Sep Jan FebMar Apr May Jun Jul Aug Sep companies, who in was the worst Source: Bloomberg, Marten & Co general have taken a Source: Bloomberg, Marten & Co performing in hammering over the September. It is the past 18 months or so. Top of the list was Capital & Regional. second month in a row that it has been in the bottom 10 and Shares in the shopping centre landlord bounced after it in the year to date it is beaten only by Intu Properties as the announced it was in talks with South African REIT worst performing listed property company, losing 53.5%. -

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Custodian REIT CREI Real Estate Investment Trusts — GBP 0.885 at close 03 August 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 03-Aug-2020 03-Aug-2020 03-Aug-2020 1.2 105 130 1D WTD MTD YTD Absolute -0.6 -0.6 -0.6 -22.4 100 Rel.Sector -0.5 -0.5 -0.5 2.2 1.1 120 Rel.Market -2.6 -2.6 -2.6 -2.7 95 1 110 VALUATION 90 Trailing Relative Price Relative 0.9 Price Relative 100 85 PE 16.1 Absolute Price (local currency) (local Price Absolute EV/EBITDA 15.8 0.8 90 80 PB 0.9 PCF 12.0 0.7 75 80 Div Yield 6.8 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Price/Sales 8.6 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.3 90 100 100 Div Payout +ve 80 90 90 ROE 5.6 80 70 80 Share Index) Share 70 Share Sector) Share - - 70 60 60 DESCRIPTION 60 50 50 50 40 The Company is a real estate investment trust. 40 RSI RSI (Absolute) 40 30 30 30 20 20 20 10 RSI (Relative to FTSE UKFTSE All to RSI (Relative RSI (Relative to FTSE UKFTSE All to RSI (Relative 10 10 0 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Aug-2019 Nov-2019 Feb-2020 May-2020 Aug-2020 Past performance is no guarantee of future results. -

Newriver REIT Plc Annual Report and Accounts 2018

& Annual Report 2018 Accounts and NewRiver REIT plc Annual Report and Accounts 2018 NewRiver REIT plc (‘NewRiver’) is a Premium Listed REIT on the Main Market of the London Stock Exchange and a constituent of the FTSE 250 and EPRA indices. Founded in 2009, we specialise in buying, managing, developing and recycling convenience-led, community-focused retail and leisure assets. Our high-quality and conveniently located portfolio provides value for money on essential goods and services to consumers across the UK, and our affordable rents and high footfall locations create desirable and profitable trading opportunities for our occupiers. It is our fundamental belief that affordability for occupiers, and not lease length, means sustainability for our business. With an experienced management team and proven business model, we have a track record of delivering growing and sustainable cash returns to our shareholders and creating thriving communities across the UK. CONTENTS Strategic Report Financial Highlights IFC Our Business at a Glance 04 Chairman’s Review 08 Our Business Model 10 Our Marketplace 12 Leveraging our Key Relationships 16 CEO Review 18 OUR FINANCIAL HIGHLIGHTS Our Strategy 24 Our KPIs 26 Property Review 32 Gross income Funds From Operations Financial Review 56 (proportionally consolidated) Our People 68 ESG Report 69 Risk Management Report 74 £107.0m £60.3m Governance FY17: £106.7m FY17: £58.2m Board of Directors 78 Corporate Governance Report 80 Audit Committee Report 85 FFO per share Ordinary dividend per share Nomination Committee -

November 2020

November 2020 Monthly roundup | Real estate Kindly sponsored by Aberdeen Standard Investments Winners and losers in October Best performing funds in price terms Worst performing funds in price terms (%) (%) NewRiver REIT 28.7 Panther Securities (28.6) Schroder European REIT 27.4 Raven Property Group (20.3) Helical 15.1 Grit Real Estate Income Group (11.5) Workspace Group 14.6 Empiric Student Property (11.5) Standard Life Inv. Property Income 14.1 Ground Rents Income Fund (10.2) Alternative Income REIT 12.2 Secure Income REIT (9.4) CEIBA Investments 9.3 PRS REIT (9.3) BMO Real Estate Investments 7.8 GCP Student Living (9.2) Inland Homes 6.8 Sigma Capital Group (7.8) Real Estate Investors 6.3 Alpha Real Trust (7.2) Source: Bloomberg, Marten & Co Source: Bloomberg, Marten & Co kjjjj October finished with the threat of a second lockdown The heaviest share price faller in October – Panther looming over the UK as COVID-19 cases continued to rise. Securities – is very illiquid so its share price can be However, this did not dampen demand for shares in some distorted with one big transaction. Of the rest, Grit Real of the companies that have already been battered during Estate Income saw a double-digit fall in its share price after the pandemic, even before news of a potential vaccine reporting a big drop in NAV. Student accommodation breakthrough broke in early November. Successful sales specialists Empiric Student Property and GCP Student of retail assets by NewRiver REIT saw its share price Living both continue to be impacted by COVID-19, with bounce 28.7% in the month to top the table. -

State Street AUT UK Screened (Ex Controversies and CW) Index

Report and Financial Statements For the year ended 31st December 2020 State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund (formerly State Street UK Equity Tracker Fund) State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund Contents Page Manager's Report* 1 Portfolio Statement* 9 Director's Report to Unitholders* 27 Manager's Statement of Responsibilities 28 Statement of the Depositary’s Responsibilities 29 Report of the Depositary to the Unitholders 29 Independent Auditors’ Report 30 Comparative Table* 33 Financial statements: 34 Statement of Total Return 34 Statement of Change in Net Assets Attributable to Unitholders 34 Balance Sheet 35 Notes to the Financial Statements 36 Distribution Tables 48 Directory* 49 Appendix I – Remuneration Policy (Unaudited) 50 Appendix II – Assessment of Value (Unaudited) 52 * These collectively comprise the Manager’s Report. State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund Manager’s Report For the year ended 31st December 2020 Authorised Status The State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund (the “Fund”) is an Authorised Unit Trust Scheme as defined in section 243 of the Financial Services and Markets Act 2000 and it is a UCITS Retail Scheme within the meaning of the FCA Collective Investment Schemes sourcebook. The unitholders are not liable for the debts of the Fund. The Fund's name was changed to State Street AUT UK Screened (ex Controversies and CW) Index Equity Fund on 18th December 2020 (formerly State Street UK Equity Tracker Fund). Investment Objective and Policy The objective of the Fund is to replicate, as closely as possible and on a “gross of fees” basis, the return of the United Kingdom equity market as represented by the FTSE All-Share ex Controversies ex CW Index (the “Index”), net of withholding taxes. -

Cohen & Steers SICAV European Real Estate Securities Fund

Cohen & Steers SICAV European Real Estate Securities Fund As of 31/07/2021 Current % of Total Security Name Sector Market Value Market Value Vonovia SE Residential €11,035,605.94 8.67 % Klepierre Retail €7,181,283.35 5.65 % British Land Co. PLC Diversified €6,909,826.29 5.43 % Icade Diversified €6,169,222.60 4.85 % Assura Group Ltd Health Care €5,249,895.51 4.13 % Segro PLC Industrial €5,168,891.94 4.06 % Leg Immobilien AG Residential €5,159,844.90 4.06 % Castellum AB Industrial Office €5,031,967.25 3.96 % Safestore Holdings Ltd. Self Storage €4,577,914.04 3.60 % Tritax Big Box REIT Industrial €4,516,401.94 3.55 % VIB Vermoegen AG Industrial €4,392,828.00 3.45 % Sirius Real Estate Diversified €4,045,943.58 3.18 % Fastighets AB Balder-B Shrs Diversified €3,511,701.88 2.76 % Aedifica Health Care €3,347,609.60 2.63 % Londonmetric Property PLC Diversified €3,214,787.08 2.53 % Eurocommercial Properties NV Retail €3,152,143.12 2.48 % Unibail Group Stapled Retail €3,081,305.04 2.42 % Instone Real Estate Group Bv Residential €2,882,196.90 2.27 % Wihlborgs Fastigheter AB Diversified €2,840,186.46 2.23 % Deutsche Wohnen AG Residential €2,571,569.28 2.02 % Fabege AB Office €2,478,319.17 1.95 % Great Portland Estates PLC Diversified €2,469,790.13 1.94 % Ctp NV Industrial €2,444,022.00 1.92 % Workspace Group PLC Office €2,430,234.91 1.91 % Catena AB Industrial €2,387,190.04 1.88 % Big Yellow Group PLC Self Storage €2,158,784.52 1.70 % Alstria Office AG Office €2,091,870.36 1.64 % Merlin Properties Socimi SA Diversified €2,059,319.02 1.62 % Neinor Homes Sa Residential €1,692,112.94 1.33 % Befimmo S.C.A. -

201009 September Property Roundup

October 2020 Monthly roundup | Real estate Kindly sponsored by Aberdeen Standard Investments Winners and losers in September Best performing funds in price terms Worst performing funds in price terms (%) (%) Sigma Capital Group 34.2 Capital & Regional (46.3) Panther Securities 19.5 Hammerson (26.3) Macau Property Opportunities 9.4 BMO Real Estate Investments (24.1) CLS Holdings 8.6 U and I Group (18.5) Phoenix Spree Deutschland 7.2 NewRiver REIT (17.1) Schroder REIT 6.6 Hibernia REIT (14.8) Yew Grove REIT 6.2 Alternative Income REIT (14.6) Helical 3.9 Regional REIT (14.4) RDI REIT 3.5 Capital & Counties (13.5) Custodian REIT 2.9 Grit Real Estate (13.3) Source: Bloomberg, Marten & Co Source: Bloomberg, Marten & Co kjjjj There was an eclectic mix of property companies to feature It is no surprise that once again it was shopping centre in the top price movers for September. Top of the tree was owners Capital & Regional and Hammerson that topped private rented sector and residential development the chart of worst performing property companies in specialist Sigma Capital Group, with a 34.2% rise. The September. Capital & Regional published results at the group launched a £1bn joint venture with EQT Real Estate, beginning of the month in which it posted a 36.6% fall in the real estate platform of global investment firm EQT, to net asset value (NAV) in just six months. Meanwhile, deliver 3,000 private rental homes in Greater London. Hammerson completed a rights issue and share Micro-cap investor Panther Securities also hit double-digit consolidation plan during September, as well as gains, while Macau Property Opportunities saw an uplift in announcing a new chief executive. -

2020 EPRA Annual Report Survey

MAKING THE JUMP 2020 EPRA Annual Report Survey Sustainability Best Practices Recommendations | 2020 EPRA Annual Report Survey | 2 CONTENTS Foreword 3 Scope of the Survey 5 2020 Awards Key Highlights 6 2020 Results Snapshot 7 2020 Award Winners 8 Analysis: Performance Measures 11 Analysis: Overarching Recommendations 13 Awards Methodology 16 Participants List 17 | ©2020 EPRA. All rights reserved. | 2020 EPRA Annual Report Survey | 3 FOREWORD In comparison with last year, 2020 results are extremely encouraging as the number of medals awarded has increased by 28% with 90 awarded companies, including 62 Gold Winners. Dominique Moerenhout - CEO EPRA This year has posed several challenges to our sector but the results To further support our industry to respond to the investment contained in this report demonstrates that the current COVID-19 community’s demand for greater transparency and accessibility crisis has only served to elevate the importance of sustainability of climate related information, EPRA has published this year new commitments. Before getting into the heart of the numbers, I would guidance for listed property companies already reporting against like to congratulate all our Members’ teams who collected data and the sBPR to meet the reporting requirements of the Task Force on coordinated the sBPR reporting, through the current challenges. Climate-related Financial Disclosures (TCFD). We hope the uptake 2020 marks exceptional results with 90 awarded companies, for the TCFD will follow the same path as the EPRA sBPR which have including 62 Gold Winners, representing almost 60% of the not stopped expanding in the last eight years. In view of this year’s responding companies. -

2020 Real Estate Review

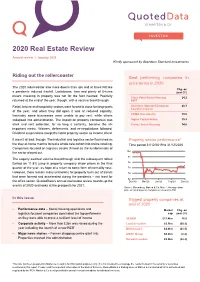

2020 Real Estate Review Annual review | January 2021 Kindly sponsored by Aberdeen Standard Investments Riding out the rollercoaster Best performing companies in price terms in 2020 The 2020 rollercoaster saw more downs than ups and at times felt like Chg. on a pandemic induced freefall. Lockdowns, tiers and plenty of U-turns year (%) meant investing in property was not for the faint hearted. Positivity Triple Point Social Housing 24.2 returned at the end of the year, though, with a vaccine breakthrough. REIT Retail, leisure and hospitality sectors were forced to close for large parts Aberdeen Standard European 20.3 Logistics Income of the year, and when they did open it was at reduced capacity. Inevitably some businesses were unable to pay rent, while others CEIBA Investments 19.0 collapsed into administration. The impact on property companies was Sigma Capital Group 15.9 stark and rent collection, for so long a certainty, became the all- Civitas Social Housing 14.8 important metric. Waivers, deferments, and re-negotiations followed. Dividend suspensions swept the listed property sector as income dived. It wasn’t all bad, though. The industrial and logistics sector flourished as Property sector performance* the stay-at-home mantra forced a whole new cohort into online retailing. Time period 31/12/2019 to 31/12/2020 Companies focused on logistics assets thrived as the fundamentals of the sector played out. 102 94 The eagerly awaited vaccine breakthrough and the subsequent rollout fuelled an 11.8% jump in property company share prices in the final 86 quarter of the year, as hope of a return to some form of normality rose.