Regulating On-Line Peer-To-Peer Lending in the Aftermath of Dodd-Frank: in Search of an Evolving Regulatory Regime for an Evolving Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Principal Trustsm Target Date Collective Investment Funds (Target Date Funds) and Has Sole Discretion Over the Management of Each Target Date Fund

PROFILE Principal Trust SM Target Date Collective Investment Funds Portfolio Advisor: Principal Management Corporation Delaware Charter Guarantee & Trust Company, conducting business as Principal Trust Company (Principal Trust) is the Trustee of the Principal TrustSM Target Date Collective Investment Funds (Target Date Funds) and has sole discretion over the management of each Target Date Fund. Principal Management Corporation provides nondiscretionary investment advisory services to Principal Trust with respect to the Target Date Funds. Principal Trust Company makes investment decisions using advice provided by Principal Management Corporation. Investment Philosophy and Process Philosophy Launched in 2009, the Target Date Funds are a series of target date collective investment funds developed for qualified retirement plans. They are managed over time toward the approximate date the participant expects to start withdrawing money. Each Target Date Fund reflects what Principal Trust believes to be an optimal asset class mix — a combination of actively and passively managed equity, fixed income and real estate — for the respective target date. The Target Date Funds consist of distinct funds staged in five-year increments. Each Target Date Fund gradually becomes more conservative by increasing its exposure to traditionally more conservative underlying investment options and reducing its exposure to more aggressive underlying investment options as the target date nears. Not FDIC or NCUA insured May lose value • Not a deposit • No bank or credit union guarantee Not insured by any Federal government agency Asset allocation/diversification does not guarantee a profit or protect against a loss. 1 The Target Date Funds embrace a multi-asset class, multi-style and multi-manager strategy while providing broad diversification and an institutional-quality investment approach. -

Dn-153040 Filed Pursuant to Rule 424(B)(3

Filed Pursuant to Rule 424(b)(3) Registration Statement No. 333-147019 $500,000,000 Borrower Payment Dependent Notes This is a public offering to lender members of Prosper Marketplace, Inc., or Prosper, of up to $500,000,000 in principal amount of Borrower Payment Dependent Notes, or “Notes.” We will issue the Notes in a series, with each series of Notes dependent for payment on payments we receive on a specific borrower loan described in a listing posted on our peer-to-peer online credit auction platform, which we refer to as our “platform.” All listings on our platform are posted by individual consumer borrower members of Prosper requesting individual consumer loans, which we refer to as “borrower loans.” Important terms of the Notes include the following, each of which is described in detail in this prospectus: Our obligation to make payments on a Note will be limited to an amount equal to the lender member’s pro rata share of amounts we receive with respect to the corresponding borrower loan for that Note, net of any servicing fees. We do not guarantee payment of the Notes or the corresponding borrower loans. The Notes are special, limited obligations of Prosper only and are not obligations of the borrowers under the corresponding borrower loans. The Notes will bear interest from the date of issuance, have a fixed rate, be payable monthly and have an initial maturity of three years from issuance, which we may change from time to time. A lender member’s recourse will be extremely limited in the event that borrower information is inaccurate for any reason. -

Proposed Rule: Investment Company Advertising: Target Date Retirement Fund Names and Marketing

SECURITIES AND EXCHANGE COMMISSION 17 CFR Parts 230 and 270 [Release Nos. 33-9126; 34-62300; IC-29301; File No. S7-12-10] RIN 3235-AK50 INVESTMENT COMPANY ADVERTISING: TARGET DATE RETIREMENT FUND NAMES AND MARKETING AGENCY: Securities and Exchange Commission. ACTION: Proposed rule. SUMMARY: The Securities and Exchange Commission is proposing amendments to rule 482 under the Securities Act of 1933 and rule 34b-1 under the Investment Company Act of 1940 that, if adopted, would require a target date retirement fund that includes the target date in its name to disclose the fund’s asset allocation at the target date immediately adjacent to the first use of the fund’s name in marketing materials. The Commission is also proposing amendments to rule 482 and rule 34b-1 that, if adopted, would require marketing materials for target date retirement funds to include a table, chart, or graph depicting the fund’s asset allocation over time, together with a statement that would highlight the fund’s final asset allocation. In addition, the Commission is proposing to amend rule 482 and rule 34b-1 to require a statement in marketing materials to the effect that a target date retirement fund should not be selected based solely on age or retirement date, is not a guaranteed investment, and the stated asset allocations may be subject to change. Finally, the Commission is proposing amendments to rule 156 under the Securities Act that, if adopted, would provide additional guidance regarding statements in marketing materials for target date retirement funds and other investment companies that could be misleading. -

Peer-To-Peer Lending Corporate Excellence Insights

August 2018 CORPORATE EXCELLENCE INSIGHTS We are a specialized provider of systematic Quality Investment Solutions and one of the few providers of Quality equity investment strategies worldwide. Corporate Excellence Insight is our monthly publication that includes a brief update on markets and our thoughts about major trends that are impacting the investment management industry. MARKET UPDATE: STRONG CORPORATE GROWTH Strong global economic and corporate profit growth outweighed the escalating trade tensions in July. Economic data surprised on the upside in the US, picked up in Japan while stabilized in Europe. Strong Q2 corporate results reaffirmed the estimates for double digit profit growth in 2018. $3.5bn 48.5 x11 U.S. WEEKLY JOBLESS CLAIMS HIT FIAT’S VALUE WAS MULTIPLIED WORLD'S FIRST BIG 5G DEAL MORE THAN 48-AND-A-HALF-YEAR LOW 11 TIMES THROUGH 14 YEARS T-Mobile US named Nokia to supply it The number of Americans filing for Sergio Marchionne, the executive who with next-generation 5G network gear, unemployment benefits dropped to a more rescued Fiat and Chrysler from bankruptcy marking the world’s largest 5G deal so far than 48-1/2-year low in July as the labor after taking the wheel of the Italian and concrete evidence of a new wireless market strengthens further, however trade carmaker in 2004 and multiplied Fiat’s upgrade cycle taking root. tensions are casting a shadow over the value 11 times through 14 years, has died economy’s outlook. aged 66. MONTHLY TOPIC PEER-TO-PEER LENDING Central banks in Europe and the United States got into the rate increasing stance, but the levels are still low and the pace of rate increase is very moderate. -

Target Date Funds: What's Under the Hood?

RETIREMENT RESEARCH January 2017, Number 17-2 TARGET DATE FUNDS: WHAT’S UNDER THE HOOD? By Edwin J. Elton, Martin J. Gruber, Andre de Souza, and Christopher R. Blake* Introduction In today’s 401(k) world, individuals must choose how in specialized assets, as well as conventional stocks to invest their retirement savings. Yet evidence shows and bonds; 2) TDF fees are only modestly higher than that they often make poor choices on their own.1 if an investor assembled a similar portfolio on his Target date funds (TDFs) were designed as a potential own; and 3) TDF investment returns are broadly in solution. TDFs provide a pre-set mix of stocks and line with other mutual funds; and TDF decisions on bonds, which shifts away from stocks and toward market timing and fund additions do not help, and bonds as individuals age. These funds are often used may hurt, performance. as the default option for 401(k)s that have automatic enrollment. By 2014, nearly 20 percent of all 401(k) assets were in TDFs, and about half of participants TDF Basics held these funds.2 Despite the growing prominence of TDFs, little A TDF is constructed from mutual funds, so it is a research has focused on the details of their holdings, “fund of funds.” TDFs are intended to provide a one- fees, and performance. This brief, adapted from a fund solution for investors that offers diversification recent study, uses data on TDFs and their underlying and a changing asset allocation mix with age. Each mutual fund investments that allows for a unique as- TDF has a “target” year and a pre-determined glide sessment of what is going on “under the hood.”3 path for gradually reducing the equity allocation as The discussion proceeds as follows. -

Target Date Funds: Characteristics and Performance

Target Date Funds: Characteristics and Performance Edwin J. Elton Stern School of Business, New York University Martin J. Gruber Stern School of Business, New York University Andre de Souza Fordham University Christopher R. Blake Fordham University AUGUST242015 Christopher R. Blake, formerly Joseph Keating, S.J. Distinguished Professor, Fordham University, is deceased prior to publication.Send correspondence to Martin J. Gruber, Stern School of Business, New York University, 44 West 4th Street, New York, NY 10012; telephone 212-998-0333; fax 212-995-4233. E-mail: [email protected]. 1 Abstract As a result of poor asset allocation decisions by 401(k) participants, 72% of all plans now offer target date funds, and participants heavily invest in them. Here, we study the characteristics and performance of TDFs, providing a unique view byemploying data on TDFs holdings. .We show that additional expenses charged by TDFs are largely offset by the low-cost share classesthey hold, not normally open to theirinvestors.Additionally, TDFs are very active in their allocation decisions and increasingly bet on nonstandard asset classes.However, TDFs do not earn alpha from timing or their selection of individual assets. (JEL G11. G23.) 2 There is a vast literature in financial economics thatfinds that participants in 401(k) and 403(b) plans generally make suboptimal asset allocation decisions.1In response to this evidence, plans have started to offer options in whichthe asset allocation decision is made for the investor and in particular options in whichthe allocation changes as a function of time to retirement.These latter options are referred to as target date funds (TDF). -

Horizons 2040 Through 2060 Target Date Funds

Horizons 2040 Through 2060 Target Date Funds Simplified Investment Risk/Potential Return Meter IMPORTANT INFORMATION: SIMPLIFIED ROUTE ADVANCED ROUTE SELF-DIRECTED ROKERAGE The Target Date Funds will be rebalanced each PORTFOLIO INFORMATION ASACCOUNT OF: OPTION quarter so that they maintain as closely as possible 06/30/2021 the established percentage of each investment INCEPTION DATE1: option.** Once the fund reaches its target date, •HORIZONS 2040-2045: 11/7/2008 the equity component will continue to be reduced for •HORIZONS 2050: 8/2/2010 10 additional years until the asset allocation matches that of the Horizons Retirement Income Fund. •HORIZONS 2055: 1/21/2015HORIZONS •HORIZONS 2060: 1/6/2020 **Rebalancing does not ensure a profit and does not protect PORTFOLIOCOBRAND OPERATING EXPENSES2: LOW HIGH against loss in declining markets. DODGER BLUE: PMS 2940.32% For Illustrative Purposes Only Holdings and composition of holdings are subject to change. SAVINGS Investment Objective Portfolio Information3: Horizons Target Date Funds are diversified portfolios ASSET FUND DIVERSIFICATION designed for people who want to leave ongoing 2.5% investment decisions to an experienced portfolio management team. The investor picks the Horizons Target Date Fund with the date closest to his or her LARGE CAP 7.4% expected retirement year. As the retirement date for MID CAP the fund gets closer, the asset mix (stock funds, bond SMALL CAP 15.0% 30.7% funds and other investments) gradually adjusts to a more NON-U.S. conservative asset mix until it eventually consolidates into EMERGING MARKET the Retirement Income Fund (generally, it takes 10 years EQUITY ALTERNATIVES 12.2% from the “targeted” year for the fund to consolidate REAL RETURN 6.6% into the Retirement Income Fund). -

Prosper Marketplace, Inc. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2009 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 333-147019 Prosper Marketplace, Inc. (Exact name of registrant as specified in its charter) Delaware 73-1733867 (State or other jurisdiction of incorporation or (I.R.S. Employer Identification No.) organization) 111 Sutter Street, 22nd Floor San Francisco, CA 94104 94104 (Address of principal executive offices) (Zip Code) (415) 593-5400 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered None None Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

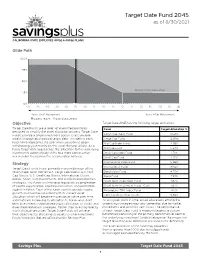

Target Date 2045 Fund Fact Sheet

Target Date Fund 2045 as of 6/30/2021 Glide Path 100% 75% 50% Steady State Allocation 25% 0% 50 45 40 35 30 25 20 15 10 5 0 5 10 15 20 25 30 Years Until Retirement Years After Retirement Equities 79.47% Cash/Bonds 20.53% Objective Target Date 2045 has the following target allocations: Target Date Funds are a series of diversified portfolios Fund Target Allocation % designed to simplify the asset allocation process. Target Date Funds provide a single investment option to accumulate Large Cap Index Fund 10.28% wealth through an expected target date. The date in each Large Cap Fund 14.69% fund name represents the year when you plan to begin Mid Cap Index Fund 4.28% withdrawing your money (in this case, the year 2045). As a funds target date approaches, the allocation to the underlying Mid Cap Fund 5.34% investments automatically shifts to a more conservative Small Cap Index Fund 1.71% mix in order to preserve the accumulated balance. Small Cap Fund 2.13% Strategy International Index Fund 15.86% International Fund 19.82% Target Date Funds invest primarily in a combination of the seven major asset classes U.S. Large Cap Stocks, U.S. Mid Bond Index Fund 4.75% Cap Stocks, U.S. Small Cap Stocks, International Stocks, Bond Fund 7.93% Bonds, Short Term Investments, and Diversified Real Return Short Term Investment Fund 1.87% strategies. The funds are intended to provide a combination of capital appreciation, capital preservation, and protection Short Term Investment Fund - Cash 1.87% against inflation. -

Designing the Future of Target-Date Funds: a New Blueprint for Improving Retirement Outcomes

Designing the Future of Target-Date Funds: A New Blueprint for Improving Retirement Outcomes Daniel Loewy Executive Summary and time-tested, beyond traditional equity and AllianceBernstein (AB) fixed income. These strategies can help reduce Target-date funds are the key to the future sensitivity to market, interest-rate and inflation Christopher Nikolich of retirement savings for American workers. risks at different points in the glide path. And AllianceBernstein (AB) While these funds have seen tremendous diversifying against these risks can improve asset growth over the past decade, their overall outcomes versus a traditional glide path investment design hasn’t kept pace with roughly 80% of the time. available innovations. The result: many target- date strategies may fail to guard against today’s We see five key areas (Exhibit 1, next page) for heightened retirement risks. evolving the state of target-date design: It’s time to revisit target-date fund designs and • Moving from a single investment single-manager structures. Most retirement manager to a multi-manager or plans still use traditional designs that were open-architecture format to access adopted years ago, but fiduciary standards have best-of-breed managers and reduce changed. In fact, the US Department of Labor concentration risk (DOL) has issued “Target Date Retirement • Diversifying the underlying investment Funds: Tips for ERISA Plan Fiduciaries,” which mix from a traditional stock/bond glide highlights the need for plan sponsors to have a path to incorporate nontraditional asset solid process for selecting and monitoring their classes, too target-date choice. • Providing greater flexibility to respond The investment environment has changed, too. -

Prosper Marketplace Ca, Inc

THESE NOTES ARE ONLY BEING OFFERED AND SOLD TO LENDER MEMBERS WHO ARE RESIDENTS OF THE STATE OF CALIFORNIA AND WHO SATISFY THE FINANCIAL SUITABILITY REQUIREMENTS SET FORTH IN THIS PROSPECTUS. PROSPER MARKETPLACE CA, INC. $250,000,000 Prosper Borrower Payment Dependent Notes $250,000,000 Open Market Borrower Payment Dependent Notes This is a limited public offering being made to lender members of Prosper Marketplace CA, Inc., or Prosper, who are residents of the State of California, of up to $250,000,000 in principal amount of Prosper Borrower Payment Dependent Notes, or “Prosper Borrower Notes,” and up to $250,000,000 in principal amount of Open Market Borrower Payment Dependent Notes, or “Prosper Open Market Notes” issued by Prosper. The Prosper Borrower Notes and the Prosper Open Market Notes are collectively referred to as the “Notes” in this Prospectus. We will issue the Notes in a series, with each series of Notes dependent for payment on payments we receive on a specific borrower loan described in a listing posted on our peer-to-peer online credit auction platform, which we refer to as our “platform.” Two types of listings appear on our platform: (1) listings posted by individual consumer members of Prosper requesting individual consumer loans, which we refer to as “Prosper borrower loans,” and (2) listings posted by financial institutions registered with Prosper setting forth the terms of existing loans and retail installment sale contracts owned by the financial institutions and offered for sale to Prosper, which we refer to collectively as “open market loans.” The Prosper Borrower Notes are dependent for payment on Prosper borrower loans, and the Prosper Open Market Notes are dependent for payment on open market loans. -

Regulatory Changes for Chinese Stocks Remaining on Track

November 30, 2020 PIonline.com $16 an issue / $350 a year THE INTERNATIONAL NEWSPAPER OF MONEY MANAGEMENT Jennifer Bishop MORE HEADACHES: Washington Will Hansen believes recent inquiries related to ESG issues are yet Regulatory changes another cause for plan sponsor concern. for Chinese stocks remaining on track Stricter accounting rules, RELATED NEWS ban on military investing n Overseas investors flocking to in future for U.S. investors Chinese government bonds. Page 2 n New rules unlikely to derail China’s e-commerce giants. Page 2 By HAZEL BRADFORD Regulation Earlier this month, a White House Despite big changes at the White executive order banned investing in House in 2021, the push to protect U.S. Chinese companies linked to its mili- investors in Chinese companies is still tary. As of Jan. 1, individuals or compa- EBSA broadening its focus on enforcement on track, as regulators prepare to hold nies can no longer own direct shares the companies to tougher accounting or funds holding shares in 31 Chinese Labor Department agency gets Earlier this year, the Labor Department began standards and some face an outright ban. companies identified as security risks. sending enforcement letters to plan sponsors and “There will continue to be tension Many more U.S. investors will be af- busy on several different fronts registered investment adviser firms requesting between the U.S. and China — even fected by accounting rules expected to documents pertaining to environmental, social with a new administration taking the be proposed next month by the Securi- By BRIAN CROCE and governance-themed fund decisions.