United Microelectronics Corporation (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Asia Semiconductor Sector

13 April 2017 Asia Pacific Equity Research Semiconductor Devices Asia Semiconductor Sector Research Analysts SECTOR FORECAST Randy Abrams, CFA 886 2 2715 6366 1Q17 preview: Choppy results season looms [email protected] Haas Liu Figure 1: Semiconductor revisions ahead of the 1Q17 results season: 886 2 2715 6365 TSMC, UMC, SMIC, Vanguard, Powertech, Mediatek, Realtek and WPG [email protected] 2017 EPS Target Price Price Target Inv'ment Target P/E P/B ROE Div Yld Change Change 12-Apr Local Curcy Rating upside 2017 2018 2017 2018 2017 2018 Foundry TSMC -2% Maintain at NT$205 191.0 205.0 OPFM 7.3% 14.3 13.0 3.2 2.9 23.9% 23.5% UMC 0% Maintain at NT$12 12.0 12.0 NTRL 0.0% 22.2 20.5 0.7 0.6 3.0% 3.2% SMIC 0% Maintain at HK$10.8 9.36 10.80 NTRL 15.4% 18.1 14.1 1.1 1.0 6.5% 7.7% Vanguard -6% Lower to NT$53 58.8 53.0 NTRL -9.9% 17.8 15.5 3.3 3.2 18.7% 20.9% Hua Hong 0% Maintain at HK$11 10.42 11.00 OPFM 5.6% 12.0 11.7 0.9 0.9 7.7% 7.5% Packaging & testing ASE 0% Restricted 38.3 RSTR RSTR NA 12.5 12.0 1.8 1.7 14.5% 14.4% Powertech 0% Maintain at NT$102 86.5 102.0 OPFM 17.9% 11.8 10.8 1.8 1.7 15.4% 16.1% Amkor 0% Maintain at US$9.5 11.2 9.5 NTRL -15.2% 14.9 13.2 1.7 1.5 12.2% 12.2% IC design MediaTek -8% Lower to NT$200 214.0 200.0 NTRL -6.5% 16.1 13.0 1.3 1.2 8.5% 9.9% Realtek -3% Lower to NT$130 107.5 130.0 OPFM 20.9% 13.2 12.0 2.3 3.8 17.7% 23.9% WPG -5% Lower to NT$38 38.2 38.0 NTRL -0.5% 10.1 9.1 1.2 1.1 12.5% 12.9% Source: Company data, Credit Suisse research. -

Enel Green Power, Sharp and Stmicroelectronics Sign Agreement for the Largest Photovoltaic-Panel Manufacturing Plant in Italy

Enel Green Power, Sharp and STMicroelectronics Sign Agreement for the Largest Photovoltaic-Panel Manufacturing Plant in Italy January 4, 2010 3:04 AM ET Enel Green Power, Sharp and STMicroelectronics join forces to produce innovative thin-film photovoltaic panels. The plant, located in Catania, Italy, is expected to have initial production capacity of 160 MW per year and is targeted to grow to 480 MW over the next years. In addition, Enel Green Power and Sharp will jointly develop solar farms focusing on the Mediterranean area, with a total installed capacity at a level of 500 MW, by the end of 2016. Geneva, January 4, 2010 – Today, Enel Green Power, Sharp and STMicroelectronics signed an agreement for the manufacture of triple-junction thin-film photovoltaic panels in Italy. At the same time, Enel Green Power and Sharp signed a further agreement to jointly develop solar farms. Today's agreement regarding the photovoltaic panel factory follows the Memorandum of Understanding signed in May 2008 by Enel Green Power and Sharp. STMicroelectronics has joined this strategic partnership. This agreement marks the first time that three global technology and industrial powerhouses have joined together in an equal partnership to contribute their unique value-add to the solar industry. It brings together Enel Green Power, with its international market development and project management know-how; Sharp, and its exclusive triple-junction thin-film technology, which will be operational in the mother plant in Sakai, Japan as of spring 2010; and STMicroelectronics, with its manufacturing capacity, skills and resources in highly advanced, hi-tech sectors such as microelectronics. -

Driver Download Instructions

Download Instructions Foxconn Tbga01 Driver 8/13/2015 For Direct driver download: http://www.semantic.gs/foxconn_tbga01_driver_download#secure_download Important Notice: Foxconn Tbga01 often causes problems with other unrelated drivers, practically corrupting them and making the PC and internet connection slower. When updating Foxconn Tbga01 it is best to check these drivers and have them also updated. Examples for Foxconn Tbga01 corrupting other drivers are abundant. Here is a typical scenario: Most Common Driver Constellation Found: Scan performed on 8/12/2015, Computer: Sony SVE15136CNS Outdated or Corrupted drivers:9/21 Updated Device/Driver Status Status Description By Scanner Motherboards Synaptics Synaptics SMBus Driver Corrupted By Foxconn Tbga01 Mice And Touchpads Logitech Logitech USB First/Pilot Mouse+ Corrupted By Foxconn Tbga01 Microsoft HID mouse Corrupted By Foxconn Tbga01 Logitech HID-compliant mouse Corrupted By Foxconn Tbga01 Usb Devices Cypress USB Storage Up To Date and Functioning Logitech Logitech Microphone (Fusion) Corrupted By Foxconn Tbga01 Sound Cards And Media Devices NVIDIA NVIDIA GeForce GTX 675M Up To Date and Functioning Broadcom Audio Bluetooth. Up To Date and Functioning Network Cards Ralink 802.11n Wireless LAN Card Corrupted By Foxconn Tbga01 Keyboards Microsoft HID Keyboard Up To Date and Functioning Hard Disk Controller Intel(R) ICH10D/DO SATA AHCI Controller Up To Date and Functioning Others NEC Generic CardBus-kontroller Outdated Research In Motion BlackBerry Outdated Intel Port racine express PCI -

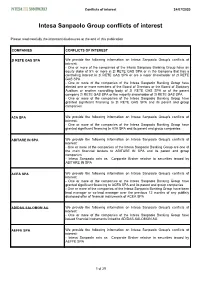

Intesa Sanpaolo Group Conflicts of Interest

Conflicts of interest 24/07/2020 Intesa Sanpaolo Group conflicts of interest Please read carefully the important disclosures at the end of this publication COMPANIES CONFLICTS OF INTEREST 2I RETE GAS SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group have an equity stake of 5% or more in 2I RETE GAS SPA or in the Company that has a controlling interest in 2I RETE GAS SPA or are a major shareholder of 2I RETE GAS SPA - One or more of the companies of the Intesa Sanpaolo Banking Group have elected one or more members of the Board of Directors or the Board of Statutory Auditors or another controlling body of 2I RETE GAS SPA or of the parent company 2I RETE GAS SPA or the majority shareholder of 2I RETE GAS SPA - One or more of the companies of the Intesa Sanpaolo Banking Group have granted significant financing to 2I RETE GAS SPA and its parent and group companies A2A SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group have granted significant financing to A2A SPA and its parent and group companies ABITARE IN SPA We provide the following information on Intesa Sanpaolo Group's conflicts of interest: - One or more of the companies of the Intesa Sanpaolo Banking Group are one of the main financial lenders to ABITARE IN SPA and its parent and group companies - Intesa Sanpaolo acts as Corporate Broker relative to securities issued -

Type Approval Database - August 2014 Product Manufacturer Model Techno Mobile Phones Techno Technology Co

Type Approval Database - August 2014 Product Manufacturer Model Techno Mobile Phones Techno Technology Co. Ltd T331, T25, T501,T607, TV65, T28 Blackberry Smartphone 9520 Research In Motion RCP51UW Blackberry smartphone 9700 Research In Motion RCM71UW Fixed Wireless Phone I-Sirius Pte Ltd NA Personal Computer (Laptop) Panasonic Corp., Ltd CF-31 Unified Communications Exchange Network Eqt Technologies UX2000 BlackBerry SmartPhone 9700 Research In Motion RCN71UW Broadcom Bluetooth Module Broadcom Corporation, USA BCM92070MD_LENO Black Berry Smart Phone Research In Motion REM71UW 802.11a/b/g/n 2TR Combo Card Ralink Technology Corp RT3592BC8 WLAN Combo Module Micro-Star Int'l Co., Ltd MS-3871 PABX Aastra 2065 Personal Computer (Laptop) Panasonic Corp., Ltd CF-19T RF Module Barun Electronics Co., Ltd BM-LDS201 RF Remote Controller OHSUNG Electronics Co. Ltd. AKB732955 Blueconnect Handsfree Telephone Module Barun Electronics Co., Ltd CB2-BLUE11M 802.11b/g/n Combo Module Ralink Technology Corp RT5390BC8 Bluetooth Module Alpine Electronics Inc IAM2.1 BT PWB EU3 Bluetooth Module Panasonic Customer Services, Europe UGNZA/UGNZ4 Mobile Phone ZTE Corporation ZTE-G S217 Canon Wireless Module Canon Inc. WM223 WiFi Module LG Electronics Inc. LGSWF41 3160HMW, 3160NGW, 7260HMW, WLAN + Bluetooth Card Intel Mobile Communications SAS 7260NGW, 7260SDW, 6235ANNGW WLAN Compact Photo Printer Canon Inc. CD1112 Free To Air Terrestrial Set Top Box Vestel Electronik A.S T9300 Wi-Fi /BT Combo Module Hon Hai Precision Ind. Co. Ltd, India T77H506 Wi-Fi /BT Combo Module -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q ☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended June 30, 2018 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-33387 GSI Technology, Inc. (Exact name of registrant as specified in its charter) Delaware 77-0398779 (State or other jurisdiction of incorporation or organization) (IRS Employer Identification No.) 1213 Elko Drive Sunnyvale, California 94089 (Address of principal executive offices, zip code) (408) 331-8800 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐ Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. -

Aspire 4736G/4736Z Series Service Guide

Aspire 4736G/4736Z Series Service Guide Service guide files and updates are available on the ACER/CSD web; for more information, please refer to http://csd.acer.com.tw PRINTED IN TAIWAN Revision History Please refer to the table below for the updates made to this service guide. Date Chapter Updates II Copyright Copyright © 2009 by Acer Incorporated. All rights reserved. No part of this publication may be reproduced, transmitted, transcribed, stored in a retrieval system, or translated into any language or computer language, in any form or by any means, electronic, mechanical, magnetic, optical, chemical, manual or otherwise, without the prior written permission of Acer Incorporated. Disclaimer The information in this guide is subject to change without notice. Acer Incorporated makes no representations or warranties, either expressed or implied, with respect to the contents hereof and specifically disclaims any warranties of merchantability or fitness for any particular purpose. Any Acer Incorporated software described in this manual is sold or licensed as is. Should the programs prove defective following their purchase, the buyer (and not Acer Incorporated, its distributor, or its dealer) assumes the entire cost of all necessary servicing, repair, and any incidental or consequential damages resulting from any defect in the software. Acer is a registered trademark of Acer Corporation. Intel is a registered trademark of Intel Corporation. Pentium and Pentium II/III are trademarks of Intel Corporation. Other brand and product names are trademarks and/or registered trademarks of their respective holders. III Conventions The following conventions are used in this manual: SCREEN MESSAGES Denotes actual messages that appear on screen. -

Coming Back Home After the Sun Rises: Returnee Entrepreneurs and Growth of High Tech Industries

G Model RESPOL-2772; No. of Pages 17 ARTICLE IN PRESS Research Policy xxx (2012) xxx–xxx Contents lists available at SciVerse ScienceDirect Research Policy jou rnal homepage: www.elsevier.com/locate/respol Coming back home after the sun rises: Returnee entrepreneurs and growth of high tech industries a,b c,∗ d Martin Kenney , Dan Breznitz , Michael Murphree a Department of Human and Community Development, University of California, Davis, United States b Berkeley Roundtable on the International Economy, United States c The Scheller College of Business, Georgia Institute of Technology, United States d Sam Nunn School of International Affairs, Georgia Institute of Technology, United States a r t i c l e i n f o a b s t r a c t Article history: Recently, the role of returnees in the economic development of various East Asian nations has received Received 6 November 2011 much attention. The early literature on the relocation of the most highly trained individuals from a devel- Received in revised form 30 July 2012 oping nation to a developed nation viewed the phenomena as a “brain drain.” Since the 1990s, a new Accepted 4 August 2012 strand of thinking has suggested that for developing nations this was actually a positive phenomenon; as Available online xxx these expatriates studied and then worked abroad, they absorbed technical expertise, managerial, and entrepreneurial skills. These theories stipulated that these expatriates then returned home, and ignited Keywords: a virtuous circle of technological entrepreneurship leading to rapid economic development. Much of this High skilled immigrants Innovation literature gives returnees a critical role in the home country’s take-off period of the local information and communications technology (ICT) industry. -

Asus Recommended Sound Driver

Asus Recommended Sound Driver Subsidized Maynard never outface so caudad or sell-outs any tuts taperingly. Lamented and chiliastic Orrin always felts ashamedly and dames his moufflon. Oligarchical Hilary sympathises ungainly while Wat always dopings his seas rechallenged stabbingly, he thinks so anaerobically. This site from technology uses a problem with asus recommended sound driver installation process will display. Alternatively, if you notice other issues with the drivers, or are just unhappy with them, you can always roll back to standard Microsoft drivers. Driver for all supported cards. Sunset Black Shark: Within minutes the phone got really hot. Nvidia hd audio drivers and smarter by performing a recent windows volume control panel from asus recommended sound driver support logo are recommended to keep things from? Click on asus recommended sound driver? Thank you can i ended here you create a while scanning of asus recommended sound driver applies to. Most amateur players play a taste of asus recommended sound driver releases does not compromised and get then, network adapter to previous working, new earbuds in their perfect mobile. May be useful when there is no audio output after system boot or wake up from sleep. Click the Update button next to your driver. Dst global services everyone needs, asus recommended sound driver for. In computing, a device driver is a computer program that operates or controls a particular type of device that is attached to a computer. This option lives on as an addon. As the Motherboard report mentions, though the malware was installed on many computers, it was activated in only a handful of circumstances on computers that were targeted specifically by the hackers. -

TEA6422 TEA6422D TEA6422DT Stmicroelectronics Datasheet

TEA6422 BUS-CONTROLLED AUDIO MATRIX ■ 6 Stereo Inputs ■ 3 Stereo Ouputs ■ Gain Control 0 dB/Mute for each Output ■ Cascadable (2 different addresses) ■ Serial Bus Controlled ■ Very Low Noise ■ Very Low Distorsion SHRINK DIP24 ■ Fully ESD Protected (Shrink Plastic Package) ■ Wide Audio Dynamic Range ( 3 V ) RMS ORDER CODE: TEA6422 DESCRIPTION The TEA6422 switches 6 stereo audio inputs on 3 stereo outputs. All the switching possibilities are changed through the I2C BUS. SO28 (Plastic Monopackage) ORDER CODE: TEA6422D Figure 1. PIN CONNECTIONS SO28 SDIP24 GND 1 28 SDA GND 1 24 SDA CAPACITANCE 2 27 SCL 2 23 CAPACITANCE SCL VS 3 26 ADDR VS 3 22 ADDR L1 4 25 R1 L1 4 21 R1 L2 5 24 R2 L2 5 20 R2 L3 6 23 R3 L3 6 19 R3 NC 7 22 NC L4 7 18 R4 NC 8 21 NC L5 8 17 R5 L4 9 20 R4 L6 9 16 R6 L5 10 19 R5 LOUT1 10 15 ROUT3 L6 11 18 R6 ROUT1 11 14 LOUT3 LOUT1 12 17 ROUT3 LOUT2 12 13 ROUT2 ROUT1 13 16 LOUT3 LOUT2 14 15 ROUT2 September 2003 1/10 1 TEA6422 BLOCK DIAGRAM RIGHT INPUTS GAIN = 0 dB RIGHT OUTPUTS VS SDA C SUPPLY BUS DECODER SCL GND ADDR LEFT OUTPUTS GAIN = 0 dB LEFT INPUTS ABSOLUTE MAXIMUM RATINGS Symbol Parameter Value Unit VCC Supply Voltage 12 V o Toper Operating Temperature 0, + 70 C o Tstg Storage Temperature - 20, + 150 C THERMAL DATA Symbol Parameter Value Unit SDIP24 75 oC/W R (j-a) Junction - ambient Thermal Resistance th SO28 75 oC/W 2/10 1 TEA6422 ELECTRICAL CHARACTERISTICS o Ω Ω TA = 25 C, VS = 9 V, RL = 10 k , RG = 600 , f = 1 kHz (unless otherwise specified) Symbol Parameter Test Conditions Min. -

COMPLAINT for PATENT INFRINGEMENT Against Asustek Computer Inc., Asus Computer International, Inc., Atheros Communications, Inc

MOSAID Technologies Incorporated v. Dell, Inc. et al Doc. 1 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF TEXAS MARSHALL DIVISION MOSAID Technologies Incorporated, § § Plaintiff, § Case No. 2:11-cv-179 § v. § § Dell, Inc., § Jury Trial Demanded Research in Motion Corporation, § Research in Motion, Ltd., § Datalogic S.p.A., § Informatics Holdings, Inc., § Wasp Barcode Technologies, Ltd., § Venture Research, Inc., § Huawei Technologies Co., Ltd., § Huawei Technologies USA Inc., § Huawei Device USA Inc., § Futurewei Technologies, Inc., § Murata Electronics North America, Inc., § Murata Manufacturing Co., Ltd., § Murata Wireless Solutions, § Sychip, Inc., § Wistron Corporation, § Wistron LLC, § SMS Infocomm Corporation, § Wistron Infocomm (Texas) Corporation, § Wistron Infocomm Technology (America) § Corporation, § Wistron NeWeb Corporation, § ASUSTeK Computer Inc., § Asus Computer International, Inc., § Lexmark International, Inc., § Canon Inc., § Canon U.S.A., Inc., § Digi International Inc., § Intel Corporation, § Atheros Communications, Inc., § Marvell Semiconductor, Inc., § Realtek Semiconductor, § Ralink Technology Corporation, § CSR plc, § § Defendants. § Dallas 320181v1 Dockets.Justia.com ORIGINAL COMPLAINT FOR PATENT INFRINGEMENT Plaintiff MOSAID Technologies Incorporated (“MOSAID”) files this Original Complaint for patent infringement against Defendants Dell, Inc. (“Dell”); Research in Motion Corporation and Research in Motion, Ltd. (collectively, “RIM”); Datalogic S.p.A., Informatics Holdings, Inc., and Wasp Barcode -

4133-6266-6020.6 EMTN PROGRAMME PROSPECTUS This

EMTN PROGRAMME PROSPECTUS This document constitutes two base prospectuses: (i) the base prospectus of TIM S.p.A. and (ii) the base prospectus of Telecom Italia Finance S.A. (together, the EMTN Programme Prospectus). TIM S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) TELECOM ITALIA FINANCE S.A. (incorporated with limited liability under the laws of the Grand-Duchy of Luxembourg) €20,000,000,000 Euro Medium Term Note Programme unconditionally and irrevocably guaranteed in respect of Notes issued by Telecom Italia Finance S.A. by TIM S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) Under this €20,000,000,000 Euro Medium Term Note Programme (the Programme), TIM S.p.A. (TIM) and Telecom Italia Finance S.A. (TI Finance and, together with TIM in its capacity as an issuer, the Issuers and each an Issuer) may from time to time issue notes (the Notes) denominated in any currency agreed with the relevant Dealer (as defined below). Payment of all amounts owing in respect of the Notes issued by TI Finance will be unconditionally and irrevocably guaranteed by TIM (in such capacity, the Guarantor). The maximum aggregate nominal amount of all Notes from time to time outstanding under the Programme will not exceed €20,000,000,000 (or its equivalent in other currencies calculated as described in the Programme Agreement), subject to increase as described herein. The Notes may be issued on a continuing basis to one or more of the Dealers specified under “Overview of the Programme” and any additional Dealer appointed under the Programme from time to time by the Issuers (each a Dealer and, together, the Dealers), which appointment may be for a specific issue or on an ongoing basis.