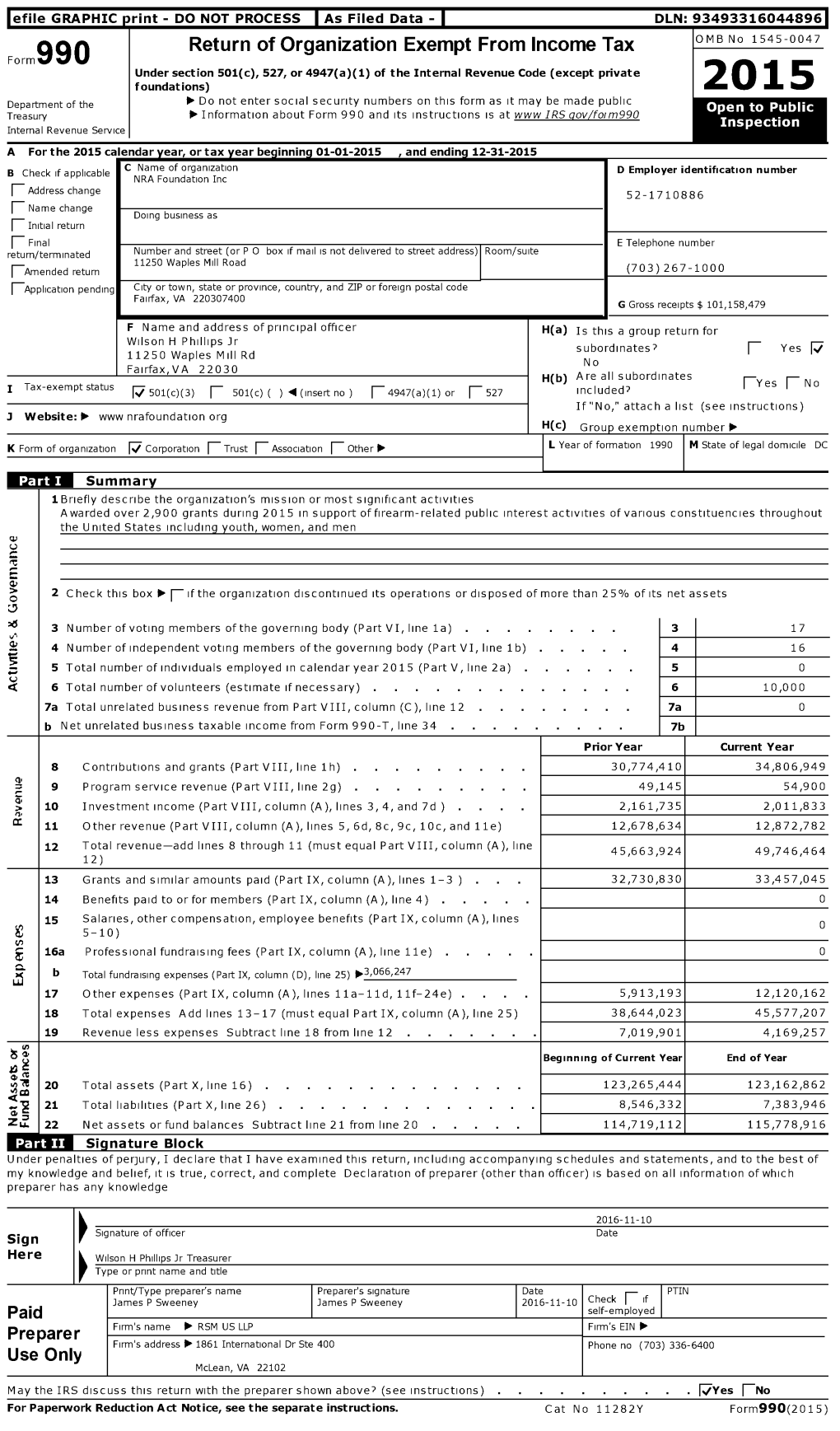

Form 990 for NRA FOUNDATION

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

May Newsletter.Pdf

Club of Rotary The Friendship Knot Tuesday, May 18, 2021 Club Meeting Our May Newsletter The Friendship Knot Meets at By Patrick W Curley on Saturday, May 15, 2021 Rotary Club of the Friendship Knot , May News Letter Wow, can you believe that it has been 5 months since we Time: Sunday at 12:00 started this adventure. It has been quite a journey. As a new type of Rotary PM Club, one that is international and focused on a common interest, we have had many obstacles and challenges to overcome that are not experienced in Club Leaders traditional Rotary Clubs. There has been much work done to set up the club, establish committees, collection of funds and developing a shared vision and mission for our club. We have had many of our members step up and Patrick W volunteer to serve as committee chairs and team leaders. Curley President For the next couple of months, I would like to see our club focus on positioning the club for the Rotary Year of 2021-2022. Jeffrey Alexander Vernon President- Elect Andrea Gonzalez Secretary Club Neckerchief is on it's way! Robert By Patrick W Curley on Saturday, May 15, 2021 Grant Landquist Treasurer James Donovan Sergeant- at-Arms Webmaster Elwin Spray Club Rotary Foundation Chair Michael Matzinger Club Membership Chair Steven R. Beck Club Service Chair Ivonne Senc�be- Reilly Club Public Image Chair Dawn Michelle Chapeau Social Media Chair Andrew Charles Johnson International Service Chair Hallie Marie Rock Club Service Projects Chair After months on waiting, our Club neckerchiefs are ordered and will be mailed to you shortly. -

OA-Annual-Report-2010.Pdf

2010 OA ANNUAL REPORT Order O The Arrow 2010 OA ANNUAL REPORT CONTENTSTable of LEADERSHIP GOODMAN MESSAGE . 1 CAMPING AWARD . 8 UNIT, CHAPTER AND ORDER OF THE ARROW LODGE SUPPORT . 2-3 HIGH ADVENTURE . 9-10 SUPPORT OF MAURY CLANCY SCOUTING . 4 AMERICAN INDIAN CAMPERSHIP . 11 NATIONAL SERVICE AWA R D . 4 2010 NATIONAL SCOUT JAMBOREE . 12-15 LODGE SERVICE GRANTS . 5 JOSH R . SAIN MEMORIAL SCHOLARSHIP . 16 THE SILVER ANTELOPE . 6 COMMITTEE MEMBERS . 17 BUILDING LEADERS . 6-7 2010 QUALITY LODGES . 18-19 STATE OF THE BROTHERHOOD . 7 Leadership REPORT ANNUAL OA 2010 Message LETTER FROM THE CHIEF AND VICE CHIEF Brothers, Scout Jamboree. The OA Service greatness of Scouting. The following Corps proved, through cheerful pages detail our cheerful service, B2010 marked a very important service, that the principles of servant celebrations and successes during milestone in Scouting’s history; we leadership are alive within the 2010. We certainly hope that you celebrated the 100th Anniversary hearts of every Arrowman. The enjoy it! of the Boy Scouts of America and central attraction of the Jamboree – established a strong foundation for The Mysterium Compass – reached It was a great honor and privilege Scouting to enter its second century. out to motivate tomorrow’s leaders to serve the Order of the Arrow The Order of the Arrow played through an innovative, interactive, and Scouting this past year, and we an instrumental role in Scouting’s augmented reality game, which look forward to seeing the OA fulfill success during its centennial year. challenged Scouts with a series its ongoing mission as Scouting’s Scouting’s National Honor Society of ethical choices. -

January 2021

Council Management Support Boy Scouts of America Unit Contacts for Katahdin Area Council #216 - Bangor, ME (Area 1) Through Month of January, 2021 Dist. Unit Commissioners Unit Contacts Recorded in Commissioner Tools *Units Percent Contacted Contacted No. District Name Units Comm Ratio Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total 01 Hancock 10 2 5.0 2 2 0.0% 04 Washington 5 999.0 0.0% 05 North Star 17 1 17.0 0.0% 06 Penobscot Valley 28 4 7.0 0.0% 07 Penquis 12 2 6.0 0.0% 09 Waldo 18 999.0 0.0% 216 Council Totals** 90 9 10.0 2 2 0.0% * The Units Contacted column reflects the number of units that have had sufficient contacts recorded year-to-date. In order to show progress, a unit is counted if it has been contacted at least once by January/February, two times by March/April, three times by May/June, four times by July/August, five times by September/October and six times by November/December. For example, a unit that was not contacted until March will not be counted in January or February, but will count in March, if it receives two contacts that month. At the end of the year a unit needs at least six total contacts to be counted. Contacts are counted by the date they are entered into Commissioner Tools, not by the actual date of the contact or visit. Posts are included in 2017 and beyond; however, Exploring only districts may not be included. -

The Council Guide

The Council Guide 2011 Edition Introduction The Council Guide Available online at www.TheCouncilGuide.com Volume 1 – Council Shoulder Insignia, councils A-L Including Red & White Strips (RWS), "Pre-CSPs", Council Shoulder Patches (CSPs), and Jamboree Shoulder Patches (JSPs) Volume 2 – Council Shoulder Insignia, councils M-Z Including Red & White Strips (RWS), "Pre-CSPs", Council Shoulder Patches (CSPs), and Jamboree Shoulder Patches (JSPs) Volume 3 – Council Shoulder Insignia, names A-L Including Community Strips (CMS), Military Base Strips (MBS), and State Strips Volume 4 – Council Shoulder Insignia, names M-Z Including Community Strips (CMS), Military Base Strips (MBS), and State Strips Volume 5 – Council Insignia, councils A-L Including Council Patches (CPs) and Council Activity Patches Volume 6 – Council Insignia, councils M-Z Including Council Patches (CPs) and Council Activity Patches Volume 7 – District Insignia, districts A-L Including District Patches and District Activity Patches Volume 8 – District Insignia, districts M-Z Including District Patches and District Activity Patches © 2011, Scouting Collectibles, LLC OVERVIEW The Council Guide attempts to catalog all Boy Scouts of America council and district insignia. Although many users may choose to only collect selected council items, The Council Guide aims to record all council insignia in order to present a more complete picture of a council’s issues. Furthermore, such a broad focus makes The Council Guide more than just another patch identification guide – The Council Guide is also a resource for individuals wishing to record and learn about the history of Scouting through its memorabilia. ORGANIZATION Since The Council Guide includes a wide variety of issues, made in different shapes and sizes and for different purposes, it can be difficult to catalog these issues in a consistent way. -

United States Bankruptcy Court

EXHIBIT A Exhibit A Service List Served as set forth below Description NameAddress Email Method of Service Adversary Parties A Group Of Citizens Westchester Putnam 388 168 Read Ave Tuckahoe, NY 10707-2316 First Class Mail Adversary Parties A Group Of Citizens Westchester Putnam 388 19 Hillcrest Rd Bronxville, NY 10708-4518 First Class Mail Adversary Parties A Group Of Citizens Westchester Putnam 388 39 7Th St New Rochelle, NY 10801-5813 First Class Mail Adversary Parties A Group Of Citizens Westchester Putnam 388 58 Bradford Blvd Yonkers, NY 10710-3638 First Class Mail Adversary Parties A Group Of Citizens Westchester Putnam 388 Po Box 630 Bronxville, NY 10708-0630 First Class Mail Adversary Parties Abraham Lincoln Council Abraham Lincoln Council 144 5231 S 6Th Street Rd Springfield, IL 62703-5143 First Class Mail Adversary Parties Abraham Lincoln Council C/O Dan O'Brien 5231 S 6Th Street Rd Springfield, IL 62703-5143 First Class Mail Adversary Parties Alabama-Florida Cncl 3 6801 W Main St Dothan, AL 36305-6937 First Class Mail Adversary Parties Alameda Cncl 22 1714 Everett St Alameda, CA 94501-1529 First Class Mail Adversary Parties Alamo Area Cncl#583 2226 Nw Military Hwy San Antonio, TX 78213-1833 First Class Mail Adversary Parties All Saints School - St Stephen'S Church Three Rivers Council 578 Po Box 7188 Beaumont, TX 77726-7188 First Class Mail Adversary Parties Allegheny Highlands Cncl 382 50 Hough Hill Rd Falconer, NY 14733-9766 First Class Mail Adversary Parties Aloha Council C/O Matt Hill 421 Puiwa Rd Honolulu, HI 96817 First -

2018 Summer Camp Leader's Guide

Leader’s Guide to Summer Camp - 2018 Dear Scout Leaders, Welcome to Summer Camp 2018 at beautiful Camp Yocona. We are excited to be celebrating Camp Yocona’s 72nd Summer of BSA Summer Camp. We are glad you have taken the first step to planning an unforgettable camp experience for your boys As we prepare for the upcoming season, we are working to improve the quality of all of our program areas, creating new evening activities, implementing suggestions from you and other leaders, and hiring a staff that will exemplify the best of the Boy Scouts of America. We are striving to add fun new experiences that build your Scouts’ character, citizenship and physical fitness. Your job as the unit leader is the most challenging and rewarding one at camp. Through your guidance, your Scouts will select programs that will help them learn new skills. The staff at Camp Yocona will do all it can to be flexible and meet your needs. We welcome any special requests and ask that you please make us aware of them as early as possible. In the following pages, you will find all of the information that is needed to plan your 2018 summer camp experience. There have been several changes to various parts of this guide aimed at keeping you informed. If any further information is needed, or any questions need answering, please do not hesitate to contact us. We are committed to making your experience one you will talk about for years to come. We look forward to seeing you soon! Ronnie Pittman CharlieVaden Smith Staff Adviser Program Director [email protected] [email protected] Leader’s Guide to Summer Camp - 2018 TABLE OF CONTENTS INCENTIVE PLAN ......................................................................................................................................3 PLANNING INFORMATION ......................................................................................................................4 CAMP FEES & CAMPSITE RESERVATIONS ........................................................................................ -

2005 Annual Report (1.67

Order of the Arrow Annual Report | 2005 Brotherhood Leadership Service Table of Contents Brotherhood 2 Membership 3 Jamboree 4 Leadership 6 Leadership Development 7 Scholarships 8 Service 10 Katrina Aid 11 High Adventure 12 National Service Grants 14 Awards 15 Financial Support 16 National Committe/Founders’ Council 17 In July of 1915, two men forever changed the face of Boy Scouting in the United States. It was during that summer that Dr. E. Urner Goodman and Carroll A. Edson founded the Order of the Arrow at Treasure Island Scout Camp in the Cradle of Liberty Council. Goodman and Edson established a legacy of servant leadership that we still embody today, 90 years later, and with 180,000 members nationwide, that legacy is stronger than ever. In 2005, the Order of the Arrow reached new heights in Scouting through the development of new and innovative programs and through a renewed emphasis on the principles behind the founding of our Order. The year saw the creation of a new high adventure program, the launching of a new training program at Philmont, and the successful support of the 2005 National Scout Jamboree. It was a busy year for the Order with our extensive programming. With the strength and dedication of our members we were able to, once again, achieve great things. This Annual Report is a refl ection of the success and accomplishment of this past year, but it is also a roadmap for the future. Even as we refl ect upon our achievements, we have set our sights on the path before us. -

New Member's Guide

New Member’s Guide Wa-Hi-Nasa 2019 Name _________________________________ My Chapter is ___________________________ My Chapter Chief is ______________________ My Elangomat is ________________________ Phone __________________________________ Social Media _____________________________ My Elangomat Crew __________________ __________________ # ____________________ # ___________________ SM __________________ SM __________________ __________________ __________________ # ____________________ # ___________________ SM __________________ SM __________________ __________________ __________________ # ____________________ # ___________________ SM __________________ SM __________________ 2 Welcome from the Chief Congratulations! You have completed your induction into the Order of the Arrow, Scouting’s National Honor Socie- ty! We hope that you will read further through this guide to help gain an understanding of our lodges different honors, our diverse chairmanships, and various traditions that our lodge holds. After reading this book, I encourage you to reach out to a committee that you find interesting, and ask how you can get involved. Next, you should begin attending your chapter meet- ings in order to bond with your fellow members of the OA as well as look for opportunities to take the lessons you learn from the OA and apply them to your unit. After the Induction weekends, we want you to attend Fall Fellowship and other lodge events. Yours In service, Matthew M. Matthew M. l 2019 Lodge Chief 3 Table of Contents Welcome from the Chief ······················································· -

Firearms, Freedom and the American Experience Annual

2015 Annual REPORT Firearms, Freedom and the American Experience MESSAGE From the President is an honor to present to you The NRA Foundation’s Annual Report for 2015. Our thanks go to you IT and your generous commitment to support The Foundation’s activities. Grants awarded to qualified programs from The NRA Foundation totaled $33.5 in 2015 and now exceed $300 million in funding since inception through more than 38,000 grants in support of the shooting sports. Funds raised by Friends of NRA continue to provide resources for expansion, growth and development of eligible programs at the local, state and national levels. A high priority of The NRA Foundation is its support of public educational programs across America. The NRA Foundation is committed to working together in planning for the future of the shooting sports and standing behind our country’s traditions. To that end, I would like to offer a special thank you to the gun collecting community. Collectors play a vital role in preserving our history and the American culture of freedom. As stated by NRA President and distinguished firearms collector, Allan Cors: “Whether it’s hunting, competitive shooting, or gun collecting, when you introduce someone new to the activities we enjoy, you’re giving firearms and the freedom to own them a new ally, shareholder and believer. That helps the NRA, but more importantly, it secures the freedoms the NRA fights for.” The Foundation is proud of its role in funding support for thousands of eligible programs in communities across the country, and without you our success would not be possible. -

ISCA Red and White Strip Checklist (Full-Strip)

ISCA Red and White Strip Checklist (Full-strip) Brought to you by the Internationl Scouting Collectors Association (ISCA) For an electronic version of this list, go to: www.ScoutTrader.org Contact Larry Kelley with any additions or changes ([email protected]) REF: ISCAChecklist-RWS.xls Last updated: 15 February 2016 (updates in yellow) Description State Have Border Twill N tag Remarks Scan STANDARD ISSUES Type 1 TLR left X Type 1 TLR right X ABRAHAM LINCOLN / COUNCIL IL Type 2 TLM X Type 2 TLS X ADIRONDACK COUNCIL / NEW YORK NY Type 2 TLM X ADMIRAL ROBERT E. PEARY / COUNCIL / PENNSYLVANIA PA Type 2 TLM X Type 1 TLR left X ADOBE WALLS AREA / COUNCIL TX Type 2 TLM X Type 1 TLR left X AKRON AREA / COUNCIL OH Type 2 TLM X ALABAMA FLORIDA / COUNCIL (119/64, 4mm gap) AL Type 2 TLM O in FLORIDA aligns with I in COUNCIL X ALABAMA FLORIDA / COUNCIL (123/64, 7mm gap) AL Type 2 TLM O in FLORIDA aligns with IL in COUNCIL X ALAMEDA COUNCIL / CALIFORNIA CA Type 2 TLM X Type 1 TLR left X ALAMO AREA / COUNCIL (107/64) TX Type 1 TLR right X Type 1 TLR left X Type 1 TLR right X ALAMO AREA / COUNCIL (88/64) TX Type 1 TLM left X Type 2 TLM X ALAMO AREA / COUNCIL (88/45) TX Type 2 TLM X ALAPAHA AREA / COUNCIL GA Type 2 TLM X ALEXANDER HAMILTON / COUNCIL (/64) NJ Type 2 TLS X ALEXANDER HAMILTON / COUNCIL (/45) NJ Type 2 TLM X ALFRED W DATER / COUNCIL (no period) CT Type 1 TLR left X Type 1 TLR X ALFRED W. -

February 2021

Council Management Support Boy Scouts of America Unit Contacts for Katahdin Area Council #216 - Bangor, ME (Area 1) Through Month of February, 2021 Dist. Unit Commissioners Unit Contacts Recorded in Commissioner Tools *Units Percent Contacted Contacted No. District Name Units Comm Ratio Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Total 01 Hancock 3 2 5.0 2 1 3 0.0% 04 Washington 4 999.0 0.0% 05 North Star 8 1 17.0 0.0% 06 Penobscot Valley 16 4 7.0 5 5 0.0% 07 Penquis 5 2 6.0 0.0% 09 Waldo 7 999.0 18 18 0.0% 216 Council Totals** 43 9 4.8 2 24 26 0.0% * The Units Contacted column reflects the number of units that have had sufficient contacts recorded year-to-date. In order to show progress, a unit is counted if it has been contacted at least once by January/February, two times by March/April, three times by May/June, four times by July/August, five times by September/October and six times by November/December. For example, a unit that was not contacted until March will not be counted in January or February, but will count in March, if it receives two contacts that month. At the end of the year a unit needs at least six total contacts to be counted. Contacts are counted by the date they are entered into Commissioner Tools, not by the actual date of the contact or visit. Posts are included in 2017 and beyond; however, Exploring only districts may not be included. -

NYLT Page 1.Pub

What is NYLT? Naonal Youth Leadership Training is an excing, NYLT acon‐packed program designed for councils to pro‐ vide youth members with leadership skills and experi‐ Naonal Youth Leadership Training Date ence they can use in their home troops and in other July 1 –7, 2018 situaons demanding leadership of self and others. The NYLT course centers around the concepts of what a leader must BE, what he must KNOW, and Locaon: what he must DO. The key elements are then taught Beauful Camp Yocona, Randolph, MS with a clear focus on HOW TO. The skills come alive during the week as the patrol goes on a Quest for the Meaning of Leadership. NYLT is a six‐day course. Content is delivered in a troop and patrol outdoor seng with an emphasis on immediate applicaon of learning in a fun environ‐ ment. Interconnecng concepts and work processes are introduced early, built upon, and aided by the use 2018 Camp Yocona of memory aids, which allows parcipants to under‐ stand and employ the leadership skills much faster. Through acvies, presentaons, challenges, discus‐ sions, and audio‐visual support, NYLT parcipants will be engaged in a unified approach to leadership that will give them the skill and confidence to lead well. Through a wide range of acvies, games, and adven‐ tures, parcipants will work and play together as they put into acon the best Scoung has to offer. July 1st—July 7th Hosted by For addional informaon contact: NYLT Course Director Yocona Area Council Bryan Clausel [email protected] Boy Scouts of America (662)808‐1343 hp://www.yocona.org/nylt NYLT Training Application * Parcipants must aend the whole course in All parcipants must have a current Annual Health Medical Record parts A, B, & C.