Press Release

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

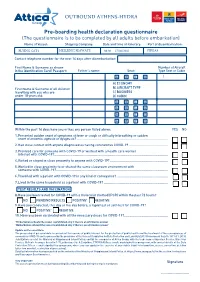

Pre-Boarding Health Declaration Questionnaire OUTBOUND

OUTBOUND ATHENS-HYDRA Pre-boarding health declaration questionnaire (The questionnaire is to be completed by all adults before embarkation) Name of Vessel: Shipping Company: Date and time of itinerary: Port of disembarkation: FLYING CAT4 HELLENIC SEAWAYS 08:30 17/06/2021 PIREAS Contact telephone number for the next 14 days after disembarkation: First Name & Surname as shown Number of Aircraft in the identification Card/ Passport: Father’s name: Seat: Type Seat or Cabin Α B C D 1 Α) ECONOMY First Name & Surname of all children Β) AIRCRAFT TYPE travelling with you who are C) BUSINESS under 18 years old: D) CABIN Α B C D Α B C D Α B C D Α B C D Within the past 14 days have you or has any person listed above: YES NO 1. Presented sudden onset of symptoms of fever or cough or difficulty in breathing or sudden onset of anosmia, ageusia or dysgeusia? .................................................................................................. 2. Had close contact with anyone diagnosed as having coronavirus COVID-19 .......................................... 3. Provided care for someone with COVID-19 or worked with a health care worker infected with COVID-19?.......................................................................................................................... 4. Visited or stayed in close proximity to anyone with COVID-19? .............................................................. 5. Worked in close proximity to or shared the same classroom environment with someone with COVID-19?........................................................................................................................ 6. Travelled with a patient with COVID-19 in any kind of conveyance? ....................................................... 7. Lived in the same household as a patient with COVID-19? ..................................................................... TEST RESULTS AND VACCINATION 8. Have you been tested for COVID-19 with a molecular method (PCR) within the past 72 hours? NO PENDING RESULTS POSITIVE1 NEGATIVE 9. -

Investor Presentation June 2017 Table of Contents 2

Investor Presentation June 2017 Table of Contents 2 Page Section 1: Group overview 3 Section 2: Portfolio companies 18 Attica Group 26 Vivartia 36 Hygeia Group 48 SingularLogic 59 Hilton Cyprus 66 RKB 68 Section 3: Financial Statement information 71 Appendix: Management biographies 84 Section 1 Group Overview MIG at a snapshot 4 High-quality portfolio of leading companies across key defensive sectors Net Asset Value (NAV) (2016) €666m Group Assets (2016) €2,715m NAV per share (2016) €0.71 Group Net Fixed Assets (2016) €1,134m Group Revenues (2016) €1,104 EBITDA Business Operations (1) (2016) €172m Group Gross Debt (€m) (2016) €1,674m EBITDA Consolidated (2016) €134m Tourism & Transportation Food & Dairy Healthcare Real Estate IT (32% of GAV) (32% of GAV) (15% of GAV) (15% of GAV) Leisure (2% of GAV) (4% of GAV) March 2017: MIG announced the sale of its entire stake in Sunce Koncern d.d. (1) EBITDA Business Operations = Group EBITDA excl. holding companies, provisions beyond normal course of business (€15m impairment of trade receivables from Marinopoulos group), gains/losses from the sale of investment property, fixed & intangible assets & revaluation of investment property Highly diversified operations across attractive sectors 5 Revenue breakdown (2016 data) EBITDA breakdown (2016 data) Gross Asset Value breakdown (2016 data) 4% 11% 19% 3% 27% 21% 32% 2% 18% 51% 15% 24% 41% 32% Food & Dairy Transportation Healthcare IT Other (Real Estate, Leisure) 2014 2015 2016 (in €m) 2014 2015 2016 2014 2015 2016 Group Sales (€m) 1,117 1,143 1,104 EBITDA Business Ops 1 89 163 172 Gross Asset Value (€m) 1,534 1,480 1,381 % margin 8.0% 14.2% 15.6% y-o-y chg (%) +4% +2% -3% GroupGross Debt (€m) 1,752 1,693 1,674 EBITDA Consolidated 66 125 134 3 NAV (€m) 923 783 666 Greek GDP 2 0.4% -0.3% -0.1% y-o-y chg (%) % margin 5.9% 10.9% 12.1% NAV pershare (€) 0.98 0.83 0.71 (1) EBITDA Business Operations = Group EBITDA excl. -

ATTICA HOLDINGS SA Annual Financial Report For

ATTICA HOLDINGS S.A. Annual Financial Report for the period 1.1.2018 to 31.12.2018 (In compliance with article 4 of Law 3556/2007) (amounts in Euro thousand) ATTICA HOLDINGS S.A. Registration Number: 7702/06/B/86/128 Commercial Registration Number: 5780001000 1-7 Lysikratous & Evripidou Street,176 74 Kallithea, Athens, Greece FINANCIAL REPORT FOR THE FISCAL YEAR 2018 CONTENTS Page Statement of the Board of Directors’ Members...................................................................................................... 4 Independent Auditor’s Report ............................................................................................................................... 5 Annual Report of the Board of Directors for the fiscal year 2018 ......................................................................... 11 Annual Consolidated and Company Financial Statements for the Fiscal Year 2018 ............................................ 40 Statement of comprehensive income for the period ended December 31 2018 & 2017 ....................................... 41 Statement of financial position as at 31st of December 2018 and at December 31, 2017 .................................... 42 Statement of changes in equity of the Group (period 1-1 to 31-12-2018) ............................................................. 43 Statement of changes in equity of the Group (period 1-1 to 31-12-2017) ............................................................. 43 Statement of changes in equity of the Company (period 1-1 to 31-12-2018) ...................................................... -

Greek Shipping Awards 2009

GREEK SHIPPING AWARDS 2009 The Winners CONTENTS Awards & Winners THE WINNERS 11 Dry Cargo Company of the Year Navios Maritime Holdings 13 Tanker Company of the Year Capital Ship Management GREEK SHIPPING Share our Passion for Shipping 15 Passenger Line of the Year AWARDS 2009 Aegean Speed Lines 17 Shipbroker of the Year The Winners Golden Destiny WRITER 19 Shipping Financier of the Year Nigel Lowry National Bank of Greece DESIGN/PRODUCTION Jo Fuller Designs 21 Technical Achievement Award NTUA Ship Design Laboratory / Germanischer Lloyd AWARDS MANAGEMENT Event Producer: Peter Attwater Event Director: Nigel Lowry 25 Piraeus International Centre Award Event Administration: Shelagh Ingledow Event & Guest Co-ordination Office Hellenic Shipbrokers Association Tel.+30.210.42.91.195 Email: [email protected] 27 Ship of the Year SPONSORSHIP & ADVERTISING SALES ‘Aktea OSRV’ Janet Wood Tel. +30.210.41.27.217 Email: [email protected] 29 International Personality of the Year Commissioner Joe Borg EVENT PRODUCTION Orama New Age Productions Mix-Music 31 Seafarer of the Year Captains Efstratios Kavros, Haralambos Petras PHOTOGRAPHER Emmanuella Bourbouhaki & Alexandros Stamatakis ADDITIONAL PHOTOGRAPHS 33 Award for Achievement in Safety or Environmental Protection George Foustanos Nikos Kokkalias Efthimios Mitropoulos AWARD TROPHIES Raoul Bollani 35 Award for Achievement in Education or Training Professor Costas Grammenos VENUE Athenaeum InterContinental Hotel, Athens 37 Lloyd’s List/Propeller Club Lifetime Achievement Award Lloyd’s List Captain Vassilis C. Constantacopoulos Editorial, Advertising and Subscriptions inquiries 69-77 Paul Street, London EC2A 4LQ 39 Greek Shipping Newsmaker of the Year Tel. +44 (0) 20 7017 5000 Victor Restis This special supplement is issued free to subscribers of Lloyd’s List and is one of a 41 Greek Shipping Personality of the Year series published at regular intervals each year. -

Leading the Way

Investor Information Attica Group in figures *In the course of 2006, the Group sold 4 vessels and as at 31st December, 2006 owned 15 vessels. Attica Group operates modern, fast, cruise-class, car-passenger ferries providing year-round Tickers transportation services for passengers, private vehicles and freight, in the Adriatic Sea, Certified Auditors the North Sea and the Greek domestic market. Attica Group: Reuters: EPA.AT DRM STYLIANOU S.A. Bloomberg: ATTICA GA A member of RSM International 2002 2003 2004 2005 2006 ATHEX: ATTICA Kifissias Avenue & 84, Ethn. Antistasseos Street Sailings 8,113 9,855 8,988 7,568 6,228 Tenfore : ATTICA.at 15231 Athens, Greece Tel.: +30 210 674 78190 Passengers 3,919,946 5,041,332 4,741,660 4,366,945 4,027,896 Blue Star Group: Fax: +30 210 672 6099 Freight units 301,811 346,644 332,930 339,381 298,090 Reuters: STR.AT e-mail: [email protected] Bloomberg: BSTAR GA Private vehicles 650,538 791,573 733,874 635,976 579,881 ATHEX: BSTAR Leading the way Tenfore : BSTAR.at Annual General Meetings Ships 23 21 16 18 19 Attica Holdings S.A.: 14th June, 2007 Average Fleet age 10 9 8 7 10 Investor Enquiries Blue Star Maritime S.A.: 14th June, 2007 Ports Served 31 33 27 30 30 Yannis Criticos ATTICA GROUP 157, C. Karamanli Avenue (in million Euro) 2002 2003 2004 2005 2006 16673 Voula, Athens Revenue 318.61 385.87 371.25 385.12 326.60 Greece Tel.: +30 210 891 9500 ΕΒΙΤDΑ 60.99 100.83 104.72 99.10 71.53 Fax: +30 210 891 9509 Depreciation 32.98 40.12 37.98 37.39 29.93 e-mail: [email protected] Net Interest Expense -38.57 -

The Greek Passenger Ferry Transport System Service Level Agreements

ERASMUS UNIVERSITY ROTTERDAM MSc in Maritime Economics and Logistics 2008/2009 The Greek passenger ferry transport system Service Level Agreements in the route Piraeus œ Samos Island By Anastasios Kefalas Copyright © Maritime Economics & Logistics Dedicated to: My grandfather Lefteris Island of Samos, 24th August 2009 - 2 - Acknowledgements W riting the Thesis was a great experience for me. As I come from the island of Samos it was a very good opportunity for me to publish the needs of the residents of the islandic areas and try to contribute the least to the solution of their problems. The accomplishment of the Thesis would not have been possible without the support and help of the people I would like to mention here. First of all, I would like to express my gratitude to my supervising professor Dr. Konstantinos Chlomoudis whose help during the Thesis was valuable. Also, I would like to thank Mr. Petros Kostagiolas for his patience and guidance. W ithout his help the Thesis would not have been completed. Furthermore, i would like to thank Mr. George Koulikas from the port authority of Port of Samos for providing me the statistical data and special thanks to all the experts that participated in the Delphic Method and gave their scientific opinion. Finally I would like to thank my friends Christos, Chris, John and Lefteris for helping me and supporting me not only during the Thesis period but also during my studies in Rotterdam. - 3 - Abstract /ive years after the liberalization of maritime transport in the majority of the Greek domestic routes (removal of cabotage) and the abolition of the age limit applying to vessels, the Greek ferry transport system is characterized by several major problems. -

Verifavia Shipping Undertakes Ihm Services for 29 Attica Group Vessels

PRESS RELEASE VERIFAVIA SHIPPING UNDERTAKES IHM SERVICES FOR 29 ATTICA GROUP VESSELS Total number of ships under IHM contract with Verifavia Shipping now exceeds 400 PARIS, ATHENS & SINGAPORE – 11th December: Greece-based ferry company, Attica Group has appointed Verifavia Shipping to provide Inventory of Hazardous Materials (IHM) services for 29 of its vessels. One of the first companies in Greece to apply for IHM certification, the addition of Attica Group’s ships takes the total number of vessels under IHM contract with Verifavia to more than 400. Verifavia has already surveyed 27 of Attica’s ferries, with two more scheduled for early 2020, conducting IHM investigations in line with the terms of the EU Ship Recycling Regulation (EU SRR) and the Hong Kong (HK) International Convention for the Safe and Environmentally Sound Recycling of Ships. The IHM reports created by Verifavia are now in the final, class certification stage of the process. The EU SRR applies to new EU-flagged ships and EU-flagged ships going for dismantling, and from 31 December 2020 will affect all existing EU-flagged ships as well as ships flying the flag of a third country and calling at an EU port or anchorage. The regulation prohibits or restricts the installation and use of hazardous materials (like asbestos or ozone-depleting substances) on board ships, as well as making it mandatory for ships to carry on board a certified IHM specifying the location and approximate quantities of those materials. George Anagnostou, Chief Operations Officer, Attica Group, explained: “Verifavia has completed IHM surveys on 27 of our vessels, with two more scheduled for early 2020. -

ATTICA HOLDINGS SA Annual Financial Report For

ATTICA HOLDINGS S.A. Annual Financial Report for the period 1.1.2019 to 31.12.2019 (In compliance with article 4 of Law 3556/2007) (amounts in Euro thousand) ATTICA HOLDINGS S.A. Registration Number: 7702/06/B/86/128 Commercial Registration Number: 5780001000 1-7 Lysikratous & Evripidou Street,176 74 Kallithea, Athens, Greece FINANCIAL REPORT FOR THE FISCAL YEAR 2019 CONTENTS Page Statement of the Board of Directors’ Members .......................................................................................................... 4 Independent Auditor’s Report ..................................................................................................................................... 5 Annual Report of the Board of Directors for the fiscal year 2019 ............................................................................. 11 Capital risk management .......................................................................................................................................... 25 Annual Consolidated and Company Financial Statements for the Fiscal Year 2019 .............................................. 47 Statement of comprehensive income for the period ended December 31 2019 & 2018 ......................................... 48 Statement of financial position as at 31st of December 2019 and at December 31, 2018 ...................................... 49 Statement of changes in equity of the Group (period 1-1 to 31-12-2019)................................................................ 50 Statement of changes in equity -

Attica Group - Premium Sales Agents Accepting Fip Cards

ATTICA GROUP - PREMIUM SALES AGENTS ACCEPTING FIP CARDS AUSTRIA ÖAMTC REISEN (1), Schubertring 1-3, A-1010 Wien, tel.: +43 1 711 99 34041, fax: +43 1 711 99 34030 e-mail: [email protected] VOIGT SEEREISEN-AGENTUR GmbH (1), Herrenholz 10-12, D-23556, Luebeck, tel.: +49 451 88 00 61 66, fax: +49 451 88 00 61 29, e-mail: [email protected] VERKEHRSBÜRO - RUEFA REISEN GmbH (2), Kärntner Ring 10, A-1010 Wien, tel.: +43 1 503 00 20 Dw 10, fax: +43 1 503 00 20 Dw 99, e-mail: [email protected] BELGIUM ARMANDO FARINA FERRIES (1), Meir 24, 2000 Antwerp, Belgium tel: +32 3 2315650, fax: +32 3 2313520, e-mail: [email protected] BULGARIA ANESI-EMDI TRAVEL LTD (1), 31,Shishman str.& 68,Vasil Levski blvd.,entr.1, Sofia 1000, Bulgaria, tel.: + 359 2 9807633, 9868822 fax: + 359 2 9818778, 9813599 e-mail: [email protected] CZECH REPUBLIC WECO-TRAVEL (CZ) S.R.O. (1), Thámova 13, Praha 8 - Karlín, 186 00 CZ, tel.: +420 234 094 155, fax: +420 234 094 156, e-mail: [email protected] FRANCE EUROMER & CIEL VOYAGES (1), 5-7, quai de Sauvages – CS10024, 34078 Montpellier cedex 3, France, tel.: +33 4 67 65 95 14, fax: +33 4 67 65 20 27, e-mail: [email protected] VIAMARE – NAVIFRANCE (1), 4, Rue de Clichy – 75009 Paris, tel.: +33 1 42 80 94 87, fax: +33 1 42 80 94 99, e-mail: [email protected] F.Y.R.O.M. AGENTUR D.O.O. - SKOPJE (1), Ruzveltova 5-A loc. -

INBOUND HYDRA-ATHENS Pre-Boarding Health Declaration

INBOUND HYDRA-ATHENS Pre-boarding health declaration questionnaire (The questionnaire is to be completed by all adults before embarkation) Name of Vessel: Shipping Company: Date and time of itinerary: Port of disembarkation: FLYING CAT 4 HELLENIC SEAWAYS 14:50 25/06/2021 HYDRA Contact telephone number for the next 14 days after disembarkation: First Name & Surname as shown Number of Aircraft in the identification Card/ Passport: Father’s name: Seat: Type Seat or Cabin Α B C D 1 Α) ECONOMY First Name & Surname of all children Β) AIRCRAFT TYPE travelling with you who are C) BUSINESS under 18 years old: D) CABIN Α B C D Α B C D Α B C D Α B C D Within the past 14 days have you or has any person listed above: YES NO 1. Presented sudden onset of symptoms of fever or cough or difficulty in breathing or sudden onset of anosmia, ageusia or dysgeusia? .................................................................................................. 2. Had close contact with anyone diagnosed as having coronavirus COVID-19 .......................................... 3. Provided care for someone with COVID-19 or worked with a health care worker infected with COVID-19?.......................................................................................................................... 4. Visited or stayed in close proximity to anyone with COVID-19? .............................................................. 5. Worked in close proximity to or shared the same classroom environment with someone with COVID-19?........................................................................................................................ 6. Travelled with a patient with COVID-19 in any kind of conveyance? ....................................................... 7. Lived in the same household as a patient with COVID-19? ..................................................................... TEST RESULTS AND VACCINATION 8. Have you been tested for COVID-19 with a molecular method (PCR) within the past 72 hours? NO PENDING RESULTS POSITIVE1 NEGATIVE 9. -

6-MONTH FINANCIAL REPORT for the PERIOD ENDED 30Th JUNE 2019

6-MONTH FINANCIAL REPORT FOR THE PERIOD ENDED 30th JUNE 2019 According to article 5 of L. 3556/2007 and relevant executive decisions of Hellenic Market Commission Board of Directors (amounts in € thousand unless otherwise mentioned) MARFIN INVESTMENT GROUP HOLDINGS S.A. 3, Achaias str. & Trizinias, 145 64 Kifissia, Greece Tel. +30 210 6893450 General Commercial Reg. Nr. 3467301000 (Societe Anonyme Reg. Nr. 16836/06/Β/88/06) INTERIM FINANCIAL REPORT FOR THE PERIOD ENDED JUNE 30th, 2019 [THIS PAGE HAS DELIBERATELY BEEN LEFT BLANK] MARFIN INVESTMENT GROUP HOLDING S.A., 3 Achaias str. & Trizinias, 145 64 Kifissia, Greece Page 2 INTERIM FINANCIAL REPORT FOR THE PERIOD ENDED JUNE 30th, 2019 Table of Contents A. REPRESENTATIONS OF THE MEMBERS OF THE BOARD OF DIRECTORS ................................................ 6 Β. INDEPENDENT AUDITOR’S REVIEW REPORT ............................................................................................... 7 C. MANAGEMENT REPORT OF THE BOARD OF DIRECTORS OF “MARFIN INVESTMENT GROUP S.A.” ON THE CONSOLIDATED AND CORPORATE FINANCIAL STATEMENTS FOR THE SIX-MONTH PERIOD ENDED AS AT 30/06/2019 .......................................................................................................................................... 9 D. INTERIM CONDENSED SEPARATE AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE PERIOD ENDED JUNE 30th 2019 ............................................................................................................................ 21 Ι. INTERIM SIX MONTH FINANCIAL STATEMENTS FOR -

MARKETS a Dismal Winter Forecast for LNG Shipping

Friday August 21, 2020 Daily Briefing Leading maritime commerce since 1734 LEAD STORY: Shipmanagers slam Singapore over Shipmanagers slam Singapore seafarer repatriation restrictions over seafarer repatriation WHAT TO WATCH: Maersk’s strategy U-turn since the restrictions 2009 financial crash pays dividends during pandemic crisis US bonds source of liquidity for selected owners State must help bankroll Greek ferry sector, says analyst OPINION: New appointments reveal Ocean Technologies’ strategy ANALYSIS: Yard Talk | Shiprecycling recovery gains momentum Rising retail sales boost US west coast throughput MARKETS: SINGAPORE HAS RECEIVED stinging criticism from shipmanager A dismal winter forecast for LNG lobby group InterManager for tougher quarantine and immigration shipping policies that it claims prevent most owners and managers from Höegh LNG seeks long-term FSRU undertaking seafarer repatriation and changeovers at the crucial contract coverage maritime hub, worsening the global crewing crisis. Navios posts second-quarter loss as dry bulk rates shrink Singapore’s Maritime and Port Authority introduced changes on July 24 that allow applications for crew sign-offs only, prioritise Singapore- IN OTHER NEWS: flagged ships, and limit approvals to those without contract extensions US retaliation challenges Hong Kong or compassionate grounds. maritime hub prospects A total of 14 seafarers missing after InterManager said restrictions imposed on non-Singapore ships ships collide “creates myriad issues to the safety of seafarers and presents a significant breach of seafarers’ humanitarian rights”. Malta urged to resolve stuck Maersk tanker with 27 rescued migrants “Their approach is everything but human-centric,” said InterManager’s Iran-UAE vessel seizures likely a ‘local director-general Kuba Szymanski.