KCG 2013 HARDWARE/IT MAP Report - SEMICONDUCTORS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

At Home with Your Computer

DEC 1995 Britain's favourite Personal Computer magazine MORTAL KOMBAT MANIA PAGE 98 Consumer PC/TVs Mortal Kombat mania ● December 1995 £2.95 Pentium Pro Arrives: Viglen’s P6 Powerhouse Overseas Price £3.95 France 110 FF Germany DM 20,00 WIN a Pentium ● Italy 18,000 Lire Spain 1,225 PTS Malta Lm 2.85c Holland HFL 17,95 Belgium 364.00 BFr Notebook p.266 Group Tests : Anti-virus packages, Storage and backup media Finland FIM 49.50 Canada CAN$12.95 VNU Business Publications At home with your PC/TVsPC/TVs computer ● Office hybrids: printer/fax/scanner Pentium Pro arrives First glimpse of ● HP Omnibook 600CT Viglen’s P6 Office hybrids Printer/ ● fax/ RAM Doublers scanner RAM Doublers Memory for less? IF YOUR CD-ROM OR 3.5" DISK ARE MISSING Anti-Virus packages ASK YOUR NEWSAGENT Seven of the best tested ALL HARDWARE TESTED BY THE VNU LABS VOL18 NO12 Group Test All sorts of storage stuff December 1995 PCW December 1995 Contents Regulars Hands On 110 Group Tests First Impressions 55 18 Newsprint PCTVs Storage and Backup 56 Gadgets Macro virus sweeps the world. Intel 134 launches the (P6) Pentium Pro. First 60 HP Omnibook 600 CT Cited as the next big growth Hardware look at “Pentium class” chip for hand- ● Often a secondary concern, storage and The latest model in Hewlett-Packard’s helds. Eight-speed CD drives. New area for PCs, the home Omnibook range will give your desktop print system sprouts cheap lasers. backup devices play an important part in com- a run for its money. -

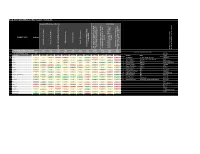

KCG 2013 HARDWARE/IT MAP Report - SERVERS

KCG 2013 HARDWARE/IT MAP Report - SERVERS Program Effectiveness Metrics Shortlisting DUMMY DATA Analysts vendor months 2=REACTIVE Responsiveness Efficacyof Comms OverallEffectiveness Access Executives to Interactions perQuarter that would shortlist vendor that would net yearnet on increase or Proactivity (1=PROACTIVE- last 3 months in THIS segment last 3months in Likely or Very Likely to shortlist Likely or Very shortlisted THIS vendor in last3 shortlisted % of analysts that are % of responding they shortlisted THIS vendor in the they shortlisted Total number of analysts Indicating number of analystsIndicating Total (decrease)in percentage ofanalysts %of analyststhat shortlist that have Quality and Availability of References Availability Quality and threshold of analyst responses (20%) Vendors receivingless than Vendors SERVERS SEGMENT AVERAGE 3.25 6.69 6.13 5.80 7.08 6.69 1.51 10.82 33% 48% 14% 2013 HARDWARE/IT SAPA AVERAGE 3.17 6.64 6.09 5.82 7.06 6.67 1.49 10.15 32% 48% 13% ANALYSTS PARTICIPATING ATTO Analysts Participating 14 BlueArc Vendor Count IPQ AE REF EFF RESP OE PRO 3 MOS %3 MOS LTS YOY Analyst Firm Canon 22 Acer 14 3.07 6.14 5.00 4.69 7.43 6.93 1.31 5 30% 31% 0% 1 Tim Bajarin Creative Strategies, Inc Panasas AMD 12 3.08 7.00 6.08 5.83 7.17 6.83 1.42 3 26% 50% 0% 2 Tony Prigmore Enterprise Strategy Group Pillar Apple 15 3.00 7.00 6.07 7.06 7.13 7.71 1.93 10 33% 61% 0% 3 Andrew Butler Gartner PMC/Adaptec ARM 31 4.52 7.00 6.06 5.18 7.26 6.86 1.59 20 40% 55% 37% 4 Donna Scott Gartner Scale Computing Cisco 36 4.25 6.08 5.69 5.95 -

Federal Register/Vol. 67, No. 86/Friday, May 3, 2002/Notices

29276 Federal Register / Vol. 67, No. 86 / Friday, May 3, 2002 / Notices TO APPENDIX TO MEMORANDUM OF ‘‘We’ve been trying to get into the Microsoft’s ?? advantage—that it devel??ps AMICI CURIAE IN OPPOSITION TO networking capability of Microsoft’s products both the basic operating-system ??oftware PROPOSED FINAL JUDGMENT IN CIVIL and find there’s one con, non theme: that makes personal com??ters run, known as ACTION NO. 94–1564 NETBIOS,’’ Caro said. Microsoft does not yet MS-DOS. and ??pphactons software, like SIGNED BY GARY REBACK support native TCP/IP, but uses NETBIOS or word-pro??essing programs or spreadsheets, 2ND STORY of Level I printed in FULL NETBEUI encapsulated within TCP/IP, he ??nat perform spec?? ?? format. Copyright 1994 Network World, Inc. said. ‘‘Microsoft s whole empire is based in the Network World July 25, 1994 94–1564 ‘‘we’re totally uninterested in any interlocking nature of their ??perating-system FILED FEB 14 1995 approach like this; it can’t handle a network and application oftware.’’ said William Joy, SECTION: TOP NEWS; Pg. 4 of more than 50 users and is terrible over the a ??ounder of Sun Microsystems, and the LENGTH: 724 words wide area,’’ Caro said. ??uthor of one version of the Unix Perating HEADLINE: Microsoft free at last?; And Windows NT has proved unable to system. Ruling still lets firm incorporate apps in its handle the applications that Otis wants to ??Vol a Central Issue Microsoft officials OSes. take off its mainframe system, because said Saturday ??nal issues related to the Clerk, U.S. -

Beyond the PC

SPECIAL REPORT PERSONAL TECHNOLOGY October 8th 2011 Beyond the PC Personaltechnology.indd 1 26/09/2011 15:09 SPECIAL REPORT PERSONAL TECHNOLOGY Beyond the PC Mobile digital gadgets are overshadowing the personal computer, says Martin Giles. Their impact will be far-reaching IF YOU HAVE a phone, these days even space is within reach. Last year Luke Geissbühler and his son, who live in Brooklyn, popped a high-de- nition video camera and an Apple iPhone into a sturdy protective box with a hole for the camera’s lens. They attached the box to a weather bal- loon, which they released about 50 miles (80km) outside New York City, after getting the approval of the authorities. The balloon soared into the stratosphere and eventually burst. A parachute brought it to the ground. By tracking the iPhone’s inbuilt global positioning system, the Geissbüh- lers were able to retrieve the box and the video of their mission, which shows the curvature of the planet clearly. The results can be seen at www.brooklynspaceprogram.org. The iPhone and other smartphones are proving extremely useful on Earth too. These devices, which let people download and install applications, or apps, from online stores run by phonemakers, tele- coms companies and others, are starting to displace ordinary mobile phones in many countries. Ofcom, Britain’s telecoms regulator, recently reported that CONTENTS more than one in four adults there uses a smart- phone. Nielsen, a market-research rm, reckons the 3 Consumerisation devices make up the majority of mobile-phone pur- The power of many chases in America. -

A Circular Economy for Smart Devices Opportunities in the US, UK and India Contents

A circular economy for smart devices Opportunities in the US, UK and India Contents Summary 2 1. Introduction: good devices, bad systems 3 2. Six circular economy models 6 3. Market opportunities in the US, UK and India 21 4. The benefits of a circular economy for smart devices 26 5. Annex: methodology 33 1 Summary Smartphones, tablets and laptops have analysis reveals that a two year old flagship of consumers without a smartphone, who moved from the fringe of computing to the smartphone can be more attractive than tend to be older and less well off. mainstream in just five years. Sales of these today’s mid to low tier best sellers. It shows smart devices exploded as consumers saw that repair makes economic and The saturated market for laptops, by the benefits of seamless connectivity, and environmental sense for at least four years, contrast, would be better suited to circular were drawn to the simplicity of new user and up to seven in some cases. And it economy models which keep laptops with interfaces. In many cases, the environment demonstrates that keeping a mobile phone a single user for longer. benefited too, as energy efficient devices in use for just one extra year cuts its displaced older computers, and new lifetime CO2 impact by a third. In India, low labour costs and more mobile-enabled cloud systems became standardised hardware in cheaper devices platforms for efficiency across the economy. Just as there isn’t a single business model make harvesting parts a viable strategy. for smart devices, there isn’t a single route Similarly, India’s existing network of small Unfortunately, this isn’t the whole story. -

Doubledisksuperpack

OCT 1995 October 1995 £2.95 Overseas Price £3.95 FX Fighter - France 75 FF Germany DM 20,00 Italy 18,000 Lire Spain 1,225 PTS Malta Lm2.85c Virtua Fighter on the PC? Holland HFL 17,95 Belgium 364.00 BFr p248 Finland FIM 49.50 Canada CAN$12.95 VNU Business Publications Docking Notebooks PCMCIA round-up Britain's favourite personal computer magazine DockingDocking ● SOFTWARE: CAD / Visual Basic 4 RAM Doubler for Windows ● PC CARDS 4 DX4 100MHz PCs The ultimate NotebooksNotebooks portable PORTABLEPORTABLE DESKTOPS?DESKTOPS? accessories SOFTWARE INTERNETINTERNET CAD round-up SERVICESSERVICES ● Visual Basic 4 Buyer’sBuyer’s GuideGuide INTERNET SERVICE PROVIDERS RAM Doubler for Windows DX4 100MHz Fast and 4affordable PCs ALL HARDWARE TESTED BY THE VNU LABS VOL15 NO10 VOL15 NO10 Now with INTERACTIVE DOUBLE DISK SUPER PACK CD-ROM and 3.5in disk PERSONAL COMPUTER WORLD CYAN•MAGENTA•YELLOW•BLACK October 1995 PCW October 1995 Contents Group Test First Impressions 61 Regulars Hands On Docking 18 Newsprint Internet Service Providers 62 NEW! Gadgets Microsoft’s gamble in launching Windows notebooks A monthly round-up of quirky and 95 in the face of a threatened lawsuit pays useful devices to tickle your fancy. Computing on the move ● The first step in getting off; Universal Serial Bus could spell the end of the PC’s serial port; Dorling-Kinder- and power on the desktop wired is to choose your 66 Apple PowerBook 5300 sley launches CD-ROM titles for adults The highly desirable PowerBook note- — a notebook with a dock- service provider, but and children; Netscape hits the £38 million with so many to choose books could only be bettered by a mark; Prisoner banned from using laptop PowerPC processor. -

Apple Confidential 2.0 the Definitive History of the World's Most Colorful

vi Reviewers love Apple Confidential “The Apple story itself is here in all its drama.” New York Times Book Review “An excellent textbook for Apple historians.” San Francisco Chronicle “Written with humor, respect, and care, it absolutely is a must-read for every Apple fan.” InfoWorld “Pretty much irresistible is the only way to describe this quirky, highly detailed and illustrated look at the computer maker’s history.” The Business Reader Review “The book is full of basic facts anyone will appreciate. But it’s also full of interesting extras that Apple fanatics should love.” Arizona Republic “I must warn you. This 268-page book is hard to put down for a MacHead like me, and probably you too.” MacNEWS “You’ll love this book. It’s a wealth of information.” AppleInsider “Rife with gems that will appeal to Apple fanatics and followers of the computer industry.” Amazon.com “Mr. Linzmayer has managed to deliver, within the confines of a single book, just about every juicy little tidbit that was ever leaked from the company.” MacTimes “The most entertaining book about Apple yet to be published.” Booklist i …and readers love it too! “Congratulations! You should be very proud. I picked up Apple Confidential and had a hard time putting it down. Obviously, you invested a ton of time in this. I hope it zooms off the shelves.” David Lubar, Nazareth, PA “I just read Apple Confidentialfrom cover to cover…you have written a great book!” Jason Whong, Rochester, NY “There are few books out there that reveal so much about Apple and in such a fun and entertaining manner. -

2Nd Pre-Conf Guide

REGISTER NOW! Enterprise Professionals: Complimentary Exhibit Hall Admission www.cebit-america.com (see page 15) MayMay 2525 –– 27,27, 20042004 JavitsJavits CenterCenter NewNew YorkYork CityCity TechnologyTechnology decisionsdecisions cancan bebe puzzling.puzzling. findfind allall ofof youryour enterpriseenterprise technologytechnology answersanswers here.here. Platinum Media Sponsor: Platinum Conference Sponsor: Program Partner: REGISTER NOW! www.cebit-america.com See Page 4 See Page 20 See Pages 24-25 Keynote Speakers: See Page 4 THOMAS M. SIEBEL MICHAEL D. CAPELLAS KATHRYN A. WALKER Chairman and Chief Chairman, President and Executive Vice President Executive Officer Chief Executive Officer Network Services 1 CeBIT America is your opportunity to: ❑✔Expand your decision making knowledge ❑✔Test drive the newest solutions and innovations ❑✔Gain Insight from industry leaders and visionaries Overview ❑✔Network with peers and share best practices ❑✔Sharpen your competitive edge in the marketplace What is CeBIT America? CeBIT America is the leading Information & Communications Technology (ICT) event for the Enterprise Business Marketplace – combining a broad-based mix of products and services to provide insight, information and answers to all of your enterprise technology needs. This world-class event brings together buyers and sellers of Information & Communications Technologies to share industry perspectives, network and conduct business. CeBIT America’s exhibition floor and conference programs are designed to provide a fresh look at ICT -

Apple Computer, 2006

9-706-496 REV: MAY 30, 2007 DAVID B. YOFFIE MICHAEL SLIND Apple Computer, 2006 Early in 2006, following a surge in the stock price for Apple Computer, CEO Steve Jobs savored a moment of triumph over one of his chief rivals in the personal computer (PC) industry. In an e-mail to his employees, he quipped that “Michael Dell wasn't perfect at predicting the future. Based on today's stock market close, Apple is worth more than Dell [Inc., Dell’s namesake company]. Stocks go up and down, and things may be different tomorrow, but I thought it was worth a moment of reflection today.”1 Back in 1997, not long before Jobs returned to the company that he had founded, Dell had recommended that Apple throw in the proverbial towel: “I’d shut it down and give the money back to the shareholders.”2 Dell’s remark was not without warrant. Apple had just gone through five years of turmoil. But not quite a decade later, Apple was riding high. In the fiscal year 2005, it posted $1.3 billion in net income on $13.9 billion in sales, and recorded an operating margin of 11.8%. Since 2001, its sales had grown at a compound annual rate of 27%. Early in 2006, its stock was trading at an all-time high of $86 a share—up from its 1997 low of $7.3 Jobs had made several dramatic moves since returning to Apple. He had pushed the company to turn out innovative products, such as the iMac and the OS X operating system. -

Brand Impact Awards 2007 Presented By: Liquid Agency | Brand Marketing

Liquid Agency | Brand Marketing Brand Impact Awards 2007 Presented by: Liquid Agency | Brand Marketing In partnership with: Socratic Technologies In conjunction with: Liquid Brand Summit 2007 May 15, 2007 The Four Seasons Hotel, Palo Alto, CA Brand Impact Awards 2007 Brand Impact Awards 2007 Brand Impact Awards 2007 A new way to measure technology brands. Liquid Agency started the Brand Impact Awards to create a new standard for measuring the effectiveness of brands. This initiative was launched in 2007 in partnership with So- cratic Technologies, a respected marketing research firm, and in its first year we focused on technology brands. The Brand Impact Awards combine quantitative research measuring Awareness, Consideration, Preference and Purchase Intent - as well as Brand Reputation levels. The results from the study were supplemented with a review by a panel of expert judges. A combination of all of this data helped determine the winners of the Brand Impact Awards. The research study evaluated more than 200 technology brands, and winners were selected in 22 categories that included B2C and B2B brands. Special awards were given to the overall Brand of the Year, as well as the winners of the B2C and B2B segments. www.liquidagency.com Brand Impact Awards 2007 Liquid Agency The Brand Impact Awards were started by Liquid Agency, a leading brand marketing firm based in Silicon Valley, as a way to recognize the brands that create the most impactful and effec- tive brand marketing programs. This initiative is part of Liquid Agency’s commitment to furthering the strategic role of brands as a key element for long term busi- ness success. -

19 Jobs After Apple

Jobs After Apple: To NeXT and Beyond Jobs After Apple: To NeXT and Beyond After being stripped of all operational responsibilities on May 31, 1985, Jobs had little to do at Apple, so he began canvassing the country’s colleges asking them to describe their ideal university computer. In early September, Jobs had lunch with Paul Berg, Nobel laureate and Stanford University biochemist. When Berg complained of the At the time he left Apple, Jobs owned difficulty of performing “wet-lab” research on gene splicing, Jobs roughly 6.5 million shares of stock, or suggested simulating the experiments on a computer. Berg was about 11.3 percent of the company. Over the course of the year, Jobs began supposedly so enthusiastic about the idea that Jobs realized he was liquidating his massive holdings at what onto something big. Within weeks Jobs decided to launch a startup would prove to be fire-sale prices. with five other Apple employees: Susan Barnes (senior controller for According to Securities and Exchange U.S. sales and marketing), George Crow (engineering manager), Dan’l Commission records, Jobs dumped 4.028 million shares in 1985 for $70.5 Lewin (higher education marketing manager), Rich Page (Apple million. By February 1986, Jobs claimed Fellow), and Guy “Bud”- Tribble (manager of software engineering). to have sold all but one share, so that he would still receive Apple’s annual When Jobs announced his plans to Apple’s board of directors, it reports. Assuming this is true and that he managed to sell at the highest price initially expressed an interest in investing in the new venture, Next realized by February, the most he could Inc. -

Altercasting As It Applies to Apple Technology

1 THE PHENOMENON BEHIND THE BITE: ALTERCASTING AS IT APPLIES TO APPLE TECHNOLOGY A RHETORICAL STUDY by Elizabeth M. Baldwin THESIS Presented to the Faculty of The Graduate College at Liberty University In Partial Fulfillment of Requirements For the Degree of Masters of Communication Major: Media Communication Under the Supervision of Dr. Stuart Schwartz Lynchburg, Virginia 2 Thesis Committee ____________________________________________ Stuart H. Schwartz, Ph. D., Chairperson ____________________________________________ Professor Todd Smith ____________________________________________ Cliff Kelly, Ph. D. 3 Copyright 2013 Elizabeth M. Baldwin All Rights Reserved 4 This Project is Dedicated to My Amazing Family- Wes, Margie, David and Mary Baldwin Whose love and support have given me the energy and encouragement to follow my goals every step of the way. 5 Acknowledgements First, I would like to thank my thesis chairman, Dr. Stuart Schwartz. He has been amazing to work with, encouraging me along the way, giving me revision after revision and years of knowledge from corporate advertising industry. I have had the privilege to have Dr. Schwartz in undergraduate studies and my graduate studies as well. His humor, dedication to the art of communication and love for the Lord has helped me make this thesis what it is. I would also like to thank my readers, Dr. Cliff Kelly and Professor Todd Smith. I took Dr. Kelly in my undergraduate classes and stayed in contact over the last several years. A man of God dedicated to encouraging and bringing positivity to his students, I cannot thank you enough, Dr. Kelly, for telling me to apply for graduate school, that one rainy day in the Ford dealership- you have helped shape my path in ways I could not repay you.