Analysis of Present States and Future Prospects「Term 2019.3 (Apr. 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

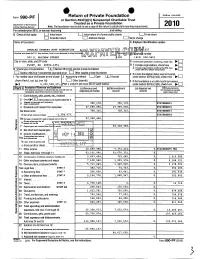

Form 990-P F Return of Private Foundation

Private Foundation OMB No 1545-0052 Form 990-P F Return of or Section 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury Treated as a Private Foundation internal Revenue Service Note. The foundation may be able to use a copy of this return to satisfy state reporting requirements. 2010 For calendar year 2010 , or tax year beginning , and ending G Check all that apply. IInitial return L-J Initial return of a former public charity L-J Final return 0 Amended return 0 Address change 0 Name change Name of foundation A Employer identification number CHARLES STEWART MOTT FOUNDATION `V/ D ( 1 1227 Number and street (or P O box number if mail is not delivered to street addr I r v { suV a) epho number 503 S. SAGINAW STREET u 1 2000 `J (810) 238-5651 C if exemption application is check City or town, state, and ZIP code pend i ng, here _ ► FLINT , MI 48502-1851 0 1- Foreign organizations, check here 2. 85% test H Check type of organization: x Section 501(c)(3) exempt private foundation Fcine there and attach computation 4947(a)(1) nonexem pt charitable trust 0 Other taxable private foundation 0 Section E If private foundation status was terminated Fair market value of all assets at end of year J Accounting method: L-J Cash x Accrual I under section 507(b)(1)(A), check here ► ^ (from Part ll, col. (c), line 16) 0 Other (specify) F If the foundation is in a 60-month termination 2, 230 528 471. -

Analysis of Present States and Future Prospects「Term 2021.3 (Apr. 2020

Term 2021.3(Apr.2020~Sep.2020) Outline of Financial Results Potomac Mills ( Woodbridge, Virginia, USA) September 26, 2020 Open! Analysis of consolidated operating results Apr. 2020~Sep.2020 Actual [Year-on-year] ※(Unit ¥bn) ※Figures below ¥10 million have been truncated. Percentage is rounded off to one decimal place. ① [Differ in number of stores] Japan(103 stores) Term 2020.3 Actual Term 2021.3 Actual Differ Unit The USA(43 stores):9 stores opened (2019.4~2019.09) (2020.4~2020.09) (%) ② 【No. of months stores were open during the term】 Total stores at the Due to the effect of the closing down, the description Store end of the term ① 137 146 +6.6 is not included. Stores No. of months total ③ 【Ordinary income】 stores operation Month 818 ② ― ― Term 2020.3 2nd Q Actual Ordinary income ¥5.70bn Bowling 12.05 5.25 (56.4) ◆Japan Ordinary income & loss ¥(14.13)bn Amusement 27.08 12.96 (52.1) [Breakdown] Decrease in sales ¥(22.23)bn Karaoke Decrease in promotion exp. +¥1.65bn (including other sales of The USA) 5.66 1.67 (70.5) (Amusement merchandise exp., etc.) Spo-cha 6.81 2.28 (66.5) Decrease in personnel exp. +¥1.32bn Decrease in purchases +¥0.78bn Others 1.58 1.08 (31.7) Decrease in rent exp. +¥0.72bn Total sales 53.18 23.26 (56.3) Decrease in advertising exp. +¥0.65bn Decrease in utility exp. +¥0.63bn Cost of sales 45.69 36.03 (21.1) Decrease in communication exp. +¥0.58bn Gross profit 7.49 (12.77) ― Decrease in other exp. -

Round One / 4680 Rcoverage Update Notes Research Coverage Report by Shared Research Inc

Round One / 4680 RCoverage Update Notes Research Coverage Report by Shared Research Inc. | https://sharedresearch.jp This PDF document is an updated note on the company. A comprehensive version of the report on the company, including this latest update, is available on our website and various professional platforms. On May 11, 2020, Round One Corporation announced earnings results for full-year FY03/20. Cumulative FY03/19 FY03/20 FY03/20 (JPYmn) Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 % of FY FY Es t . Sales 22,404 48,869 71,896 101,318 25,554 53,188 77,046 104,779 97.3% 107,640 YoY 4.8% 5.7% 4.6% 5.6% 14.1% 8.8% 7.2% 3.4% 6.2% Gross profit 1,861 6,131 7,466 14,460 3,163 7,496 8,287 12,377 YoY 21.6% 13.6% 8.2% 12.6% 70.0% 22.3% 11.0% -14.4% GPM 8.3% 12.5% 10.4% 14.3% 12.4% 14.1% 10.8% 11.8% SG&A expenses 662 1,471 2,212 3,016 802 1,682 2,543 3,497 YoY 19.1% 30.8% 33.8% 30.9% 21.1% 14.3% 15.0% 15.9% SG&A ratio 3.0% 3.0% 3.1% 3.0% 3.1% 3.2% 3.3% 3.3% Operating profit 1,199 4,660 5,254 11,443 2,360 5,813 5,744 8,880 75.2% 11,810 YoY 23.0% 9.2% 0.1% 8.6% 96.8% 24.7% 9.3% -22.4% 3.2% OPM 5.4% 9.5% 7.3% 11.3% 9.2% 10.9% 7.5% 8.5% 11.0% Recurring profit 1,133 4,511 5,040 11,220 2,341 5,702 5,557 8,721 75.2% 11,600 YoY 28.6% 10.7% 1.3% 9.3% 106.6% 26.4% 10.3% -22.3% 3.4% RPM 5.1% 9.2% 7.0% 11.1% 9.2% 10.7% 7.2% 8.3% 10.8% Net income 781 3,001 3,278 7,159 1,441 3,705 3,531 4,794 74.7% 6,420 YoY 120.0% 22.2% 7.9% -14.9% 84.5% 23.5% 7.7% -33.0% -10.3% Net margin 3.5% 6.1% 4.6% 7.1% 5.6% 7.0% 4.6% 4.6% 6.0% Quarterly FY03/19 FY03/20 (JPYmn) Q1 Q2 Q3 Q4 Q1 Q2 Q3 -

201 ,QWHUQDWLRQDO 9Aluation Handbook ,QGXVWU\ Cost of Capital

201,QWHUQDWLRQDO9aluation Handbook ,QGXVWU\ Cost of Capital Market Results Through0DUFK 2015 Duff & Phelps &RPSDQ\/LVW 1RWH 7KLV GRFXPHQW SURYLGHV D OLVW RI WKH FRPSDQLHV XVHG WR SHUIRUP WKH DQDO\VHV SXEOLVKHG LQ WKH ,QWHUQDWLRQDO 9DOXDWLRQ +DQGERRN ̰ ,QGXVWU\ &RVW RI &DSLWDO GDWD WKURXJK 0DUFK 7KHLQIRUPDWLRQ KHUHLQ LV VSHFLILF WR WKH KDUGFRYHU ,QWHUQDWLRQDO 9DOXDWLRQ +DQGERRN ̰,QGXVWU\ &RVW RI &DSLWDO GDWD WKURXJK 0DUFK DQG LV QRW DSSOLFDEOH WR DQ\ RWKHU ERRN XSGDWH RU GRFXPHQW Cover image: Duff & Phelps Cover design: Tim Harms Copyright © 2016 by John Wiley & Sons, Inc. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions. The foregoing does not preclude End-users from using the 2015 International Valuation Handbook ࣓ Industry Cost of Capital and data published therein in connection with their internal business operations. -

Analysis of Present States and Future Prospects「Term 2019.3 (Apr. 2018

Term 2019.3 (Apr. 2018~Mar. 2019) Outline of Financial Results Promenade Temecula(Temecula, California) March 30, 2019 open! Analysis of consolidated operating results ① Apr. 2018~Mar. 2019 Actual [Year-on-year] ※(Unit ¥bn) ※Figures below ¥10 million have been truncated. Percentage is rounded off to one decimal place. Term 2018.3 Actual Term 2019.3 Actual ① [Differ in number of stores] Unit Differ(%) Japan (105 stores): 1 store opening, 4 store closings (2017.4~2018.3) (2018.4~2019.3) The USA (32 stores): 11 store openings Total stores at the ② [Ordinary income] end of the term ① Store 129 137 +6.2 Stores No. of months total Term 2018.3 Actual Ordinary income ¥10.26bn stores operation Month 1,496 1,560 +4.3 Japan Ordinary income & loss +¥0.44bn Bowling 24.52 24.29 (0.9) [Breakdown] Increase in sales +¥0.64bn Amusement 45.34 49.68 +9.6 Decrease in repairing exp. +¥0.41bn Karaoke (including other sales of the USA) 9.84 10.94 +11.1 Decrease in personnel exp. +¥0.30bn Increase in promotion exp. ¥(0.56)bn Spo-cha 13.28 13.46 +1.3 (Due to amusement merchandise exp. increase) Increase in purchase ¥(0.13)bn Others 2.90 2.92 +0.7 Increase in advertising exp. ¥(0.12)bn Total sales 95.91 101.31 +5.6 Others ¥(0.10)bn Cost of sales 83.06 86.85 +4.6 The USA Ordinary income & loss +¥0.52bn [Breakdown] Increase in sales due to increase in Gross profit 12.84 14.46 +12.6 No. -

Round One / 4680

R Round One / 4680 COVERAGE INITIATED ON: 2009.07.07 LAST UPDATE: 2018.04.05 Shared Research Inc. has produced this report by request from the company discussed in the report. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, and neutral analysis. In order to highlight any biases, we clearly attribute our data and findings. We will always present opinions from company management as such. Our views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. Round One / 4680 RCoverage LAST UPDATE: 2018.04.05 Research Coverage Report by Shared Research Inc. | www.sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the business section later in the report. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 4 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- 5 Highlights ------------------------------------------------------------------------------------------------------------------------------------------------------------5 -

Analysis of Present States and Future Prospects「Term 2020.3 (Apr. 2019

Term 2020.3 (Apr. 2019~Sep. 2019) Outline of Financial Results Meadowood Mall (Reno, Nevada) August 17, 2019 open! Analysis of consolidated operating results ① Apr. 2019~Sep. 2019 Actual [Year-on-year] (Unit ¥bn) ※Figures below ¥10 million have been truncated. Percentage is rounded off to one decimal place. ① Term 2019.3 Actual Term 2020.3 Actual [Differ in number of stores] Unit Differ(%) Japan (103 stores): 3 store closings (2018.4~2018.9) (2019.4~2019.9) The USA (34 stores): 9 store openings Total stores at the end ② [Ordinary income] of the term ① Store 131 137 +4.6 Stores No. of months total Term 2019.3 2nd Q Actual Ordinary income ¥4.51bn stores operation Month 768 818 +6.5 Bowling 11.59 12.05 +3.9 Japan Ordinary income & loss +¥1.17bn [Breakdown] Increase in sales +¥1.84bn Amusement 23.99 27.08 +12.9 Karaoke Decrease in rent fee +¥0.10bn (including other sales of the USA) 5.14 5.66 +10.0 Increase in interest exp. ¥(0.25)bn Spo-cha 6.67 6.81 +1.9 Increase in lease fee ¥(0.20)bn Others 1.44 1.58 +9.4 Increase in Depreciation ¥(0.19)bn Total sales Increase in promotion exp. ¥(0.14)bn 48.86 53.18 +8.8 (Due to amusement merchandise exp. increase) Cost of sales 42.73 45.69 +6.9 Others +¥0.01bn Gross profit 6.13 7.49 +22.3 The USA Ordinary income & loss +¥0.03bn [Breakdown] Increase in income due to increase in P / L S.G.A. -

Company Overview Valuation Data Source

Valuation Data Source company overview No. Company No. Company No. Company "Bank "Saint-Petersburg" Public 60 AbClon Inc. 117 Activision Blizzard, Inc. 1 Joint-Stock Company Abdullah Al-Othaim Markets 118 Actron Technology Corporation 61 2 1&1 Drillisch AG Company 119 Actuant Corporation 3 1-800-FLOWERS.COM, Inc. Abdulmohsen Al-Hokair Group for 120 Acuity Brands, Inc. 62 4 11 bit studios S.A. Tourism and Development Company 121 Acushnet Holdings Corp. 5 1st Constitution Bancorp 63 Abengoa, S.A. 122 Ad-Sol Nissin Corporation 6 1st Source Corporation 64 Abeona Therapeutics Inc. 123 Adairs Limited 7 21Vianet Group, Inc. 65 Abercrombie & Fitch Co. 124 ADAMA Ltd. 8 22nd Century Group, Inc. 66 Ability Enterprise Co., Ltd. 125 Adamas Pharmaceuticals, Inc. Ability Opto-Electronics Technology 126 Adamis Pharmaceuticals Corporation 9 2U, Inc. 67 Co.,Ltd. 127 Adani Enterprises Limited 10 3-D Matrix, Ltd. 68 Abiomed, Inc. 128 Adani Gas Limited 11 361 Degrees International Limited 69 ABIST Co.,Ltd. 129 Adani Green Energy Limited 12 3D Systems Corporation 70 ABL Bio Inc. Adani Ports and Special Economic 13 3i Group plc 130 71 Able C&C Co., Ltd. Zone Limited 14 3M Company 131 Adani Power Limited 72 ABM Industries Incorporated 15 3M India Limited 132 Adani Transmissions Limited 73 ABN AMRO Bank N.V. 16 3S KOREA Co., Ltd. 133 Adaptimmune Therapeutics plc 74 Aboitiz Equity Ventures, Inc. 17 3SBio Inc. 134 Adastria Co., Ltd. 75 Aboitiz Power Corporation 18 500.com Limited 135 ADATA Technology Co., Ltd. 76 Abraxas Petroleum Corporation 19 51 Credit Card Inc. -

Printmgr File

352913_001-Pinnacle ARCvr Eng9_007409-Pinnacle ARCvr Eng.qx10 17/03/2017 01:46 Page 1 ® Scotia Private Pools and Pinnacle Portfolios For more information about Scotia Private Pools ® and Pinnacle Portfolios: Annual Report visit: www.scotiabank.com/scotiaprivatepools December 31, 2016 www.scotiabank.com/pinnacleportfolios Money Market Fund call: Scotia Private Short Term Income Pool 1-800-268-9269 (English) Bond Funds Scotia Private Income Pool 1-800-387-5004 (French) Scotia Private High Yield Income Pool Scotia Private American Core-Plus Bond Pool Balanced Fund write: Scotia Private Strategic Balanced Pool 1832 Asset Management L.P. Canadian Equity Funds 1 Adelaide Street East Scotia Private Canadian Value Pool 28th Floor Scotia Private Canadian Mid Cap Pool Scotia Private Canadian Growth Pool Toronto, Ontario Scotia Private Canadian Small Cap Pool M5C 2V9 Foreign Equity Funds Scotia Private U.S. Value Pool Scotia Private U.S. Mid Cap Value Pool Scotia Private U.S. Mid Cap Growth Pool Scotia Private U.S. Large Cap Growth Pool Scotia Private International Equity Pool Scotia Private International Small to Mid Cap Value Pool Scotia Private Emerging Markets Pool Scotia Private Global Equity Pool Scotia Private Global Real Estate Pool Pinnacle Portfolios Pinnacle Income Portfolio Pinnacle Balanced Portfolio Pinnacle Growth Portfolio ® Registered trademark of The Bank of Nova Scotia, used under licence. SM54D 9098E-1 (03/17) Table Financial Statements 1 Money Market Fund of Contents 3 Scotia Private Short Term Income Pool Bond Funds 6 Scotia Private Income Pool 10 Scotia Private High Yield Income Pool 18 Scotia Private American Core-Plus Bond Pool Balanced Fund 29 Scotia Private Strategic Balanced Pool Canadian Equity Funds 36 Scotia Private Canadian Value Pool 41 Scotia Private Canadian Mid Cap Pool 47 Scotia Private Canadian Growth Pool 52 Scotia Private Canadian Small Cap Pool Foreign Equity Funds 56 Scotia Private U.S. -

Scotia Private Pools®

516607_001-Pinnacle ARCvr Eng9_007409-Pinnacle ARCvr Eng.qx10 10/01/2018 21:46 Page 1 ® Scotia Private Pools and Pinnacle Portfolios For more information about Scotia Private Pools ® and Pinnacle Portfolios: Annual Report visit: www.scotiabank.com/scotiaprivatepools December 31, 2017 www.scotiabank.com/pinnacleportfolios Money Market Fund call: Scotia Private Short Term Income Pool 1-800-268-9269 (English) Bond Funds Scotia Private Income Pool 1-800-387-5004 (French) Scotia Private High Yield Income Pool Scotia Private American Core-Plus Bond Pool Scotia Private Global High Yield Pool write: Balanced Fund 1832 Asset Management L.P. Scotia Private Strategic Balanced Pool 1 Adelaide Street East Canadian Equity Funds 28th Floor Scotia Private Canadian Value Pool Scotia Private Canadian Mid Cap Pool Toronto, Ontario Scotia Private Canadian Growth Pool M5C 2V9 Scotia Private Canadian Small Cap Pool Foreign Equity Funds Scotia Private U.S. Value Pool Scotia Private U.S. Mid Cap Value Pool Scotia Private U.S. Large Cap Growth Pool Scotia Private International Equity Pool Scotia Private International Small to Mid Cap Value Pool Scotia Private Emerging Markets Pool Scotia Private Global Equity Pool Scotia Private Global Infrastructure Pool Scotia Private Global Real Estate Pool Pinnacle Portfolios Pinnacle Income Portfolio Pinnacle Balanced Portfolio Pinnacle Growth Portfolio ® Registered trademark of The Bank of Nova Scotia, used under licence. SM54D 9098E-1 (03/18) Table Financial Statements 1 Money Market Fund of Contents 3 Scotia Private Short Term Income Pool Bond Funds 6 Scotia Private Income Pool 10 Scotia Private High Yield Income Pool 19 Scotia Private American Core-Plus Bond Pool 29 Scotia Private Global High Yield Pool Balanced Fund 31 Scotia Private Strategic Balanced Pool Canadian Equity Funds 37 Scotia Private Canadian Value Pool 42 Scotia Private Canadian Mid Cap Pool 47 Scotia Private Canadian Growth Pool 52 Scotia Private Canadian Small Cap Pool Foreign Equity Funds 56 Scotia Private U.S. -

Shared Research Inc

SymBio Pharmaceuticals / 4582 COVERAGE INITIATED ON: 2014.10.31 LAST UPDATE: 2019.09.25 Shared Research Inc. has produced this report by request from the company discussed in the report. The aim is to provide an “owner’s manual” to investors. We at Shared Research Inc. make every effort to provide an accurate, objective, and neutral analysis. In order to highlight any biases, we clearly attribute our data and findings. We will always present opinions from company management as such. Our views are ours where stated. We do not try to convince or influence, only inform. We appreciate your suggestions and feedback. Write to us at [email protected] or find us on Bloomberg. Research Coverage Report by Shared Research Inc. SymBio Pharmaceuticals / 4582 RCoverage LAST UPDATE: 2019.09.25 Research Coverage Report by Shared Research Inc. | www.sharedresearch.jp INDEX How to read a Shared Research report: This report begins with the trends and outlook section, which discusses the company’s most recent earnings. First-time readers should start at the business section later in the report. Executive summary ----------------------------------------------------------------------------------------------------------------------------------- 3 Key financial data ------------------------------------------------------------------------------------------------------------------------------------- 5 Recent updates ---------------------------------------------------------------------------------------------------------------------------------------- -

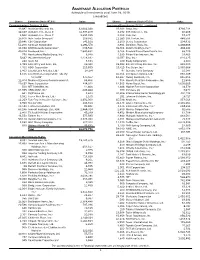

Aggressive Allocation Portfolio

AGGRESSIVE ALLOCATION PORTFOLIO Schedule of Investments as of June 28, 2019 (unaudited) Shares Common Stock (47.6%) Value Shares Common Stock (47.6%) Value Communications Services (2.6%) Consumer Discretionary (5.2%) - continued 43,687 Activision Blizzard, Inc. $2,062,026 37,303 Crocs, Inc.a $736,734 10,689 Alphabet, Inc., Class Aa 11,574,049 3,292 CSS Industries, Inc. 16,065 1,533 Alphabet, Inc., Class Ca 1,657,035 3,013 Culp, Inc. 57,247 15,600 Auto Trader Group plcb 108,651 11,280 D.R. Horton, Inc. 486,506 10,845 CBS Corporation 541,165 3,200 Denso Corporation 134,932 54,200 Comcast Corporation 2,291,576 3,984 Domino's Pizza, Inc. 1,108,668 16,650 DISH Network Corporationa 639,526 36,361 Duluth Holdings, Inc.a,c 494,146 40,624 Facebook, Inc.a 7,840,432 6,164 Emerald Expositions Events, Inc. 68,729 770 Hemisphere Media Group, Inc.a 9,948 1,399 Ethan Allen Interiors, Inc. 29,463 5,647 IAC/InterActiveCorpa 1,228,392 10,077 Etsy, Inc.a 618,425 280 Ipsos SA 7,383 100 Exedy Corporation 2,100 1,459 John Wiley and Sons, Inc. 66,910 19,852 Extended Stay America, Inc. 335,300 4,700 KDDI Corporation 119,599 19,419 Five Below, Inc.a 2,330,668 1,403 Liberty Latin America, Ltd.a 24,174 97 Genuine Parts Company 10,047 4,675 Liberty Media Corporation - Liberty 30,364 G-III Apparel Group, Ltd.a 893,309 SiriusXMa 177,557 18,567 Harley-Davidson, Inc.