Report on the Corporate Governance and Ownership

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Top 100 Italian Brands

IITALTALBBRANDRAND 20112011 TOPTOP 100100 IITALIANTALIAN BBRANDSRANDS | ItalBrand 2011 | TOP Italian Brands | | 1 | About the ItalBrand In every country the different brands have become popular in different ways. And no matter how well global brands known in this country, national brands have the greatest impact on consumers. And today these are the brands that becomes a major and very valuable assets, because a strong brand, regardless of its scale allows the company to retain or to gain significant market share, and also provides an opportunity to actively develop and promote their products in foreign markets. Also the business are increasingly confronted with a situation where the brand has become one of the most expensive assets in the company's value, even compared with manufacturing facilities. And in such a situation, the cost of advertising is paid the most attention in mergers and acquisitions, as well as in public offerings of shares on stock markets or placing other types of securities in order to attract investment. And it is here necessary to solve the puzzle, when the company realizes the full value of their brand, but can not express it in concrete figures. After several researches made, the optimal solution was found, and since early 2010, the agency MPP Consulting has established long-term project of evaluation of national brands and in 2011 created the rating of the most expensive brands of Italy. The main task of rating ItalBrand 2011 was to determine the 100 most expensive Italian brands, as well as their current real market value, based on the financial performance of companies using such brands (trademarks), as well as the positions of each company in the market and prospects for development both companies and their brands. -

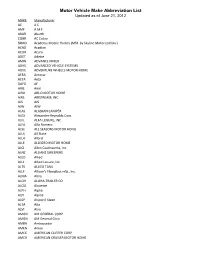

Motor Vehicle Make Abbreviation List Updated As of June 21, 2012 MAKE Manufacturer AC a C AMF a M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd

Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 MAKE Manufacturer AC A C AMF A M F ABAR Abarth COBR AC Cobra SKMD Academy Mobile Homes (Mfd. by Skyline Motorized Div.) ACAD Acadian ACUR Acura ADET Adette AMIN ADVANCE MIXER ADVS ADVANCED VEHICLE SYSTEMS ADVE ADVENTURE WHEELS MOTOR HOME AERA Aerocar AETA Aeta DAFD AF ARIE Airel AIRO AIR-O MOTOR HOME AIRS AIRSTREAM, INC AJS AJS AJW AJW ALAS ALASKAN CAMPER ALEX Alexander-Reynolds Corp. ALFL ALFA LEISURE, INC ALFA Alfa Romero ALSE ALL SEASONS MOTOR HOME ALLS All State ALLA Allard ALLE ALLEGRO MOTOR HOME ALCI Allen Coachworks, Inc. ALNZ ALLIANZ SWEEPERS ALED Allied ALLL Allied Leisure, Inc. ALTK ALLIED TANK ALLF Allison's Fiberglass mfg., Inc. ALMA Alma ALOH ALOHA-TRAILER CO ALOU Alouette ALPH Alpha ALPI Alpine ALSP Alsport/ Steen ALTA Alta ALVI Alvis AMGN AM GENERAL CORP AMGN AM General Corp. AMBA Ambassador AMEN Amen AMCC AMERICAN CLIPPER CORP AMCR AMERICAN CRUISER MOTOR HOME Motor Vehicle Make Abbreviation List Updated as of June 21, 2012 AEAG American Eagle AMEL AMERICAN ECONOMOBILE HILIF AMEV AMERICAN ELECTRIC VEHICLE LAFR AMERICAN LA FRANCE AMI American Microcar, Inc. AMER American Motors AMER AMERICAN MOTORS GENERAL BUS AMER AMERICAN MOTORS JEEP AMPT AMERICAN TRANSPORTATION AMRR AMERITRANS BY TMC GROUP, INC AMME Ammex AMPH Amphicar AMPT Amphicat AMTC AMTRAN CORP FANF ANC MOTOR HOME TRUCK ANGL Angel API API APOL APOLLO HOMES APRI APRILIA NEWM AR CORP. ARCA Arctic Cat ARGO Argonaut State Limousine ARGS ARGOSY TRAVEL TRAILER AGYL Argyle ARIT Arista ARIS ARISTOCRAT MOTOR HOME ARMR ARMOR MOBILE SYSTEMS, INC ARMS Armstrong Siddeley ARNO Arnolt-Bristol ARRO ARROW ARTI Artie ASA ASA ARSC Ascort ASHL Ashley ASPS Aspes ASVE Assembled Vehicle ASTO Aston Martin ASUN Asuna CAT CATERPILLAR TRACTOR CO ATK ATK America, Inc. -

© 2018 Donata Panizza ALL RIGHTS RESERVED

© 2018 Donata Panizza ALL RIGHTS RESERVED OVEREXPOSING FLORENCE: JOURNEYS THROUGH PHOTOGRAPHY, CINEMA, TOURISM, AND URBAN SPACE by DONATA PANIZZA A dissertation submitted to the School of Graduate Studies Rutgers, The State University of New Jersey In partial fulfillment of the requirements For the degree of Doctor of Philosophy Graduate Program in Italian Written under the direction of Professor Rhiannon Noel Welch And approved by ________________________________ ________________________________ ________________________________ ________________________________ New Brunswick, New Jersey OCTOBER, 2018 ABSTRACT OF THE DISSERTATION Overexposing Florence: Journeys through Photography, Cinema, Tourism, and Urban Space by DONATA PANIZZA Dissertation Director Rhiannon Noel Welch This dissertation examines the many ways in which urban form and visual media interact in 19th-, 20th-, and 21st-centuries Florence. More in detail, this work analyzes photographs of Florence’s medieval and Renaissance heritage by the Alinari Brothers atelier (1852- 1890), and then retraces these photographs’ relationship to contemporary visual culture – namely through representations of Florence in international cinema, art photography, and the guidebook – as well as to the city’s actual structure. Unlike previous scholarship, my research places the Alinari Brothers’ photographs in the context of the enigmatic processes of urban modernization that took place in Florence throughout the 19th century, changing its medieval structure into that of a modern city and the capital of newly unified Italy from 1865 to 1871. The Alinari photographs’ tension between the establishment of the myth of Florence as the cradle of the Renaissance and an uneasy attitude towards modernization, both cherished and feared, produced a multi-layered city portrait, which raises questions about crucial issues such as urban heritage preservation, mass tourism, (de)industrialization, social segregation, and real estate speculation. -

The Ohio Motor Vehicle Industry

Research Office A State Affiliate of the U.S. Census Bureau The Ohio Motor Vehicle Report February 2019 Intentionally blank THE OHIO MOTOR VEHICLE INDUSTRY FEBRUARY 2019 B1002: Don Larrick, Principal Analyst Office of Research, Ohio Development Services Agency PO Box 1001, Columbus, Oh. 43216-1001 Production Support: Steven Kelley, Editor; Jim Kell, Contributor Robert Schmidley, GIS Specialist TABLE OF CONTENTS Page Executive Summary 1 Description of Ohio’s Motor Vehicle Industry 4 The Motor Vehicle Industry’s Impact on Ohio’s Economy 5 Ohio’s Strategic Position in Motor Vehicle Assembly 7 Notable Motor Vehicle Industry Manufacturers in Ohio 10 Recent Expansion and Attraction Announcements 16 The Concentration of the Industry in Ohio: Gross Domestic Product and Value-Added 18 Company Summaries of Light Vehicle Production in Ohio 20 Parts Suppliers 24 The Composition of Ohio’s Motor Vehicle Industry – Employment at the Plants 28 Industry Wages 30 The Distribution of Industry Establishments Across Ohio 32 The Distribution of Industry Employment Across Ohio 34 Foreign Investment in Ohio 35 Trends 40 Employment 42 i Gross Domestic Product 44 Value-Added by Ohio’s Motor Vehicle Industry 46 Light Vehicle Production in Ohio and the U.S. 48 Capital Expenditures for Ohio’s Motor Vehicle Industry 50 Establishments 52 Output, Employment and Productivity 54 U.S. Industry Analysis and Outlook 56 Market Share Trends 58 Trade Balances 62 Industry Operations and Recent Trends 65 Technologies for Production Processes and Vehicles 69 The Transportation Research Center 75 The Near- and Longer-Term Outlooks 78 About the Bodies-and-Trailers Group 82 Assembler Profiles 84 Fiat Chrysler Automobiles NV 86 Ford Motor Co. -

KTM Industries Buy CHF 90.00

KTM Industries RESEARCH (CDAX, Automobile & Parts) Value Indicators : CHF Share data : Description : Buy DCF: 90.05 Bloomberg: KTMI GR Europe's largest manufacturer of FCF-Value Potential 21e: 77.61 Reuters: KTMI.VI sports motorcycles. CHF 90.00 ISIN: AT0000KTMI02 Market Snapshot : CHF m Shareholders : Risk Profile (WRe): 2019e Market cap: 1,280 Freefloat 38.0 % Beta: 1.4 CHF Price 56.80 No. of shares (m): 23 Pierer Industrie AG 62.0 % Price / Book: 3.4 x Upside 58.5 % EV: 2,282 Remaining management 1.1 % Equity Ratio: 41 % Freefloat MC: 486 Net Fin. Debt / EBITDA: 1.4 x Ø Trad. Vol. (30d) : 328.54 th Net Debt / EBITDA: 1.5 x Taking a fresh look at Europe's leading motorcycle company; Initiation with Buy We initiate our coverage of KTM Industries, a leading European motorcycle manufacturer with a BUY recommendation and a PT of CHF 90 . KTM Industries AG (KTMI) is a parent company with majority stakes in leading brands, including KTM, Husqvarna Motorcycles, WP Suspensions and Raymon, which, together, create a vertically integrated supply chain with which KTMI ensures production of all critical and performance-related components for motorcycles. KTMI is primarily a growth story, based on the following factors: ° A growth story: Historically, KTMI chalked up an incredible growth rate of ~15.6% CAGR in motorcycle unit sales for the 1993-2018 time period. We are fairly confident that the company can prolong its growth as it is maintaining its high level of innovation and has a shorter time- to-market cycle than competitors. It can generate synergies with the Husqvarna brand, boost street model sales in emerging markets via partnerships, and increase market share globally. -

1 Craft and the Birth of Post-War Italian Design

Macintosh HD:ROSSI 9780719089404 PRINT.indd / 9:3:AM - 08-12-2014 9:3:AM - 08-12-2014 / Macintosh HD:ROSSI 9780719089404 PRINT.indd 1 ✧ Craft and the birth of post-war Italian design Introduction N N OVEMBER 1950 Italy at Work: Her Renaissance in Design Today opened at New York’s Brooklyn Museum (see plate 1).1 Primarily I American conceived, funded and organised, Italy at Work aimed to boost Italy’s post-war reconstruction by presenting the nation’s hand- made wares to the American consumer. Despite the word ‘design’ in the title, craft materials and techniques dominated the two thousand five hundred exhibits (see figure 1.1) and the five room sets designed by architects including Carlo Mollino and Gio Ponti. Enjoying critical and popular acclaim, Italy at Work spent the next three years travelling to eleven other museums across North America, closing at the Museum of the Rhode Island School of Design in November 1953.2 In May 1951, just as Italy at Work was embarking on the second leg of its tour, the ninth Triennale di Milano esposizione internazionale delle arti decorative e industriali moderne e dell’architettura moderna (Milan Triennial International Exposition of Modern Decorative and Industrial Arts and Modern Architecture) (see plate 2) opened in Milan, with the theme L’unità delle arti (The Unity of the Arts). The Italian architect and artist organisers attempted to project a unified image of post-war modernity, but this was clouded by internal conflicts that reflected wider political turmoil. While industrial design was present, craft remained the main- stay of Italy’s exhibits, and both were given multiple roles by competing visions for the nation’s post-war future. -

Brand Listing As of 9/5/21

Brand Listing as of 10/1/21 Name Show(s) Booth 10 to 12 Baby Lounge CHILDREN'S CLUB 8121 8 Oak Lane CHILDREN'S CLUB 1568 98 Coast Av. CHILDREN'S CLUB 1461 A Bit of Honey CHILDREN'S CLUB 1503 AC Rendon CHILDREN'S CLUB 1557 Adrienne Vittadini Bambini CHILDREN'S CLUB 1372 AGI TEXTILES LTD CHILDREN'S CLUB 1431 Aimama CHILDREN'S CLUB 1738 Akido CHILDREN'S CLUB 8028 akkko CHILDREN'S CLUB 1374 Albetta CHILDREN'S CLUB 1326 Alitsa CHILDREN'S CLUB 8142 All Navy CHILDREN'S CLUB 1473 Alviso CHILDREN'S CLUB 1665 American Jewel CHILDREN'S CLUB 1608 American Widgeon CHILDREN'S CLUB 1352 Amor Bebe CHILDREN'S CLUB 1366 Amore Bebe CHILDREN'S CLUB 1366 Anavini CHILDREN'S CLUB 8126 Andrew Marc CHILDREN'S CLUB 1751 Andy & Evan CHILDREN'S CLUB 1714 Angel Dear CHILDREN'S CLUB 1306 Angels New York US CHILDREN'S CLUB 1476 Antoinette Paris CHILDREN'S CLUB 8013 Appaman CHILDREN'S CLUB 1414 Apple Park CHILDREN'S CLUB 1317 Automobili Lamborghini Kidswear CHILDREN'S CLUB 1609 Autumn Cashmere CHILDREN'S CLUB 1702, 963 Autumn Cashmere Kids CHILDREN'S CLUB 1702 Baby Bar & Co CHILDREN'S CLUB Baby Club Chic CHILDREN'S CLUB 1350 Baby Cross CHILDREN'S CLUB 8112 Baby Mode CHILDREN'S CLUB 1366 Baby Noomie CHILDREN'S CLUB 1320 Baby Steps CHILDREN'S CLUB 1527 Babyface CHILDREN'S CLUB 8014, 8015, 8016, 8017 Babysen CHILDREN'S CLUB 1361 Bailey's Blossoms CHILDREN'S CLUB 1730 Bari Lynn CHILDREN'S CLUB 1616, 1617 Be Mi Los Angeles CHILDREN'S CLUB 8027 Bean's Barcelona CHILDREN'S CLUB 8014, 8015, 8016, 8017 Bear Camp CHILDREN'S CLUB 1422 Bebe Gabrielle CHILDREN'S CLUB 1607 Beggi Ceremony -

World Motorcycles

INDUSTRY MARKET RESEARCH FOR BUSINESS LEADERS, STRATEGISTS, DECISION MAKERS CLICK TO VIEW Table of Contents 2 List of Tables & Charts 3 Study Overview 4 Sample Text, Table & Chart 5 Sample Profile, Table & Forecast 6 Order Form & Corporate Use License 7 About Freedonia, photo courtesy of corporate press office Custom Research, Related Studies, 8 World Motorcycles Industry Study with Forecasts for 2016 & 2021 Study #2972 | January 2013 | $6300 | 429 pages The Freedonia Group 767 Beta Drive www.freedoniagroup.com Cleveland, OH • 44143-2326 • USA Toll Free US Tel: 800.927.5900 or +1 440.684.9600 Fax: +1 440.646.0484 E-mail: [email protected] Study #2972 January 2013 World Motorcycles $6300 429 Pages Industry Study with Forecasts for 2016 & 2021 Table of Contents Motorcycle Outlook & Suppliers .....................87 Competitive Strategies ............................... 300 United States .............................................90 Industry Globalization Trends ...................... 302 EXECUTIVE SUMMARY Canada ......................................................98 Research & New Product Development .......... 303 Mexico .................................................... 104 Manufacturing .......................................... 306 Marketing & Distribution ............................ 308 MARKET ENVIRONMENT WESTERN EUROPE Cooperative Agreements ............................. 310 General ...................................................... 4 Mergers & Acquisitions ............................... 317 World Economic Overview -

Eligible Company List - Updated 2/1/2018

Eligible Company List - Updated 2/1/2018 S10009 3 Dimensional Services Rochester Hills, MI Supplier Employees Only S65830 3BL Media LLC North Hampton, MA Supplier Employees Only S69510 3D Systems Rock Hill, SC Supplier Employees Only S65364 3IS Inc Novi, MI Supplier Employees Only S70521 3R Manufacturing Company Goodell, MI Supplier Employees Only S61313 7th Sense LP Bingham Farms, MI Supplier Employees Only D18911 84 Lumber Company Eighty Four, PA DCC Employees Only S42897 A & S Industrial Coating Co Inc Warren, MI Supplier Employees Only S73205 A and D Technology Inc Ann Arbor, MI Supplier Employees Only S57425 A G Manufacturing Harbour Beach, MI Supplier Employees Only S01250 A G Simpson (USA) Inc Sterling Heights, MI Supplier Employees Only F02130 A G Wassenaar Denver, CO Fleet Employees Only S80904 A J Rose Manufacturing Avon, OH Supplier Employees Only S19787 A OK Precision Prototype Inc Warren, MI Supplier Employees Only S62637 A Raymond Tinnerman Automotive Inc Rochester Hills, MI Supplier Employees Only S82162 A Schulman Inc Fairlawn, OH Supplier Employees Only S78336 A T Kearney Inc Chicago, IL Supplier Employees Only D80005 A&E Television Networks New York, NY DCC Employees Only S64720 A.P. Plasman Inc. Fort Payne, AL Supplier Employees Only S36205 AAA National Office (Only EMPLOYEES Eligible) Heathrow, FL Supplier Employees Only S31320 AAF McQuay Inc Louisville, KY Supplier Employees Only S14541 Aarell Process Controls Group Troy, MI Supplier Employees Only F05894 ABB Inc Cary, NC Fleet Employees Only S10035 Abbott Ball Co -

The Luxury Consolidation Jungle: Large Group Affiliated Brands Versus Independent Players (Kings of the Jungle Vs Code Breakers)

Chair Department Business and Management Corporate Strategies THE LUXURY CONSOLIDATION JUNGLE: LARGE GROUP AFFILIATED BRANDS VERSUS INDEPENDENT PLAYERS (KINGS OF THE JUNGLE VS CODE BREAKERS) SUPERVISOR Prof. Alessandro Marino CANDIDATE Francesca Locarno Matr. 666271 CO-SUPERVISOR Prof. Alberto Festa The luxury consolidation jungle: group affiliated brands versus independent players Abstract 2 Introduction 3 1. The strategic groups theory: a review of the literature 4 1.1 Developments of the strategic groups theory 4 1.2 A review of the strategic groups literature 6 1.3 Mobility barriers 11 1.4 The theory of intra-industry competition 15 1.5 Strategic group theory and the development of new theoretical approaches 18 1.6 Summing up 21 2. The Luxury Industry: the consolidation jungle 23 2.1 Definition of luxury 23 2.2 Global overview of the market and changing trends 26 2.3 Industry characteristics and success factors 34 2.3.1 Industry characteristics 34 2.3.2 Industry success factors 36 2.4 The consolidation jungle: the key players 37 2.4.1 Industry structure 37 2.4.2 The four big conglomerates 40 2.5 Current trends: vertical integration, consolidation, diversification and war for talents 45 3. The luxury industry in the consolidation curve 51 3.1 The industry consolidation: a theoretical framework 51 3.2 The consolidation curve: the Merger Endgame 54 3.3 The consolidation curve and niche strategies 56 3.4 Which is the luxury industry stage in the consolidation curve? 59 4. Analysis (ex post) of the strategies of the group affiliated brands versus 61 those of independent players 4.1 Methodology of the analysis 61 4.2 Analysis of Porter’s value chain and of the most strategic dimensions for luxury companies. -

View Annual Report

Pirelli & C. S.p.a. - Milan DATA MEETS PASSION 2017 Annual Report SIGNIFICANT EVENTS SUBSEQUENT TO THE END OF THEFINANCIAL YEAR 86 ALTERNATIVE PERFORMANCE INDICATORS 87 CONTENTS OTHER INFORMATION 88 REPORT ON RESPONSIBLE MANAGEMENT LETTER FROM THE CHAIRMAN 6 02. OF THE VALUE CHAIN 92 LETTER FROM CEO 8 102 NOTICE OF SHAREHOLDERS’ MEETING 10 METHODOLOGICAL NOTE ECONOMIC DIMENSION 112 CORPORATE BODIES 11 ENVIRONMENTAL DIMENSION 132 PRESENTATION OF 2017 PIRELLI INTEGRATED REPORT 14 SOCIAL DIMENSION 153 DATA MEETS PASSION 18 HOW THE DIGITAL REVOLUTION HAS CHANGED EVERY ASPECT OF OUR LIVES, PRIVATE AND BUSINESS by Tom McCarthy 22 REPORT ON THE CORPORATE GOVERNANCE 192 THE TECHNOLOGY OF OUR DESIRE by Mohsin Hamid 24 03. AND STRUCTURE OF SHARE OWNERSHIP THE NEXT COGNITIVE REVOLUTION by Ted Chiang 26 GLOSSARY 202 EMILIANO PONZI 28 INTRODUCTION 203 COMPANY PROFILE 203 01. DIRECTORS’ REPORT ON OPERATIONS 32 INFORMATION ON THE OWNERSHIP STRUCTURE 205 COMPLIANCE 209 COMPANY PROFILE 42 BOARD OF DIRECTORS 209 MACROECONOMIC AND MARKET SCENARIO 57 PROCESSING OF CORPORATE INFORMATION 215 SIGNIFICANT EVENTS OF 2017 61 BOARD COMMITTEES 216 GROUP PERFORMANCE AND RESULTS 63 STRATEGIES COMMITTEE 217 RESEARCH AND DEVELOPMENT ACTIVITIES 74 APPOINTMENTS AND SUCCESSION COMMITTEE 217 PARENT COMPANY HIGHLIGHTS 77 RELATED-PARTY TRANSACTIONS COMMITTEE 218 RISK FACTORS AND UNCERTAINTY 79 COMPENSATION COMMITTEE 218 OUTLOOK FOR 2018 85 REMUNERATION OF THEDIRECTORS 219 CORPORATE GOVERNANCE, SUSTAINABILITY, 07. RESOLUTIONS 466 CONTROL AND RISKS COMMITTEE 219 SYSTEM OF INTERNAL CONTROL AND RISK MANAGEMENT 220 08. CERTIFICATIONS 480 INTERESTS OF THEDIRECTORS AND RELATED-PARTY TRANSACTIONS 224 BOARD OF STATUTORY AUDITORS 224 A. CERTIFICATION OF THECONSOLIDATED FINANCIAL INFORMATION FLOWS TO THE DIRECTORS AND STATUTORY AUDITOR 227 STATEMENTS PURSUANT TO ART. -

219936-3-17805-V11.0 47-40704104 BASE PROSPECTUS Pirelli

BASE PROSPECTUS Pirelli International plc (incorporated with limited liability in England and Wales) and Pirelli & C. S.p.A. (incorporated with limited liability as a Società per Azioni in the Republic of Italy) as Issuers €2,000,000,000 Euro Medium Term Note Programme guaranteed on the basis set out below by Pirelli Tyre S.p.A. (incorporated with limited liability as a Società per Azioni in the Republic of Italy) or Pirelli & C. S.p.A. Under this €2,000,000,000 Euro Medium Term Note Programme (the "Programme"), Pirelli International plc ("Pirelli International") and Pirelli & C. S.p.A. ("Pirelli") (each an "Issuer" and together, the "Issuers") may from time to time each issue notes (the "Notes") denominated in any currency agreed between the relevant Issuer and the relevant Dealer (as defined below). The payments of all amounts due in respect of the Notes issued by Pirelli International will be unconditionally and irrevocably (subject as described below) guaranteed by either Pirelli Tyre S.p.A. ("Pirelli Tyre") or Pirelli as specified in the applicable Final Terms or, in the case of Exempt Notes, the applicable Pricing Supplement (in such capacity, a "Guarantor"). Notes issued by Pirelli will be unconditionally and irrevocably guaranteed (subject as described below) by Pirelli Tyre if so specified as a Guarantor in the applicable Final Terms or, in the case of Exempt Notes, the applicable Pricing Supplement (in such capacity, a "Guarantor", and together with Pirelli in its capacity as Guarantor as described above, "Guarantors"). If no Guarantor is specified in the applicable Final Terms or, in the case of Exempt Notes, the applicable Pricing Supplement, Notes issued by Pirelli will not have the benefit of a guarantee (subject to Condition 2.3 (Release and Appointment of Guarantor)).